A little upwards movement was expected to begin Friday’s session.

This did not happen.

Summary: Monday should see strong downwards movement. The target remains at 1,428 for the preferred bear wave count, or 1,693 for the less preferred bull wave count.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

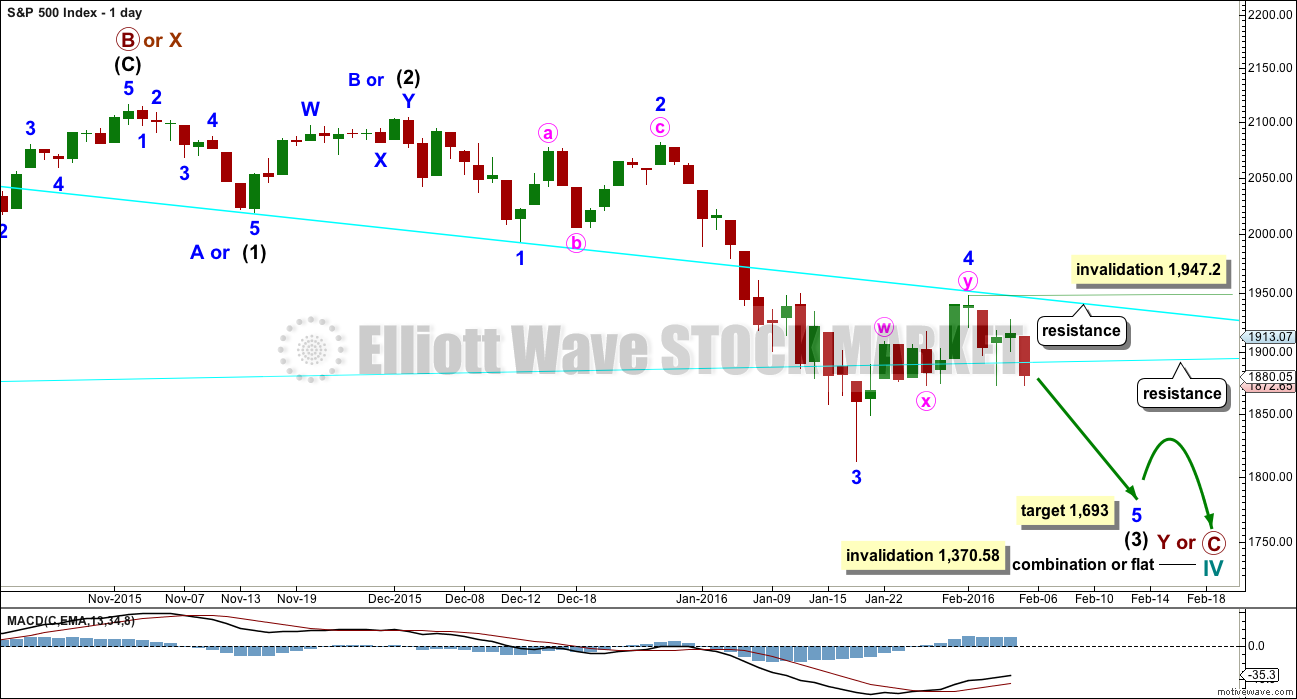

BULL ELLIOTT WAVE COUNT

DAILY CHART – COMBINATION OR FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction. When and if these two ideas diverge, I will separate them out into two separate charts. For now I will keep the number of charts to a minimum.

Primary wave A or W lasted three months. Primary wave C or Y may be expected to also last about three months. It is now in its second month at this stage and may not be able to complete in just one more. It may be longer in duration, perhaps a Fibonacci five months. That would still give a combination the right look at higher time frames.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,693 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

This daily chart and the hourly chart below both label minor wave 3 as complete. It is also possible that the degree of labelling within minor wave 3 could be moved down one degree, because only minute wave i within it may be complete. The invalidation point reflects this. No second wave correction may move beyond its start above 2,081.56 within minor wave 3. If this bounce is minor wave 4, then it may not move into minor wave 1 price territory above 1,993.26.

Price has come up to find resistance at the upper cyan trend line. This line goes back to 20th July, 2015, (its first anchor) and is reasonably shallow, has been repeatedly tested, and has reasonable technical significance. It should be expected to offer reasonable resistance. So far it does look like this has ended the correction.

Price has closed below the lower cyan line, but has still not broken out of the consolidation zone which has its lower edge above 1,872. A close below this point on a day with an increase in downwards volume would be a classic breakout and would provide a lot of confidence in the expectation of downwards movement.

