A little upwards movement was expected before downwards movement, but this is not what happened.

Price moved lower earlier than expected.

Summary: The wave counts diverge strongly today. The main wave count requires confirmation with a new high above 2,178.29; if that happens, then a third wave within a third wave upwards may be underway. The alternate now expects a deeper sustained pullback has begun today.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

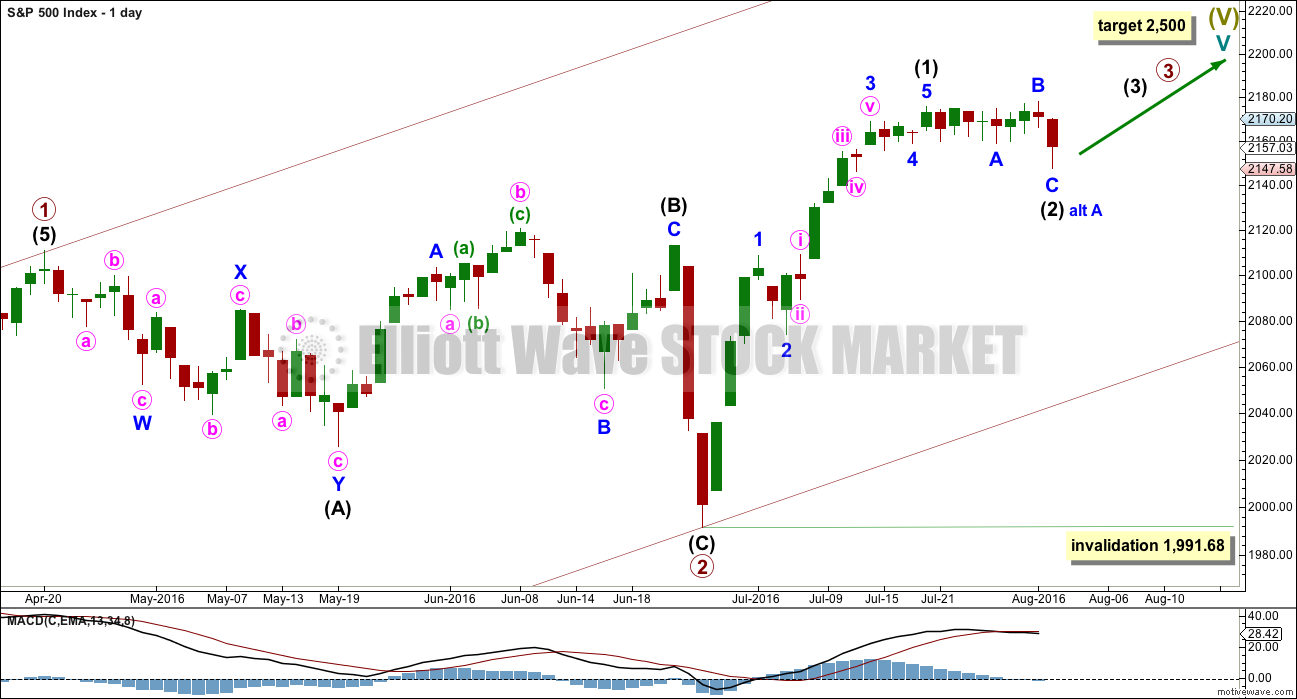

MAIN WAVE COUNT

WEEKLY CHART

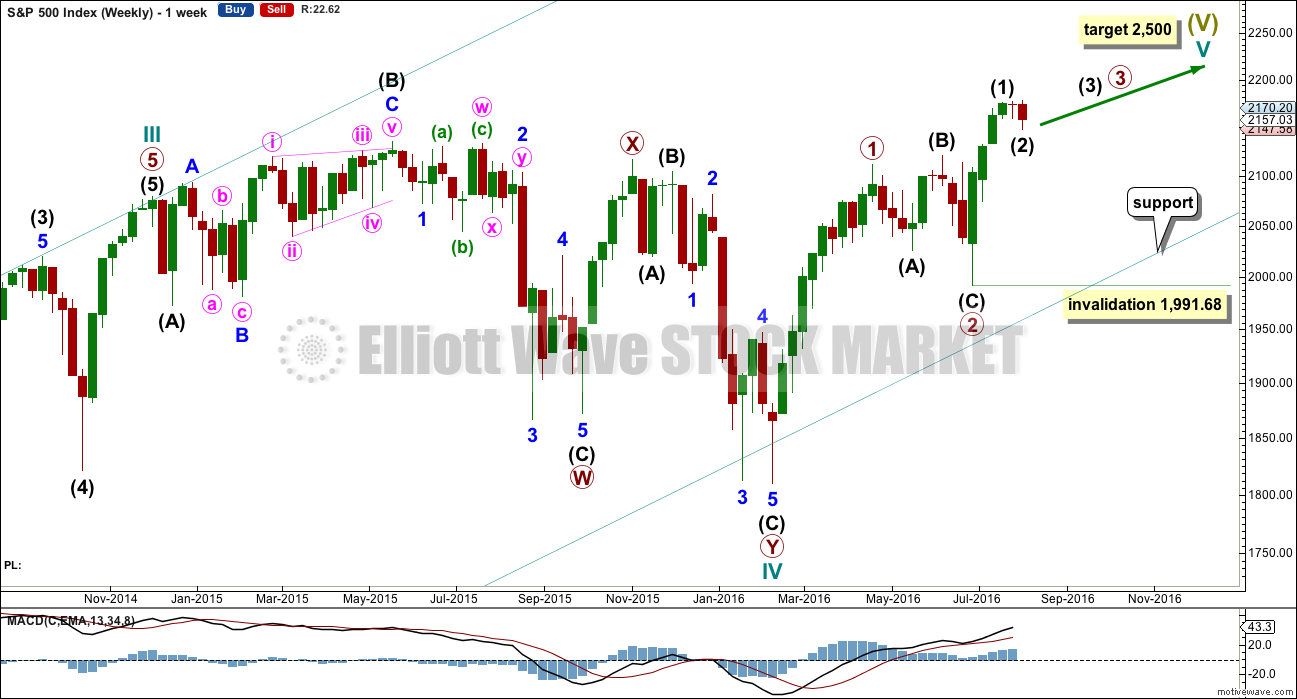

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is now seen as a more shallow 0.28 double combination lasting 15 months. With cycle wave IV five times the duration of cycle wave II, it should be over there.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 15 months (two more than a Fibonacci 13).

If the target for cycle wave V is for it to be equal in length with cycle wave I, then it may also be expected to be about equal in duration. So far cycle wave V is in its sixth month. After this month, a further 22 months to total 28 seems a reasonable expectation, or possibly a further 15 months to total a Fibonacci 21.

This first weekly wave count expects the more common structure of an impulse is unfolding for cycle wave V. Within cycle wave V, primary waves 1 and now 2 should be over. Within primary wave 3, no second wave correction may move beyond its start below 1,991.68.

There is one other possible structure for cycle wave V, an ending diagonal. This is covered in an alternate.

DAILY CHART

It is most likely that primary wave 2 is already complete as a shallow regular flat correction. Primary wave 3 is most likely underway.

Within primary wave 3, intermediate wave (1) is a complete impulse. Intermediate wave (2) may now be a complete flat correction. While there is no confirmation that intermediate wave (2) is over, it may yet move further sideways / lower.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,991.68.

Intermediate wave (2) is expected to be shallow and not a deep pullback when it is done.

HOURLY CHART

The structure within this flat correction is reanalysed today.

Minor wave A fits as a regular flat. Minute wave c within it ends slightly below the end of minute wave a; a truncation is avoided.

Minor wave B fits as a double zigzag. Minor wave B is a 1.16 length of minor wave A, within the normal range of 1 to 1.38. Intermediate wave (2) is an expanded flat.

There is no Fibonacci ratio between minor waves A and C.

Minor wave C is a complete five wave structure. This fits on the hourly and five minute charts.

A new high above 2,178.29 would provide confidence in this wave count. At that stage, a third wave up at two degrees would be indicated.

