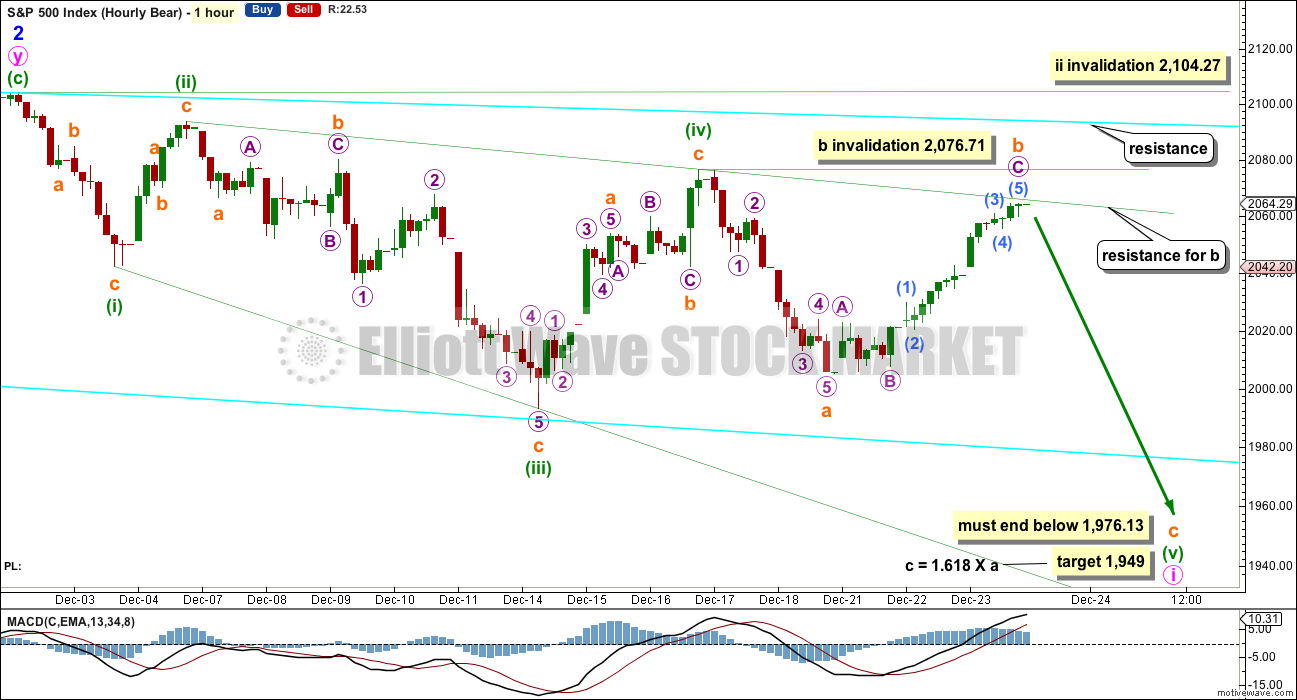

A quick update of the preferred bear wave count at the hourly chart level only.

My CMT ethics guidelines require me to notify members of any opportunity I see before I take advantage of it myself.

If the bear wave count is right and a leading expanding diagonal is unfolding, then this may be the end of upwards movement.

HOURLY BEAR CHART

This would at this stage still be my preferred wave count for the S&P. It looks like a leading expanding diagonal may be unfolding downwards. The final fifth wave should be incomplete.

Diagonals normally adhere well to their trend lines. So if this wave count is right, upwards movement should stop here because price may find resistance at the upper (ii)-(iv) diagonal trend line.

The fifth wave must be longer than the third wave in length to meet the rules for an expanding diagonal, so the fifth wave must end below 1,976.13.

First, third and fifth waves of leading diagonals are most commonly zigzags. At 1,949 subminuette wave c would reach 1.618 the length of subminuette wave a.

Subminuette wave b may not move beyond the start of subminuette wave a. The risk for this wave count is low, and the reward is high. The risk / reward ratio is 1:9.7.

This analysis is published about 11:22 p.m. EST on 23rd December, 2015.

The diagonal theme seems to be typically three days down and three up give or take…if the fifth wave is also a zig-zag the pop higher should last a few days at least before the final bottom is put in…followed by the manic wave two…maybe I’ll get my bullish engulfing candle after all! 😀

got whipsawed on the last 15 min lol.

k just like you got your up candle today :)?

A quick FIB from the lows to highs is around 2022 and is the 38.2 fib resistance…

The key in this MARKET is the Russel 2000, once we break 1100 which is only 8 POINTS from here. IT WILL BE GAME OVER 🙂

Bullish traders were right about those pivots. How large a bounce from here? I think we should at least see a challenge of the 200 dma…once again…!

I’m waiting for Lara’s analysis tonight. I think the bounces are over done here and beyond a maniac market and enough is enough with this bull market. It can’t keep doing this. This is not how markets function.

It is the presumption of the bullish traders that the round number pivots are going to be defended by the banksters at all costs and so the drama unfolds. Will the pivots be decisively broken after what is looking like an almost completed initial impulse down with or does the tug-of war rage on?

I think a decisive break would lead to a cascade down to at least 1870.00

Welcome back Lara!

Think we just finishing a 5 up (wave c of an abc up?). May extend – wave iv of c is poss at about 2005.73. Below that shouldn’t be extending.

Wave up from todays lows to 2005.73 looks like a 3 wave structure to me and we went below it’s b at 1994.95 so this move should prove corrective

Pronounced hammer on indices today indicative of persistent CB buying. The spent billions…again. May indicate a bit more upside in the wings so I expect more upward movement tomorrow…keeping hedges in place…

short cover but still weak.

Good morning everybody.

We have still a series of lower highs and lower lows. Today’s low is slightly lower than the prior swing low of December 14th.

From a regular TA perspective looking at support and resistance we would want to wait to see price break comfortably below the last swing low of December 14th at 1,993.26. A daily candlestick below that purple trend line on my TA chart would do it.

From an EW perspective my wave count today will expect we are seeing an expanding diagonal unfold, now in the fifth wave. From the chart published here the fourth wave moved higher.

The fifth wave must be longer than the third. It will reach equality with the third at 1,980.98. So it should end below that point.

Lara,

Welcome back. Hope you are well.

Is the above going to be your only count or the preferred count with some alternates? In other words, can the bear count of a series of 1-2’s for an impulse down still be in play.

Thanks,

Rodney

I think the FTSE is looking that way imo with successive 1-2s, this move could be another, my chart

Happy NY Lara!

………………………….hmmmm

Who is he? http://www.investopedia.com/contributors/53687/

I guess the market makers are keeping the lid on UVXY so you guy can pick up the Jan 65 calls for less than a buck…!!! 😀 😀 😀

Not for long I wager… 🙂

verne

take care. I am signing off matey!

🙂

O.K. options…take care and see ya at the bottom… 🙂

i will return tommorow

bye

Vern; What levels are you watching today? TIA

I think any short term opposition to the down-trend will materialize around the round number pivots I mentioned- DJI 17,000.00 and SPX 2000.00 The decline may hover around that area for a bit due to market intervention. I would be interested in seeing how close it is to the Cyan support line Lara gave us and will go take a look at her chart…when those levels break the psychological impact is going to be substantial and will usher in the middle of the third wave down when the real action gets going…I think Lara’s ultimate target for three down is under SPX 1500.00

ES 60 Bottom fib

ISM BAD. WE JUST BROKE 2,000. So, i am calling it a DAY!

laters…

Sneaky and really unpredictable : TVIX down on the day

T2108 down on the day ………they normally move in opposite directions

PS TVIX green line is the pre market open

TRIN is bullish at .76

This is a third wave down at least at intermediate degree. Don’t allow the short term gyrations to distract from the bigger picture. No amount CB thrashing around is going to materially affect the target for this move down IMHO…looks like we are seeing a mini fourth in the pause that refreshes…

This is how BULL MARKETS END. WHEN EVERYONE IS BULLISH FOR NO GOOD REASON!

The VIX IS UP 23%. I am sure that is BEARISH 🙂

Well that sneaky old market!!! I’m very glad my auto buy got triggered on NYE (only just did!), albeit my position is MUCH smaller than I would have liked.

Hoping for a bit of a bounce to get fully positioned, but if this is a third that’s wishful thinking. If we cut through 2005 & 1993 I’m all over it.

This to me LOOKS LIKE THE BEGINNING OF THE THIRD WAVE….

Wave b (or x) of last move up from 1993 taken out – so last move up proven corrective (3 waves).

What are the targets going down? Is 1997 still in play?

