More upwards movement was expected, but I had not expected to see a red candlestick for another one or two days. Downwards movement remains above the invalidation point.

Summary: The mid term target remains the same at 2,178 for primary wave 3 (or cycle wave b for the bear wave count) to end. Upwards movement should not end until the upper blue 1-3 trend line on the daily chart is overshot. In the short term a fourth wave correction needs to complete sideways movement before the upwards trend resumes.

Click charts to enlarge.

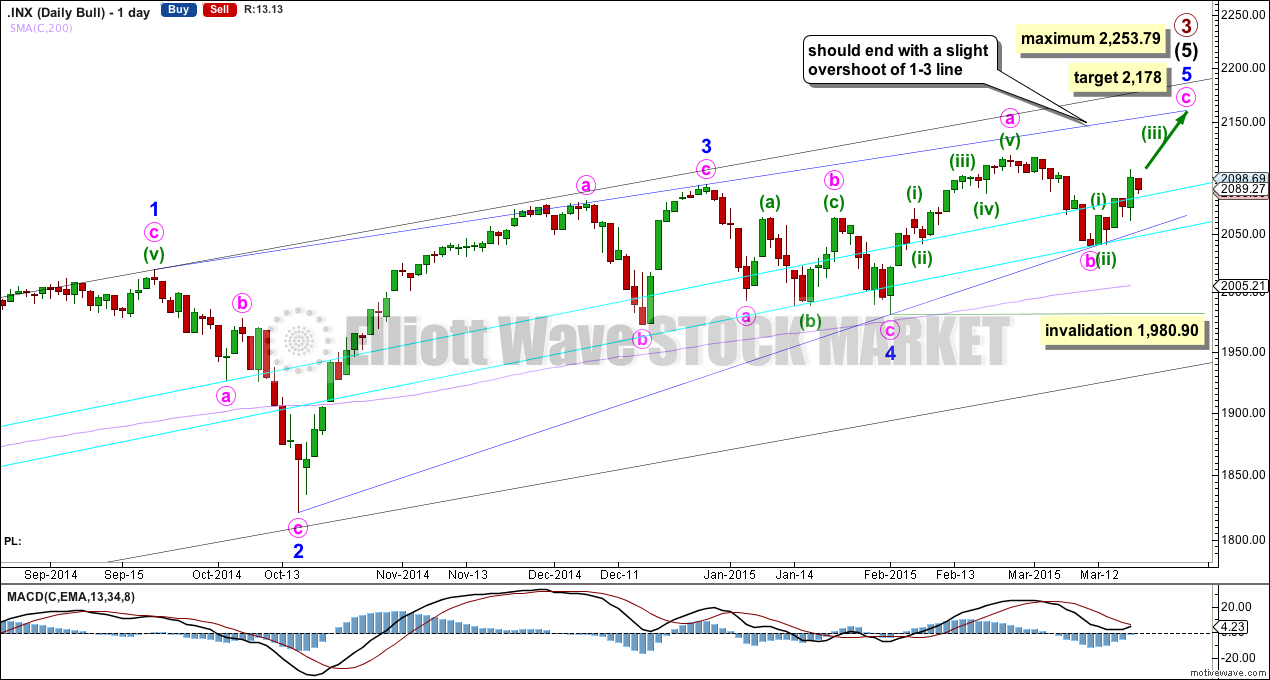

Bullish Wave Count

Upwards movement from the low at 666.79 subdivides as an incomplete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3.

The aqua blue trend lines are traditional technical analysis trend lines. These lines are long held (the lower one has its first anchor in November, 2011), repeatedly tested, and shallow enough to be highly technically significant. When the lower of these double trend lines is breached by a close of 3% or more of market value that should indicate a substantial trend change. It does not indicate what degree the trend change should be though. It looks like the last five corrections may have ended about the lower aqua blue trend line, which gives the wave count a typical look. To see a weekly chart where I have drawn these trend lines go here.

The wave count sees intermediate wave (5) as an ending contracting diagonal. Ending diagonals require all sub waves to be zigzags. So far this is a perfect fit. Minor wave 3 has stronger momentum than minor wave 5 on the daily chart.

The diagonal is contracting. The only problem with this possibility is that minor waves 2 and 4 are more shallow than second and fourth waves within diagonals normally are. In this case they may have been forced to be more shallow by support offered from the double aqua blue trend line.

Because the third wave within the contracting diagonal is shorter than the first wave and a third wave may never be the shortest wave, this limits the final fifth wave to no longer than equality with the third wave at 2,253.79.

