For the short term, a pullback was expected to end about either 2,700 or 2,690. Downwards movement for the session reached below the second target to 2,681.90.

Summary: The target for a primary degree third wave to end is now at 2,913. This target may be reached in several weeks.

For the short term, the picture for tomorrow is unclear.

A new high tomorrow above 2,717.49 would indicate at least a little more upwards movement. The short term target would be at 2,734, where a consolidation may begin that could last from one to a very few days.

A new low below 2,671.17 would indicate a deeper pullback may continue towards 2,587 – 2,578.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

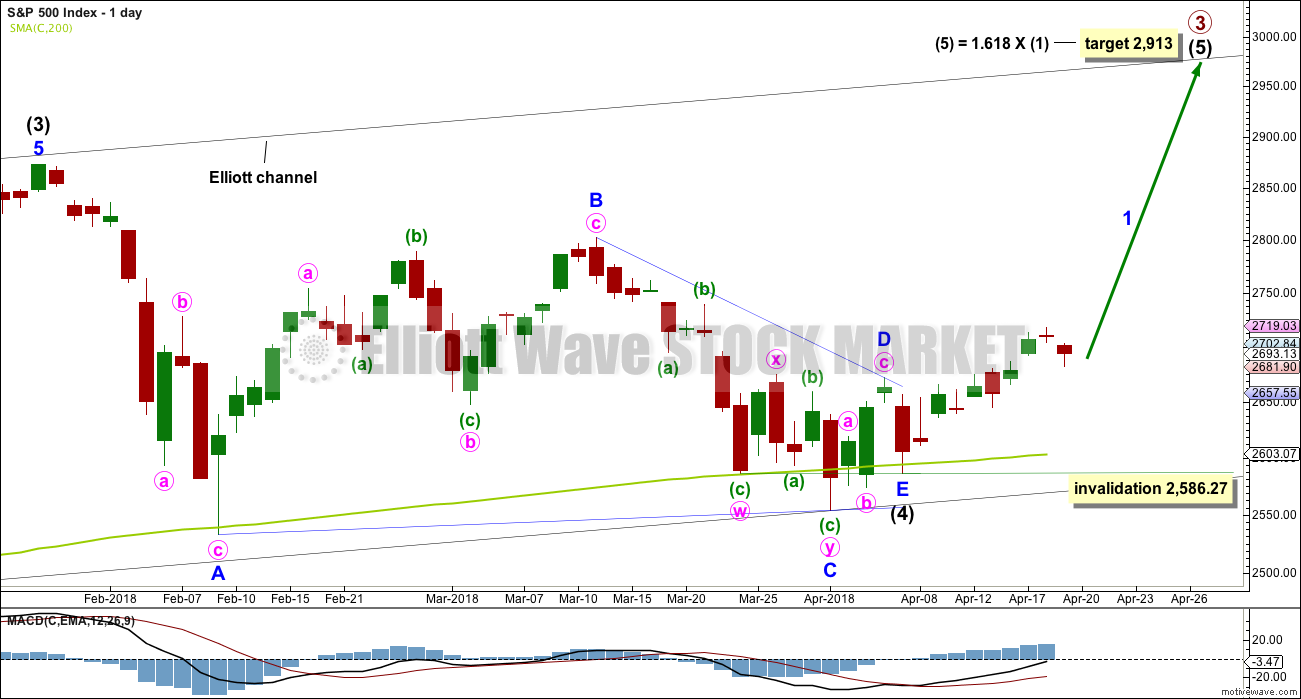

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique with a slight adjustment. The upper edge may provide resistance for intermediate wave (5).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. However, it would be extremely likely to remain within the wider teal channel (copied over from the monthly chart) if it were to be reasonably deep. This channel contains the entire bull market since the low in March 2009, with only two small overshoots at the end of cycle wave IV. If this channel is breached, then the idea of cycle wave V continuing higher would be discarded well before the invalidation point is breached.

Intermediate wave (4) will be labelled as a complete triangle today, lasting 11 weeks. If this labelling is correct, then there would be perfect proportion and perfect alternation between intermediate waves (2) and (4).

There is no adequate Fibonacci ratio between intermediate waves (3) and (1). This would make it more likely that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (3) or (1). The most common Fibonacci ratio for intermediate wave (5) would be equality in length with intermediate wave (1), but that would expect a truncation, which is unlikely. The next likely Fibonacci ratio in the sequence is used to calculate a target.

In terms of weeks none of intermediate waves (1), (2), (3) or (4) exhibit a Fibonacci duration. Intermediate wave (5) may also not exhibit a Fibonacci duration, which makes an estimate on how long it may last very difficult. It may be expected to last several weeks, at least 8.

DAILY CHART

Intermediate wave (4) may be a complete regular contracting triangle, which may have come to a quicker than expected end.

