Downwards movement was again expected for FTSE.

Although upwards movement remains below the invalidation point and is just at the trend line, this market is not behaving as expected. I have a new alternate wave count which should be seriously considered.

Summary: With upwards movement of 17th February on an increase in volume, this market is not behaving as expected. A new wave count is required. A new high above 6,115.10 would invalidate the main wave count and confirm the new alternate. At that stage, expect FTSE is most likely in a larger and deeper bear market rally which may end about 6,453.

To see a monthly chart and the bigger picture, with an explanation of why there are only bear wave counts for FTSE, click here.

New updates to this analysis are in bold.

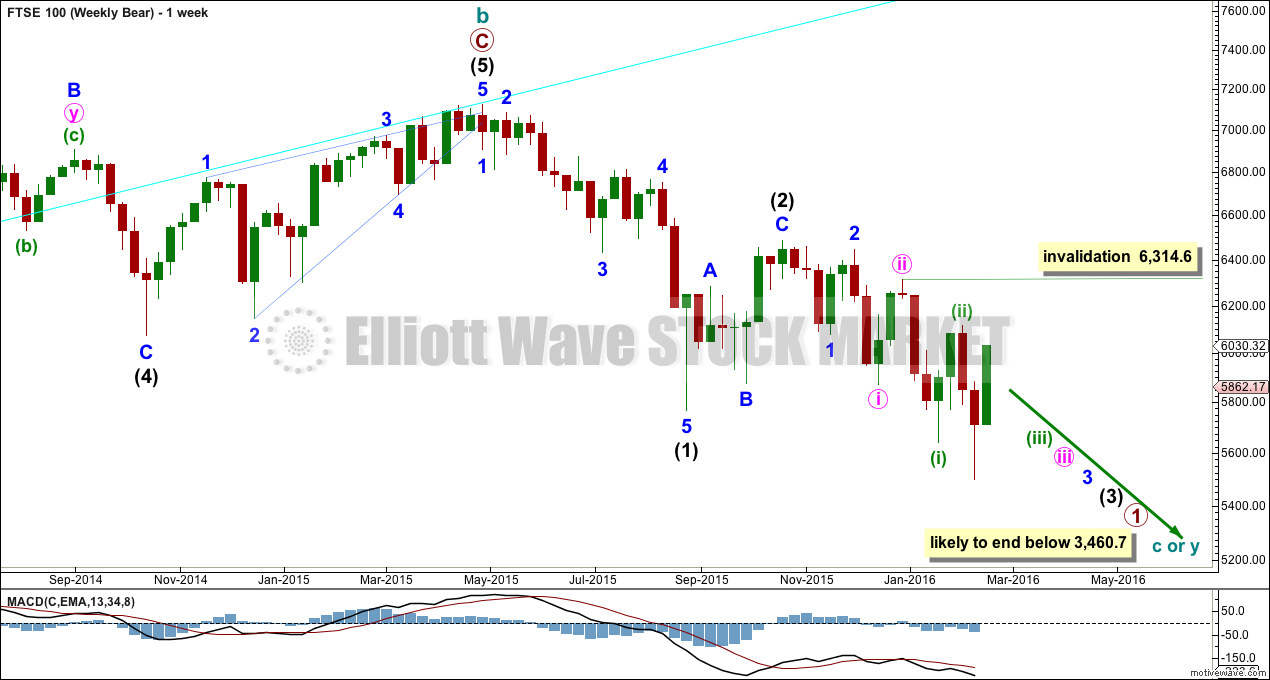

MAIN WEEKLY WAVE COUNT

From the all time high in April 2015, FTSE has a five down and a three up. This current fall should move well below the end of intermediate wave (1) at 5,768.22 and then remain below that point. Intermediate wave (3) must move beyond the end of intermediate wave (1), far enough below to allow room for a subsequent fourth wave which may not move back into intermediate wave (1) price territory.

Price has now made a new low below the August low at 5,768.22. Downwards movement should continue, if this wave count is correct.

The main difference between this main wave count and the new alternate is the correction labelled here minor wave 2 within intermediate wave (1). This main wave count sees that movement as a combination: flat – X – zigzag lasting 19 days. There is alternation between minor waves 2 and 4: minor 2 was a combination and minor 4 was a triangle. Minor wave 4 lasted 35 days.

