End of week analysis expected Monday to see strong downwards movement.

This is exactly what happened.

Summary: The trend is down and a strong third wave is building. Expect surprises to be to the downside. A small quick second wave correction may move price a little higher when markets open tomorrow. It should be over quickly, lasting less than 11 hours in total. Use the upper edge of the orange channel on the hourly chart for resistance. In the short term, targets are 1,797 which may be met in 6 more sessions, and then 1,511 which may possibly be met in 16 more sessions.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

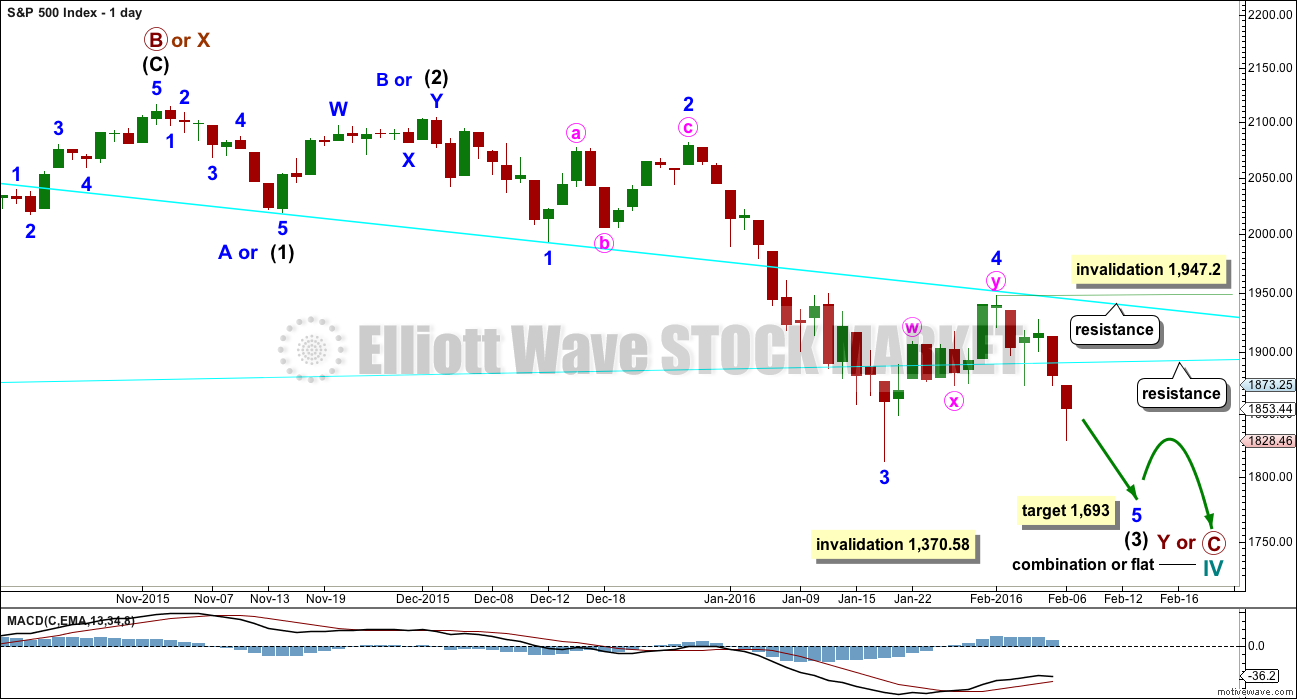

BULL ELLIOTT WAVE COUNT

DAILY CHART – COMBINATION OR FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction. When and if these two ideas diverge, I will separate them out into two separate charts. For now I will keep the number of charts to a minimum.

Primary wave A or W lasted three months. Primary wave C or Y may be expected to also last about three months. It is now in its second month at this stage and may not be able to complete in just one more. It may be longer in duration, perhaps a Fibonacci five months. That would still give a combination the right look at higher time frames.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,693 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

This daily chart and the hourly chart below both label minor wave 3 as complete. It is also possible that the degree of labelling within minor wave 3 could be moved down one degree, because only minute wave i within it may be complete. Within minor wave 5, no second wave correction may move beyond its start above 1,947.2.

Price has come up to find resistance at the upper cyan trend line. This line goes back to 20th July, 2015, (its first anchor) and is reasonably shallow, has been repeatedly tested, and has reasonable technical significance. It should be expected to offer reasonable resistance.

