S&P 500: Elliott Wave and Technical Analysis | Charts – October 8, 2020

Summary: A target for primary wave 3 to end is now at 4,606. The invalidation point is moved up to 3,209.45.

The second wave count considers the possibility that a once in multi-generations trend change may have occurred. Some confidence in this wave count would come with invalidation of the first wave count below 2,191.86.

At this stage, a new high above 3,588.11 would invalidate the second very bearish Elliott wave count, leaving only a bullish Elliott wave count.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts are here, with video here.

ELLIOTT WAVE COUNTS

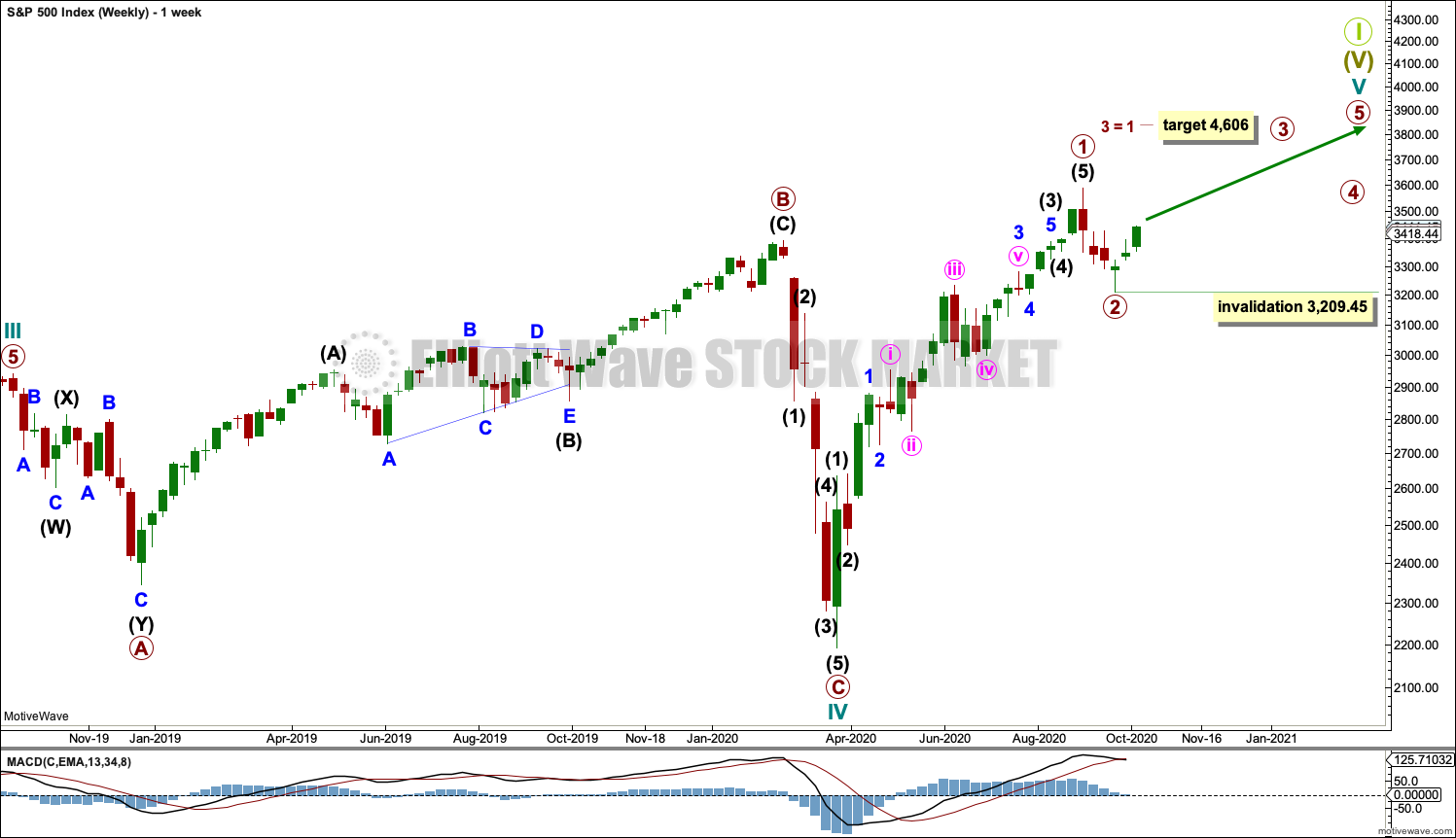

FIRST WAVE COUNT

WEEKLY CHART

Cycle wave V may last from one to several years. So far it has lasted 6 months.

Cycle wave V would most likely subdivide as an impulse. But if overlapping develops, then an ending diagonal should be considered. This chart considers the more common impulse.

Primary waves 1 and 2 may be complete.

Primary wave 3 may have begun. It may only subdivide as an impulse. No second wave correction within primary wave 3 may move beyond its start below 3,209.45.

There is already a Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). The S&P500 often exhibits a Fibonacci ratio between two of its actionary waves but rarely between all three; it is less likely that cycle wave V would exhibit a Fibonacci ratio. The target for Super Cycle wave (V) to end would best be calculated at primary degree, but that cannot be done until all of primary waves 1, 2, 3 and 4 are complete.

DAILY CHART

Primary waves 1 and 2 may both be complete. Primary wave 3 may now be underway.

Primary wave 3 may only subdivide as an impulse. No second wave correction within primary wave 3 may move beyond the start of its first wave below 3,209.45.

Primary wave 1 looks extended. The target for primary wave 3 expects it to also be extended.

HOURLY CHART

It is possible that primary wave 2 was over as a relatively brief and shallow 0.27 zigzag. Today this wave count now has enough support from classic technical analysis for the other two short-term wave counts to be discarded.

Primary wave 3 may only subdivide as an impulse. Intermediate waves (1) and (2) within primary wave 3 may be incomplete. Intermediate wave (3) may have begun.

Intermediate wave (3) may only subdivide as an impulse. Minor waves 1 and 2 within intermediate wave (3) may be complete. Minor wave 3 may have begun.

Draw a base channel about intermediate waves (1) and (2). Along the way up, corrections may find support about the lower edge of the base channel. A breach of the base channel reduces the probability of this wave count. The channel is overshot, but it is not properly breached. There is no full hourly candlestick below and not touching the lower edge.

