Price moved lower.

The main Elliott wave count was invalidated and an alternate Elliott wave count was confirmed.

Summary: Overall, next week should continue with downwards movement to end about 2,147.58. On Balance Volume is giving a stronger bearish signal but VIX and the AD line indicate this downwards movement is weak.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

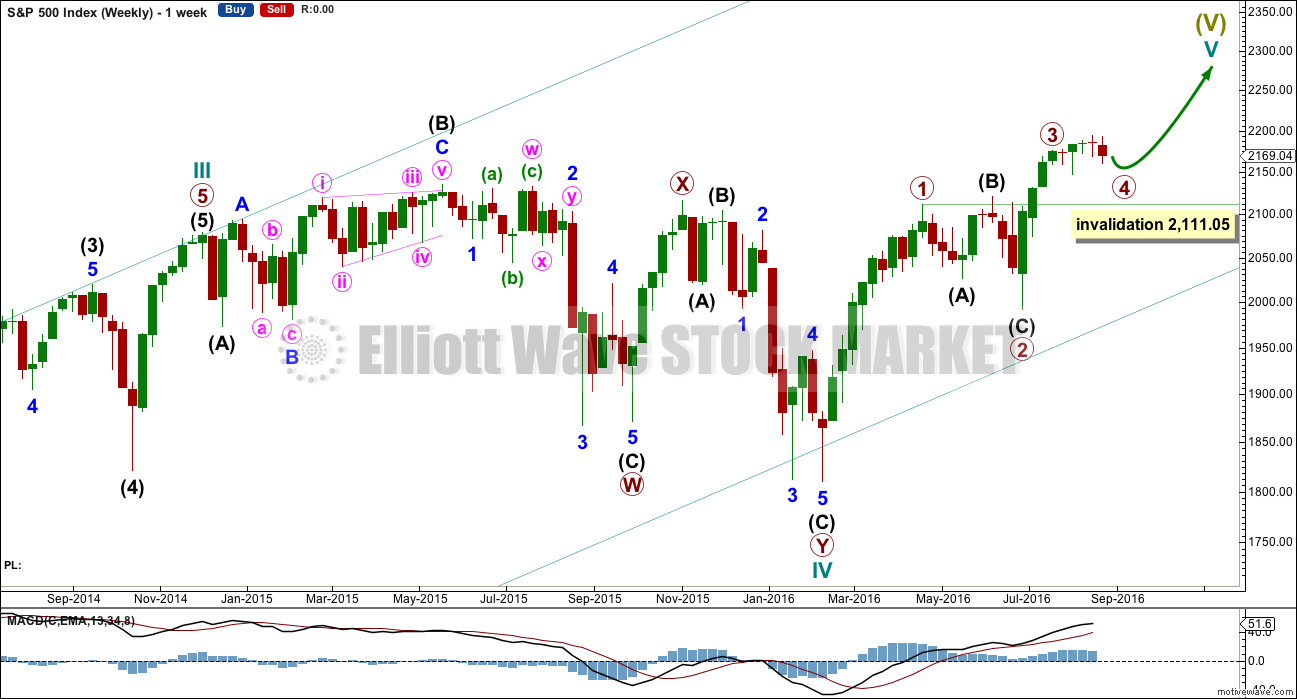

MAIN WAVE COUNT

WEEKLY CHART

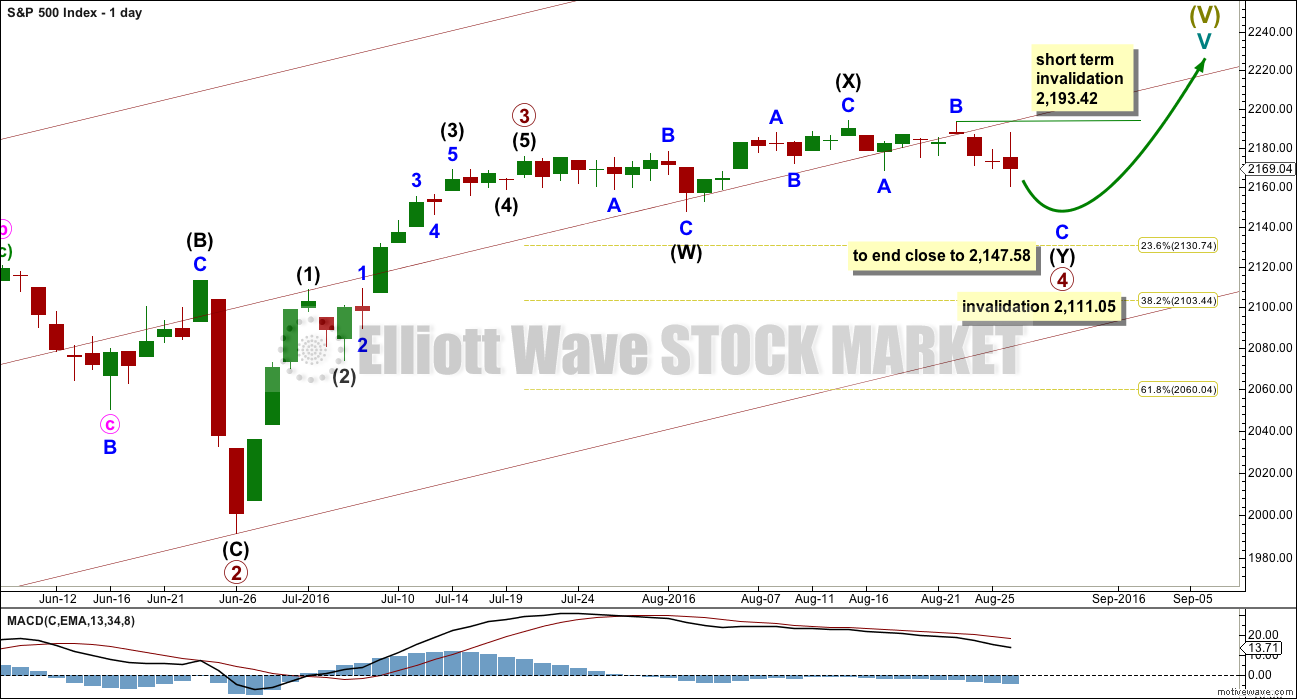

This is the new main wave count.

Cycle wave V must subdivide as a five wave structure. So far upwards movement is unfolding as an impulse with the fourth wave completing. This may be primary waves 1, 2, 3 and now 4, with primary wave 5 upwards still to come.

Primary wave 3 is shorter than primary wave 1, but shows stronger momentum and volume as a third wave normally does. Because primary wave 3 is shorter than primary wave 1 this will limit primary wave 5 to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 will be limited to no longer than 183.95 points in length.

Primary wave 2 was a shallow 0.40 expanded flat correction. Primary wave 4 may be exhibiting alternation as a more shallow double combination.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

Primary wave 2 lasted 47 days (not a Fibonacci number). Primary wave 3 lasted 16 days (not a Fibonacci number). So far primary wave 4 has lasted 27 days. So far the proportion between primary waves 2 and 4 give this wave count the right look, especially if primary wave 4 continues further.

If primary wave 4 exhibits a Fibonacci number in days of duration, then the next Fibonacci number in the sequence is 34. It may end in another seven days.

Within primary wave 4, the first structure in the double is an expanded flat labelled intermediate wave (W). The double is joined by a three in the opposite direction, a zigzag labelled intermediate wave (X). There is no limit to X waves within combinations, and they may make new price extremes beyond the start of the correction in the same way as B waves within flat corrections may.

The second structure in the double is unfolding as a zigzag labelled intermediate wave (Y). Double combinations have a purpose to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends close to the same level as the first. Intermediate wave (Y) is likely to end close to 2,147.58.

While double combinations are relatively common, triples are very rare. When the second structure in the double is complete, then the probability that the whole correction is over would be very high.

In the short term, while the structure of minor wave C is incomplete, no second wave correction within it may move beyond the start of its first wave above 2,193.42.