Price has now broken below the lower cyan line. It looks like a downwards breakout is underway; the next wave down is unfolding. The lower cyan line may now provide resistance for upwards corrections.

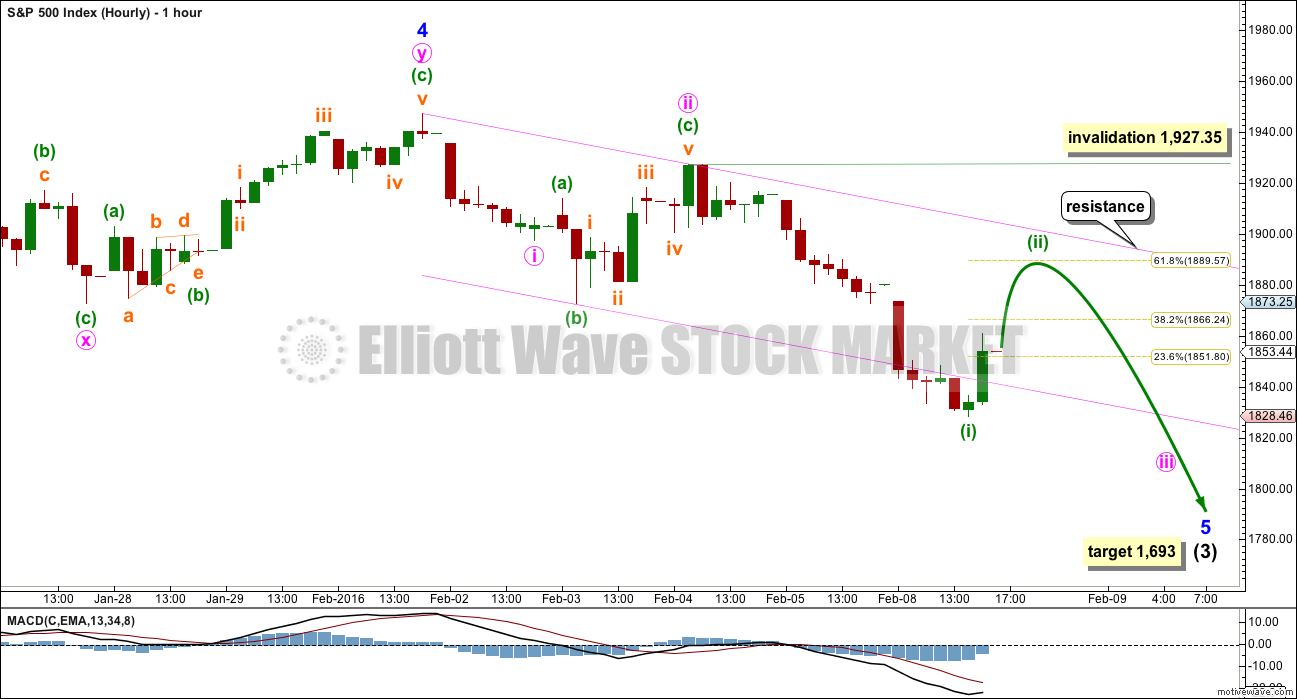

HOURLY CHART

At this stage, the corrective structure for minor wave 4 which has the best fit is a double zigzag. This movement now has a clear three wave look to it on the daily chart.

If this is a fourth wave correction, then the least likely structure for it would be a zigzag or zigzag multiple. That would not provide adequate alternation with the second wave zigzag.

However, alternation is a guideline, not a rule, and it is not always seen.

The probability that the correction was a fourth wave is reduced. The probability that this bounce is a second wave has increased.

Because both bull and bear wave counts see this structure in the same way on the hourly chart, further comment will be with the bear wave count.