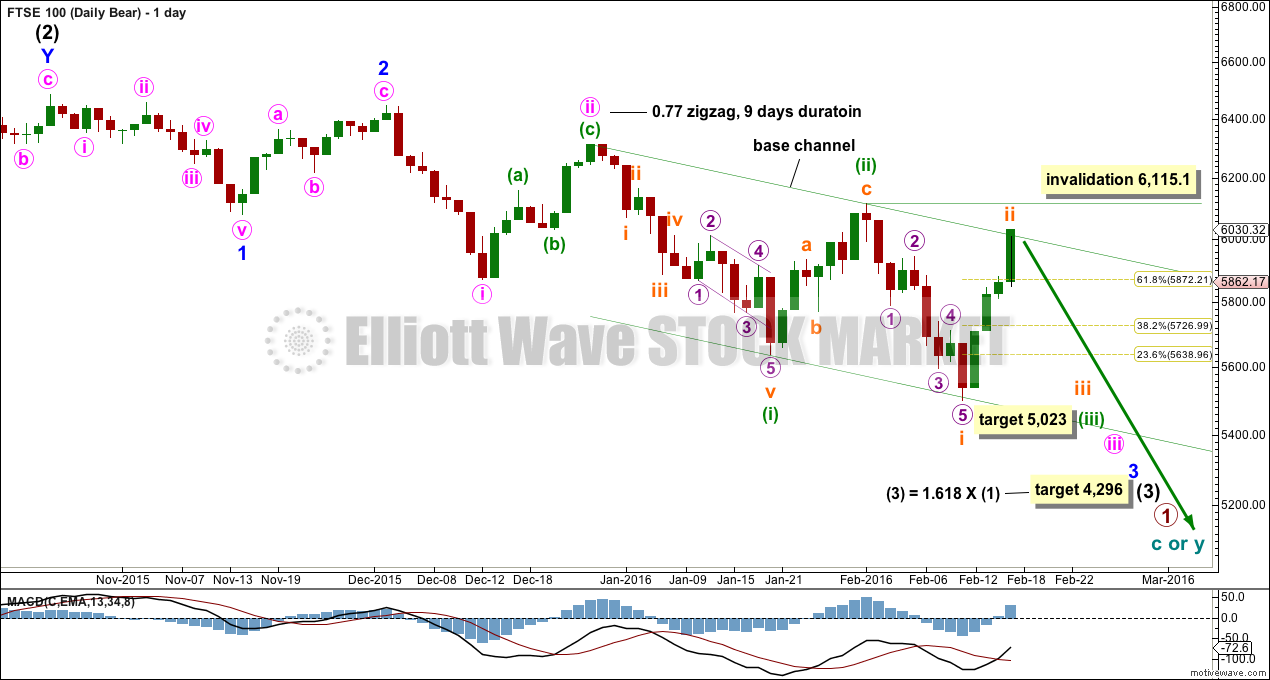

MAIN DAILY WAVE COUNT

So far the middle of the third wave may not have passed for FTSE. Upwards movement labelled minuette wave (ii) is back in minute wave i price territory. This cannot be minute wave iv, so it may only be yet another second wave correction if this wave count is correct.

Intermediate wave (2) lasted 42 days. Minor wave 2 lasted 11 days. Minute wave ii lasted 9 days. Each subsequent second wave is shorter in duration than its predecessor giving the wave count the right look. None of these waves are exhibiting Fibonacci durations.

Minuette wave (ii) may have completed in a Fibonacci 8 days total, reaching a little above the 0.618 Fibonacci ratio. A lower degree second wave correction should not breach a base channel drawn about a first and second wave one or more degrees higher.

Within minuette wave (iii), yet another first and second wave may be completing for subminuette waves i and ii. Again, subminuette wave ii is in the price territory of the first wave one degree higher, so this upwards movement may not be minuette wave (iv). If this wave count is correct, then this may only be yet another second wave correction.

Subminuette wave ii has passed the 0.618 Fibonacci ratio. The last daily candlestick has closed just above the base channel. If this wave count is correct, then upwards movement should stop here. Price should find resistance at the base channel.

