Downwards movement continued as the preferred hourly chart expected.

Summary: Divergence (slight) with RSI and VIX indicates this downwards move is over for now. This increases the probability of the leading diagonal scenario. If price breaks above the upper edge of the base channel on the hourly bear wave count tomorrow, then this scenario will be preferred. The possibility that these two indicators are wrong and that price may yet rocket off to the downside tomorrow will remain while price remains below the upper edge of the base channel.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

BULL ELLIOTT WAVE COUNT

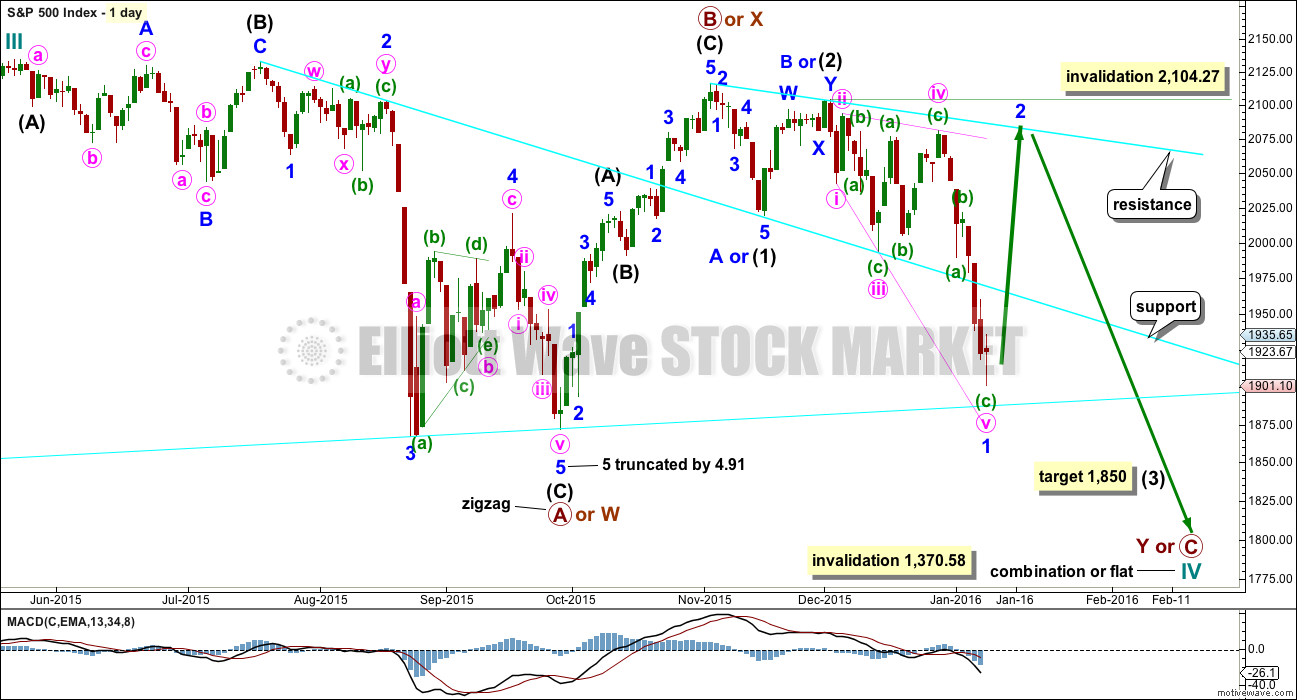

DAILY CHART – COMBINATION OR FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, combination or triangle. The two daily charts look at these three possibilities.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

If a zigzag is complete at the last major low as labelled, then cycle wave IV may be unfolding as a flat, combination or triangle.

Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction.

Primary wave A or W lasted three months. Primary wave C or Y may be expected to also last about three months.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,850 intermediate wave (3) or minor wave C would reach 2.618 the length of intermediate wave (1). At this stage, this will be the sole target for this third (or C) wave to end as it fits better with more short term targets calculated at the hourly chart level.

There may now again be a complete downwards first wave leading expanding diagonal. Due to classic technical analysis, it is my judgement today that this idea should be taken very seriously. Price may be ready for a multi day bounce.

If price moves above 1,986.02, then this idea will be used for both bull and bear wave counts. If a leading diagonal is complete, then it should be followed by a very deep second wave correction which may not move beyond the start of the first wave above 2,104.27.

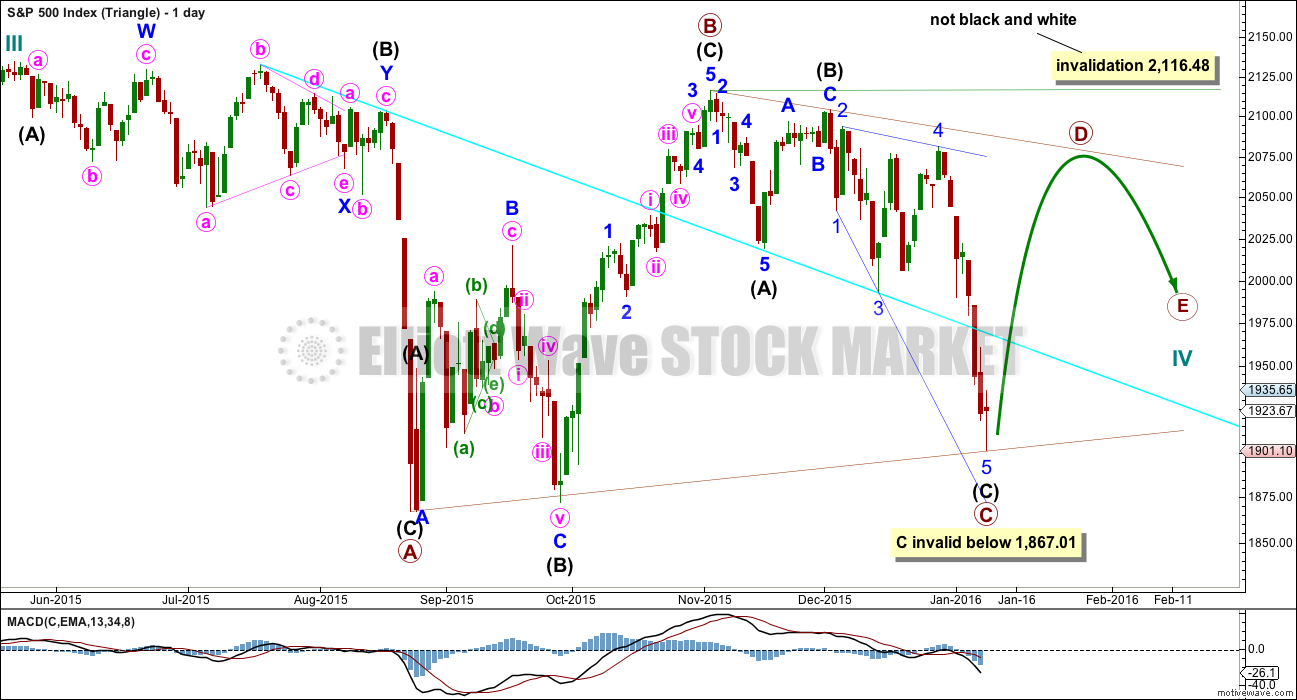

DAILY CHART – TRIANGLE

Cycle wave IV may unfold as a shallow triangle. This would provide alternation with the 0.41 zigzag of cycle wave II.

