Sideways movement fits both Elliott wave hourly wave counts and does not provide clarity.

The upper price point to differentiate the two ideas may be moved lower.

Summary: The trend is down. The only question still today is: are we going to see a deeper bounce here or will the middle of a big third wave turn up very soon? A new high now above 1,901.44 would indicate a bounce is underway which may end about 1,948 – 1,953, or may just meander sideways for a few days. A new low below 1,857.83 at this stage would be very bearish. If that happens, look out for surprises to the downside, not just in price but market behaviour overall.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

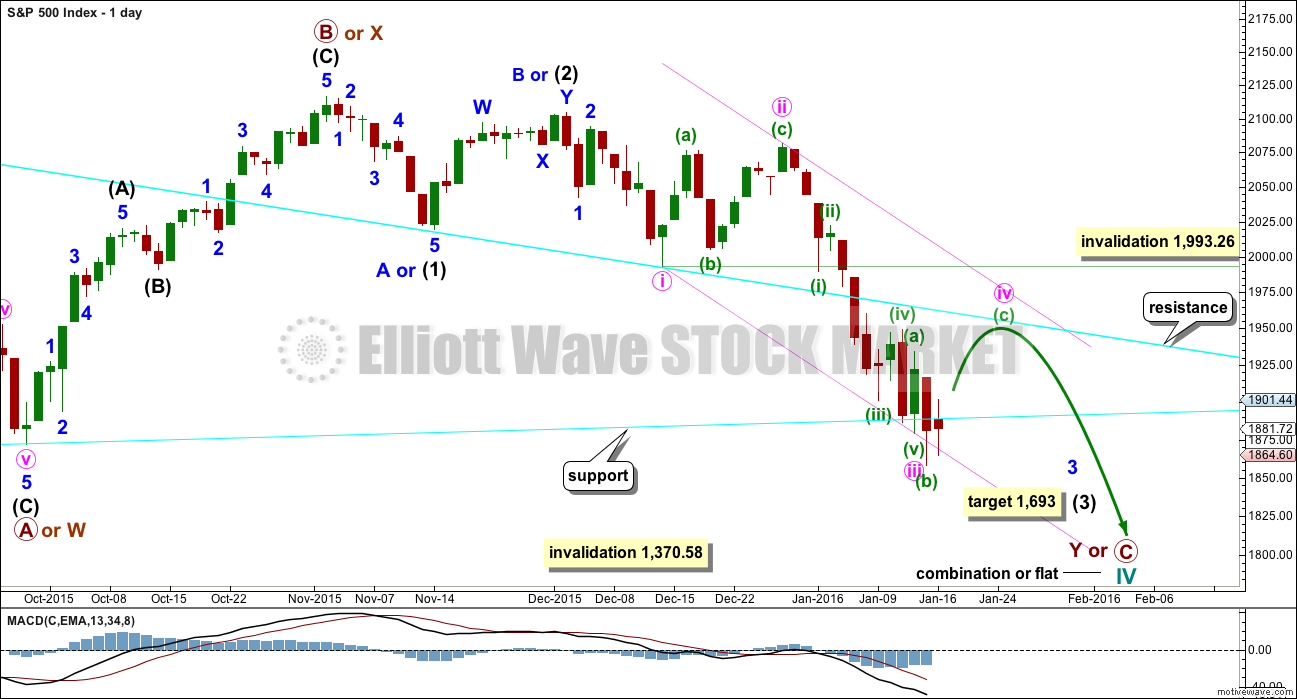

BULL ELLIOTT WAVE COUNT

DAILY CHART – COMBINATION OR FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction.

Primary wave A or W lasted three months. Primary wave C or Y may be expected to also last about three months.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,693 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

The middle may have passed within intermediate wave (3), but this has a lower probability than the scenario presented with the bear wave count. This idea is presented to consider all possibilities.

It is possible that minute wave iii is a complete five wave impulse. This has a low probability and should only be used if it is confirmed with a new high above 1,901.44. There would be no Fibonacci ratio between minute waves i and iii.

Minute wave iv may not move into minute wave i price territory above 1,993.26. It may end when price finds resistance at the upper cyan line.

Price is finding support about the lower cyan trend line which is drawn from the October 2014 lows to the August 2015 lows.