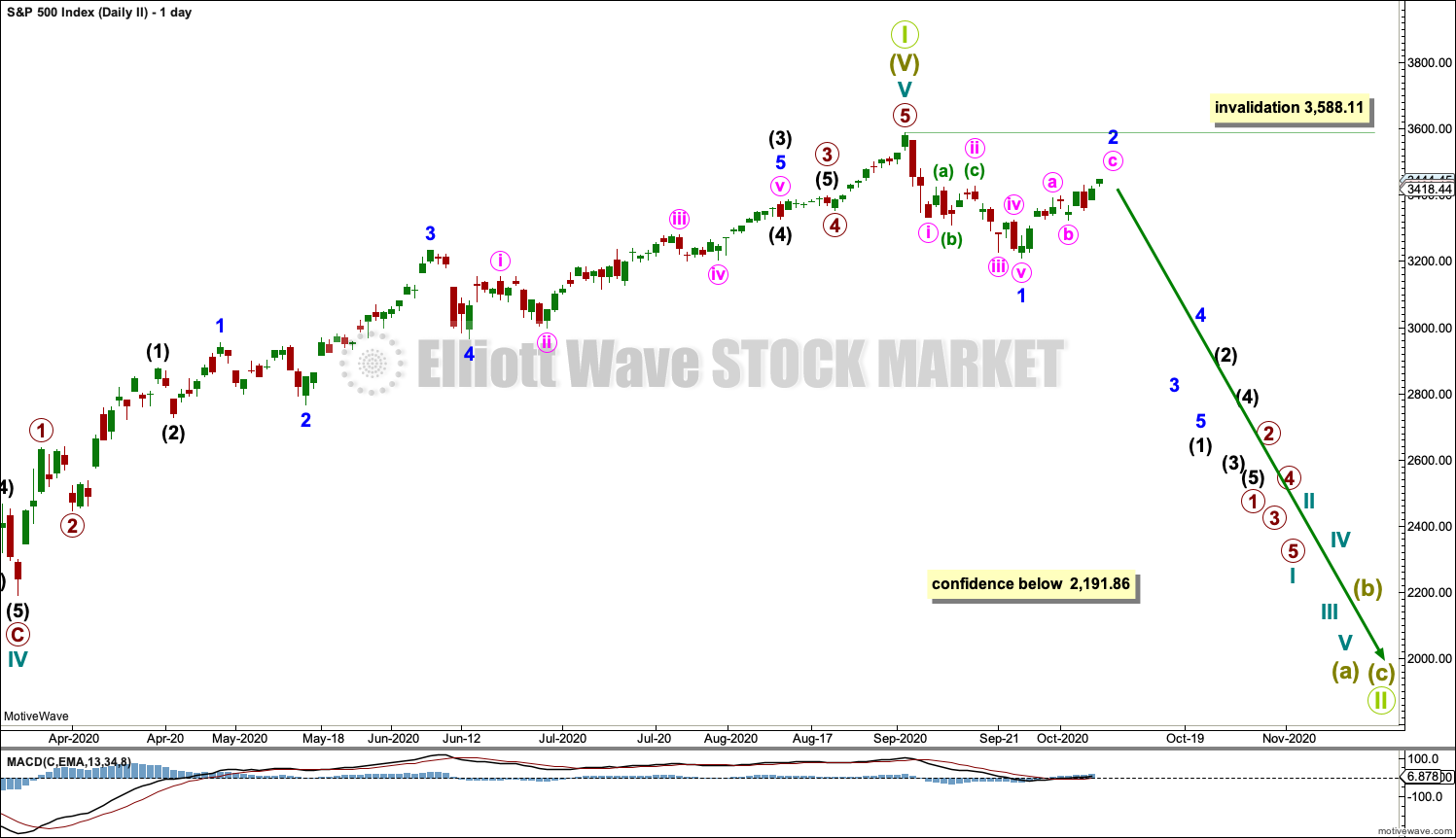

SECOND WAVE COUNT

DAILY CHART

This wave count is the same as the first wave count with the exception of the degree of labelling within cycle wave V. If the degree of labelling is moved up one degree, then it is possible that cycle wave V to end Super cycle wave (V) to end Grand Super Cycle wave I is complete.

A new low below 2,191.86 would add confidence in this wave count. At that stage, the first wave count would be invalidated.

A new bear market at Grand Super Cycle degree may be expected to last over a decade. It may take price below the start of Super Cycle wave (V) at 666.79 in March 2009.

A first five down, labelled minor wave 1, may be complete. Minor wave 2 now also may be complete. A third wave down at minor degree may just have begun. It should exhibit strength if this wave count is correct.

Major new downwards trends for this market usually begin with strength. The lack of any 90% down days or back to back 80% down days reduces the probability of this wave count. Now with the AD line making a new all time high and two back to back 80% upwards days the probability of this wave count has reduced further.

HOURLY CHART

Minor wave 2 may be an incomplete zigzag.

Minor wave 2 may not move beyond the start of minor wave 1 above 3,431.56.

