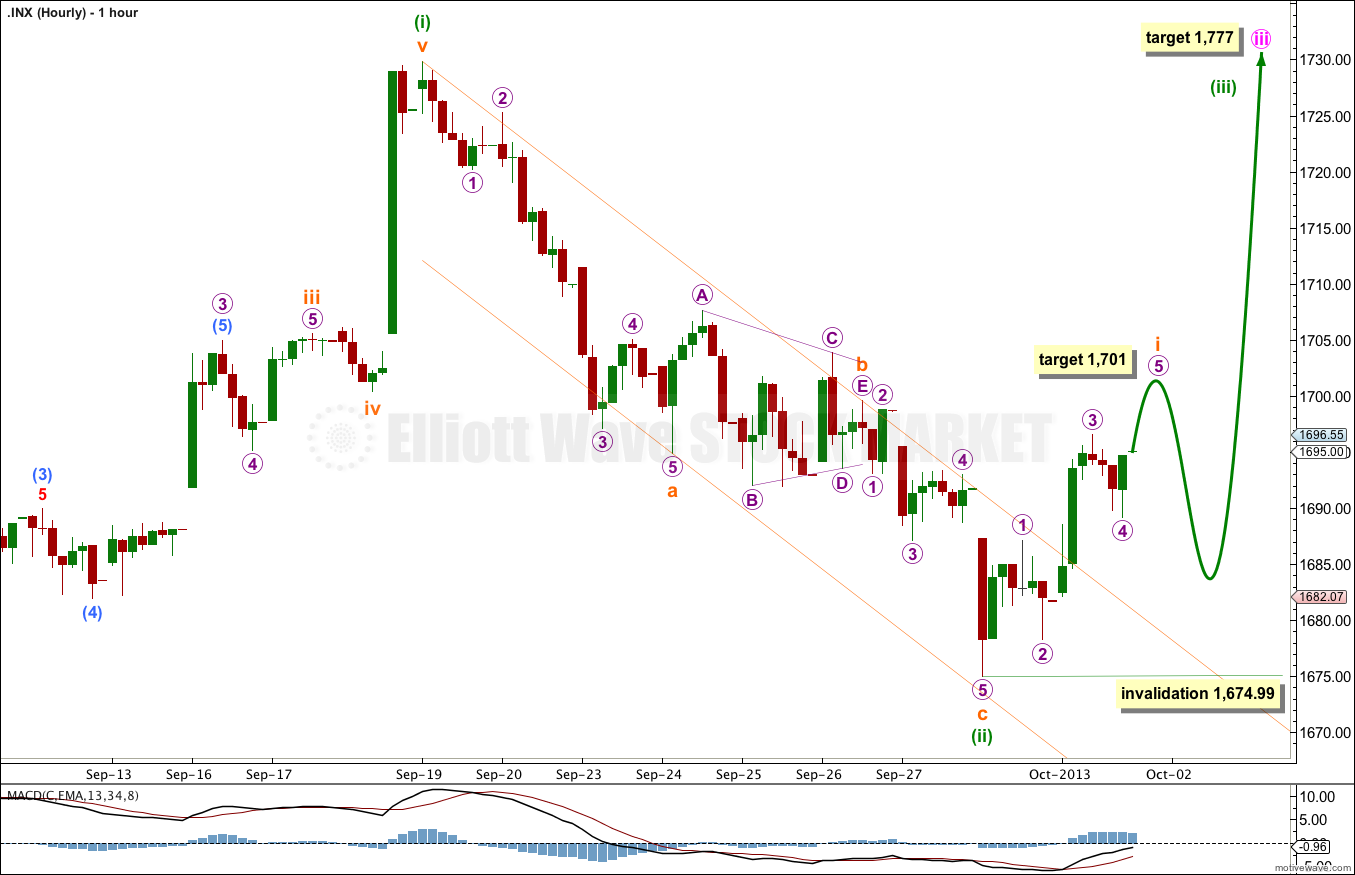

Yesterday’s analysis expected downwards movement to last all or most of Tuesday’s session, but this is not what happened. Price has moved higher, and there is now a very clear breach of the channel on the hourly chart.

I will not keep publishing the alternate daily chart as of today. It remains technically valid, but has entirely the wrong look. I will keep it in mind as a very unlikely alternate.

Click on the charts below to enlarge.