All sub-waves subdivide as single or multiple zigzags. Only one sub-wave is a more complicated multiple, which was minor wave C, which is the most common triangle sub-wave to subdivide as a multiple. Minor wave E falls well short of the A-C trend line, which is the most common way for triangles to end.

Intermediate wave (5) must subdivide as a five wave structure. It may only be an ending diagonal or an impulse. An impulse is much more common, so it will be expected until proven otherwise. Within both an impulse or diagonal, minor wave 2 may not move beyond the start of minor wave 1 below 2,586.27.

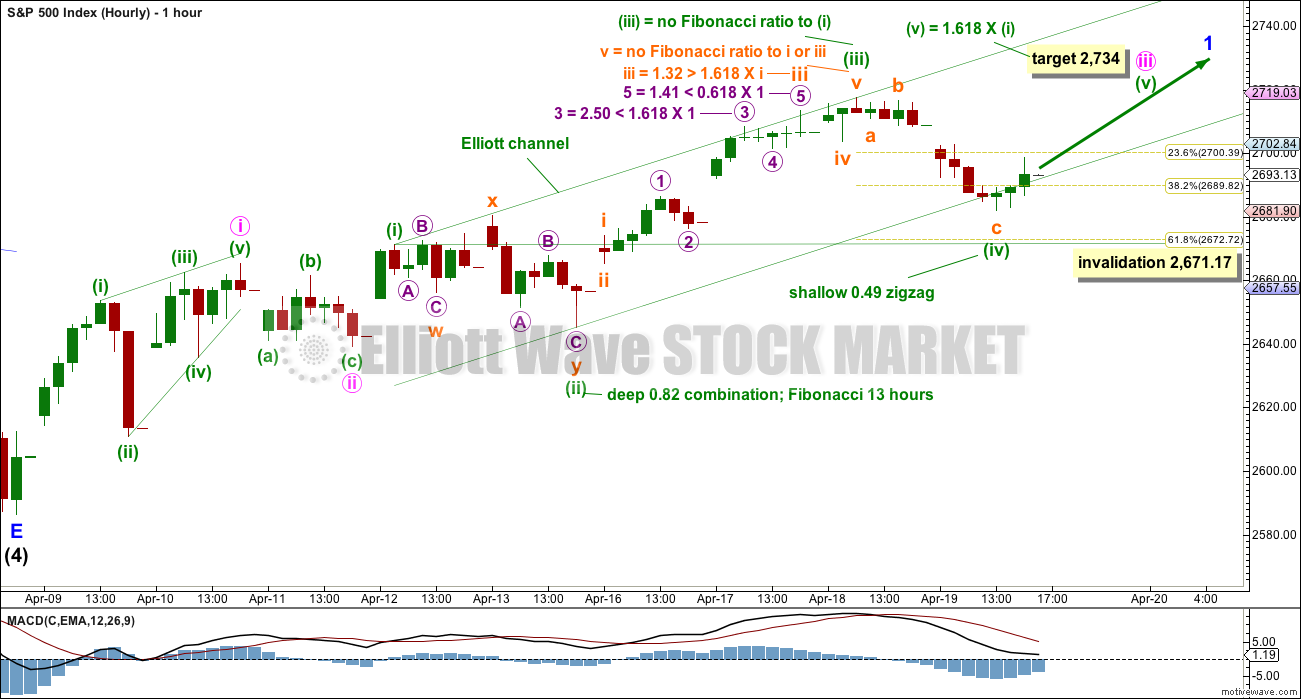

HOURLY CHART

Within intermediate wave (5), minor wave 1 may be an incomplete impulse.

So far within minor wave 1, minute wave i fits as a leading contracting diagonal. This was followed by a shallow zigzag for minute wave ii. Minute wave iii may be incomplete.

Minute wave iii may only subdivide as an impulse. So far within it minuette waves (i) through to (iv) may now be complete.

Minuette wave (iv) may have ended close to the lower edge of the Elliott channel and a little below the 0.382 Fibonacci ratio. There is perfect alternation here between minuette waves (ii) and (iv).

If minuette wave (v) were to only reach equality in length with minuette wave (i), it would be truncated. The next Fibonacci ratio in the sequence is used to calculate a target.

If it continues further tomorrow, then minuette wave (iv) may not move into minuette wave (i) price territory below 2,671.17.