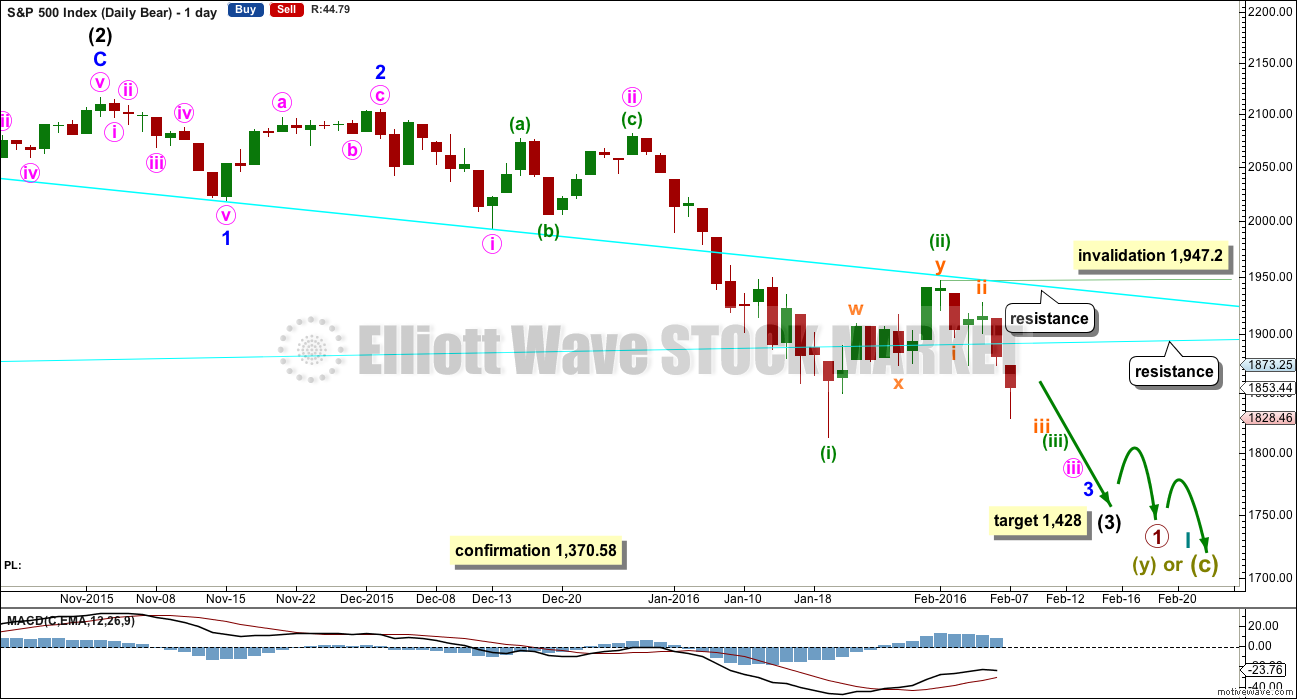

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Downwards movement so far within January still looks like a third wave. This third wave for intermediate wave (3) still has a long way to go. It has to move far enough below the price territory of intermediate wave (1), which has its extreme at 1,867.01, to allow room for a following fourth wave correction to unfold which must remain below intermediate wave (1) price territory.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

Intermediate wave (2) lasted 25 sessions (no Fibonacci number), minor wave 2 lasted 11 sessions (no Fibonacci number), minute wave ii lasted 10 sessions (no Fibonacci number), minuette wave (ii) lasted a Fibonacci 8 sessions, and subminuette wave ii lasted just two sessions. Each successive second wave correction of a lower degree has a shorter duration which gives the wave count the right look, so far.

If subminuette wave ii continues any higher, it may not move above the start of subminuette wave i at 1,947.20.

The degree of labelling within minute wave iii may also be moved up one degree. This correction may be minute wave iv. I will wait to see how momentum behaves for the next wave down to make a final decision on which degree of labelling is correct. For now I will leave the labelling as the most likely for a second wave due to the duration and the structure of a double zigzag.

If the next wave down shows a strong increase in momentum, then it would be the middle of a big third wave.

If the next wave down shows weaker momentum than minuette wave (i), then it would be a fifth wave to end minor wave 3.

HOURLY CHART

Subminuette waves i and ii are complete within minuette wave (iii).

Subminuette wave ii was a deep 0.60 expanded flat lasting just 11 hours.

The pattern so far within this third wave is typical. Each successive second wave correction is more brief than its predecessor one degree higher. Micro wave 2 may be reasonably expected to be over more quickly than 11 hours. It may end about either the 0.382 or 0.618 Fibonacci ratios, neither one is favoured at this stage. If it gets up high enough, it should find very strong resistance at the upper edge of the orange base channel.

Micro wave 2 may not move beyond the start of micro wave 1 above 1,927.35.

At 1,797 subminuette wave iii would reach 2.618 the length of subminuette wave i.