For me I am looking for 1950 then 1850 and then 1750-1700.

Cincuenta,

Apologies – I’m not sure of longer term targets at the moment. To me there seems to be quite alot of alternates at higher degree – we could still be in a bullish wave 4 (triangle), which once complete would see new all time highs.

I’m currently only concentrating on quite short term support / wave structure whilst the larger degree counts unfold / shows more of its intentions (i.e. alternates at higher degree gradually get invalidated)

Lara will no doubt clear up alot of confusion in here update today

If it helps – my short term target for this wave 3 down from 2062 is 1971 (that is where this wave 3 would be 2.618 x length wave 1).

But I am waiting for us to take out 1993, and I’m not happy with the action in UVXY (it is not going up as it should as the market is moving lower, so seems to be suggesting we might bounce up a bit very soon).

So (for me) it’s one step at a time!

k thanks a bunch. those ETFs take 1-2 day to explode wait till the close I guess but it should pop.

NDX DOWN 3% I am sold we are going to FALL OFF A CLIFF – JUST SAYING!

Thanks Olga! That’s exactly what I was looking for.

The action in UVXY is quite revealing and you are quite right in that it is NOT doing what it SHOULD. It means everyone is breathlessly waiting for that bounce…waiting to pounce for the upside reversal…mmmpffff…!!! 🙂

The pause around 2000 as the banksters funnel in futile billions is probably your best best. Once that pivot gives way premiums are going to skyrocket. You probably are not as worried about that as you sell shares short as opposed to trading options but I expect the bid/ask spread on shares are also going to become ridiculous…hopefully not too soon…

This is interesting…But what is true is NOTHING HAPPENS LIKE IT DOES IN THE PAST!

Stats

The VIX futures are up but nothing like I would have expected

2HR ES chart short term support ………?

Look at the Oct high

Definitely something a bit strange about that. The logical conclusion would be that it indicates a level of complacency bordering on the insane, considering what’s ahead, but that really should not surprise us. Every one “knows” the invincible FED is going to step in to arrest the decline before it gets REALLY bad. After all, have they not been able to do it for the last seven years??!!… so no need to worry, we’ll just ride it out. I imagine when the days of daily 5% declines or more arrive they will be thoroughly disabused of that sad delusion. Get your volatility calls while they are still relatively cheap…they are going higher… a LOT higher…!

Yep, VIX is acting strange. I don’t know what to make out of it.

EW theory is all about sentiment. If the VIX is truly representing the degree of persistent bullishness (and with the kind of fraudsterism and manipulation taking place these days who knows?) by the unwillingness of folk to buy protection for their long positions, it speaks volumes to this being a top of Grand Super Cycle Degree. The pendulum has a very long way to go before swinging to the other extreme…I want to see a CLOSE below DJI 17,000.00 and SPX 2000.00 for the all clear to jettison remaining upside hedges. When this happens, we are not going to see anymore ridiculous 78% upside re-tracements; we will instead see occasional pauses in the waterfall descent…

The real move up begins as we approach capitulation in the short term. The sluggish action so far suggests that we are nowhere near that juncture…

Best music for third wave. My fav artist from France :

http://youtu.be/urpjInmrnrM

It’s simple – the force is here and the trend is clearly down. No doubt!

Keep it simple …

Chinese PMI reports today show five consecutive months of contraction at less than 50%. CSI down by as much as 4% following report. US futures down in sympathy but let’s see what the banksters have got left in the tank. So far not looking like we are going to get that bullish engulfing candle…nonetheless, without a decisive smash of DJI 17,000 and SPX 2000 tomorrow EARLY I am keeping some dry powder…

***Circuit breakers triggered in China after 7% decline…shape of things to come in US markets. It is not that the banksters have not been buying….they have. Nevertheless, they are about to reap the whirlwind after seven years of sowing the wind of endless market meddling. Short side traders should have no doubt that the criminal banksters are already conniving to rob them of downside profits by halting trading as the decline accelerates and perhaps even freezing accounts to prevent liquidation of profitable trades. Plan accordingly… ***

…And yes, this is indeed the profile of Mr. Third; as I said previously, when he shows up, nobody wastes time asking “Is he here??!! 🙂

Yes the third wave is here

I don’t see how this is going to bounce up now – no way

-300 handles on Es in a few days matey

Save it no jinx

😉

Vernecarty/stuart

you are right , I Change the count, in any case should 5 correct waves down.

ES DOWN 21 handles… The 3rd wave is probably here 🙂

Wow trading halted in Asia

Ssec down around 7%

This is awesome

Once again. OIL PRICE DOESN’T MATTER with EQUITY MARKETS. It is up 2% but WORLD MARKETS ARE SELLING OFF!

AMAZING HOW THINGS WORK TILL THEY DON’T….

Oil catching up to the down side wiped out .70%

Verne

You up ? The price action is crazy across the globe matey!

Es down 14 handles …..

ES down 18 oh man

Global sell off with Asia getting crushed.

Europe should be interesting

Es holding near lows – just wow !

In world news Saudi and Iran are in conflict … Should be a good catalyst!

Futures way down lol

Hang tight …

Futures markets heading lower. DOW Futures lost 25 handles just in a blink of an eye. ES is holding on +2 handles. this should be interesting!

oil is being saved again. I think the FED is buying the OIL FUTURES NOW LOL

what a grand surprise futures up 7 handles. the games continue…

will this week be range bound higher again and again ?

spoke to soon, they are fading it 😉

i wonder if any bounce was expected back in aug 2015 when we went straight down?

that is why it is so tricky to short and jump out and back in..

hi

all

i am all for falling off a cliff here on the markets. Waiting for futures now. If we do go up it should be pushed down hopefully!

I am also curios on what early portion/stage of the 3rd wave we are in?

verne

i dont think this market is predictable for a BUY THE DIP anymore. Never assume anything in this market and I wouldn’t bet on anything but MORE DOWN SIDE from here….

My expectation, based on my best understanding of the wave count is that we should now be in minute two of minor three of intermediate three down- that infamous, much anticipated, but nonetheless elusive triple third. I have in the past concluded that that was what the count should be only to have the market seemingly inexplicably scurry higher so nothing is ever certain. If that is the correct count, the move down should be fast and furious and quickly take out the August lows. I will have a bit more confidence when I see DJI 17,000.00 and SPX 2000 decisively broken and any counter rally failing to retake them. This battle around the 2000 pivot has been waging since last October and for the bearish case to be irrefutably made it really needs to be taken out and STAY that way…keep an eye on futures…

I agree. Its sounds bad but every SINGLE Friday after market closes I wait for SUNDAY NIGHT FUTURES. ITS ADDICTING 😉

2,019 or 2,000 should be BROKEN THIS WEEK FOR THE LOVE OF HUMANITY!

Futures down quite a bit…so far. Expect more thrashing around from the banksters in the near term; I would not be be at all surprised to see it go hugely positive on Sunday night – they are SO predictable. I still would like to see a monster bearish engulfing candlestick to confirm the demise of the banksters’ inflationary ambitions. If futures go more deeply in the red Sunday night…I will assume Mr. Third has indeed arrived, and will remain with us for some time…when the FED and its cronies decide resistance to the downside is futile and they are no longer even willing to attempt to manipulate futures…well…need I say more? 🙂

I really think the FED only cares about the BOND MARKET….

I really think they will let the market just fall out of bed…

huge shooting star reversal….

Whatever bounce we get if we do get one because of the so called “January effect” should be short lived maybe +1.5% MAX….

hi

all

I was reading on zerohedge’s website as usual being the BEAR that i am 🙂

The interesting thing they pointed out is the out of control price of AMAZON. I will be doing more research on that trade setup. It could be a good mid year MASSIVE SHORT too. I have never shorted an individual stock so not sure how the capped options could be on that .. I guess all the FANGs stocks should dump…..

That is a great plan. Amazon’s PE ratio is now over 900 (that is just crazy).

I got nothing against Bezos personally but do question why they keep on dumping so much money in R&D when the website hasn’t even changed really in 15 years. However, If I make money on that short. I will probably buy 1 thing on Amazon 😉

Topping candle for SPX yearly looks great!

🙂

Nice candle close for the past 2 months….

Still possible we saw a very deep five three five down for a minute two down ahead of a final pop higher. It would be a truly manic final burst upward next week to conclude this long and dreary saga ahead of a truly epic bear market for the ages. Still holding a few upside hedges and am really hoping for that pop next week. It would present the shorting opportunity of a lifetime for anyone still on the sidelines. Bye’ all, and once again HAPPY NEW YEAR!