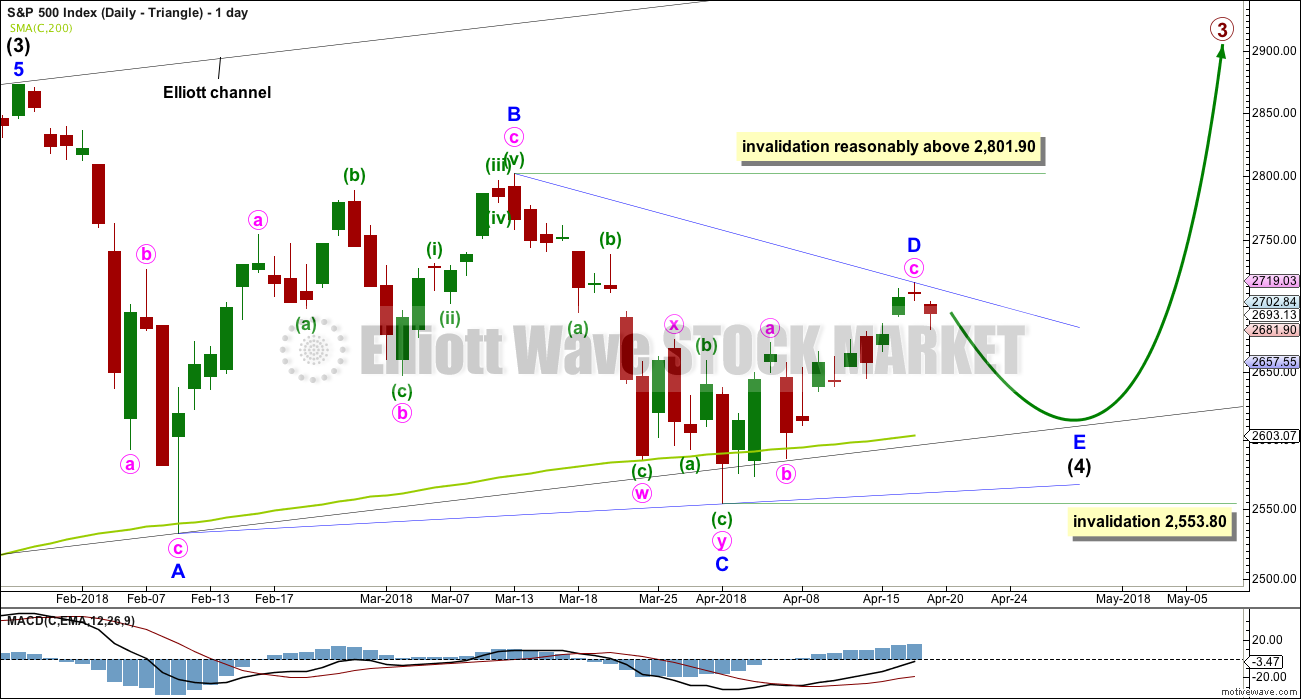

ALTERNATE WAVE COUNTS

DAILY CHART – TRIANGLE

It remains possible that the triangle is incomplete.

The triangle may be either a regular contracting or regular barrier triangle. Within the triangle, minor waves A, B and C may be complete.

If intermediate wave (4) is a regular contracting triangle, the most common type, then minor wave D may not move beyond the end of minor wave B above 2,801.90.

If intermediate wave (4) is a regular barrier triangle, then minor wave D may end about the same level as minor wave B at 2,801.90. As long as the B-D trend line remains essentially flat a triangle will remain valid. In practice, this means the minor wave D can end slightly above 2,801.90 as this rule is subjective.

It is possible that minor wave D could be over today, so an hourly chart is provided for this idea.

Minor wave E would most likely fall reasonably short of the A-C trend line.

If this all takes a further two weeks to complete, then intermediate wave (4) may total a Fibonacci 13 weeks and would be just two weeks longer in duration than intermediate wave (2). There would be very good proportion between intermediate waves (2) and (4), which would give the wave count the right look. However, two more weeks at this time does not look like it may be long enough for a triangle to complete. It may not exhibit a Fibonacci duration.

There are now a few overshoots of the 200 day moving average. This is entirely acceptable for this wave count; the overshoots do not mean price must now continue lower. The A-C trend line for this wave count should have a slope, so minor wave C should now be over.

Within the zigzag of minor wave D, minute wave b may not move beyond the start of minute wave a below 2,553.80.

HOURLY CHART – TRIANGLE

It is possible that minor wave D is a complete zigzag. If it is complete, then within it there is no Fibonacci ratio between minute waves a and c.

The best fit channel is very similar to the Elliott channel on the first hourly chart. Price remains mostly within the channel; it has not been breached by clearly downwards movement.

If a zigzag is complete, then within minute wave c there is a problem of disproportion between minuette waves (ii) and (iv). The S&P does not always exhibit good proportions between its corrective waves; this wave count is still valid though and should be considered, but the disproportion does reduce its probability.

If price breaches the best fit channel and makes a new low tomorrow below 2,671.17, then this would be the main wave count. Minor wave E would most likely fall reasonably short of the A-C trend line and may end about 0.8 to 0.85 the length of minor wave D. Minor wave E may last a few days.