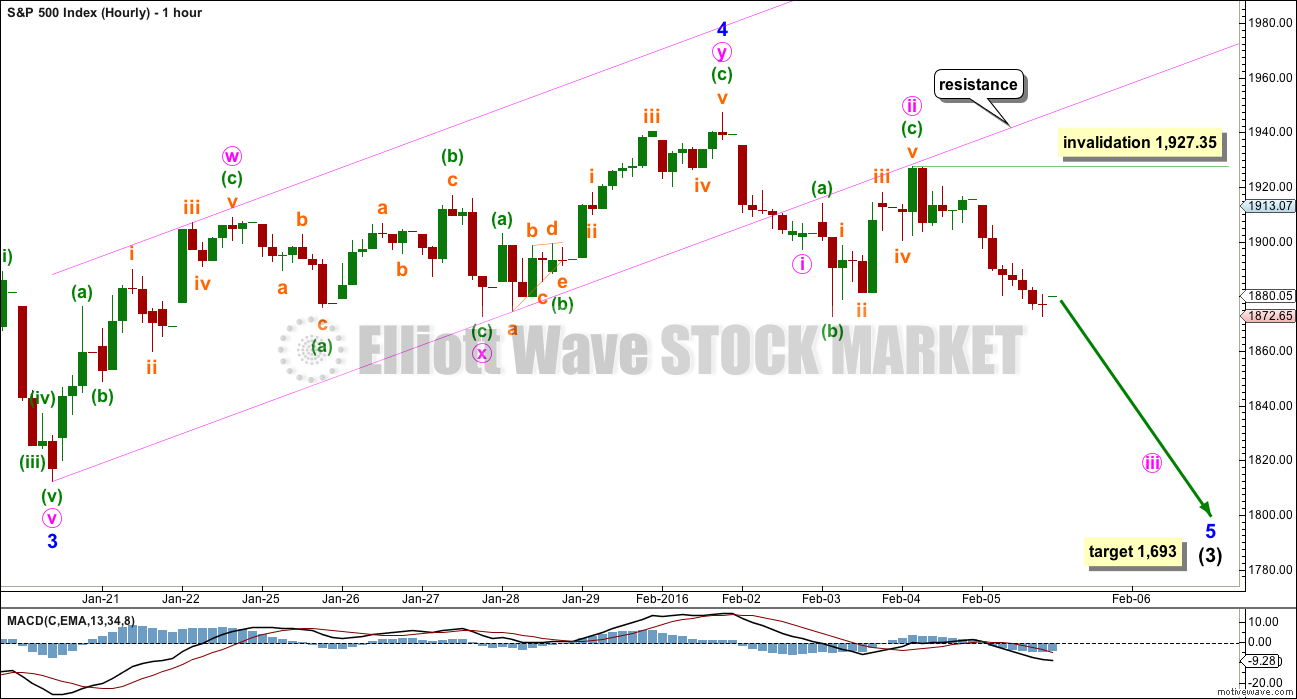

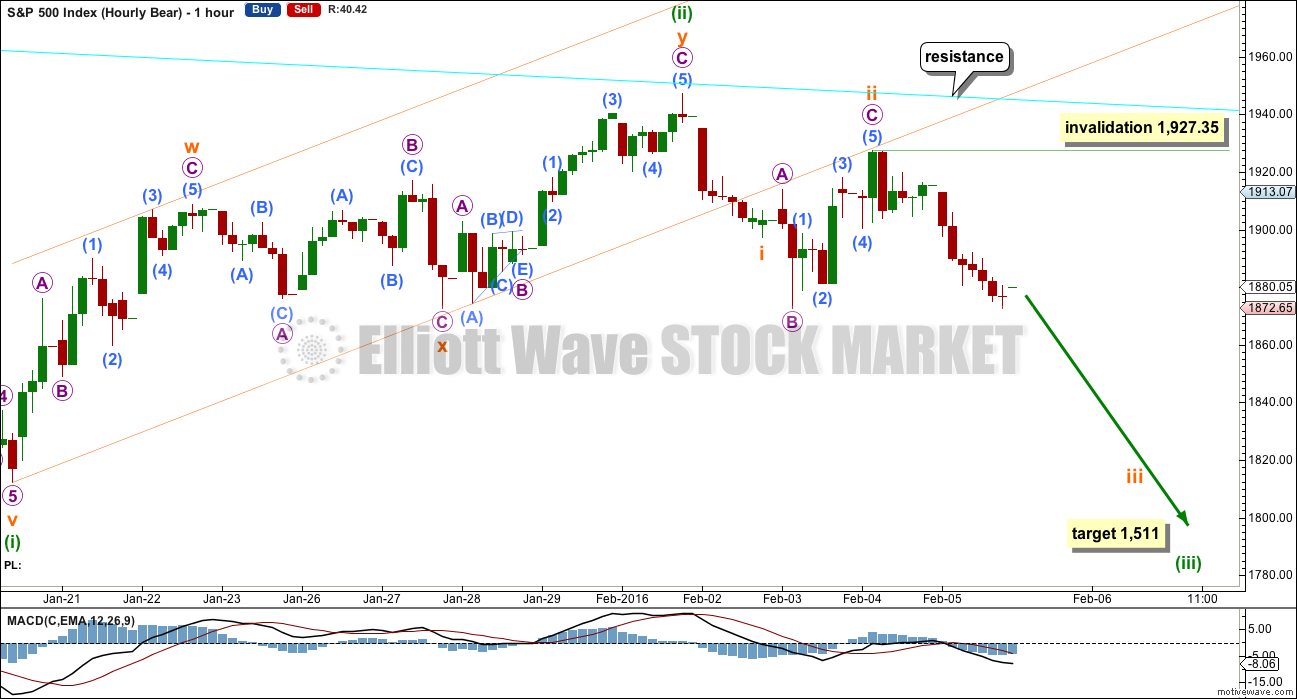

HOURLY CHART

At this stage, the corrective structure for minor wave 4 which has the best fit is a double zigzag. This movement now has a clear three wave look to it on the daily chart.

If this is a fourth wave correction, then the least likely structure for it would be a zigzag or zigzag multiple. That would not provide adequate alternation with the second wave zigzag.

However, alternation is a guideline, not a rule, and it is not always seen.

The probability that the correction was a fourth wave is reduced. The probability that this bounce is a second wave has increased.

