The correction continued another day, which was allowed for.

The Elliott wave counts on the hourly chart are again reduced to two.

Summary: Upwards movement remained below 1,988.63, so the triangle remains valid and still has the best overall look. The combination which may continue for several more days also remains valid. A downwards breakout is still expected, likely to come this week, and would be confirmed as underway with a new low below 1,911.21 and a break below the bright aqua blue trend line on the daily charts. If this comes with a downwards day on increased volume, then more confidence may be had in a downwards breakout.

To see an outline of the bigger picture on monthly and weekly charts click here.

To see a video explanation of the wave count at weekly and daily chart levels click here.

Changes to last analysis are bold.

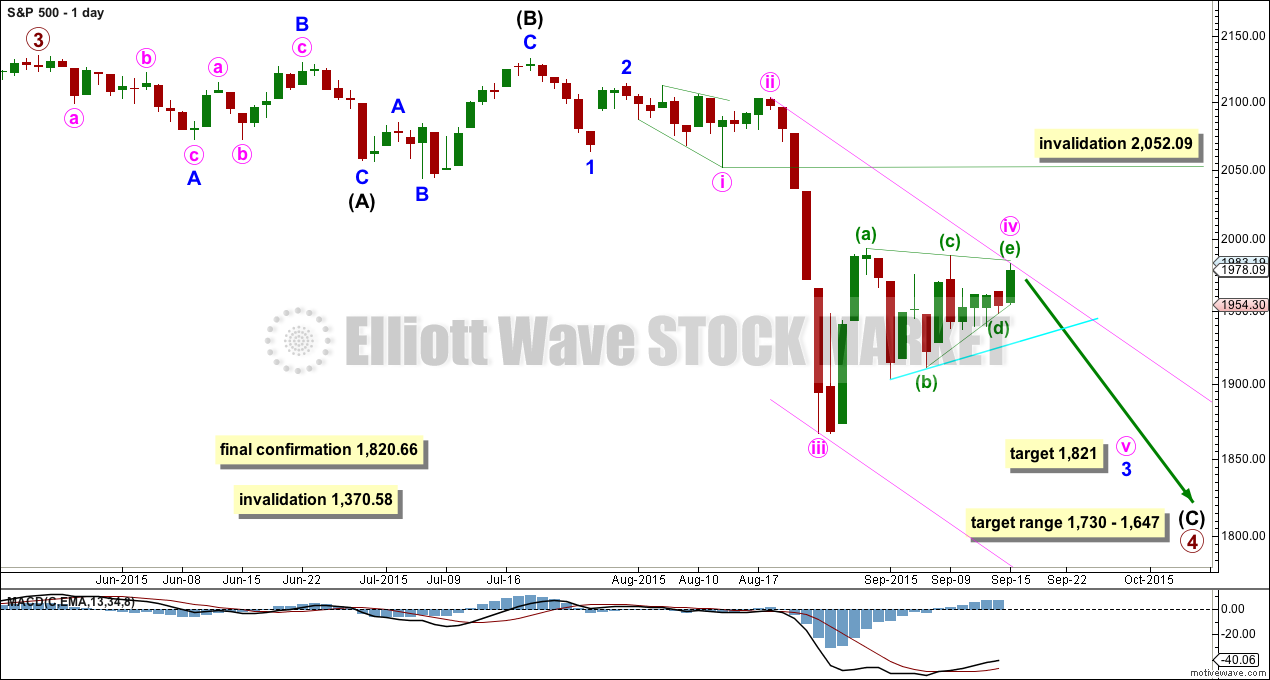

BULL ELLIOTT WAVE COUNT

DAILY CHART

Primary wave 4 may be longer lasting than primary wave 2 as these types of sideways corrective structures tend to be more time consuming than zigzags. Primary wave 4 may complete in a total Fibonacci 21 weeks. Primary wave 4 has started its 17th week, but it may not exhibit a Fibonacci duration because the S&P does not reliably do this. Time estimates may only be taken as a very rough guide.

Within primary wave 4, it may be that intermediate waves (A) and (B) are both complete as three wave structures indicating a flat may be unfolding. Intermediate wave (C) down must be a five wave structure; it looks like it is unfolding as an impulse. For now I will leave this degree as is, but depending on where intermediate wave (C) ends I may move it back down one degree. It is also possible that only minor wave A may be unfolding as a flat correction.

