Downwards movement was expected for Tuesday.

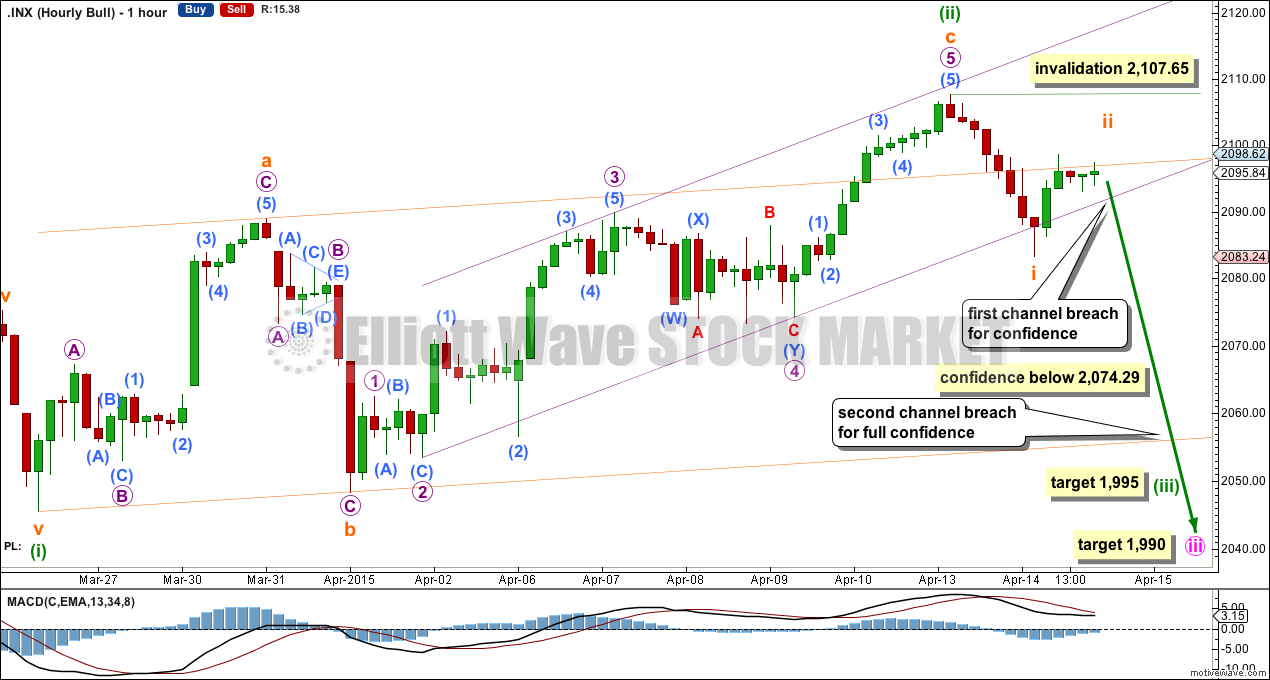

Summary: The S&P remains within a consolidation phase. I still expect the breakout, when it comes, should be downwards. I expect downwards movement to 1,995 has begun this week, but the upwards sloping violet channel on the hourly chart is still not properly breached. This channel needs to be breached for confidence in the target. A new low below 2,074.29 would increase confidence that the trend has changed to down.

Click charts to enlarge.

Bullish Wave Count

If primary wave 3 is over then primary wave 4 should begin. Upwards movement from the low at 666.79 subdivides now as a complete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3. The wave count sees intermediate wave (5) as an ending contracting diagonal. Ending diagonals require all sub waves to be zigzags.

Primary wave 2 was a relatively shallow 0.41 zigzag lasting 12 weeks. Primary wave 4 may be more shallow and is most likely to be a flat, combination or triangle. It may be longer lasting than primary wave 2 as these types of sideways corrective structures tend to be more time consuming than zigzags. Primary wave 4 is likely to end in the price territory of the fourth wave of one lesser degree between 1,730 – 1,647. It may last about 13 or maybe even 21 weeks, and has started its seventh week.

To see a weekly chart and how to draw the aqua blue trend lines and the black channel, go here. Primary wave 4 should break below the black channel.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58. Invalidation of this bull wave count would provide full confidence in the bear wave count.

Because primary wave 4 may be an expanded flat, running triangle or double combination it may include a new high beyond its start at 2,119.59. If this happens the bear wave count would be invalidated.

There is triple (quadruple?) divergence with price and MACD at the weekly chart level supporting the idea of a trend change, either already or coming up soon.