Because both bull and bear wave counts see this structure in the same way on the hourly chart, further comment will be with the bear wave count.

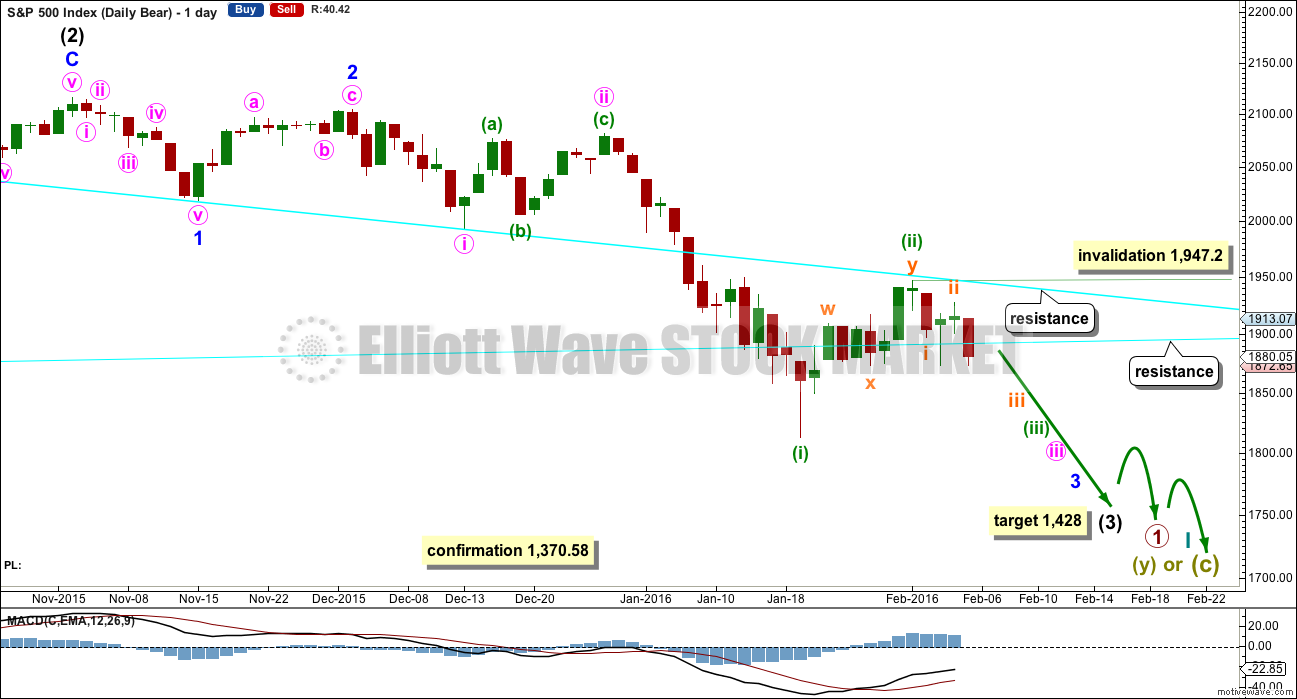

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Downwards movement so far within January still looks like a third wave. This third wave for intermediate wave (3) still has a long way to go. It has to move far enough below the price territory of intermediate wave (1), which has its extreme at 1,867.01, to allow room for a following fourth wave correction to unfold which must remain below intermediate wave (1) price territory.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

The correction for minuette wave (ii) may be over totalling a Fibonacci eight sessions and finding resistance at the upper cyan trend line. A channel drawn about it (no longer shown on the daily chart but may be seen on the hourly chart below) was breached, and a throwback to that line is now also complete.

Intermediate wave (2) lasted 25 sessions (no Fibonacci number), minor wave 2 lasted 11 sessions (no Fibonacci number), minute wave ii lasted 10 sessions (no Fibonacci number) and now minuette wave (ii) may have lasted a Fibonacci 8 sessions. Each successive second wave correction of a lower degree has a shorter duration which gives the wave count the right look, so far. Subminuette wave ii may have lasted two sessions.

If subminuette wave ii continues any higher, it may not move above the start of subminuette wave i at 1,947.20.

The degree of labelling within minute wave iii may also be moved up one degree. This correction may be minute wave iv. I will wait to see how momentum behaves for the next wave down to make a final decision on which degree of labelling is correct. For now I will leave the labelling as the most likely for a second wave due to the duration and the structure of a double zigzag.

If the next wave down shows a strong increase in momentum, then it would be the middle of a big third wave.

If the next wave down shows weaker momentum than minuette wave (i), then it would be a fifth wave to end minor wave 3.

HOURLY CHART

The channel about minuette wave (ii) is clearly breached and price turned up for a typical throwback.

Subminuette wave ii may have been a slightly unusual expanded flat correction. This resolves the problem of the upwards wave labeled micro wave C as a five wave structure yet price made a new low today below its start.

The expanded flat is unusual in that micro wave B is just over 2.4 times the length of micro wave A. The normal common length is up to 1.38 and the maximum convention is of 2 times. There is no Elliott wave rule which gives a maximum length for a B wave within a flat correction, a convention is not the same as a rule. I have seen a few expanded flats over the years with particularly long B waves. They are unusual but possible. The subdivisions all fit perfectly which is the most important point.

If subminuette wave ii is over at 1,927.35, then on the daily chart the proportions of these second waves are all forming nicely to give the wave count the right look.

Within subminuette wave iii, no second wave correction may move beyond the start of its first wave above 1,927.35.