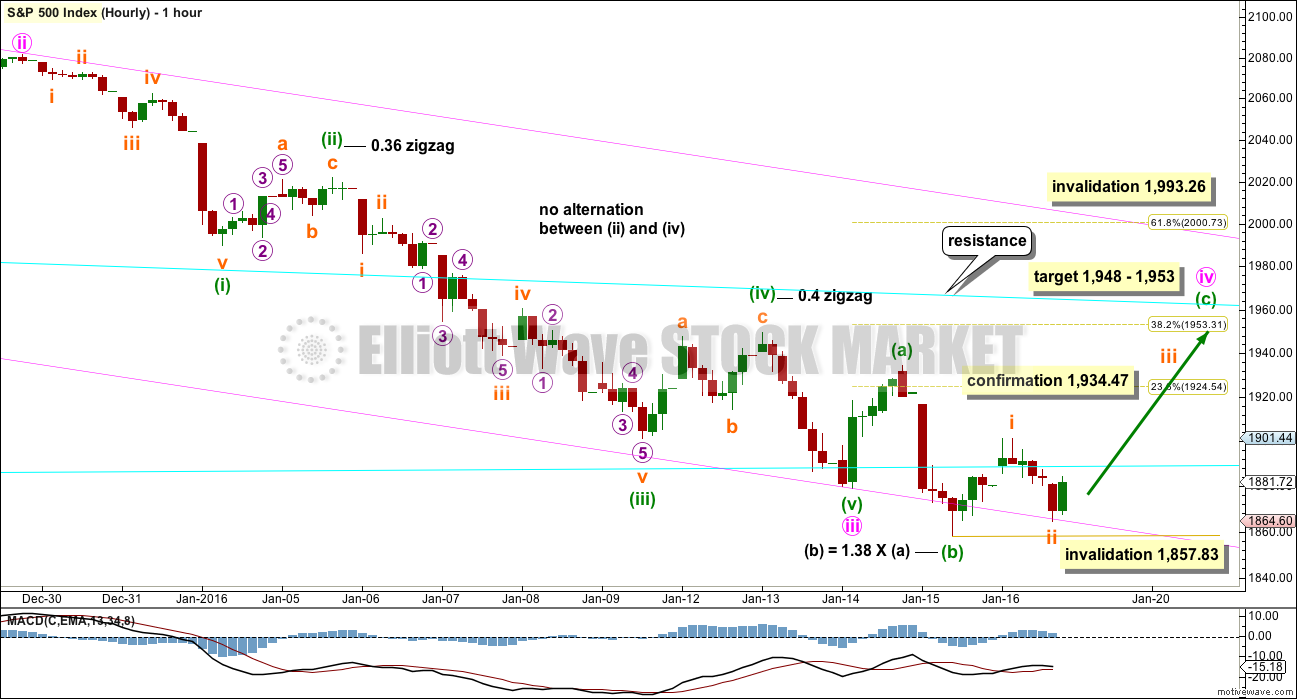

HOURLY CHART

This hourly chart follows on directly from the labelling of the daily chart.

Minute wave iii may be over as an impulse. Minute wave iii does show an increase in momentum beyond that seen for minute wave i on the daily chart.

On the hourly chart, there are a few problems with this wave count which reduce its probability:

1. There is no alternation in either structure or depth between minuette waves (ii) and (iv), both are shallow zigzags.

2. Minuette wave (iii) did not breach a base channel drawn about minuette waves (i) and (ii) (no longer shown for reasons of clarity in the chart).

3. There are no Fibonacci ratios between minuette waves (i), (iii) and (v).

4. There is no Fibonacci ratio between minute waves i and iii.

It is technically possible that this idea is correct. Alternation is a guideline, not a rule, and momentum is a guide and not a rule. This idea is presented to consider all possibilities, so that we are prepared for the unexpected.

This idea requires a new high above 1,901.44 for confirmation.

Minute wave iv may be unfolding as an expanded flat correction, which are very common structures. I have checked the subdivisions of minuette wave (b) on the five and one minute chart and this movement is ambiguous. It may subdivide as either a three wave zigzag or a five wave impulse. This wave count sees it as a zigzag. The next hourly chart sees it as an impulse. Both possibilities must be considered.

Minuette wave (b) is a 1.38 length of minuette wave (a), at the maximum normal range of a B wave within a flat correction. At 1,948 minuette wave (c) would reach 1.618 the length of minuette wave (a). That price point is reasonably close to the 0.382 Fibonacci ratio of minute wave iii at 1,953 giving a 5 point target zone.

If minute wave iv is a shallow flat, then it would exhibit perfect alternation with the deep zigzag of minute wave ii.

Minute wave iv may also unfold as a triangle or combination. I am labelling it as a flat because that is the most likely structure, but a triangle or combination would also be shallow and also provide perfect alternation with minute wave ii.

If this wave count is correct, then as minute wave iv continues the labelling within it may change. It is impossible to tell which of several structural possibilities minute wave iv may complete as, so it is impossible to tell with accuracy the pathway that price may take for this correction. The only thing which is clear is that it would still be incomplete.

Minute wave ii lasted 10 days. At this stage of a big third wave, I would expect minute iv to possibly be more brief. A Fibonacci five or eight days in total may be expected; so far it would have lasted two days.

The target also coincides nicely with the upper cyan line copied over from the daily chart. Price should find strong resistance there.

No second wave correction may move beyond its start below 1,857.83 within minuette wave (c).

