Last analysis expected more upwards movement towards a target at 1,817, which I expected to be reached during Monday or early Tuesday.

The structure is now complete and upwards movement fell well short of the target.

The wave count remains the same.

Click on the charts below to enlarge.

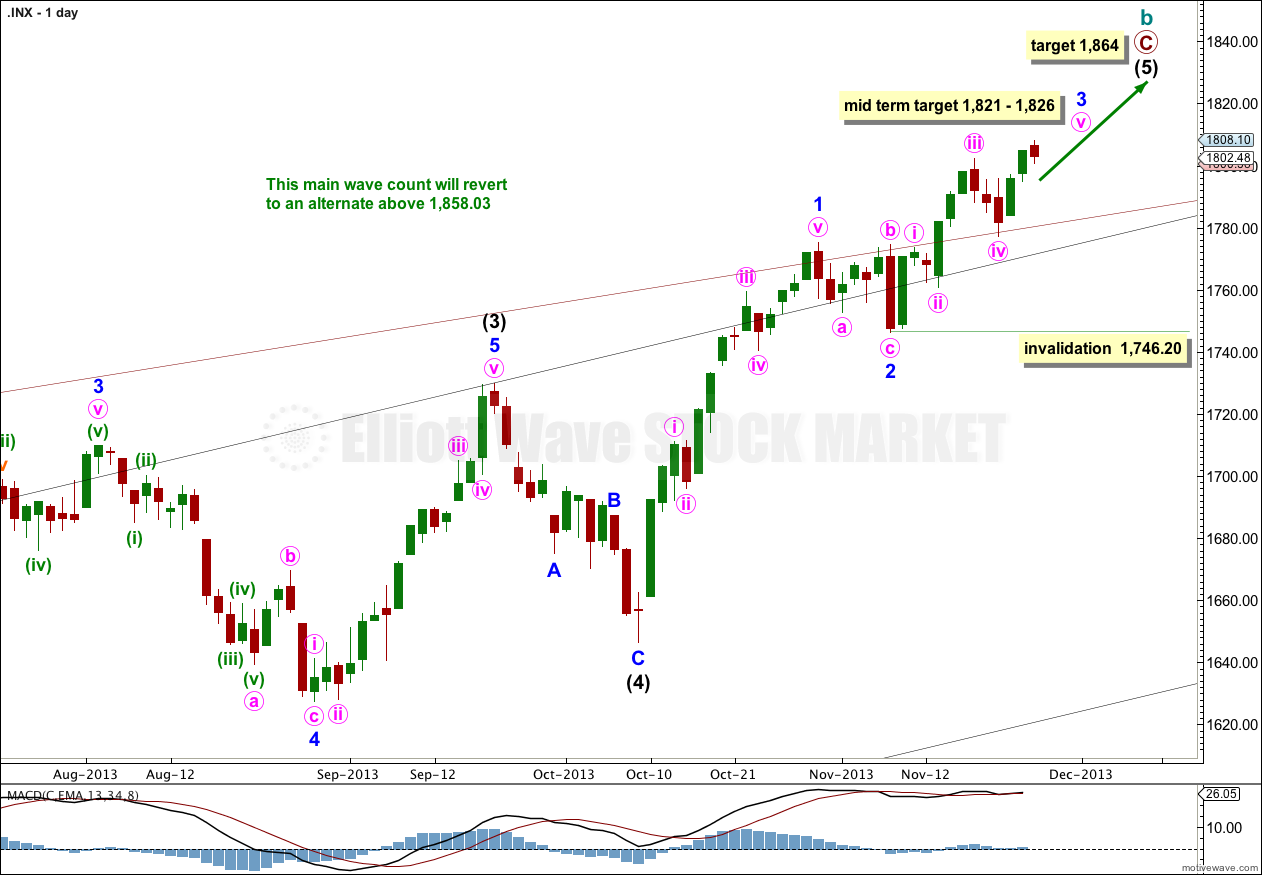

Main Wave Count.

This wave count has a higher probability than the alternate. Upwards movement over the last 4 1/2 years subdivides best as a zigzag. If something is “off” about the supposed recovery then it must be a B wave because there is plenty that is off in this scenario in terms of social mood.

Downwards corrections may now find support along the upper edge of the big maroon channel from the monthly chart, if the upper trend line is pushed out to encompass all of primary wave A.

Intermediate wave (5) is incomplete, with minor waves 1 and 2 completed.

At 1,826 minor wave 3 would reach 0.618 the length of minor wave 1. Minor wave 1 is extended, so minor waves 3 and 5 may not be.

At 1,821 minute wave v would reach equality in length with minute wave iii.

At 1,864 intermediate wave (5) would reach equality in length with intermediate wave (1). This is the most common ratio between first and fifth waves so this target has a good probability.

Within minor wave 3 minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,746.20.