At the daily chart level, this wave count sees primary wave 4 as a possible regular flat correction: intermediate wave (B) is a 98% correction of intermediate wave (A). However, regular flats normally have C waves which are close to equality with their A waves, and they normally fit nicely within parallel channels. Here intermediate wave (C) is much longer than (A) and will still move lower as its structure is incomplete. When the five wave impulse down for intermediate wave (C) is complete, then I will revisit the structure of primary wave 4 which may not be a flat. The structure at the daily chart level so far fits for the very bearish wave count better than this wave count.

If this impulse does not bring price down to the target range or the lower edge of the big channel on the weekly chart, then it may only be intermediate wave (A) of a bigger flat for primary wave 4. If it does bring price lower to the target range, then it may be primary wave 4 in its entirety.

Full and final confirmation of a bear market (mid term) would come with:

1. A clear five down on the daily chart.

2. A new low below 1,820.66.

As each condition is met further confidence may be had in the bigger picture for this wave count.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58. Invalidation of this bull wave count (still bullish at cycle degree) would be confirmation of the bear wave count.

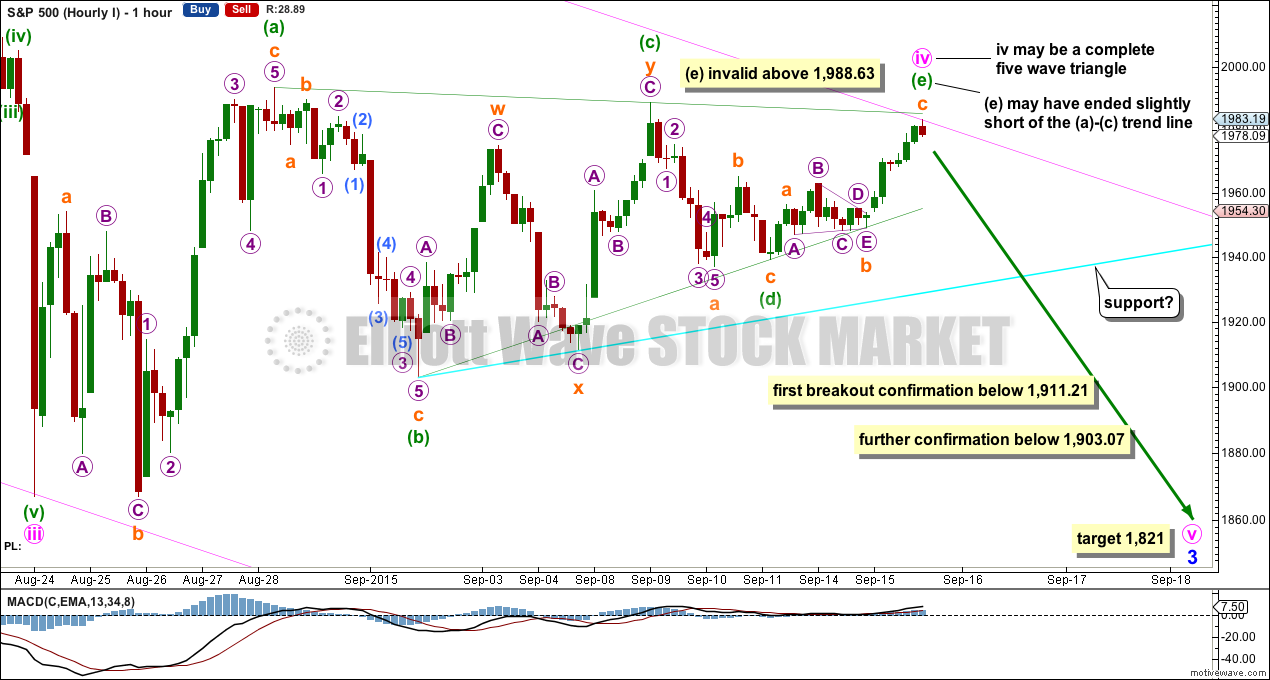

I have two ideas at the hourly chart level today. They are presented in order of probability. The second idea has a very low probability, and is presented to consider all possibilities just in case the first one is wrong.

At this stage, I am discarding the idea that the current consolidation could be a second wave correction. It would be only just over halfway through which would see at its end the duration much greater than minute wave ii one degree higher. That idea has such a low probability it should be discarded. I am confident this consolidation is a fourth wave, and so far it looks very much like a triangle.