Within minor wave E, a bounce for minute wave b may not move beyond the start of minute wave a above 2,717.49.

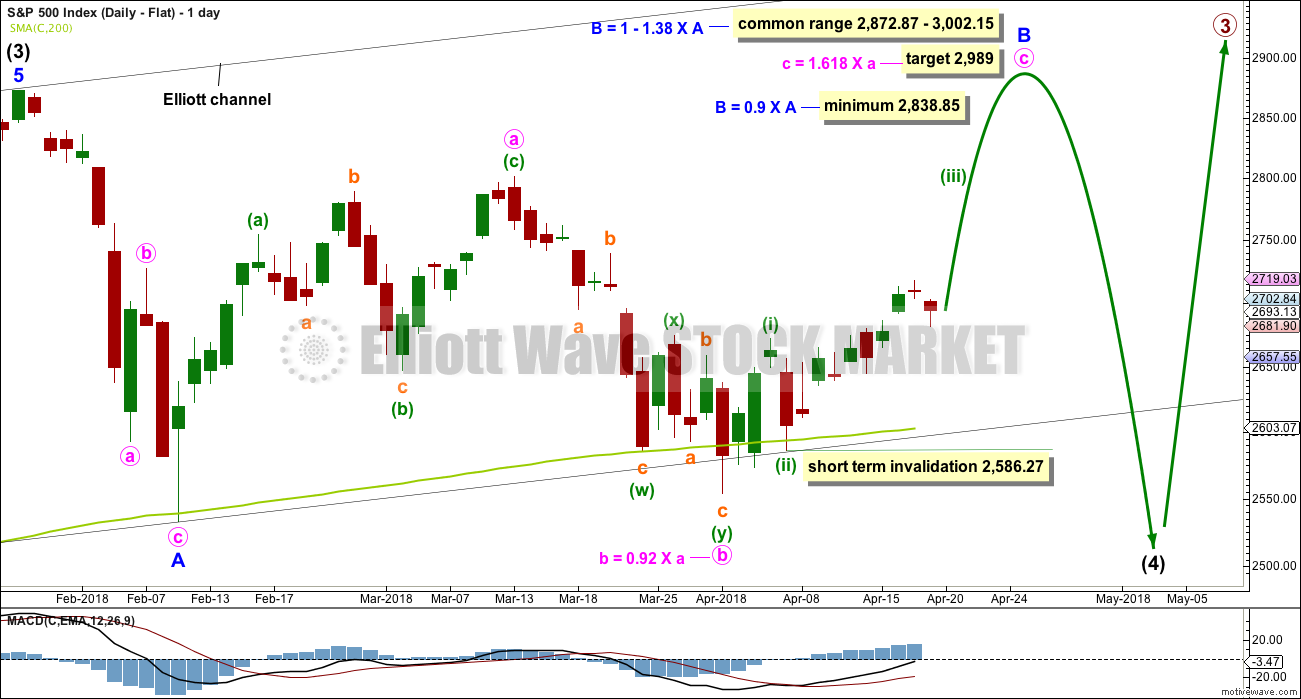

DAILY CHART – COMBINATION

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but in my experience this is very rare, so it will not be expected. The much more common flat for minor wave Y will be charted and expected.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. It may also be a double zigzag.

Minute wave b must now reach a minimum 0.90 length of minute wave a. Minute wave b must be a corrective structure. It may be any corrective structure. It may be unfolding as a zigzag. A target is calculated for it to end. Within minuette wave (b), no second wave correction may move beyond its start below 2,586.27.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely but does have precedent in this bull market.

Minute wave b may make a new high above the start of minute wave a if minor wave Y is an expanded flat. There is no maximum length for minute wave b, but there is a convention within Elliott wave that states when minute wave b is longer than twice the length of minute wave a the idea of a flat correction continuing should be discarded based upon a very low probability. That price point would be at 3,050. However, if price makes a new all time high and upwards movement exhibits strength, then this idea would be discarded at that point. Minute wave b should exhibit obvious internal weakness, not strength.

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above. A target is today calculated for minor wave B to end, which would see it end within the common range.

Minor wave B may be a regular flat correction, and within it minute wave a may have been a single zigzag and minute wave b may have been a double zigzag. This has a very good fit.

At its end minor wave B should exhibit obvious weakness. If price makes a new all time high and exhibits strength, then this wave count should be discarded.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This is possible but may be less likely than a smaller breach.

