Downwards movement was expected.

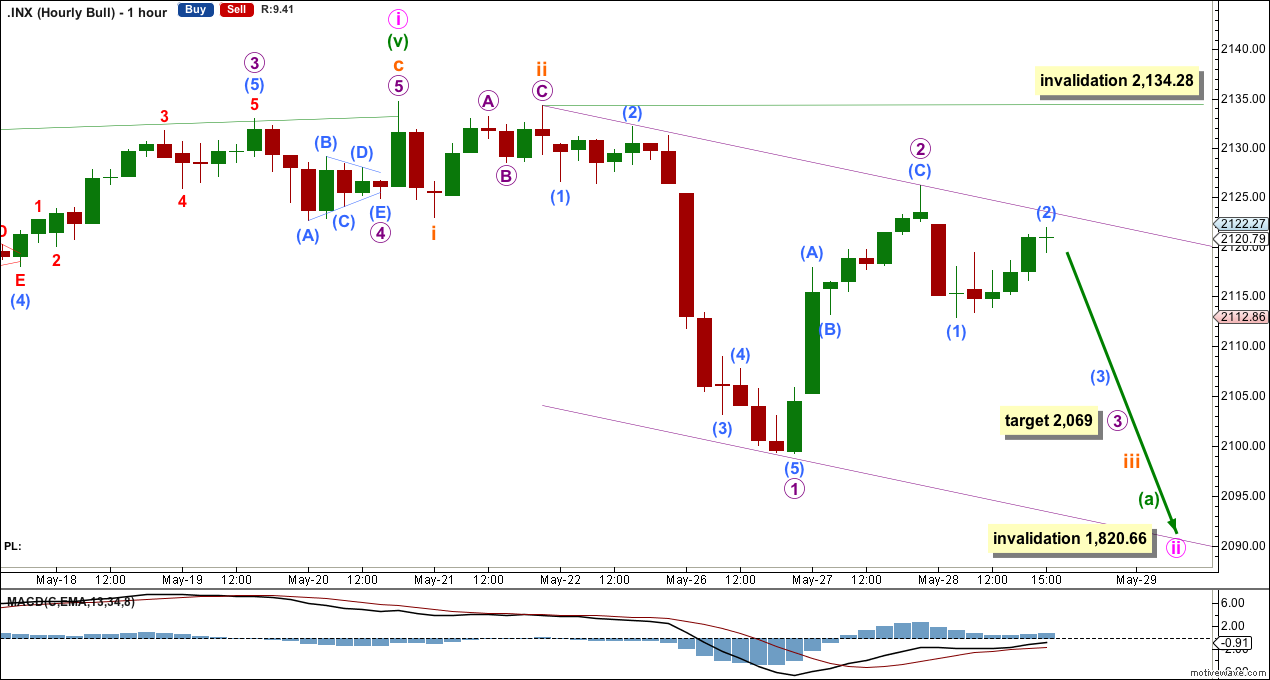

Summary: The next move for the S&P may be a strong third wave down to a short term target about 2,069.

Changes to last analysis are italicised.

To see a weekly chart and how to draw trend lines go here.