The triangle may be either a regular contracting or regular barrier triangle. An expanding triangle would also be technically possible, but as they are the rarest of all Elliott wave structures I would only chart and consider it if it shows itself to be true. Prior to that, the probability is too low for consideration.

Primary wave B would be a complete zigzag. The subdivisions all fit and now it has a clearer three wave look to it.

Primary wave C should unfold downwards as a single or double zigzag. So far it may be a single zigzag, with intermediate wave (C) an ending expanding diagonal.

Primary wave C may not move below the end of primary wave A at 1,867.01. This invalidation point is black and white for both a contracting and barrier triangle.

Primary wave C may now be a complete zigzag. Primary wave D upwards should unfold as a single or double zigzag. For a contracting triangle, primary wave D may not move beyond the end of primary wave B above 2,116.48. For a barrier triangle, primary wave D should end about the same level as primary wave B at 2,116.48. The triangle would remain valid as long as the B-D trend line remains essentially flat. This invalidation point is not black and white. This is the only Elliot wave rule with any grey area.

Thereafter, primary wave E downwards may not move beyond the end of primary wave C.

The whole structure moves sideways in an ever decreasing range. The purpose of triangles is to take up time and move price sideways. Price exits the triangle in the same direction that it entered, in this case up. When the triangle is complete, then the bull market would be expected to resume. This triangle should take several months yet to complete.

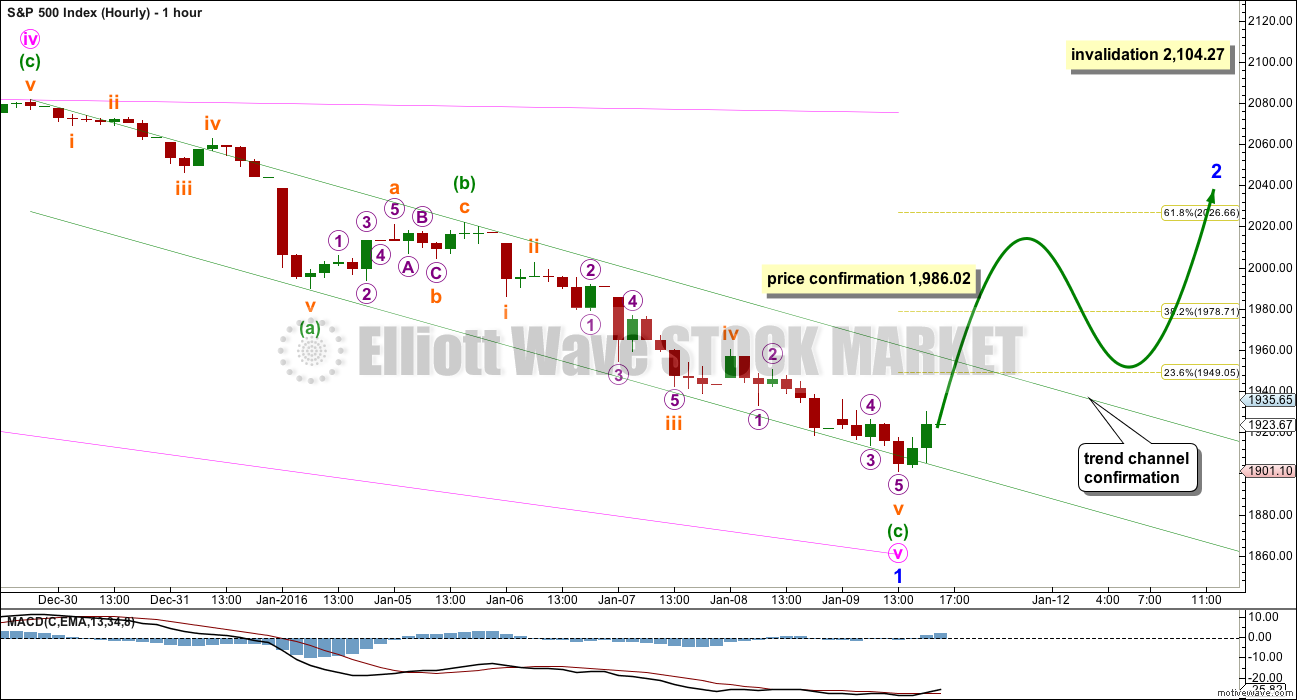

HOURLY CHART

This hourly chart follows on directly from the labelling of the main daily chart.

The zigzag for minute wave v has again moved lower and again may be seen as complete.

Within the leading diagonal, minute wave iii was just 0.39 points longer than 1.618 the length of minute wave i. Minute wave v would now be 17.72 points longer than 1.618 the length of minute wave iii. This is just less than 10% the length of minute wave v, so still just an acceptable Fibonacci ratio (although in practical terms because these waves are big it is a big difference).

If price breaks above the green channel which contains this zigzag, that may be taken as confirmation that upwards movement will continue for several days, maybe about two weeks, for a very deep second wave correction.

Minor wave 2 should be deeper than the 0.618 Fibonacci ratio of minor wave 1. It may not move beyond the start of minor wave 1 above 2,104.27.

If price continues to fall on Tuesday, this idea will be discarded.

If this idea is discarded, then the main bull wave count will be relabelled from the high of intermediate wave (2) to see a series of first and second waves to start intermediate wave (3), exactly the same as the daily bear wave count.

