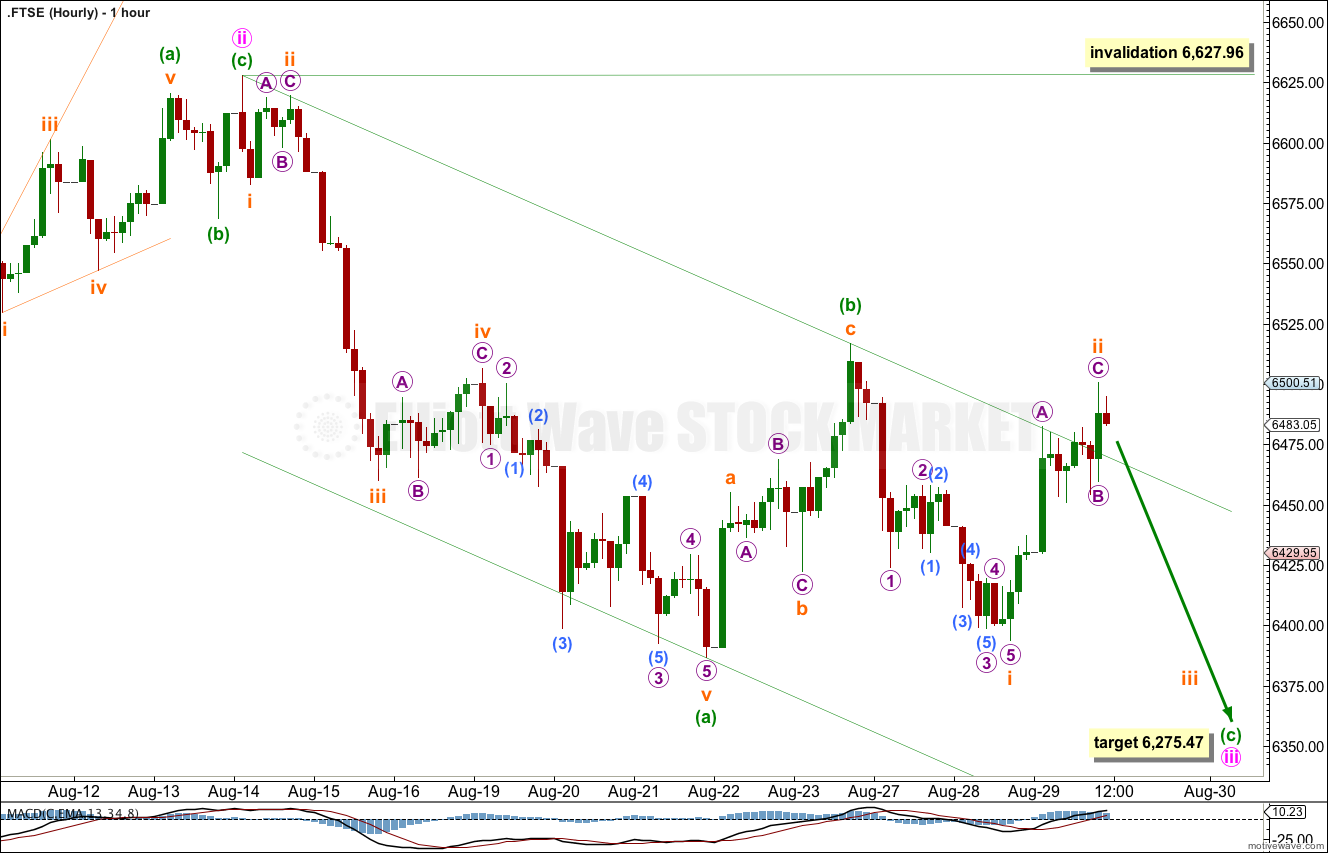

Last week’s analysis expected upwards movement to a target at 6,476 to 6,486. Price moved higher to 30.71 points above the target before turning lower.

The wave count remains the same.

Click on the charts below to enlarge.

This daily chart focusses on the structure of intermediate wave (4) within primary wave C of cycle wave b.

The correction for intermediate wave (4) is very unlikely to be over. I have tried to see if the downwards movement labeled minor wave A can subdivide as a three or a double three. It fits as neither. It does fit nicely as a five wave impulse, and this is likely only minor wave A of intermediate wave (4).

I would expect minor wave C to end just a little below 6,023 to avoid a truncation.

Minor wave C looks like it may be unfolding as an ending expanding diagonal because on the hourly chart the downwards movement for minute wave i subdivides perfectly as a three wave zigzag and cannot be seen as a five wave impulse.

Intermediate wave (4) may not move into intermediate wave (1) price territory. This wave count is invalidated with movement below 5,989.07.

With minute wave i subdividing only as a zigzag minor wave C must be an ending diagonal.

All the subwaves within an ending diagonal must subdivide as zigzags. Minute wave iii must subdivide as a zigzag.

So far within minute wave iii minuette wave (a) is a completed. Minuette wave (b) may be a completed zigzag as labeled, or it may move further sideways and a little higher as a flat, triangle or double. Because the downwards movement labeled subminuette wave i subdivides easily as a five wave impulse the probability that minuette wave (b) is over is high.

Ratios within minuette wave (a) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 1.07 points longer than 2.618 the length of subminuette wave i.

Ratios within subminuette wave v are: micro wave 3 has no Fibonacci ratio to micro wave 1, and micro wave 5 is 1.54 points longer than 0.382 the length of micro wave 3.

Within minuette wave (b) zigzag there is no adequate Fibonacci ratios between subminuette waves a and c.

Within subminuette wave b expanded flat correction, within minuette wave (b), micro wave C is 2.37 points short of 2.618 the length of micro wave A.

Ratios within subminuette wave i downwards are: micro wave 3 is 1.88 points longer than 0.618 the length of micro wave 1, and micro wave 5 is 1.09 points longer than 0.382 the length of micro wave 3.

Within subminuette wave ii there is no adequate Fibonacci ratio between micro waves A and C.

At 6,275.47 minuette wave (c) would reach equality with minuette wave (a).

If minuette wave (b) continues then it may not move beyond the start of minuette wave (a). Movement above 6,627.96 would invalidate this wave count.