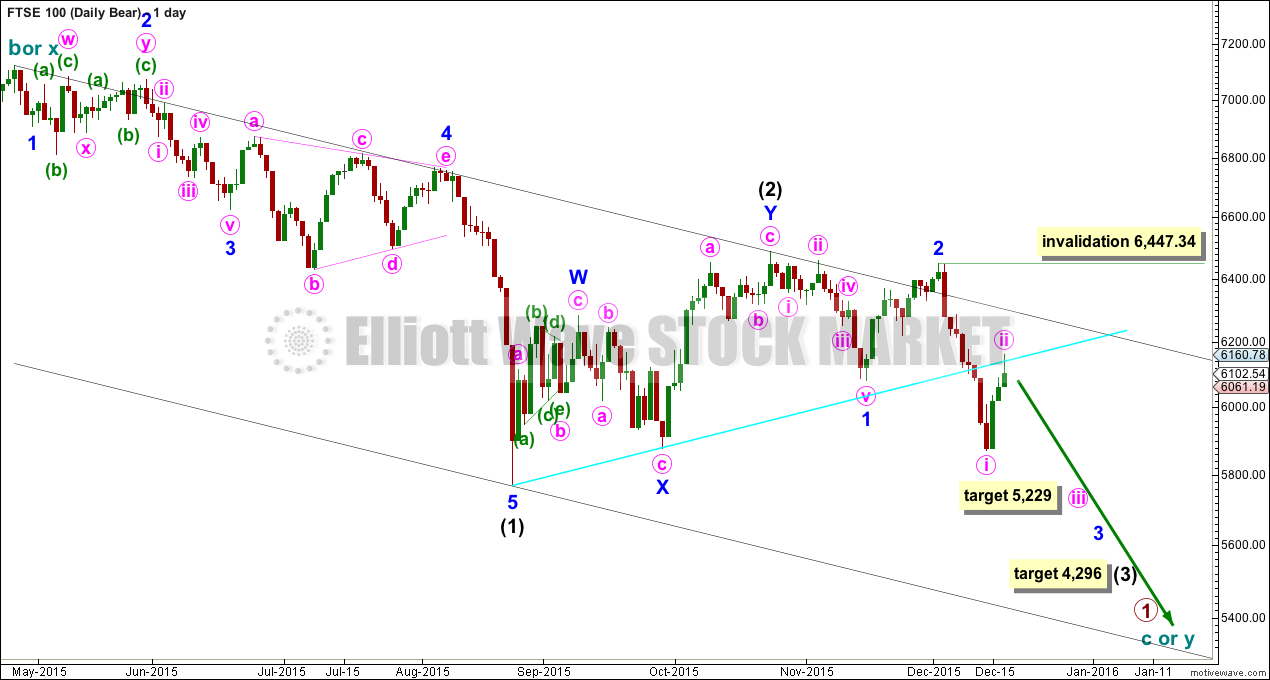

Again, I have only bear Elliott wave counts for FTSE.

Summary: FTSE may be within the middle of a third wave down. The middle of the third wave may end at 5,229.

To see monthly and weekly charts and the bigger picture see last analysis here.

New updates to this analysis are in bold.

MAIN WAVE COUNT

The current wave down for FTSE may be a strong third wave. I am swapping over the two wave counts this week. It is my judgement that this wave count has a higher probability.

If the next wave down shows an increase in momentum, then this would be confirmed as the preferred wave count for FTSE.

At 4,296 intermediate wave (3) would reach 1.618 the length of intermediate wave (1). When minor waves 3 and 4 within this impulse are complete, then the target may also be calculated at minor degree. At that stage, it may widen to a zone or it may change.

Within intermediate wave (3), I am removing the target for minor wave 3. It will again be calculated when minute waves iii and iv within the impulse are complete. For now I want to focus on the next interruption to the trend expected at the end of minute wave iii.

At 5,229 minute wave iii would reach 1.618 the length of minute wave i. If this target is wrong, it may not be low enough.

Minute wave ii has very likely ended at Thursday’s high as it should find resistance at the upwards sloping cyan trend line. If it does not end there though and continues, then it may not move beyond the start of minute wave i above 6,447.34. This is the risk with the FTSE wave count today.

