I have only bear Elliott wave counts for FTSE.

Summary: So far I have not been able to find other bull alternatives which fit. Of all the markets I currently analyse, FTSE is the clearest bear. I have two wave counts for FTSE. Both see the all time high as a trend change at cycle degree (the degree may be wrong; it may be super cycle degree).

To see monthly and weekly charts and the bigger picture see last analysis here.

New updates to this analysis are in bold.

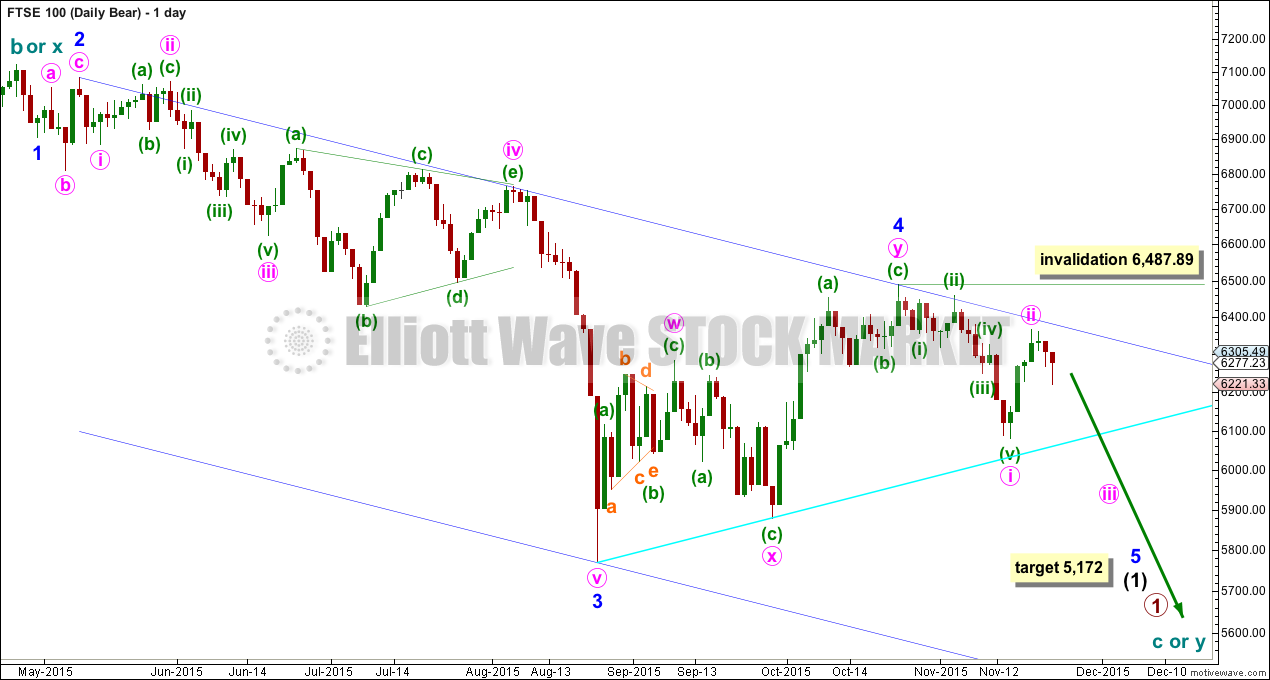

FIRST WAVE COUNT

So far downwards movement may be 1-2-3-4 with a fifth wave needed.

If the next wave down shows a decrease in momentum beyond that seen for minor wave 3, then this first wave count would be preferred. At 5,172 minor wave 5 would reach equality in length with minor wave 3.

The channel is drawn using Elliott’s second technique. In this instance minor wave 5 may find support at the lower edge. Along the way down, upwards corrections against the trend should find resistance at the upper edge. If this wave count is wrong, the first indication would be a breach of the upper edge of the channel.

Minute wave ii may not move beyond the start of minute wave i above 6,487.89 within minor wave 5.