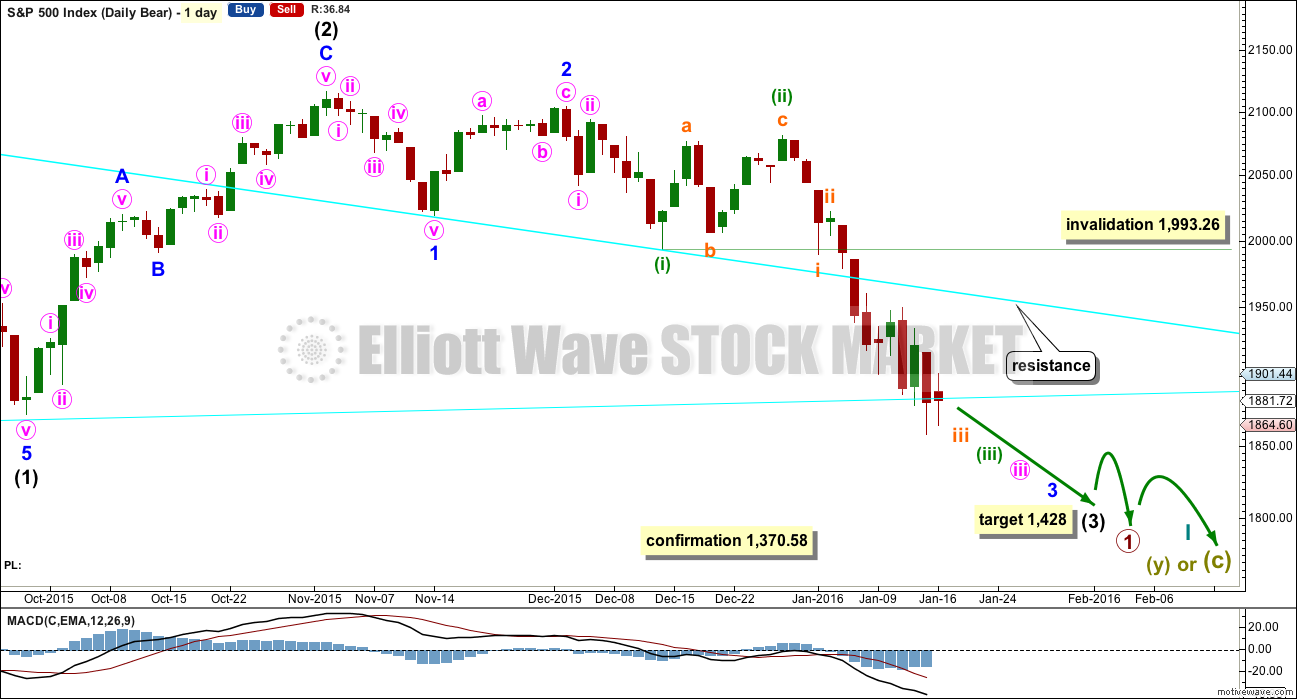

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

The downwards movement labelled intermediate wave (1) looks like a five.

Ratios within intermediate wave (1) are: minor wave 3 is 7.13 points short of 6.854 the length of minor wave 1, and minor wave 5 is just 2.82 points longer than 0.618 the length of minor wave 3. These excellent Fibonacci ratios add some support to this wave count.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

Because minuette wave (ii) was a deep correction of minuette wave (i), it would be expected that the correction of minuette wave (iv), when it arrives, should be shallow against minuette wave (iii). Minuette wave (iv) may not move into minuette wave (i) price territory above 1,993.26.

Intermediate wave (3) still has to show an increase in downwards momentum. Momentum for intermediate wave (3) is increasing, but it should be stronger than momentum within intermediate wave (1) (the August 2014 low, now off to the left of this chart).

