Last week expected upwards movement for the Dow. We did see some upwards movement, but only after the main daily wave count was invalidated.

I have two new wave counts for you this week. While price remains below 15,340.09 and above 14,551.27 both wave counts will remain valid. Price needs to break out of this range to give us clarity.

Click on the charts below to enlarge.

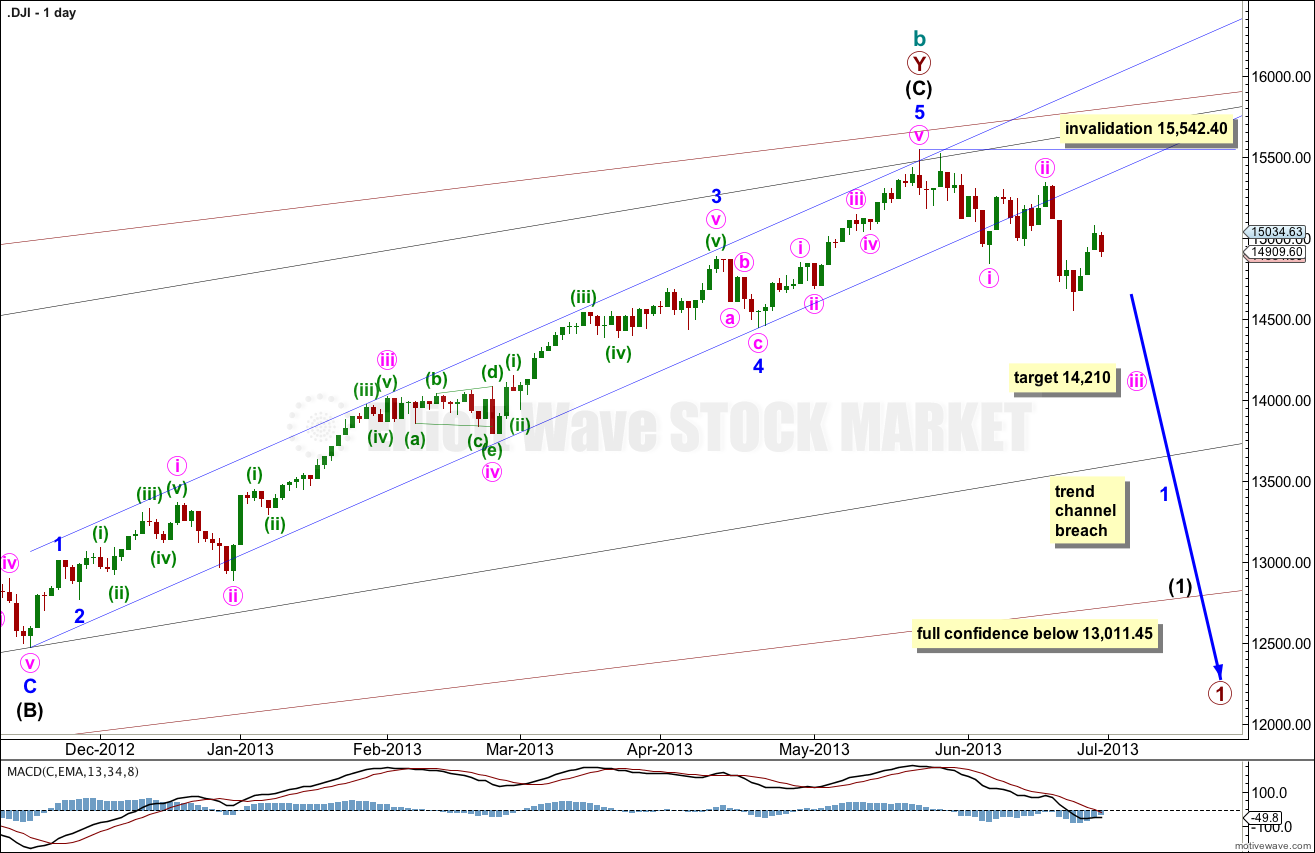

Main Wave Count.

It is possible that we have seen a trend change at cycle degree. However, we do not have confirmation of a trend change yet. The next downwards trend for cycle wave c should last between one to several years and take price substantially below 6,469.95. It would be wise to wait for some confirmation of a trend change of this size before having confidence in it.