BEAR ELLIOTT WAVE COUNT

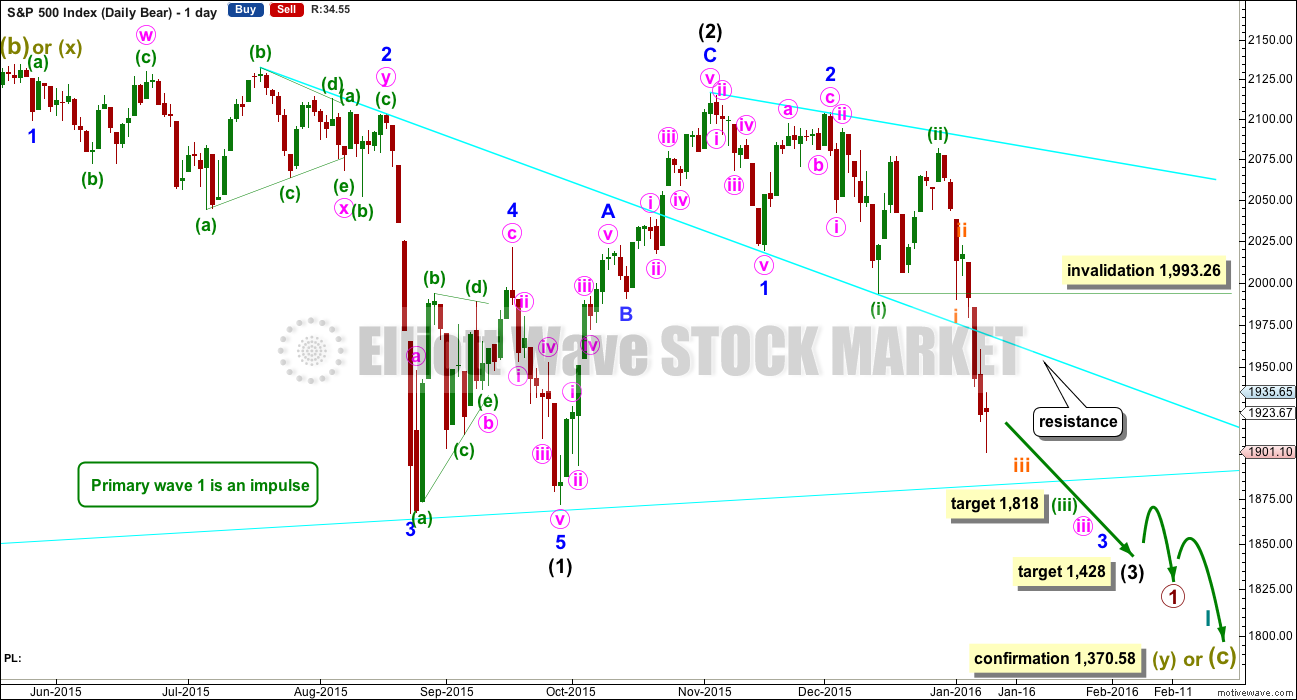

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

The downwards movement labelled intermediate wave (1) looks like a five. If minor wave 2 is seen as a double flat with a triangle for wave X within it, then the subdivisions all fit nicely.

Ratios within intermediate wave (1) are: minor wave 3 is 7.13 points short of 6.854 the length of minor wave 1, and minor wave 5 is just 2.82 points longer than 0.618 the length of minor wave 3. These excellent Fibonacci ratios add some support to this wave count.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

At 1,850 minor wave 3 would reach 2.618 the length of minor wave 1. This first target is removed now because it does not fit with the new target for minuette wave (iii). If price falls through this first target, then the next Fibonacci ratio in the sequence is 4.236 which would be reached at 1,693. If minor wave 3 is very extended, then the degree of labelling for all downwards movement from the all time high will be moved up one degree.

It is still possible (but still less likely) that primary wave 1 is unfolding as a leading diagonal. I will keep that chart up to date and will publish it if and when it begins to diverge from the idea presented here. For now I want to keep the number of charts published more manageable.

At 1,818 minuette wave (iii) would reach 2.618 the length of minuette wave (i).

Because minuette wave (ii) was a deep correction of minuette wave (i), it would be expected that the correction of minuette wave (iv), when it arrives, should be shallow against minuette wave (iii). Minuette wave (iv) may not move into minuette wave (i) price territory above 1,993.26.

The scenario of a leading diagonal now complete and a deep second wave correction to follow works in exactly the same way for this bear wave count.

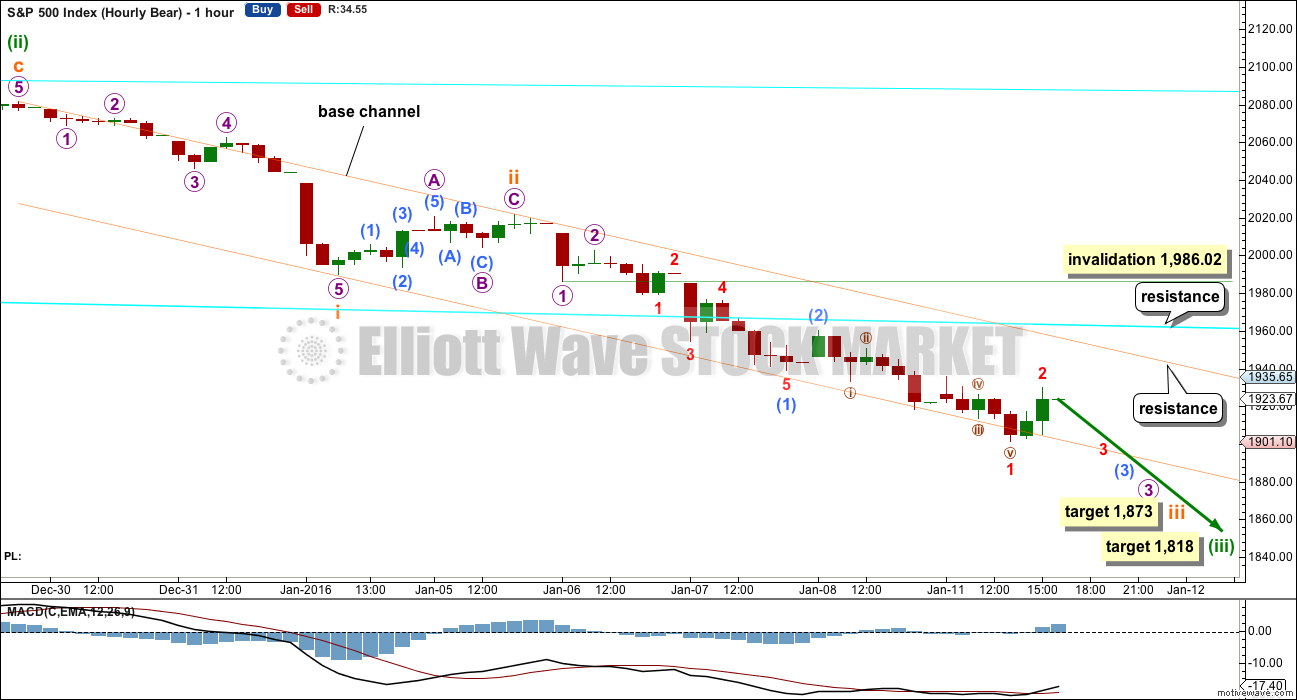

HOURLY CHART

It is my judgement that this labelling of the start of minuette wave (iii) has the best most typical look. It is not the only way to see this impulse so far though; the labelling may change as more structure unfolds.

