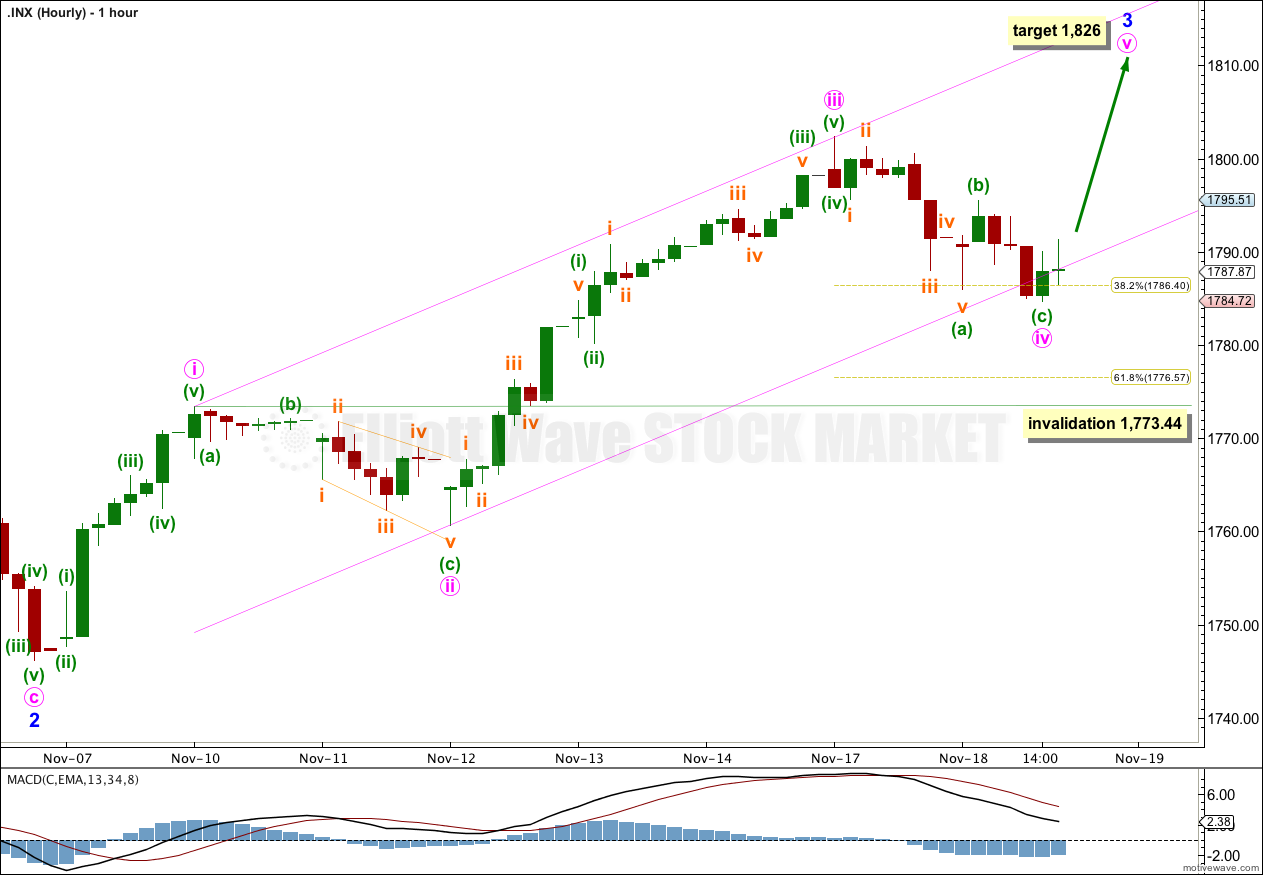

Yesterday’s analysis expected a fourth wave correction to continue, and possibly end at the end of Tuesday’s session. This is what happened.

There were several possibilities yesterday for the structure of this fourth wave, and the most common flat correction was anticipated. This structure did not complete as a flat though, and it fits best as a zigzag.

Click on the charts below to enlarge.

Main Wave Count.

This wave count has a higher probability than the alternate. Upwards movement over the last 4 1/2 years subdivides best as a zigzag. If something is “off” about the supposed recovery then it must be a B wave because there is plenty that is off in this scenario in terms of social mood.

Downwards corrections may now find support along the upper edge of the big maroon channel from the monthly chart, if the upper trend line is pushed out to encompass all of primary wave A.

