A little upwards movement to 1,930 – 1,932 was expected. Price moved a little higher, reaching to 1,927.21 during the session.

Summary: I expect more upwards movement tomorrow. The target for this correction to end is at 1,963, but that may be too high. When the small orange channel on the hourly chart is clearly breached by downwards movement, that shall provide trend channel confirmation that this correction is over and the next wave down has begun. The middle of a strong third wave may be approaching, so expect any surprises to be to the downside.

To see an outline of the bigger picture on monthly and weekly charts click here.

Changes to last analysis are bold.

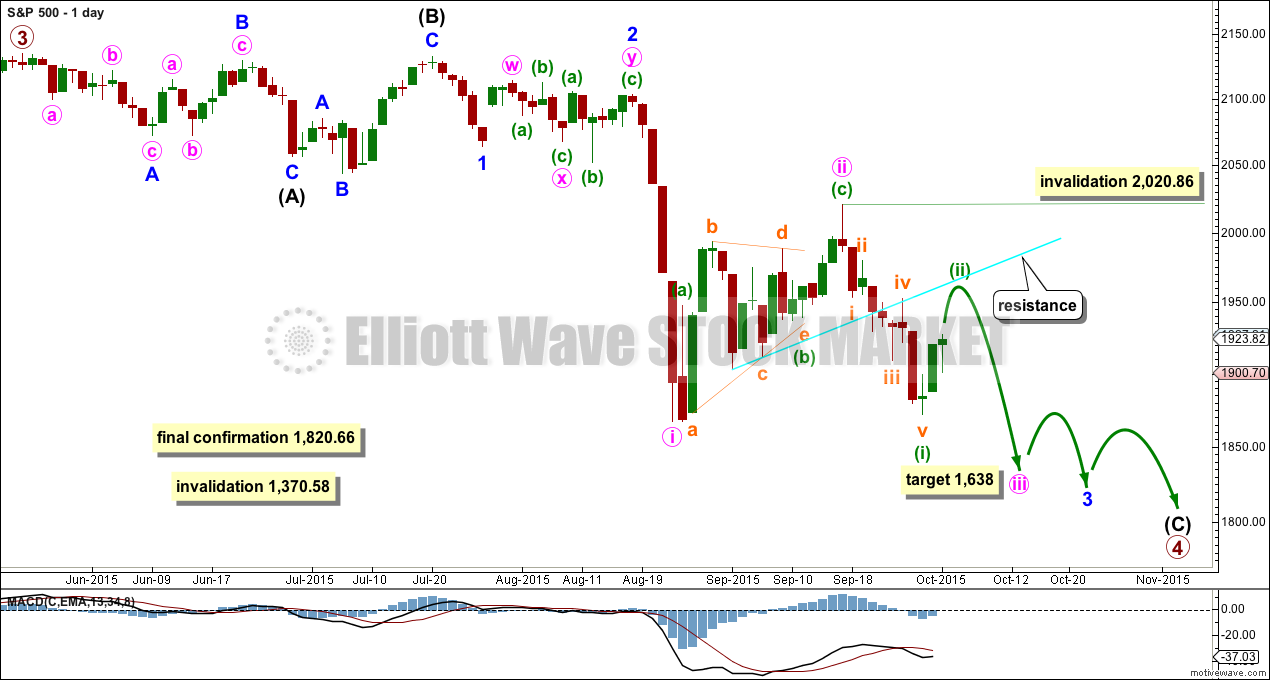

BULL ELLIOTT WAVE COUNT

DAILY CHART

Primary wave 4 may be longer lasting than primary wave 2 as these types of sideways corrective structures tend to be more time consuming than zigzags. Primary wave 4 may complete in a total Fibonacci 21 weeks. Primary wave 4 is within its 19th week, but it may not exhibit a Fibonacci duration because the S&P does not reliably do this. Time estimates may only be taken as a very rough guide.

