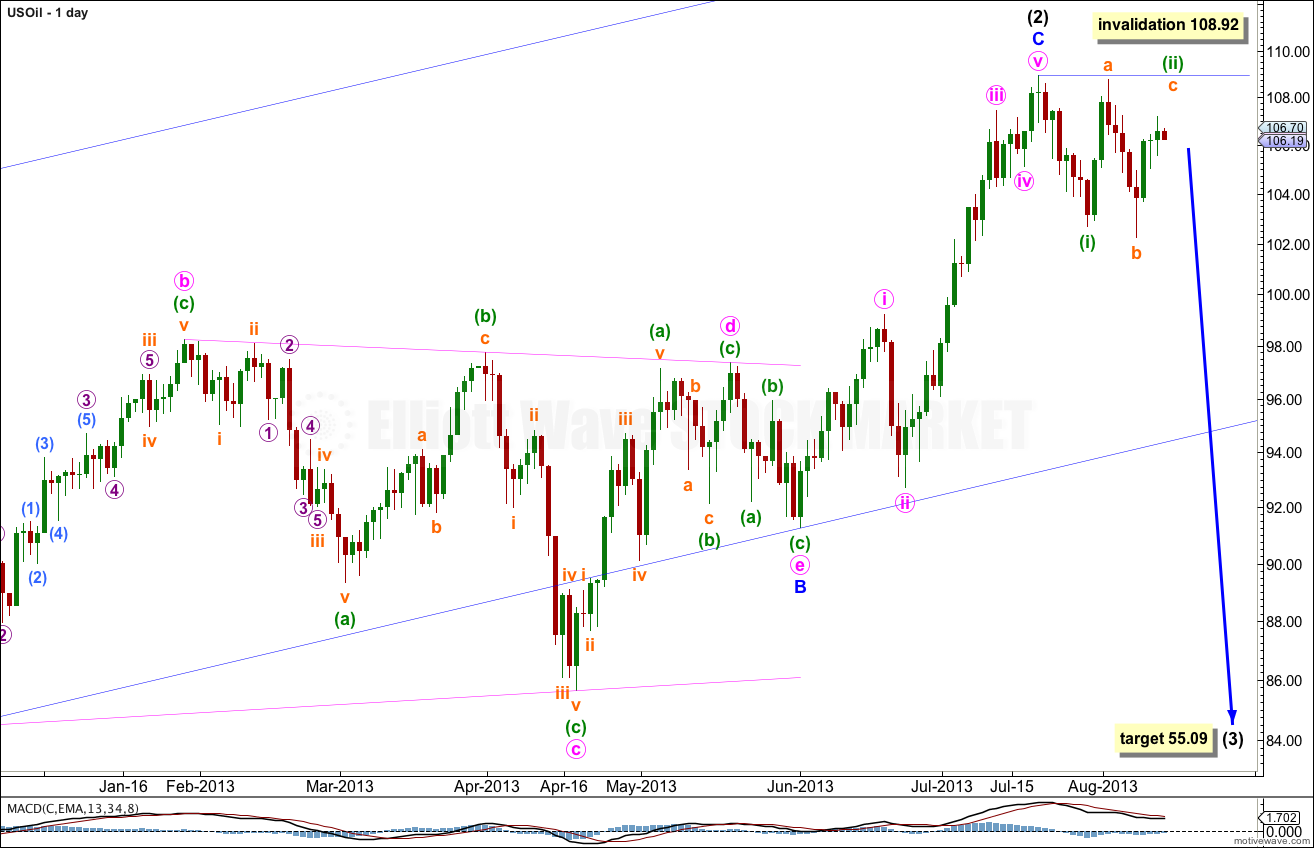

Last week’s analysis expected downwards movement to a short term target at 98.66 or 92.42. Price did move lower to make a new low at 102.24 but then turned back upwards. Price remains below the invalidation point on the daily chart and the wave count remains valid.

Click on the charts below to enlarge.

Within a cycle degree c wave downwards primary waves 1 and 2 are complete. Within primary wave 3 intermediate waves (1) and (2) are complete, with the start of intermediate wave (3) at 108.92.

There is a clear evening doji star candlestick pattern at the high of intermediate wave (2) indicating a trend change here.

At 55.09 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Within intermediate wave (3) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 108.92.

