A new high above 6,894.88 indicates FTSE has not had a big trend change. The upwards trend remains intact. Intermediate wave (5) is not over.

Click on charts to enlarge.

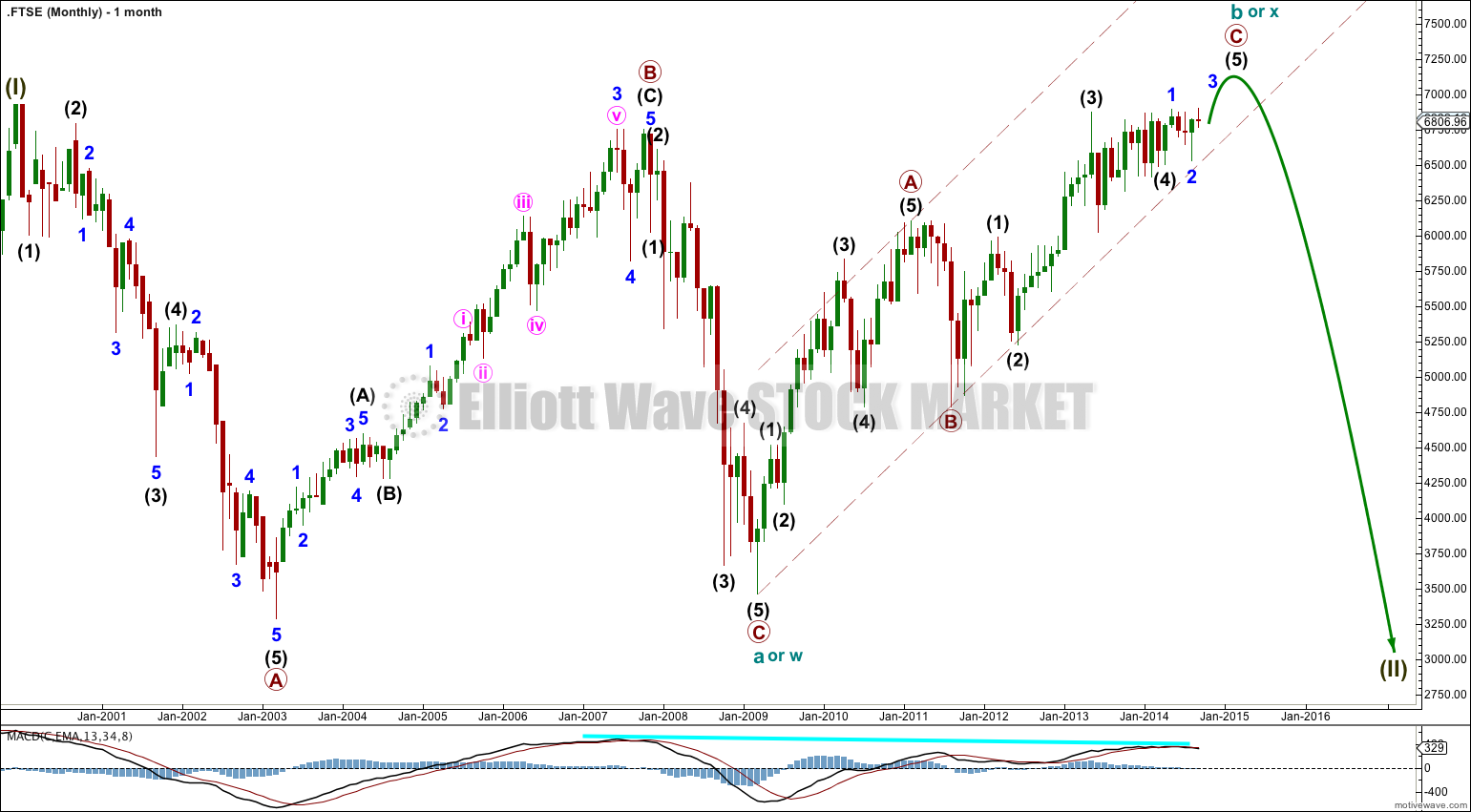

The bigger picture sees FTSE in a huge correction for a super cycle wave (II).

Super cycle wave (II) may be either a regular flat correction (labeled cycle a, b, c) or it may be a double flat or combination (labeled cycle w, x and y).

A regular flat correction would expect a five wave structure downwards for cycle wave c to move at least a little below the end of cycle wave a at 3,460.71 to avoid a truncation. Cycle wave c would be expected to last from one to several years, with a shorter time frame more likely.

A double flat or combination would expect a three wave structure downwards for cycle wave y to end about the same level as cycle wave a at 3,460.71. Cycle wave y would be expected to last from one to several years, with a longer time frame more likely. It could look like a repeat of cycle wave a.

There is divergence at the monthly chart level with MACD which supports this wave count.

Cycle wave b (or x) subdivides as a zigzag and is incomplete.

The daily chart focusses on the last wave up, intermediate wave (5).

Intermediate wave (5) cannot be over. A new high above the end of minor wave 1 cannot be part of a new downwards trend.

At 7,247 intermediate wave (5) would reach 0.618 the length of intermediate wave (1).

Intermediate wave (5) must subdivide as either an impulse or an ending diagonal. An ending diagonal requires all the subwaves to be zigzags. Because minor wave 1 looks best as a five wave structure I expect that intermediate wave (5) is most likely to subdivide as a simple impulse.

Minor wave 3 may only subdivide as an impulse. Within it I am not convinced that minute wave ii is complete because although so far downwards movement subdivides as a three wave structure this is a very shallow brief movement, which is more likely to continue lower. Minute wave ii may end about the 0.382 or 0.618 Fibonacci ratios of minute wave i, with the 0.618 ratio as more likely because second wave corrections are most often deep.

Within minute wave ii minuette wave (b) must subdivide as a three wave structure and may make a new high above the start of minuette wave (a) at 6,904.86 as in an expanded flat. Minute wave ii may also be a double zigzag or double combination.

Minute wave ii may not move beyond the start of minute wave i below 6,528.73.

At 7,156 minor wave 3 would reach 1.618 the length of minor wave 1.