When primary wave 4 is complete, then a target may be calculated for primary wave 5 to end. That cannot be done yet.

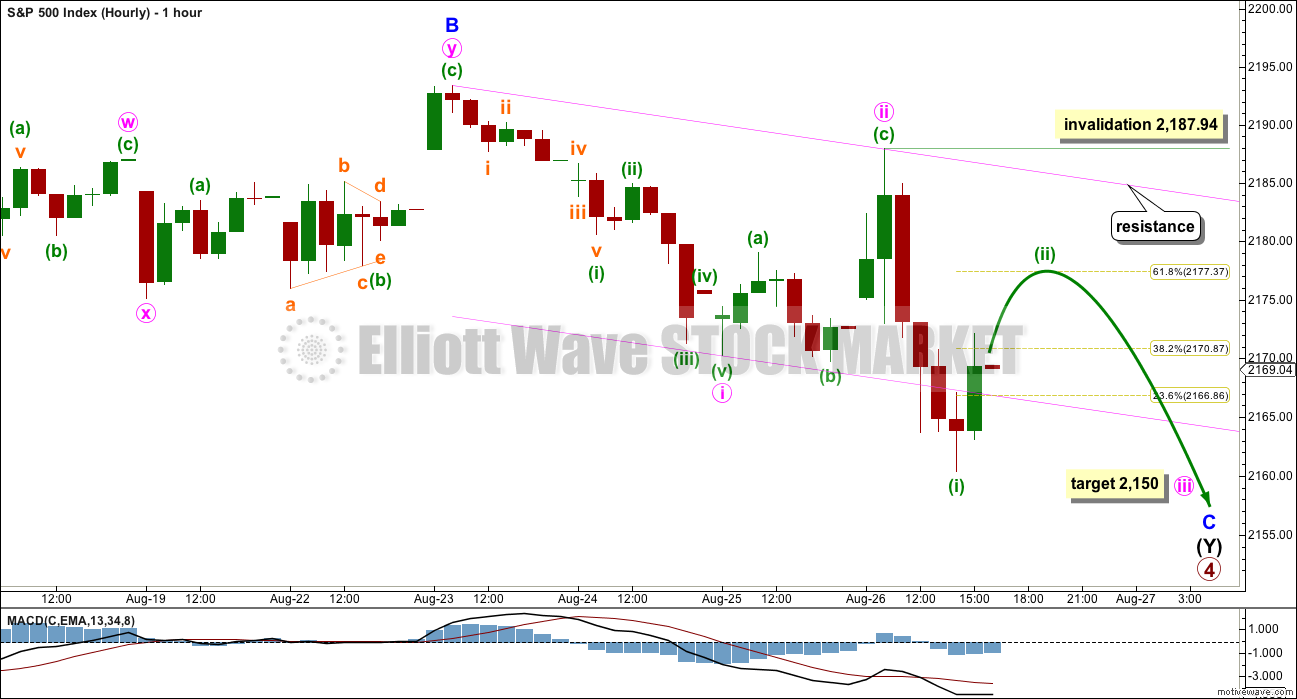

HOURLY CHART

Minor wave C must subdivide as a five wave structure. So far, within minor wave C, a five down for minute wave i is complete followed by an expanded flat for minute wave ii.

At 2,150 minute wave iii would reach 1.618 the length of minute wave i.

Minute wave iii must subdivide as an impulse. Within minute wave iii, minuette wave (ii) may not move beyond the start of minuette wave (i) above 2,187.94. Minuette wave (ii) may end close to the 0.618 Fibonacci ratio of minuette wave (i) at 2,177.

The pink channel is a base channel about minute waves i and ii. When minuette wave (ii) is complete, then minuette wave (iii) should have the power to break below support at the lower edge of the channel. Once it has done that, then the lower edge may provide resistance.

Minuette wave (ii) should find resistance at the upper edge of the base channel.

