S&P 500: Elliott Wave and Technical Analysis | Charts – July 20, 2020

Today price has closed to a new swing high, but volume and breadth suggest weakness.

Summary: A short-lived upwards breakout may continue for another one to very few days, before a trend change. The upwards breakout may not make a new all time high above 3,393.52.

The main wave count remains bearish and has two final targets at 2,034 and 1,708. A weekly alternate wave count has a target at 1,289 for a third wave down.

A new low below 2,965.66 would invalidate the third alternate wave count and provide confidence in downwards targets.

The third alternate wave count is bullish. A new high above 3,393.52 is now required for confidence in this wave count.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

MAIN WEEKLY CHART

This main Elliott wave count expects that the bull market beginning in March 2009 was cycle wave I of Super Cycle wave (V). The trend change in February 2020 may have been only at cycle degree. Cycle wave II may last from one to a few years.

Cycle wave II would most likely subdivide as a zigzag; thus far that looks like what is unfolding. Primary wave A may be complete. Primary wave B may be almost complete. When primary wave B may again be complete, then again a second target for primary wave C may be calculated.

Cycle wave II may not move beyond the start of cycle wave I below 666.79.

DAILY CHART

Draw the wide maroon trend channel carefully: draw the first trend line from the end of primary wave 1 at 2,093.55 (December 26, 2014), to the end of primary wave 3 at 2,940.91 (September 21, 2018), then place a parallel copy on the end of primary wave 2 at 1,810.10 (February 11, 2016). The channel was fully breached in March 2020 indicating a trend change from the multi-year bull trend to a new bear trend. Resistance at the lower edge has been overcome; price has closed above this trend line. During the next downwards wave this line may offer some support.

Cycle wave II may subdivide as any Elliott wave corrective structure except a triangle. It would most likely be a zigzag (zigzags subdivide 5-3-5).

Primary wave B may continue higher as a double zigzag.

If primary wave A is correctly labelled as a five wave impulse, then primary wave B may not move beyond the start of primary wave A above 3,393.52.