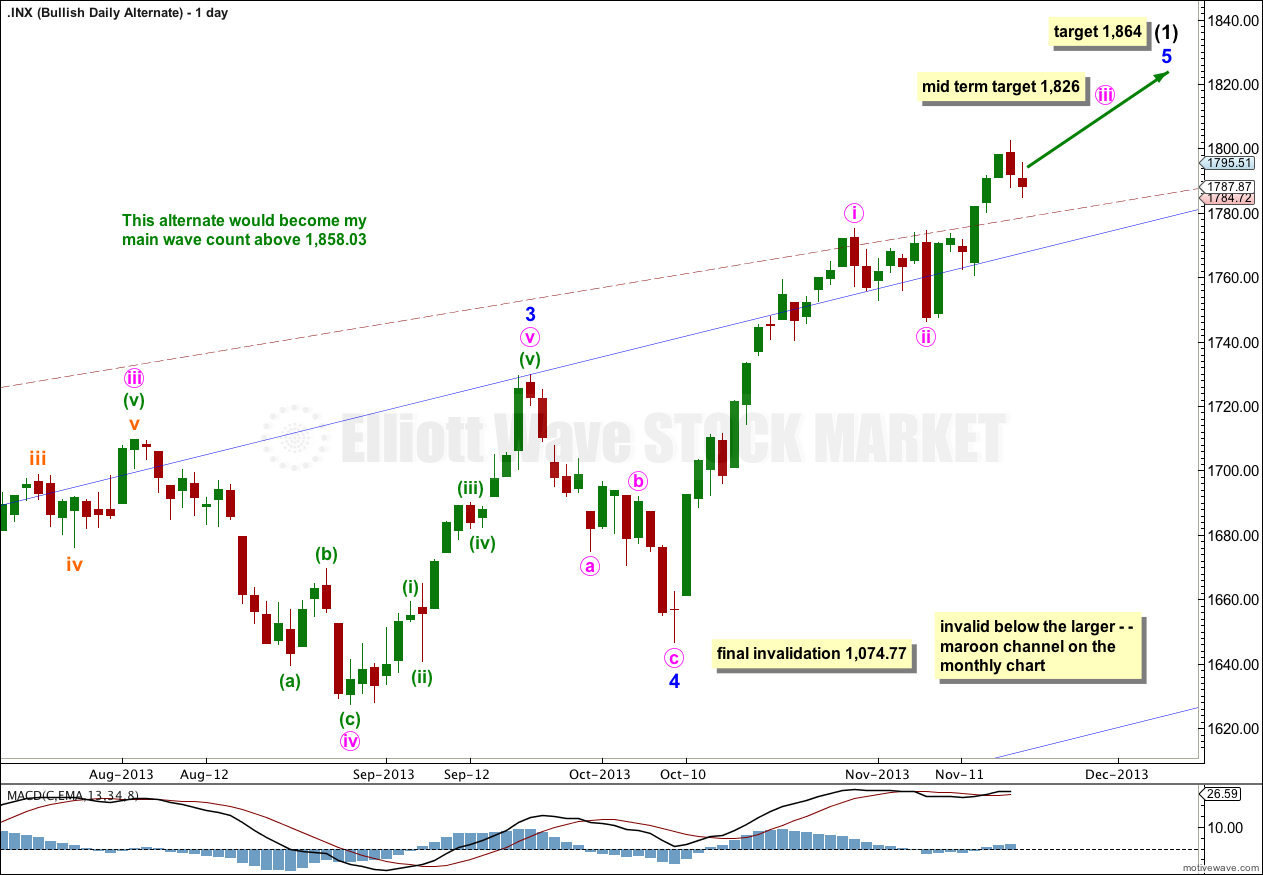

Intermediate wave (5) is incomplete with just minor waves 1 and now probably 2 within it completed.

At 1,826 minor wave 3 would reach 0.618 the length of minor wave 1. Minor wave 1 is extended, so minor waves 3 and 5 may not be.

Also now at 1,826 minute wave v would reach equality in length with minute wave iii. This increases the probability of this target.

At 1,864 intermediate wave (5) would reach equality in length with intermediate wave (1). This is the most common ratio between first and fifth waves so this target has a good probability.

Within minor wave 3 minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,746.20.

Minute wave iv continued lower ending just below the 0.382 Fibonacci ratio of minute wave iii.

There is a slight overshoot of the parallel channel. I will expect the next wave up for minute wave v to end either midway within the channel, or to find resistance at the upper edge.

Minute wave iv completed as a zigzag; this is how it subdivides on the five minute chart. There is some alternation between minute waves ii and iv: minute wave ii is deeper and its C wave is much longer than its A wave, and minute wave iv is shallower with an A wave longer than the C wave.

Within minute wave iv minuette wave (c) is 0.64 longer than 0.618 the length of minuette wave (a).

Minute wave iv has now lasted a Fibonacci 13 hours, and minute wave ii lasted 16 hours; they are reasonably in proportion. I expect it is now highly likely that minute wave iv is completed.

I will expect upwards movement for about two to three days to the target at 1,826.

When there is a clear five up on the hourly chart then I will have full confidence that minute wave iv is over. Prior to this confirmation the invalidation point must remain at 1,773.44. If minute wave iv continues further sideways and lower it may not move into minute wave i price territory.

Alternate Bullish Wave Count.

It is possible that a new cycle degree bull market began at 666.79. So far it is not yet halfway through, and I would expect it to last for a few years (at least five more years and maybe longer).

At some stage then the current upwards impulse, labeled intermediate wave (5) for the main wave count and minor wave 5 for this alternate, will be completed. At that stage both wave counts would expect a trend change. The main wave count would expect a huge cycle degree trend change, and this alternate would expect an intermediate degree trend change. If the downwards movement subdivides as a three and remains within the maroon channel then this alternate would be preferred. If it breaches the channel this alternate would be discarded.

The maroon – – – channel is an acceleration channel drawn about primary waves 1 and 2 on the monthly chart. I would not expect intermediate wave (2) to breach this channel. If downwards movement breaches the channel I would discard this wave count.

The daily chart shows the structure of minor wave 5. It is incomplete. Targets are the same because they are calculated using the same wave lengths as the main wave count. This bullish alternate does not diverge from the main wave count at this stage, and it will not for some weeks to come.