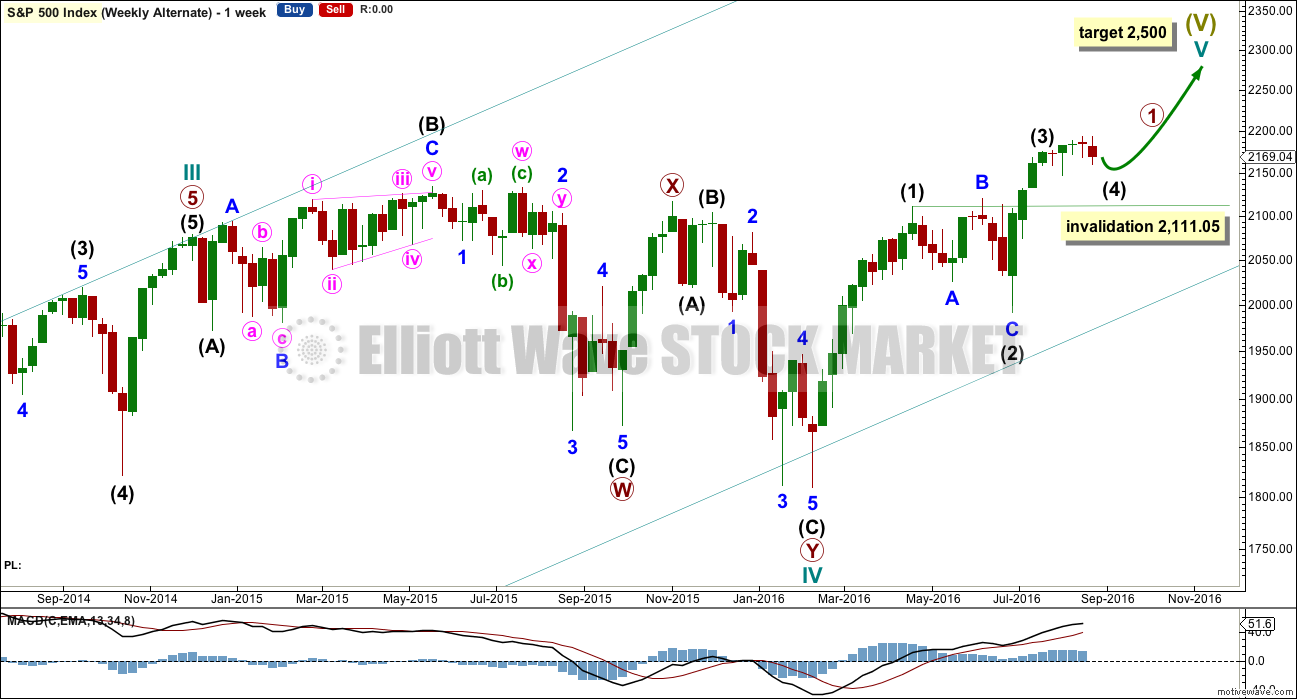

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate is identical to the main wave count with the exception of the degree of labelling within cycle wave V.

Here the degree of labelling is moved down one degree. It is possible that only primary wave 1 is completing as a five wave impulse. When it is complete, then primary wave 2 would be expected to be a deep pullback which may not move beyond the start of primary wave 1. At that stage, the invalidation point would move down to the start of cycle wave V at 1,810.10. At that stage, a new low below this point would confirm a bear market for both Elliott wave and Dow Theory.

At 2,500 cycle wave V would reach equality in length with cycle wave I. This is the most common ratio for a fifth wave, so this target has a good probability.

At this stage, this alternate wave count differs only in the degree of labelling to the main wave count, so subdivisions for daily and hourly charts would be labelled the same.