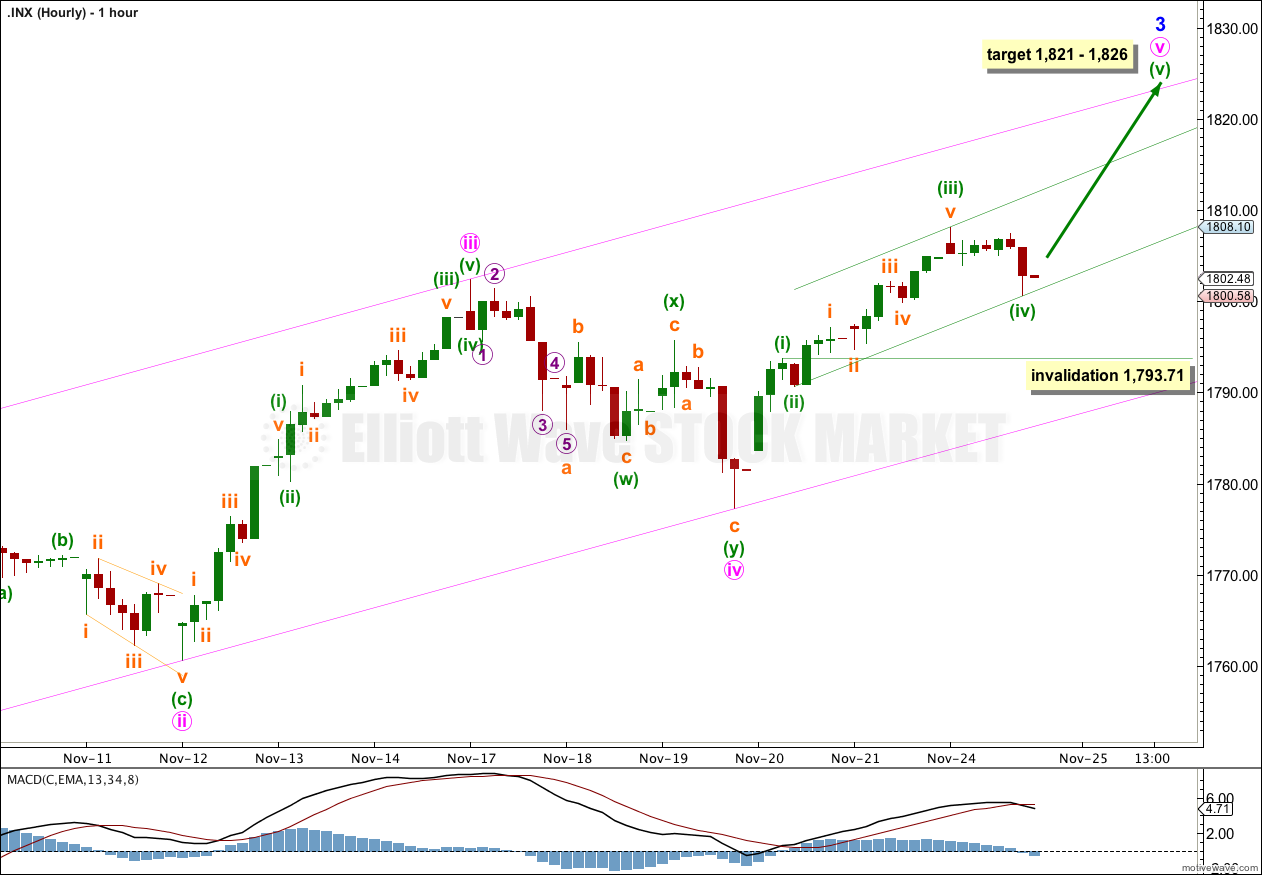

Within minute wave v of minor wave 3, minuette waves (iii) and (iv) are now very likely complete.

Only the final wave of minuette wave (v) is now needed to complete minor wave 3 at all wave degrees.

Minuette wave (iii) failed to reach the target at 1,817 by 8.9 points which was calculated at 1.618 the length of minuette wave (i). Minuette wave (iii) is 1.02 points longer than equality with minuette wave (i).

The target will remain the same, and will expect minuette wave (v) to be extended. It may last about two days.

It is extremely likely that minuette wave (iv) is over because it is already longer in duration than minuette wave (ii). If the final fifth wave within it extends a little lower it should not be by much, and it should not last for long. Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 1,793.71.

Keep drawing the parallel channel about minor wave 3. Draw the first trend line from the lows labeled minute waves ii to iv, then place a parallel copy upon the high labeled minute wave iii.

Also draw a parallel channel now about minute wave v. Draw the first trend line from the lows labeled minuette waves (ii) to (iv), then place a parallel copy upon the high labeled minuette wave (iii). I would expect upwards movement to find resistance at the upper edge of this channel in the first instance. If it breaks through resistance here I would expect it to next find resistance at the upper edge of the wider pink channel.

Alternate Wave Count.

It is possible that a new cycle degree bull market began at 666.79. So far it is not yet halfway through, and I would expect it to last for a few years (at least five more years and maybe longer).

At some stage then the current upwards impulse, labeled intermediate wave (5) for the main wave count and minor wave 5 for this alternate, will be completed. At that stage both wave counts would expect a trend change. The main wave count would expect a huge cycle degree trend change, and this alternate would expect an intermediate degree trend change. If the downwards movement subdivides as a three and remains within the maroon channel then this alternate would be preferred. If it breaches the channel this alternate would be discarded.

The maroon – – – channel is an acceleration channel drawn about primary waves 1 and 2 on the monthly chart (it is drawn in exactly the same way on the main wave count, but there it is termed a corrective channel). I would not expect intermediate wave (2) to breach this channel because a lower degree (intermediate) wave should not breach an acceleration channel of a higher degree (primary) first and second wave.

The daily chart shows the structure of minor wave 5. It is incomplete. Targets are the same because they are calculated using the same wave lengths as the main wave count. This bullish alternate does not diverge from the main wave count at this stage, and it will not for some weeks to come.