The black channel is a base channel about intermediate waves (1) and (2). Intermediate wave (3) should have the power to break below support at the lower edge of this channel.

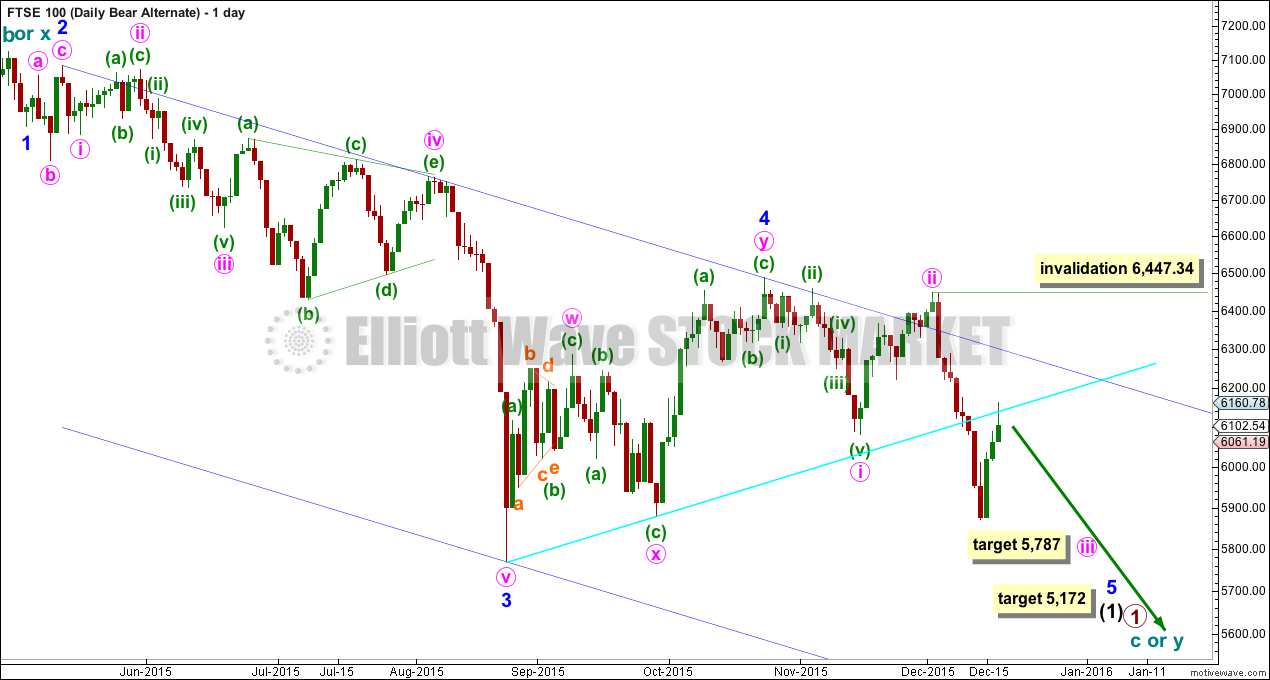

ALTERNATE WAVE COUNT

So far downwards movement may be 1-2-3-4 with a fifth wave needed.

If the next wave down shows a decrease in momentum beyond that seen for minor wave 3, then this wave count would be preferred. At 5,172 minor wave 5 would reach equality in length with minor wave 3.

The Elliott channel is not working perfectly, but it may still show where price may find some resistance along the way down.

No second wave correction may move beyond its start above 6,447.34 within minute wave iii.

At 5,787 minute wave iii would reach 1.618 the length of minute wave i.