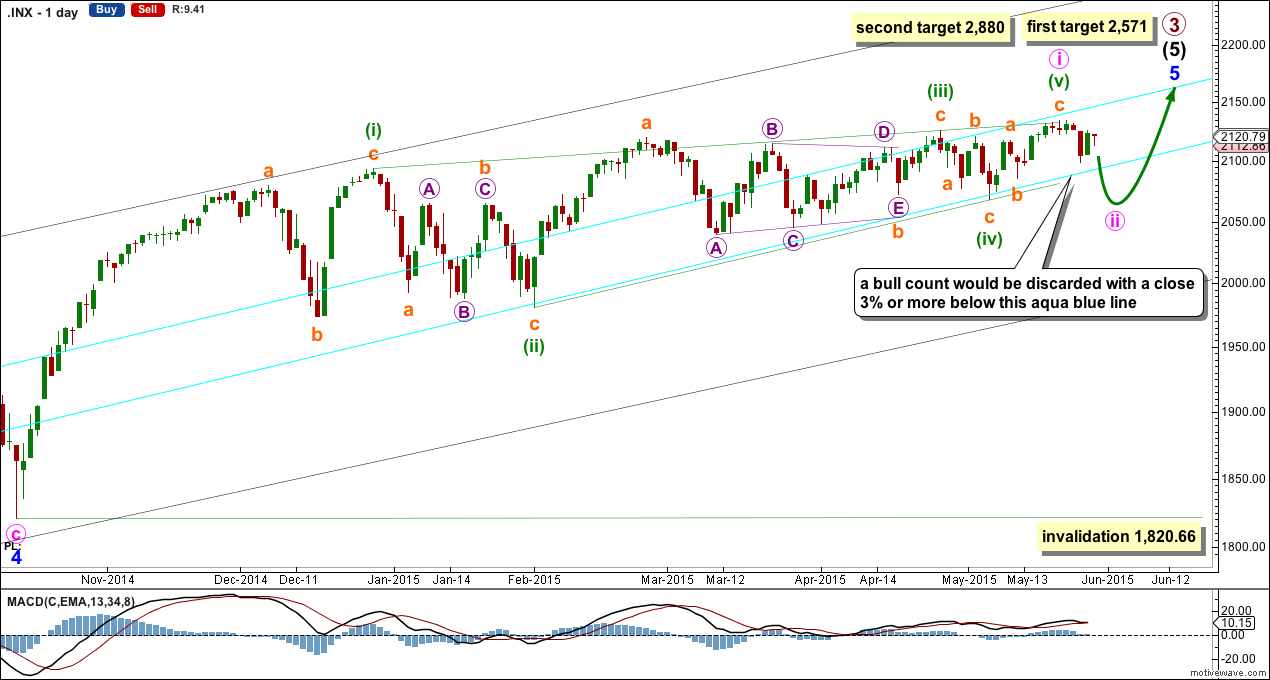

Bull Wave Count

The bull wave count sees primary 1-2-3 within an impulse for a cycle degree wave V.