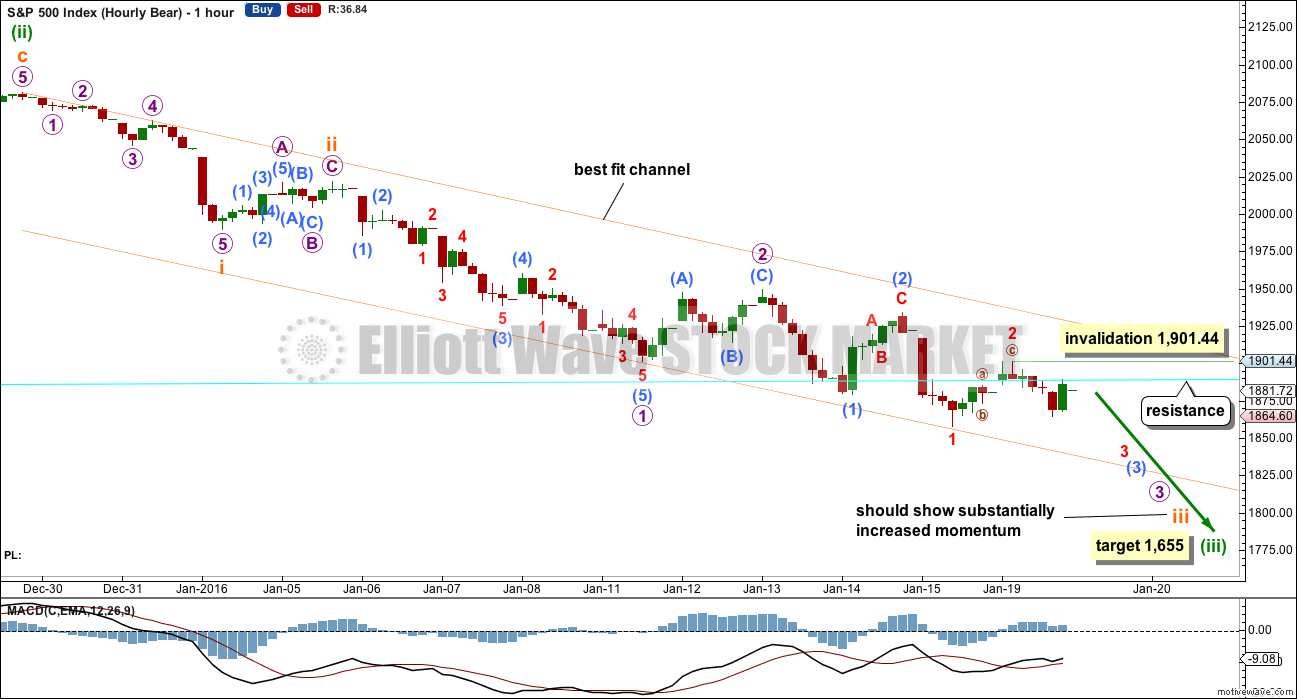

HOURLY CHART

The subdivisions on the hourly chart for both wave counts are the same, but here the degree of labelling within the impulse of micro wave 1 is moved down one degree.

Instead of the end subminuette wave iii this may be only another first and second wave complete.

At 1,655 minuette wave (iii) would reach 4.236 the length of minuette wave (i).

This wave count still requires a further increase in downwards momentum.

The lower cyan line is copied over from the daily chart. This line may provide resistance now that price has breached it.

The best fit channel so far is working well. Downwards movement for Friday found support there. Upwards corrections may find resistance at the upper edge (if the cyan line is breached).

Labelling shows an expectation of the best fit channel to be breached. This may happen, but it does not have to. In the first instance, look for price to find support at the lower line. If that line is breached, then look for corrections to then find resistance. This is a best fit channel, not a base channel, so it should not be expected to behave as a base channel behaves.

Another first and second wave may be complete. There would now be a series of eight first and second waves up to intermediate degree. This wave count expects to see explosive downwards movement beginning this week and into next week.

When third waves extend they extend in both price and time. The movements within an extended third wave are stretched. Low degree corrections within them will show up at higher time frames. At the start of an extended third wave there is necessarily a series of first and second waves. This often convinces us that there is no third wave, that something else must be happening, and it does that right before the third wave takes off strongly. The number of first and second waves on this chart does not reduce the probability of this wave count at all.