(See ya on Monday Lara, it will be good to have you back…. 🙂 )

Verne EWI has been off calling (forcasting) the market. Hence why I started subscribing to Lara (as well). What I am looking at is Russell 2000. We can see a clear five way down in Augut lows for RUT2000. This tells me the higher probability is that the fifth wave in large caps were truncated. Nevertheless, I think the EWI’s count is incorrect. Now again I could be wrong. The higher probability goes with the bear.

I agree with you on EWI. In fact I sent Steve an email a few weeks ago and told him that he was a perfect contrarian indicator! How ironic that the only time I have ever seen a bullish wave count from those guys the past six years is AFTER the market had topped. Poor guy. He must have taken so much grief over being so consistently wrong the past few years that he felt obligated to give a bullish count at this juncture, despite all the irrefutable evidence staring them in the face. Your point on this is well taken, though I have learned the hard way it is never a bad idea to stay hedged, even with a small portion of one’s portfolio. As we all know some of the most vicious counter-rallies occur during bear markets. if we remain below the 200 dma next week for the first in a long time I will be ALL IN on the bearish side. I am very convinced listening to all the talking heads that they have no idea what is coming, or worse, they are pulling our leg…

intraday rallies and 2,000 and below early next week no jinx….

SHARP AND FAST DOWN I SAY. SAVE IT MATEY!

I think the Fed was able to manipulate the market, while EWI was in denial. I guess, one could argue the Fed manipulate the markets by impacting market psychology and in a way related to Elliott Waves. I think the market truncated in large caps because of Fed’s decision not to increase interest rates back in September. Yet, we had to finish the fifth wave because it was the dominate trend. This is just an opinion.

Again I agree. While I don’t know how the FED’s intervention ultimately affect the wave forms, no one watching the price action the last few years could have any doubt that they were very active in the markets. The EW principle would insist that they were only successful because social mood cooperated and allowed them to be. In my own mind the final trigger that would wake everyone from their FED induced slumber was the bond market and the implosion seems to be underway. To the extent that this inflated market has stayed aloft for such a protracted period, will the swiftness of the decline unfold once it really gets going IMHO…

This market will drop with FORCE. The 3rd wave will be awesome.

Hang in there matey!

WOW JUST HEAVY SELLING- Well at least we got 19 of my 30 points I was looking for today….

MY WATCH LIST IS JUST SAYING SELL ALL DAY 🙂

Vix going higher with A NICE HAMMER. Didn’t have time to tag my name on my charts to get the post up…

Happy NY everyone

Will shorts cover for the week end?

Don’t think so…the bottom’s set to drop out of this baby…

SHOOTING STAR REVERSAL

MACD READY TO CROSS OVER DOWN SOON!

Everything coiling like a snake…I for one am going neutral near term…something in the wind….

HAVE A PROSPEROUS NEW YEAR EVERYONE!!

THANK YOU. YOU TOO MATEY!!

Grasping at straws here

Nothing about this crazy market would surprise me. The price action today has been totally nutso!

Something’s Gotta Give…if this thing breaks to the downside this would be the sneakiest bear attack I have ever seen in my life…what a way to usher in the new year!!!!!!! it sported a hammer for most of the day!

Happy New Years all!

Laters….

Options and futures close at 2:55 pm est

Regular stocks close at 4 pm est

Call your broker they can explain it…

Too bad options closing early. I still expect that pop at the close and really wanted to go into the week-end short term neutral. What if we wake up to massive down-side futures to start the year…??!! RATS!! 🙂

sometimes you got to roll with the punches….

Talk about eerie…SPX doubled back to fill gap from this morning and reversed almost immediately…! How strange is that..!! The market is becoming truly schizoid……

speechlessly ,,,,,,,,,,

Avnerilian, your minuette wave four has intruded into wave one territory….

Unless I’m mistaken some small over lapping is acceptable on futures contracts due to the leverage. Cash markets are a no-no however.

I’m sure it says that in the blue book somewhere (Frost & Precther’s EWP)

Any Elliotticians care to clarify (or correct me) on this point?

From my understanding you are correct. But the wave count should have the ‘right look’.

The time duration between waves 2 and 4 of the impulse being so out of proportion makes that count look quite strange and they do not fit into a parallel channel. So I think the waves labelled as the same degree are likely of different degrees.

The waves look like 3’s to me so could be an expanded diagonal

Big Dubai on fire now

https://twitter.com/Globe_Pics

Uh Oh…!

Is the bear going on the prowl early??!!

Man… I gotta go but this market is totally nuts!!

if we hit 2051.70 there’s a very good chance this up move was corrective.

We just fell out the bottom of the up moves base channel – not good!

Edit: Just seen the building on fire in Dubai – absolutely terrible

A harbinger of things to come perhaps…?

Hey Olga, I hope you were able to take quick profits on that UVXY short; I think it is set to head for the moon…

Yeah – actually I almost top ticked that move up!! Pure luck – I closed the UVXY short and all my other positions early because I had to leave.

I set an auto buy just below 2044 for a small long UVXY position which got triggered on the dive down into yesterdays close. It looks like we’ve now completed a 5 down from 2081, so I’m hoping for another bounce up to fully load up, otherwise I’ll be on catch up.

Don’t particularly like the look of the aparent wave ii down from 2081, but the market is currently moving down in 5s, and up in 3’s so that’s good enough for me.

Will be very interesting to read Lara’s take on recent market action.

Full day

http://www.thestreet.com/stock-market-news/11771386/market-holidays-2015.html

Thanks John. I wondered why my chart clock showed a full day of hours left when a calendar I looked at earlier indicated an early close…

Right I’m out of all my positions – gotta go.

B of the (possible) ABC down from 2081, I see as at 2071.15 – if we go above that then I’ll be expecting highs above 2081 early next year.

HAPPY NEW YEAR to everyone!

See you all next year!!! 🙂

I’ll set an auto buy just under 2044 just in case!!! 🙂

stalling

PS, is it a full day today?

I thought not, but just looked at market hours on a website and it just states ‘open’. Can anyone shed any light on this?

In any case I’m in GMT timezone so need to get off pretty soon

According to MarketWatch

Both the New York Stock Exchange and Nasdaq will observe regular trading hours on Thursday, closing at 4 p.m. Eastern.

According to Marketwatch

http://www.marketwatch.com/story/when-do-markets-around-the-world-close-on-new-years-eve-2015-12-24

Both the New York Stock Exchange and Nasdaq will observe regular trading hours on Thursday, closing at 4 p.m. Eastern.

Just want to make sure everyone see this correction of my earlier post.

One more push for five up, and we should see some green after a small abc…

There it is…five up!!!

Interesting development on the five minute chart. Upward move so far STILL looking corrective, we need five up…hmmnnn….

Is market open normal hours today?

Just seen your earlier comment – I also want to go into next year short term neutral.

Most certainly won’t be holding this short after today – could get gapped below 2044 when market re-opens. Feels unnatural to me being long this market other than VERY short term

Stop loss on my short UVXY ‘punt’ moved up to 2050.

This move up looks pretty weak atm

Edit: price just moved out of the (very small degree) base channel so hopefully someone lit the gas

If yesterdays possible triangle was in fact a series of 1,2s, this move up might be a wave 4 correction, in which case I will get stopped out and we should go below 2044.

Invalidation for that idea is a move above the possible wave 1 low (around 2069.09)

Sold 50% of my short UVXY – need to leave soon and don’t want to be holding this into new year.

Despite a few good trades I’m **still** down slightly from a week or so ago – might as well have stayed in bed!!!

2015 has been a good (frustrating) year – I think 2016 will be alot better!!

No kidding. I now understand where that expression of the market remaining irrational longer than most folk can remain solvent came from. For those of us who have been patient, we will be smiling all the way down…

🙂

Any thoughts on copper & other metals here?

Gold I’m expecting will go below $1000 – I’m a buyer in the 900’s. Hate for gold is getting extreme.

The interesting question for me is at what level will paper gold price detach from the reality of physical gold availability/demand/mining costs etc.

I won’t post my charts as they are based on Laras gold counts so not really fair to do so.

That detachment has already begun. Have you tried to buy silver any where near spot price lately? :);

I was early going long the miners. COT data has been extreme for quite some time so hard to say how imminent the reversal is. I do think we are late in the decline. I would be surprised to see a break of 1000.00 for the yellow metal.

Bottom line is I think we are due for one heck of a bounce in a probable intermediate B wave up.

Yeah – I’ve been pecking at physical on the way down from 1200.

I’m not exactly a gold bug but also don’t want all my eggs in banking institutions.

Physical cash and physical gold all the way for me – the trade of the century may well be timing a move from physical cash to physical gold at just the right time (easy right??!!)