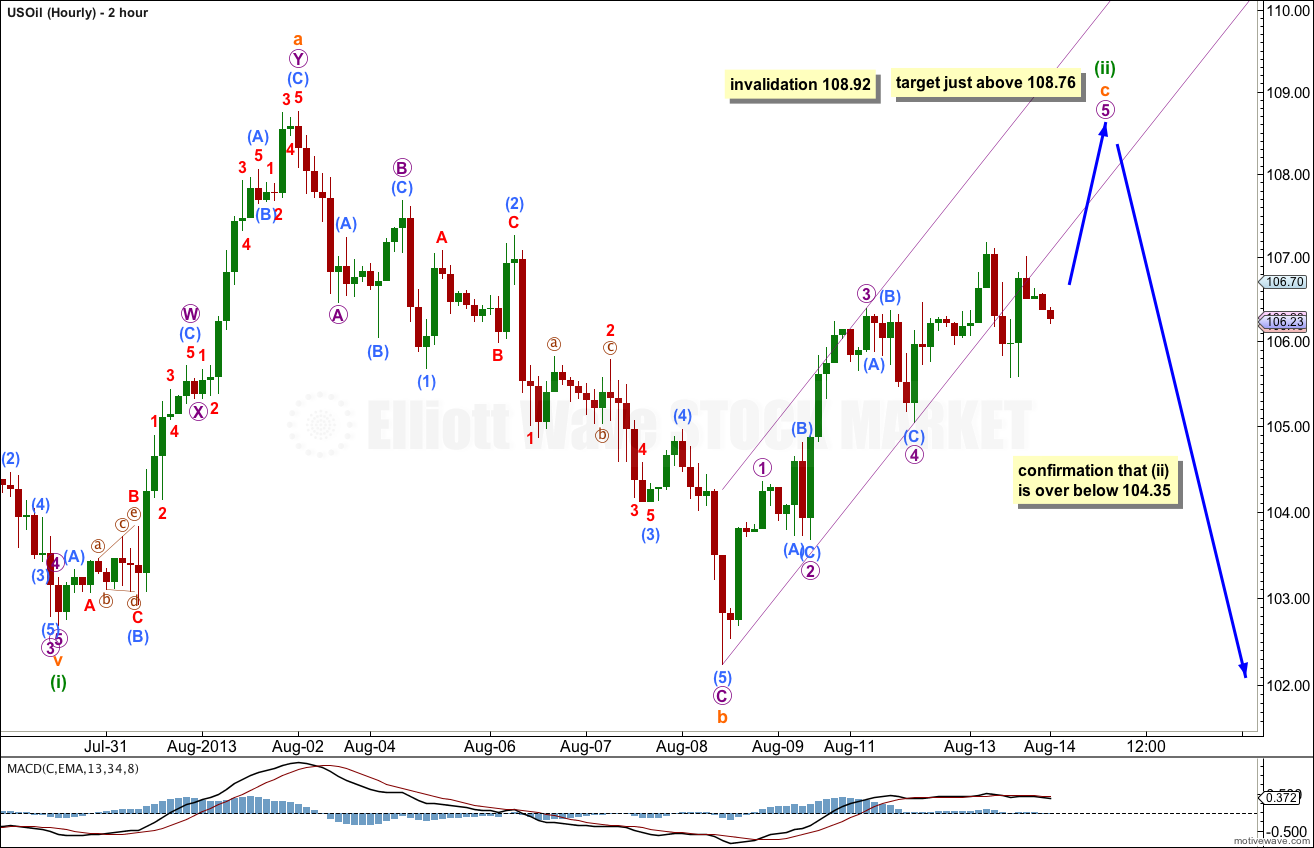

I have reanalysed the upwards movement labeled now subminuette wave a within minuette wave (ii) as a double zigzag. The previous analysis of a single zigzag here did not look right, with a very short A wave and a very long C wave with no Fibonacci ratio between them.

The downwards movement labeled here submineutte wave b fits best as a three wave zigzag. I cannot see a five wave structure in here. This is an indication that minuette wave (ii) may not be over and may be continuing as a flat correction. Within it subminuette wave c is an incomplete five wave impulse.

If subminuette wave c fails to end at or above 108.76 then the structure will be a running flat. It is likely that subminuette wave c will end a little above 108.76, or very close to it. There is no Fibonacci ratio between micro waves 3 and 1, with micro wave 3 longer by 0.60.

There is another possibility that minuette wave (ii) was over as a double zigzag at the high labeled subminuette wave a at 108.76, and movement from this point is a first and second wave of a leading diagonal for the start of minuette wave (iii). The expected direction and invalidation point is the same (I will not chart this option this week).

When we see price move below 104.35 then downwards movement may not be a fourth wave correction within subminuette wave c and so subminuette wave c and minuette wave (ii) must be over. At that stage I would expect that a third wave downwards is unfolding.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 108.92.