Yesterday’s Elliott wave analysis of the S&P 500 expected a little more upwards movement to end between 1,945 and 1,950. We did see upwards movement, but it was much more than expected and breached the invalidation point on the hourly chart.

Summary: In the short term I expect more upwards movement to a target at 1,964. The target may be met in either one or four more days. Price should not move above 1,973.72.

Click on charts to enlarge.

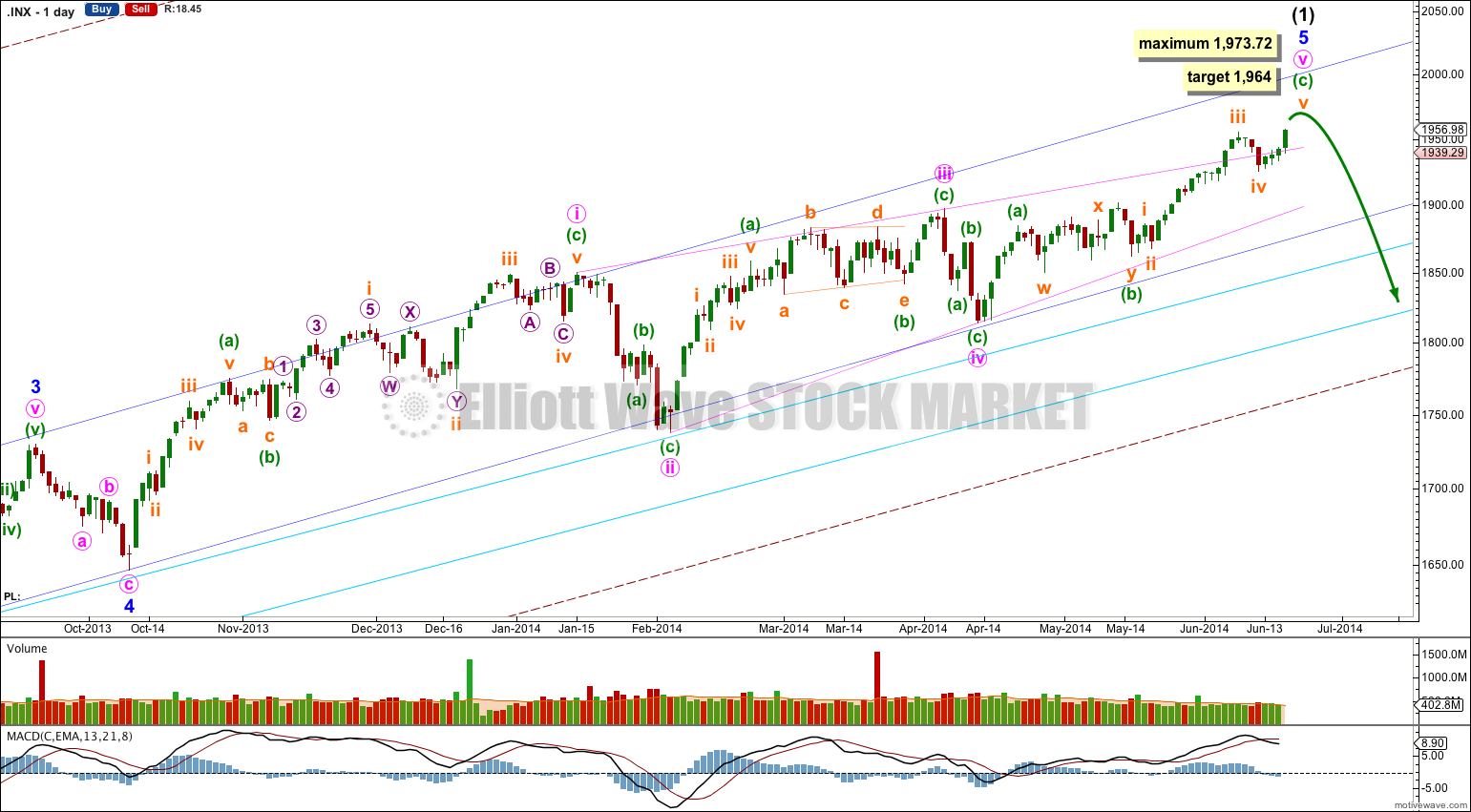

The aqua blue trend lines are critical. Draw the first trend line from the low of 1,158.66 on 25th November, 2011 to the next swing low at 1,266.74 on 4th June, 2012. Create a parallel copy and place it on the low at 1,560.33 on 24th June, 2013. While price remains above the lower of these two aqua blue trend lines we must assume the trend remains upwards. This is the main reason for the bullish wave count being my main wave count.