TECHNICAL ANALYSIS

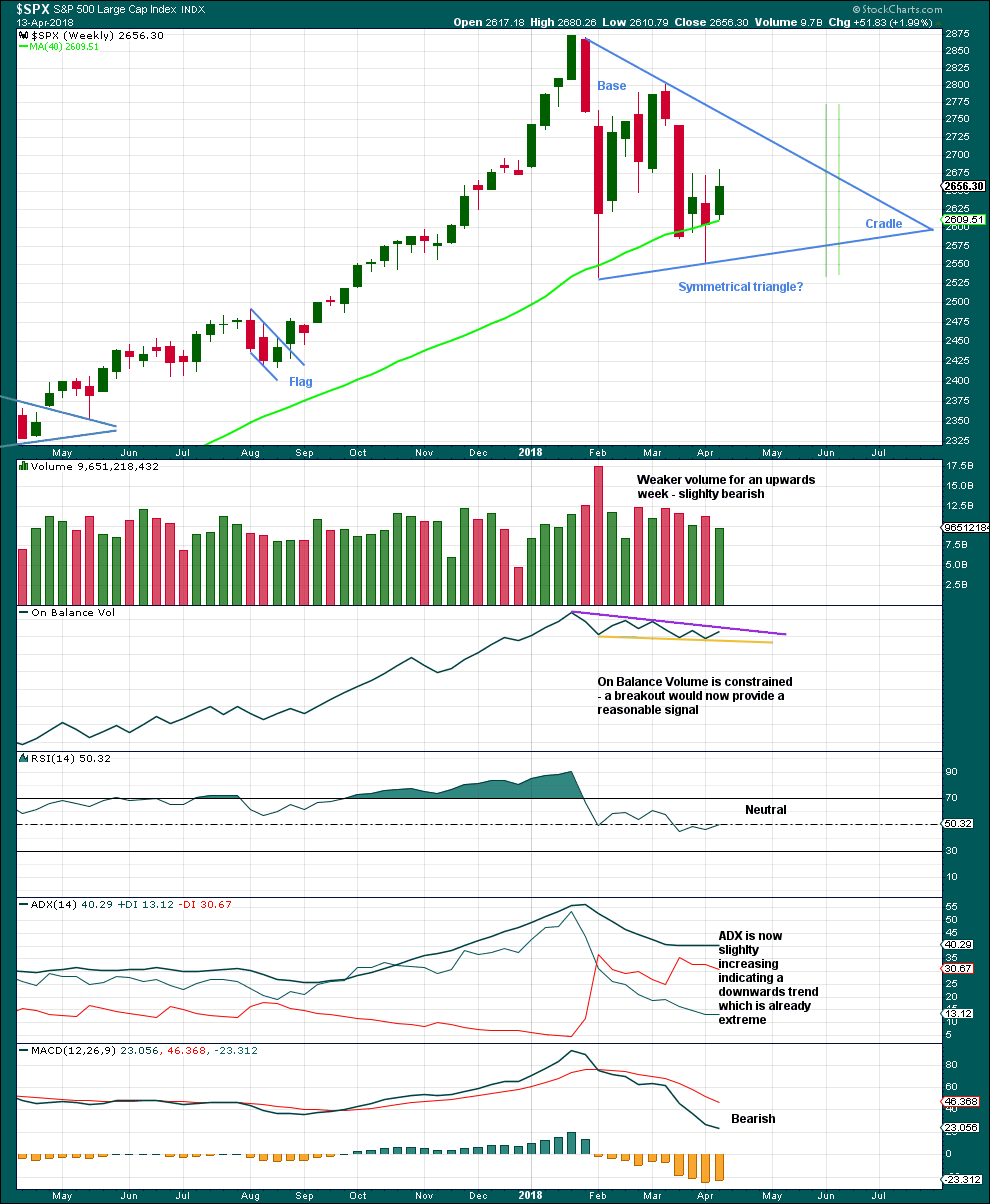

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout has not yet happened. There is a high trading range within the triangle, but volume is declining.

The triangle may yet have another 8 – 9 weeks if it breaks out at the green lines.

Before that happens though On Balance Volume may give a signal. It must give a signal in the next one to very few weeks as the trend lines are converging.