Draw a channel about this third wave down now using Elliott’s second technique: draw the first trend line from the ends of minute waves ii to iv, then place a parallel copy on the end of minute wave iii. Minute wave v may end either midway within the channel or about the lower edge.

FIRST HOURLY ELLIOTT WAVE COUNT

This first hourly wave count again follows on from yesterday’s first hourly wave count and is mostly the same.

The nine wave triangle idea presented yesterday was invalidated.

I have changed some labelling within the triangle subdivisions. The double is seen in sub wave minuette wave (c) of the triangle. The final wave of minuette wave (e) is seen as a zigzag, falling just slightly short of the (a)-(c) trend line.

When sideways movement unfolds in an ever decreasing range and MACD hovers about the zero line, then a triangle is the most likely structure. The labelling of this triangle meets all Elliott wave rules for a regular contracting triangle, and this is the most common type. The triangle trend lines are almost perfectly adhered to (the sole small exception is an overshoot within minuette wave (c) at the lower edge). This wave count has the “right look”.

Any further continuation upwards of minuette wave (e) may not move beyond the end of minuette wave (a) above 1,988.63.

The first indication now that the correction may be over will come with a breach of the lower triangle (b)-(d) trend line. A new low below 1,903.07 could not be minuette wave (d) continuing lower, and so at that stage the triangle must be over. If this comes for a downwards day showing an increase in volume, then a downwards breakout would be indicated and supported by volume.

Extend the triangle trend lines outwards. The point in time at which they cross over is in 1.25 days. This sometimes shows when a trend change is seen, and sometimes this trend change is the end of a short quick fifth wave to follow the triangle. This trick does not always work, but it works often enough to be something to look out for.

SECOND HOURLY ELLIOTT WAVE COUNT

It has been my experience over the years that too many times when I think a triangle is unfolding it is invalidated right at the last minute and the correction turns out to be a combination. Alternates should always be considered when it looks like a triangle is unfolding so that we are prepared for all possibilities.

At this stage, if a combination is unfolding, then it may be a zigzag or flat – X wave (as a triangle, now complete) – zigzag or flat for (y) to complete for the second structure.

The first structure looks more like a zigzag than a flat, which means the second structure is most likely to be a flat correction for a double combination.

At this stage, a new high above 1,988.63 is required to provide some confirmation of this idea. At that stage, the preferred Elliott wave count for the first hourly chart would be invalidated.

A false upwards breakout may happen for the start of minuette wave (y). Minuette wave (y) may move in overlapping sideways movement in an ever increasing range.

This idea has a very low probability now for three reasons:

1. X waves are commonly zigzags. It is unusual for an X wave to be a triangle.

2. This would see the duration of the correction much longer than minute wave ii. Minute wave ii lasted four days. While combinations and triangles are more time consuming structures, so far this correction has lasted 15 days. For it to continue for several more days would see it grossly disproportionate to minute wave ii, which would give the wave count an unusual look at the daily chart level.

3. The triangle for minuette wave (x) does not look quite right. Triangles do not normally have trend lines which come to touch so close to their terminus.

This last idea is an alternate to consider all possibilities.