So far the lower edge of the base channel is providing support. If price manages to break below this support line, then it would be confirming a big third wave should be underway.

The target for intermediate wave (3) remains the same at 4,296 where it would reach 1.618 the length of intermediate wave (1).

A shorter term target is calculated for minuette wave (iii). At 5,023 it would reach 1.618 the length of minuette wave (i).

If targets are wrong, they may not be low enough.

Of all the indices I follow with Elliott wave counts, FTSE remains the clearest bear.

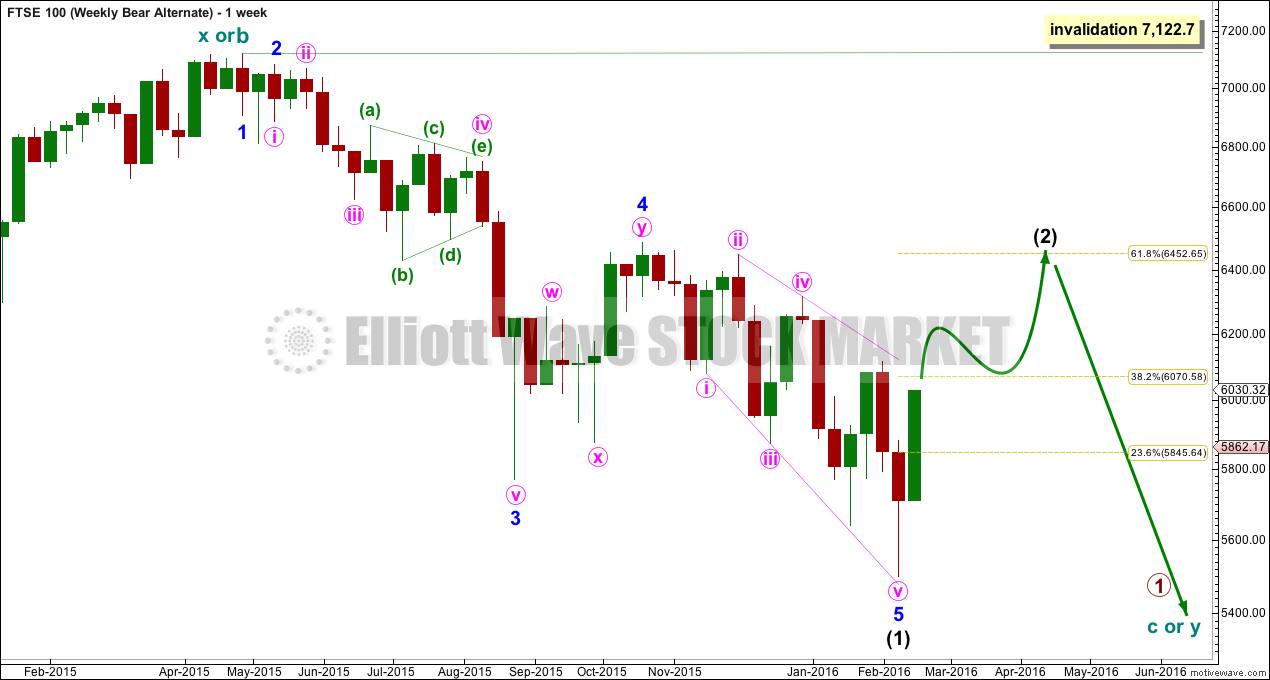

ALTERNATE WEEKLY WAVE COUNT

The first movement after the all time high is seen differently for this alternate wave count. At the daily chart level, it does not have as good a fit which is why it will remain an alternate until confirmed by price.

If there are two corrections within there rather than just the one, now minute wave i does not subdivide perfectly as a five and looks like a three on the daily chart.

Now minor waves 2 and 4 are more grossly disproportionate.

This wave count sees the possibility of a five wave impulse over at the recent low, with minor wave 5 an ending expanding diagonal.

Intermediate wave (2) may continue for weeks and may end about the 0.618 Fibonacci ratio at 6,453.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 7,122.70.

ALTERNATE DAILY WAVE COUNT

If price moves above 6,115.10 and invalidates the main wave count, then this wave count would be confirmed.

The most likely target for intermediate wave (2) is the 0.618 Fibonacci ratio at 6,453.