At 1,511 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

If this wave count is wrong in labelling subminuette wave ii as over, then any further upwards movement should find very strong resistance at the cyan line copied over from the daily chart. The strength of this line was reinforced with another test at the high of minuette wave (ii).

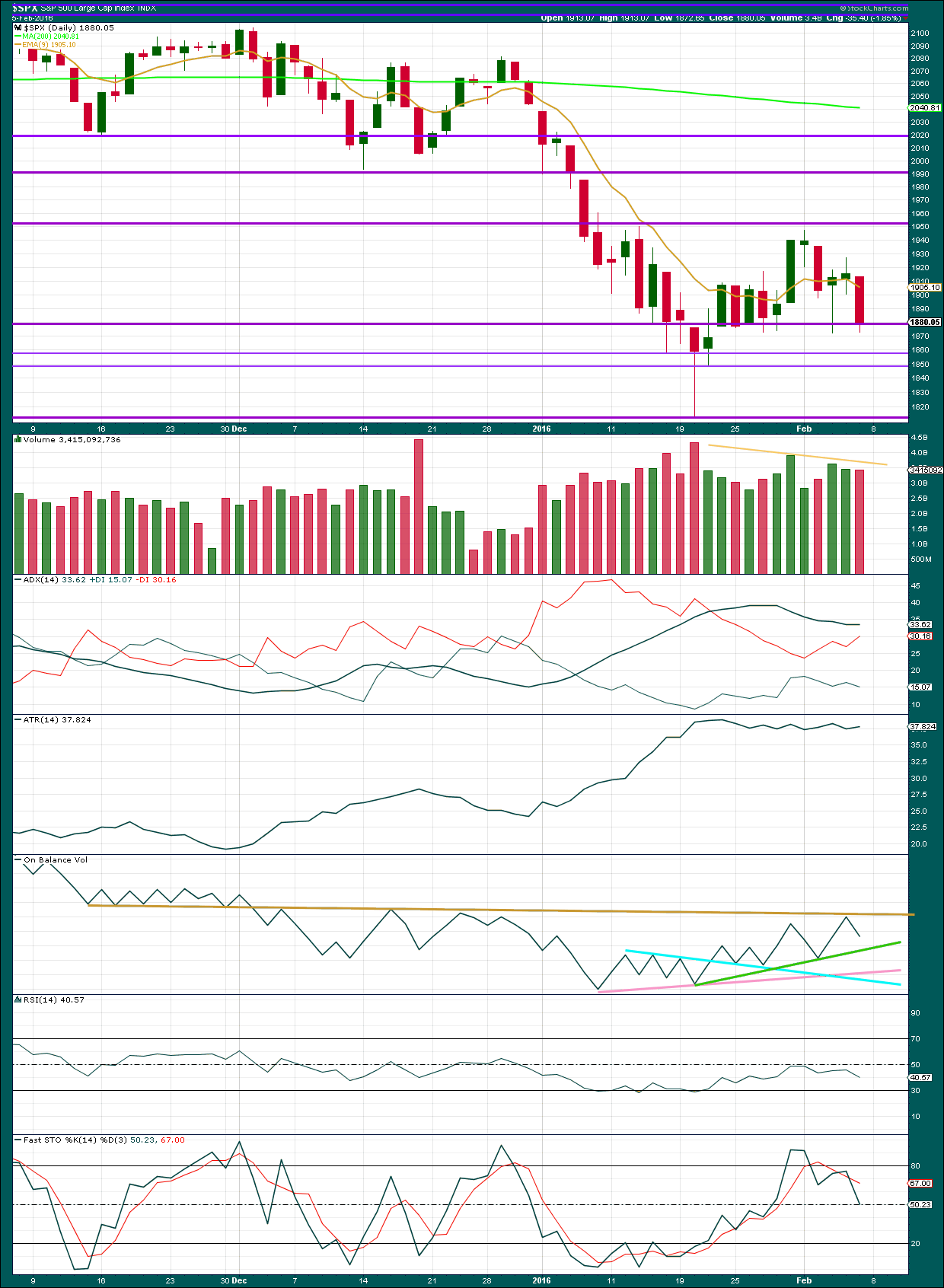

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A reasonably strong downwards day comes with slightly lighter volume. The fall in price for Friday was not supported by volume. On its own this is not enough to doubt the Elliott wave count as overall the volume profile remains more bearish than bullish, but it is giving some mixed signals in the last seven sessions.

Price remains within a consolidation zone which has the upper limit about 1,950 and the lower limit about 1,870. As price moves sideways, overall volume is declining. There is some concern that the three strongest volume days within the consolidation are seen for upwards days, which strongly suggests an upwards breakout is more likely than downwards and is contrary to the Elliott wave counts.

A breakout of this consolidation is required for confidence in the next direction of price. A break above 1,950 or below 1,870 on a day with an increase in volume would be a classic breakout.

ADX is still flat indicating price is consolidating. ADX has not indicated a trend change, the -DX line remains above the +DX line.

ATR is also flat, agreeing with ADX that the market is consolidating.

Within this consolidating market, some more downwards movement would be expected to continue until price finds support and Stochastics reaches oversold at the same time. Stochastics is not yet oversold, so price may continue to one of the lower support lines which are about 1,857 and 1,848. However, a downwards day below 1,872 with a sharp volume increase would still indicate an end to the consolidation and a downwards breakout.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point. So far the S&P has made a new low below 1,821.61, but it has not closed below 1,821.61.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 07:33 p.m. EST.

