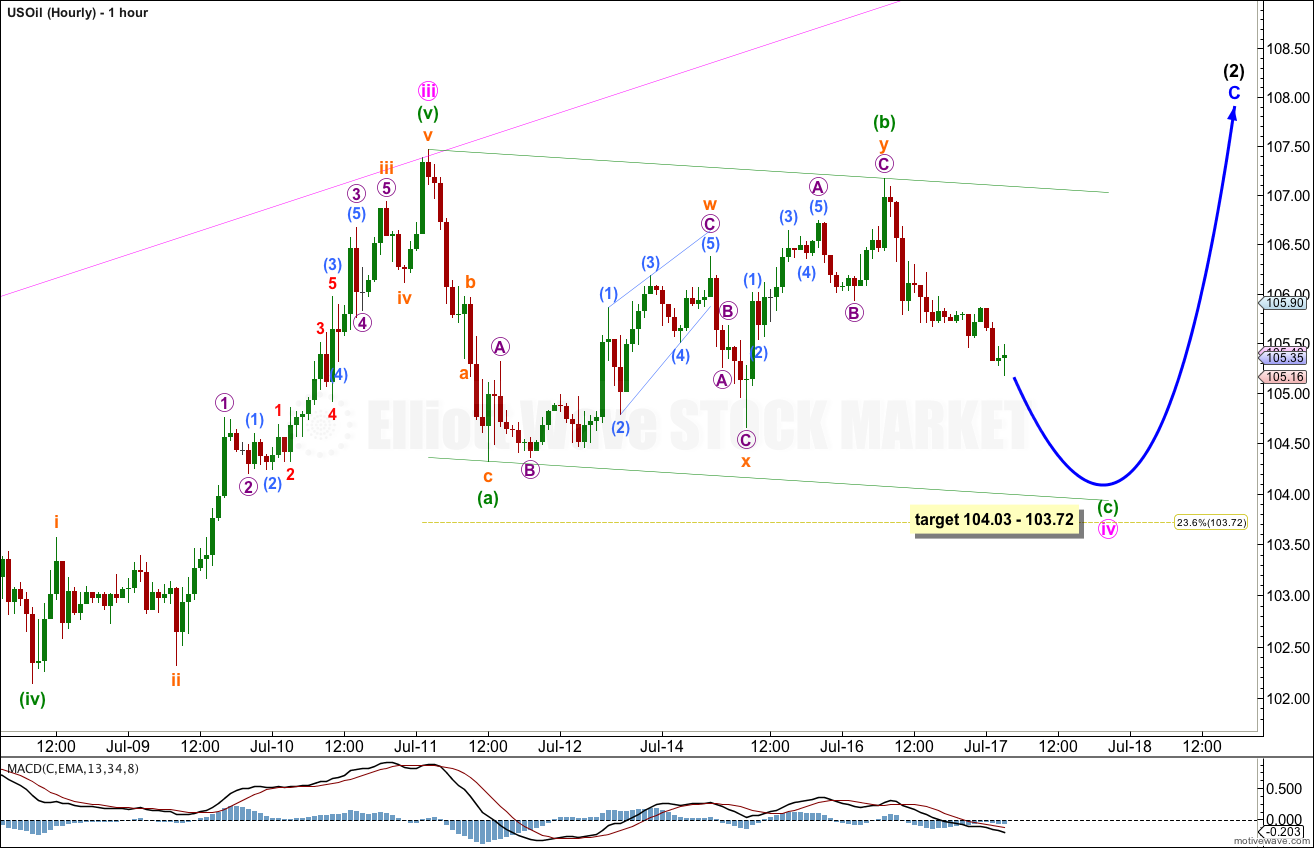

Last week’s analysis expected more upwards movement to a short term target at 105.57 to 105.60. Price has reached up to 107.46, 1.86 above the small target zone, before turning lower and breaching the small parallel channel drawn on last week’s hourly chart indicating a short term trend change.

Click on the charts below to enlarge.

Intermediate wave (2) is an incomplete zigzag. Within it minor wave B was a triangle and minor wave C is unfolding as an impulse which is incomplete.

Within the impulse of minor wave C minute waves i, ii and now iii are complete. Minute wave ii was a very deep 82% zigzag correction. Given the guideline of alternation I will expect minute wave iv to be a relatively shallow flat, triangle or combination.

There is no adequate Fibonacci ratio between minute waves iii and i. I will expect to see a Fibonacci ratio between minute wave v and either of iii or i.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 99.21.

We may now use Elliott’s channeling technique to draw a channel about minor wave C. Draw the first trend line from the highs labeled minute waves i to iii, place a parallel copy upon the low of minute wave ii. Expect minute wave iv to find support at the lower edge of this channel.

Intermediate wave (2) may not move beyond the start of intermediate wave (1). This wave count is invalidated with movement above 110.56.

Minute wave iv looks incomplete so far. It looks like it is unfolding as a shallow regular flat correction.

Within minute wave iv minuette wave (a) subdivides nicely as a zigzag. Minuette wave (b) is a complete double zigzag and is a 91% correction of minuette wave (a) meeting the mininum requirement of 90% for a flat and indicating a regular flat may be unfolding.

This wave count expects a five wave structure downwards to complete for minuette wave (c) which may find support at the lower edge of the parallel channel containing minute wave iv. This may end about the 0.236 Fibonacci ratio of minute wave iii at 103.72.

At 104.03 minuette wave (c) would reach equality in length with minuette wave (a).

This gives us a small 0.31 cent target zone for the end of a little more downwards movement.

If minuette wave (c) continues lower through this target zone and below the small parallel channel containing the flat correction of minute wave iv then expect downwards movement to find support at the lower edge of the parallel channel drawn on the daily chart.

When minute wave iv is complete then we should expect more upwards movement most likely to new highs above 107.38 as the final fifth wave upwards completes.