You are onto something there Olga. The accumulation of precious metals or their producers once the commodity bottom is in could well be the trade of the century. All fiat currencies are going to zero, it’s only a matter of time. I want to get as many shares of GORO in my portfolio as I can afford at the bottom. It is one of the few miners that actually will pay its dividends in the metal itself…imagine that…payment in real money!!! 🙂 🙂 🙂

Head fakes

on the graph

We have one more pop higher…we were clearly not in a third down…extremely remote chance that this morning’s move down was start of new impulse down; all the signs point to it being corrective…look for gap at 2063.36 to get filled

This up move is not exactly inspirational at the moment

Don’t like this, On the sidelines

HMMMMM 21 min old

A portion of my watchlist. It will be hard to get a bounce with damage like this….

Do not, and I repeat, DO NOT, underestimate the resolve of the banksters. They are ultimately going to get crushed, no doubt, but I think they have one more desperate upside push up their sleeves. I expect the next upside move to be met with some heavy weight players waiting in the wings and that this will evidence itself in the mother of all bearish engulfing candles…as someone says…”Stay Frosty!” 🙂

It’s kind of ironic, it looks like whatever happens today despite the hundreds of billions they have spent, we will end the year in the RED!

2044.76 is the pivot point support on the SPX HR We are just above it ……

I am having a hard time keeping up with all this stuff

‘I am having a hard time keeping up with all this stuff’

Me too John!!

End of fifth down approaching I think…

Think we might be in 4 of the final fith down now – if so it will literally kiss my line in the sand.

Above 2050.50 it should be done.

Or possibly four of three this morning with five down still to come…this move up looking corrective…

Close enough for UVXY. Taking some off the table and rolling into later dates…

I’ve just gone slightly short UVXY (only -1000 shares) – just for fun as we’re so close to my re-buy.

Lets see how that goes!!!

So did I , All my support lines broke

I mean I shorted UVXY (so in effect long the S&P)- I have support at 2044 – if that breaks I’m out of it and back long UVXY

I’m not a day trader–not my skill set, but I do enjoy watching traders in action!

Good luck!

Thanks.

I’m not really a day trader – its not really my skillset either.

I just take any low risk opportunities that I see as the market doesn’t give them away very often (and those that it does often end up being invalidated).

Looking for VIX to print red candle on the five minute chart. Plan on also picking up a few bearish call credit spreads in anticipation of pull-back…

There it goes…. Verne!

Heading lower it seems…no bounce yet…not that there is anything wrong with that…! 🙂

Channel bottom …….

TEMPORARY HAMMER TIME

IT CAN STILL MOVE LOWER 🙂

get ready for a big year in 2016 🙂

Triangle………..sort of

All

This could all happen really fast. Seriously think about how fast SELL OFFs are. This could be it. Sit tight and manage based on your risk tolerance….

Probably a huge down day at this point… 🙂

WE MUST BREAK 2051….

Futures mildly lower- not the stuff of which third waves are made. Odds are some kind of small degree correction continues slightly lower at the open, followed by one last pop higher. If it turns out to be one last impulse up unfolding, I would not be surprised to see a truncation. For those who have not yet established a short position in the market it may be the last best opportunity to do so fairly cheaply. For a market that has gone absolutely nowhere for the last twelve months, I suspect an awful lot of traders can sense that the end is near and will act accordingly. I kinda feel sorry for the banksters…NOT!! 😀 😀 😀

Possible downside target if we are going back up to highs above 2081:-

c=1.618*a @ 2051

Line in the sand (previous swing low) 2044

I’ll be selling my position as close to 2044 as possible and re-buying if we go below 2044

Sold 50% of my position @ 2052 – awaiting more downside!!??

I’m now 75% sold out of UVXY – getting twitchy!!

Possibly currently in (iv) of (c) down – one more stab lower? I hope so!!!

My target met – I’m out. Will re-buy 100% below 2044

Looking for a trade above 30 roll and reload…

Looks like we’ve had five down…bounce should start soon unless we get an extension…

I’m still (slightly) down from the loss I took a few days ago when the count got invalidated.

This market certainly doesn’t want the small guy to make a buck easily…

Ain’t that the truth…however, I think that’s going to change soon…with the big guys really feeling the pain…

*IF* this is a wave 2, it is again a very deep retrace

Technically, it could go as low as 2005.33, the December 18 start of the presumed one up…

Exactly – If we go below 2044, that will be my next target

Zooming out – the move up from 2005 looks alot more like a 3 wave structure than a 5 to me. 2044 looks like the end of wave b (or x).

I still think we are going down, but need to await 2044 confirmation just in case. I will then be on the lookout just in case the structure from 2005 was a five.

I have a feeling that you staying in your trade will prove to be the right move again. But again I’ve been burnt too many times!!!

You are doing the right thing by being nimble. It takes an iron gut to handle the shenanigans of these market players and one way I deal with it is by giving myself lots of time for them to wear themselves out…which they eventually will…but this thing has indeed lasted a lot longer than anyone would have imagined for a b wave.. 🙂

Nice move on the UVXY short. I grabbed a few SPY calls earlier. I really wish the pop would come today so I can cash out and go into the holiday break neutral short term. I have a feeling the action next year is going to be hot and heavy…

Hi Olga RE:”what are you trading? Options or Futures?

you can’t win with this market from the get go. Sometimes you got to let trades go negative to go positive….”

I have been trading the TVIX. yesterday it spiked down , HFT trick I am sure, and took out the stop that I had been moving up ……….red circle

Here is the spike on the SPY HR

Hi John,

Thanks for that (actually I just queried what you were using as a basis for stops). I often trade UVXY which is supposed to do the same as TVIX. I found setting stops based on S&P price action rather than UVXY price really helped my trading success rate. Perhaps that would smooth out some of the spikes that got you stopped out?

Clearly whatever works best for you is best to stick with.

I had huge issues trading 2x (or greater) ETFs – sometimes still do. The inevitable crazy price swings makes my emotional side that much more on edge. I use EW to (try) keep reality at the forefront of my trading and the emotional side under wraps.

and it begins – no jinx all

hi

all

look at the HUGE SELL at 3:30 LIKE CLOCK WORK. THIS COULD BE IT – NO JINX!

LOOKS ALMOST LIKE LATE AUG RIGHT :)?

hi

all

buckle up for tommorow and into the new year – NO JINX!

MIGHT BE A BIG DROP….

Some Ellioticians still see bullish potential and are counting the high yesterday off the December 18 lows as minute one up and today as a second wave correction. We will certainly know tomorrow if we see a strong reversal off the day’s lows and blow past yesterday’s high. if we are in a third wave down it really should not be looking back at this stage of the game. It’s time for the market to show its hand and overnight futures should point the way- they should be down big time; if not we should look for a strong reversal tomorrow I think…the end of the year should be most interesting either way! Yearly gain or loss is at stake for the indices and rest on tomorrow’s outcome.

Thats good to know. The contrarian in me is swaying towards a drop from here rather than a retrace if plenty are expecting a wave 3 up.

If we go above the apex of the possible triangle from today I’ll be selling out (again!) and trying to rejoin the party at a better price.

2060s or 2058 or 2020. I dont see it any higher. LAST TRADING DAY HALF DAY!

Thank you all for being there for me today. It means a great deal!

Strange cagey action in the market and I have no idea how to properly count today’s action. I figured the meandering meant it was corrective but we could be getting a stair-stepping decline that starts slow and picks up speed…patience is indeed a virtue when it comes to this market…’nite all 🙂

YES AND ANOTHER BEARISH SETUP 🙂

Verne, your short – who cares how it goes down as long as it does 🙂

I agree that the aparent triangle could be a series of 1,2s, but the tri wave b does not look impulsive to me (could be leading diagonal).

Time will tell all!

Amen, brother…it may take some time, but I think this thing is toast…!!! as you would say…laters! 🙂

4 weeks to 1850-1800 tops

NO JINX

First target for (C)=(A) @ 2058.

Looks like someone is buying!!!

That spike down was weird. Looks like cowboy action to me and not the real article…

It should go lower – I’ve scaled out of some of my position just in case, as I took back quite a bit of what I lost yesterday.

This bounce might be just (ii) of (c) down – if so we’re going quite a bit lower

Triangle wave (B)???

If so we’re going down in (c) then back up above yesterdays high

oh no… i hope not…

i think the rules for triangle is more distance and not that close in range…

the real money comes into the market right now the last hour and the 30 minutes of course.

this could be a good day for the bears hopefully..