At 2,332 intermediate wave (3) would reach equality in length with intermediate wave (1). This is a reasonable Fibonacci ratio to use for the target because intermediate wave (2), if it is over, would be very shallow at only 0.15 of intermediate wave (1).

At 2,445 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

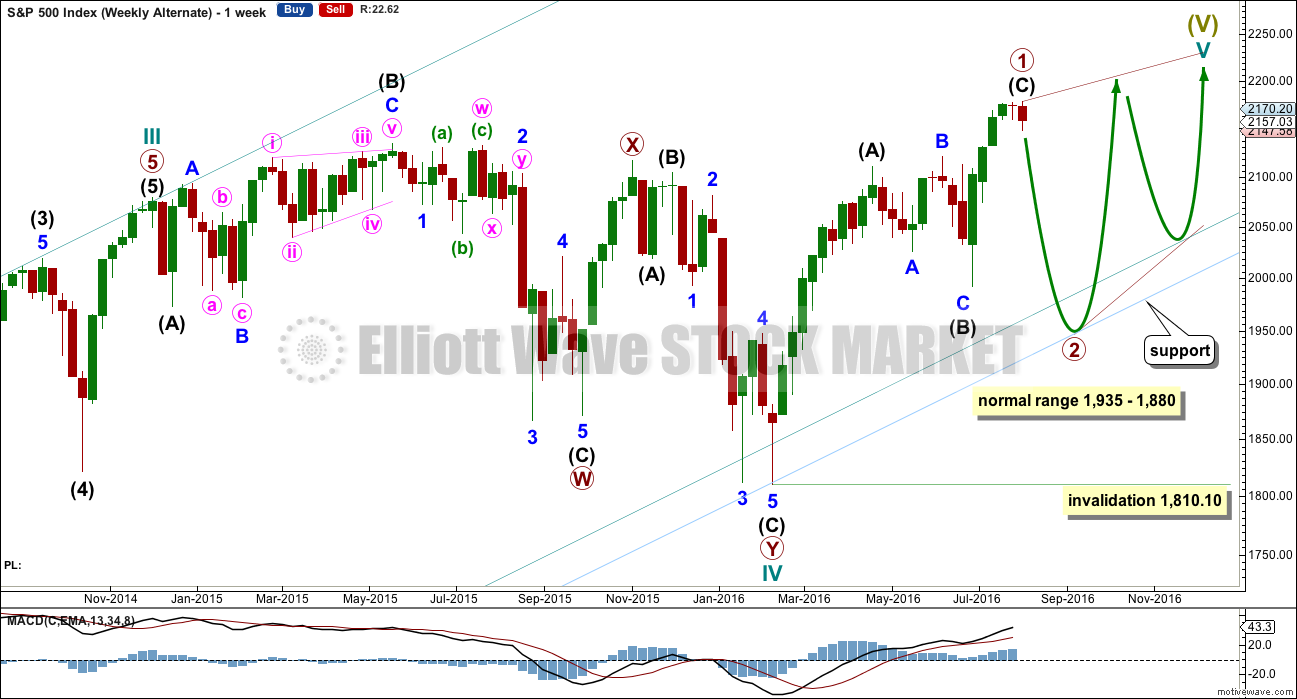

ALTERNATE WAVE COUNT

WEEKLY CHART

Cycle wave V may be unfolding as an ending diagonal. The most common type of diagonal by a reasonable margin is a contracting diagonal. When primary waves 1 and 2 are complete, then primary wave 3 would most likely be shorter than primary wave 1. If primary wave 3 were to be longer than primary wave 1, then the less common variety of an expanding diagonal would be indicated.

Within an ending diagonal, all the sub-waves must subdivide as zigzags and the fourth wave must overlap back into first wave price territory. The whole structure is choppy and overlapping with a gentle slope. The classic pattern equivalent is a rising wedge.

Primary wave 2 may now be a complete zigzag. Within primary wave 2, intermediate wave (C) may be a complete five wave impulse. Primary wave 2 downwards must be a zigzag, and it is most likely to be very deep.