TECHNICAL ANALYSIS

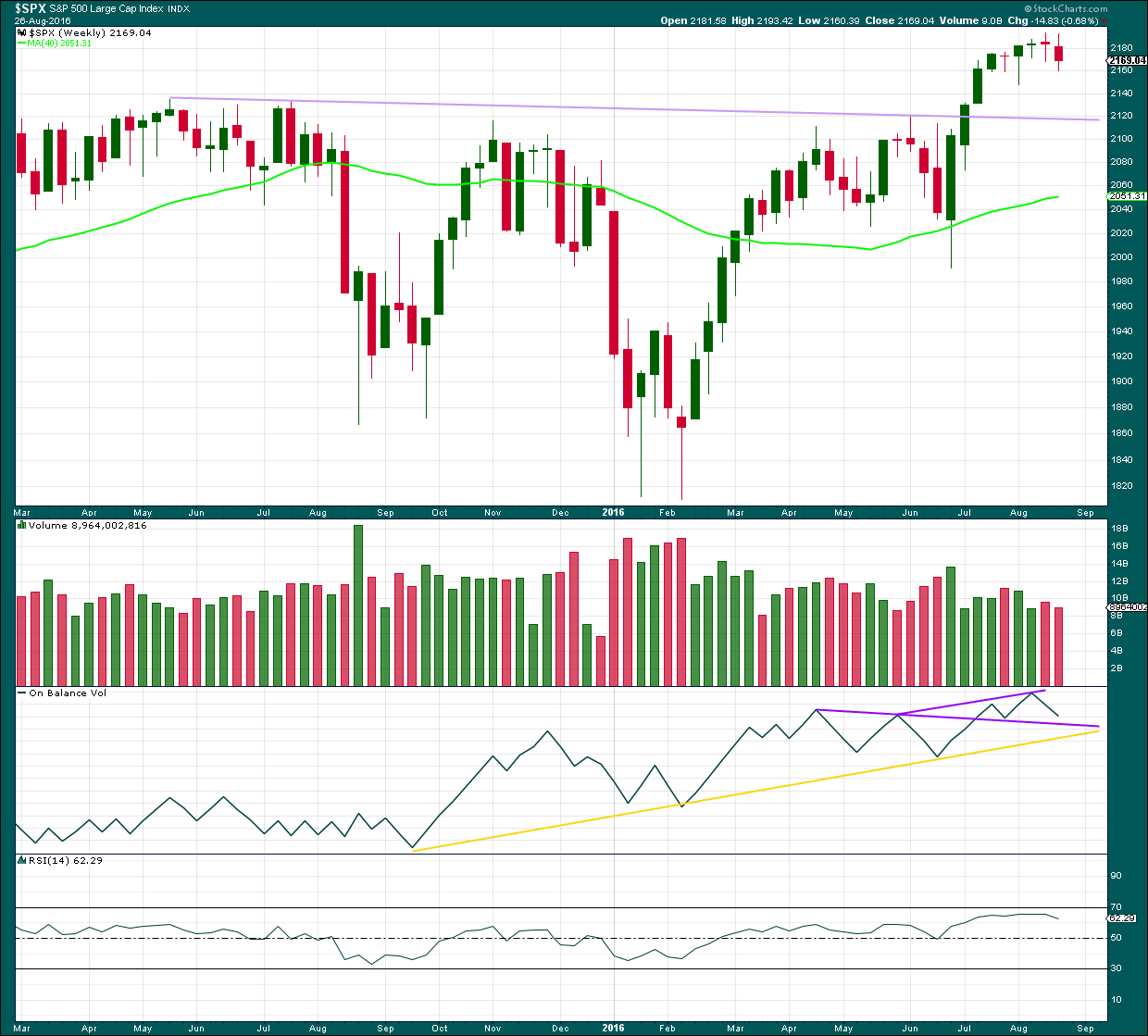

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week completes a red weekly candlestick with lighter volume than last week. The fall in price was not supported by volume at the weekly chart level.

The last four candlesticks complete an Evening Doji Star candlestick pattern. After a clear upwards trend, this is a reversal pattern and indicates a reversal from up to either down or sideways, and makes no comment on how far price may move lower. The last candlestick in the pattern does not have support from volume weakening the reversal implications of the pattern.

This weekly candlestick also completes a Bearish Engulfing pattern with the candlestick three weeks before. The low of this week is well below the open of the week three weeks ago. Again, the pattern is not supported by volume which weakens the reversal implications.