I JUST DONT SEE HOW THEY CAN PUSH THIS MARKET UP WITH EVERYTHING CRASHING FOR THE LOVE OF HUMANITY.

Triangle Rules:-

A triangle subdivides into five waves (A-B-C-D-E), whereof at least four of them are zigzags.

Today’s move definitely starting to look corrective. I agree we are in for one more pop to the upside…

I’m happy with that – unload on (c) and re-load at new highs.

If only it were that simple!!!

Looks like (c) down from the triangle might have just started….

i thought that wave b(of ii) took far too long. The truth always shows itself eventually

My only concern about the B designation is how little of A was re-traced…

Price avalanche risk…

This is grinding at the lows.. We should get resolution within the next hour for final direction. I will take -8 or -10 on the SPX today….

If this is the much anticipated wave c (or wave y) (of (ii) up), c = 1.618*a @ (approx) 2076.50 – which is also the 61.8% retrace of the impulse down.

oh o.k

olga,

so what is the target for this drop down ? Is it still 1850?

I am still learning. Better to learn from experts….

I’m not really interested in targets at that timeframe at the moment so do not know exact targets or if they have changed due to recent action (though i am very interested in overall trend direction on that timeframe). You would therefore need to study Laras counts to get targets.

At the moment I am only concerned in the odds that the market has turned back down or not (i.e. I am looking at much lower degree waves) and quite short term targets so I can get back 100% into my position.

Day trading may be viewed as gambling, but I would really struggle to have a long term position in this market atm, unless I got in at the right price with good risk/reward

oh o.k thanks!

The price action for the past few months makes complete sense. If the market is going from BULL MARKET to BEAR MARKET. THIS IS THE TREND CHANGE PROCESS possibly. That is why it is taking so long. I hope once we break 2,000 this should wash out quickly within weeks is my guess – no jinx….

You could well be right, but (in my opinion) any opinion not based on EW (or other technical analysis of actual price movement) is just a mixture of bias, emotion, news, historical moves and other external ‘noise’ so I would not give it any weight in actual trading decisions.

I have found that events follow the wave count (assuming you are following the correct one), not the other way around. This can be a hard (and expensive) pill to swallow

oh o.k

I think this is the move now after further consideration. This setup just looks REALLY BEARISH AND JUST right….

No question that scalping the market has been the only way to generate a reasonable return. I feel sorry for the buy-and-hold crowd. With very, very rare exceptions that is a guaranteed way to loose money…

I think the market is starting to (or will in future) pay out based on effort you put into it.

In my opinion, the buy and hold crowd have had it very good for a very long time with very little effort / understanding. If those days have not gone, they are certainly numbered.

Of course there are people who I feel for (pensions etc), but it will at least shine a light on how unsustainable goverment promises are so hopefully bring in a more sustainable system.

i dont want this to go past 2073….

A little good electronic guitar music by Edge…

https://www.youtube.com/watch?v=cLShxhQwwwA

uh oh MIRACLE BUYER just showed up ALL….

hopefully the OIL PRESSURE CAN KEEP THEM AWAY

:/

Stopped out !

what are you trading? Options or Futures?

you can’t win with this market from the get go. Sometimes you got to let trades go negative to go positive….

imo

Are you basing your trading decisions / stops on EW John?

What caused you to get stopped out?

This wave (b) is certainly testing my patience!!!

(if thats what it is – could the up move be over at the earlier 38.2% retrace?)

Edit: Now we’re cooking (I hope!!)

We’ve now breached the top of the wave (b) channel, but If this is a small degree wave (ii) it’s starting to look a bit odd to me ((b) took far too long).

Can anyone see a different count from yesterdays high?

cross my fingers olga

i sure hope you are onto something….

$TRIN is at 2.20………Something is cooking

now this is a computer driven market …

price respects technical levels….

today nothing but sell for hours upon hours and now stalled…..

lets wait for the close for peace of mind 🙂

hi all

its over… down it goes…

no jinx

uh oh

oil crashing down all

If we saw the end of b (of ii up) at 2070.81, I see fib targets for c up @ 2075.49 (very close to 50% retrace) and 2078.36 (very close to 76.4% retrace).

Though b down (of ii up) might not be over!!

Post moved to top

VIX moving strong into 17….

ES HR Black line looking problematic for the moment

Can you guys post charts? If you are having a problem , JING works well

https://www.techsmith.com/jing.html

There you go!

Thanks ! I have a BIG problem trying to visualize from text..

I don’t generally post charts as I don’t usually annotate sub waves (they change too often on the fly) – very lazy!!

I generally just put base channels, targets and invalidations on my charts

Impulse down a bit tricky to interpret on five minute chart. Not sure If I am looking at a mini wave four or a of an abc…

If you mean from yesterdays high, it looks like a textbook impulse to me on 1min chart??

Perhaps I’m missing something?? I’m seeing a 5 wave move up off todays low right now (poss wave a of ii up?)

I see it…I was looking at DJI but SPX is clearer…

UVXY not playing nicely (not giving me much of a discount on this wave up!!).

It could get worse as the masses pile in…. 🙂

UVXY opened up a gap from yesterday’s close at 25.71 and filled a gap from Monday’s close at 26.57. If that gap is not filled today I will consider it a break-away…

NEGATIVE divergence clues

macd ready to cross over down…

hi

all

my bear spirit is back.

thank you so much for hanging in there with me 🙂

Still holding a small hedge against an upside surprise which will be jettisoned with the fall of the 200 dma…

I was also looking at the monthly chart and there is an outside chart we could be in primary wave territory..

Broke down through the daily pivot , maybe we fill those unfilled gaps

Transports down as well. What else do we need to hold up this market?

I meant to post this here and mistakenly put it on another thread. I think Olga has a great point. I remained short despite the slight breach yesterday.

I am wondering if what Lara labelled the end of minuette three on the alternate chart could have been actually the end of minute one down, and we have now had a five three five correction up for minute two. If that is the case we should now be in minute three down with sharply increasing momentum today. If not, I would be inclined to think intermediate two is not done.

Click to Edit – 2 minutes

Reply

Hats off for staying in your trade.

I’m too bruised from this market to stay 100% convicted until proven otherwise. If we’re in a bear market, bear market rules will ease my earlier pain!!

Believe me Olga, I’ve got my share of scars.

I am starting to figure out how the banksters operate and I think the situation developing in the credit markets is going to greatly reduce their ability to whipsaw the market. The mood is starting to turn dark…keep an eye on the 200 dma…

Oh yeah

oil gap down now…

thanks! I had been holding short for days 😉

if oil is leading the markets as ART CASHIN says. we just broke the lows.

this should be interesting.

In my opinion we completed a 5 up from 2044.36 with wave 5 of the 5th wave counting as an impulse (so could not be a b wave of W4) and we have now impulsively gone below its wave 4 (so wave 5 cannnot be extending). So I’m 75% back in the game with a stop loss at yesterdays highs.

Seems to me low risk trade set up. Even lower risk would be to wait for an abc 3 wave up structure to develop and waiting until we drop below end of b up. After that I’ll be back at 100%

thank you Olga. i feel more confident now….

Yesterdays high also terminated near the c = 0.618*a target of 2082

We now have 5 down – if we now get a 3 wave up and then drop below its wave b, I’ll be all over it!!

BTW – the last up move might have been it’s abc (wave ii up) already (so a tiny wave 4 down already occured).

Thats the problem I get quite often and why I’m already 75% back in the game – we might not see the 3 wave up here. If it impulses straight down from here then thats likely what we got…..

Sitting right on the daily pivot 2072.09

The red line above is 2076.71

$TRIN is over 1.50

SPX HR We are up to this S/R line again

2076.71 red line

We should open below this

Verne

Is the risk still low here from this post ?

I’m confused

Our desire to short worst-case scenario today provided the price not exceed above the levels invalidation 2104 or 2093 of lara.

If this happens then we shall transfer the minute ((ii)) right new top or the minor 2 in The bear.

so – wait until price stop under the invalidation point and then down the road will open….

Thank you for your member support. I am just watching today!

Verne

Are we in a leading expanding diagonal still ?

Or a NEW bull market uptrend to 2500?

Is anyone here positive on Martin Armstrong? He will present some 2016 targets soon based on year-end close of major markets (if anyone can interpret what he says).

Well since I’m

Not in the markets I can read his work

It is probably safe to say you can’t go wrong buying this market because nothing matters IMO.

You try to sell this market you will have a high chance of loosing as evident in just the past year alone!

It is clear that Goldman Sachs target of 2100 is on deck

For years they give accurate views of end of year targets

Just incredible! In Goldman you can never go wrong IMO you try to bet against them you lose!