The normal range of a second and fourth wave within a diagonal is from 0.66 to 0.81 the first or third wave. This gives a range for primary wave 2 from 1,935 to 1,880.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

Ending diagonals have corrective characteristics as they subdivide into a series of zigzags. Ending diagonals contain uncertainty; the trend is unclear as they unfold due to the deep corrections of their second and fourth waves. They are terminal and doomed to full retracement. This may explain some persistent weakness to this upwards trend at this time. The final target at 2,500 for the main wave count would be far too optimistic if this alternate is correct and the diagonal is contracting.

Third waves of even diagonals should still be supported by volume and should still exhibit stronger momentum than the first wave.

For this alternate wave count, a deep pullback could very soon be expected for primary wave 2 to last several weeks.

DAILY CHART

If this wave count is confirmed by a new low below 1,991.68, then confidence would be had in price moving lower to the target range.

It should be clear from structure and momentum that a deeper pullback is underway for this alternate wave count before that confidence point is passed though.

Primary wave 2 should be a big obvious three wave structure.

TECHNICAL ANALYSIS

WEEKLY CHART

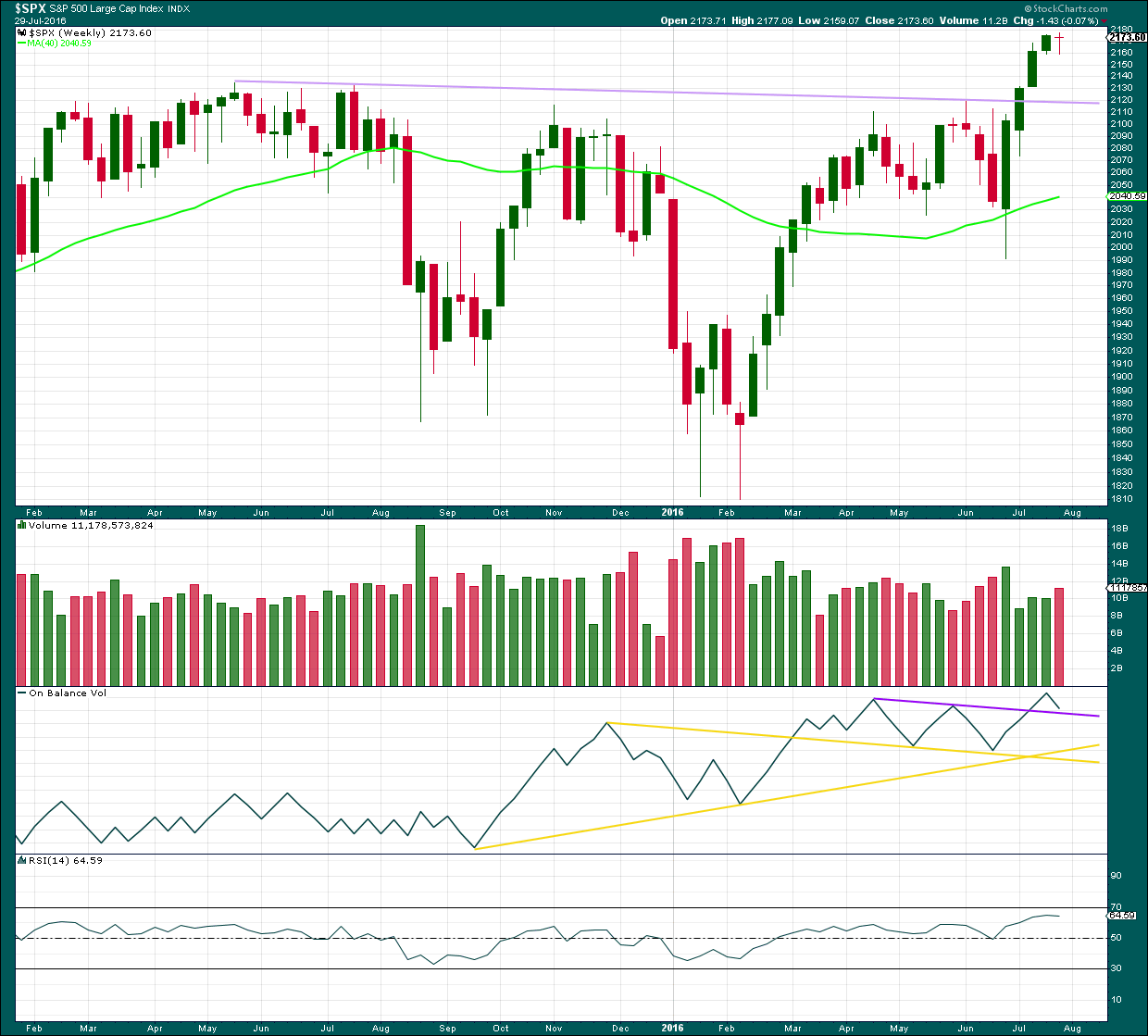

Click chart to enlarge. Chart courtesy of StockCharts.com.

The week before last week completed a stalled candlestick pattern. This indicated a trend change from up to either down or sideways. Last week completed a small red doji, so the trend may have changed from up to sideways. It may still yet turn down.

The bearish implications of the stalled candlestick pattern may now be fulfilled, or more downwards / sideways movement may continue.

Last week’s red doji comes with an increase in volume. This short term volume profile is slightly bearish. Only slightly because the candlestick is a doji and not a regular candlestick with a red body.

On Balance Volume has come down to almost touch the upper purple line. It may find support here. If this line is breached, then some support may be expected at the next trend line.

RSI is not extreme and is flattening off. There is still room for price to rise.