Bullish Wave Count.

This bullish wave count expects a cycle degree correction was over at 666.79 for a fourth wave, and a new cycle degree bull market began there for a fifth wave. Within cycle wave V primary waves 1 and 2 are complete. Within primary wave 3 intermediate wave (1) may be almost complete.

Minor wave 5 is an incomplete ending contracting diagonal. Within an ending diagonal all the subwaves must be single zigzags, and the fourth wave should overlap first wave price territory.

Contracting diagonals commonly end with an overshoot of the 1-3 trend line. I had expected the structure was complete at the high of subminuette wave iii, but the overshoot continues.

The diagonal is contracting because minute wave iii is shorter than minute wave i. Minute wave v may not be longer than equality with minute wave iii at 1,973.72 because a third wave may never be the shortest wave.

There is divergence with price trending higher and MACD trending lower on the weekly chart, and now again on the daily chart for most recent movement. This classic technical divergence supports this wave count and indicates that at least a reasonably sized correction should arrive soon. By reasonably sized I mean in fitting with this bullish wave count: Intermediate wave (2) should last at least two or four weeks, probably longer, and should not breach the lower aqua blue trend line nor the lower edge of the maroon – – – channel. The wave count remains bullish at primary degree.

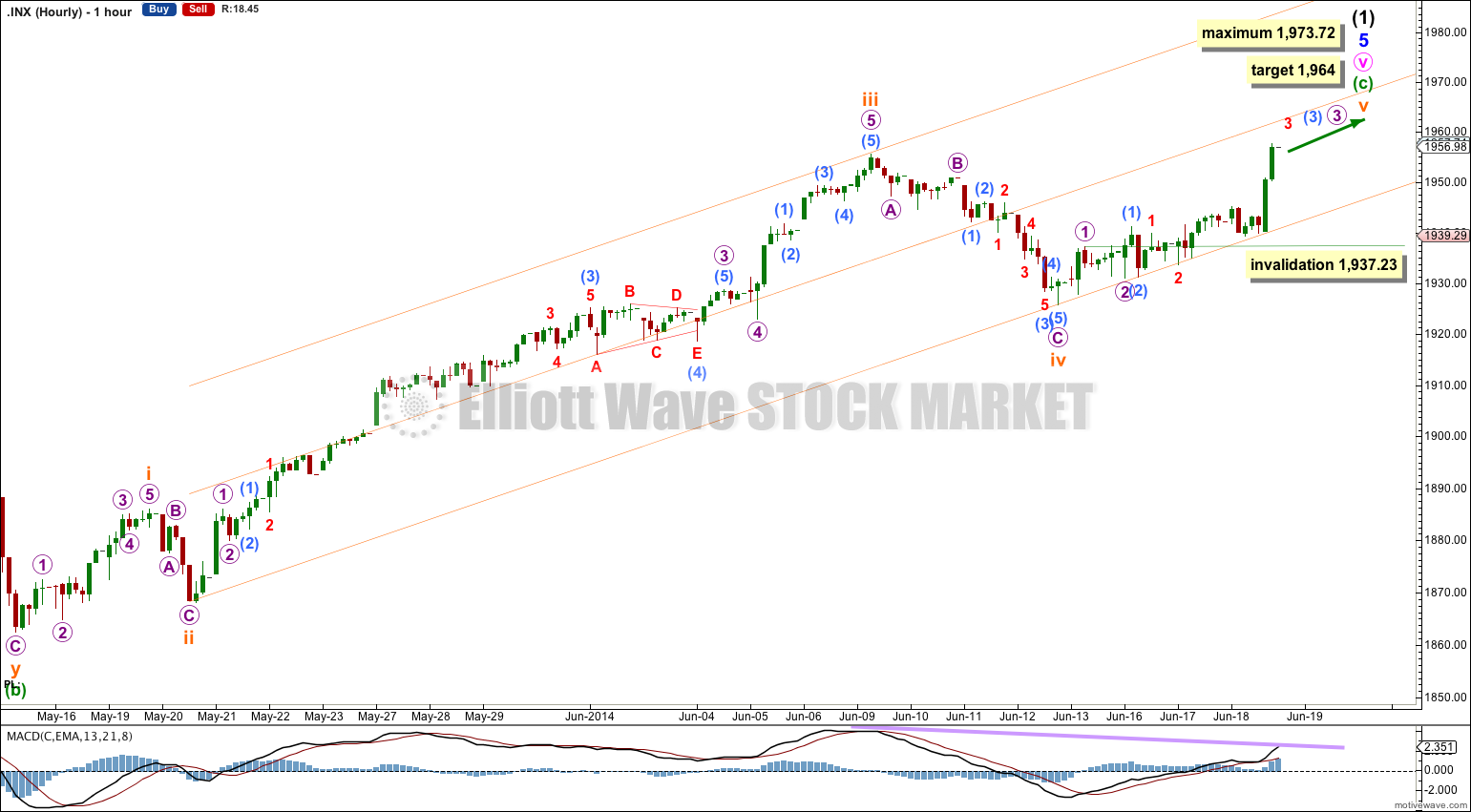

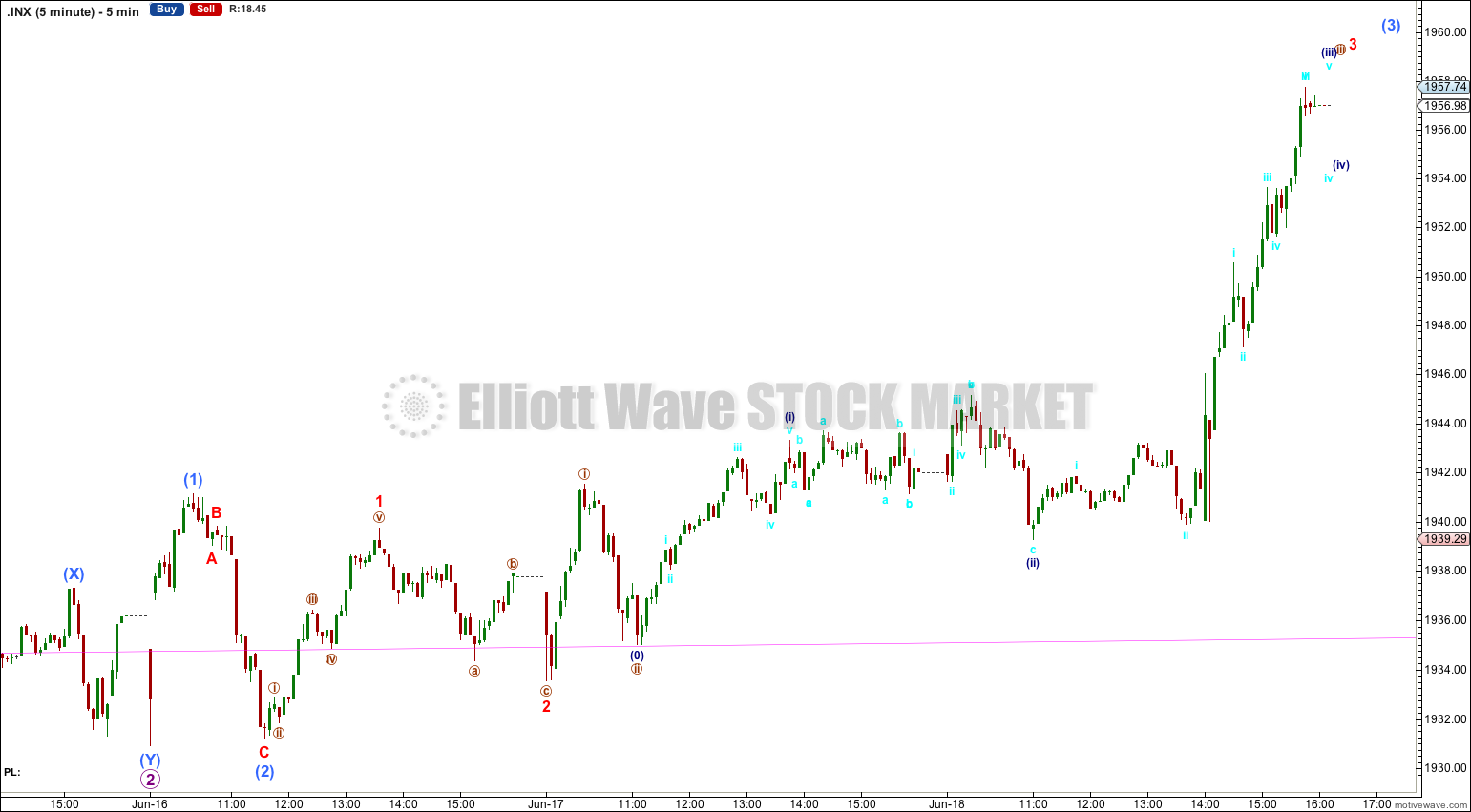

Upwards movement for Wednesday’s session ended in the middle of a third wave, and I expect more upwards movement tomorrow to complete the structure for subminuette wave v.

If minuette wave (c) began lower down than recently labeled then this structure fits with momentum; subminuette wave iii has the strongest upwards momentum. Minuette wave (b) is seen as a combination rather than a triangle, as a zigzag – X – expanded flat.

There is no Fibonacci ratio between subminuette waves i and iii. This makes it more likely we shall see a Fibonacci ratio between subminuette wave v and either of i or iii. At 1,964 subminuette wave v would reach 1.618 the length of subminuette wave i.

I have drawn a channel about minuette wave (c) using Elliott’s second technique: draw the first trend line from the lows of subminuette waves ii to iv, then place a parallel copy upon the high of subminuette wave iii. The lower trend line perfectly shows where corrections are finding support on the way up. Subminuette wave v is most likely to end about the mid line of this channel.

Within subminuette wave v micro wave 4 may not move into micro wave 1 price territory below 1,937.23.

Within minuette wave (c) subminuette wave i lasted two days, subminuette wave ii lasted one day, subminuette wave iii lasted a Fibonacci 13 days, and subminuette wave iv lasted three days. So far subminuette wave v has lasted four days. If it ends in either one more or four more days it would have lasted a total Fibonacci five or eight days.

Once the structure of subminuette wave v can be seen as complete then I would again expect a trend change. The first indication of this trend change would be a clear breach of the orange channel on the hourly chart. Thereafter, movement below 1,925.78 would provide first price confirmation of a trend change.