What is clear is momentum is only slightly increasing so far within subminuette wave iii, which has yet to breach the base channel. Third waves most commonly breach base channels drawn about the first and second wave of the same degree. I would expect the base channel to be breached because this is the middle of a big third wave at intermediate degree.

At their ends, subminuette wave iii and minuette wave (iii) should show a clear and strong increase in downwards momentum beyond their respective first waves. So far momentum is only slightly increasing, so I would expect a further increase, if this wave count is correct.

Along the way down the upper edge of the base channel should provide resistance. This trend line is the line which differentiates this idea and the idea presented for the first hourly chart. If this line holds, then this bear hourly wave count should be preferred.

Micro wave 4 may not move into micro wave 1 price territory above 1,986.02, but it should not get anywhere near that point. The upper edge of the base channel should provide strong resistance.

Subminuette wave ii shows on the daily chart as a small green candlestick. Subminuette wave iv may also show on the daily chart (but it does not have to). The next very short lived interruption to the trend that may be large enough to possibly show up on the daily chart may be subminuette wave iv.

Minuette wave (iii) would reach 1.618 the length of minuette wave (i) at 1,818.

The middle has still not passed within minuette wave (iii). There is a very slight increase in downwards momentum today (there is no divergence warning of an end to downwards movement yet), but the increase is not convincing for a third wave. This may be resolved by a further increase in momentum.

At 1,873 subminuette wave iii would reach 1.618 the length of subminuette wave i. This target does not look to be low enough at this stage.

Again, if targets are wrong, they may not be low enough. Expect surprises to be to the downside for this wave count.

At the end of Monday’s session classic technical analysis indicators are pointing to a low in place, at least short term. If price moves higher tomorrow, then the bear wave count will be relabelled to see a leading diagonal complete and a deep second wave correction unfolding upwards. The idea presented for the main bull wave count works in exactly the same way for this bear.

TECHNICAL ANALYSIS

DAILY CHART

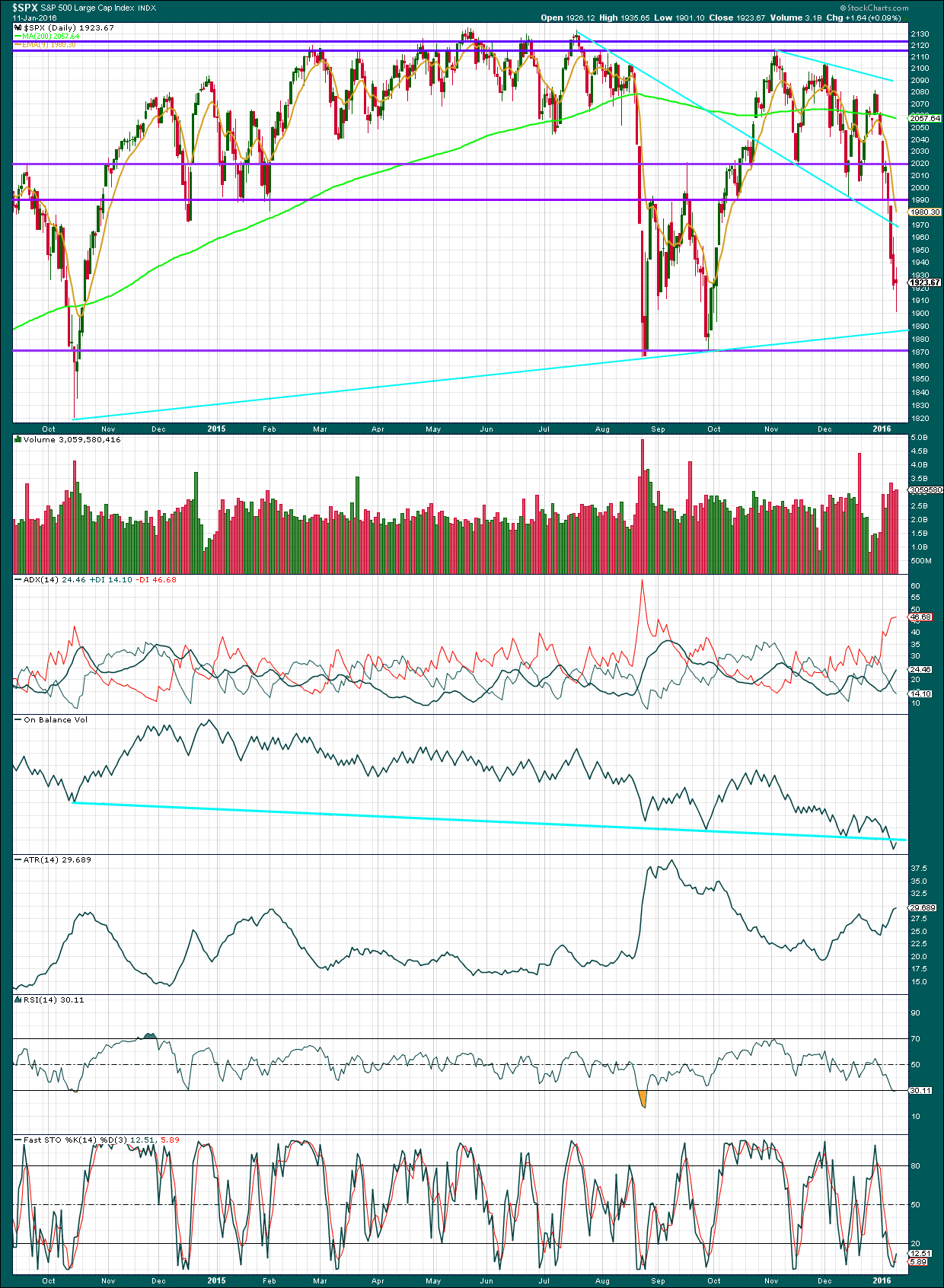

Click chart to enlarge. Chart courtesy of StockCharts.com.