TECHNICAL ANALYSIS

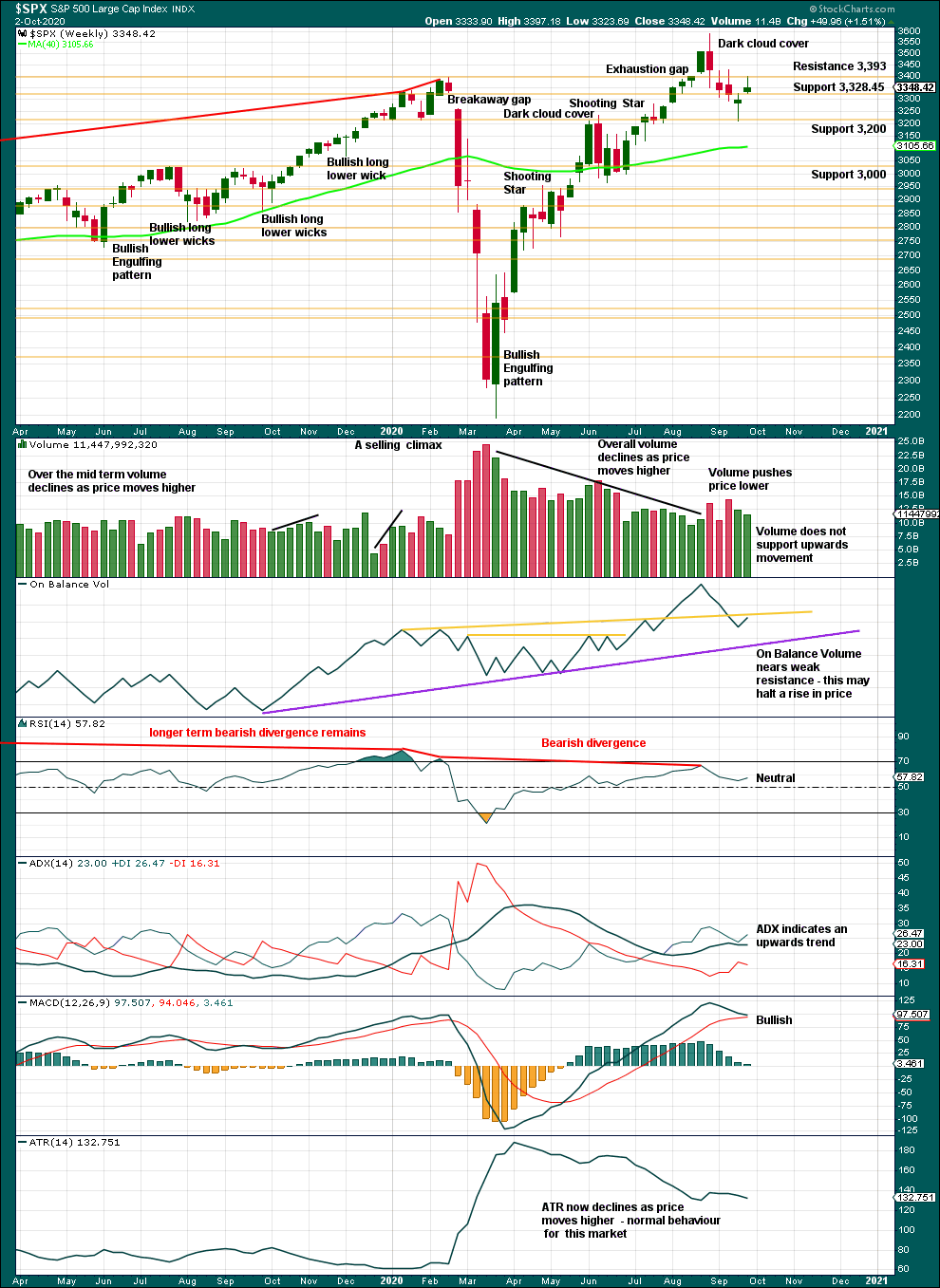

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range week with a longer upper wick and declining volume is not convincing for bulls last week. With a lack of support for upwards movement, it looks like the pullback may continue lower.