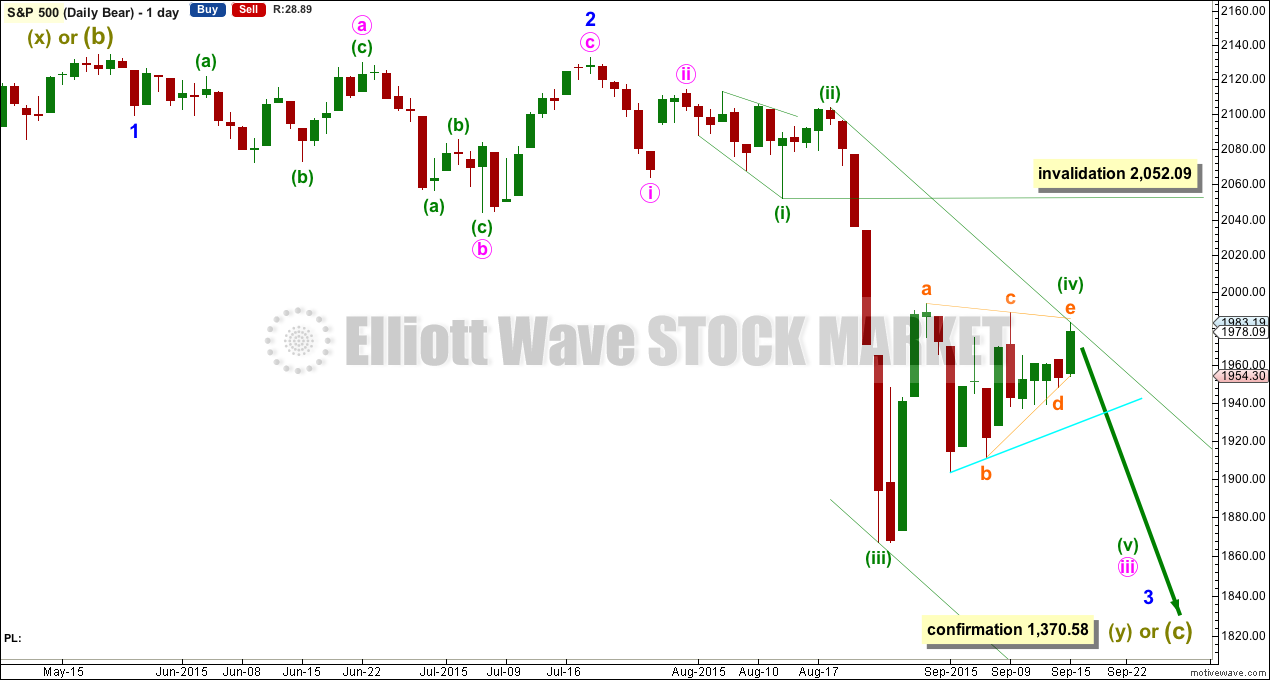

BEAR ELLIOTT WAVE COUNT

DAILY CHART

A big impulse down must begin, for this bear wave count, so a series of overlapping first and second waves should now be complete. The idea for the bull wave count does not work for this bear wave count.

A new low below 1,370.58 would invalidate the bull wave count confirming a huge market crash. Before that price point is passed though, structure should be a strong indication that this bear wave count would be correct. It is supported by regular technical analysis at the monthly chart level.