DAILY CHART

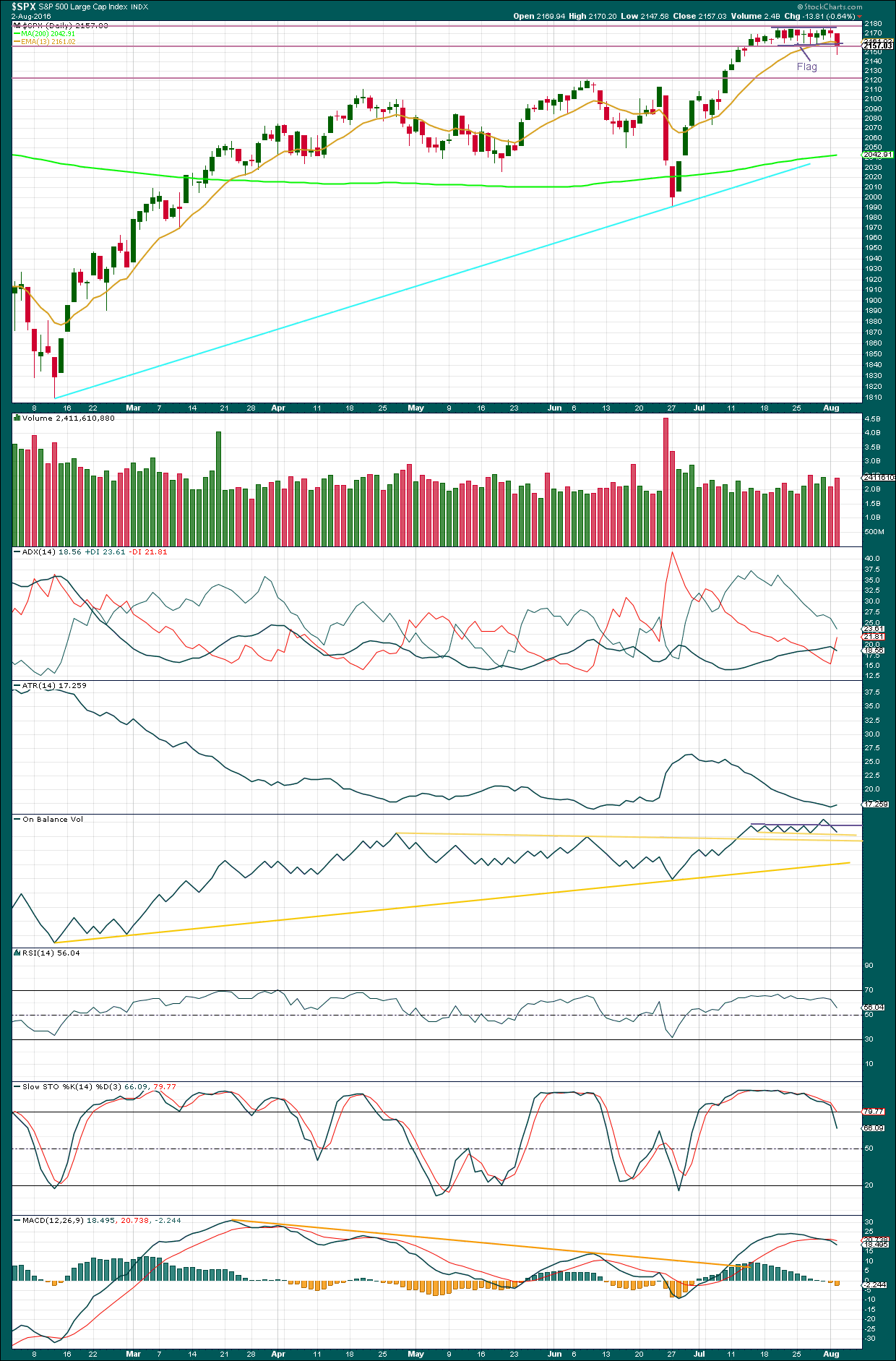

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has overshot the lower edge of the consolidation zone but not managed to close below it. A downwards breakout from this small flag pattern is not clear today.

There was some support from volume for the fall in price today; volume today is stronger than yesterday. However, volume is still lighter than the prior upwards day of 29th of July. To some extent this market has fallen of its own weight today.

The bullish signal given by On Balance Volume three days ago is now negated. OBV has returned below the upper grey line and is now finding support at the yellow line. A break below either yellow line would be a bearish signal from OBV.