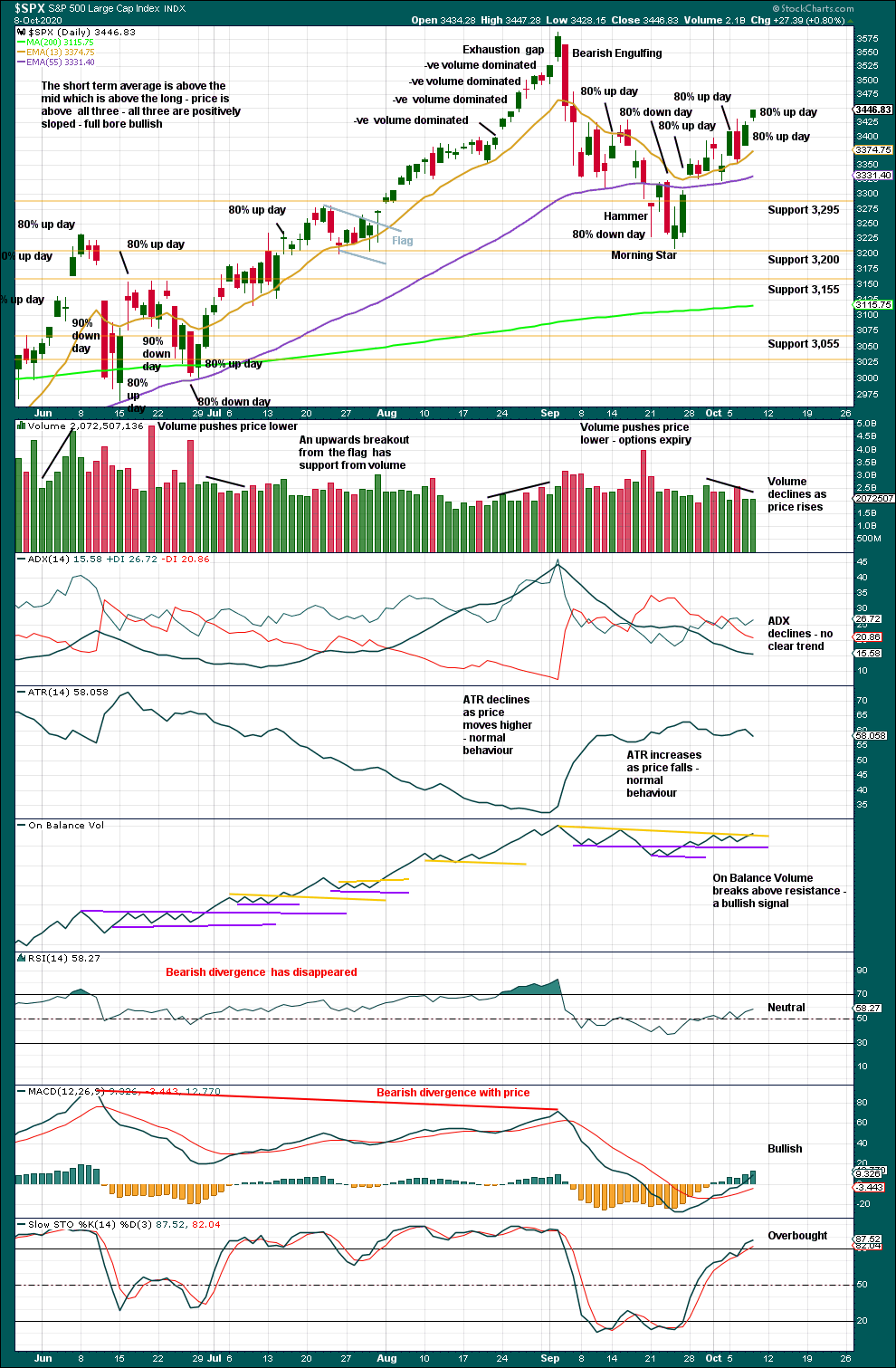

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are now two back to back 80% upwards days.