Within intermediate wave (5) minor wave 1 lasted 238 days (5 days longer than a Fibonacci 233), minor wave 2 lasted 18 days (2 short of a Fibonacci 21), minor wave 3 lasted 51 days (4 short of a Fibonacci 55) and minor wave 4 lasted 23 days (2 longer than a Fibonacci 21). While none of these durations are perfect Fibonacci numbers, they are all reasonably close. So far minor wave 5 has lasted 31 days and the structure looks incomplete. The next Fibonacci number in the sequence for minor wave 5 is 34, which is just three sessions away. Minor wave 5 may end in another three sessions although this looks very unlikely now. If it completes in another five sessions it would be reasonably close to a Fiboancci 34.

Within minor wave 5 minute wave b may not move beyond the start of minute wave a below 1,980.90.

Contracting diagonals normally have fifth waves which end with a slight overshoot of the 1-3 trend line. Because this is such a common tendency I will still expect more upwards movement to see this trend line overshot. It is possible that the fifth wave is over already, and this idea is presented as an alternate.

Diagonals almost always adhere well to their trend lines. This one has slight overshoots within minute wave a of minor wave 3, but the 1-3 trend line is not breached. For this diagonal to have the “right look” minute wave c must continue upwards from here. A breach of the lower blue 2-4 trend line would see this wave count substantially reduced in probability in favour of the alternate below.

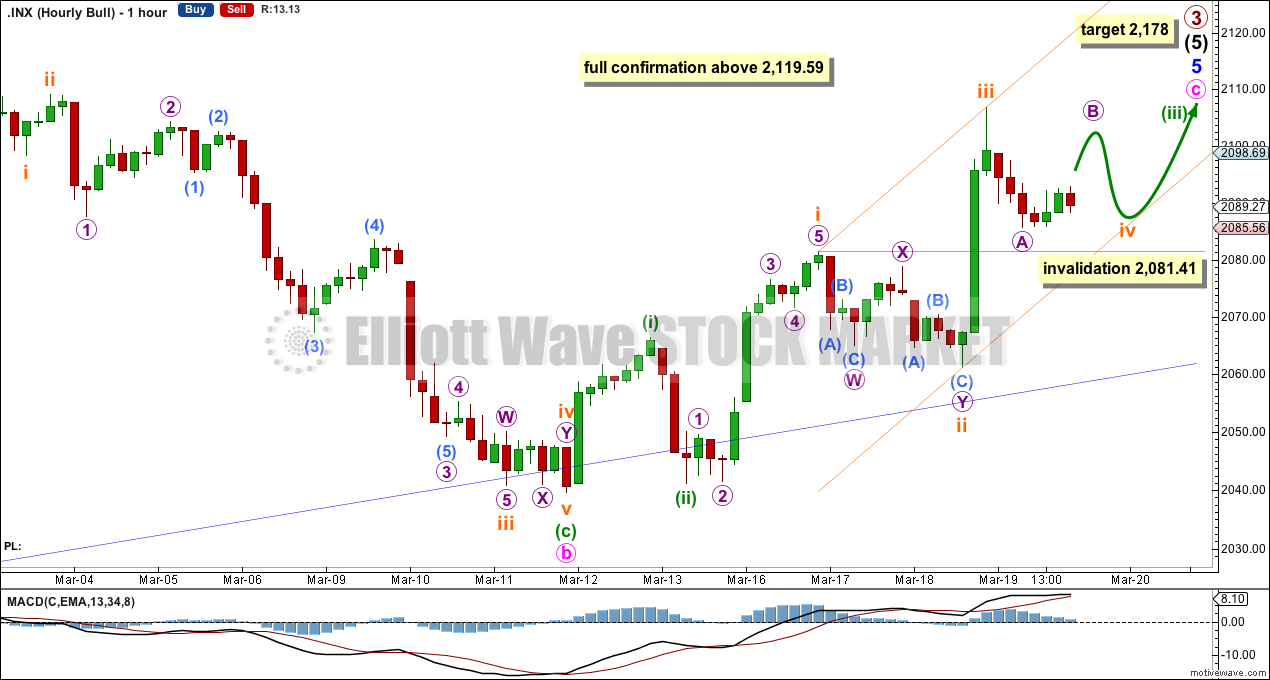

Downwards movement indicates subminuette wave iii is over. The structure is problematic on the five minute chart, and this is a perfect illustration of why sometimes the analysis of a five minute chart hinders rather than helps the analysis. This has happened too often for my comfort, and so I will no longer publish the five minute chart as a matter of course. I will use it only when it assists and clarifies. For the S&P the right look at the hourly and daily chart is more important.

