Last week’s analysis of FTSE expected downwards movement for the week which is what we have seen. The wave count remains the same.

This week I will follow only the main monthly wave count. The alternate does not diverge in expectations for direction at this stage.

Also this week I will begin to analyse FTSE at the hourly chart level for you.

Click on the charts below to enlarge.

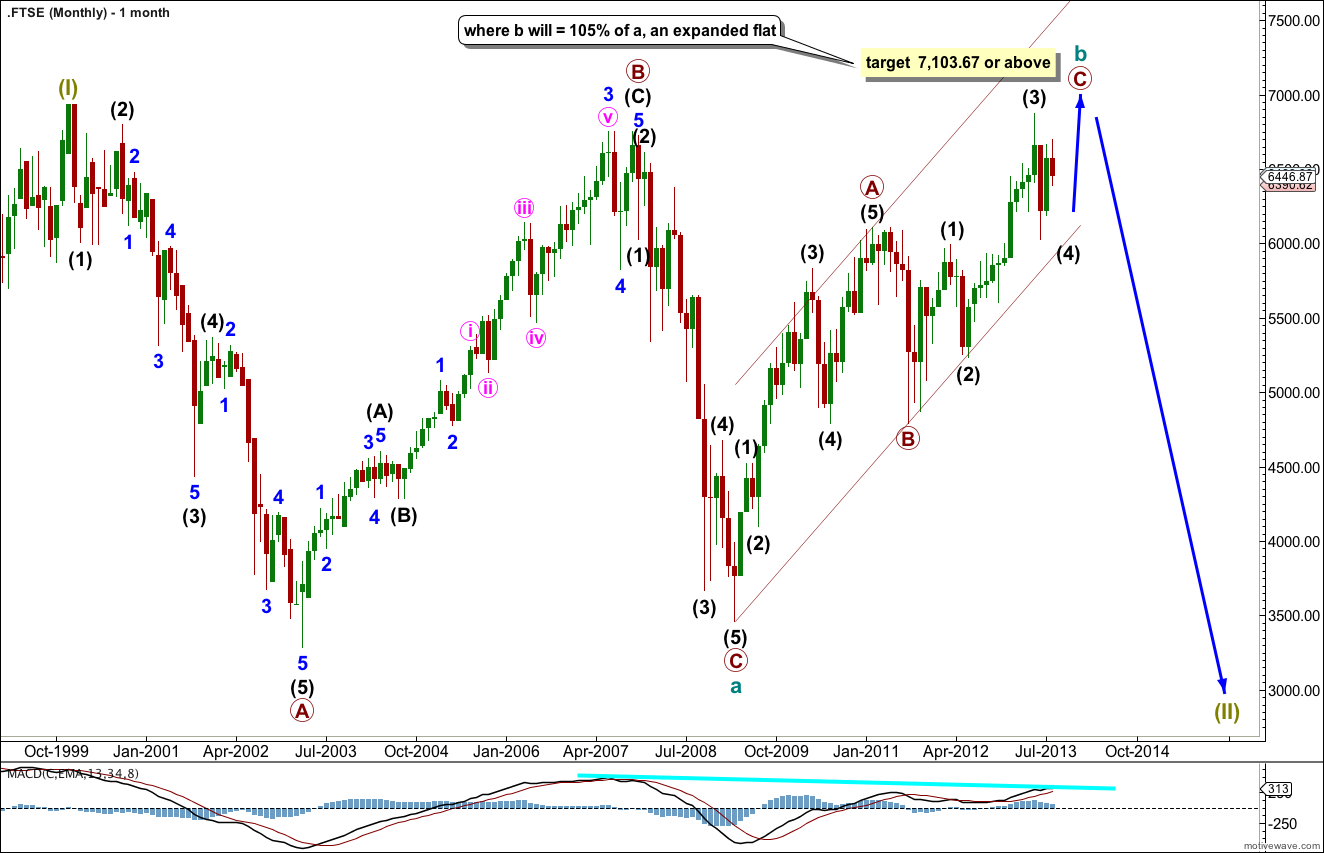

At super cycle degree this structure may be an expanded flat: cycle wave a subdivides into a three wave zigzag (with a truncated C wave), and cycle wave b subdivides into a corrective structure and has passed the minimum of 90% the length of wave a.

The most common type of flat is an expanded flat. This requires cycle wave b to reach up to 105% the length of cycle wave a at 7,103.67 or above. The last upwards wave is likely to reach this point.

When primary wave C is a completed five wave structure we may expect a trend change at cycle wave degree.

If cycle wave b reaches 105% the length of cycle wave a at 7,103.67 or above then we may expect cycle wave c to move substantially below cycle wave a at 3,460.71.

If cycle wave b ends before 7,103.67 then we may expect cycle wave c to end just slightly below 3,460.71 as the structure at super cycle wave degree would then be a regular flat correction.

This daily chart focusses on the structure of intermediate wave (4) within primary wave C of cycle wave b.

The correction for intermediate wave (4) is very unlikely to be over. I have tried to see if the downwards movement labeled minor wave A can subdivide as a three or a double three. It fits as neither. It does fit nicely as a five wave impulse, and this is likely only minor wave A of intermediate wave (4).

I would expect minor wave C to end just a little below 6,023 to avoid a truncation.

Minor wave C looks like it may be unfolding as an ending expanding diagonal because on the hourly chart the downwards movement for minute wave i subdivides perfectly as a three wave zigzag and cannot be seen as a five wave impulse.

Intermediate wave (4) may not move into intermediate wave (1) price territory. This wave count is invalidated with movement below 5,989.07.