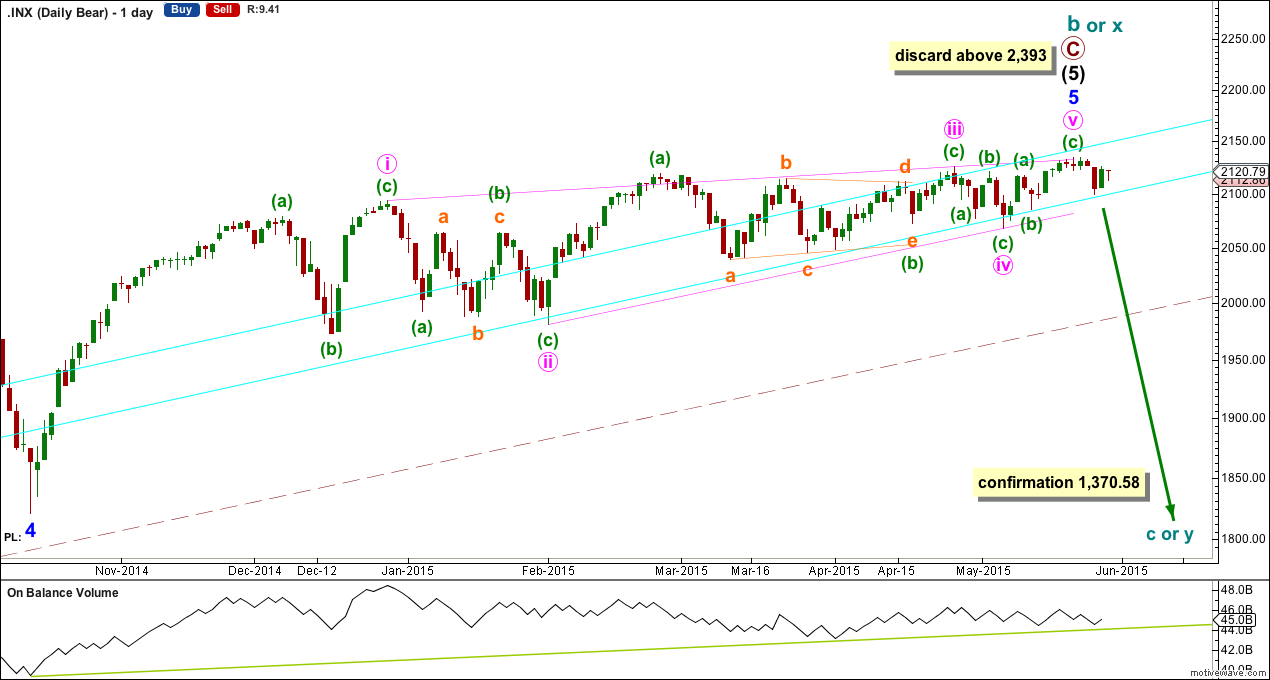

The bear wave count sees primary A-B-C zigzag for a cycle degree B wave.

We should always assume the trend remains the same until proven otherwise. I will have the main wave count relatively bullish while price remains above the lower aqua blue trend line which has provided support for this bull market since 2011. Only when that trend line is breached by a close of 3% or more of market value will I have my main wave count bearish.

The complete contracting diagonal may have been only minute wave i as a leading diagonal within minor wave 5.

At 2,571 intermediate wave (5) would reach 1.618 the length of intermediate wave (3). If upwards movement keeps going past this first target, or when price gets there the structure is incomplete, then the second target would be used.

At 2,880 primary wave 3 would reach 2.618 the length of primary wave 1.

There is now a complete contracting diagonal structure, although the final fifth wave has only slightly overshot the (i)-(iii) trend line. There is now first confirmation of a trend change at least at a small degree on the hourly chart. Normally a second wave correction following a first wave leading diagonal is very deep. In this case it may be expected to be shallow due to strong support offered by the lower aqua blue trend line. An overshoot of this line is allowed for (like that seen for the end of minor wave 4 at the left on the daily chart) as long as price does not close 3% or more below the line.

For both main and alternate bull wave counts some downwards movement is now expected. For this main bull count it may be a low degree second wave for minute wave ii, which should not breach the lower aqua blue trend line by a close of 3% or more of market value.

Minute wave ii may not move beyond the start of minute wave i below 1,820.66. While this price point would provide final price invalidation of this bull wave count, it would be discarded before this point is passed when the aqua blue trend line is breached.

Another possible first and second wave completed on Thursday makes a series of three overlapping first and second waves. The middle of a third wave down should unfold on Friday or Monday. This should see a strong increase in downwards momentum.

At 2,069 micro wave 3 would reach 1.618 the length of micro wave 1.

If micro wave 2 continues any further it may not move beyond the start of micro wave 1 above 2,134.28.

Mico wave 3 should break through support at the lower edge of the base channel drawn here. Once that lower trend line is breached it should then provide resistance.

Although it is possible just that minute wave ii is over as a zigzag at the low labelled micro wave 1, this would be a remarkably quick and very shallow movement for a minute degree second wave. It would have lasted only three days to minute wave i 49 days. The probability exists, but it is extremely low, less than 1% in my judgement. What this means is it is highly likely minute wave ii will continue lower next week.

Alternate Bull Wave Count

It is possible that the S&P has seen a primary degree (or for the bear count below a cycle degree) trend change five days ago.

This alternate bull wave count simply moves the degree of labelling within the contracting diagonal all up one degree to see it as an ending diagonal for minor wave 5.