Subminuette wave iii has no Fibonacci ratio to subminuette wave i. This indicates that subminuette wave v is most likely to exhibit a Fibonacci ratio to either of i or iii, and equality in length with subminuette wave i at 40.24 points is most likely.

Subminuette wave ii was a 0.5 correction of subminuette wave i and a double zigzag. Given the guideline of alternation I would expect subminuette wave iv to not be a zigzag, but to be a flat, combination or triangle. At this stage micro wave A subdivides nicely as a three wave structure (which is clear on the five minute chart today). Because subminuette wave iv is unlikely to be a zigzag this is more likely just wave A of a flat or a triangle.

An expanded flat and running triangle may both include micro wave B which moves above the start of micro wave A at 2,106.85. There is, unfortunately, no upper price point which will tells us that subminuette wave iv is over and subminuette wave v is underway.

If subminuette wave iv is a flat it would most likely be a regular flat, moving sideways. The other likely structure for subminuette wave iv is a contracting or barrier triangle, with are also sideways moving structures.

I will expect sideways movement (which may include a new high) for another one or two sessions before this fourth wave correction is over. Thereafter, the upwards trend should resume. Minuette wave (iii) would reach 2.618 the length of minuette wave (i) at 2,111.

Subminuette wave iv may not move into subminuette wave i price territory below 2,081.41.

Draw a channel about minuette wave (iii): draw the first trend line from the highs labelled subminuette waves i to iii, then place a parallel copy on the low labelled subminuette wave ii. Subminuette wave iv may find support at the lower edge of the channel, and may end there. Subminuette wave v may end midway within the channel.

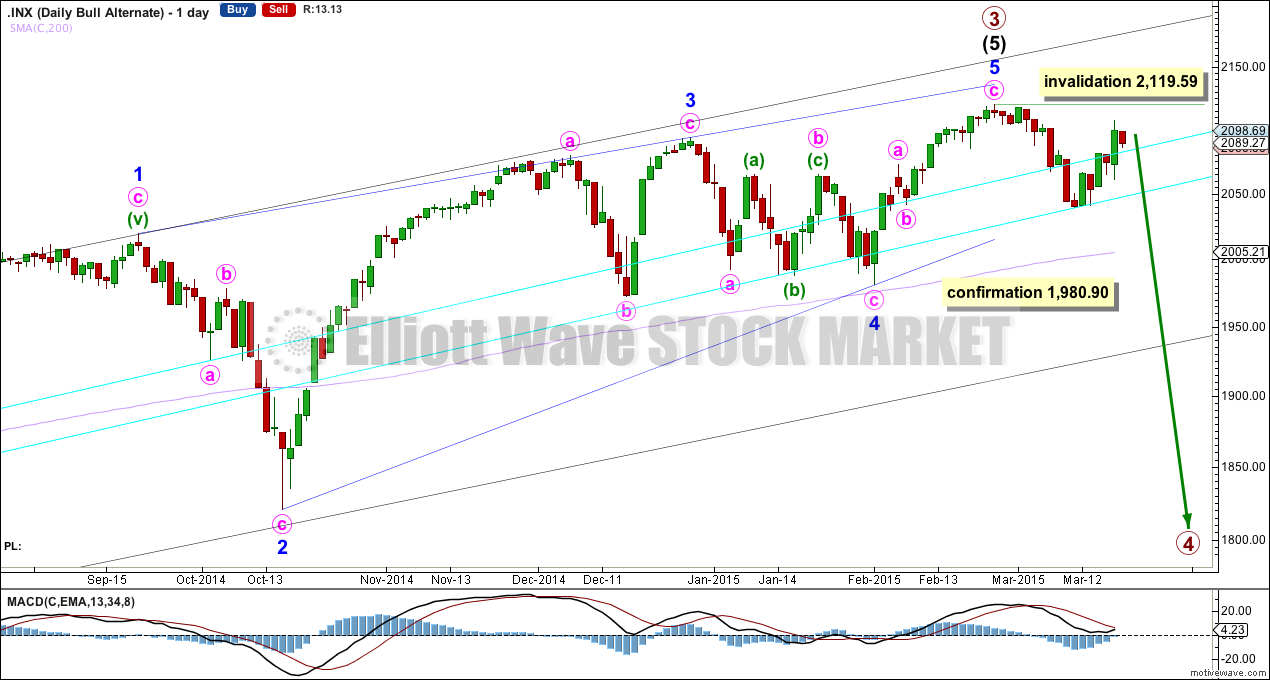

Alternate Bullish Wave Count

This wave count is identical to the main wave count up to the low labelled minor wave 4. Thereafter, this alternate looks at the possibility that minor wave 5 may be over. Minor wave 5 would have fallen slightly short of the 1-3 trend line. This is unusual but does occasionally happen for fifth waves of contracting diagonals.