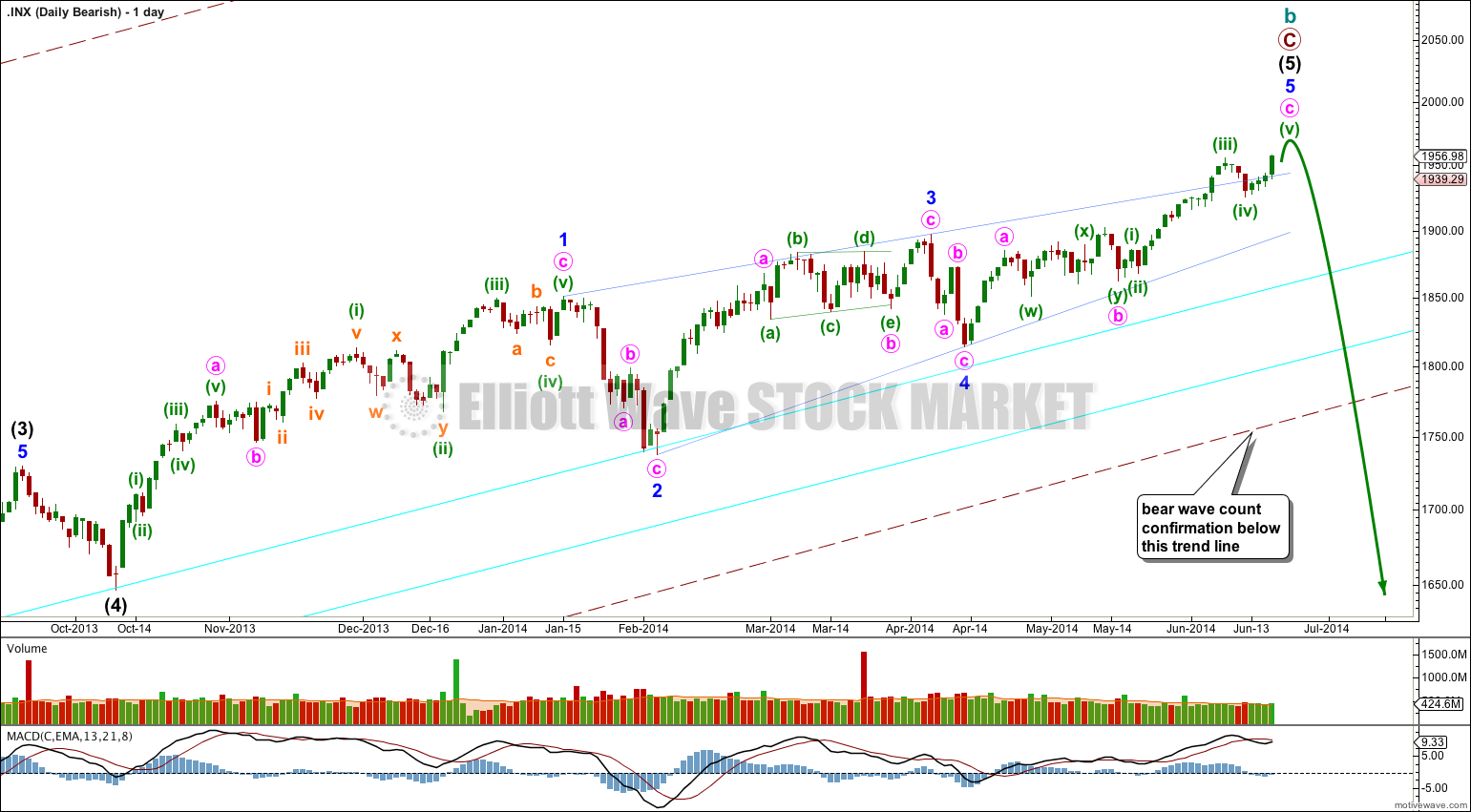

Bearish Alternate Wave Count.

This bearish alternate wave count expects that the correction is not over. The flat correction which ended at 666.79 was only cycle wave a of a larger super cycle second wave correction.

Cycle wave b is now longer than the maximum common length of 138% for a B wave of a flat correction, at 149%.

A clear breach of the large maroon – – – channel on the monthly and weekly charts is required for confirmation of this wave count. If that happens then this would be my main wave count and would be strongly favoured. Only once this wave count is confirmed will I calculate downwards targets for cycle wave c for you; it would be premature to do that prior to confirmation.

This analysis is published about 07:20 p.m. EST.

Thanks Laura. I had noted in the previous post about the market going to new highs and having divergence on the RSI (I don’t use macd). The chart just didn’t look right to me to end at yesterday’s high and the RSI also looked like it needed to finish printing. And as you said there should be some capitulation volume. I don’t normally even look at volume on the indexes during bull markets because I don’t find it adds any new insight. I added it to my screens and have been thinking that the volume is just so uneventful. I keep wondering who is buying into this strength? I am now confident along with you that the market is going to have a strong pullback; I would just like to see the spike in volume.