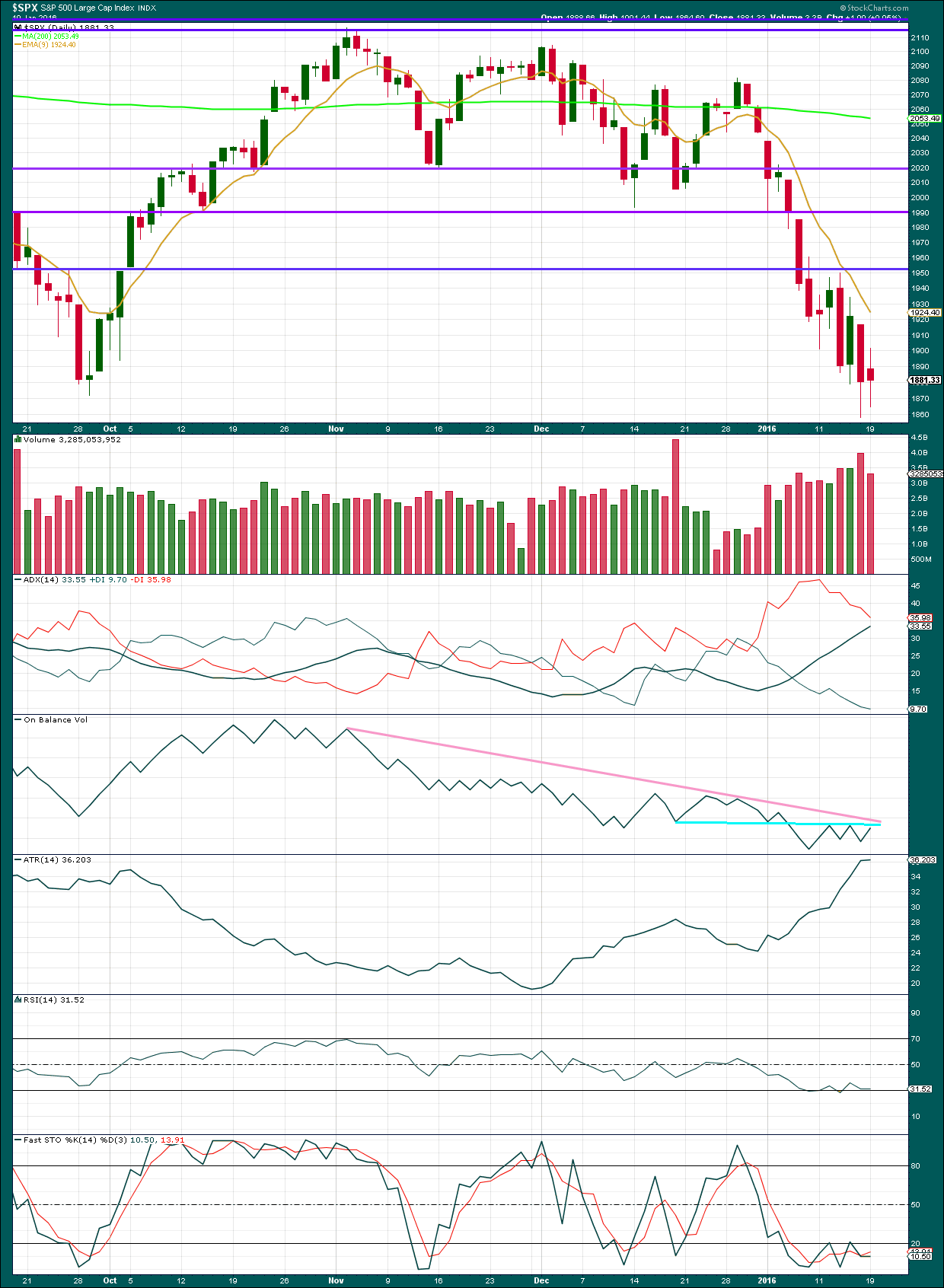

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Note: This analysis is updated at 7:12pm EST after StockCharts volume data is finalised.

Tuesdays session saw a red candlestick on decreased volume. A new low was not made and the candlestick has a small real body with about equal upper and lower shadows. Tuesdays session was a balance between bulls and bears, with the bears slightly winning. Because no new low was made and the session represents overall a small corrective movement the lack of volume is not concerning.

Overall the volume profile continues to be consistently bearish.

ADX and ATR are in agreement and indicate there is a trend. The trend is down. Expect corrections to find resistance at the 9 day EMA.

On Balance Volume has come up to touch the cyan line again. OBV works very well with trend lines. It would be reasonably likely that this line may help to stop the rise in price. This is a short term bearish signal.

In a trending market, particularly a big third wave, RSI may reach extreme oversold and stay there while price continues to fall. I will be looking for divergence between price and RSI to indicate a correction. There was slight divergence between price and RSI at Friday’s low at the end of last week. Today’s sideways move may have resolved that; slight divergence can be resolved quickly in a big bear market.

Stochastics may also remain extreme for reasonable periods of time. There is no divergence with Stochastics and price today.

McCLELLAN OSCILLATOR

Click chart to enlarge. Chart courtesy of StockCharts.com.

The negative divergence (red lines) during the last rise in price to the last major high of 3rd November, 2015, was strong and a good bearish signal for the following fall in price. As price rose to 3rd November, it came on declining breadth.

There is now double positive divergence between price and the McClellan Oscillator. The new low on 15th January came on weaker breadth than the low three days earlier on the 13th (pink lines), and was also weaker than a prior swing low of 14th December (green lines). This may be a warning that the scenario in the first Elliott wave hourly chart may be correct, that price may be about to move higher for a bounce which may last another few days.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 05:31 p.m. EST.

Well hey all my EWSM friends. I had to leave my computer right at the low of the day. When I plugged back in well after the close, I was eager to read all that you had to say. I did hear on the radio how it closed so I was prepared to see the rally back up to 1876. Lara has not yet given her analysis of the day. But she has commented during the day. That is really helpful.

What I think at this point is that the weak and late shorts are been whipsawed. But for the Bears, it is a gift and time to feed a bit more on those bull stakes. Now just think how much more selling will take place. All who bought today may be in for a big surprise tomorrow or the day after. Many bulls will not want to hold their positions over the weekend. That will contribute to the selling.

We do not have capitulation. It is not over all the news. This bear has yet to make an economic earthquake.

So I am glad I did not have to sit through today’s 2 1/2 hour rally because may have buckled and covered my shorts. I did that last week, remember. Then I missed a 40 point gap down the next morning.

You can find bullish hammers with down days to follow. Check out the bullish hammer in the week between 9/21/15 and 9/28/15. The market fell the next two days and made new lows.

My thoughts for what they are worth because I make no pretense that I am expert at this. That’s why I pay Lara and enjoy your thoughts. It is very helpful.

She just posted.

It’s a very detailed report!

Hi

All

1 hammer doesn’t mean much. I guess we just have to wait and see.

I just thought if we took our 1821 then this was a clear break ?

Jack

I think unless and until we open big time green tommorow like this it will be nerve recking. So is this still the 3rd wave ?

Whatever unleashes after all these 1&2s is going to be a beast. Scares me when I think about it…

We might be in a dollar squeeze…folks are pointing that out now…it might be wise to have six months’ worth of expenses in cash (dollars).

Ya’ll better make sure to have some cash. You don’t want to be standing in line to get your cash out of an ATM machine at the rate of $20 per day.

Indeed, a very wise idea.

A fire proof safety box can be easily purchased from a hardware store. That would be a good place to safely store about six months worth of cash, just in case.

It sounds really pessimistic… and far out.. when I say it, but I do think it may be a wise precaution.

Leaving it in the bank isn’t exactly earning lots of interest. So not much loss really.

Hi

All

As of now futures have erased the entire loss of the spx today ?

This is just getting out of control don’t you think ?

It’s like it never happened – so was the surprise for more upside ???

How many more short covers will

It take to go back to spx 2,000 level

?

Futures now lost have of gains and +8 – crazy price action !

All seems very black and white to me – whilst we remain below 1901 nothing has changed imho.

I can count a 5 down from 1901, and a 3 up from the low so everything looks as it should atm

Thanks Olga. Much appreciated…

I am still cautious because of what the bulls have been doing for so so many years to the bears….