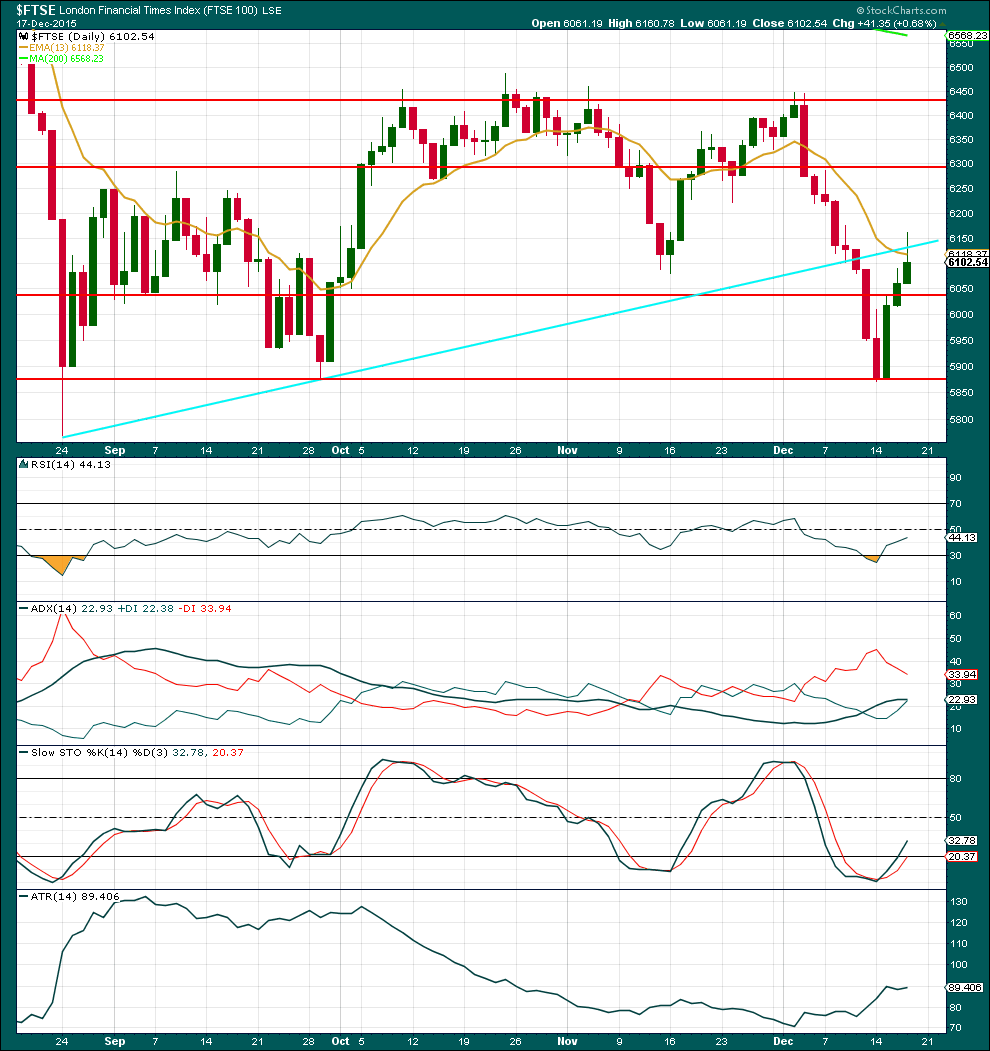

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is no volume data on either the FXCM feed or StockCharts. Volume analysis is done from Yahoo Finance data.

There was some support by an increase in volume as price fell. Stronger volume is seen for downwards days than upwards days. Most importantly, the last three days of upwards movement has come on declining volume for each successive day.

There is a very strong bearish engulfing candlestick pattern at the high of 2nd December. Thursday’s green candlestick has a long upper shadow. Although the bulls pushed price strongly upwards they could not hold it there, so the bears pushed it back down. Three upper shadows in a row have lengthened, so each day the bears had a greater impact. This indicates it is likely tomorrow’s candlestick may be red.

Price broke below the cyan trend line and has come back up for a possible throwback. When price behaves like this a perfect opportunity to join the trend appears, often at a good price.

ADX is flat to rising. It is indicating there may be a downwards trend. The last three days of upwards movement has flattened ADX. If the ADX line turns back upwards, then a downwards trend would again be indicated.

ATR mostly agrees as it is rising overall. This indicates the market should be trending.

The last three days have resolved RSI being oversold. There is again plenty of room for the market to fall. If price falls through the next two horizontal lines of support at 6,040 and 5,877, then the next line of support is at 5,768.

This analysis is published about 10:43 p.m. EST.