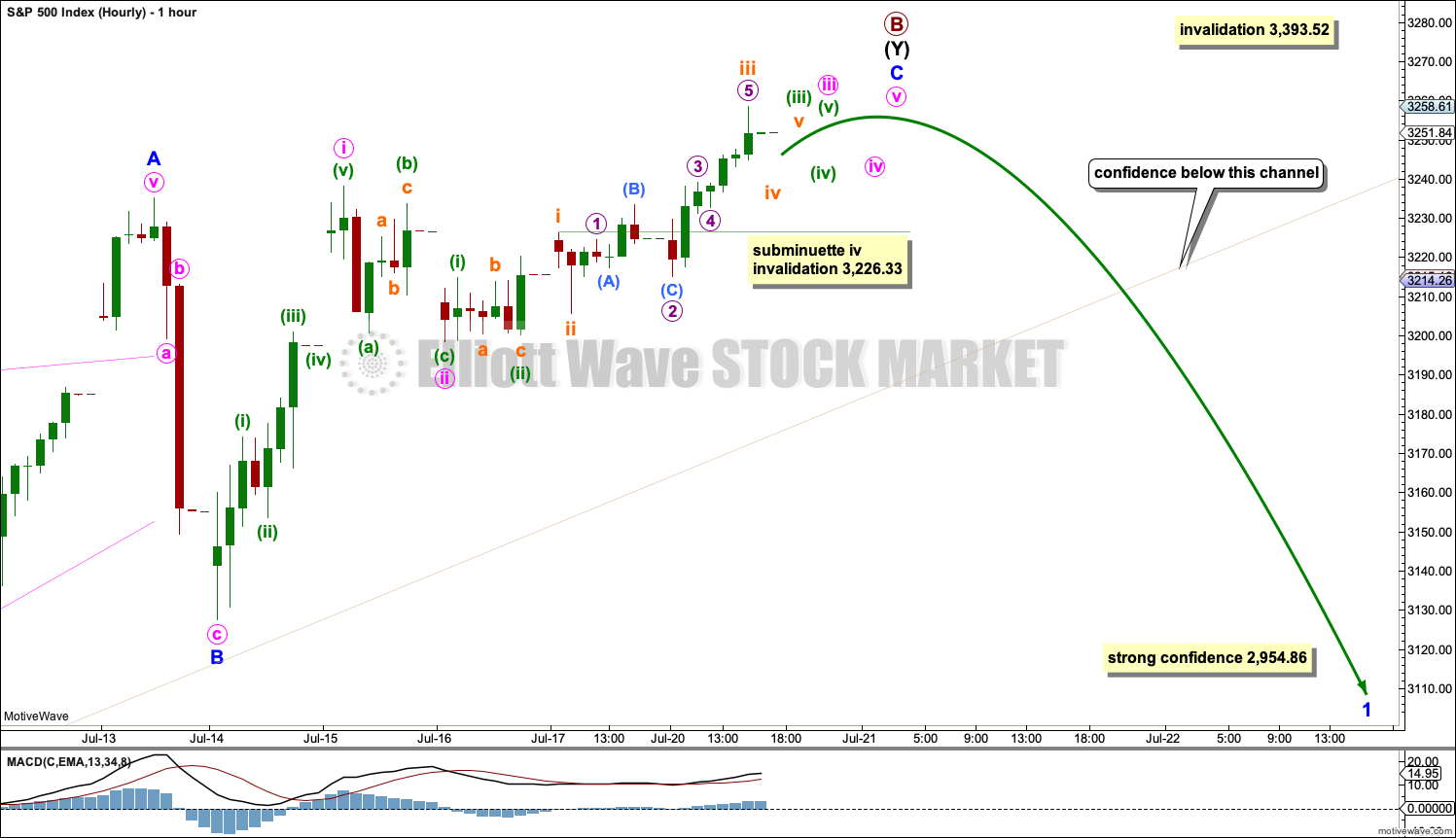

HOURLY CHART

Primary wave B may be an incomplete double zigzag. Primary wave B may not move beyond the start of primary wave A above 3,393.52.

Minor waves A and B within the double zigzag of intermediate wave (Y) may be complete. Minor wave B may have completed as a relatively quick zigzag. Minor wave C may be nearing an end.

A short upwards wave for minor wave C has now moved above the end of minor wave A at 3,235.32 to avoid a truncation.

Use the best fit channel to indicate a possible trend change.