I also think buy the dip Always works.

Nothing has changed in 6 years!

I have no idea when the market will turn over

My guess is 2018

Verne

I give up. I’ll visit back later

More than likely spx

Will be at 2150+ in 2-3 weeks!

Options2014 I have a question for you. Before you started reading this site, how did you make decisions about your trades? In other words, what did you base your trading plan on? Just curious.

I had several subscriptions and 12 monitors covering all world markets.

Obviously you cannot implement every idea from all your information sources so how do you decide what information will be employed in your trading/investing plan?

I canceled all of them to join this site. I actually ended up learning but still being negative for year to date. I didn’t get out friday last week since I thought the lows was in and now just holding on to contracts with no unknown future as this MARKET might keep on marching higher.

I thought we had been in a down trend. I dont know anymore.

My plan was simple. Short till we get to 1850. Nothing sophisticated.

Obviously we are in some kind of weird trading range sideways.

I admire your willingness to stick with your convictions even if you got a bit discouraged. I personally was prepared to say ‘Uncle” if it closed above 2100 and was relieved that it met stiff resistance prior… 🙂

I have been shorting for years 😉

Losses upon losses. This MUST be it.

I have been searching for knowledge for years. I wish I WOULD HAVE JOINED THIS SITE SOONER….

Verne

Originally I made the claim for the Santa rally and had the bullish bias explained!

I don’t know what happened to me. It seems I got carried away with the counts and dropped an idea!

I thought maybe we would make highs and we pulled back 5%

I am afraid I have to sit this one out for weeks as the down trend is not visible to me.

How can the third wave start back from 2080-2100?

We already made a series of lower highs and lower lows ?

https://www.youtube.com/watch?v=9SmUlYUFVHg

What is the Plunge Protection Team? What do they have to do with the stock market?

Several different titles around, PPT was one, another was President’s Working Group On Financial Management.

Members like Secretary of Treasury, Chairman Federal Reserve, Presidents of major banks and investment firms like Goldman, JP Morgan etc.

Basic intent seems to be high level intervention in major markets. Conspiracy theory or fact, you decide.

I think it’s a fact

It all goes back to Regan and now Obama of course.

I think that the ppt Team is doing a great job!

I have now lost all confidence to be honest!

I’m taking 1 day off!

I’m waiting for Lara’s next analysis for direction now!

Verne

This whole spx setup looks like we might as well spend 1 more year making highs into the rest of 2016. This is starting to look like another year stuck range lol

I don’t have anymore confidence in this market at this point.

Hi.

All

Is it just me or does anyone else starting to lose the bear spirit ?

When you step back and look at the global picture, can there be any doubt what’s in store for the two remaining CB inflated US indices? Come back in a few weeks and re-read your despairing posts today…one swallow doth not a spring make…. 🙂

Hi

All

Is the setup still really bearish ?

I want to be a bear but I’m stuck since the market keeps pushing for the past 3 days higher ?

Does volume even matter anymore ?

Jack

Which products do you trade ?

How long have you traded the spx?

Do you trade index options contracts ?

I used to mostly trade Russell 2000, and NAS100. Because of Lara I’ve started trading SPX. I like trading triple leverage ETFs. I see them as lower risk in an established trend (I know these ETFs could be a rip off). I do occasionally trade Options. I’ve been trading for eight years.

Jack

Ok cool I just lost my trading spirit today. I do only options on indicies. So either you are right or wrong on a position.

I’m taking another day off I don’t understand the price action or wave counts that keep changing and blowing right through all the targets.

I called the moves to 2080 as a joke and here we are lol

Everything that I look at (read) is telling me that the larger trend is down. I think this is just the start of a substantial bear market.

I do have a semi bull theory, and it could only happen if banks let lose and start aggressively lending money using fractional reserve, because of slightly higher interest rates. They are some elliotitions that say even if banks start lending like crazy people are not going to borrow because of consumer phycology.

I think we are just forming the top.

Go see the triple short oil ETF starting 2011. It went from a few dollars to about 200.

Jack

I know but still come on this is taking for ever. I have followed the SPX alone for 2 years and this year alone it has move right back to 2080 LOL

When do you really think we start the decline to 1850 ? Jan 2016 or Feb 2016?

Check this guy out in exceptional bear dot com. He talks about the “new Elliott wave” and “diags.” Check it out. I think is cool. I don’t have a subscription with him. His methods for subscription is not user friendly.

I am not a good timer when it comes to short term. I am a swing trader with longer time frames, and my mission in life is to catch and ride the third waves.

I wish I knew exactly when…I just think the trend is down

are you kidding down still? we are at 2080 man?

All

ARE WE IN A CONSOLIDATION?

I dont understand at this point what is going on?

i thought the 3rd wave down was in the early stages?

Please help me understand?

Just take a look at Lara’s various scenarios options. Nothing that has happened in the SPX so far has exceeded the scope of what she has presented as being possible. The odds are STILL high that the market is either already in a third wave down, or getting ready to begin one. I have long ago stopped expecting the market to do what I THINK it should, and simply accept what it DOES. The various wave counts give us the opportunity to get positioned for the most likely eventual outcome, even the though timing may be a bit difficult to pin precisely. The key to not getting discouraged is to keep the larger picture in mind. It seems to me to be pretty clear…. 🙂

The problem I have is the wave count length in time is comming to an end by Jan 30 2016.

I can’t have anymore confidence in markets with changing target dates!

Forget about dates…look at the wave COUNT!

When you enter a trade, there should be both a NUMBER that says you a wrong, and a TIME PERIOD in which you have a reasonable expectation for the trade to reach your profit target. It makes no sense to talk about dates apart from the specific context of a given trade- is it a short term trade? (days or weeks) a medium term trade?(several weeks to several months) a long term trade-( six months or longer) for example.

If I read correctly I thought we would hit 1976 first and then bounce?

We just keep on moving up and now almost 100% retrace

How can this be a down wave

It doesn’t make any sense to me ? A down wave does a retrace of 100% of A move ?

100% re-trace of what exactly? While extremely rare, and I have never seen one, Elliott wave rules do allow for up to, but not more than 100% re-tracement for second waves.

Well, tomorrow looks like a good day to have one of those engulfing down candles again…godspeed

i wouldn’t bet on it.

😉

All

If we close 2070 or 2100 by the end of 2015. Is the bull market still on? I don’t know what price level is considered for it to be over?

in 6 TRADING DAYS+4%….

Verne

Well, well, well. Looks like this might be your early bounce from 1993 to 2100 as opposed to waiting for another drop to 1976 to bounce this high like you had been saying.

Also, even if the bulls manage to bust it higher for 1.5 more trading days.

Look at the monthly candles for Nov-Dec 2015.

Is that a reversal candle?

The last remaining valid bear count (unless intermediate two is not complete)is a wave two up at minute degree. It still looks like a counter-trend move to me and won’t be invalidated unless we take out 2104.27. I suspect we move a bit higher before we see a reversal.

what about the third wave???

I agree Vern…this means hello third wave of the third wave of some kind

Another viable count is an upward minute three of minor C to complete an abc for intermediate two. If we see continued upward movement tomorrow this would be my personal choice. Invalidation point would be new ATH above 2134.71

We are currently at the Cyan resistance line which has previously provided stout resistance. Hopefully overnight futures will tell us if Mr Third has finally arrived. One thing is for certain, there will be no mistaking when he does…

I have lost all confidence to be honest!

I’m taking 1 day off!

I’m waiting for Lara’s next analysis for direction now!

So based on what has developed do you still think we can bounce now once we get to 1976 one day in 2016?

This upward movement is probably the bulls’ last hurrah. Unless it is a diagonal at larger degree, the next serious bounce should not come until primary wave two…a long way down from current levels…

Verne

Is this wave for 3 months target still 1850 by end of month Jan 2016? Please explain. I am still new to this site.

Verne,

Since the high of Nov 3, 2015 of 2,116.48 we have almost completely retraced the entire move down to 1993 and now only down -1.6% in 2 months if we hold here at 2078. JUST WOW!

I wonder if the 3rd wave has been postponed now?

I wonder if the BULL MARKET JUST KEEPS ON MARCHING TO NEW HIGHS?

I wonder what level we need now 2100 just one more time why not before going down 60 days only for -1.6%?

We have now got 5 up from 2071.76. I’m not too happy about some of the sub divisions on the 1 min chart, though Lara has cautioned me previously about looking too deeply into the sub divisions.

Short term downside key levels (for me) are now 2077.53, 2075.55 and of course 2071.76

b count for leading diagonal invalidated with move above 2076.71. Next invalidation point for minute two at 2104.27

VIX not confirming upward break-out. Holding shorts with a few upside hedges remaining…

Yeah – I’ve got a feeling we won’t go much higher than this but will (try to) stay disciplined!