I am adding another trend line (thanks to John for pointing this one out to us) which may provide support. This cyan line is drawn from the October 2014 low to the August 2015 low. If and when price reaches that line, we may see a bounce.

Volume is slightly higher than Friday. The fall in price for the last several days is supported by volume. The volume profile is bearish.

ADX and ATR agree. There is a trend, it is down.

This longer term trend line for On Balance Volume may provide resistance and halt the bounce that ended Monday’s session. It is not too steep and has been tested four times. It has reasonable technical significance.

RSI is just beginning to move into oversold. Very importantly, at the end of Monday’s session, there is slight divergence between price and RSI. Monday saw price make new lows, but when we zoom in on RSI it can be seen that RSI moved slightly higher. That small divergence is bullish and suggests a bounce should unfold about here. This supports the scenario on the hourly bull wave count (which also works for the bear) which suggests a multi day bounce for a deep second wave correction to begin. This divergence is small but is often (not always) a fairly reliable indicator of a trend change, at least short term. It should be taken seriously.

There is slight divergence with price and Stochastics. Price made a new low, but Stochastics turned upwards.

Click chart to enlarge. Chart courtesy of StockCharts.com.

Note: StockCharts inverts VIX. This makes it easier to read (in my opinion).

At the end of Monday’s session price made a new low but VIX has turned upwards. I have noticed that each time this happens that is the end of the price swing (it works for both directions). I have noticed this divergence on this chart for the lows at 16th November 2015, and 14th December 2015.

This divergence between price and VIX is not always seen at price lows, but when it occurs it often signals a low.

I have found one instance on this chart where divergence between price and VIX was seen and was then followed by new lows. On 15th December 2014, price made a new low but VIX turned upwards. That was not the end of the price swing though. Price found a low the following day.

This indicator most often works, but not always. It favours the scenario of a leading diagonal complete now beginning a following deep second wave correction as presented for the hourly bull wave count.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 08:53 p.m. EST.

check out RUT,, SPX to follow ?

Day by day! No need to rush!

As a fairly new UK based member who is trying to learn about EW and trading I am really grateful for the insightful comments made by other members on here. I feel it adds significant value to the subscription too know what other members (many of whom are obviously very clever and experienced traders) are thinking and provides a valuable learning tool.

Does anyone else think it would be useful for members to get into the habit when commenting to add the value of the S&P at time of posting and to also quote the New York time for consistency?

I just think for not alot of extra effort it would had clarity and perspective to the comments and aid the learning experience for members like me.

Many thanks once again to all the regular contributors.

Simon S&P 1922. New York Time 2.34pm

Thank you Simon matey. It has truly been one really demanding week. Well the only thing is sometimes I could respond the night before and I use futures levels and cash durring cash hours. Other times I just comment before a move or durring so I think charts help but specific levels are hard to manage as price could swing so fast in a blink of an eye!

The best way to learn this stuff is start practicing your counts on the small hourly charts – which is what I am still doing – In general any profession including trading is a life long learning process – you will notice you get smarter as time goes on – trading calls require a final decisive decision and only you can make that! I will be glad to post some books I have read if it helps. I do live for the trading so one thing I will say is you should love this stuff! It makes it more rewarding!

Be postive!

Welcome Simon. Yes, we have some amazingly smart and experienced members here who are kind enough to share their insights.

I agree, it’s a good idea to know what time EST a comment was made.

This website is set to EST. And so when a member posts a comment right at the top underneath their name is the date and time. The time will always be EST, or as I refer to it, New York time.

Hi Lara, many thanks for clarification re the time.

I still think that particularly for many of the comments made during NY trading hours, confirmation of the S&P price at time of posting by the member would be very useful to me and others in many instances. I guess it may be just the way I think and use the service by dipping in and out at various times during the day. Perhaps you could consider including it as an option on the comments template?

Many thanks for your occasional intraday updates which are invaluable and for me more than make up for not having daily video updates anymore. Maybe you would consider posting the S&P price at time of posting?

Finally is there anyway members can be alerted to any intraday comments you make?

Feel free to ignore me I’m just thinking out loud really, but trying to give you a bit of feedback to maybe improve the experience for myself and hopefully others.

Kind regards.

A new high today above yesterdays high…. looks like a correction is unfolding on the daily chart. The question is, how high will it go?

I have no confidence in the triangle wave count, really I’m only publishing it to follow a process of considering all options and then ceasing to publish only as they are invalidated by price. As I did with bull wave counts. So this comment (all comments actually) ignores the triangle daily chart.

If the scenario on the daily / hourly bear is correct: this upwards correction should remain within the channel. The upper trend line of that channel remains a very important delineation point between the two ideas. So far it is holding and so all members please remain alert that a very VERY strong move down could possibly unfold tomorrow.

However the scenario for the daily / hourly bull is also valid today. Second waves following leading diagonals are normally very deep, this one should be choppy and overlapping but end much higher about 2,027 or higher. This would be only day one of a multi day Dead Cat Bounce to last about two weeks.

Because the second option is valid any shorts for the first option must carefully manage risk. Risk management is the key to profit.

I do not recommend trading against the trend unless you are a very experienced and nimble trader. We have a few of those here, so this warning does not apply of course to them.

That is exactly what I was thinking 2,000 or 2,020 area for the bull case.

I personally favor the 10DMA. Chart attached. Anything between the 50% and 61.8% fib area as well..

BULLISH 🙂 Temporary of course!

Thanks Lara. You have taught me well over the years that these channel lines are significantly important. You thoughts about the need to be ‘experienced and nimble’ are well taken and both must be true. I cannot be glued to the computer screen all day. So I must act accordingly.

I am not sure what the next few days will bring into the markets. What I do know is this, my account had a very healthy gain this past week to 10 days. And your analysis was very helpful. Thanks again.

Fantastic. Me too! I had a nice profit on S&P and FTSE.

I’m going to wait out this correction, and when I am confident it is over I’ll enter short again. This next one I hope to be able to hold for longer than just a few days.

Yep. Second close of UVXY beneath upper B band says the bounce will probably continue. It did not pop sufficiently high IMHO to warrant a shorting attempt. I will be nibbling on calls on the way down and backing up the truck if it goes under 28. We have not had more than three days upwards movement since Dec. Bye y’all…sweet dreams…! 🙂

Unless we goto around 1990 tommorow. More than likely the short term trend is up. No reason to fight the tape!