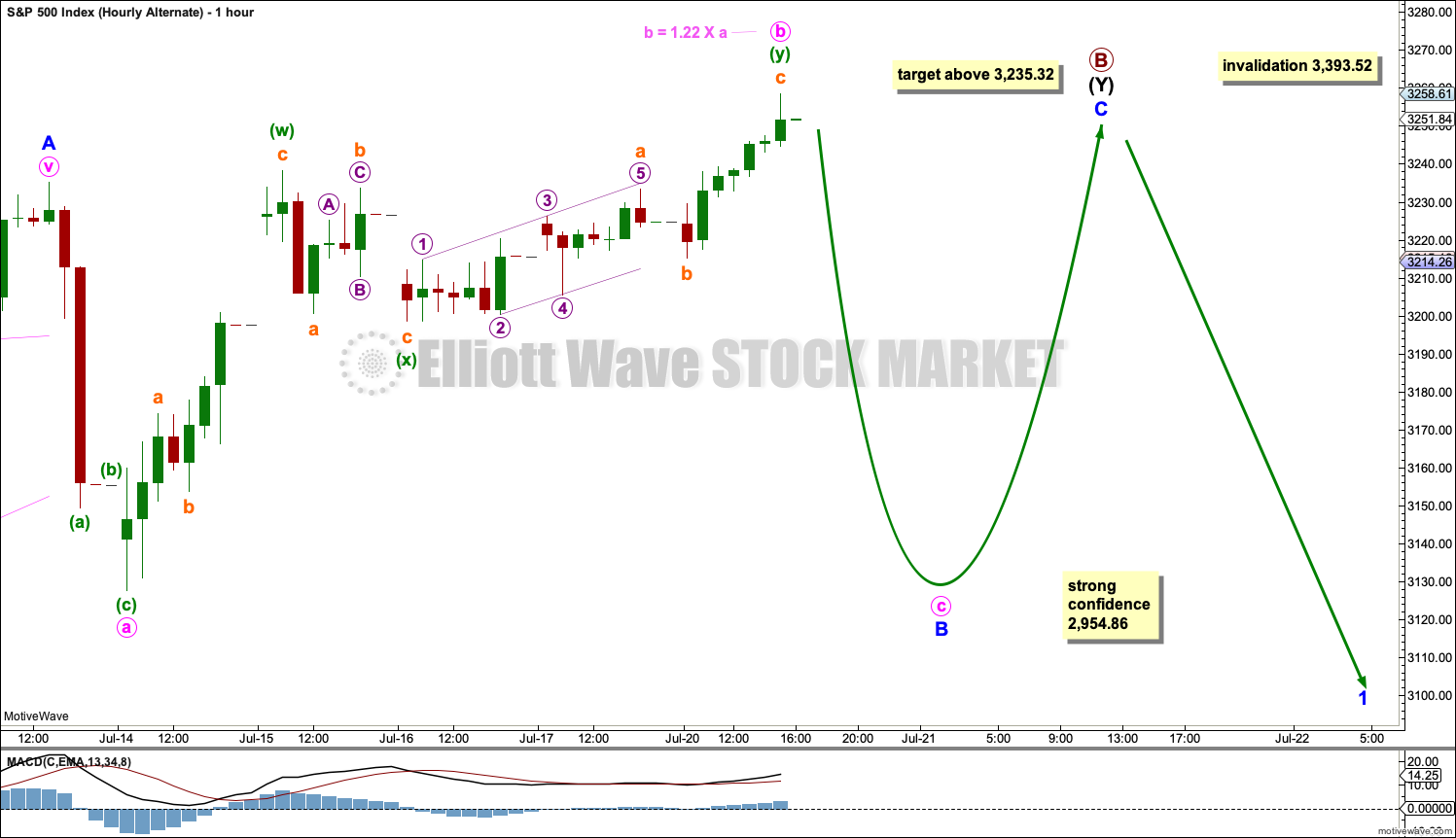

ALTERNATE HOURLY CHART

It is also possible that minor wave B may be an incomplete expanded flat correction. However, this wave count would require a strong breach of the best fit channel on the main wave count charts. This reduces the probability of this wave count, but it remains valid. The S&P500 has a tendency to breach upwards sloping channels before continuing on higher, as it forms rounded tops.

Minute waves a and b within the expanded flat may be complete. Minute wave c should move below the end of minute wave a at 3,127.66 to avoid a truncation.

When minor wave B may be a complete expanded flat, then minor wave C should unfold higher to end above the end of minor wave A at 3,235.32 to avoid a truncation. Minor wave C does not have to move beyond the price extreme of minor wave B.

FIRST ALTERNATE WEEKLY CHART

This alternate weekly chart follows the First Alternate Monthly chart. It is best viewed on a weekly chart time frame.

By simply moving the degree of labelling in the bull market beginning March 2009 up one degree, it is possible that a Grand Super Cycle trend change occurred on February 19, 2020. The bull market from March 2009 to February 2020 may have been a complete fifth wave labelled Super Cycle wave (V).

A bear market at Grand Super Cycle degree may be expected to last at least a decade, possibly longer. Corrections for this market tend to be much quicker than bullish moves, and so a fair amount of flexibility is required in expectations for duration of the different degrees.

Grand Super Cycle II would most likely subdivide as a zigzag, although it may be any corrective structure except a triangle. It should begin with a five down at the weekly chart time frame, which would be incomplete.

The first wave down on the daily chart is labelled cycle wave I. If this degree of labelling is wrong, it may be too high; it may need to be moved down one degree.

Following cycle wave I, cycle wave II may be an incomplete double zigzag.

If it continues any higher, then cycle wave II may not move beyond the start of cycle wave I above 3,393.52.

THIRD ALTERNATE DAILY CHART – BULLISH

This alternate daily chart follows the third alternate monthly chart. It will be published daily because the structure of the current upwards wave is different and so the invalidation point is different. This alternate chart labels the subdivisions of the long bull market differently. The channel is a best fit.

The target for the end of this bull market is provisional. It would best be calculated at primary degree, but that cannot be done until all of primary waves 1 through to 4 are complete. At that stage, the target will be recalculated and will very likely change.

Cycle wave V must subdivide as a five wave motive structure, most likely an impulse. Primary wave 1 within cycle wave V may be nearing completion.

Within primary wave 1: intermediate waves (1) through to (4) may be complete.

