Last week’s analysis expected more upwards movement from gold towards a short term target at 1,431. Price did move higher but has fallen well short of the target.

Click on the charts below to enlarge.

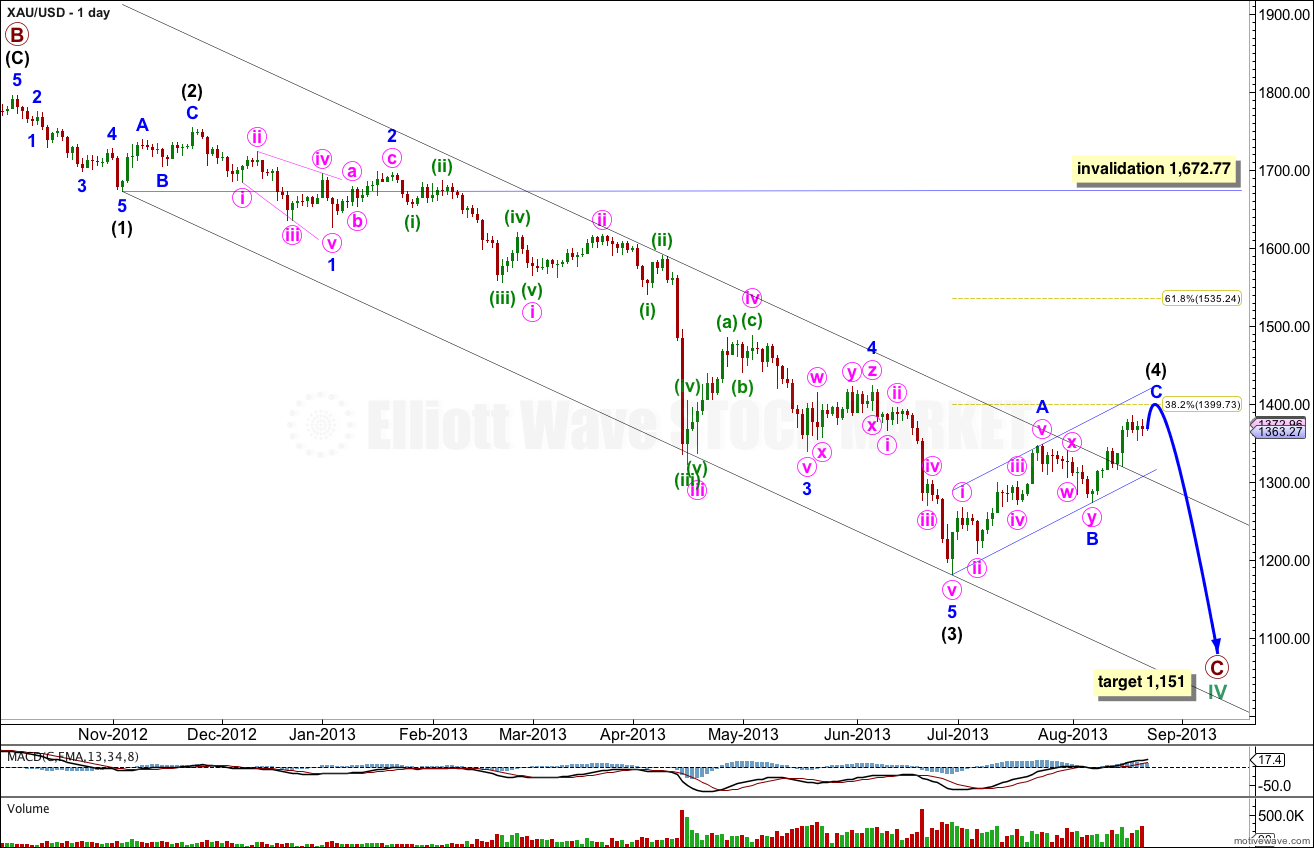

This daily chart focuses on the new downwards trend of primary wave C within a cycle degree wave IV.

Within primary wave C intermediate waves (1) through to (3) are complete.

Intermediate wave (4) so far has lasted eight weeks and it is incomplete. Intermediate wave (2) lasted three weeks and was a deep 66% zigzag.

Within intermediate wave (4) movement should be very choppy and overlapping. At this stage it looks like it may be unfolding as a zigzag because minor wave A subdivides as a completed five wave impulse and minor wave B subdivides as a zigzag. Minor wave C is incomplete.