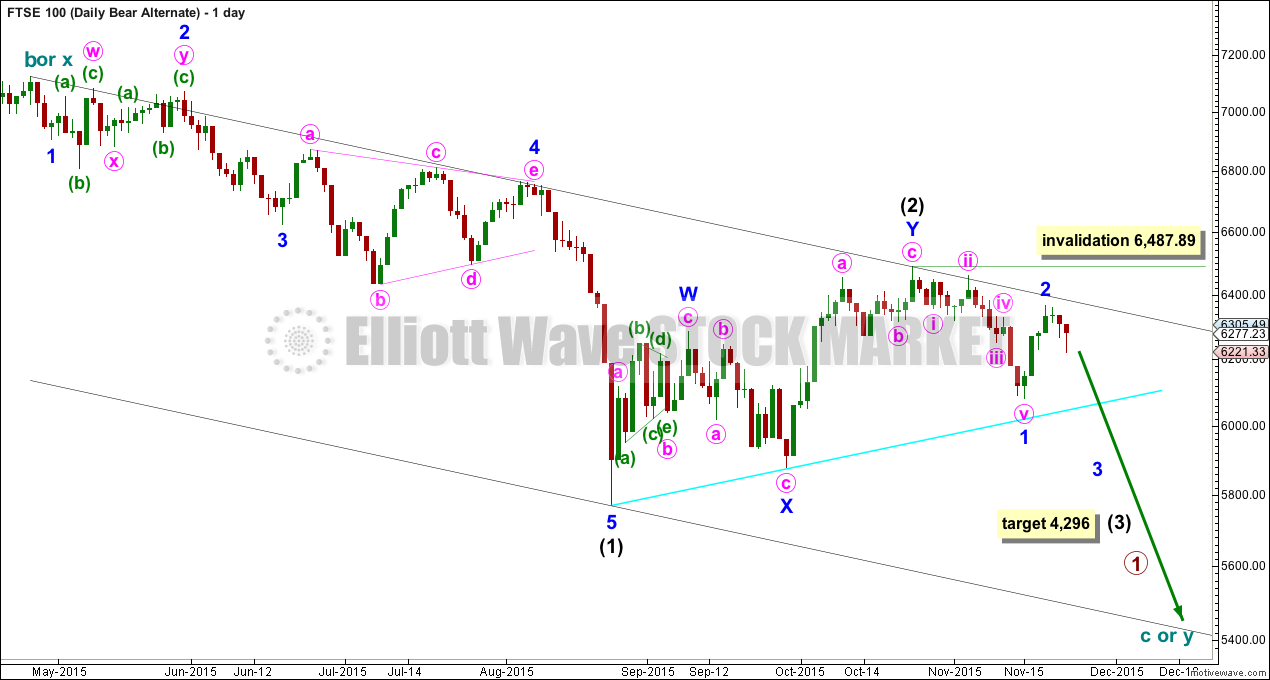

SECOND WAVE COUNT

The next wave down for FTSE may be a strong third wave.

If the next wave down shows an increase in momentum, then this would be the preferred wave count for FTSE.

At 4,296 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Minor wave 2 may not move beyond the start of minor wave 1 above 6,487.89 within intermediate wave (3). Again, if this wave count is wrong, first indication would come with a breach of the upper edge of the black channel. This channel is a base channel about intermediate waves (1) and (2). Along the way down, upwards corrections should find resistance at the upper edge of that channel.

If a third wave down is underway, then it should have the power to break below the lower edge of this base channel. If that happens, this wave count would be strongly preferred over the first wave count. A third wave would be confirmed.