Bullish

Yep. Huge band of resistance in the 2000-2010 area. We should get there in few days…assuming the bulls can hold out… 🙂

Bullish!

I wonder what Lara makes of this price action. If we are now are back in the bear scenario especially given the fact we hit 1947 today…

Verne

Is this looking bearish yet?

You know what I think…! 🙂

i am leaning more bullish until we get a definitive close red.. Like i said I am waiting…

We are just doing a test of that support line perfectly normal…

be careful 😉

Verne

Check it out matey!

Double bottom anybody?

that fell out. waiting for more market data to see how we close. I currently remain open..

hi

All

i am taking a random survey now.

Green or Red close today ?

i say chop up and close green. Even if it is a few points so be it!

I was gone for awhile. Right now SPX is up 1 point. I have no prediction about the close. Nothing has happened. The SPX is still slowly going down the 5 minute and hourly channels. A breakout upwards on the hourly will be a bullish clue. But for the current bear count, it should break out to the downside and increase momentum. Neither has happened so I have no idea. Thanks for the question.

This is all very short term of course. I do believe we have plenty of evidence we are in a bear market. The weekly and monthly MACD and moving averages give us strong evidence to back up the longer term bear wave count.

thanks for the response. I agree 50/50 but today I have a bullish bias given the price action yesterday off of 1901 reversal up into the close.

Verne

Sometimes the most difficult thing to do is buy when everyone wants to sell 😉

It seems to me the principle is simple. In a down-trend, SHORT THE RALLIES DUDE!! 🙂 🙂 🙂

( I know, I know… it is very counter-intuitive. Banksters are scary people!!)

The market is teetering on the edge of a cliff…somebody is probably going to push! 🙂

Yeah true but only at the cash open was it worth it not at the lows.

I still think this could run up for 2-3 days and holding puts will get crushed then…

but hey i could be wrong.

what am i – 9 for 10 calls right 😉 imho 0 haha jk

I don’t know about you options, but have to futures trading up triple digits overnight and having the market slosh back and forth narrowly between gains and losses a few hours after the open is not very bullish….we have seen this movie before recently…of course, I could be wrong and things could rocket up at the close…I guess we will see….

I agree down -1% isn’t really bullish but remember yesterday how crazy it was we still reversed off of 1901 and closed even +1 point but that was a reversal to the upside.

We still got a couple hours. That is all i am saying.

I remain flexible and not tied to one view.

Like I said – analyze and then react. I dont like to react to intra day chop fest and then the the 3:30 RAMP TEAM SHOWS UP and crushes those puts….

Verne

WINNING!

I rest my case 😉

Good day sir!

Soooo… are you long the market matey?

Or yer’ just talkin’! 😀

I am shorting the pops and scooping up as many cheap volatility calls as they will let me have….courtesy of a few upside hedges in the green…. 🙂

No jinx but I am long. I was trying to emphasize what I think to you early on over several notes.

I really could have gotten a better level but i will take it.

This is going near the 10DMA imo in 5-8 trading days.

You probably do not want to bet against me 😉 haha jk

I can give you another clue. The VIX is going to get crushed to around 18-19.

Unfinished business…

Be on the winning side 🙂

Be safe matey!

Here is a hypo BULL FLAG!

This is of course showing we need a gap fill lower at around 18 or so…

I would take it seriously imo.

laters matey!

It depends on WHAT KIND of puts you’re holding don’tcha think? 🙂

Oh right, I don’t those those 3 or 4 times etfs like you. For years, I ONLY TRADE Index Options with specific targeted strike prices based on research i have done. It is what the BANKS and HEDGE FUNDS mostly use.

BTW ES busting higher…

Green or Red close today?

I am glad to see you are putting your money where your mouth is options. Good luck on your upside positions…and mind your stops matey… I expect to ditch 75% of my own upside hedges by the close tomorrow and watch the rest of the action from the sidelines… I remain bearish… 🙂

Come on give up haha I’m flexible – Just take what the market gives you! I live for the thrill!

UVXY gap down from this morning immediately filled. I have NEVER seen this happen on a true trend reversal. Uber bearish, especially if we get a bullish engulfing candle today…

till the close…

we don’t have a trade setup…

please wait. it is hard but the right thing to do…

You kidding right?! 🙂

What triggers are you looking at my man?!

No, Nasdaq not breaking down. Everything is holding – a few points is no reason to get bearish. If it wanted to fall it had every reason to yesterday but it didn’t.

I really will not be surprised to see this close in the 1930s or 1940s today. Maybe even 1950!

Keep the focus.

I think Tuesday bounce days are back.

Dangerous market – nobody really knows until the final hour. So, it is better to wait and see and then react. 🙂

There is a very interesting shift in market psychology occurring before our eyes. Remember the old days when the banksters would violently push up futures and all the shorts would bail and the bulls would come in and buy like lemmings for weeks at at a time and the market would go up, and up, and up, and…? well, you get the picture. It’s true the market has not yet fallen off a cliff but it is trading awfully heavy. There has been no active selling pressure to speak of and still the market cannot make any headway. The banksters have spent an obscene amount of money and they are not changing market SENTIMENT one iota. That is absolutely huge!!

Yes, I do remember those days. Believe me!

We will rise no jinx.

1,960-1,970ish or heck 1,980-2,000

let us take it step by step.

I dont see any real conviction to push this thing lower. It is true russell 2000 is tanking but it has been for a while it can wait a week or so for us to catch up 😉

Plus if this wants to drop it should show up by the close..

Till the close I say…

The change in the character of the market is as Lara states, “The surprises will be to the downside.”

I agree but I am flexible- I AM LONG TERM BEARISH and short term bullish nothing wrong with that. 80 hours being a BULL won’t kill me.

Green close most likely with a doji or hammer candle no jinx…

I have learned that re-acting to the market is generally a loosing proposition (unless you are a skilled day-trader). What works best is doing your due diligence to be reasonably certain about the market’s direction (the trend-is your friend!), the getting positioned AHEAD of the market’s most powerful anticipated moves. It is really surprising how few traders actually practice this and get totally distracted by market minutiae…just my two cents options…. 🙂

I am as a whole in general a position/swing trader but I can switch gears easily to day trading if I see a good move but I don’t promote it. I agree the larger degree moves are best for position trades based on homework I have done for years. However – For certain days that are decisive “inflection point days or confirmation trend direction days” you can’t plan ahead so you have wait to make the right decision. Especially with options. See my point?