A close 3% or more of market value below the double aqua blue trend line would provide trend line confirmation of a sizeable trend change. I will only have confidence in this wave count when there is confirmation of this trend change.

A new low below 1,980.90 would provide further confirmation of a trend change.

To have confidence in this big trend change the shorter 34 day SMA needs to cross below the longer 144 day SMA, and price needs to be below both.

So far within the sideways movement of minuette wave (ii) the strongest volume was on a down day. This indicates that when the breakout comes from this sideways consolidation phase it is more likely to be down than up.

A trend line drawn from the start of minute wave i at 2,119.59 to the end of minute wave ii and extended out almost perfectly shows where minuette wave (ii) has very likely ended. This pink trend line may continue to provide resistance to corrections along the way down.

Downwards movement for Tuesday’s session is not quite enough to clearly breach the violet channel about subminuette wave c. Only a full hourly candlestick below the lower edge of this channel and not touching the lower trend line would provide confidence in a trend change.

Tomorrow the market may open with a little upwards movement to complete a correction for subminuette wave ii. It may not move beyond the start of subminuette wave i above 2,107.65.

At 1,995 minuette wave (iii) would reach 1.618 the length of minuette wave (i). Minuette wave (iv) to follow should be a shallow correction and should show clearly on the daily chart lasting several days.

At 1,990 minute wave iii would reach 1.618 the length of minute wave i. When minuette waves (iii) and (iv) are complete then I will add to the target calculation at a second wave degree, so at that stage the target at 1,990 may widen to a small zone or it may change.

A clear breach of the wider orange channel would provide full and final confidence that the S&P is in a third wave down.

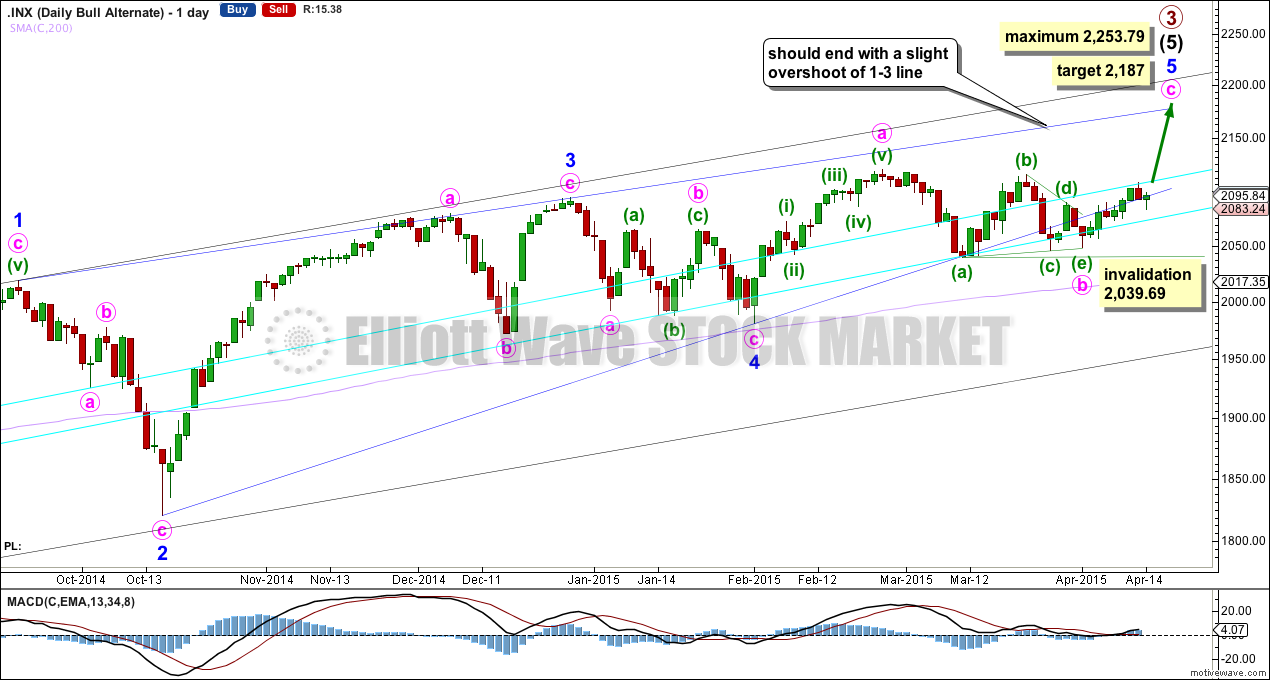

Alternate Bullish Wave Count

This alternate wave count is identical to the main wave count up to the low labelled minor wave 4. Thereafter, it sees minor wave 5 incomplete.

