Movement above 1,685.66 and outside the channel on the hourly chart indicates a trend change.

The wave counts remain the same.

Click on the charts below to enlarge.

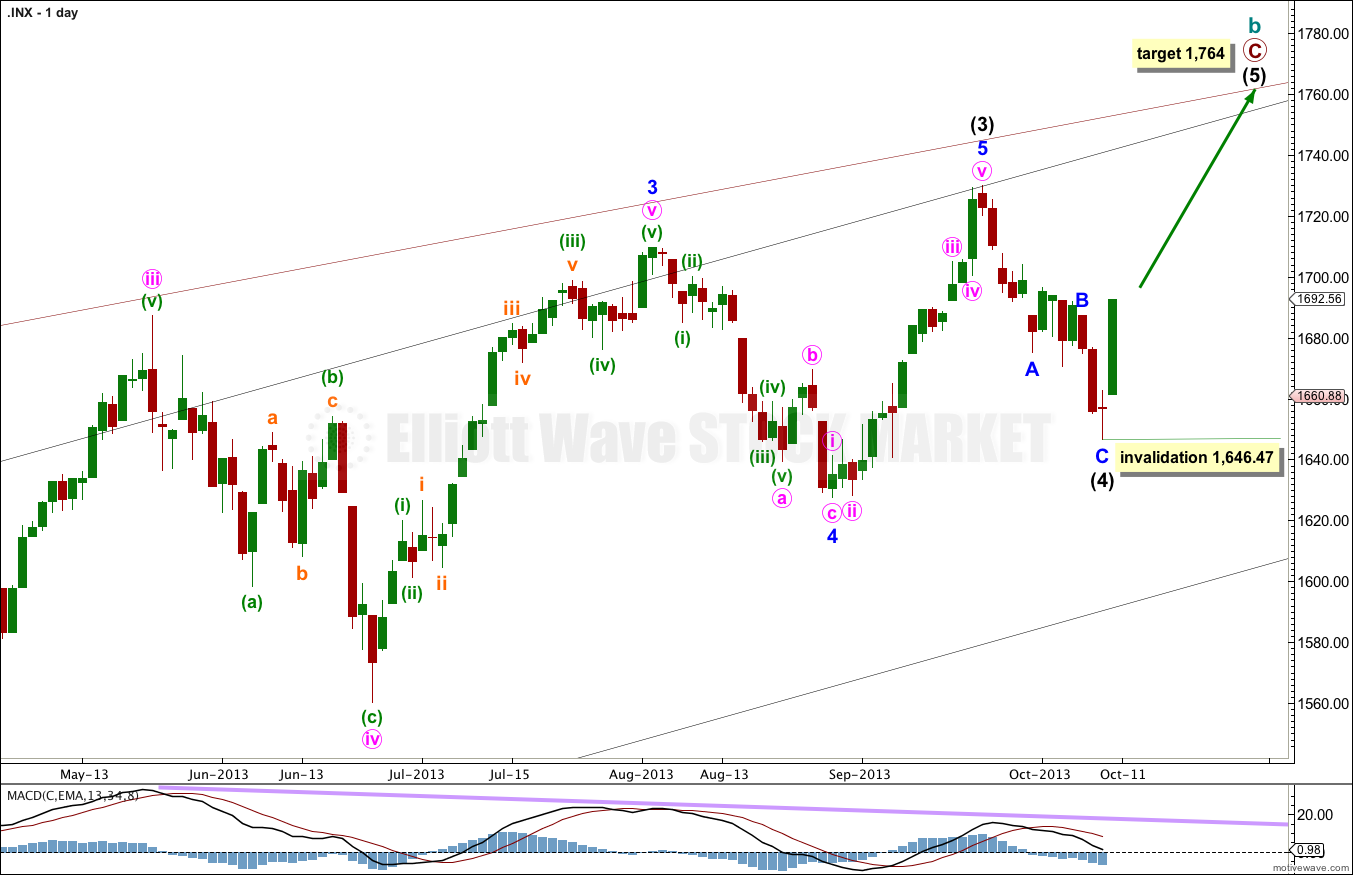

Main Wave Count.

Intermediate wave (4) is now over, it lasted 14 days, just one more than a Fibonacci 13.

If intermediate wave (5) exhibits a Fibonacci time relationship it may end in a Fibonacci 13 days (or sessions) on 28th October.