Within primary wave 4, it may be that intermediate waves (A) and (B) are both complete as three wave structures indicating a flat may be unfolding. Intermediate wave (C) down must be a five wave structure; it looks like it is unfolding as an impulse. For now I will leave this degree as is, but depending on where intermediate wave (C) ends I may move it back down one degree. It is also possible that only minor wave A may be unfolding as a flat correction.

At the daily chart level, this wave count sees primary wave 4 as a possible regular flat correction: intermediate wave (B) is a 98% correction of intermediate wave (A). However, regular flats normally have C waves which are close to equality with their A waves, and they normally fit nicely within parallel channels. Here intermediate wave (C) is much longer than (A) and will still move lower as its structure is incomplete. When the five wave impulse down for intermediate wave (C) is complete, then I will revisit the structure of primary wave 4 which may not be a flat. The structure at the daily chart level so far fits for the very bearish wave count better than this wave count.

If this impulse does not bring price down to the lower edge of the big channel on the weekly chart, then it may only be intermediate wave (A) of a bigger flat for primary wave 4.

Full and final confirmation of a bear market (mid term) would come with:

1. A clear five down on the daily chart.

2. A new low below 1,820.66.

As each condition is met further confidence may be had in the bigger picture for this wave count.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58. Invalidation of this bull wave count (still bullish at cycle degree) would be confirmation of the bear wave count.

Within the next wave down, whether it be a third wave or a fifth wave (as per the alternate daily wave count), no second wave correction may move beyond its start above 2,020.86.

The Dead Cat Bounce which may have ended eleven trading days ago still looks more like a second wave than a fourth wave. It is most common for the S&P to show the subdivisions of its third waves clearly on the daily chart when they extend, and so this current downwards movement looks like a typical third wave so far.

At 1,638 minute wave iii would reach 1.618 the length of minute wave i.

Every day I look at the structure from the all time high on this daily chart to see if I can see a complete corrective structure for primary wave 4. Today it is not possible that it is over because the current downwards wave is incomplete.

HOURLY CHART

This hourly chart will suffice today for both the main wave count and the alternate below. For the alternate everything is just moved up one degree.

I changed the labelling of the end of minuette wave (i). Within this impulse, on the five minute chart, micro wave 4 may have subdivided as a triangle.

If minuette wave (ii) is not an expanded flat, and if it ends at the last low three days ago, then it may be an incomplete double zigzag.

On the five minute chart, the wave down labelled subminuette wave x will not subdivide as a five, so this may only be a three. If tomorrow’s session begins with a new high above the high for Thursday at 1,927.21, then that would confirm that minuette wave (ii) is continuing higher. The second zigzag in the double may end close to the 0.618 Fibonacci ratio at 1,962. If this target is wrong, it may be too high.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 2,020.86.

Draw a best fit channel about this correction. When the lower edge is clearly breached by at least one full hourly candlestick below it and not touching the lower trend line, that shall provide trend channel confirmation that minuette wave (ii) is over and the next wave down is underway. While price remains within the channel the short term upwards trend should be assumed to remain intact.

The next wave down for this main wave count is a third wave at three degrees. It should show a strong increase in downwards momentum beyond that seen for the last strong wave down, labelled minute wave i on the daily chart.