TECHNICAL ANALYSIS

DAILY CHART

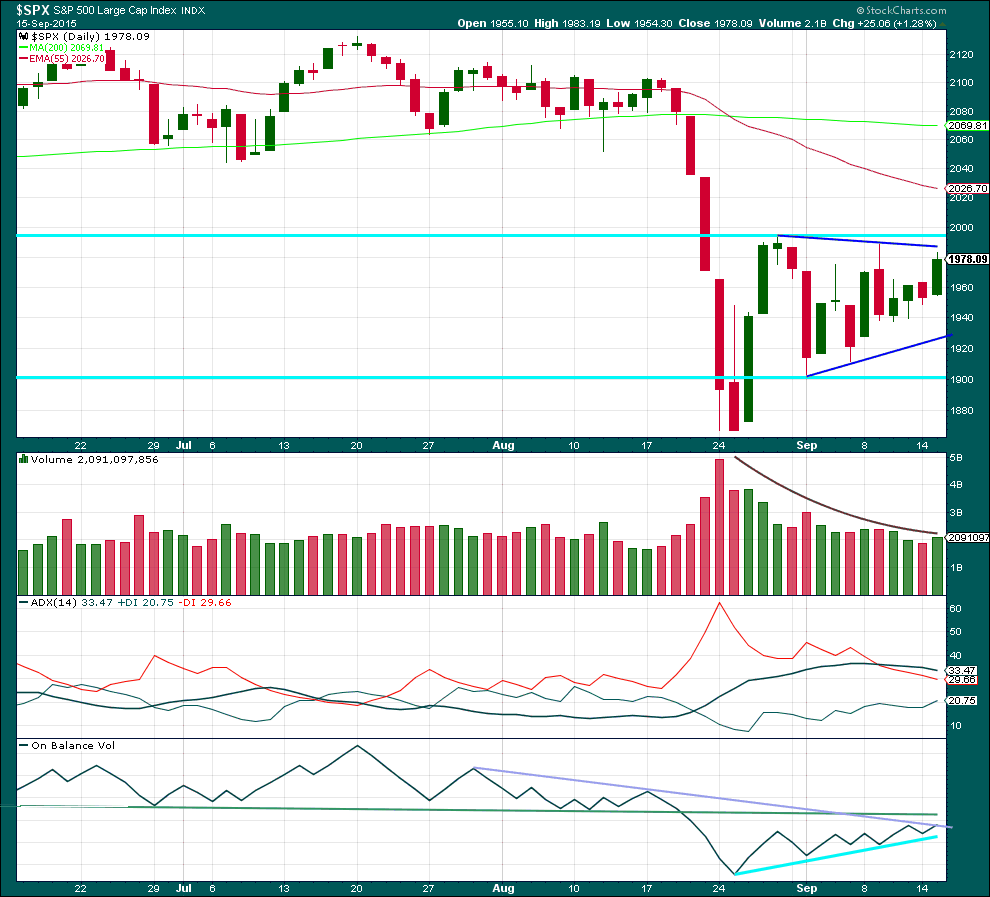

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: Price remains below the resistance trend lines and volume is still overall declining, although Tuesday’s candlestick is larger and volume is slightly higher. This movement still looks corrective. Price remains range bound and a breakout has not yet occurred.

ADX is flat indicating the market is not currently trending. ADX does tend to be a lagging indicator.

I have redrawn the purple line on On Balance Volume because the last line was breached. The green line is more technically significant because it is more shallow, longer held and tested more often. OBV should find resistance at that line, if it comes up to touch it. A break below the shorter held bright aqua blue line on OBV would be further bearishness. If OBV turns down from here, then that would strengthen the resistance of the purple line as it is now drawn. OBV is being squashed between the purple downwards sloping line and the upwards bright blue line. The breakout should come very soon.

The sloping purple lines showing some support and resistance on price first need to be breached for a price breakout. An upwards breach is not expected, but is a slim possibility (only in the sense that anything is possible). A breach of the lower line is expected. When price breaks above or below the horizontal aqua blue lines, then that would provide strong confirmation of a breakout. The breakout should come on a day with increased volume, this is especially so for any upwards breakout. But to the downside the market can fall of its own weight.

If I wanted to see anything bullish in this whole picture, I could say that within this recent sideways movement the strongest day’s volume is the first day of this consolidation which had highest volume. But that really would be stretching credulity, because as price rose for the first three days of the correction volume fell. It’s not really bullish at all.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

This analysis is published about 09:30 p.m. EST.

Lara, it seems the triangle alternative has been discarded, with S&P reaching up to 1,992+/- (before close). However, is there a chance that wave D over throws 1,988 and therefore keeps the triangle alternative still alive? Otherwise, chances are that we are in a (B) up to 2,000+ something (maybe the last low was a(A) wave)

No, the B-D trend line would not be essentially flat. It would now have a clear upwards slope.

And that’s the problem with triangles right there. So many times I’ve seen what looks like a perfect triangle unfold, complete and then invalidate.

There was a triangle in there somehow, but it’s part of the correction not the whole.

I’ll have two wave counts again for you today. I may need to do a quick video update to point out a couple of things about them.

Hello lara,

This is my analysis of IWM/russel 2k. QQQ looks same. What do you think about this count?

SPX definitely looking like an ABC correction with with B concluding as a triangle and C up underway. Could have been a double zig zag.

Yes, it does look like that doesn’t it!

Thats my new wave count today. I’ve explained how it works and the problems with it in an extra video today.

It looks like it works for the Russell 2000.

But I’ve checked, it wouldn’t work for the S&P500.

They’re different markets, they’ll have different wave counts.

And so, yes. It may be for the Russell 2000 that the correction is over.

One thing to check though: for the ending diagonal look at the wave lengths. 3 must be shorter than 1 and 5 must be shorter than 3. Does it work?

Could a triple top be in play here in the last few months?

I see for your minor (blue) 2 you have it ending later.

I tried to see if this would work today but I can’t see it. The subdivisions won’t work.

That’s a shame, because if it did work the proportions would be better between 2 and 4. It would make the duration of this current correction make more sense.

I guess my question was not very clear (my wave numbering was marked only in a very general manner). My question was: if there was a triple top marking a trend change, are those 3 tops considered part of the final wave 5 up? Where do we start counting the first wave down? After the third triple top?

thx

In big picture I like Lara’s Bull scenario. Probably correct down to 1800, 1700, 1600 or whatever, let EW guide. Then SPX moves up, up and up. Because in the world economy, Europe and China will be looking bad so big money will flow to US dollar and US equities. US markets will be best of the worst.