The bullish signal from On Balance Volume has reasonable technical significance because the trend line breached had four tests and was reasonably long held and close to horizontal.

If ADX turns up, then it would give a strong bullish signal.

New all time highs may be close by.

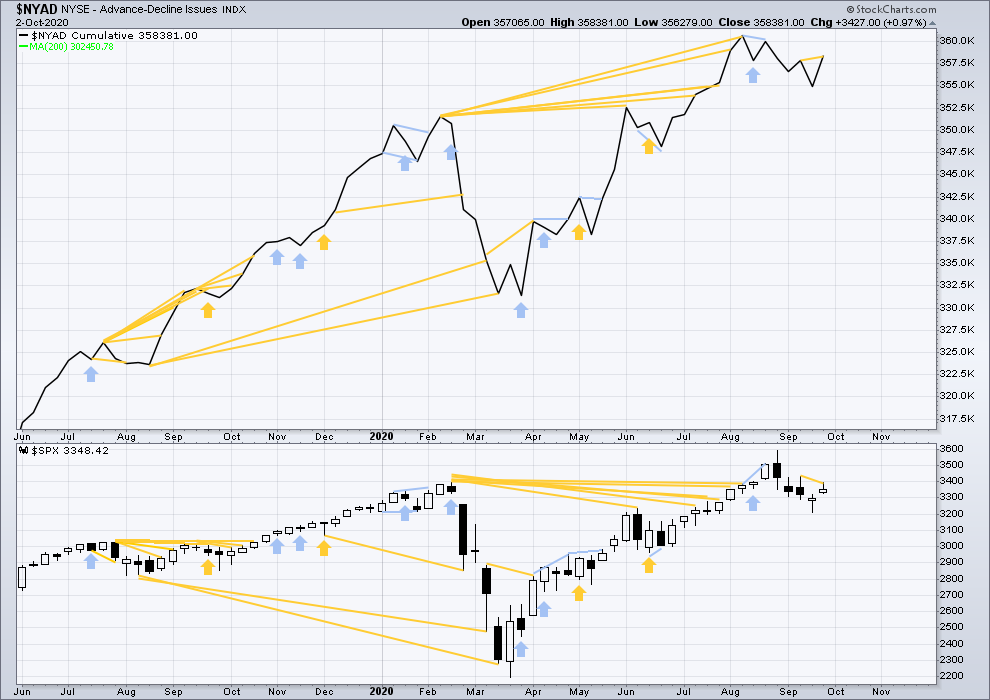

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Lowry’s Operating Companies Only AD line has still not made new all time highs. The last high for the OCO AD line was in the week beginning January 13, 2020. There was 7 and a half months of bearish divergence between price and the OCO AD line at the September high. This may now support the more bearish second wave count. It is possible now that a major trend change may have occurred.

The NYSE All Issues AD line made new highs in the week beginning 1st of June.

Last week the AD line has made a new short-term high above the high of two weeks prior, but price has not. This divergence is bullish for the short term.

Large caps all time high: 3,588.11 on September 2, 2020.

Mid caps all time high: 2,109.43 on February 20, 2020.

Small caps all time high: 1,100.58 on August 27, 2018.

This rise has been led by large caps, which is a feature of an aged bull market. Only large caps have made new highs above the last swing high of the 11th of August.