TECHNICAL ANALYSIS

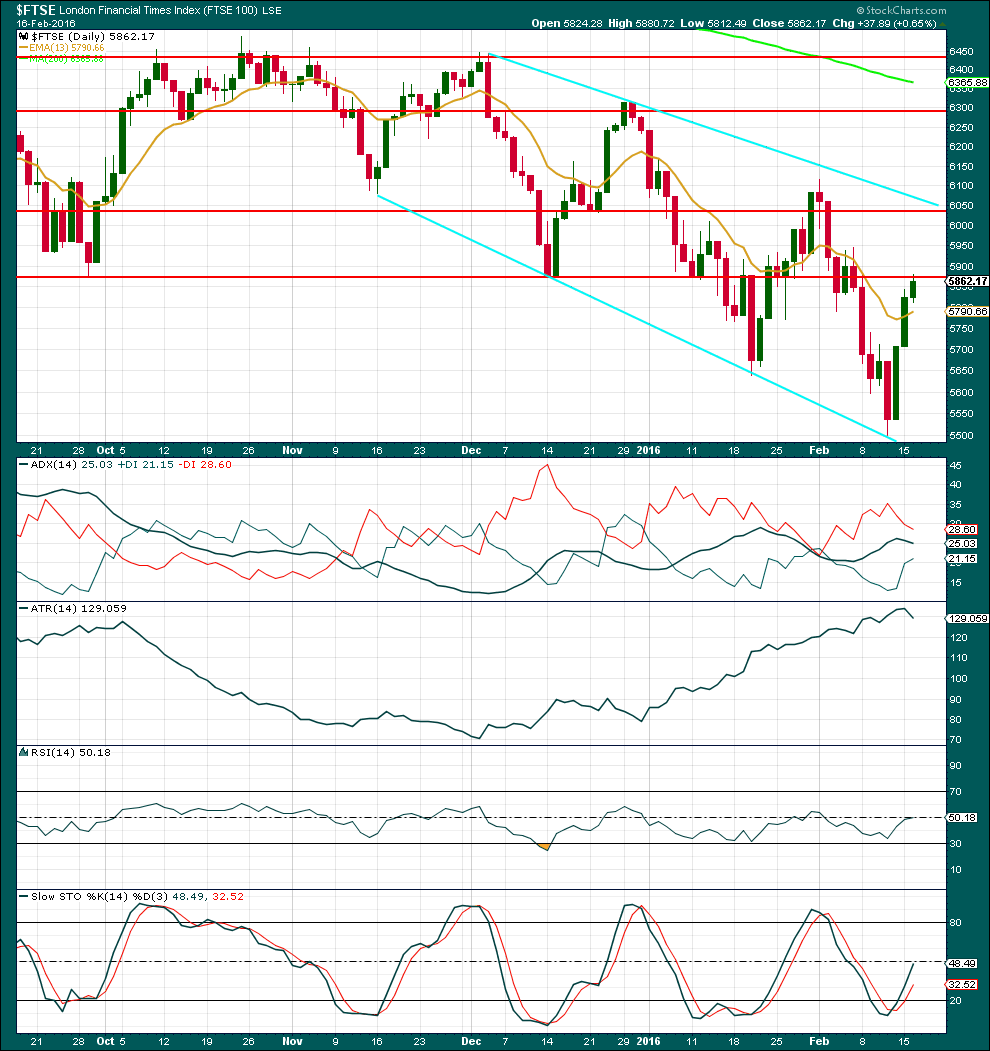

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is no volume data on either the FXCM feed or StockCharts. Volume analysis is done from Yahoo Finance data.

Upwards movement for the 17th of February comes with an increase in volume. This is concerning for the main wave count and supports the alternate.

The stalled pattern, a bearish version of three white soldiers, is invalidated by the following long green candlestick.

ADX indicates the market is not trending, but it may be about to indicate a trend change: the -DX line is crossing below the +DX line.

ATR is increasing. This indicates the market is trending.

RSI is just above neutral. There is room for this market to rise or fall.

Stochastics is also just above neutral. There is room for the market to rise or fall.

This analysis is published @ 03:43 a.m. EST on 18th February, 2016.

Hi Lara

Based on recent moves in FTSE do you have a preference?

TIA

Ali