At 1,764 primary wave C would reach equality with primary wave A.

Within intermediate wave (5) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,646.47.

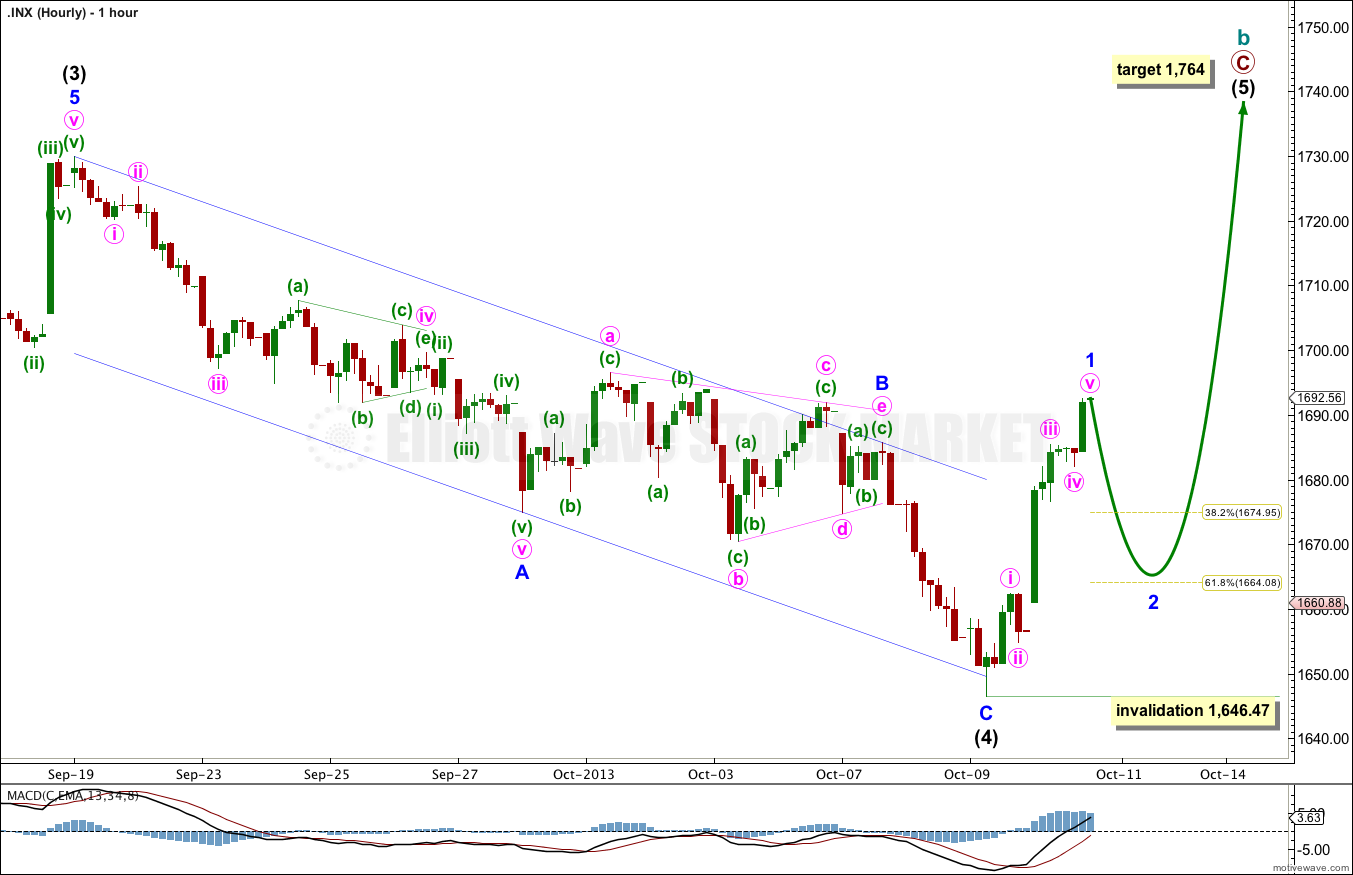

Thursday’s session is a clear five wave impulse to the upside, which gives me more confidence that we have seen the end to the correction.

Ratios within minor wave 1 are: there is no Fibonacci ratio between minute waves i and iii, and minute wave v is just 0.66 longer than 0.618 the length of minute wave i.