TECHNICAL ANALYSIS

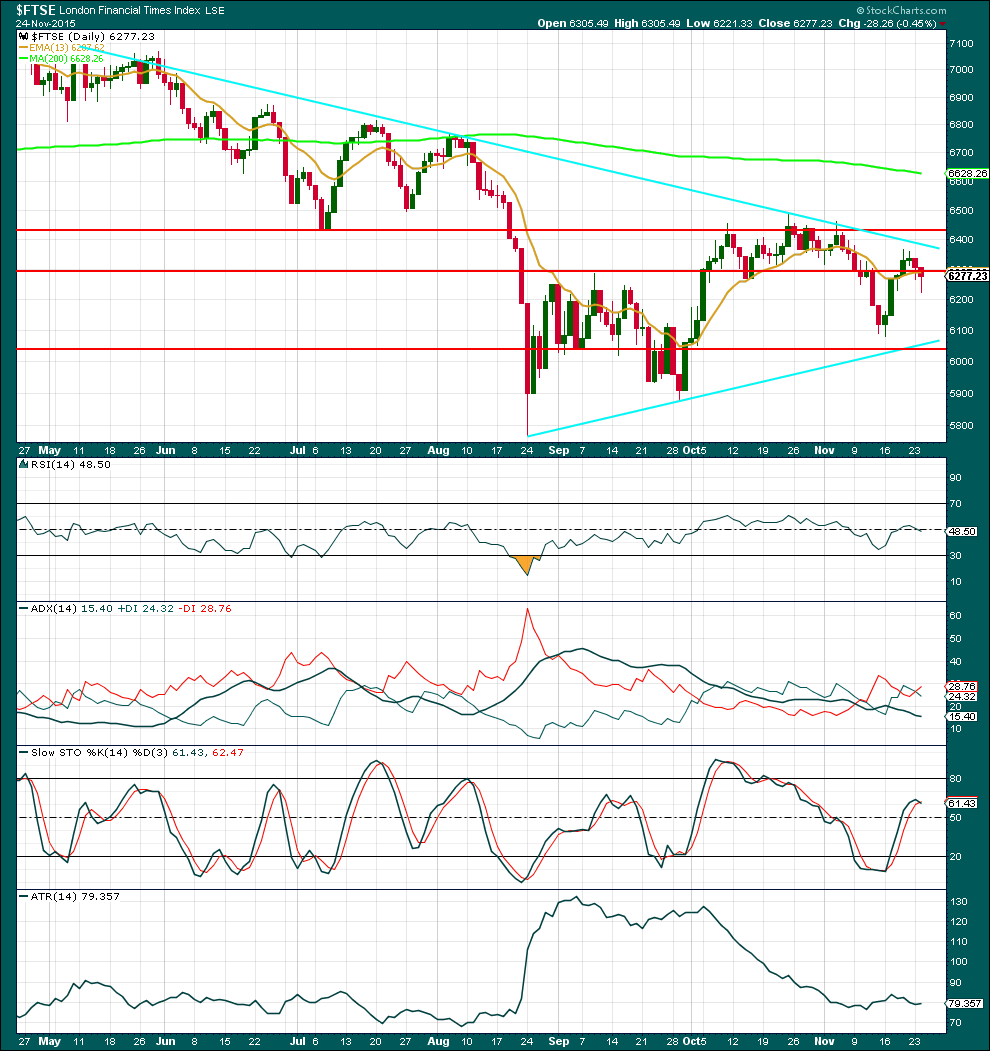

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is no volume data on either the FXCM feed or StockCharts. Volume analysis is done from Yahoo Finance data.

Price has essentially been moving sideways since the low of 24th August. During this time, the downwards day of 18th September has strongest volume which indicates a breakout from this sideways move is more likely to be downwards than upwards.

Overall, ADX is pointing lower. The consolidation is maturing, the trend should resume soon, but for now the breakout has not yet happened.

A new low below the low of 24th August and an increase in volume would add confidence that a downwards breakout is underway.

Prior to that, a break below either the lowest red horizontal trend line or the lower cyan sloping trend line would indicate a breakout if it comes on a downwards day with higher volume.

Likewise, a break above the upper horizontal line of resistance on higher volume would indicate an upwards breakout.

Overall for the last week, ATR is low and flat and should be expected to increase when price breaks out and begins to trend again.

This analysis is published about 04:33 a.m. EST.

Great update Lara.

Given the recent (albeit suspicious) bullishness in the equities market I am looking at the possibility the the FTSE may be tracing out a W-X-Y-X-Z (continuing on the from W-X-Y noted) with the current price action forming the Z wave.

I figure if this is the case, the pattern could potentially complete around the 6445 area – which has been previously tested and provided resistance . This potential upwards move would also correlate with the expected upwards movement to 2117 in the SPX, which means everything in the bear market idea would all fit nicely together 🙂

Time will tell… watching carefully.

Thanks again for all your great analaysis

It’s possible. But then minor 4 would be huge in comparison to minor 2 (it’s already a lot longer in time). And triples are very rare.