It is amazing how a 40 point reversal off the lows scared me to thinking we could goto 1970….

great point about 1901. now I can go to rest!

John

Is this really really a problem?

Tons of analyst are saying the 1820 was support and we could bounce. Is there conviction here from your view? Much appreciated matey…

As BEARISH AS I AM. I GOT SPOOKED HONESTLY!

here we go again, they are selling down that new crude contract already, futures will follow and set up a repeat of today, hopefully without the late heroics

Verne

Seriously though, that closing print and exhaustive selling? This could get ugly to the upside fast? Still bearish?

It still does not look as if we have had a selling climax. A lot of analysts are talking about how bearish sentiment is but my question for them is where is the fear? We have had few days with long lower wicks that did not stem the decline. I am still looking for a strong reversal off the bottom AND a UVXY spike. More downside I think…a strong gap up at the open tomorrow that moves above the upper BB could signal an impending interim bottom.

good point. I was really amazed at the bounce and almost was looking the wrong way. Thanks for keeping me on track…

The bears are having none of it. Glad I kept the hedges light. That “hammer” looks like a massive head-fake IMHO. The “bounce” lasted all of thirty minutes….uber

bearish…

Verne

You still that strong about this decline? I am actually extremely worried that this could bounce to be honest!

I would think closing under that 1857 level is important ?

Going above 1901 would cause me more concern.

At the moment this is just another scary looking (gap fill) correction.

Below 1836 seals the deal on this correction

We may have just done another 1&2. Suppose the big third is behind us, we still have the little brother 5 to come through.

I’ve got to say though, very brave of the bulls. IMHO brave and foolish. Judging from VIX, this thing got legs. Judging from the hammer (bears are royally screwed…). I guess time will tell. I am in the bear camp…

thats right…

I still cannot see the middle of the third wave.

This correction is too high to be a fourth wave, it is in first wave price territory.

It will only fit as another 1-2.

Hi Lara,

Thanks. Does that hammer on the close today mean anything or look suspicious to you at all?

The only concern I had was that the reversal seemed so strong and powerful that it had me second guess this decline and look back up to 1950-1980 for resolution but that was just quick judgement, nothing concrete behind it to be honest. Plain old math 13 days down and due for a bounce but nothing more. So, not sure if that really counts for a justification or explanation.

But, like Verne said this could be a head fake.

I agree that when I look at historical declines i have noticed hammers in the middle of a decline but they never had any follow through. I am just trying to understand.

In general are 3rd waves this long drawn out?

Actually your new report answers my questions!

verne

I got to tell you. This reversal does look intimidating to me at least. Your thoughts?

Picking up a few light near term upside hedges. NDX printing a fat green candle with long lower wick. Holding mid and long term short positions.

Move up today designed to dislodge johnny-come-lately shorts at a loss despite today’s massive downside move. A good example of the importance of being positioned ahead of big down moves. Only weak hands are going to be shaken out. This thing is just getting started, regardless of how the banksters thrash around… 🙂

spx 2000 next?

Verne

Do you see the size of this hammer on the daily? Really looks interesting. Could signal a MASSIVE BOUNCE?

That is possible but it would be a disaster without capitulation. I would expect a very sharp bounce that would not last. I think you are seeing a buying crowd that is absolutely convinced this is as low as we go as the August lows have been re-tested. I am keeping a sharp eye on UVXY and how we trade after the open tomorrow. If UVXY turns around and starts to head North BEFORE the red candles in the market are printed that means trouble ahead…way too much complacency…not good, not good at all…!

are we at a point where margin calls will push us down?

The trend is down my friend. These are events that can pop up. Anything can really accelerate the decline at this point….

They have a few days after getting the call and hope springs eternal… Margin debt peaked last year and has also been on the decline the last several months- another sign of a top…

It’s so nice to wake up and see that long red candlestick and fat profits 🙂 Happy days!

There is only one wave count now at the hourly chart level. And the middle of this big third wave has STILL not passed.

Price has broken below the best fit channel on the hourly bear today. That line may now provide resistance. If that is the case then there isn’t much room for it to move up, corrections will become quicker and more shallow.

I don’t think we shall see any more deep second waves at this stage. I think the middle of the third is very close indeed. Tomorrow maybe it could pass?

Micro 3 still has to show stronger momentum than micro 1. So a further increase is expected.

At this stage targets will remain the same. But remember, if they are wrong they won’t be low enough.

Expect surprises to the downside in price. Look out for unexpected happenings… another “fat finger” day? That kind of thing.

At what level would you expect to see a bounce?

I am doubtful a true bounce is going to materialize but rather intra-day retracements that will make some traders nervous. I agree with Lara’s recent post that we have certainly not seen capitulation yet. We are starting to gear up for it though. I rolled a few volatility calls to give some more time but still very much on the short side.

To be more specific, I did expect a bit of a pause, and possible bounce, around the vicinity of the August lows because of group-think…

I agree. Still way too much complacency. We need a hundred point futures down overnight to make the crowd aware of what is really going on; and then we need a 300 point down day to jolt them into the new reality of a super cycle bear market. It’s been a long time coming…

Lara,

I hate to say it, but this late day bounce looks pretty deep. We may actually close up for the day. Now I am completely confused, but I am looking forward to your analysis to show where we are likely to head next. I am guessing we are in for at least a couple of days up upwards movement.