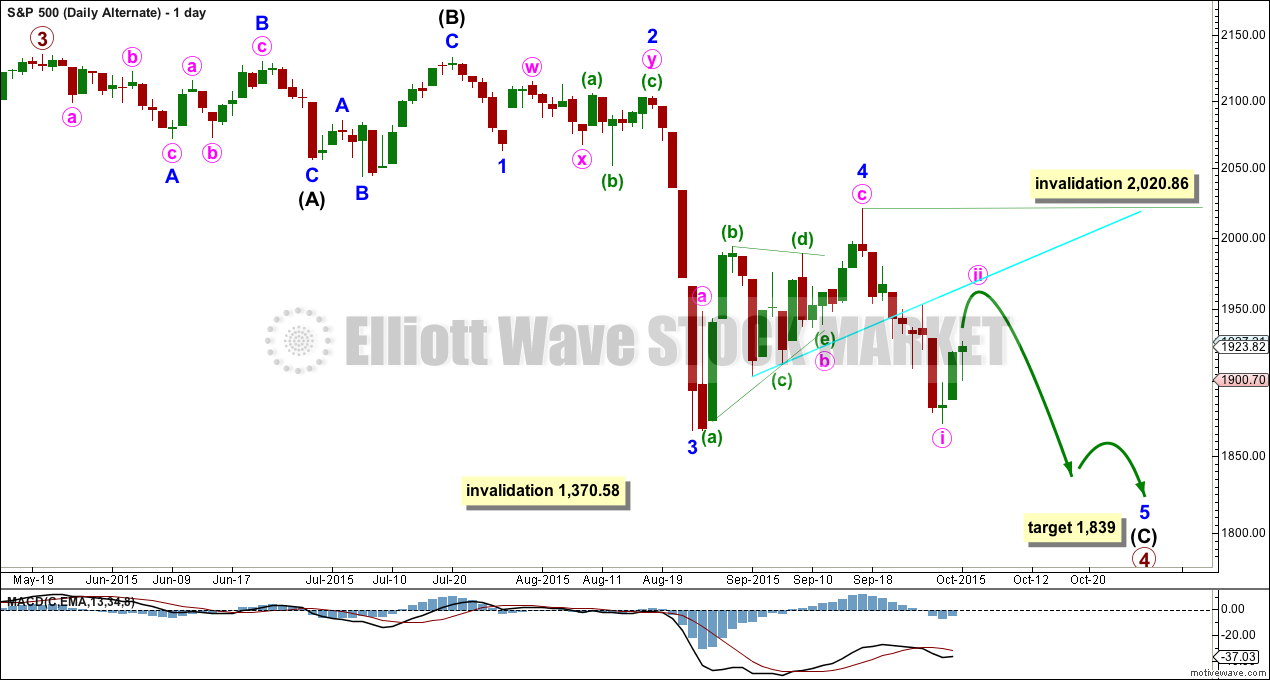

ALTERNATE BULL ELLIOTT WAVE COUNT

DAILY CHART

Here the subdivisions of the waves are seen in exactly the same way as the main wave count, except the degree of labelling within the last wave down and the following Dead Cat Bounce are all moved up one degree.

Minor wave 2 was a deep 0.58 double combination and minor wave 4 was a deep 0.65 zigzag. There is little alternation in depth but adequate alternation in structure. Minor wave 2 lasted 15 days and minor wave 4 lasted 17 days. There is good proportion which gives the wave count the right look.

If the next wave down does not exhibit a strong increase in momentum, then this would be a good explanation.

At 1,839 minor wave 5 would reach 2.618 the length of minor wave 1.

The subdivisions on the hourly chart are exactly the same only moved up one degree. The short term outlook is exactly the same.

The difference is in the expected momentum. If the next wave down does not exhibit an increase in momentum, then this would be a reasonable explanation.

Sometimes for the S&P its fifth waves show a small increase in momentum. This idea will only be discarded if the next wave down shows a strong increase in momentum.

It is most common for third waves to be extended for the S&P. When its third waves extend they show their subdivisions clearly on the daily chart. Here the third wave does not show its subdivisions, but the current fifth wave does. This looks opposite to how I would expect these waves to unfold, and at this point this is my main objection to this alternate wave count. However, it is entirely viable. Momentum may tell us which wave count is correct.