Use Elliott’s first technique to draw a channel about primary wave 1. Draw the first trend line from the ends of intermediate waves (1) to (3), then place a parallel copy on the end of intermediate wave (2). Intermediate wave (4) remains within the channel and may have found support about the lower edge.

Intermediate wave (3) within primary wave 1 is shorter than intermediate wave (1). Because intermediate wave (3) may not be the shortest actionary wave, intermediate wave (5) is limited to no longer than equality in length with intermediate wave (3) at 3,432.15.

When primary wave 1 may be a complete five wave structure, then primary wave 2 should then unfold as a multi-week pullback and may not move beyond the start of primary wave 1 below 2,191.86.

In the short term, invalidation of this wave count by a new low below 2,965.66 would add confidence to a bearish wave count.

This alternate wave count is bullish.

Bearish divergence between price and inverted VIX and RSI do not support this wave count. Weak volume does not support this wave count.

Cycle wave V may last from one to several years.

THIRD ALTERNATE HOURLY CHART

Copy the black Elliott channel over from the daily chart. The lower edge may be about where deeper pullbacks find support.

Minor wave 1 within intermediate wave (5) may be a complete leading contracting diagonal. Minor wave 2 may also be complete. Minor wave 3 may be underway and may have just moved through its middle today. If minute wave ii is yet to begin, then it may not move beyond the start of minute wave i below 3,127.66.

Minor wave 3 should exhibit strength.