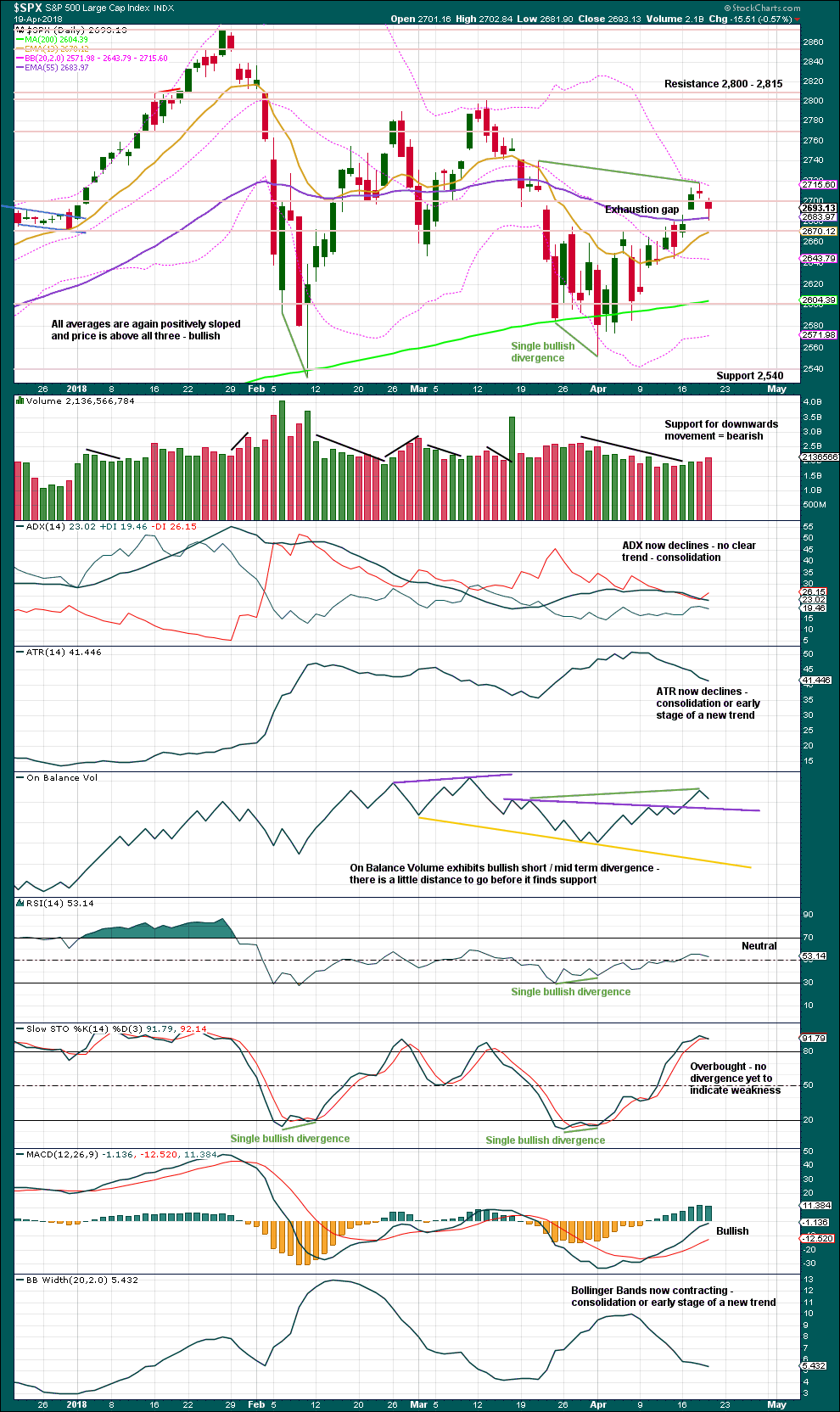

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last gap is now closed. It can no longer be labelled a measuring gap. It should now be labelled an exhaustion gap. This supports the second hourly chart for the Daily – Triangle wave count, which expects a pullback to last a few days has begun. Look for support about 2,670 and below that about 2,600. Volume today also supports this view.