On Balance Volume is coming lower to close in on the purple support line. This support may halt the fall in price.

RSI is not extreme. There is room for price to rise or fall.

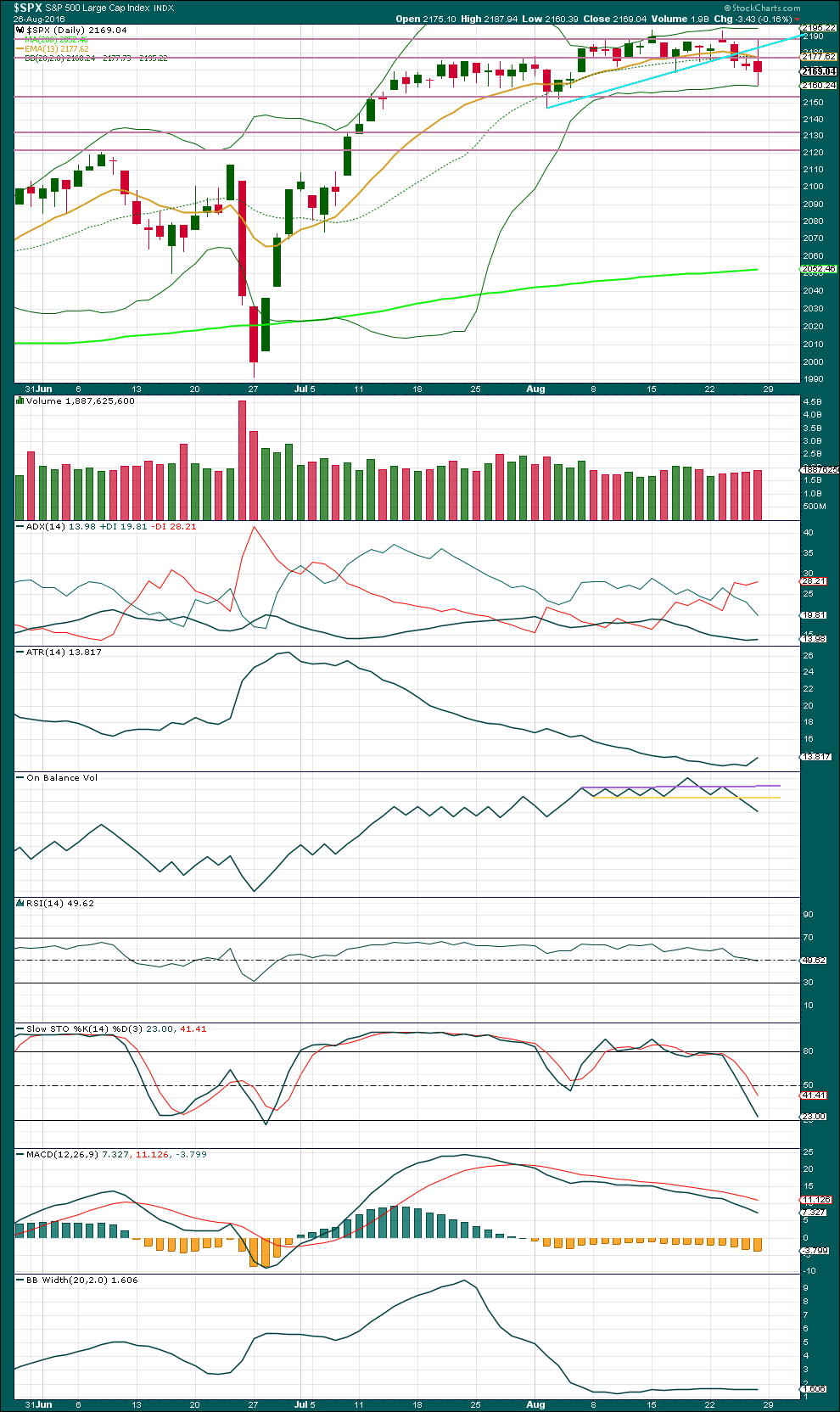

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Four days in a row of red daily candlesticks come with a steady increase in volume. The fall in price is supported by volume, so more downwards movement is extremely likely. This is one method which has been working well in recent months for this market, so it should be expected to continue to work until it does not.