Minor wave 2 should take price lower tomorrow. It may end about the 0.382 or 0.618 Fibonacci ratio, with the 0.618 ratio at 1,664.08 slightly more likely.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement below 1,646.47.

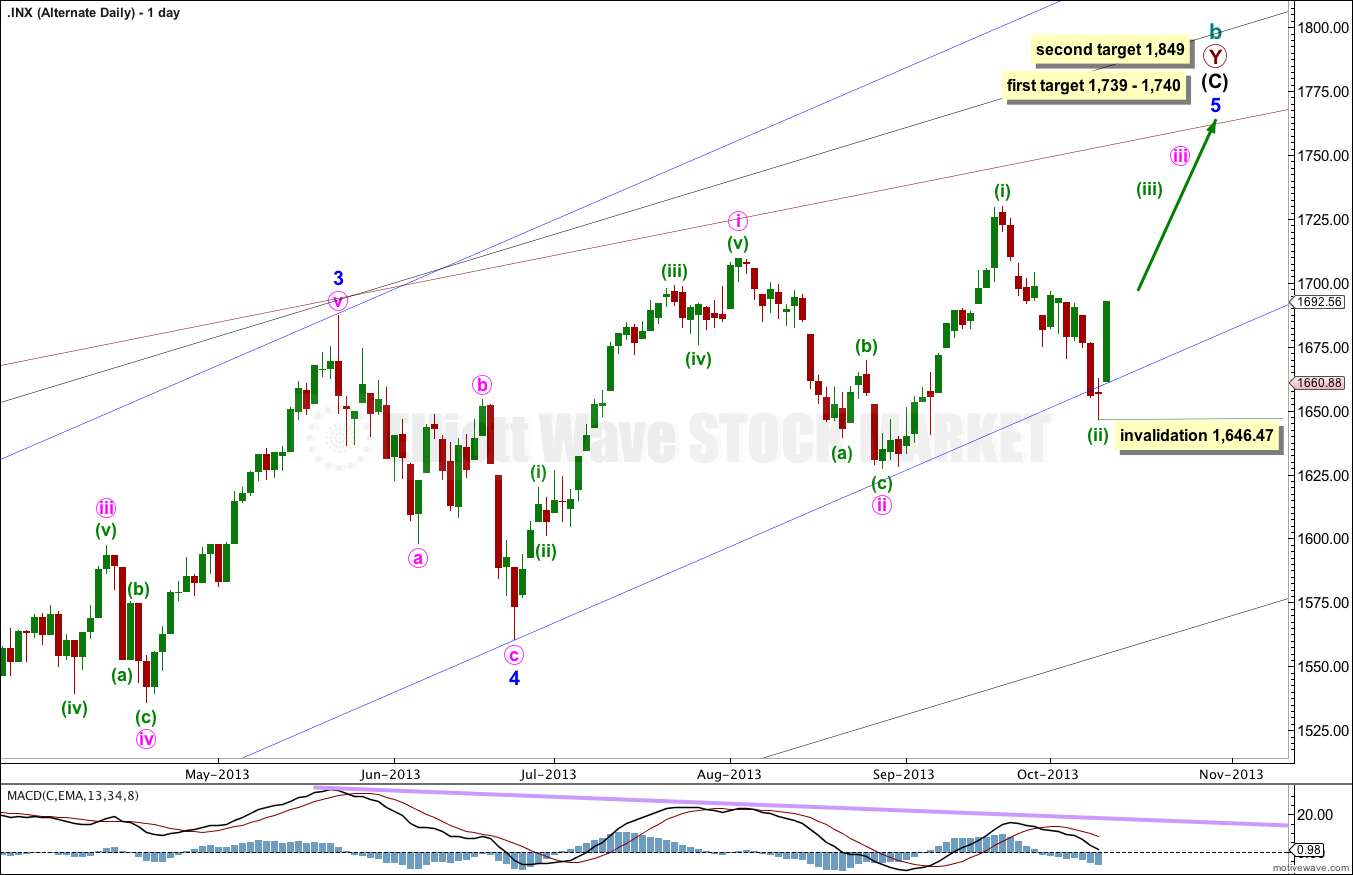

Alternate Wave Count.

This wave count requires a lot more upwards movement than the main wave count, and it is very unlikely this structure could be completed by October 28th.