TECHNICAL ANALYSIS

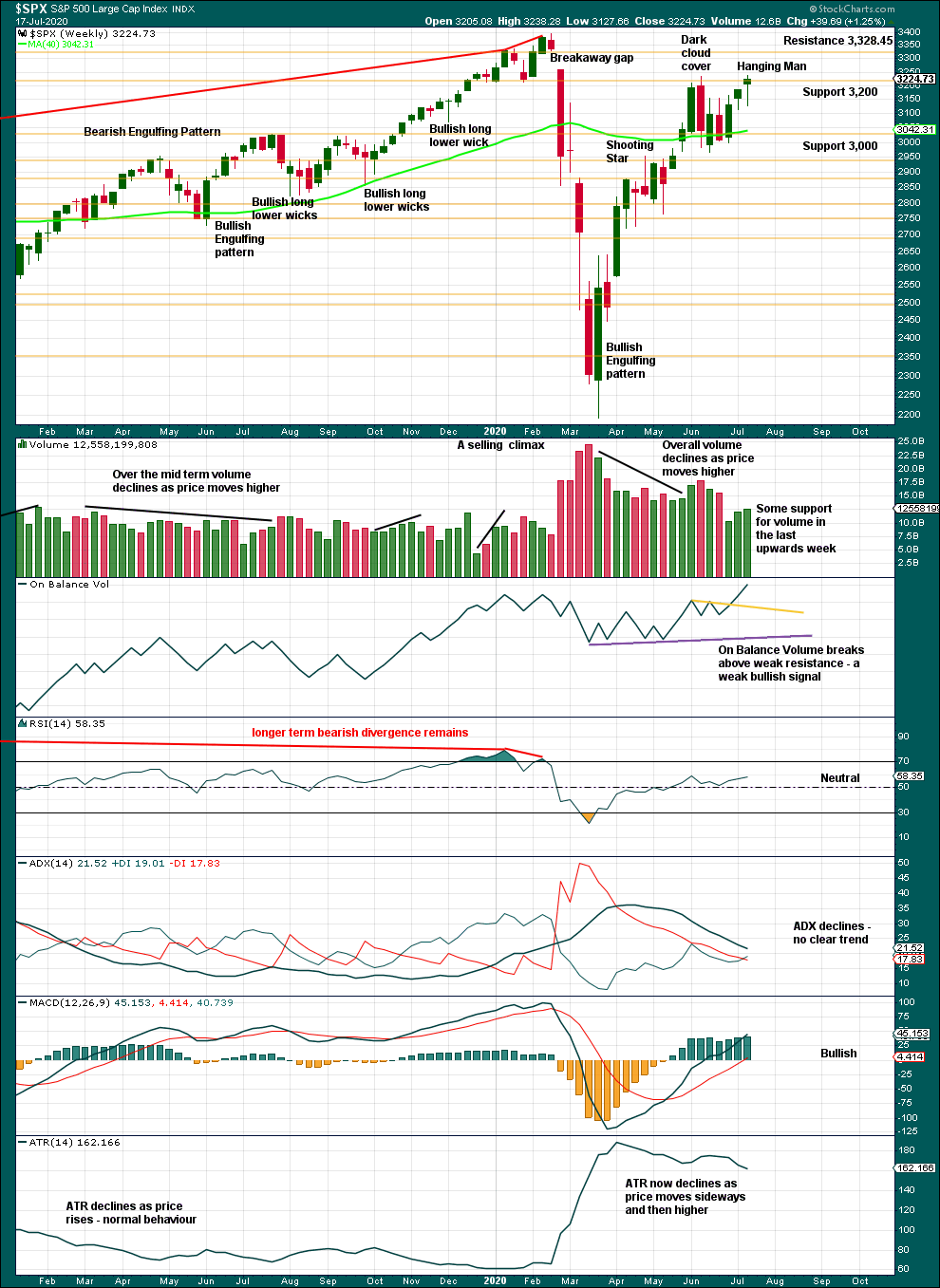

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week a bearish reversal pattern completes as a Hanging Man. However, the bullish implications of the long lower wick on a Hanging Man mean that the following candlestick should be bearish to give confidence in the Hanging Man as a reversal pattern. This essentially makes a Hanging Man a two candlestick reversal pattern.

Overall, this chart is bullish and offers some support to the bullish alternate wave count.