At 1,441 minor wave C would reach equality in length with minor wave A. This target should be met in another week or two.

At 1,151 primary wave C would reach 1.618 the length of primary wave A. This target is a long term target. When we know where intermediate wave (4) has ended within primary wave C then we may use a second wave degree to also calculate this target, and it may widen to a zone or may change.

Within primary wave C intermediate wave (4) may not move into intermediate wave (1) price territory. This wave count is invalidated with movement above 1,672.77.

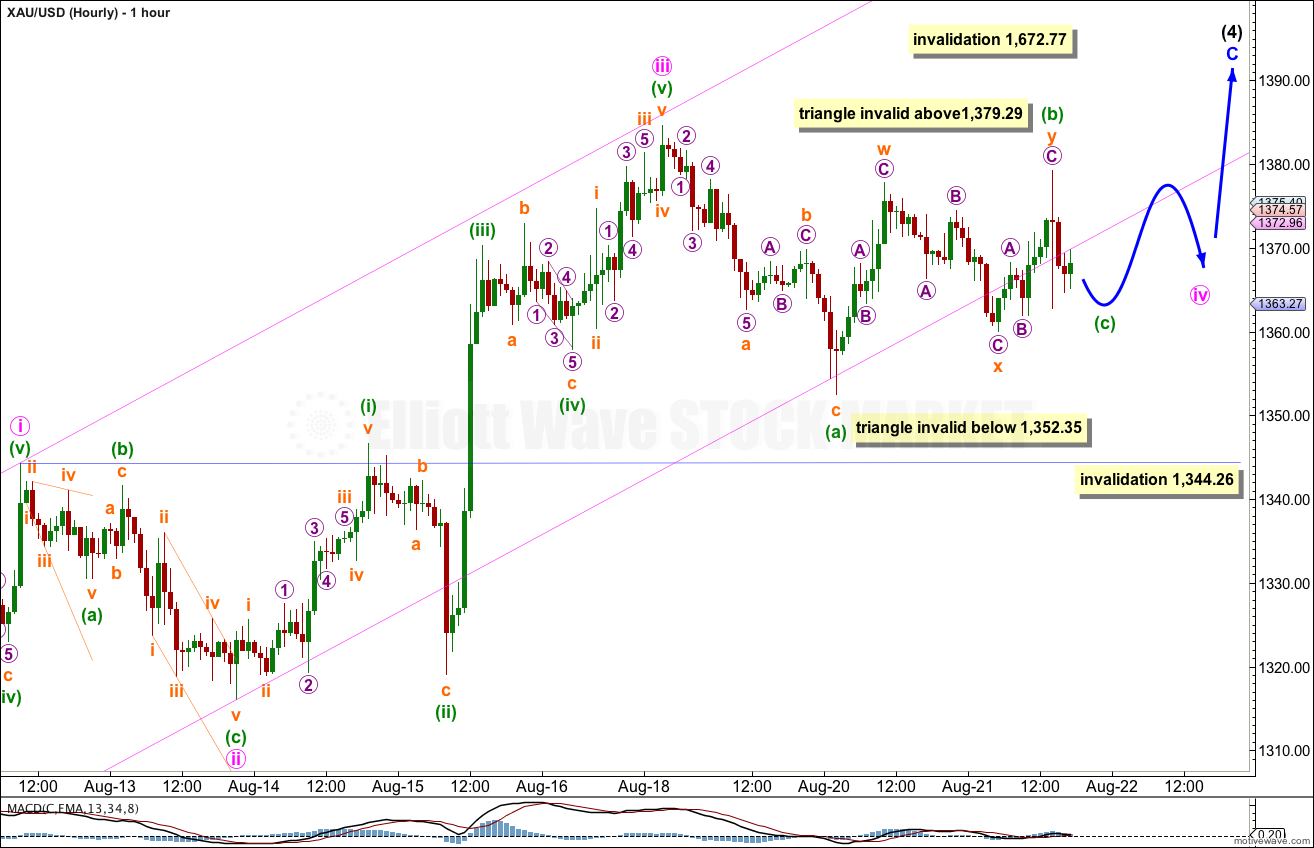

Upwards movement completed a third wave, minute wave iii, within minor wave C. Minute wave iii is 2.62 short of equality with minute wave i. This limits minute wave v to come to no longer than equality with minute wave iii which was 68.58 in length.

