Last analysis expected some upwards movement for one to two days. Price has moved higher, although the daily candlestick for Friday is red. The wave counts remain the same, and the alternate has reduced in probability.

Click on the charts below to enlarge.

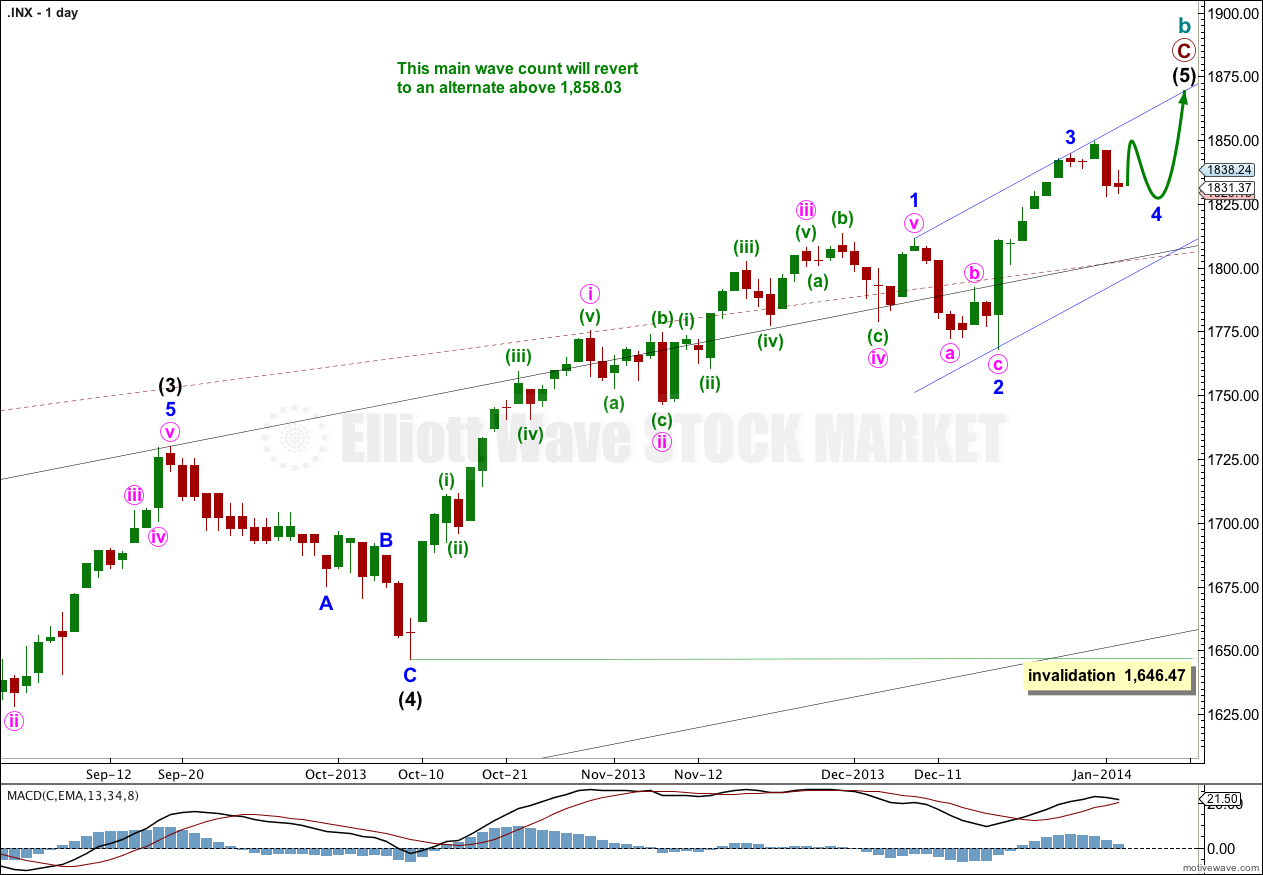

This wave count has a higher probability than the bullish alternate. Upwards movement over the last 4 1/2 years subdivides best as a zigzag. If something is “off” about the supposed recovery then it must be a B wave because there is plenty that is off in this scenario in terms of social mood.

Minor waves 1, 2 and 3 are complete. Minor wave 4 is most likely only half way done. If it ends on 9th January, 2014 it would have lasted a Fibonacci 8 days.

We may be about to see a larger fractal at minor wave degree of the structure within minor wave 1 at minute wave degree; there the first wave was extended, the third wave was shorter, and the fifth wave was shorter still.

Intermediate wave (3) is just 0.76 points short of 2.618 the length of intermediate wave (1). We may not see a Fibonacci ratio between intermediate wave (5) and either of (3) or (1).