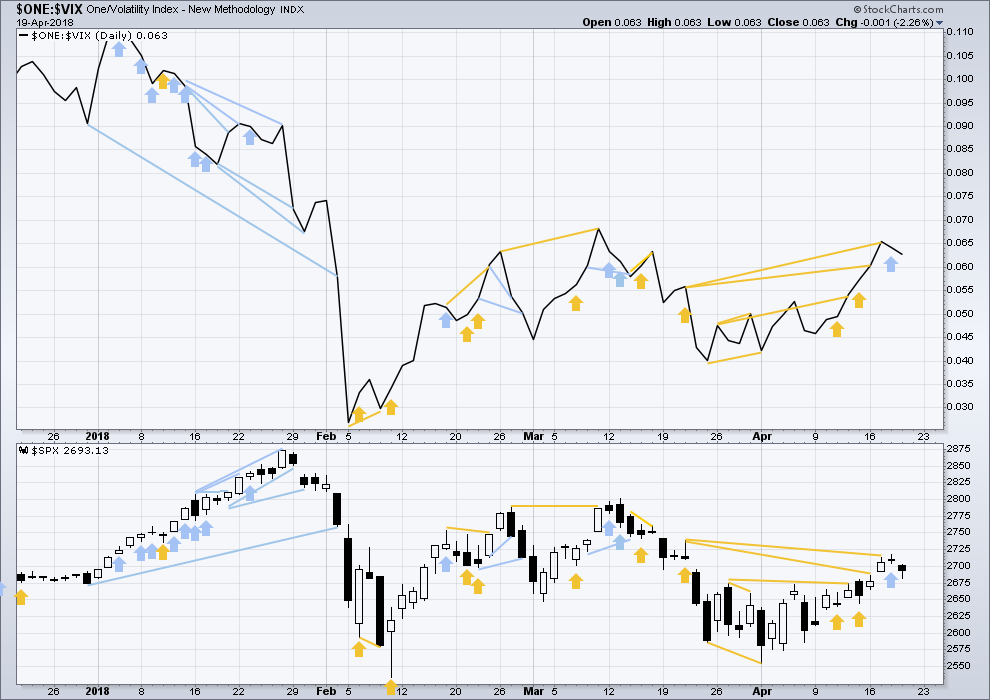

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Bearish divergence yesterday between price and inverted VIX has now been followed by a downwards day. It may be resolved here, or it may need another downwards day to resolve it. There is no new divergence today between price and inverted VIX.

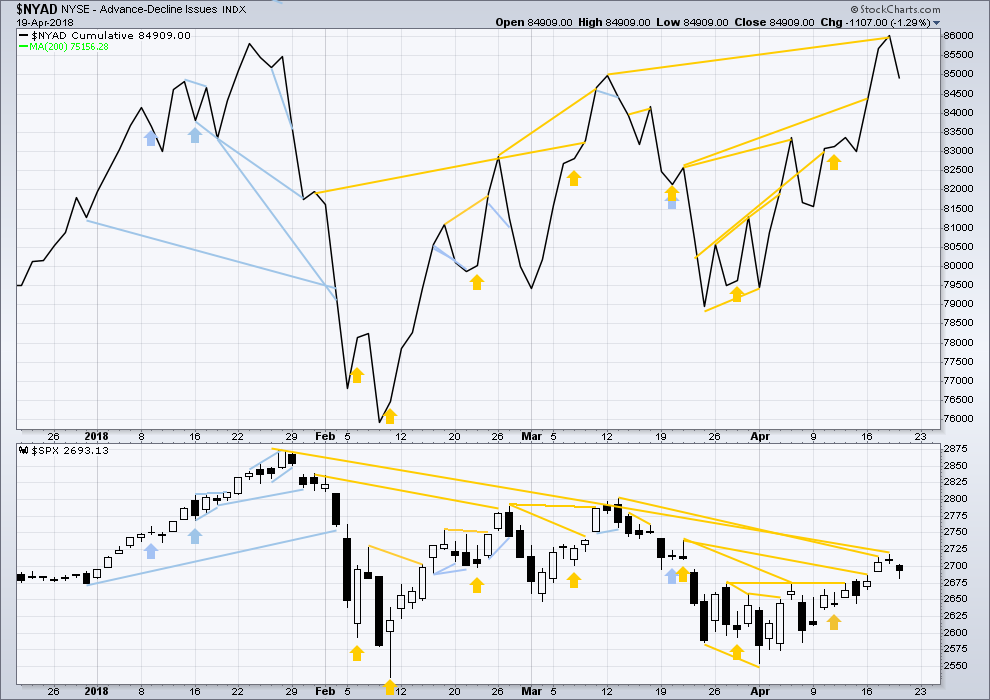

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps last week moved higher. There is no divergence to indicate underlying weakness. The small caps this week are rising faster than mid and large. Small caps made a slight new high yesterday above the prior swing high of the 13th of March. Small caps are very close to a new all time high.

Breadth should be read as a leading indicator.

The new all time high from the AD line remains very strongly bullish and supports the main Elliott wave count.

For the short term though, downwards movement from price today has good support from declining market breadth. This is bearish.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:15 p.m. EST.

Hi Lara,

I have a question for you. You indicated that if we don’t hold 2671 that we could head toward 2578-2587. I read an article today that the S&P was forming a bearish head and shoulders pattern. Is there a risk that we would cross the neckline of a bearish head and shoulder pattern if we retraced as far as 2578? I don’t know the rules for these patterns.

Respectfully yours,

Andrew

I’m looking at the daily chart and I’m really struggling to see a head and shoulders pattern.

Looking back at prior small swing highs prior to 26th of Jan, I can’t see a good left hand shoulder in there.

And I would want to be seeing the ATH on the 26th of Jan as the head.

A chart of the idea would be helpful

There’s an Inverse H&S on the daily with a target for S&P to 2,800.

the question was about a bearish H&S pattern

I too can see a bullish inverse H&S pattern

but I can’t see a bearish pattern

this question has come up before, with the statement that there is a bearish H&S pattern forming, and I still haven’t seen a chart that shows it

and I can’t see where it could possibly be.

