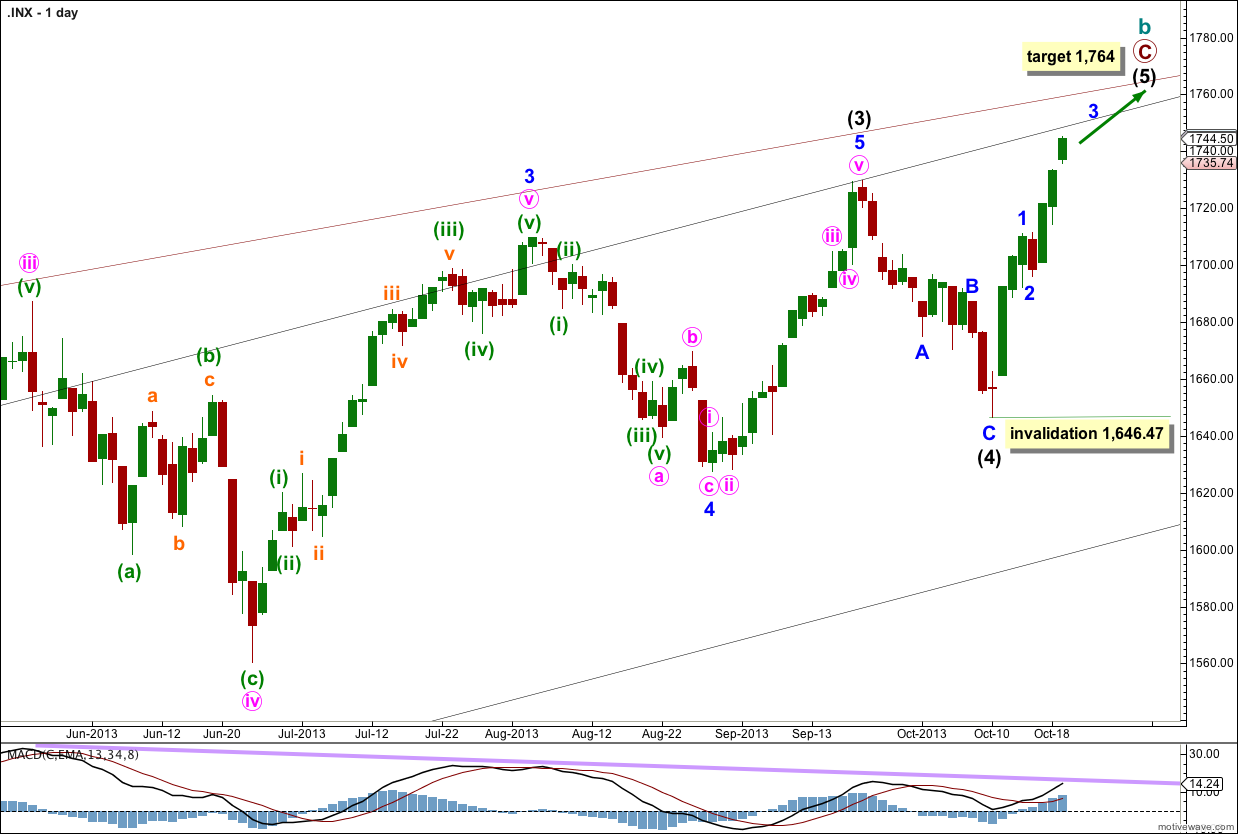

Last analysis of the S&P 500 expected more upwards movement to end the week, with an increase in momentum. This is exactly what happened.

Price has fallen short of the short term target, but is on track to reach the mid term target next week.

The wave count remains the same.

Click on the charts below to enlarge.

Intermediate wave (4) is now over and lasted 14 days, just one more than a Fibonacci 13.

If intermediate wave (5) exhibits a Fibonacci time relationship it may end in a Fibonacci 13 days (or sessions) on 28th October. Please note: this is a rough guideline only. Within this wave count there are no Fibonacci time relationships at primary or intermediate degree. Sometimes this happens, but not often enough to be reliable.

October is a common month for big trend changes with the S&P 500. This wave count could very well complete the structure for intermediate wave (5) this month.

At 1,764 primary wave C would reach equality with primary wave A.

Within intermediate wave (5) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,646.47.

This third wave is unfolding as expected, and it is showing some increase in upwards momentum as indicated by MACD.

Price remains within a very narrow parallel channel which is drawn here as a best fit.

Minute wave iii is now a possibly complete five wave impulse. It is longer than minute wave i, but there is no Fibonacci ratio between the two waves.

Ratios within minute wave iii are: minuette wave (iii) is just 0.25 shorter than equality with minuette wave (i), and minuette wave (v) is just 0.03 of a point short of 0.618 the length of minuette wave (i). Because of these excellent Fibonacci ratios within this impulse, and because the third wave is shorter than the first, I expect there is a very good probability that minute wave iii is over here and was shorter than expected.

Because there is no Fibonacci ratio between minute waves iii and i there is an increased probability that minute wave v should exhibit a Fibonacci ratio to either of minute waves iii or i. At 1,761 minute wave v would reach 0.618 the length of minute wave iii. This is just one point off 1,760 where minor wave 3 would reach equality in length with minor wave 1.

When minor wave 3 is completed (and it may complete on Monday or possibly Tuesday next week) then I would expect some downwards movement for one to three days for minor wave 4.

Within minor wave 3 if minute wave iv is not over here and moves lower it may not move into minute wave i price territory. This wave count is invalidated with movement below 1,721.65.

When minute wave v is completed then the invalidation point must move lower to the high of minor wave 1 at 1,711.03.