This wave count absolutely requires confirmation at the daily chart level before any confidence may be had in a primary (or cycle) degree trend change. Confirmation would come with:

1. A close of 3% or more of market value below the lower aqua blue trend line.

2. A clear five down on the daily chart.

3. A new low below 1,820.66.

As each condition is met the probability of a substantial trend change would increase.

Primary wave 4 would most likely be a time consuming flat, triangle or combination in order to exhibit structural alternation with the zigzag of primary wave 2. Primary wave 2 lasted 12 weeks. Primary wave 4 is likely to be longer in duration because combinations and triangles particularly are more time consuming than zigzags which tend to be quick corrections. Primary wave 4 may be expected to last more than 12 weeks, and may end with a total Fibonacci 13 or more likely 21 weeks.

Bear Wave Count

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count.

To see the difference at the monthly chart level between the bull and bear ideas look at the last historical analysis here.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 170% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it. Full and final confirmation that the market is crashing would only come with a new low below 1,370.58. However, structure and momentum should tell us long before that point which wave count is correct, bull or bear.

On Balance Volume should continue to find support at the trend lines drawn. When the longer held green trend line is broken by OBV a trend change would be supported.

Technical Analysis

ADX turned up slightly for yesterday, but remains below 15. No clear trend is indicated. Short swings with low volatility may be expected.

Stochastics may return to oversold before this downwards movement is over. While Stochastics remains above 20 I would expect this downwards swing is incomplete.

On Balance Volume shows persistent long divergence with price, back to December 2014. This may indicate a larger correction could develop about here.

While price remains above the long held aqua blue bull trend line a bull market may be expected to remain intact. This trend line must be breached before a bear market would be indicated.

VIX is showing some negative correlation: while price made new highs VIX increased. This may indicate a more substantial correction could develop from here.

While the S&P 500 has made new all time highs on 20th May, the DJIA also made new highs. However, the DJT and Nasdaq, which should be market leaders, did not make new all time highs. A continuation of the bull market is unconfirmed. But as yet a trend change to a bear market is also unconfirmed. All four markets need to make new lows below the last major swing low of 15th October 2014 for Dow theory to confirm a bear market.

This analysis is published about 07:42 p.m. EST.

Today challenging 50 dma to downside for the first time since presumed top seven days ago. If 50 dma not decisively taken out today I strongly suspect we will see that final manic throw-over early next week.

I completely agree. I have a wave count which expects that… and it looks really good.

Thanks Verne and Steven for your comments. I too am concerned the top is not yet in. If the majority can see this upward wedge and is trading accordingly, then the market will normally fool them all. I am looking for a bit of irrational exuberance with everyone having gone long. Then the breakout of the wedge to the downside will occur.

Thanks again,

Rodney

I seriously doubt the diagonal is over The series of 1-2 counts is of course technically possible but that is generally not the way completed ending contracting diagonals behave in my experience. The reversals are brutal and sharp and swiftly retrace to their origins with nary a backward look. I think this market is not topped out quite yet. The only caveat on this score is the continuing slide of the transports.which has been leading downturns

The ole 1-2-1-2-1-2 bearish count that never pans out. I’ve traded this market successfully to know odds favor a new ATH. I can’t help but wonder if wave v of the ED is going to be a DZZ to give it a typical throw-over. Is it black & white an ED must all be zigzags or is there a new interpretation that all waves must be 3’s or corrective?

I completely agree. Although price went down on Friday, when I look at recent movement it fits perfectly as a triangle. I’m changing the wave count to expect one more all time high. Target 2,154.

If we get a reasonable overshoot of the upper diagonal trend line then it may convince those looking at the rising wedge structure that they were wrong, that the breakout is up and the wedge failed. And then it would be ready to fall.

the 1-2, 1-2 bearish wave count is really problematic. I’ve been here before…. and I don’t want to do that again.