Subminuette wave i lasted one session and subminuette wave ii lasted two sessions. If subminuette wave iii is extended in price, it would also extend in time. A reasonable expectation would be for it to last a total Fibonacci 8 sessions. So far it has lasted 2.

At 1,511 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Minuette wave (i) lasted 14 sessions, one more than a Fibonacci 13. Minuette wave (ii) lasted a Fibonacci 8 sessions. If minuette wave (iii) is extended in price, it would also be extended in time. A reasonable expectation would be for it to last a total Fibonacci 21 sessions, give or take one or two either side of this number. So far it has lasted 5 sessions.

These expectations regarding time are rough estimates only. The S&P sometimes exhibits waves which have Fibonacci numbers for how many days / sessions they last, but not always.

Micro wave 2 may not move beyond the start of micro wave 1 above 1,927.35.

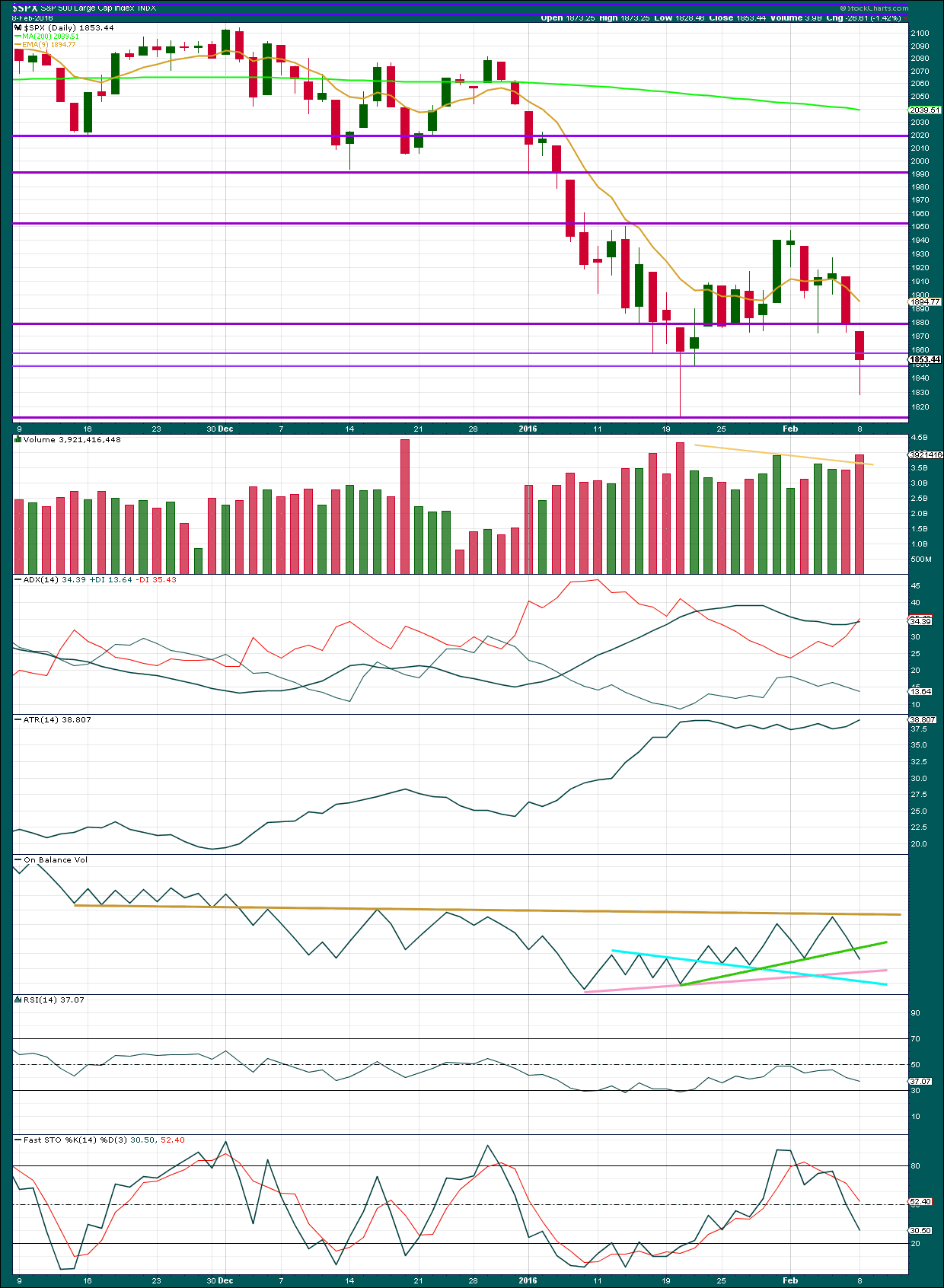

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A stronger downwards day with stronger volume than any of the recent upwards days removes any doubt about the volume profile. The volume profile is again bearish. This fall in price for Monday is well supported by volume.