ADX today is declining, indicating the market is not trending. It has not yet indicated a trend change from up to down.

ATR today has increased, indicating a new trend may be developing. But with only one day of increase, this is not clear yet.

RSI is not extreme. There is plenty of room for price to rise or fall.

Stochastics is returning from overbought. If price is consolidating, then a little more downward movement may be required until price finds support and Stochastics is oversold at the same time. The next support line for price is about 2,120.

VOLATILITY – INVERTED VIX MONTHLY CHART

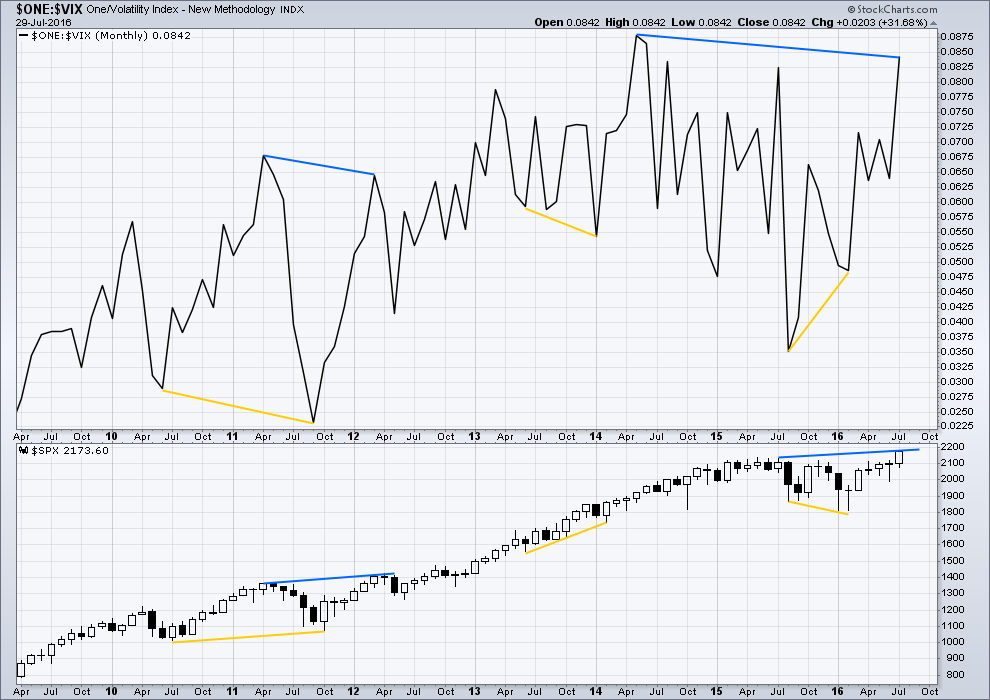

Click chart to enlarge. Chart courtesy of StockCharts.com.