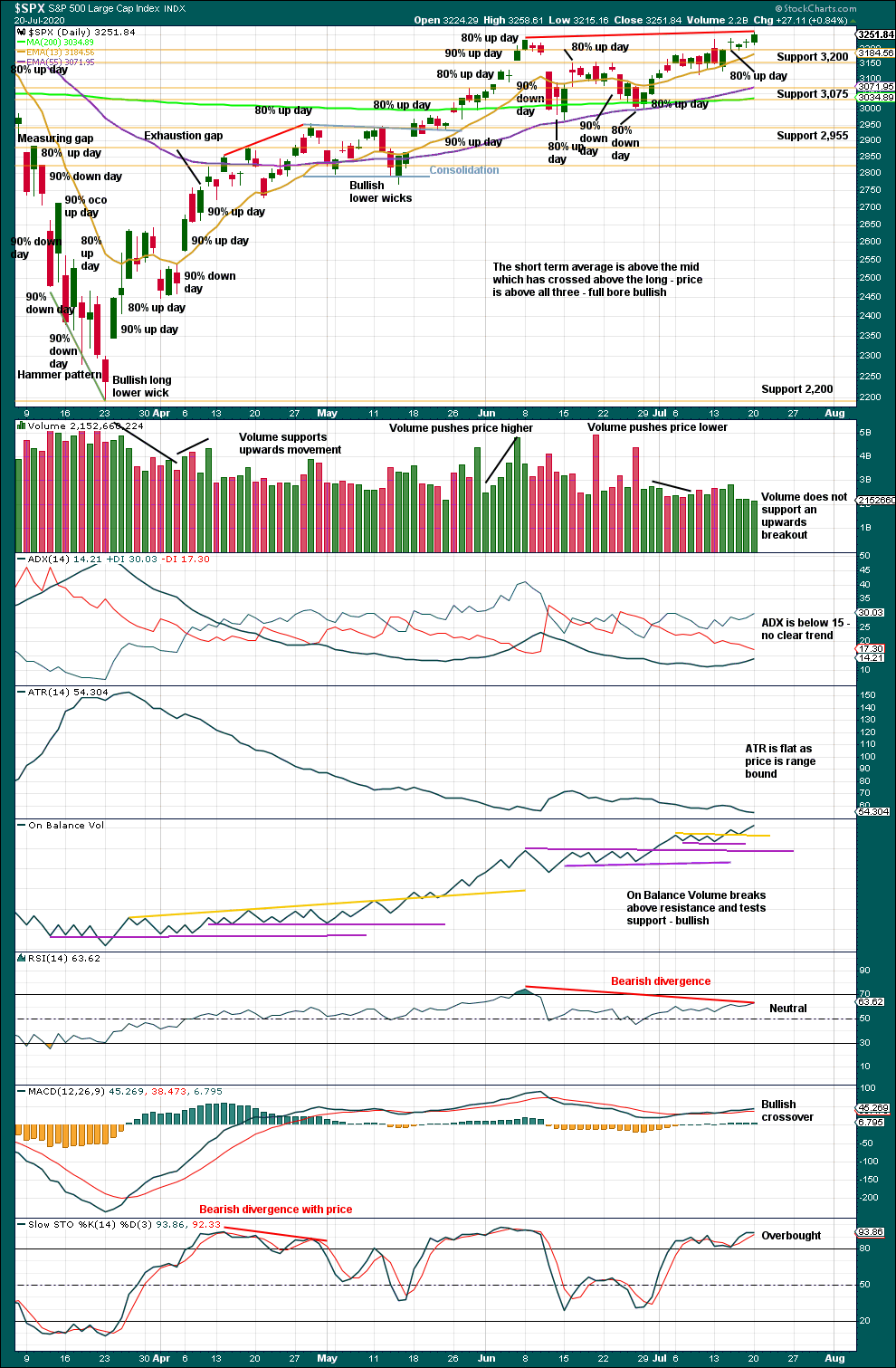

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The breakaway gap of 24th February has its upper edge at 3,328.45. A bearish analysis remains reasonable while this gap remains open. If this gap is closed, then a more bullish analysis that would expect new all time highs would increase in probability.

The high of the 8th of June has been breached today on a closing basis. But a lack of volume, which is a required for confidence in an upwards breakout, is a concern for a bullish scenario.

On Balance Volume is bullish, but now the short-term volume profile is bearish. Strong divergence between price and RSI is bearish.

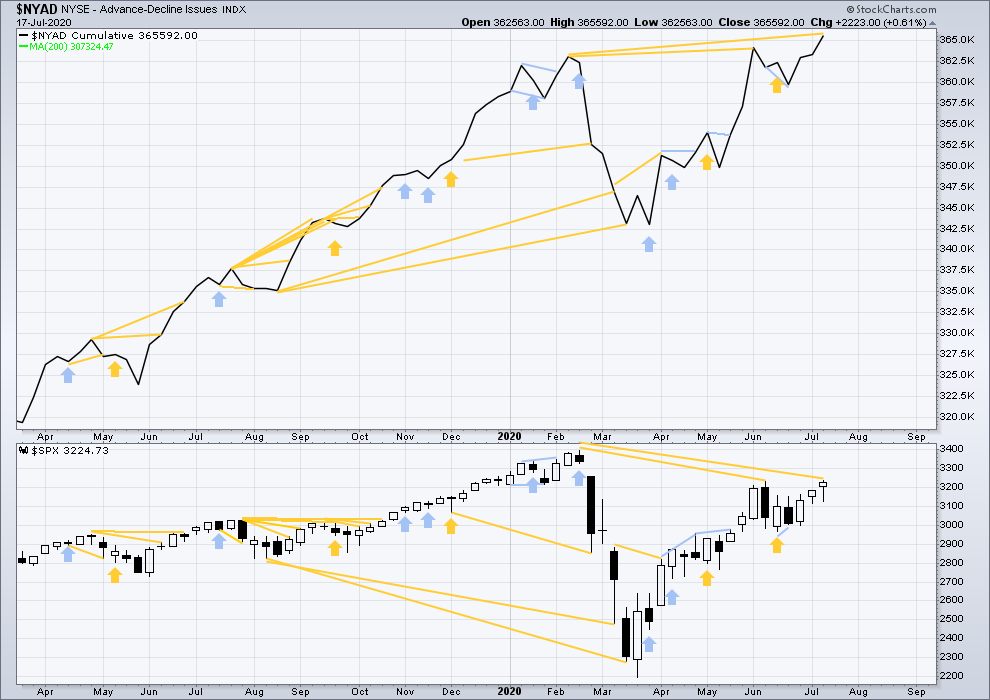

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Last week the NYSE all issues AD line has made a new all time high, although Lowry’s Operating Companies Only AD line still has not. This divergence is bullish and noted on this chart, but failure of the OCO AD line to confirm this divergence reduces the strength of the signal.

Large caps all time high: 3,393.52 on 19th February 2020.

Mid caps all time high: 2,109.43 on 20th February 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

At the end of last week, it is only large caps that have made new swing highs above the prior high of the 8th of June. Small and mid caps have not. The rise over the last five weeks is led mostly by large caps, so it lacks breadth. This is normal of an aged bullish move and supports the main Elliott wave count.