ADX is now again beginning to turn upwards indicating the market is again trending. The trend is down.

ATR also is beginning to agree as it is increasing. This market is trending.

On Balance Volume gives another bearish signal today with a break below the green trend line. The next lines to offer support are the pink line which is not very technically significant, and the lower blue line which has more technical significance.

RSI and Stochastics are not yet oversold. There is room yet for this market to fall.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then my modified Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point. So far the S&P has made a new low below 1,821.61, but it has not closed below 1,821.61.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 08:07 p.m. EST.

Interesting! The banksters have jumped on the futures quite early this evening. They seem determined to bring about the “third wave that never was”. I don’t ever recall them springing into action this early in the evening. They must have big plans for the markets tomorrow… 🙂

Can you believe this flat line for the close? 15 minutes sideways.

Totally par for the course nowadays. Gap and go tomorrow.

Gap down or up?

That is always a very good question in this crazy ol’ market 🙂

My money is on down (I’m still holding short) – the market should have achieved everything to the upside that it needed to today, but that’s not always a good enough reason for it to oblige.

One thing is for sure – if those members taking part are not successful in this trade, it is certainly not through lack of perseverance.

This correction could be a fourth wave counterpart to minute ii on the hourly bull and subminuette ii on the hourly bear (except for the bear this would be moved down one degree, subminuette i would be incomplete)

It looks good, and now if this idea is correct it should be over because it’s hitting the upper edge of the Elliott channel. Perfect alternation, good proportion, sitting in the channel.

Oh boy – that idea means another subminuette wave ii bounce after this wave i down is complete… not sure I’ll have enough finger nails left! 🙂

If we do put in an interim bottom ahead of a sub-min two bounce tomorrow, UVXY will most likely confirm with a nice spike and long upper wick above the upper B band and print a red candle.

hmm,, could be,, what would that project down to approximately

Just dropped out the lower channel of the fast wave c move up – first clue that it might be over – below 1852.42 would be second clue

I’ve got my finger on the sell my shorts button. Tell me I’m wrong.

Personally I do not intend to sell unless we go above the upper channel on my chart with some conviction. I can count 5 up, but until we go below 1852, wave 5 of (c) could be extending.

I think we’re currently in wave 4 of a small degree impulse down, or we might have had an impulse and this is a corrective bounce (hard to know at such tiny degree). 1852 would clear things up slightly

Yes, I’m seeing that possibility too. And charting it shows that it looks pretty good.

Glad we’re on the same page boss! 🙂

He! He! You just gotta love the banksters. They probably rattled the cages of lots of bears today. VIX and UVXY showing steady accumulation. More downside indicated. I expect it to be absolutely explosive!

So important to keep the big picture and mind, as well as the clearly stated invalidation points or you will drive yourself cuckoo with this volatility. Nitey Nite!

😀

I’ll not tell you you’re wrong, but I will say that if you are then you will close a great position right before the strongest move.

That bear wave count is preferred. Next week is likely to see very strong downwards movement.

I’m holding my short.

That is because you are too nice to tell me I am wrong. No really, I understand. I know the bear is preferred and I agree with it. I am thinking the gap above is going to be filled. I did liquidate my shorts because I had too much profit on the table, in part at least, thanks to you. I have given back a lot of profits over the years and it is probably my worst mistake. I promised myself not to let that keep happening. I am satisfied in that, for the year 2016, my account is up roughly 30%. I am also a bit frazzled by worry / nerves and I do not like it.

This may all backfire on me and I will have to play catch up. Worse I would get back in after a gap down only to sell at the bottom. Such is the life of those who trade the markets.

You did the right thing Rodney. Not only will you sleep well tonight, there will certainly be future opportunities, and no amount of profits is worth peace of mind. This bear is just getting started. I do think we will see one more plunge down tomorrow before a bigger correction starts and I plan on unloading short term positions then. You are right about not trying to trade any gap down tomorrow. Better to wait.