Thanks,

Peter

Probably not a bad idea to take some profits here. I don’t think we are done yet but another deep bounce could be in the works. One can always reload…especially of you are holding short term positions…. 🙂

VIX starting to put in vertical climb. UVXY really should take out August lows but these derivative ETFs don’t always behave as expected. We need to start being alert for a long upper wick and/or bearish engulfing candle in the near future…

I will be placing contingency buy orders for the UVXY put 10X trade soon… 🙂

Lara,

S&P 1,821.61 has now been breached… On its own does this have a material significance?

What are your current thoughts for where we now are?

I think the strongest move down is STILL just ahead and will be triggered by market failure to reverse today in what appears to be a much-anticipated “re-test” of the August lows. DJI’s low of actually 15370.33 remains intact as of this posting around 12 pm ET

I’m thinking you’re right Verne. Lara’s 1428 bear target seem to be playing out at the moment.

Yes. That is my expectation.

I am eyeing the 2000 and 2007 tops in the 1500 area and expect our first really strong bounce thereabouts. I think it will be the start of primary two up.

It sure looks like the market wants to put in YET ANOTHER second wave…holy smokes!

What comes after miniscule??!!

Nano. Subnano. Pico.

Metric system prefixes.

Gadzooks! Shades of “Honey I shrunk the Waves!” 🙂

I have to say, one benefit of the “managed” orderly decline is that spreads have remained quite reasonable, allowing traders late to the party to get in with-out paying prohibitive premiums…just trying to look on the bright side of banksterism! 🙂 🙂 🙂

VIX starting to get a bit of life but no where near capitulation action. It really needs to smash trough the upper BB and open and remain above it for at least one session, which is clearly not going to be today.

Do you know where I can look to track VIX? Don’t think it is on IG is it? Thanks

Any market data feed should have it live- yahoo finance, investing.com etc

I am surprised you cannot generate a real-time live feed chart directly from your brokerage account…ticker is simply V-I-X

It was there- I’m just an idiot! Thanks

Has it at 26 now- sound right?

Yep! Now above 30. A very useful tool… 🙂

Next area of support is 1820…it might fall right through it

There is only one way this conundrum is going get resolved based on the wave count. If what is going on is interventionist buying behind the scenes, we are going to see the bottom literally drop out with a monstrous downside gap…what kind of dummies would try to arrest an intermediate third wave decline?!

Incredible!! Are they Chinese??!

The Chinese aren’t alone in trying to manipulate a market. They’re not the first, and certainly won’t be the last. They all try it.

And they too are doomed to fail.

When the crowd psychology sees fear take hold nothing can seem to stop it.

To be fair to the CCP they did appear to manage to hold up a few second wave corrections for a wee while. At least, that is how they will see it.

But from an EW perspective, those corrections were going to happen anyway.

Indeed. Remarkable, the relative power of the two emotions, greed vs fear. Shocking how years of gains can evaporate in a few weeks’ time, even before the crowd starts to stampede. They still ain’t seen nothing yet, from what the the VIX is telling us…reloading volatility on this itty bitty bounce off the lows…

VIX still BELOW yesterday’s highs…this is NUTS!

I think a detonation is coming…

🙂

By ‘detonation’ do you mean an implosion downwards or a explosion upwards for SPX 500? And yes this is crazy this morning.

Downwards. This thing is acting like a dam about to break… 🙂

Well, we’re at the August lows now. Tempted to sell my shorts, but also keen to keep holding- will see what happens over today I guess!

Maybe that’s it. EVERYBODY is looking for a reversal….WOW!!

Nothing wrong with selling at reasonable profit targets. I cashed in a few volatility calls. 🙂

This is really crazy. I was able to buy diamond short term puts today CHEAPER than they closed yesterday on a stink bid. What’s going on???!!!!!

At least UVXY calls starting to pop but not yet explosive. I expected, considering what futures were doing, a much bigger gap open…WAY TOO MUCH COMPLACENCY!!!!!

There is something strange going on. Considering what the markets are doing in the US and globally, this level of complacency is incomprehensible….bordering on astounding actually…what on earth could we be looking at in terms of sentiment…borderline insanity..??!!

Some of the comments yesterday suggested it may be good to share trade ideas…

I don’t recommend that anyone else follows this, as I’m posting for information only (at 14:05 GMT)

Risking a small long on the SPX at 1840 with a stop loss set at 1830 and targetting 1900

If (and thats a BIG if) it gets to target I’ve got a short order set to sell that i plan on holding until at least 1813

Might just drop to 1813 on open, but like i said, small stakes. Just trying to snag a couple of points profit while trying to get a decent entry on the downward trend

Hi Stuart:

Are you looking for a small degree possible fourth wave to bounce that high, or another 1,2…?