Ratios within minute wave iii are: minuette wave (iii) is 1.80 longer than 1.618 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to either of minuette waves (i) or (iii).

Within minuette wave (v) of minute wave iii are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.40 longer than 0.382 the length of subminuette wave iii.

The movement within minute wave iv may be a regular contracting triangle unfolding. It looks like minuette wave (b) within it is completed, and because this is less than 90% the length of minuette wave (a) it cannot be a flat. Because minuette wave (b) unfolds as a double zigzag a combination is unlikely, because the X wave within a combination may only subdivide into a simple three and may not itself be a combination.

If this analysis is correct for minute wave iv then we should expect more very choppy overlapping sideways movement for another day to three as the triangle completes. Following this we should see a sharp upwards thrust as minute wave v completes, which may not be longer than 68.58.

For the triangle to remain valid minuette wave (c) may not move below the end of minuette wave (a) at 1,352.35 and minuette wave (d) may not move above 1,379.29. Although, if the triangle is a barrier triangle then minuette wave (d) may move very slightly above 1,379.29, as long as the B-D trend line is essentially flat. The upper invalidation point for the triangle is not as firm as the lower invalidation point.

Minute wave iv may also be unfolding as an expanding triangle, but the rarity of this structure means the probability is very low.

Minute wave iv may also be unfolding as a combination and the X wave within it may be incomplete. It may also be a more time consuming flat correction with the B wave within it incomplete. I will consider these other possibilities if they show themselves.

What’s clear is this correction is incomplete.

When minute wave iv is complete then I will recalculate the target for minor wave C to end. I cannot do that for you yet.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,344.26.

When minute wave iv is completed the lower invalidation point no longer applies.

As far as Gold Goes I see Gold finished its downtrend and hit double bottom and now will go above the previous wave which Positive divergence on MACD which i underlined perfectly suggests so and this could be a W shape and we see gold rise back as far as 1800 I don’t see how people suggest gold to go to 1000$ although yea that death cross on weekly chart may sure take it there but that Positive MACD divergence just breaking my head and is like a needle in my brain and i think the 5th wave was a failed 5th wave and finished as double bottom

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You definitely know what youre talking about, why throw away your intelligence on just posting

videos to your weblog when you could be giving us something

informative to read?

Hi LARA .. whene are you going to post the new analyses .. what about gold now .. hit 1422

Later today. I can only do one market at a time!

It’s now on Elliott Wave Gold. There’s a link on the right hand sidebar too.

Ya i see it now thanks alot

Hi Lara,

what I would find very helpful for the trading of gold on your new daily website (www.???), if you would give hints to people who are kind of “beginners” with elliott wave theory, “where to set limits for trades”. In other words to mention price marks which show from your elliott wave perspective a relativ high probability – if your count is valid- not to go above or beneath. Thanks a lot and greetings from Germany:-)

Susanne

Hi Susanne,

I completely understand the wish to have more guidance as to when to enter and exit trades, but I am not legally able to do this. I am not a registered investment advisor so I cannot legally offer trading advice.

What I can do is provide the best analysis I’m capable of so that I’m able to predict direction correctly more often than not. It is up to each individual to make their own trading decisions based upon their risk appetite.

My eBook “Money Wave” outlines a strategy for how to use EW analysis in trading, as does this article in my category “trading tips”.

My invalidation points are good places to set stop losses, my targets are good points to take profit. That’s the general idea. I provide confirmation points and advise at which points beyond I have more confidence in the wave count. If you have a low appetite for risk the idea here is to wait for a confirmation point to be passed before entering the trade.

Hi Lara, I can see gold has hit your target of 1399.71 and paused. Do you still expect a turning here or is 1535 a possibility for the end of the 4th wave?

Kind regards

The structure is now complete so I’d expect a turn. I would use the parallel channel about minor wave C as first confirmation; when the channel is breached minor wave C should be over. Also movement below 1,355.31 would provide price confirmation of a trend change.

I expect intermediate wave (5) should begin here or very soon.

Many thanx Lara, just one more question and that is about news and how it affects TA. With the Syrian situation going on does this have the potential to affect the labeling on the EW count?

Kind regards