I certainly would not want to put words in Lara’s mouth, but I don’t think it is a case of anyone being nice, it is more likely a case that nothing is ever 100% certain. It is impossible to tell you that you are wrong as you could well be totally correct.

Lara can only present the probabilities she sees and rank them in order from most to least probable. This is much easier said than done – I have said numerous times, that there is no human I have ever known who can do this with as little emotion or bias than Lara. Emotion and bias are enemy number 1, so it’s not surprising (to me) that this approach gives Lara an enviable hit rate.

I may be totally out of the ball park, but I am i right in thinking that the profits you have given back previously were because you were shorting in a market with Bull market rules (upwards overall trend)? The reason I query is because if we are now in a bear then bear market rules are now in play which is a different ball game.

Rather than totally cash out, you could perhaps think about leaving a small amount at play, so you can build confidence that this time perhaps is different.

That said, 30% is not a bad return for a months work. It has not been the easiest of months so you totally earned it! If it works better for you then maybe walk away from the nut house and enjoy it rather than go mad(er) counting waves all day 🙂

BTW – you’re not the only person that the market often leaves feeling frazzled. I don’t think Mr Market has any other reason to exist 😉

I’m now only just back to breaking even from that total disaster of a day a couple Fridays back – so I just did 2 weeks of full on concentration just to get back to the same spot!!

And tomorrow I could well be bulldozed 2 weeks (or months!) backward again – happy days!!

Thank you all so much for your comments. They are always helpful.

With regard to my comment on Lara’s being too nice, I said it in more than half jest. People tell me I am a humorous sort of guy and I do like humor in life. I love to laugh and help others do the same.

The other half is that Lara is not only an outstanding technician and Elliott wave analyst, she strikes me as a generally and genuinely nice person. Several times over the years I’ve had opportunity to communicate with her outside the blog (by the contact us button). Every time she strikes me as nice.

All that being said, I knew I was getting tired of this every day. And I also know that there will be opportunities to get in and get out again. I am going to sleep well and be content with this past six weeks work. Break time. That is another thing I like, breaks. I tend to take a lot of time in the mountains where I live. I cut off from all electronic media and devices. I live in the wilderness. I know I am nuts because those closest to me keep telling me. Like the time I spent 4 days in 14 below zero degrees Fahrenheit.

See you all tomorrow.

It looks to me like the 1873-1880 range is going to be very difficult for the bulls to overcome. A lot of resistance above that area.

There is also an open gap at 1879.00

Other than shaking the trees for loosely clinging bears…do they have anything else in mind? Enough already!!! 🙂

Atm, I think it’s done imho. If we go above the white channel on my chart below then it is a serious proposition.

Up to now price kissed it perfectly, albeit price did that to my purple trendline earlier and here we are!

I think if futures don’t implode, it may run to that gap first thing tomorrow. Going much past it would get my attention that something more bullish may be underway. Either way, these gyrations in no alter the larger context of what we are seeing. Don’t you JUST LOVE the excitement? (just kidding… ) 🙂

Right at the upper channel – backed off for now. Is that it??? Poked just above the 32.8 retrace

The usual daily dose of scary wave c. Doesn’t do a bears nerves any good at all.

Oops – 38.2% retrace I meant (not shown on chart)

well,,, maybe a meltdown in the last hour, rather than yesterdays meltup.

I think Mr Market wants to fill a bit of that gap from yesterday.

RSI suggests he might be running on vapours.

Slippery as an eel….

1889 is the 61.8% retrace on the hourly bear chart of Lara’s. I think we are headed there. Son of a gun!

doc4bax I am hoping your proposed late day meltdown comes to fruition. It has a good start here at 3:30 PM.

Well if I didn’t see it with my own eyes I would not believe it!!

Looks like micro 2 still in progress.

We should go above 1861 to avoid a truncation

Would someone please tap the banksters on the shoulder and tell them to just give it up?!

Or better yet, just pour a little bit of gear oil on the “slope of hope”!

The DJI pivot needs to be resolved with a move under 15,760.00, preferably in the next hour or two… 😀 😀 😀

Perhaps going back for one last kiss of that purple trendline on my chart? Seems to be stalling price atm.

Above 1857 micro 2 likely still in progress.

This market wears me out! 🙂

Me too. But isn’t that what these consolidations are supposed to do? Frustrate and wear out all traders.