On Balance Volume is giving a clearer and stronger bearish signal with a move down and away from the yellow line. Volume and On Balance Volume both strongly support the Elliott wave count.

Volume for downwards days is still lighter than prior upwards days though. There is still evidence of the market falling mostly of its own weight, but there is some increase selling pressure.

The ADX line has turned upwards during Friday’s session, but with it under 15 a trend is not yet indicated. If this is a downwards trend, it would be in the very early stages or it would be very weak.

ATR is also turning upwards for Friday, but one day of increase is not enough to say a trend is returning.

RSI is neutral and exhibits no divergence with price to indicate weakness.

Stochastics is not yet oversold, so there is room for price to fall further. When Stochastics is firmly oversold and price finds support, then the downwards swing may be expected to end. Price may find some support about 2,155.

Bollinger Bands remain tightly contracted. This indicates the market is still likely consolidating and not yet in the new stages of a downwards trend.

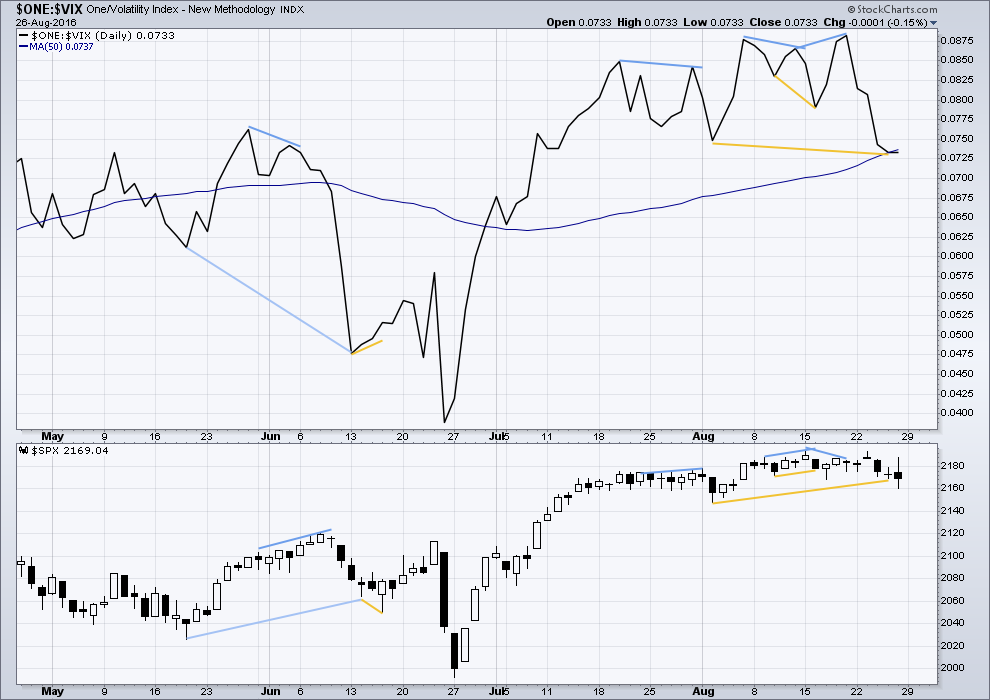

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volatility is declining as price is rising. This is normal for an upwards trend.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. Each of these instances was followed by expected price movement if only for two days. Divergence with VIX and price is not always working, but it is still sometimes working. So it will be noted.

It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days.

There is a slightly longer term divergence noted between VIX and price: VIX made a new low below the prior low of 2nd of August but price has made a higher low. This is hidden bullish divergence and indicates weakness in price. This signal contradicts the bearish signal given by On Balance Volume.

It will be my judgement still that on balance the signal from On Balance Volume is likely to be stronger than this signal from VIX.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is support from market breadth as price is rising.