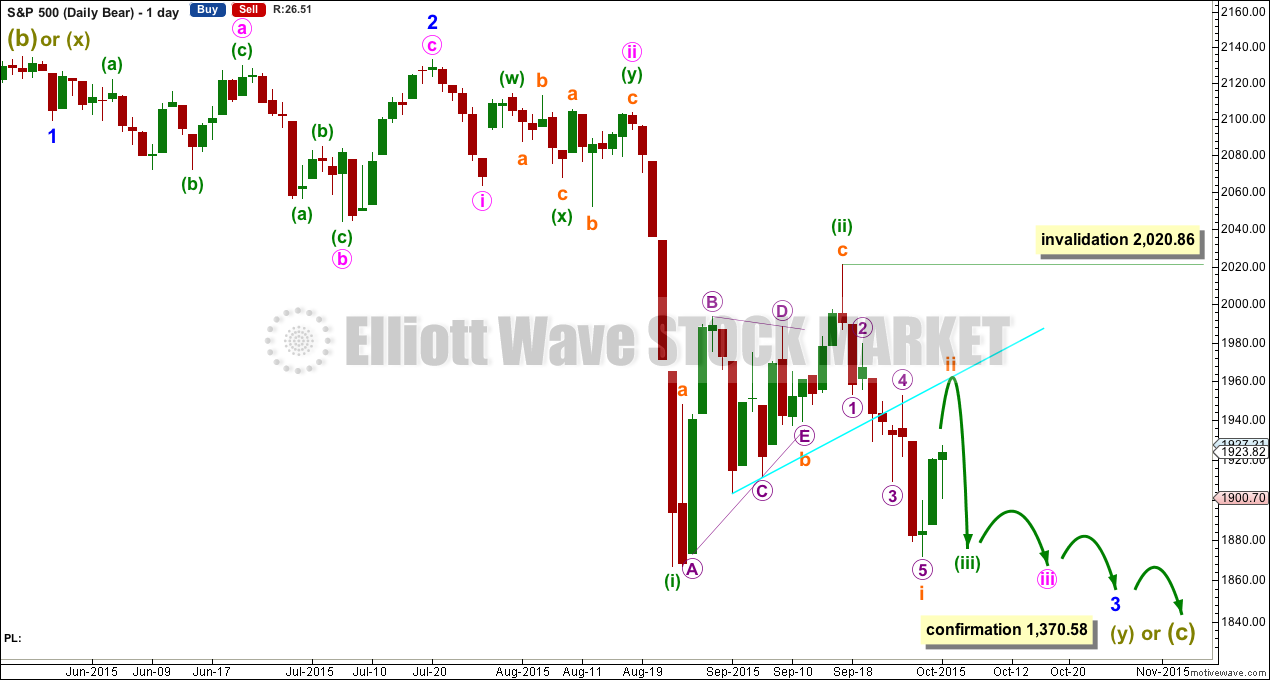

BEAR ELLIOTT WAVE COUNT

DAILY CHART

A big impulse down must begin, for this bear wave count, so a series of overlapping first and second waves should now be complete. The idea for the bull wave count (a flat correction unfolding downwards) does not work for this bear wave count.

A new low below 1,370.58 would invalidate the bull wave count confirming a huge market crash. Before that price point is passed though, structure should be a strong indication that this bear wave count would be correct. It is supported by regular technical analysis at the monthly chart level.