Hi

All,

This is July-Oct 2008. Close up!

Enjoy!

Jack

Since I share a passion for music – especially the classic english alternative rock!

Enjoy!

New Order – Substance 1987 (Disc One)

https://www.youtube.com/watch?v=9-NFosnfd2c

Hey man thanks for another great song…

Hi

All

Futures sinking now. Just fyi – phew – even got somewhat concerned on the bounce today!

#bearishtilltheend

bye!

Verne,

Speaking of Bears…

Call me old-fashioned. I simply cannot imaging the denouement of of an intermediate third of a primary degree wave that does not at some point sport a triple digit decline in overnight futures at its strongest. I think the best is yet to come…for the bears that is… 😀

Me too! The best is yet to come. Mass Capitulation & Fear.

Yeah, this is the part that VIX breaks that upper band for a 5-7 day run up. That would be the heaviest part of the sell off. Come on already!

Noticed that main media was flashing new about JP Morgan telling folks not to buy the drop in the markets. When was the last time public investor’s interest was front and center for the big banks such as JP Morgan. Quite possible, they wanted to create that fear so the fence sitters bailout as well. CBOE is showing the put/call ratio of 1.16 for 3:00 PM today. I think rest of the week will tell the tale of the tape.

Was that all of micro 2 or just (a) of micro 2?

I’m guessing the latter albeit I’m on high alert that these second waves might be over faster than I think as we calmly drift toward the waterfall.

Could be either one Olga. I need to remember, the bear will have sharp and strong counter trend rallies. But they will be short or shorter. Today’s afternoon counter trend rally has 7 waves. It can be counted something like a-b-c-x-a-b-c(2). I am holding fast because the surprises are on the downside and I do not want to miss out on downside gaps.

Also, in a bear market, the impulse waves downward should / will extend just like in a bull market. We saw plenty of that the last several years.

Today’s gap IMO is a middle gap. First we had the breakout gap(s), now the mid gap and looking for the exhaustion gap before the end of this move / wave down. My projection is 50+ points beyond today’s low. That puts us around 1875 or so. Just my strategy for what it is worth and that may not be much.

Continued good luck all.

My mistake, my projection should read “1775” not 1875.

Not easy to watch it rip 25 points or so off the lows in an hour

The next few days will

Give the real clue!

1-2 hours of price action is not enough to convince me!

Unless the fed has a new policy that could be a game changer – but IMO they only care about the bond market

I do see intra market divergence between spx and Nasdaq!

This week is key!

Always a temptation to trade in and out of these small degree re-tracements. Even if we are in a fourth wave down, barring another truncation similar to what we saw in August, the January 20 lows at the very least will be taken out. The trade back above DJI 16,000.00 is illustrative of the remarkable bullishness that remains in the markets and suggests the steepest portion of the decline has yet to arrive. More downside ahead…imo, much more….

I k r

I was so tempted today but the spread on contracts is to big with Vix swinging 2 points.

Vix closed at the lows today – wierd

You really never can tell what is in store tommorow

They can just wash this market in 2 weeks to be honest

The next 2-3 days could make or break this move honestly

Gap from Friday not filled though. At least two more days before we see some kind of interim bottom I think. It needs to punch through the upper B band, hopefully with some increasing downside momentum. If not, the possibility of a fifth, as opposed to a third would imo have to be given more serious consideration.

We really don’t have that much room to fall on the VIX unless something crazy happens to be honest! Open gap is between 24-25. We closed today at 26…

Just look at how tight the compression has gotten since I brought it up last time. It was like 11 point spread now only 7?

The MACD daily is ready to cross over but not yet!

Tricky times matey!

I lightened up a bit near todays swing low, but I re-purchased just after the close – just in case micro 2 is already done (which I think unlikely – but you never know).

I’ve still around 25% powder dry from Friday to utilise so hoping we do go a bit higher. Loaded up around 75% on Friday after hours based on the very slight invalidation (and my max frustration theory – which played out almost exactly). Was concerned all weekend that I had made a big mistake – totally expected to see the market up 2% this morning and getting bulldozed once again (totally based on emotion – not what the charts were telling me).

Just goes to show – the trades you are confident in usually fail, and the ones you worry about often work out.

Me too. Saving some ammo from mid-term trades to deploy on shorter term entry on what I expected would be bankster buying of the decline in some sort of second wave re-trace. Volatility curled back up at day’s end so it may be over. If futures head South overnight, will again try to get filled on usual quick temporary reversal after gap down open tomorrow. We may have to be nimble trading this unpredictable grizzly… 🙂

I was concerned about the open gaps as well today. However, even looking back the last 2 never got filled either on a bounce. 1998 and 2040ish.

Barry,

I agree – it is times like this that doubt comes in.

I still am thinking down, down and down as Joseph says!

Just broken out top of very short term base channel up from todays lows and back into orange base channel, so this could be micro 2 up.

Poss gap fill??? I’ll certainly be using it to add more shorts.

–

DJI having one last longing, loving, lonesome embrace of the round number pivot of 16,000.00. Next fall away should be long and steep, probably not to be reclaimed until primary two up at some future rendevouz….RIP banksters…. 🙂

Chart updated.

1,825.

Thank you Lara.