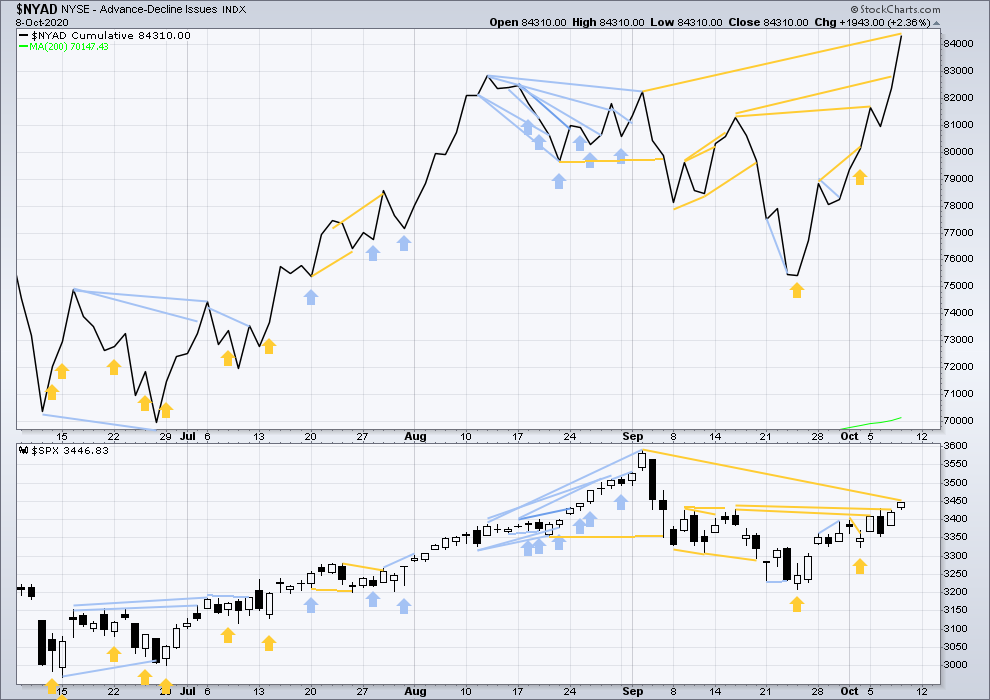

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Today the NYSE all issues AD line has made a new all time high. This signal is strongly bullish and supports the change to a bullish Elliott wave count.

The OCO AD line will be watched carefully. If that too makes a new all time high, then that would be a very bullish signal; it has not done so yet.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Inverted VIX remains well below all time highs. The all time high for inverted VIX was in the week beginning October 30, 2017. There is nearly 3 years of bearish divergence between price and inverted VIX. There is all of long, mid and short-term bearish divergence.

Last week price has moved higher, but inverted VIX has declined. This divergence is bearish for the short term. It will be given less weight than the AD line though as the AD line tends to be more reliable.

Comparing VIX and VVIX: Last week both have moved higher. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Again, both price and inverted VIX have moved higher. Price has made a new high above the prior high of the 28th of September, but inverted VIX has not. This divergence is bearish.

Inverted VIX remains well above lows of the 3rd to 8th of September, but price is below. This divergence remains bullish.

Comparing VIX and VVIX at the daily chart level: Today VIX has moved lower, but VVIX has moved slightly higher. This divergence is bearish for the short term for price, but it is weak.

DOW THEORY

Dow Theory still concludes a bear market is in place.

Dow Theory confirmed a bear market with the following lows made on a closing basis:

DJIA: 21,712.53 – a close below this point was been made on the March 12, 2020.

DJT: 8,636.79 – a close below this point was been made on March 9, 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, a bear market was confirmed:

S&P500: 2,346.58 – a close below this point was made on March 20, 2020.

Nasdaq: 7,292.22 – a close below this point was made on the March 12, 2020.

At this time, to shift Dow Theory from viewing a bear market to confirmation of a new bull market would require new highs made on a closing basis:

DJIA: 29,568.57

DJT: 11,623.58 – closed above on 7th October 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, confirmation of a bull market would require new highs made on a closing basis:

S&P500: 3,393.52 – closed above on 21st August 2020.

Nasdaq: 9,838.37 – closed above on June 8, 2020.

Published @ 05:58 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.