Yep. I will occasionally do a speculative trade myself. They are lots of fun when they pan out. Nevertheless, the core of the trader’s arsenal should be a simple system and trading plan that he can use to CONSISTENTLY generate trading profits, regardless of what the market does…

I thought this quote from one of the greatest traders in history is nice.

“The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.”

Jesse Lauriston Livermore

Poor Jesse! Despite his erudition, it did not end well for him did it? 🙁

verne,

I would like to make sure I understand. When you say “uber bearish” do you mean for the markets or for UVXY? I am guessing the first, for the markets, but I just want to make sure. Thanks.

I meant for the markets. Although UVXY tanked again today, prospects for a sustained run higher should be producing fat red candles. Those long upper wicks mean something a bit different than you would think as they are usually a bearish signal. When they happen at any other time than a market capitulation on UVXY, it is signalling accumulation…another little hint on why I am bearish…hope that helps a bit Rodney… 🙂

Interesting ES daily candle

bullish 🙂

The SPX moved up and tagged the upper channel line on the 5 minute chart. It has since moved off and into negative territory. It is not looking very strong for the bulls.

The bottom channel line on my charts is somewhere between 1890 and 1870 at this time. Of course they are slanted downwards. A move down to these lines could complete a wave five and lead to a more substantial rally. Just my thoughts for whatever little they are worth.

Thanks to all for your observations and comments.

I like to wait for the close these days. Intra day calls are just to difficult in this choppy mess. Just like yesterday. It could all change in the last hour or 15 minutes near the bell. I suspect we close somewhat positive today and reach 1975ish in a few days… imo

If you are right, UVXY should pop back up to close to yesterday’s high and put in a big fat bearish engulfing candlestick to signal a bottom. This assumes we don’t have a really extended possible fifth wave that takes out last August lows.

yes!

Wow! It is truly astonishing how market meddling can completely distort normally reliable signals and wreck the price discovery process. Thankfully, this kind of meddling has impact only over the short term and with experience, one learns to detect such shenanigans…forget about anymore cheap UVXY calls… 🙂

OPEX this week……..could/should be choppy

Vern, can you tell anything by strike prices etc?

Absolutely! I noticed this morning that my upside hedges were not popping the way they should ahead of the beginning of a strong upward trend and so bid ask spreads can definitely give you a heads up on the EXPECTED action around any particular strike price (that is the amount of the premium). The UVXY calls did not completely collapse the way they should have ahead of a sustained move up. Spreads do tend to be wider for thinly traded instruments, or when the market makers are trying to keep you out of a position, like UVXY puts after a capitulation spike. Yesterday someone definitely had their hand in the cookie jar.

Getting close to being impossible to see the move up today as a new impulse because of how deeply it retraced. I guess it COULD still be a deep two…

This thing had better not, for the sake of the hapless bulls, print a red candle today. If after all that overnight thrashing around in the futures market, the banksters cannot sustain a rally lasting more than a few hours what does that tell you about downside potential? Where’s the beef?! er… I mean volume? 🙂

OK; maybe five up and a of an abc correction underway…

Anyone jumping on the pop this morning is ALREADY underwater…not a very good start to a rally IMHO

OK Let’s see what the bulls have got left in their tanks. They need to take out 1947.38 and they need to do it pronto…otherwise “farewell Spanish ladies…!” 🙂

Is it really time to dump my hedges?? That soon??!! Rally, I hardly knew ya…!

Yes it is. Eyeing the 31.93 gap up from the January close but I doubt it will be filled. Will be most interesting to see where UVXY closes today. Upside hedges hardly exploding- this thing is being faded as we speak….

We are looking at either four of the c five up, or a down of the impulse up…

Have to leave the house – will try to keep an eye on it from my phone just in case it drops through the floor.

Still some ways to go yet so don’t want to jump in too early.

It’s looking and smelling kinda toasty to me Olga… 😀

We have five up off yesterday’s lows. To see the move as an abc I think we still need a four and five up for the C wave…

(iii) of (possible) c is shorter than (i) of c atm.

So either this is a very weak move (wave (v) will be short) or wave (iii) is extending even further.

Lots of mixed signals. First futures down, now they are up. Europe is up substantially, so odds are bounce continues at the open. Ordinarily one would jump all over that SPY hammer from yesterday but I remain cautious about this market action. I am looking for UVXY to close deep in the red again today, and a close above the channel top line around 1935. Taking out 1940 on strong upward movement would be even better. If this futures pop fades, look out below and it will probably happen in Europe as well. If we close at the high or close to it, an abc pop to the upside and the leading diagonal wave count would in all likelihood be in play. Strange times…

We’ve now likely got a 5 wave move up from yesterdays lows (though wave (iv) looks like a wave at one degree lower to me, so what looks like wave (v) might be just ii of an extending (iii)).

I’ll be watching the structure very closely on any pull back for signs that this move up is much shorter lived than anticipated.

Even a 5 wave move up from the lows could just be a c wave correction – if its followed to the downside by a clear 5 down then 3 up, I’ll be all over it!!

Me too. What ever the height of this bounce, we ought to thank the banksters for another glorious opportunity to get short. UVXY tends to make new lows just ahead of monster waves down so It would be REALLY nice to see it slip back down to around the 25-28 area. If that happens, hear me now and believe me later…BACK UP THE TRUCK PEOPLE!! 🙂 🙂 🙂

Exactly – I have been (and remain) sceptical for a few days as the market doesn’t generally hand out gifts like that, but yer never know. If Mr Market feels generous, I’m happy to oblige.

Tempted to short UVXY, but that could be a bit risky right now. If we go out the top of the base channel, might do some very swift small position scalping for fun.

This scary move up is already looking tired to me!!

I won’t recommend this to most folk Olga but you could probably squeeze a few days’ profit out of a short with today’s second close back below the upper BB. I know you have quick-trigger finger! 🙂

GBP is diving against USD – for certain something does not smell right

Jack or Verne

Futures crashing down now 8 handles. That hammer today on the SPX was probably a head fake. In my past experience it is similar to what is seen on most corrections I think before a huge red candle the following day…

Until the open tomorrow – this could get worse.

bye

IMHO this third wave is not over. It has got to have a fifth wave of the same degree.

Let’s not forget to take some profits…I have never heard anyone say, “yeah I went broke because I took some profits.” Just an opinion

And as Verne would say hedge for protection

Thanks Jack!

In honor of David Bowie(RIP) Man who sold the world song:

https://www.youtube.com/watch?v=fregObNcHC8

Thank you man, much appreciated

Anytime. Es futures crashing man!

Is looking good…

What’s your target on Es ? Cash equivalent ?