A new low below 1,980.90 would invalidate the main wave count. A close below the lower aqua blue trend line of 3% or more of market value would provide added confidence in this wave count. At that stage I would expect that downwards movement may be the early stages of primary wave 4. The bearish wave count below would also be entirely possible, but would require further confirmation.

Primary wave 2 was a 0.41 zigzag correction lasting 62 days in total. I would expect primary wave 4 to be more shallow because it may find support at the lower edge of an Elliott channel (which must be drawn on a weekly chart at this stage). Primary wave 4 should break out of the black channel copied over here from the weekly chart (this is a channel containing primary wave 3). A breach of that channel would provide further confidence that primary wave 3 is over and primary wave 4 is underway.

Primary wave 4 may last about a Fibonacci 55 days if it is a flat correction. If it is a combination or triangle it may be more time consuming, maybe up to a Fibonacci 89 days.

We should always assume the trend remains the same, until proven otherwise. At this early stage we have no confirmation of a big trend change, so this idea must remain an alternate until we do. We should assume the trend remains up.

The new downwards movement has begun with a completed three down at the hourly chart level. This substantially reduces the probability of this alternate today. It is possible that a leading diagonal is unfolding in a first wave position, but first wave leading diagonals are not very common.

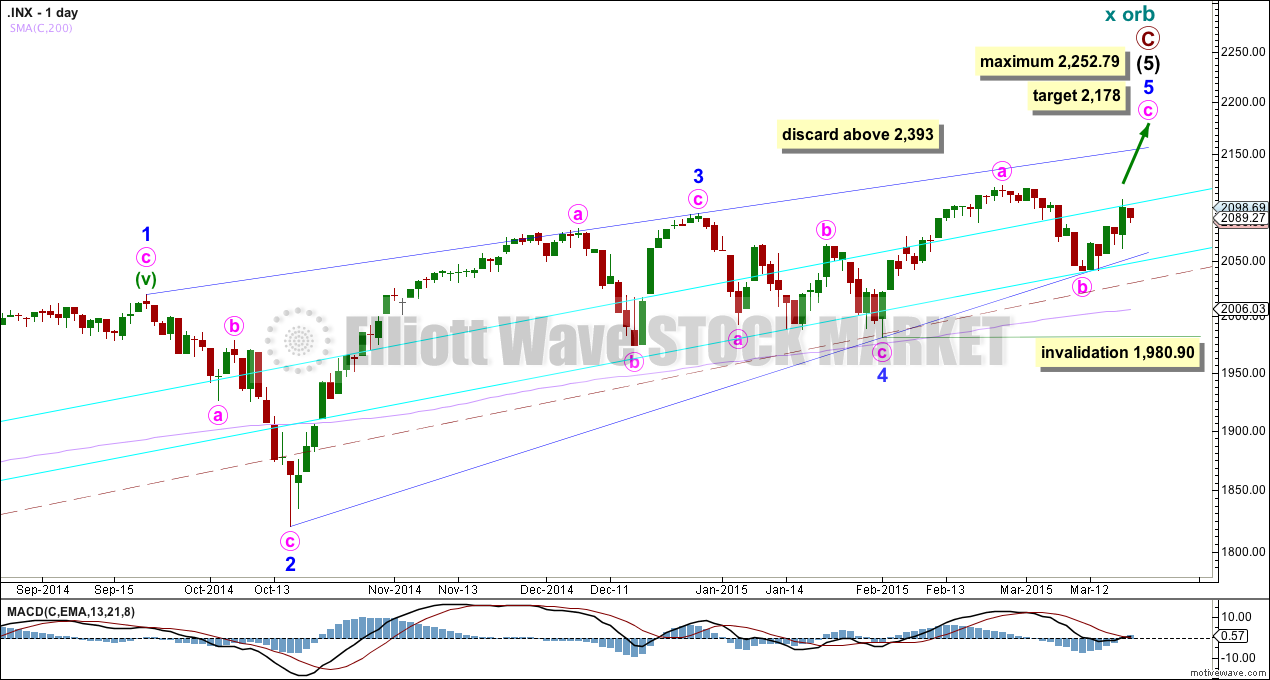

Bear Wave Count

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count. The alternate bull wave count idea also works perfectly for this bear wave count.

To see the difference at the monthly chart level between the bull and bear ideas look at the last historical analysis here.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 167% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it.

This analysis is published about 06:49 p.m. EST.