Oh ya, I’m gonna have a porterhouse tonight…

Can you make mine medium rare…? 🙂

lol will do…that is exactly how I like mine…

Jack

When going short imo:

Roxette – Listen To Your Heart

https://www.youtube.com/watch?v=yCC_b5WHLX0

Thank you Ace! We have got to listen to our hearts…as you know gut feelings are important…

Lara,

Thank you again for posting during trading hours. One quick question. Are you at all concerned that momentum still seems to be lagging? While the move down today is sizeable, volume still appears somewhat light to me. Could that be because we still have not reached the third wave yet, or is it more likely that the bull wave count is correct?

Thanks,

Peter

I do not have confidence in that bull wave count. I present it (and first too) because I am naturally very conservative and cautions. The bear wave count is such an enormous call to make.

This is entirely normal for a third wave, I have no problems whatsoever at this stage. Momentum on the hourly chart increased today. Once price breaks below support at 1,812 then momentum should build further.

This is how third waves build. Slowly. When they reach the middle they can be explosive. Towards the end momentum should remain strong.

I would suggest any member questioning what is happening here takes some time to go back over the daily charts from 12th August 2008 to 10th October 2008.

That wave was an intermediate degree third wave down. Look how it started. Notice momentum.

Thanks – if any member wants to see it – I ran it for you down here. I always go back to 2008. It is easy to get discouraged if you haven’t sat through a 3rd wave fully. This is the patience part. It really is nerve recking here to be honest! Especially a small bounce can make you doubt yourself. I remain bearish until proven otherwise….

Attached is 2008 with percentage decline near estimates I ran….

A very short term target: at 1,825 submicro (5) would = submicro (1). *Edit: only had one coffee and typed numbers in wrong. Calculations checked and corrected.

This may be where the current small impulse ends.

If the base channel here is breached to the downside then use the lower edge for resistance.

If price moves above the lower edge then use the upper edge for resistance.

Micro 2 should be relatively shallow and quick. If it shows on the daily chart it may be only one day, and a doji or a green candlestick with a long upper wick / small real body.

Short term: I can see another impulse almost complete, another first wave this must be.

The second wave corrections are becoming quicker and more shallow. The next one for micro 2 shouldn’t show on the daily chart, so this is where it could get stronger and mostly straight down from here.

Todays downwards movement is overshooting a base channel which could be drawn on the hourly chart about subminuette i and ii. If that breach holds and price remains below it then the lower edge should provide resistance. If price gets back in the channel then the upper edge should provide resistance for the next second wave.

It looks like it will be this week that the strength of this third wave becomes clear.

Good luck everybody!

I’ll be riding my first big third wave down with you all on this one 🙂

ThanQ thanQ thanQ…

Thank you!!!

I don’t know what else to say…

Should be a sweet ride…!

Good luck Lara, hope you and everyone else makes a few £, looking good atm

I have a better position on FTSE.

A small short on S&P.

Trading the indices is new to me. I’m still getting used to the volatility!

Vern–you reference the August highs for UVXY but if we are truly in a Bear wouldn’t it be likely UVXY would move much higher than August 2015, possibly more similar September 2011 ?

Yes Sir! I think those highs are going to be obliterated, despite my conservative musings…

I like analysis that keeps an eye on the big picture and Mike Swanson of Wall Street Window has a interesting comparison with the last big decline. We may have to re-visit the current degree assignment…I will post a thought provoking chart… 🙂

Taking profits on some mid-term positions. Rolling capital into later dates.

Feb 16 UVXY 50 calls picked up for about four Washingtons Friday should sell for a few Jacksons in the next few days! 🙂 🙂

Look for FED to attempt to implement their “managed decline” strategy and buy this decline. Any re-tracement would be a gift for anyone waiting to get positioned.

UVXY gap open consistent with run toward spike levels. Time for the 10X trade. Loaded remainder of short positions on slight reversal after opening. Here we go…! 🙂

Vern– UVXY seems to be lagging this AM, what do you think is the reason?

And your 10X trade–do you mean loading up on UVXY now to catch a big move up or are you referring to your “counter play” where you catch UVXY at the top and ride it down?

For the brave of heart….both!

The lag in explosive action upward is reflecting persistent bullishness in the market believe it or not. I suspect some folk are anticipating the end of a fourth down and not in panic mode yet.

All the talking heads on the various media are talking up the “buying opportunity” and telling folk “not to panic”. I guess some folk are “buying it” 🙁 Talking heads notwithstanding, panic they will. You can bet on it. 🙂

UVXY has yet to punch through the upper B band so it has plenty of room to run. It really should take out the August highs before the next serious market bounce imo. For those traders that like a bit more finesse, here is a good place to start laddering bullish (for UVXY)put credit spreads during the run up and exiting the sell side when it closes back below the upper B band for TWO sessions. God luck everyone! (especially Olga!) 🙂 🙂 🙂

Thanks.

A bit more detail for educational purposes Davey. The upside UVXY trade is very tricky as the timing has to be perfect. The window for its execution is literally one or two trading sessions depending on entry. Ideally entry is made the day prior to the capitulation spike and exited the following day. It is sometimes possible (but difficult) to get filled the day of the spike at the open and exit the trade prior to the close for the ten-bagger.

Having profit targets (both for UVXY and/or a major index) is critical to a successful exit strategy. This is where Lara’s analysis is worth its weight in Platinum!

The upside trade is NOT for beginners (unless you try it with a contract or two). The details I sent you about the downside trade is easier and less risky. Happy hunting! 🙂 🙂 🙂

GOLD is in blow off top and time to short.

I would be careful with that!

I don’t think so, not today anyway.