What I would like to know is how are they going to replace the billions they spent today trying to stem the tide. It is possible depositors’ moolah is ALREADY being deployed in the insane effort??!! Shiver me timbers matey!!

😀

I guess it’s possible there are bullish bagholders still out there chasing the dream.

There is certainly someone around with deep pockets

Central and multinational banks = digital fake monopoly money. There is no limit. Only constraint is market psychology. If banksters create too much fake money too fast the market just collapses in disbelief.

That’s putting it mildly…! More like a Royal Pain in the …well…you know… 🙂

This is the third time it’s coming up for air…third time’s the charm perhaps…?

I think Lara’s favourite trade might have just played out (kiss and run)

hee hee,, Is that what Lara does? kiss and run?

It’s certainly what the market does quite often 🙂

As Olga says it looks most likely that micro 2 is over.

The S&P should now be in a third wave down at six degrees.

Maybe by the end of this week, but certainly it should happen next week, momentum should build to explosive levels downwards.

There will be corrections along the way. They are opportunities.

The best guide to where those corrections may end will be trend lines. For now price seems to be sitting just above the lower edge of the orange channel on the hourly chart. When that is breached then it should provide resistance.

Todays analysis will be pretty much the same. It will have to be early and then the regular technical analysis updated later.

WTI about to go sub $28… Will it happen?

$27.98

crude is going into freefall again, this can only help the bears

Crude feeling the pressure now

Need to break below the purple and orange base channels to take us out of the danger zone

Purple trendline gone up in smoke – we’ll see if we get a bounce on the orange base channel – hovering above it right now.

Below 1834 proves the move up from yesterdays low is corrective.

in theory we could still be in (b) of micro 2 but I think it is unlikely as this wave has gone on long enough. i think micro 2 is probably over (though I could be wrong!!)

bounced off 1834. The US close should be interesting.

DJI 16,000.00 proving to be very sticky indeed. There is a lot of trader psychology hanging on the outcome of this pivot’s fate. It looks like a lot of folk are expecting it to be rescued from further decline by an all-benevolent FED. 🙂

Micro 2 could be over, or we might still have a bit higher to go yet – we might now be in ii of (c) of micro 2.

A move below (approx) 1834.50 invalidates that idea

Imho – as things stand right now (EW very subject to change on 1min chart!!) – moving below 1843.57 now would make this move up from 1840.24 a 3 wave structure which would mean micro 2 is likely over and we’re on the next leg down.

Above invalidated with a move above 1853.45

This doesn’t look like a small degree third wave up (iii of (c) of micro 2) unless it picks up steam very soon – so I suspect micro 2 is over and we have just seen a 1,2 from todays high unfold. Will have greater confidence below 1840.24. Above 1861 and we’re very likely in iii of (c) of micro 2 imho

We could also be tracing out a triangle for (b) of micro 2 but that wouldn’t make much sense to me as this wave is getting long in the tooth now – we should be getting close to completion if micro 2 has not finished already.

There are other possibilities but none of them make much sense here (imo) as their purpose is to extend time.

It’s looking like a triangle, but I’m only on my mobile atm so can’t be certain

It does have the look of a triangle of some kind. I imagine the triangle would have to be part of a more complex structure since it’s a second wave.

Movement out of it should be sharp…

Yeah – can’t be sole structure in a second wave – usually b wave.

If we rip higher we know that’s what it was (should be in wave e now) – but I’m not confident – think it will end up invalidated as has no real purpose right here.

Broke below purple trendline (my chart above) – should now act as resistance. Just need to fall back out of the orange base channel for more confidence that micro 2 over

“” German Finance Minister Joins DB CEO, Says “Not Worried About Deutsche Bank” “”

Oh…….. OKAY!

Anyone interested in buying a bridge in Brooklyn?

What does that go for anyways?

I love taking the water taxi – it is just great!

I will accept any reasonable offer.

Bloomberg probably has a bid on that. I sure miss Giuliani. He did tons for NYC….

Bnaksters are becoming ever more impotent in their ability to bamboozle the emotions of market participants. A few short months ago a buying futures from 3% deep in the red overnight would have resulted in a manic buying spree at the open that would have at least lasted several hours, and in some cases several days. Their impotence does not however, deter their tilting at windmills. Who in their right mind is buying the long side of this market (except the banksters) ? I guess they don’t recognize an intermediate three down from a….well, you can fill in the blanks….I hope everyone is taking advantage of their high folly… 🙂

Short those rips 🙂

Looks like yesterday was a of micro 2 (purple) with this morning right after open as b of micro 2. Now comes c of micro 2 and the shorting opportunity that vernecarty mentioned earlier. But I defer to the wave experts here, Lara and Olga.