The lower 2-4 trend line of the contracting diagonal is now breached by three full daily candlesticks below it and not touching it. Diagonals normally adhere very well to their trend lines and this part of the wave count now looks wrong.

This wave count is still technically possible but it has a very low probability. The breach of the 2-4 trend line is the only reason why this wave count is an alternate.

Within the triangle of minute wave b, if minuette wave (c) continues further it may not move beyond the end of minuette wave (a) below 2,039.69. If we see a new low below this point this week I will discard this alternate wave count.

It is at this stage that this alternate wave count diverges from the main wave count. A new high above 2,114.86 would increase the probability of this alternate, and if it is correct we should see that this week.

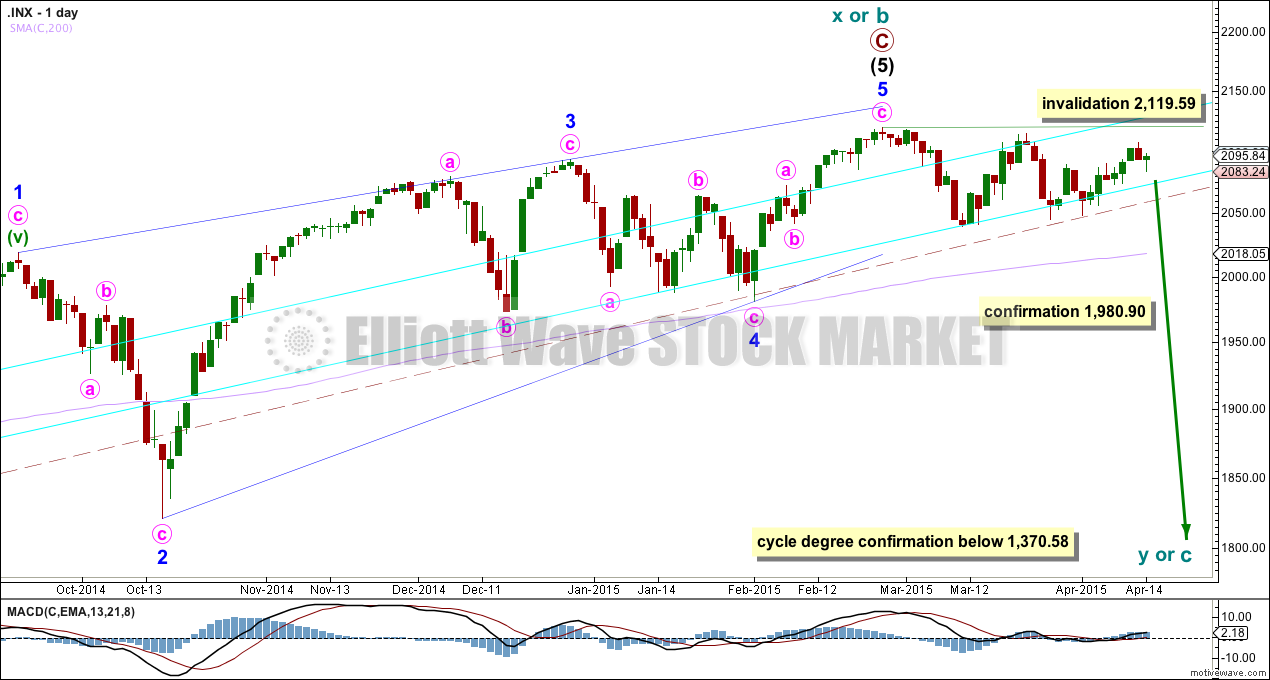

Bear Wave Count

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count. The alternate bull wave count idea also works perfectly for this bear wave count.

To see the difference at the monthly chart level between the bull and bear ideas look at the last historical analysis here.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 167% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it. Full and final confirmation that the market is crashing would only come with a new low below 1,370.58. However, structure and momentum should tell us long before that point which wave count is correct, bull or bear.

This analysis is published about 06:50 p.m. EST.

Moving higher on very low volume to invalidate main hourly count. 2119.59 high not taken out though so we could be looking at minuette two correction

continuing…it could be completing a five up…still waiting for the elusive three down…

Hi Lara. According to my data feed from Investing.com, price today rose to a high of 2109.00. So, does this mean that the hourly bull is really invalidated as your invalidation point is 2107.65? If so, that leaves only the alternate bull and the bear counts.