Futures bought considerably off their lows so they are really trying to fight the third down it appears… 🙂

This orderly crash is spooky…

Nevertheless, IMHO it has to do with the lag of liquidity…so is sort of going to look like a freight train moving without breaks

k those are my tasks plus some..

laters…

Oil getting hammered lower. We going for $20 anyone?

will keep going lower in till we see a squeeze, hasn’t materialised yet imo

VIX has plenty of room to run up still…

RSI just at 60. Again works both ways – we could go into over bought for days.. Just saying. Keep an eye for that…

50+ seems like this target…

MAKE NO MISTAKE. If we get a monster candle with a fade like AUG 2015. Chances are we are the end of the decline and due for a bounce…

Trade or invest at your own risk.

Hi

All

It is my belief that 1,550 will hold the first time we hit. That should be strong support based on the 2 previous years 2000 and 2008 tops.

Trade at your own risk…

Path could be:

a. 1,650-1,573

b. 1,780

c. 1,300-1200

laters..

If the FED had allowed that head and shoulders pattern to take its natural course, we would already be in recovery. We will probably bounce in primary two there. After that, it will be like a hot knife through butter at that line in primary three down. Sorry…! Nice Chart. Very important.

thanks – slight typo it was late – based on the 2 previous years 2000 and 2007 tops

Hi

All

I had to attend to other things today. So, that is why i wasn’t around!

laters…

Just a friendly member reminder on TECHNICALS. We can stay over sold on RSI for days and PRICE can keep falling. RUT is a recent prefect example of 8 DAYS so far!

Futures getting crushed!

Just FYI!

Follow the MACD…

Isn’t MATH just so rewarding? As simple as this calculation is – just amazing… NO JINX!

1,2,3

https://www.youtube.com/watch?v=4l5VAQ7mBLo

Thanks Lara for the detailed work! In addition to the bullish divergences, I have watched the put/call ratio, and it is at extremes past 2 days see chart attached ( if it works right)!! The 5day MA hit .93 on Friday only seen at swing tradable bottoms of 2011, bear stearns collapse in march 2008, and in several times in the actual crash in fall 2008. So I am very cautious on short side for the bounce to reduce the bears, as scary as the head & shoulders pattern in SPX on verge of breaking neckline for the waterfall or Elliot Wave 3. Additionally Chinese new year coming up in a couple of weeks, I doubt government in chinese market would allow a crash right before with 2900-3000 holding past few days…which is important for US market.

I do not recall every seeing a potential third wave unfold with such visible, exquisite, accordian-like detail, down to miniscule degree…

what is the general strategic approach here?

Is the following sensible:

Bull

Break 1901 – wait for 1935-50 to enter short positions

Break 1958 – exit short positions.

Bear

Break 1857 – with ease add short positions

Break 1857 – struggle, wait for possible C wave up

Thank you for any responses.

Lara’s Hourly bull had a wave B ending at 1857, so this wave up from 1857 should be a 5 wave structure for wave C. We should therefore not go below 1857 (wave ii (of (c)) cannot go below the start of wave i). So to go below 1857 would invalidate that count which would be very bearish.

It is possible that this move down could go below 1857 in yet another wave i, then back up again above 1857 (but not above today’s highs), in yet another wave ii. I guess it has such a low probability that Lara has not published it. If this is a coiled up third wave it cannot keep doing 1,2’s for much longer before it snaps.

As for me – I’ve got a small long volatility (i.e. short S&P) position already, and if we go below 1857, I’ll be loading up a fairly large position with a stop loss at todays high (1901.44).

Also, Lara has not mentioned it (again I think because of very low probability) but this move down today could be wave (b) of orange 2 up.

I’ve got my eye on all of the above just in case something unexpected plays out intraday, but with Lara not publishing it I guess I am probably being far too cautious

Just because I have not published something does not mean it can’t happen.

Quite often I don’t see something until its right upon me. That is the nature of markets.

At this time I am looking at each bounce as an opportunity to add to my short position. I am holding a short, and I’d like to add to it.

When third waves extend they often begin slowly. They create doubt, a lot of it, at their beginning. Sometimes the number of first and second waves to start has us believing it is just wrong, there is no third wave.

We most certainly could see another one or two… maybe more.

As soon as you see momentum increase and if that best fit channel on the bear is breached to the downside (doesn’t have to be, but it may) then look out. The middle of a really big third wave may be approaching.

One disadvantage of daily observing the market is that one occasionally fails to distinguish the forest from the trees. All things considered, I think we have sufficient information to be sitting on a fairly

siszeable short position, medium and long term, regardless of what the market does tomorrow…the smart money has long left this market…remember Buffet’s Exxon dump…? 🙂

I totally agree. I missed a good entry due to travelling so trying to catch up. My real entry point is much lower but I tend to discard all memory of earlier profits and pretend today is day one in order to stay nimble

From what I have followed, it seems to me very likely (all things being equal) you are up more market points than me by staying in your position despite me (I think) initially getting in lower than you end last year. That kinda says it all. The trend is your friend!

I don’t think at this stage anybody could’ve asked for a better analysis. It’s pretty much right on where we’re.

Good job Lara!

Thank you very much Jack.

Wow!

To me that move up to todays high looked alot more like a correction (as per Lara’s hourly bear) on the 1min chart than an impulsive wave 1.

I wouldn’t mind a lower entry point but guess all will be revealed tomorrow.

Nibbled on some UVXY @ 47.00 after the close – just in case!!