Very difficult to adhere to stops. Critical to living to fight another day. I still expect the reversal to be brutal. The banksters are very well aware of where a lot of traders have placed stops and know how to methodically take them out…

Agreed – will hopefully buy back in at a better price (though vix doesn’t always play along with that theory).

Every dog has it’s day!!!

Look at the first hourly chart from 12/18

That count has been invalidated by todays action (if I’m looking at the right chart), but I think I understand what you mean

I think this wave up has a three wave look to it. I think we just did an abc 3-5-3 wave up starting from 1993 to complete a wave two of one of the waves down…with all these 1-2s is kinda difficult to keep up

Yeah I can see that – it has quite a good look to me. Only issue I can see is that the wave down to 1993 is also a three wave structure (could we be in a larger degree diagonal down??!!)

If this goes higher the aqua downsloping trendline would be a good place for this 3 wave structure from 1993 to terminate (about 2092 atm).

It doesn’t look strong enough at the moment to get there but it will not be the first time that has been the case.

if this is an abc up from 2005, c = 0.618*a @ (about) 2082.68

2082 would look right…

Sold 75% of my position at a loss. Will buy back in if we impulse under 2071.76 short term. Move above invalidation still looks very weak to me.

Kinda expected so not feeling too bad

Vern: Why 2073.31 ? TIA

Trying to evaluate possibility of an impulse up on five minute chart and 2073.31

invalidates my theoretical count…

Well it seems the market knows 2076.71 is fairly important.

Fingernails officially gone

Yeah!

The bulls probably smelled a few hungry bears lurking around the corner…unloaded half my upside hedges 😀

Just picked up a bit more volatility while the risk/reward is so attractive.

Got a feeling I will get my rear end handed to me on a plate very shortly but there yer go

Seems to me to be smart trading…these banksters really know how to rattle the cages of the uninitiated…reducing your cost basis is one smart way to foil ’em when the wave count is in your favour…would really like to see VIX gap at 16.91 filled to seal the deal…. 🙂

SPX 15 min

RED LINE 2076.71

Indicators look ready to roll over

O.K. We need to take out 2073.31 to confirm today’s high is in. Very deep second waves seems to be the order of the day…

Looks like transports are exiting the party early…stage left…SPX 2076.25 must hold if the party is indeed over… 🙂

77 million shares only for a presumed third wave up to new highs??!!

FAHGETABOUDIT!!

that is new york lingo 😉

Most appropriate, when talking to,and about banksters no? 🙂

i am a new yorker….

I LOVE New York!! 😀 😀

I am not sure how long the bulls can hang on, but whatever they do, they had better not give up the 200 dma today…if they can manage it…just saying…

Yesterday’s gap at 2056.5 should be downside trigger… 🙂

2076.71 WOW!

UVXY already bouncing off this morning’s lows. Stand by…2076.71 remains the line in the sand…

Well if there was ever a low risk trade it’s right now!!!

Too bad I jumped in too early – must get a new crystal ball….

You should be OK as long as you gave yourself at least a few weeks out (if using options)…I had a feeling the banksters would take another run at the 200 dma… 🙂

verne

you honestly think we can still make it by the end of jan to near 1850?

Nothing is for certain obviously, but if I were a betting man, I would definitely bet on new lows over new highs matey….there is so much pent up energy in this coiling snake I expect it break hard and to break fast…meanwhile VIX continues to inch higher… 🙂

oh ok matey…

Yep – no complaints from me. It’s the nature of the beast.

Keep a close eye on your hedges folks. If they give back this morning’s gains…well…you know what to do…. 🙂

Yesterday we had another example of how the news cycle is used to misinform the gullible investing masses. Supposedly the retailers had a “late” surge of buying and this augurs well for the financial health of the retail sector. Of course, news of great retail sales have always been the driver of the Santa Claus rally so…. VOILA! Up we go……Yeah… Right! 🙂

SPX HR , I see what I missed: The pivot point support : Anyway R1 is next if we don’t go back the fill that double gap

Is anybody surprised? This is the way banksters operate folks. They are trying to intimidate any an all short-sellers. I for one am not buying it and shorting this rally big time. They are pushing on a string. 🙂

2080 looks like the first target

I do not think they are going to breach 2076. Too many traders are waiting on ’em….

this is not fun anymore.

Puts to call ratio spike too high yesterday to support a downturn (checkout $CPC on stock charts). If anything what concerns me is that puts to call ratio supports a near term bullish turn.

Any thoughts on that…

Puts to call ratio spiked too high yesterday to support a downturn (checkout $CPC on stock charts). If anything what concerns me is that puts to call ratio supports a near term bullish turn.

Any thoughts on this…

The price action in VIX options show a huge disparity in what folk are willing to pay for calls vs puts with December expirations. A lot of folk are not buying the notion of much short-term upside potential. The crowd is not ALWAYS wrong…. VIX made a low of 14.45 on DEC 24 at SPX 2067.36…not even close today…. 🙂

I did not see this coming, although seasonality suggested it would: I haven’t looked , but I doubt there have been many Christmas crashes…..We will see if resistance holds

we take out 76 and I give up. this is not fun anymore.

$TRIN index closed at 1.75 yesterday and opened this morning at 0.58…..

ES daily: At Fib and channel resistance

Another variation

ES HR RSI looks over extended

Closing thoughts. This statement alone has me convinced with the entire bearish setup we head way lower “The risk for this wave count is low, and the reward is high” -Lara

A day of indecision. 200 dma support on Friday, resistance today.

We should get clarity in tomorrow’s action. Bye’ all. 🙂

Nuts

That “hammer” could be a bit of a head fake. Torpid action more reflects an absence of committed sellers than any inherent bullishness. A true hammer as a reversal signal should really also come at the end of a clear down-trend.

The $TRIN spent most of the day between 1.60 & 2.00

An Arms Index value above one is bearish, a value below one is bullish and a value of one indicates a balanced market. Traders look not only at the value of the index, but also at how it changes throughout the day. Traders look for extremes in the index value for signs that the market may soon change directions. The Arm’s Index was invented by Richard W. Arms, Jr. in 1967.

Verne

A hammer is at the bottom. What I see is a A hanging man candle(reversal candle on the SPX)…

Are VIX futures anticipating a January effect ?

Not sure why UVXY printing a red candle today. It looks like we are in a slow motion impulse down. Action much clearer on transports etf IYT. I suspect by the close the strange divergence from VIX will be reversed. I took advantage to get filled on some bullish put spreads.

I’m waiting for further wave counts by Lara. Until then the trend is down as I understand. I have no doubt about this!

Kimble charting solutions has noted the pennant pattern with lower highs and higher lows developing since 2011. The pattern is very close to the apex and the implication is that a monster move is in the works. Still looking for a trade down to the 1976 area and one final manic move up to close out the pennant’s apex.

http://blog.kimblechartingsolutions.com/wp-content/uploads/2015/12/spxpennantpatternfollowtheforcedec282-675×315.jpg

Verne–how high will that final manic move up go?

It would depend on the final degree of labeling that Lara decides on. The current label would see the re-tracement as minute two of minor three of intermediate three down and it would have to end lower than the start of minute one at 2104.27. Technically, it could retrace 100% and still be viable but it cannot exceed it. I would expect it to end in the 2100 area.

Thanks

Verne

I dont see how near or 2,100 fits anymore at all. We cant even get above 2,093, 2,076, 2,060. So, it would almost be highly unlikely that if we retrace we go back and break above to 2,000 towards 2,100 after we tag below 1976 ish. Technically that seems almost impossible and nothing supports that outlook from a monthly or weekly chart view. This wave count from what I understand last approx 3 months since November 2015 and that ends late Jan 2016. So, unless I am reading something wrong or if you can point me to the place Lara wrote a possible bounce from below 1976 back to 2100 that would be great….

A bounce in the 1976 area that goes past 1993 favours the leading expanding diagonal. Retracements from leading expanding diagonals tend to be quite deep. I cite the higher value of around 2100 only so we would have a number that tells that that interpretation of the wave count is probably incorrect if it goes any higher, not that it necessarily must reach that level. Although extremely rare, second wave corrections may correct 100% of the first wave.

oh o.k. i can’t wait for Lara’s assessment when she returns. This is getting kinda choppy here to analyze….

What could be a worse case scenario is if you exit out of the short again to early like last August.