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3.

If price rises through this first target the next target will be used. At 1,849 minor wave 5 would reach equality with minor wave 3.

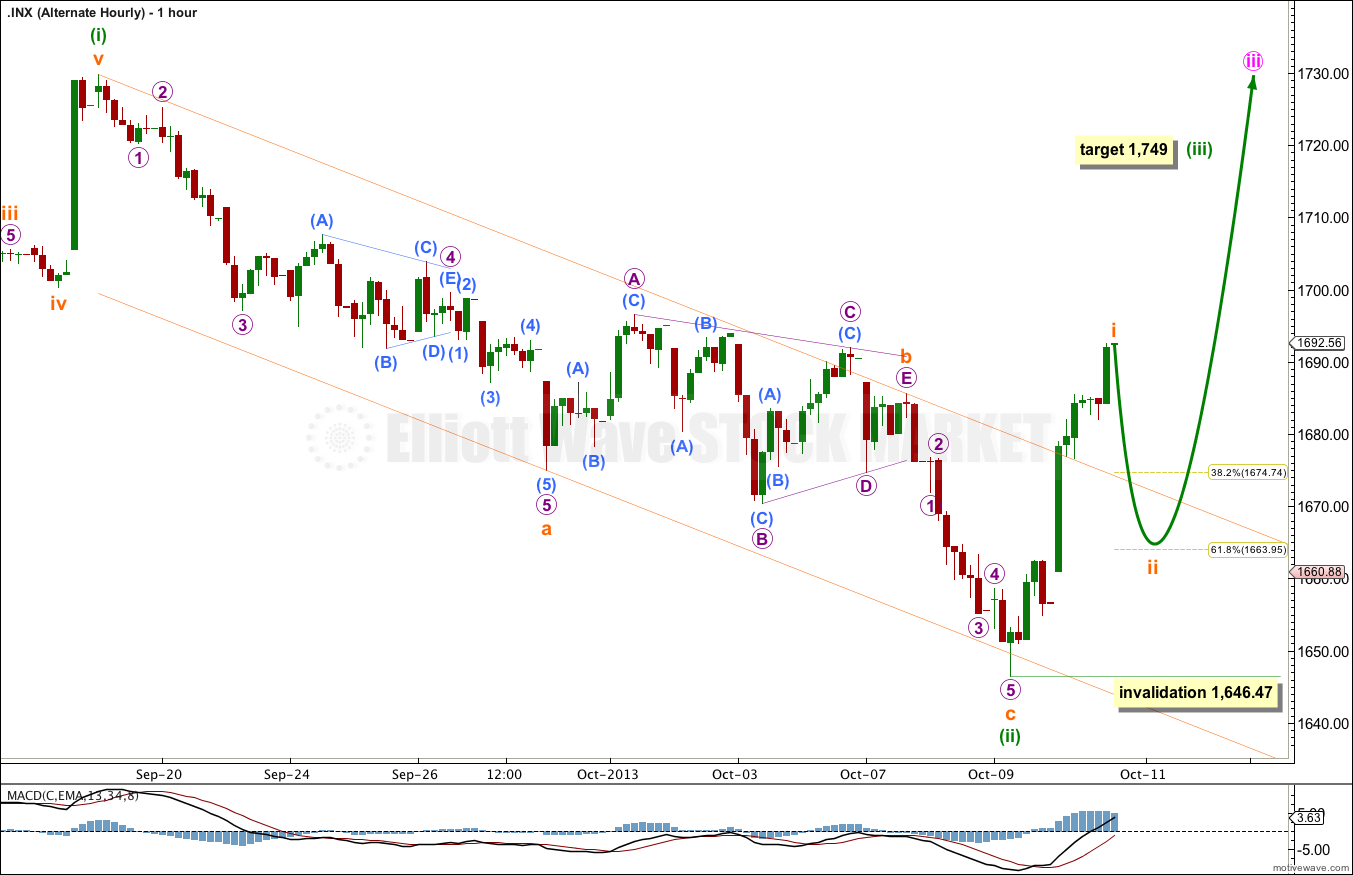

At 1,749 minuette wave (iii) would reach equality in length with minuette wave (i).

Subminuette wave ii should move price lower tomorrow. There is no divergence at this stage between this alternate and the main wave count.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,646.47.