TECHNICAL ANALYSIS

DAILY CHART

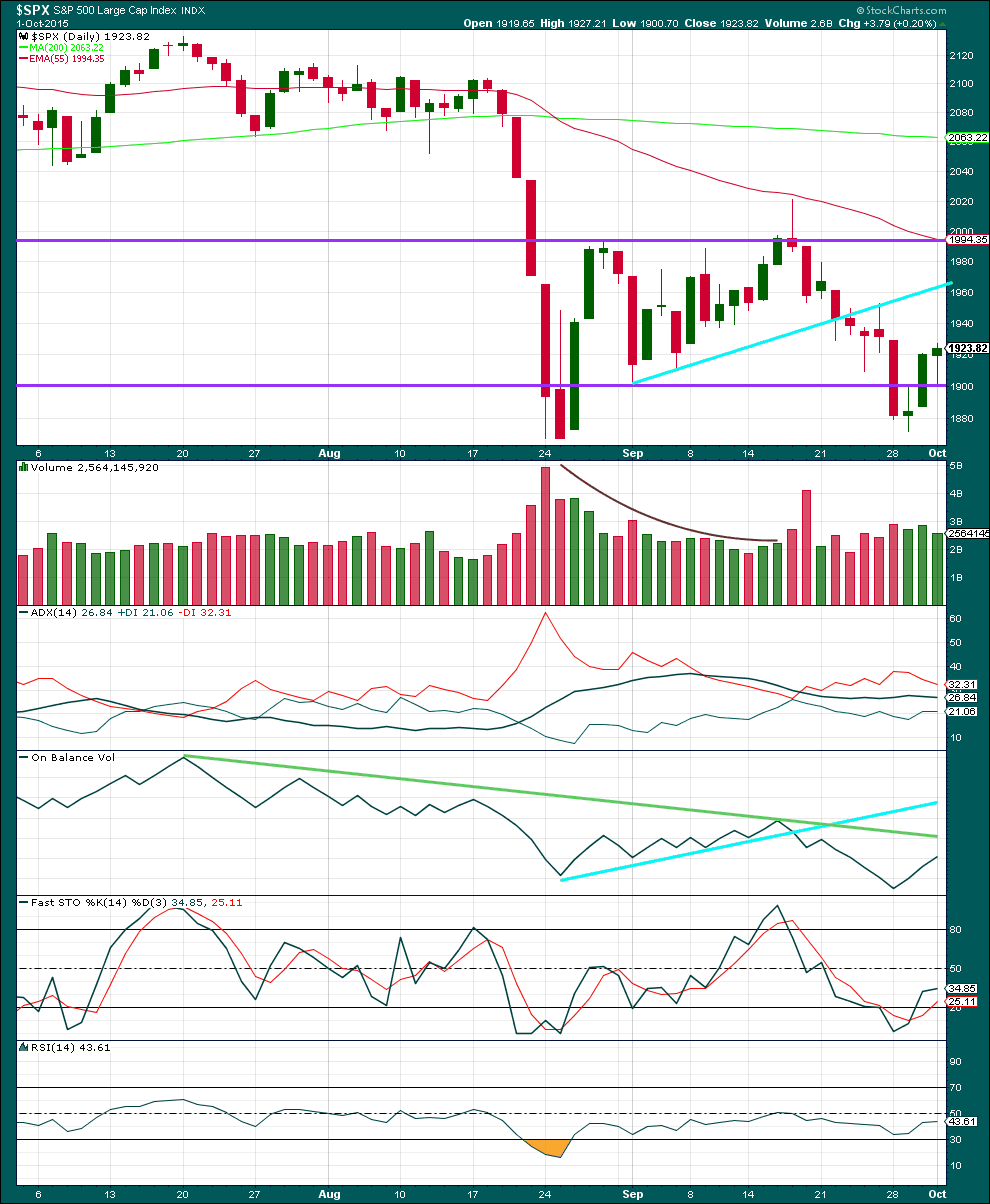

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: A decline in volume for this upwards green candlestick indicates that the rise in price was not supported by volume.

Today’s small green candlestick has a small body with a long lower wick. Overall, it is more bullish than bearish, but it is not strong. The bulls managed to make a new high, but the bears resisted by pushing price lower. The bulls overall prevailed to produce a close above the open but not by much. The bulls and bears are reasonably balanced, with the bulls slightly in charge today.

The morning doji star candlestick pattern at the end of the last low came after a downwards trend lasting seven days. This would indicate a trend change, a low in place, and further upwards movement. A few days of upwards movement may be expected if this candlestick pattern is to work. However, these candlestick patterns do not always work.

Each time price falls volume rises, and each time price rises or drifts sideways volume has been declining, or as in the case today increasing only very slightly. The volume profile is bearish. There is little ambiguity.