Also, take a look at the RUT it is getting smoked. My guess is the SPX will catch up in 1-2 weeks 😉

Russell, small caps, and value line indices are very clearly about to start third waves down. Some folk are seeing an impulse up in DJI and SPX from the Dec 18 low which would have a third up starting tomorrow. It’s possible but I think doubtful. It also be another tricky truncation to throw traders off. Either way very obvious divergences exit among the various indices and that is not a good sign. I don’t know how high this bounce will go but I think it will be short lived; another good example of the importance of staying hedged…again the 200 dam will tell all…I am looking for an outside reversal day.

Verne

No reason to be wishy washy here.

The correction is going to happen soon.

I’m taking this super serious and not playing any bounces !

Verne,

The thrust down from here will not allow for the maniac run up imo, you will be counter trend trading once we close below 2,000-1,976…Chris’s work is longer term view and the break down is a definitive direction…

So If I understand what you are saying you want to exit a 3rd wave and wait for a bounce and then trade down the 3rd wave again?

I think you are onto something options and that is a likely scenario if we are not seeing a leading expanding diagonal. The bottom could really drop out of this market and we see the kind of no-looking-back waterfall we saw in August…only amplified…movements out of wedges are generally really brutal…

I like to exit equity positions at the end of the third wave, but wait for the fourth to exit volatility positions as that is when we generally get the massive spike…

The only thing that concerns me is that put to call ratio is too high to support a drastic wave down…$CPC

everyone is talking about that. i dont think that matters. it is one of those coincidence things – people need an excuse for this to go up.

!!!! Interesting

Related: http://www.investopedia.com/ask/answers/013015/what-are-main-differences-between-symmetrical-triangle-pattern-and-pennant.asp

Verne

The run up from 1976 doesn’t look right from a charting view perspective. Weakness should continue for sometime….

ES DAY

A curiosity:

I have no idea why this old gap area would be in play ,(if it in fact is) but I also don’t understand how robots are programmed to trade

$TRIN index is above 1.50 which is bearish

John,

From what I know, basically they use a combination of 30-100 technical indicators and then just buy or sell. But again, it also depends on the firm. Some firms can’t unwind so they just diversify and rotate into sectors. The question is how many sectors can you rotate in? if everything is going down 🙂

Seems like this thing is moving lower. OIL IS DOWN! YES FINALLY!

The bugger broke just long enough for me to add to my short then it went back up into the channel

hang in there. i believe Lara’s views….

I have a talent for finding , what I call ‘AW’ trend lines:They only last 15 minutes

(AW = Andy warhol)

Verne

Here is my view:

In 2 months we moved from 2116 to 1993 back up to 2060 on Fridays close.

That is a pretty strong market even with all the bearish signs – or is it just how bear markets start ?

So we only moved max -123 points in about 60 days with a final pin of about only -56 points. So either the range hold games by HFt and corporate buy backs takes longer into mid to late election cycle like people are saying in 2016 or this decline could be the start of the -20% correction right here, right now….

Verne

My only question is how many more fibonacci days to 1850 from here? The golden question. This is getting beyond exhausting to watch this keep on bouncing. Past Jan or Feb 2016 is beyond my patience waiting for this drop…

Verne

What is really interesting is we did not even bounce in the end of August 2015 as it was just a straight shot down to 1867 and lower till they pushed futures back up from 1830s. I was not part of this site back then.

How did you all navigate the August 2015 crash ? I’m curious…

I had trouble with it as I exited my short position way too early. I was thrown off by a strange divergence between VIX and UVXY in that the latter did not spike with VIX at the end of the third wave down. The fifth wave truncation was also problematic as I was looking for a lower low that never came. I suspect these developments may be a part of algos front running the market and distorting price action and derivatives evaluation…it bodes ill I think for the market in general and inattentive traders in particular.

See that is my point if this is the third wave it is best to ride it down until we see a bottoming formation. I’m not playing the bounces as that’s to tricky….

Look at that Vix now with the hammer it could just go for days 5-15 days to 53+

Trade safe…

Verne

I think it is safe to assume that the bull market is running on its last legs and is exhausted. Once we clear 2,000 and drop much lower oh say even -100 to 250 points lower from here it should seal the deal. It looks great on the monthly chart perspective and fits with all the analysis on this site…

We already spent 1 whole year putting a TOP in for the 6 year bull market run. No more highs – please no jinx…

HFTs trade on technicals and they will NOT be buying is my guess. JNK and HYG are just tanking – look at those for instance…

Verne

I really don’t see this going back up past 1980-90 once we break 2,000. To much work for the Bulls….

I will just wait for Lara’s post… For a more accurate assessment of the elliot wave count…

2 Paths attached – no jinx….

laters

Verne

If the third wave is in fact starting to unfold right here. I am sticking with Lara’s target of 1850 – my guess is we could even break that depending on how strong this move down is. I don’t day trade anyways so the bounce doesn’t mean much from my perspective…

I think we are going to break it…

I sure hope so. I can’t wait!

Verne

Look at the similarity of price action of Nov-Dec compared to Jul-Aug this year?

NO JINX MATEY!

Most interesting. Same series of emotional interplays. Higher degree wave count should eventuate in a deeper plunge. Price action around last set-up mostly above 200 dma, this time below…

Ideally we all want a red candle like this down to 1850…

That would be fantastic….

hi

verne

Check out the attempts to break near 2,000. Will the 3rd time crack it?

hi

Verne,

Any thoughts on decline time horizon?

hi

All

Hope the holidays are going well. O.k, we got 3-5 weeks here and just need to stay focused and positive. Lara’s work is really good – probably the best out there from my experience and I have paid so many analyst but not compare. If in fact this is the 3rd wave coming up it could possibly be within the next month or so.

That was a strange little sell off at session end

The pattern since November seems to be that penetrations of the 200 dma to the upside have become increasingly weaker. Penetrations to the upside have made lower highs, and with the exception of the last one down, lower lows.

Merry Christmas everyone!

I set a sell on S&500 this morning, then went surfing, now listening to Fat Freddy’s Drop. Merry Christmas. May you all be as chill as I am 🙂

Surfing! Sounds great! Have fun!

Price action suggests a big move next week. The leading diagonal fits perfectly and can be still completed in time for a deep year end wave two rally…I like it… 😀

p.s. Look for UVXY to make a new 52 week low at the possible minute two move up. I suspect that will be the low for quite a long time to come…

Verne

Happy weekend – i got time to step back – i am just glued on the SPX. There are 2 important points I want to bring to your attention. On the S&P CASH index this past Friday we have a spinning top candle and I also noticed a hammer on the VIX this Friday. Typically, based on what I have studied in the past this is a major negative sign and screams sell across the US indices, The ndx also has a reversal candle. What I am trying hard to understand is why would you try to play the bounce from 1970 or 1950 back to oh say 1990 when the target is 1850? If you get out of a short position and go back in for example it could cost more for the same options contract. Corrections are sharp and fast so this should be 2-4 weeks at most – NO JINX ALL. For education only why wouldn’t just hold out the options contracts until you get to the target 1850? The VIX level impacts the cost of the options. See my point?

Your thoughts much appreciated….

Verne

Updated – SPX has a doji and NDX has the spinning top….What is really tricky is the MACD daily is ready to cross over?

I agree with your technical observations. As for the efficiency of trading short ranges, even a one point move can give you a 100 % return on carefully chosen near dated options. If you are using credit spreads, a half a point move (on bullish put credit spreads) allows you to get positioned for the next move down at greatly reduced cost, and sometimes cost free! As the decline unfolds the premiums are going to become prohibitive so I am trying to build big positions six months out using the rallies. So far as a time horizon, the rallies during the zig-zags seem to be lasting about three or four days and shorting them for the last month has been the right trade. I expect the banksters to keep trying and we may see another outside reversal day on Monday. I think the trend is STILL down.

Thanks Verne. I still think holding on till the target 1850 and over shot – hopefully 🙂 is the safe bet since the target is only 200 points. But six months out is just over kill and pricey 1-2 months is pretty safe if you will at this junction of the price action and decline. Take a look at the chart I attached. It will be 1 year come this Feb 2016 that the MACD MONTHLY SELL SIGNAL IS STILL WORKING. We only had one text book definition correction of -13% on the S&P in August that lasted only several days. That is pretty crazy. So unless we blow right past Feb 2016 and the sell signal is still on – i will be concerned about this being dragged out. Odds favor a resolution in the coming month imo…

If this is the 3rd wave finally? No reason to try to time it…. like you said “Buckle up”

trade safe matey!

Verne

What do you mean by this statement “the leading diagonal fits perfectly and can be still completed in time for a deep year end wave two rally”

Please elaborate….

Thanks!