1870

1850

1820

Maybe 1780

Also looking at RUT@1010

I do think Lara’s analysis is right on…we’ve got to watch out for the expanding diagonal

I am wondering if we even have a third wave. The thing that characterizes third waves is FEAR, notably missing in this rather orderly decline. I think we just completed a first wave down and a shallow wave two is up next before the party begins in earnest. As I have said before, when a third wave hits, nobody is asking:

“Is it here??!!”

Our on-going perplexity about the action in that regard, in my mind, answers the question, and confirms that it has not yet arrived. 🙂

ps Think about it, for the first wave down we have over a thousand points in the DOW. Since this is at intermediate degree I suspect it will NOT be the first fib ratio. Do the math. 😀

Jack you make two very good points. First, a fifth wave may be missing and we may see more downside soon to complete the waves.

Second, and I really like it, “I have never heard anyone say, “yeah I went broke because I took some profits.”” That is the exact reason why I took my profits yesterday in the shadow of concerning technical indicators.

I am waiting and watching to see what happens next. Thanks for your contributions.

The number of stacked third waves after so many first and second waves for the possible continuing impulse down portends a move down that should be positively breath-taking. It would be just like this sneaky bear to throw out all those technical head fakes and have everyone looking for a bounce,

just as he is ready to pounce. I cannot help but keep wondering if the dramatic pull-back in volatility today is possibly akin to the market drawing a deep breath for a stentorian blast to the downside….everything that I can see from a global perspective powerfully militates against continuing unbridled bullishness…is it possible that the uncharacteristic collapse of the VIX and UVXY is heralding an uncharacteristic decline…? Just thinking out loud… 🙂

Verne

I just wrote 2 questions to you. Please review!

This membership is great – there is always someone around to answer a question. You can’t find that on most technical subscriptions.

Much appreciated!

YES matey that is precisely what I was thinking!

Great minds do think alike and Lara’s preferred BEAR wave count is correct!

Verne

We both posted the same idea exactly at:

January 12, 2016 at 12:24 am

Now that must mean something 🙂

Hi

Team Awesome(Aver, Verne,Jack,John,Olga or Rodney)

To give some more eyes on this. I did one more monthly MACD cross over to show how markets fall on 2 huge historical cases:

SEPT 99 to SEPT 00 – Around -40%

NOV 07 to NOV 08 – Around -52%

In both cases it only took 1 year?

But now ever since 2015 in our case:

What do you think about my idea on this chart?

FEB 15 and now we are only a couple weeks to the first week of FEB 16? Not working so far as we are only down -11.8%?

So, unless this turns around in the next 2 weeks and goes crashing down into the early week of FEB 16 it looks like its not fitting the past patterns?

Heavy Banksters and governments manipulation happened(ing)…

Jack

But do you buy the 1 year MACD idea I have outlined? In your technical background – does that look right?

I think this sell of is just getting started. As you know they say the past don’t repeat exactly…it rhymes. We have to stay nimble and watch out for the quick second and fourth waves that could take all profits away

This EW stuff is a very good strategy for executing trades. Take a look at the percentage drops from 2007-2008. I don’t see trading as a get rich quick scheme.

I agree !

They are in full-bore panic mode. In the past their efforts would last for months. Now the efficacy is measured in mere hours. The coming bounce may not last as long as folk expect…

I think the crash when it comes, is going to be sudden, brutal, and relentless. There is no denying the mountain of evidence. Our job is to wait for the market to come to us…

Hi

Lara,

Thanks for the video today that helped me.

I did one more monthly MACD cross over to show how markets fall on 2 huge historical cases:

SEPT 99 to SEPT 00 – Around -40%

NOV 07 to NOV 08 – Around -52%

In both cases it only took 1 year?

But now ever since 2015 in our case:

FEB 15 and now we are only a couple weeks to the first week of FEB 16? Not working so far as we are only down -11.8%?

So, unless this turns around in the next 2 weeks and goes crashing down into the early week of FEB 16 it looks like its not fitting the past patterns?

Do you agree?

Am I measuring the MACD cross over signal for FEB 2015 wrong?

Does this analysis even qualify as been valid in the technical charting books you have studied?

Thanks,

options2014

I think you mean a moving average crossover, not MACD.

Anyway, I don’t see any crossover of the 50 period MA with the 200 period MA prior to the last two bear markets in that monthly chart.

I don’t see those two moving averages cross in Feb 2015.

But then you’ve got them on a monthly chart so those are actually 50 and 200 MONTH moving averages. Not daily moving averages.

And so I’m not getting your point.

Sorry, allow me to explain – I have drawn the vertical lines on the chart to guide it up to the MACD monthly.

If you follow all the vertical lines upto the MACD you will notice the black line crosses touches the red line and starts to head lower. Once that happens in both 99 and 07 in exactly 1 year – the market went down big.

Is that interpretation wrong?

I would add, it’s not an interpretation. The chart is black and white.

After MACD crossed the market went down.

The only difference is in how long after the MACD cross did the bull market end and the bear market begin.

The interpretation part is; will the same thing happen again?

Lara,

Please take a look at this updated chart I made.

Does my question make sense?

Brilliant. That’s the chart that makes sense to me.

Now I can see why you were referring to MACD when your first chart had moving averages…. because you were referring to MACD!

Yes, of course it could happen again.

The difference I see this time is it is starting off more slowly. And so that makes me suspect that it may be longer lasting.

And if the bear wave count is correct and we are looking at the early stages of a huge C wave down, then it could last more than a year. Maybe three?

And we are yet to see primary wave 1 end. Which would be followed by primary 2. Which may be deep.

It is fitting the past pattern in that the pattern is the same, it’s just more drawn out. As Jack says above; the past doesn’t repeat exactly, it rhymes.

good points.

Fantastic analysis Lara – Many thanks

You’re most welcome 🙂

Thanks Lara for the update including a video.

I think the leading diagonal makes a lot of sense. If the markets rally significantly, they can get rid of the oversold oscillators and indicators at the hourly and daily levels. And yet, the weekly and monthly MACD and other indicators may level off but will still be negative and ready to make the next move down with the markets.

The market must give us tell us which of the wave counts will stand.

Thanks again.

I thought with a possible bounce coming tomorrow a video would be timely.

And I need to put a video on the YouTubes from time to time to promote the service 🙂

That upper edge of the small channel on the hourly chart will be the defining line.

I’m out anyway. Closed my short for a nice profit today. Now I await the next bounce.

How high can a dead cat go?

It depends on his PAWS! he! he! 😀