Looking at the daily chart again carefully I think the shape does not look quite right for a triangle. minor wave A seems disproportionately long compared to Minor B i.e. I think the drop in minor wave A was too deep for a triangle and could be more like a wave 1.

Just my tpw!

Minor A is the briefest wave so far at only 10 sessions.

Minor B was a 0.79 length of minor A, which is in my experience exceptionally close to a very common length of about 0.8 to 0.85.

So to my eye minor A is neither too time consuming nor too long. It looks just fine.

You are in essence proposing a series of unfolding first and second waves. That is certainly possible. The thesis is testable in that if correct, it predicts a demolition of the 200 day SMA on the next encounter in a third wave down. You will certainly have a definitive answer next week. I just so happened to be positioned for either a completing triangle or third wave with bull and bear spreads. Serious adjustments will be made depending on what transpires at the ole’ 200 day.

Back to the old triangle idea. Minor wave E now underway.

When there’s a five down that may be minute a.

Then expect a bounce for minute wave b.

Finally minute c down.

Triangles can sometimes come to a quicker than expected end, I’ve been surprised by them before. Let us look out for that possibility.

If this wave count is correct then we may be about to retest the 200 day MA. If that happens, then it may provide a perfect entry point for a long position which may be held for months.

updated daily chart which must again be the main count, because the new idea is invalidated by price

Yep! 🙂

The false break above the 50 day virtually gurantees a 200 day revisit.

Heck, the banksters had even bearish old me bamboozled!

Now there is a huge caveat here methinks. We are all assuming that the 200 day will provide support as it has the last few tags. BB activity are suggesting some danger there. What the bulls do not want to see is a clean slice through and a CLOSE below….that would berry, berry bad for the bulls!

Have a great weekend everybodiiie!

And that is the long position I have been waiting for since the end of January top. The timing works perfect for me as I have a lot of family vacations and solo backpacking trips planned for the summer starting next month through September. Buy in May and Go Away!

I wonder what is the status of my t-shirt that reads:

Front Side – “I hate B waves”

Back Side – “I Hate Triangles”

How about…

“3’s Please Me!”

And the back…

“I Short the 4’s”

There ya go!

B waves, probably….but…I love triangles! 🙂

Waiting for SPY @ 265 to go long. Good support with gap fill, fib 38.2 and 200ma on a 30min timeframe

I am sure MMs would be happy to sell to you at 265.00 🙂

I see a low of 265.61, nice call. Did you get it?

No, I had my SPY buy at 265.10. Hopefully, that gap will be filled Monday. That’s the only gap to be filled…I’m playing the wedge to 273-275.

Anybody have a count ? Should I just sit out the E?

Well…for what it’s worth, I see a fairly clear ABC down here off the high from a day ago. On the 5 minute it’s not too hard to see a 5-3-5 structure to it, now complete. Your wave count mileage may vary…a lot!! Despite the 50 day, despite the 2671 invalidation…I’m not yet convinced this market is generally headed down yet in that E wave. But if it renews hitting fresh lows here or Monday….get short or get small!!

Today’s optionsX shenanigans

Wave E started?

Any thoughts we have breached the 2671 level

Please share

Appears to be so. That said, I’m sure Mr. Market will do its best to sow confusion and doubt nonetheless.

2466? How do you get there ?

I’ve got a protective short on but what I’m really waiting for is the bearish symmetry of this down move on the 1 minute chart to get broken to the upside and signal a short term trend change to up. Which seems to have just happened…The sell off here is consistent…but not really very strong. Yet anyway.

VIX hasn’t moved much in this little sell off…seems rather bullish short term to me.

Each of the mid Feb, late Feb, and early Mar swing highs had the same pattern being shown here: a gap open up day, a turn at the top day, then an initial down day. Followed in two of the three by large ripping sell offs; one only went down a bit more for two days before pushing higher again. A rather bearish pattern of late repeating here.

As traders it is so easy to miss the forrest for the trees and it never ceases to amaze me!

The important thing right now is what is happening around the 50 day….

Trade safe.

What is the VIX telling us today?

I think all signals, including VIX are hopelessly skewed. We have all seen how often price is doing the exact opposite of what we were expecting based on technical indicators. A number of articles have been appearing recently pointing out some of the anomalies in VIX I have been talking about for years. I am not at all convinced it remains a very useful metric.

Lol!!! Those pesky indicators never did work anyway. And it’s 4/20, so there’s an awful lot of skewedness today! Including the market, though tell me, is it skewed…or skewered??

Make mine Kabob….Thank You! 😀

But semi-seriously, we now need to very seriously consider a revisit to the 200 day….

And below, IMO. 2466.

First!

Ah-ThanQ 🙂