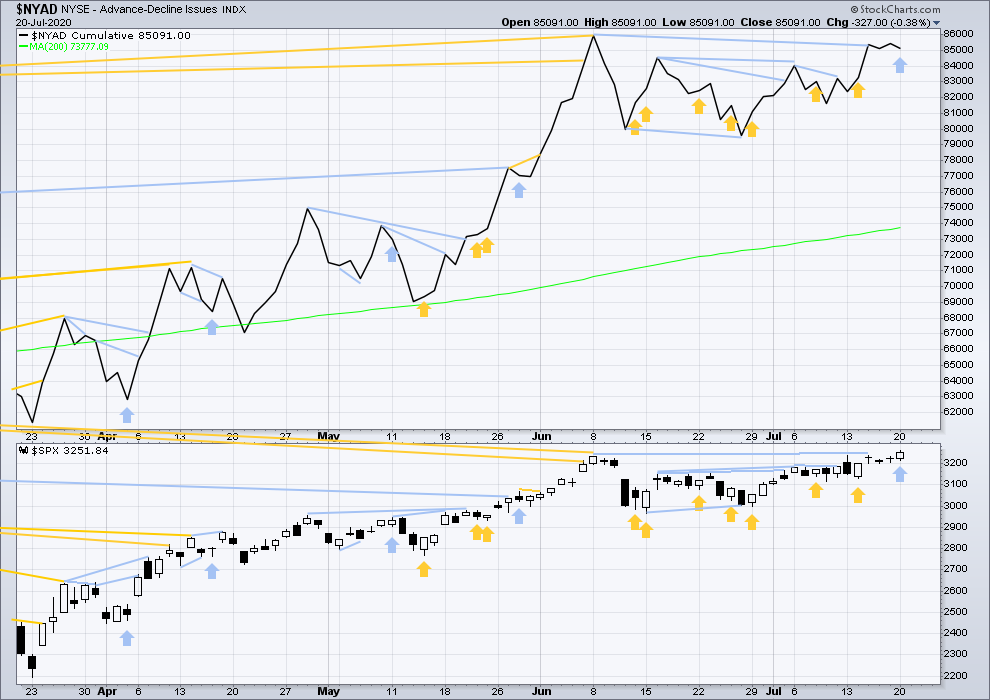

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Although the NYSE AD line has made new all time highs on the 8th of June 2020, Lowry’s OCO AD line did not. Bullish divergence may still support a bullish wave count.

The AD line has made a new swing low, but price has not. This divergence is bearish.

Today price has moved higher, but the AD line has moved lower. Upwards movement today has not come with support from rising market breadth. This divergence is bearish.