Intermediate wave (1) lasted 18 days. Intermediate wave (5) may last a total of a Fibonacci 89 days which would see it end on 10th February, 2014. However, Fibonacci time relationships are not very reliable for the S&P. This is a rough guideline only,

At super cycle degree the structure is an expanded flat correction. Within the flat the maximum common length of cycle wave b is 138% the length of cycle wave a, and this is achieved at 1,858.03. When cycle wave b is longer than the common length of cycle wave a then the probability that an expanded flat is unfolding would reduce and it would be more likely that a long term bull market is underway. Above 1,858.03 I will swap this main wave count over with the bullish alternate.

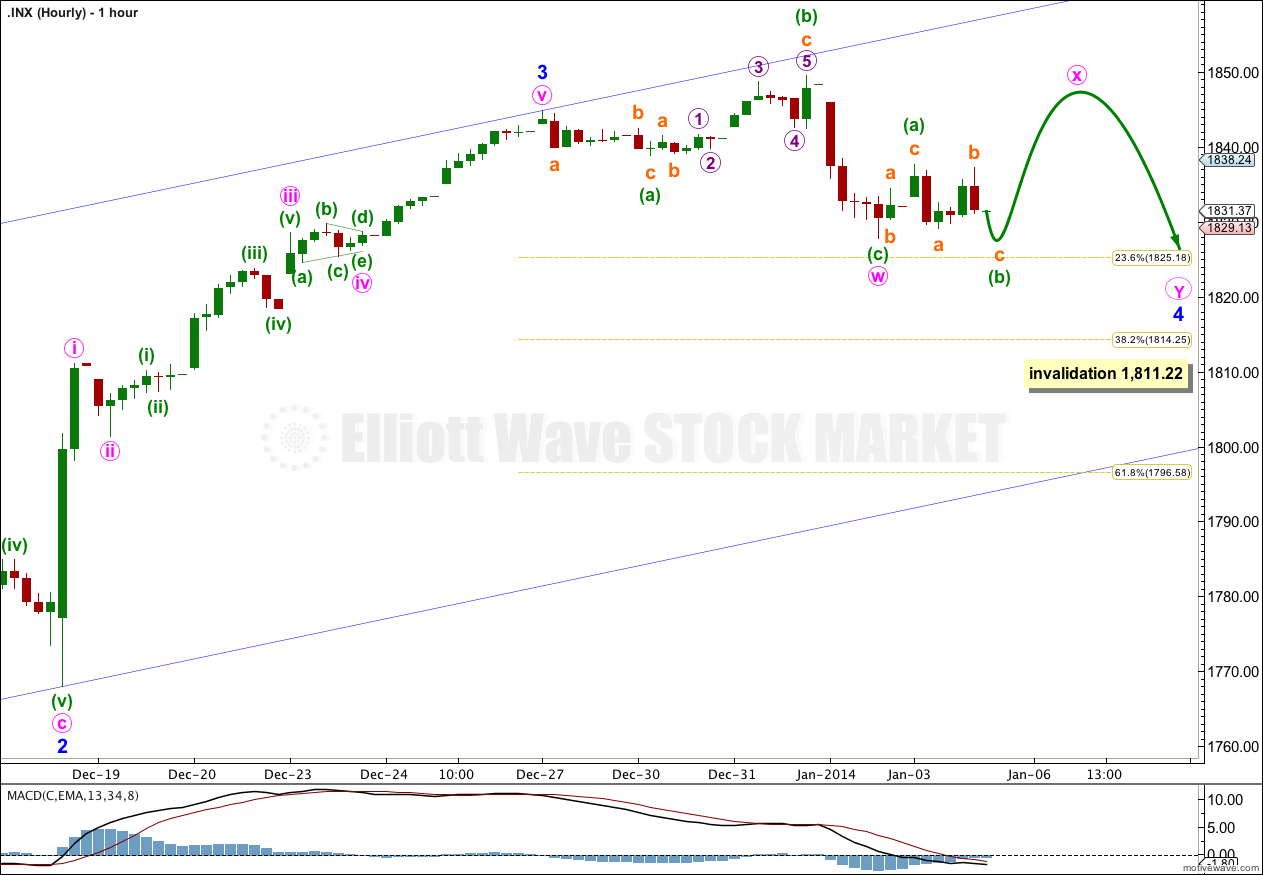

Main Hourly Wave Count.

This is the main hourly wave count because I would expect minor wave 4 to last longer than four days to be better in proportion to minor wave 2 which lasted seven days. This first flat correction may be the first structure in a double flat or double combination.

The purpose of double flats and double combinations is to take up time and move price sideways. I would expect minor wave 4 to finally end about the same level as minute wave w at 1,827.74, and to not move significantly lower than this point.