My bad. I have my degrees wrong. The a-b-c move is submicro (light blue) to complete micro 2 (purple). A new low below 1828 adds confidence to this count.

Very kind of you Rodney, but Lara is an EW expert, I am very much an EW student.

I used to fly planes (pilot) – (well I guess I still do – you never lose your licence nor ability but I’m not current anymore). 99.9% of the time it was incredibly boring / routine – 0.1% of the time you had some kind of failure / incident and possibly feared for your life.

The difference between an expert pilot and an ordinary one, is that you survived those 0.1% incidents (think Hudson River landing). Thats when a pilot really earns his salary. I would like to think I was an expert pilot – like Lara studied EW and has vast experience, I made it my business to do the same in aviation just in case I got unlucky.

That’s the hige difference between Lara and I (and difference between Lara most other Ellioticians imho) when it comes to EW 🙂

Joseph

Since you had been out yesterday. The most important topic was how 3rd waves played out in 2008! So, I made this chart!

Down, Down and Down!

Lara,

Noticed yesterday the volume of QQQ on a normal day is approx. 50 million shares but yesterday the volume was reported at 91 million shares traded. This came along with similar significant volume of tech leaders. Wondering if this will amount to a decent washout but will wait to see the action over the coming days?

Lara,

When you say sessions do you mean days? I cannot see 1,797 taking 6 more days?!

I always mean days.

I use days and sessions interchangeably.

I count the daily candlesticks.

Oh I get it. According to Bloomberg, the scuttlebutt is that the European markets walked back from the cliff because Deutsche Bank has assured investors that it has enough capital to continue servicing the riskiest debt it holds….hmmppffff!!!

WHAT CAPITAL???!!!

may I politely ask…? 😀

Interesting that DB said they have the capital and yet they did not show any evidence. When a politician or a bank bangs the table as they speak, know that the truth is exactly the opposite.

Who are the geniuses buying government bonds GUARANTEED to LOOSE you money if held to maturity?!

The investing community has apparently now wholly embraced the “greater fool” theory, convinced that they will ultimately find buyers for this hazardous waste at even more negative rates. What times we are living in!! Futures have again started to head South so we may not get as good an entry point as previously anticipated. I am starting to get a feeling that the next wave down is going to head straight for the 2013 triple top break-out per Lara’s target, bankster bone-heads notwithstanding…I hope you are ready! Lock and Load!! 🙂

Co-ordinated bankster buying across European and US markets. They have burned through a phenomenal amount of capital- literally billions, and in the case of CAC and DAX, buying them from 3% deep in the red. The folly of central banksters apparently knows no bounds, and I am more convinced than ever that these cabals of the corrupt will not survive – they are dead men walking. If you have any of your hard-earned money within the grasp of these creatures, it may not be there when you need it so secure it while you still can. Absolutely incredible!!

Another amazing opportunity to load the cannons as micro two moves a bit higher… 🙂

Verne Jack or Joseph

As a chart and market commentary enthusiast that I am and since times are very very critical we should take attendance before the open.

Good idea ?

Nikkei 225 Closes Down 918.86 points 5.40%

Where have you been my man.

On vacation – jk lol

long weekend

Ok ok

Here is a clean chart of what is going with bollinger bands!

Jack

It was a trap. Futures sinking down -1% now. The bounce at the close was a fake!

I suspect that only the most gullible would have been trapped by yesterday’s counter-trend bounce off the lows, and certainly no one following any kind of EW analysis (I hope!). I must say it is rather surprising how few people I talk to have any clue what is happening in the markets. It really does help to explain the persistent bullishness we have been seeing in market action. What short memories the investing community has! Many are being led off a cliff by the financial news media…how sad! 🙁

Those greedy Bulls got away with a lot of money over the last 6 years!

Nothing last forever!

#bearKarma

Sentiment out there is still bullish…this is a great news for the bears…

Verne

I like to call this the I,II,III confirmation for now imo….

Getting interesting now. Fasten your seatbelts, everyone!

Indeed!

Cheers matey!

first,, woo hoo. Nikkei looking nasty,, down over 4 percent