At the end of this week, there is bullish divergence between price and the AD line: the AD line has made a higher low as price made a new low for Friday below the prior low of 17th of August. This downwards movement from price for the last four days is not supported by market breadth. It is more likely to be a short term correction than the start of a deeper pullback.

DOW THEORY

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 12:46 a.m. EST on 28th August, 2016.

Hi Lara,

I’m showing frightfully low volume in SPX today. What’s your guess why? Is that just punch-drunk traders have finally thrown up their hands?

Seems there is a correlation between low volume and low number of comments today!

This is a big vacation week. People take off this week for a summer break, using Labor Day wknd to get a 10 day vacation…

Volume will pick up next Tuesday

Thanks Ari. That fits nicely actually with the EW count.

Price falling of it’s own weight… and rising on very weak volume.

I am also seeing very light volume on StockCharts today. That fits the EW count nicely.

Updated hourly chart:

With minuette (ii) showing up on the daily chart so clearly it looks like minor C is going to be somewhat time consuming, maybe over a week or so. It has to be a five wave structure.

I’ll be charting and publishing an alternate idea for minor C today; an ending diagonal. The invalidation point for that would be at 2,193.42.

I like this new main wave count, as I have been suspecting for some time that we were going to see a short cycle level wave five. One more (short) primary wave five and then the market starts to deal with deteriorating economic realities.

Its better for gold, too. I get really uncomfortable when people tell me that the markets and gold are both going up. That can’t last.

Hi Lara:

I was wondering if a move below 2111.05 re-opens the door to a possible ending diagonal (at primary degree), or is it difficult to see a three wave structure for wave three?

Exactly. Yes, it would. But one reason why I’m not publishing it is exactly as you suggest, the upwards movement does not subdivide well as a zigzag.

It is great to now have a clear road map for the market’s near term direction, something we have not had for awhile. The most challenging thing with EW is spotting the reversals ahead of invalidation points – you certainly don’t want to be getting positioned for a third wave up, or down, if the opposite is about to happen.

The banksters have been following the same game plan and I expect they will continue to do so. I will be looking for the long lower wick, and a top BB penetration by VIX to again signal the end of this downward movement. I think it will come sooner than most expect. There seems to be universal consensus among EW chartists that the impulse up is incomplete so my own strategy will be to use a modified BTD approach.

I have been trying to fine tune the bid/ask spread in option chains as a way to spot impending trend changes. Market makers and HFT flash boys have far superior tools to the average retail trader and get information about order flows before the crowd. One problem I figured out is that the market makers will collude to offer absolutely ridiculous bid/ask spreads to steer traders away from options they don’t want them to buy – it is not just a matter of liquidity. The secret is knowing when you can get filled at much better than the stated bid/ask and this is a great key to spotting impending trend changes.

I will use this last leg of the P4 wave to get positioned for the final leg up. The modified buy-the-dip approach will be to sell bearish call spreads going out two weeks and buy back the sell side of the spread as close to the end of P4 as can be determined, thus allowing me to remain long during the final wave up. Keeping a very close eye on the bid /ask of these spreads, in conjunction with the VIX and any reversal candles such as one with a long lower wick or a hammer should get one pretty close. I expect the next move up to be the banksters last hurrah….

The Banksters’ Last Hurrah. It sounds like a title to a good book or movie. I will be looking to exit all long positions as we near targets and completion of another 5 wave impulse up. The bigger unanswered question will be the proper degree of labeling. That will tell us if a move to 2500 SPX is in the cards. Only time will show the cards in the hand.

If the primary count is correct, it will not be long before we once again begin chasing the ever elusive bear. Speaking of bears, next Sunday afternoon I head to the mountains for a week in search of this ever elusive bear. My trusty and faithful canine, Hunter, and I will track him down so we can ask him when he will appear in earnest.

Have a great day and great week all.

Lovely, thanks for going on the bear hunt Rodney.

Good luck! Lets home Mr Bear is communicative 🙂

First!