I’ll be looking for a slight divergence (between the current day and the day immediately prior) between price and RSI, or perhaps price and Stochastics (less reliable) before I look for a correction.

Gold is in an upwards trend. Trading against the trend isn’t a good idea, even if it is moving lower in a correction. Corrections aren’t trading opportunities, they’re opportunities to join a trend.

‘Nuff Said!! 🙂

Boss talking about jumping in front of a moving train…

Ouch!! 🙂

How amusing! The feckless FED are still pretending that US equities are “de-coupled” from global markets. This morning they are on another Quixotic mission – “We are not in a third wave down…really!”

Dummkopfs!

Get short while you can still do so profitably…

The harder they pump, the bigger the pop… 🙂

The news regarding Chinese FX reserves is in and it is hardly a surprise. We know they have been burning through them futilely defending their currency and propping up their equities. A lot of talking heads are going to try and make some connection to that report and US markets, as if the state of their reserves was not an open secret; I suspect they are under-reporting the extent of the draw-down, as is their habit with all statistics regarding their economy. I think the Chinese are going to single-handedly usher in the next leg of gold’s decline as they desperately try to raise cash to stabilize their imploding economy by unloading a large portion of their vast gold hoard many months from now.

The leisurely development of the impending third wave down suggests it is going to be long and very deep indeed. It is already looking like the fall of DJI 16,000 will happen out of the gate this morning, which will be the trigger for deployment of my remaining shorting capital for near term trades. It’s about time… 🙂

You said it vernecarty. It is about time. I also will be acquiring my final shorts to complete my position. Good luck to us all.

Yes good luck all

Jack

Great song for the third wave interruption

Beastie boys – sabatoge

http://youtu.be/z5rRZdiu1UE

lol cool song…please talk to your buddies that trade futures and tell them: sell, sell, sell!!!

Just a reminder imo—

Big picture!

Futures a little up. I can’t believe it

Got to wait for the cash open ???

Nothing to see here till tommorow

Futures only mean something if it persists into the open.

Silly banksters! 🙂

hi

All

All US futures slightly up a few points and then faded. Nasdaq was leading lower but now just flat.

later!

Hi

Lara,

Any reason you are using the fast stochastic with default settings 14-3? Typically full stocashtics 12-3-3 can give a better view?

I’ve looked back at past (recent) consolidation periods for S&P and noted that fast stochastics appeared to be more useful.

That’s my judgement, and I know it’s not necessarily the judgement of others.

Ok, thanks. I am always updating my technical research. There are so many tools that work at times but the ones that stand out are the ones to always use.

Still holding on to the SDS options I bought last week. When I bought them, gave myself some more time by buying the 02/12, 23.5 strike price. I think SDS option prices are undervalued as compared to option prices of more popular 3x leveraged rut2000 TZA and nas1000 sqqq. During this run up built up 100% of my short position. Planning to take profit as crash gets on…

I was planning to take some profit off of my small SDS option position, but the automated sell trade I had put on missed by pennies…wish it didn’t. I’ve yet to find a person that went broke by taking profits.

Options is really not my thing. ETFs will forgive a bad trade that is why I like the ETFs better.

Next week should be interesting, may all of us make some money.

Jack

What is your take on a bounce at a lower level? I see 1750 as a potential bounce but then again this is the stronger part of the 3rd wave so we could and should punch right through that to 1573-1550.

That’s true…

I’ve plans to sale at least 1/3 of my position between 1809-1775 (with the magic number of 1790). If I see an incomplete wave structure I might get greedy and try to hold on to them till 1750 with a stop at 1790 and once it clears 1775 will move stop down to 1775.

I’m a little concern that this wave two is not over yet. Didn’t want to be holding majority of my small SDS option position through the weekend.

I think we’re gonna have some resistance at 1872 (obviously), 1863, and 1820-1809.

The MA(200) Weekly has not been touched since 2011. Just ridiculous to be honest!

is a good place for it to bounce off for a few points…minor wave correction. Might only last a few minutes or couple of hours.

Well missed the gold action. Take a look at NUGT.

Not gonna play it now. I think we’re gonna have one more wave down. If I missed it not gonna worry about it.

I had plans to start buying gold when/if it hit 950.

Yeah, I pulled the 1 year chart on that just now and measured the declines at some levels randomly. That had some pretty good moves down!

Check out the percentage declines. Just massive LOL

RSI Daily is way over bought. It could turn at any point to be honest!

Well take a look at DUST. I might play that if I see a setup for gold decline.

See I am thinking if we’re crashing then everything is gonna crash…gold, silver, copper, oil…nothing is gonna be safe accept..cash. Then is gonna be time to buy silver and gold…because at some point CBs are gonna print.

In previous crashes, what tends to happen is that gold stocks start down with everything else, but then recover and go the opposite direction. It makes sense. Everybody sells in a panic, but then, when they start to think a little they realize that gold is a safe haven and the stocks start to catch a bid.

That is true…IMO I don’t think we have seen the bottom yet…as some would say it don’t feel right.

Here goes DUST – would you look at the drop -Just WOW -66.1%!

What is really scary is the MACD and RSI are still pointing south imo.

I dont see a reversal signal yet either – give it a couple days to a week to get a nice old hammer at the lows maybe for a short term bounce?

I am not playing gold anything till I see a setup. Gold might go up for another couple of weeks.