The two structures in the double should be joined by a three wave structure in the opposite direction which would be labeled minute wave x. So far on the five minute chart it looks like a very small zigzag unfolded upwards, followed by an incomplete three down. Minute wave x may be unfolding as a flat correction.

When minuette wave (b) within minute wave x is complete I can calculate a target upwards for minuette wave (c) to complete minute wave x for you. I cannot do that yet. Minuette wave (b) may make a new low below the start of minuette wave (a) at 1,827.74, and so there is no lower invalidation point for this main wave count for Monday.

Minute wave x should last another one day, and possibly two at the most. Thereafter, I would expect more choppy overlapping movement for another two or so days.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,811.22.

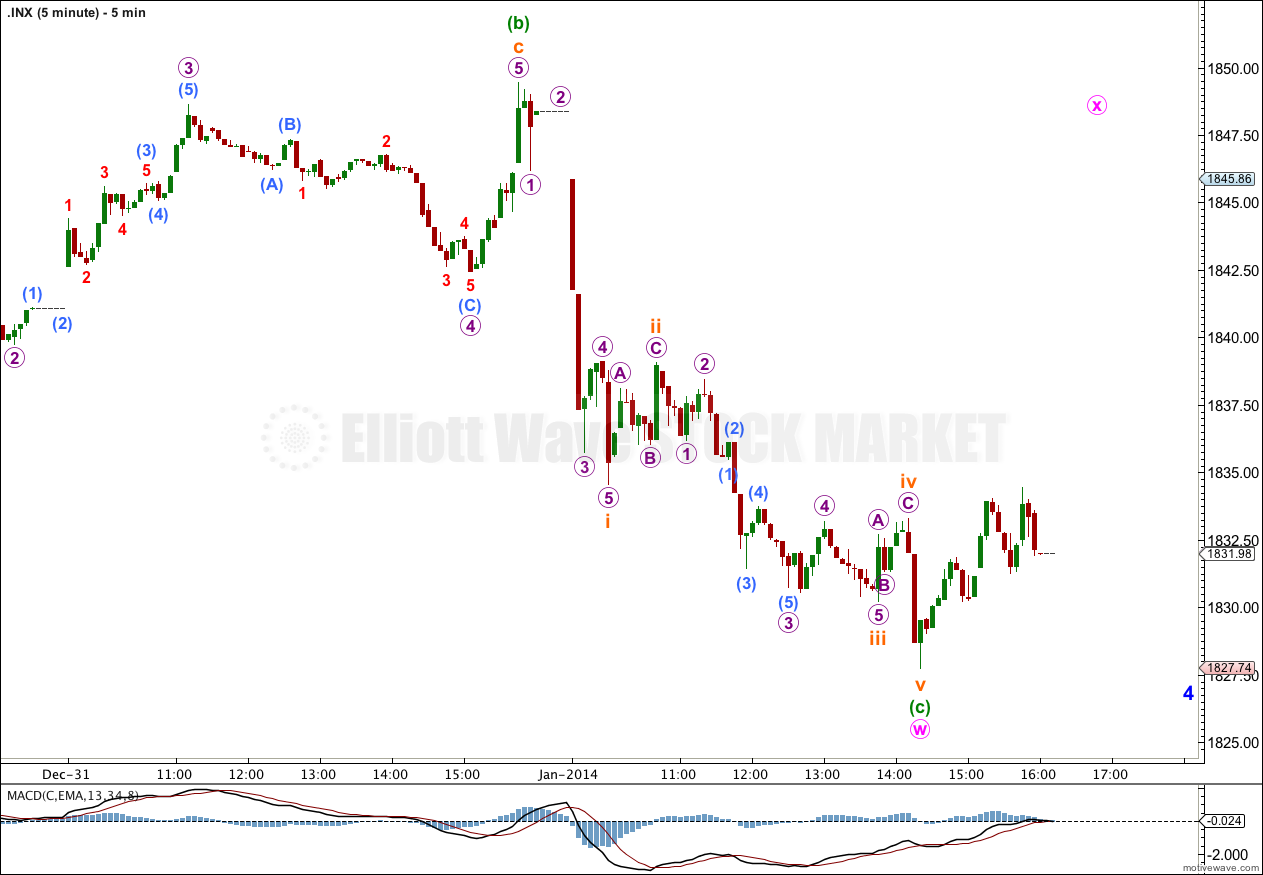

Alternate Hourly Wave Count.

Because the upwards wave labeled minute wave i subdivides best as a zigzag on the five minute chart it may be that minor wave 5 is unfolding as an ending diagonal. Within an ending diagonal all the subwaves must subdivide as zigzags. However, this is a very short and brief zigzag for a minute degree first wave within a diagonal. This must reduce the probability of this alternate wave count.