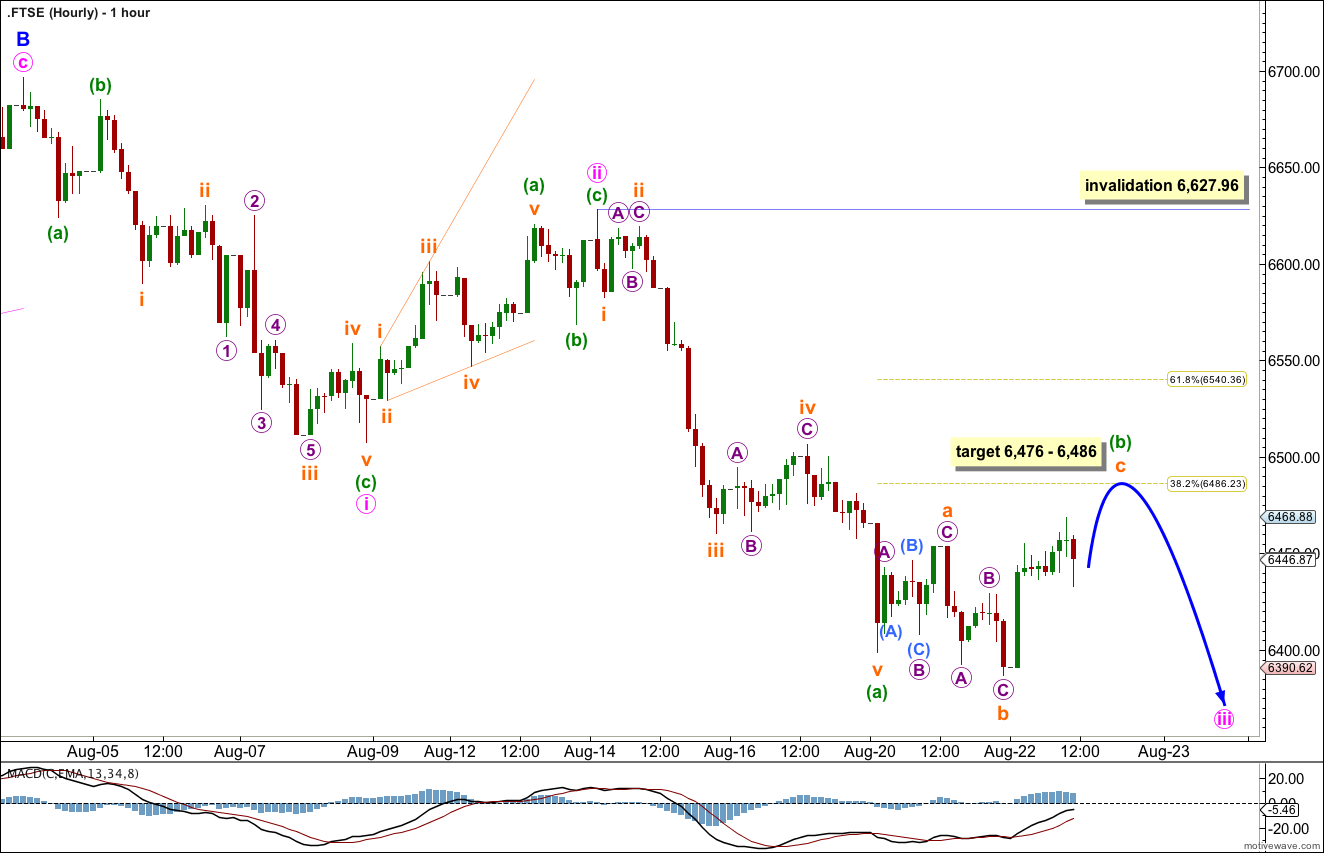

This hourly chart focusses on minor wave C.

Minute wave i subdivides as a zigzag. Within this zigzag minuette wave (c) is 19.05 points short of 2.618 the length of minuette wave (a).

Within minuette wave (c) there are no adequate Fibonacci ratios between subminuette waves i, iii and v.

Ratios within subminuette wave iii of minuette wave (c) are: micro wave 3 is 9.33 points short of 1.618 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to either of micro waves 1 or 3.

Within minute wave ii zigzag there is no Fibonacci ratio between minuette waves (a) and (c).

Within an ending diagonal all the subwaves must subdivide as zigzags. This is why minute wave iii is labeled as a zigzag, and this is the only structure where you will see a third wave labeled as anything other than an impulse.

Within minute wave iii minuette wave (a) is a completed five wave impulse.

Ratios within minuette wave (a) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 9.57 points longer than 0.618 the length of subminuette wave iii.

Within minute wave iii zigzag minuette wave (b) is an incomplete expanded flat correction. Subminuette waves a and b both subdivide nicely as three wave zigzags. Submineutte wave b is a 122% correction of subminuette wave a. At 6,476 subminuette wave c would reach 1.618 the length of subminuette wave a. At 6,486 minuette wave (b) would reach the 0.382 Fibonacci ratio of mineutte wave (a). This gives us a 10 point target zone for a little more upwards movement.

When mineutte wave (b) is complete then minuette wave (c) should unfold downwards as a five wave structure. Minuette wave (c) is extremely likely to make a new low below the end of minuette wave (a) at 6,398.63 to avoid a truncation. When I know where minuette wave (b) has ended then I can calculate a target for minuette wave (c) downwards for you.

Within the zigzag of minute wave iii minuette wave (b) may not move beyond the start of minuette wave (a). This wave count is invalidated with movement above 6,627.96.

EMA(13) / EMA(34) APEX bounce and now bearish crossover … Looking for a drop under 1621 with you now http://scharts.co/17Ok0rf