VIX from StockCharts is inverted. As price moves higher, inverted VIX should also move higher indicating a decline in volatility which is normal as price moves higher. As price moves lower, inverted VIX should also move lower indicating an increase in volatility which is normal with falling price.

There is still strong multi month divergence with price and VIX. While price has moved to new all time highs, this has not come with a corresponding decline in volatility below the prior all time high at 2,134. This strong multi month divergence between price and VIX indicates that this rise in price is weak and is highly likely to be more than fully retraced. However, this does not tell us when and where price must turn; it is a warning only and can often be a rather early warning.

At this time, although divergence with price and VIX at the daily chart level has been recently proven to be unreliable (and so at this time will no longer be considered), I will continue to assume that divergence with price and VIX at the monthly chart level over longer time periods remains reliable until proven otherwise.

This supports the idea that price may be in a fifth wave up. Divergence between the end of a cycle degree wave III and a cycle degree wave V would be reasonable to see. Fifth waves are weaker than third waves. This strong divergence indicates that price targets may be too high and time expectations may be too long. However, it remains to be seen if this divergence will be reliable.

DOW THEORY

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd Nobember, 2015) – has now closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – has not closed above this point yet.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 11:26 p.m. EST.

Both wave counts remain valid while price is below 2,178.29.

At this stage a new low now below 2,147.58 is going to be a very strong indicator that the diagonal scenario is more likely. If that happens I’ll swap them over, that will be my main wave count. Which means it’s more likely a deep pullback may have begun.

But for now I’ll leave them as they are, and expect another slow steady rise on light volume is underway.

If this is a third wave at intermediate degree within a third wave at primary degree up, as per the first main wave count, then it really should have support from volume!

Just got 50% short. Looks like it could be rolling over here.

Looking to add, so much for rolling over. I’ll wait for the next rollover to add.

My thought is, the bottom of the 13 day sideways pattern should be a strong resistance area and should provide a good risk/reward. Let’s see if provides any kind of a ceiling to this move.

Looks like the NY Fed’s trading computer must shut off right at the bell. LOL!

We will see if the .618 retracement holds the market back..2167 or you mentioned on spx….might be close enough now …..wasn’t convincing upside movement . Volume might give us a clue. Adp report today put a bid under market. I think that eventually higher employment will spook the market if that should happen, since the fed will raise rates or state they are leaning that way. Friday’s job report could quell market for a final move up if in line with adp. Some overhead resistance now since the market stayed in that band for 10 days or so….if there isn’t some news to bounce the market through tomorrow, might see another move down.

Boring Day! Tomorrow is another day!

Out of here!

Looks like the supportive magical b uid is back this am…look at those crazy 5 minute candles back and forth….sheez.

2161 is the 62% retracement of yesterday’s move down in the ES I think the equivalent is 2167 in the SP. How it trades there should tell us much (only if it get’s there).

Hi quang. What does es stand for?

It’s the e-mini futures contract for the SP.

Thanks

“Primary wave 2 may now be a complete zigzag. Within primary wave 2, intermediate wave (C) may be a complete five wave impulse.”

Hi Lara: I think you intended to say “Primary One”, under discussion of the alternate wave count.

Your faithful editor, Ex Officio…. 🙂

Yes, I did. Thanks for finding it!

First again???

well since you asked,, you are second,, I am first. woo hoo

Haha 🙂

Futures quiet so far! Goin to bed

Lets see what tomorrow brings! Hoping the alternate count holds

LOL

I don’t think it works like that Doc….