Within minor wave 5 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,827.74.

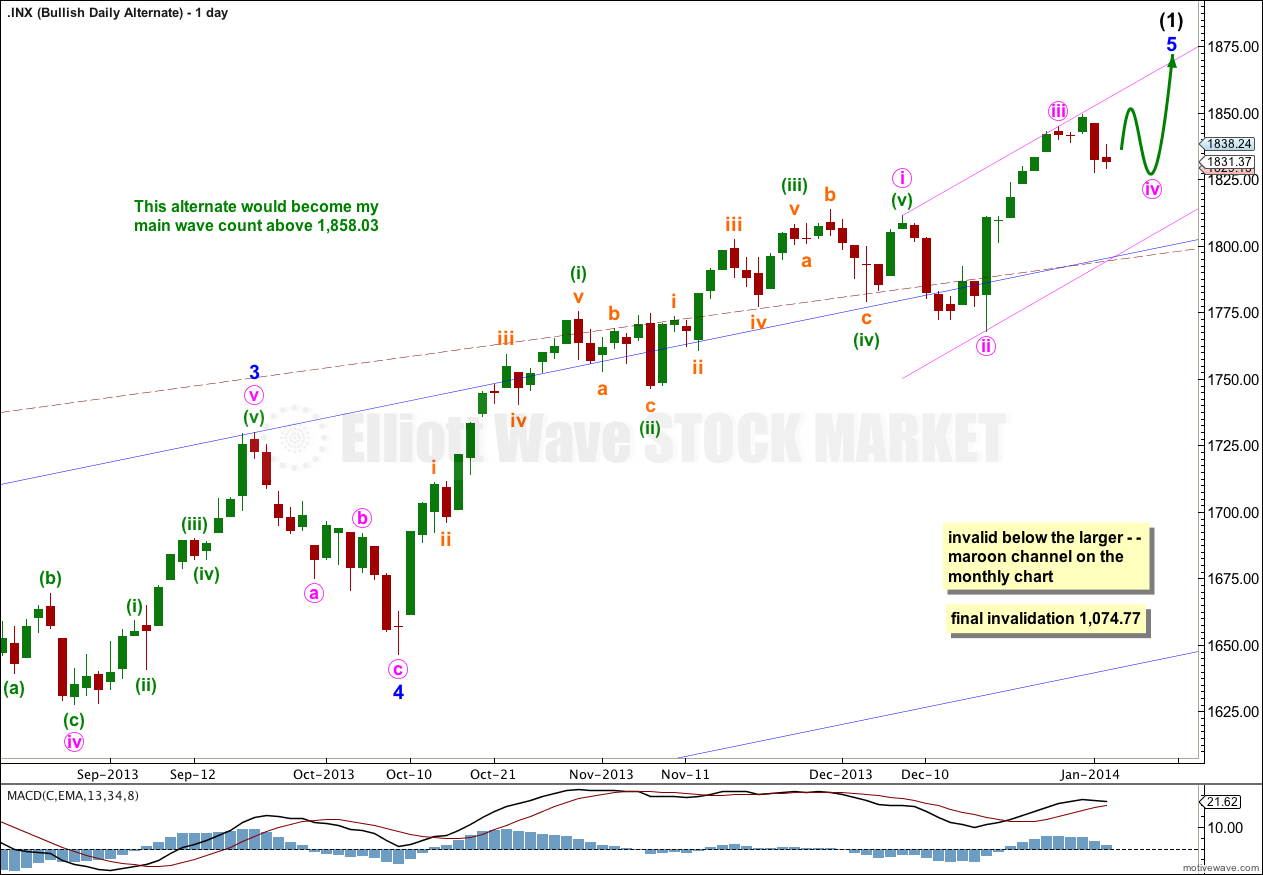

Bullish Alternate Wave Count.

It is possible that a new cycle degree bull market began at 666.79. So far it is not yet halfway through, and I would expect it to last for a few years (at least five more years and probably longer).

The current upwards impulse, labeled intermediate wave (5) for the main wave count and minor wave 5 for this alternate is incomplete. The structure within the final fifth wave is the same, and the structure on the hourly chart is the same. Targets would be the same for this bullish wave count. This wave count does not diverge with the main wave count, and it will not for several weeks or a couple of months or so yet.

The maroon – – – channel is an acceleration channel drawn about primary waves 1 and 2 on the monthly chart (it is drawn in exactly the same way on the main wave count, but there it is termed a corrective channel). I would not expect intermediate wave (2) to breach this channel because a lower degree (intermediate) wave should not breach an acceleration channel of a higher degree (primary) first and second wave.