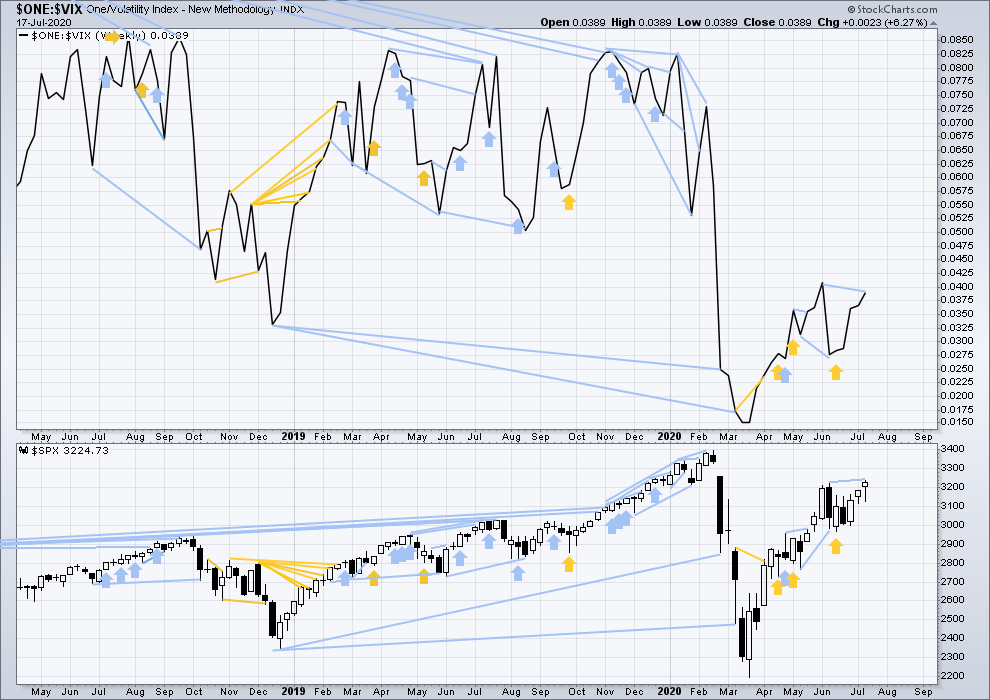

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Inverted VIX remains well below all time highs. There remains over two years of strong bearish divergence between price and inverted VIX.

Last week price has made a new short-term swing high above the prior swing high of the 8th of June, but inverted VIX has not. This divergence is bearish.

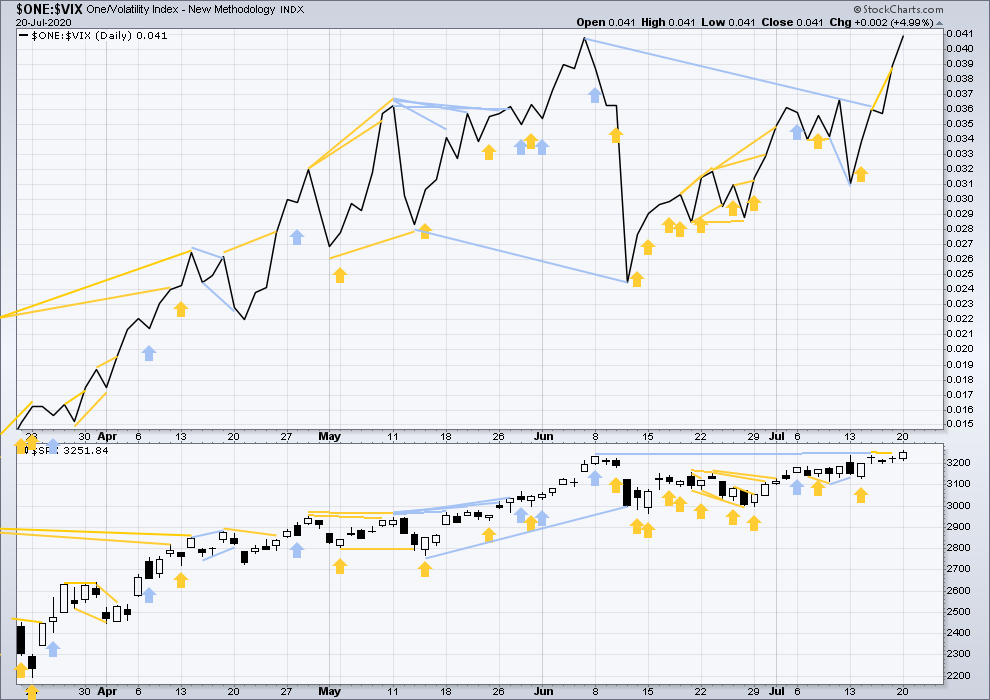

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

VIX has made a new swing low below the prior swing low of March 13th / 14th, but price has not. This divergence is bearish for the short to mid term and supports the main Elliott wave count.

Short-term bullish divergence has been followed by upwards movement, so it may now be resolved.

Today both price and inverted VIX have moved higher. There is no new divergence.

DOW THEORY

Dow Theory has confirmed a bear market with the following lows made on a closing basis:

DJIA: 21,712.53 – a close below this point has been made on the March 12, 2020.

DJT: 8,636.79 – a close below this point has been made on March 9, 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, a bear market has now been confirmed:

S&P500: 2,346.58 – a close below this point has now been made on March 20, 2020.

Nasdaq: 7,292.22 – a close below this point was made on the March 12, 2020.

At this time, to shift Dow Theory from viewing a bear market to confirmation of a new bull market would require new highs made on a closing basis:

DJIA – 29,568.57

DJT – 11,623.58

Adding in the S&P and Nasdaq for an extended Dow Theory:

S&P500 – 3,393.52

Nasdaq – 9,838.37 – closed above on June 8, 2020.

Published @ 06:25 p.m. ET

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.