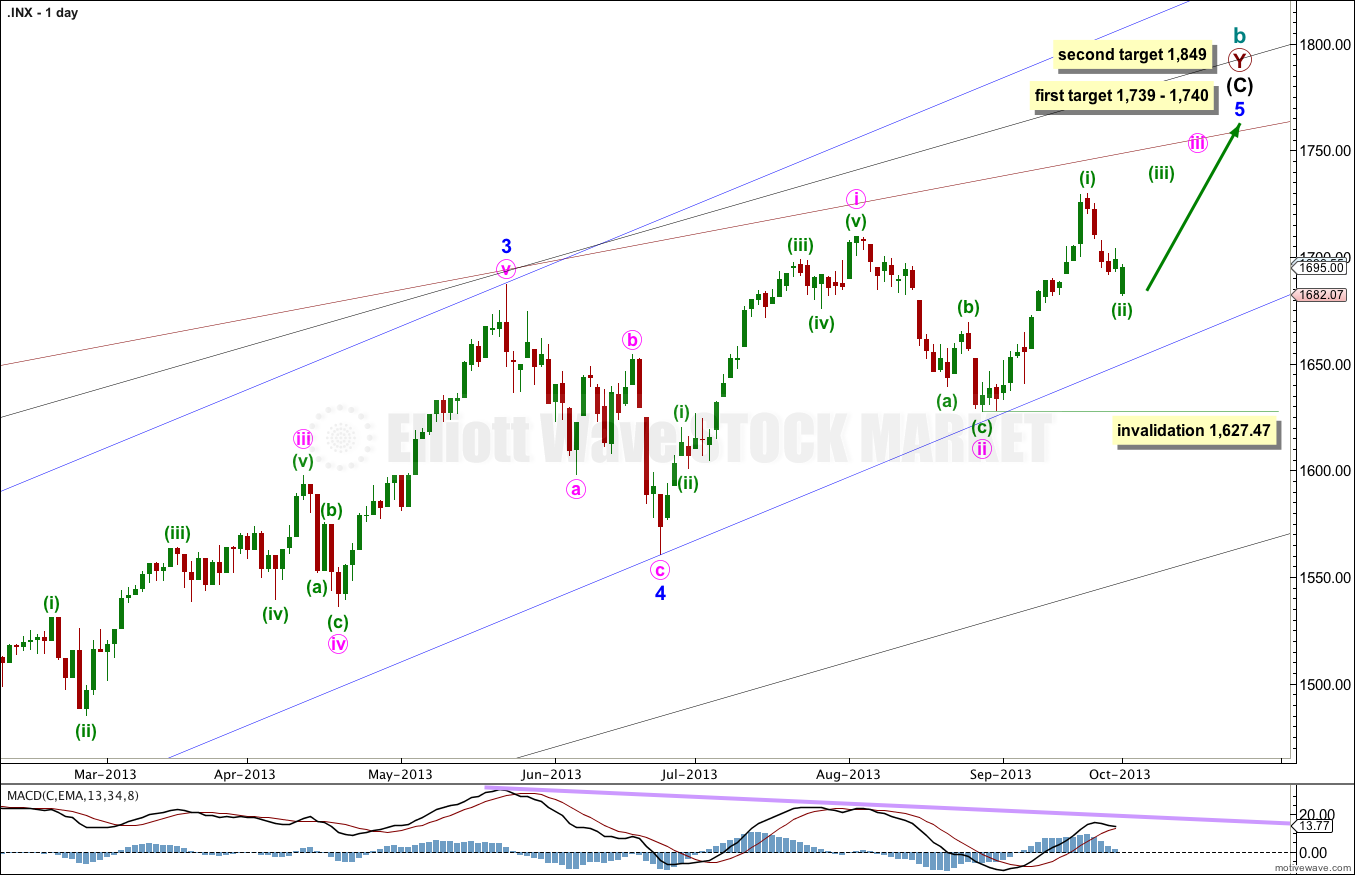

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3.

If price rises through this first target the next target will be used. At 1,849 minor wave 5 would reach equality with minor wave 3.

When minute waves iii and iv within minor wave 5 are complete I will add to the target calculation at minute wave degree, so at that stage it may change.

Minor wave 1 lasted a Fibonacci 21 days, minor wave 2 lasted a Fibonacci 8 days, minor wave 3 has no Fibonacci duration at 98 days, and minor wave 4 lasted 22 days, just one day longer than a Fibonacci 21.

Minor wave 5 may not exhibit a Fibonacci time relationship. The next possibility may be the 29th of October (give or take two days either side of this date) where minor wave 5 would have lasted a Fibonacci 89 days. This is a date to look out for, but cannot be relied upon because Fibonacci time relationships do not occur often enough to be reliable.

Keep drawing the wider parallel channels from the monthly chart and copy them over to the daily chart.

The very clear trend channel breach of minuette wave (ii) indicates this structure is over. The triangle of subminuette wave b must have ended earlier than previously labeled. Subminuette wave c subdivides as a five wave impulse.

There is no Fibonacci ratio between subminuette waves a and c.

Ratios within subminuette wave c are: there is no Fibonacci ratio between micro waves 1 and 3, and micro wave 5 is 0.87 short of 1.618 the length of micro wave 3.

So far to the upside there is a three wave structure. When this completes with micro wave 5 upwards it would be a clear five up, and this would add confidence to a trend change at the low of 1,674.99.

At 1,701 micro wave 5 would reach equality with micro wave 1. There is already a good Fibonacci ratio between micro waves 3 and 1; micro wave 3 is 1.32 short of 1.618 the length of micro wave 1. We may not see a Fibonacci ratio between micro wave 5 and either of 1 or 3 so this target at 1,701 does not have a high probability.

When micro wave 5 is completed I will expect a second wave correction. I would expect subminuette wave ii to most likely reach down to 0.618 the length of subminuette wave i.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement below 1,674.99.

The mid term target remains the same. At 1,777 minute wave iii would reach equality in length with minute wave i.