The black ADX line has flattened off indicating the market is not trending. I would expect it to begin to rise again and indicate a downwards trend when we see the next downwards day.

I added a new trend line to On Balance Volume today. If price moves higher, it may stop when OBV comes up to touch the downwards sloping green trend line.

If price gets up that high, then it should find resistance again at the upwards sloping bright aqua blue trend line on the price chart.

Kaufman’s Moving Average has provided resistance to upwards movement.

RSI is neither overbought or oversold. There is room for the market to fall or rise.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

This analysis is published about 07:56 p.m. EST.

It looks like the X wave of this double moved lower. It was itself a double zigzag and subdivides well as two zigzags on the five minute chart. This current upwards move is hard to see complete or not.

I’ll be drawing a channel about the double zigzag: first trend line from the start of this upwards wave, to todays low for subminuette x, second copy on the high of subminuette w. A channel drawn that way contains all this movement very nicely.

I want to see that channel breached by downwards movement before I’d have confidence that the correction is over.

For now the upper trend line is close and the structure on the five minute chart looks likely to be incomplete. Maybe it will end when price finds resistance at the upper line of that small channel.

It does not look like price will get as high as the aqua blue trend line on the daily charts.

Next week the wave count (preferred one) will expect new lows below the August low and an increase in downwards momentum. The middle of a third wave at three degrees.

Good luck everybody, and may you all have a wonderful weekend.

Looking like a`final thrust from some kind of triangle which usually presages the final wave. Reversal should be sharp.

Lara,

Still my concern is that wave B (or minute ii) seems too easy, too basic EWT textbook to me (a+triangle b+c, or an a+b+c, depending on how you look at it). Until now, I was convinced based on all the evidence that we were witnessing wave C, but now I doubt it some. What if wave B is in fact, for instance, a (your b orange)+w+x (your minute ii @2,020)+y (b) @ the last low, and now we are beginning wave c of B? If that is the case, we are going to have 5 waves up to 2,020 or so again. And there, wave B is done.

We will have to wait a couple of days of more to be more certain of this scenario, but now am leaning towards 50/50 that wave B is not done yet.

If DOW 16000 is not decisively taken out today, I think it means the upward correction is not over. The fact that this pivot is still being contested even with the strong move down this morning makes me think the third wave is still not here and we still have a bit more upside.

Yes I think you are right verne.

It looks like subminuette wave (x) morphed into a flat or double combination and subminuette wave (y) is now moving upwards.

Probably next week now for any strong downwards movement.

It is a good reminder that the Elliott waves portray the response of market participants and so the tug of war is being played out in these more complex waves. It looks to me like the bears are employing the “whack- a mole” strategy and allowing the banksters to bid the market up and then executing steep, if only temporary sell-offs. At some point I imagine we will see that impulse down unfold but clearly the bears are scalping this market..so should we…profits quickly evaporate otherwise.

Problem with scalping is possibility of missing the big down move?

True. For the patient (or those with longer dated options), the August lows will almost certainly be taken out eventually.

I want to almost bet that the thrust down is not going to happen until after October options expiration 2 weeks from now…

Ari’s observation is interesting as he suggested this about a week back. Interestingly enough, if that happens it will duplicate the 2011 correction very closely in the time it took before retesting recent August lows. If the wave counts are correct, that would be quite a bit of meandering before the bottom drops out. May not be a bad idea to roll October positions if this drags out past Tuesday next week.

I’m sorry Mathius, I’m really having difficulty seeing your idea. A chart with a brief outline would be so helpful for me. I’m very visual.

I’m figuring you’re talking about minute ii (pink circle) continuing as some kind of combination?

I have no problem with the simple A-B (triangle) – C zigzag correction of minute ii. In fact, if a correction has a simple clear look then I’ll go with simple.

The wave down from the high on 17th September at 2,020 does look like a pretty clear five on the daily chart. support.