Supposedly gold just broke out of an ending diagonal…hence why we have had the thrust upwards…

Jack, I also like trading options on the ETFs, but only those with heavy volume. When they’re thinly traded the spreads can be ridiculous. Its hard to get a good price buying or selling.

That’s why I don’t trade options on leveraged ETFs like SDS. Spreads are huge. I think its easier to make money with puts on SPY. You can always get a fair price at both ends.

I agree…the volume on SDS options is low. Probably is why they are cheap…

That was a smart move Jack. I was a bit of a gun-slinger getting a few speculative Feb week one expirations and had the contracts expire worthless. Stuff happens 🙂

Still holding a ton several weeks out which I expect to return several hundred percent. I totally agree if a third wave is at hand they are STILL woefully under-priced. The persistent bullishness of the market is giving option trades a a great opportunity to get positioned relatively cheaply. Expect a huge jump in premiums when the DJI 16000 pivot falls next week.

Thank you Vern, and appreciate you for sharing the SDS info.

I agree, when the third wave hits the premiums are going to go through the roof…

Verne

What’s is really interesting is some well known traders are looking for a right shoulder Building. Now that is pretty out there!

Hi

Lara,

I had another question about how third waves at this stage really work. In the research you have done for all these years and text books you have studied and real market experience. In this stage of the 3rd wave. It is a high or low probability we could get a corrective wave before we hit the target of SPX level 1,428 like we saw after the 14 day sell off that was from 2,080 to 1,812 then went 12 days up as high as ~7% to 1947 to close this past Friday back down at 1,880.05?

Best Regards,

I was thinking exactly the same and wondering how many shorts were caught given the markets ended the week at lows. It was interesting that President Obama made it a special point to have a conference to talk about economy and markets. In the current environment, FED doesn’t want to reverse the rate hike as they will loose market’s Trust but it will not surprise me if there is a coordinated attempt by the central bankers before the next week starts.

They rather take control while they can otherwise it will get pretty bad and ugly in a hurry. US FED is regretting the rate increase (I think it was the correct move but markets are in tailspin since the rate hike), in the long run these markets will come down but short term the risk is playing short in the oversold markets but crashes do happen in oversold markets so you never know.

Regardless of the rate hike oil was heading lower!

Last year Greece was the excuse

Last year China was the excuse

What really is funny is why US monetary policy is concerned with international problems

The .25 rate increase didn’t cause all these problems

The real cause of all these market problems are no risk attitude and over bought , over bullish stocks in bio tech, tech and financials.

Those will lead to the downside! Those will stick out as the largest declines.

This reminds me of year 2000 to be honest! I like to call this the tech 2.0 bust!

IKR

I’ve even heard one excuse for Oil dropping is people are realising that climate change is happening and will switch to alternative energy sources.

I think that’s really stretching credulity.

When Oil was close to the highs and I had a huge arrow pointing lower with low targets I received some rude comments, and an assertion that Oil simply couldn’t drop that low, it would be below the cost of production.

Well… it has dropped. A lot. And it keeps falling.

I don’t think the reasons are fundamental. I think it’s just crowd psychology on a grand scale. I think it’s the usual culprit, fear.

There is no question they are going to take back the rate hike. They are going to do it with very red faces, but they will do it. What I am uncertain about is whether they are going to announce another round of QE. I suspect the rate hike walk back will be preceded by a lot of dovish talk which will do nothing to halt the market slide. I imagine the dovish talk will probably come around the intermediate four correction, and the actual rate hike walk back will come at the end of intermediate five down of primary one. With bond yields starting a long term march higher, a lot of smart folk are betting against additional QE. The FED are between the proverbial rock and a hard place…

The second wave corrections are becoming briefer.

Minuette (ii) at 8 days was quicker than minute ii at 10 days.

Now subminuette ii is most likely over in just 2 days.

So the next correction for micro 2 should be over within a day I expect, if this pattern continues.

Which means the middle of this third wave should be approaching and fast.

This statement is based on the assumption that the pattern seen so far will continue. That is the most likely scenario and so the one we should expect.

But it is not the only possibility. As always, this is a statement of probability not certainty.

HI Lara,

Is it possible for you to do an update to NASDAQ and QQQ analysis in wake of the recent selloff in tech sector?

Regards,

It’s possible.

But I don’t think it’s very likely today.

Maybe just a chart, that should be doable.

Lara,

I have only been with you a few weeks, but you have been on top of the SPX like nobody I’ve seen. Nice work.

You have provided projections for the larger degree waves. Is it possible to project the lengths of the smallest waves, like the current subminuette iii?

Yes, it is possible.

One reason why I have consciously chosen to not do that is it may provide a target that will only be a short term interruption to the trend.

The bigger profits will be in the bigger movements. That is my focus.

I understand what you are saying, and it makes sense. For those who are going short or buying inverse ETFs it makes sense to buy and hold. Otherwise you can miss a big move. However, for those of us who trade options its a little different situation, since we lose premium every day that we hold too long. It would really help to be able to plan entries and exits, even short term. I think that we all understand that projections are best guesses only, based on probabilities. They are not predictions.

I was thinking about the same. For options trading would help to get short term charts.

Ok.

A fair point.

I’ll add it.

Thomas I second that. I’ve been a member for almost 3 weeks now & her analysis has been spot on. I’m going to listen carefully her words such as “very strong resistance”. I’m glad to have found this website. A lot to learn here from others as well as from Lara about technical analysis & Elliottwaves

Thanks Lara!

woo hoo! first again. thanks for the analysis,, looking forward to next week.