We may use a parallel channel about primary wave Y to confirm this trend change. Because double zigzags are reasonably common and triples are very rare when the second zigzag within a multiple is over the probability that the entire correction is over is extremely high. Also in this case cycle wave b is already longer than the maximum common length in relation to cycle wave a of a flat correction and it would be likely it would not continue yet higher. When the channel about the zigzag of primary wave Y is breached that will provide confirmation that the structure for primary wave Y is over, and at that stage it would be extremely likely that cycle wave b would be over.

Within the new downwards trend at 14,210 minute wave iii would reach 1.618 the length of minute wave i.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count would be invalidated with movement above 15,542.40.

We may have full and final confidence in this trend change at cycle degree with price movement below 13,011.45. At that stage the alternate would be invalidated.

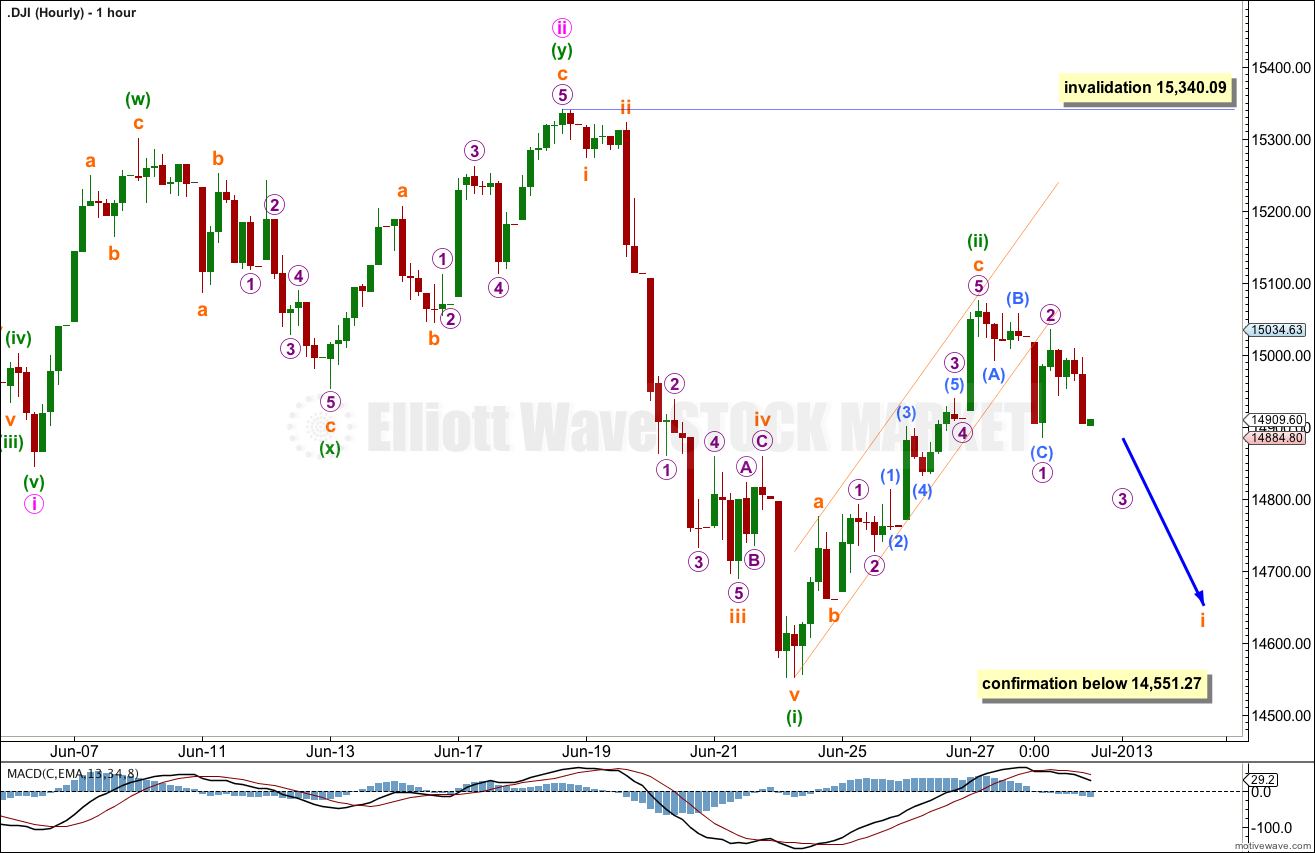

Within minute wave iii we may have seen the end of minuette waves (i) and (ii) last week. Minuette wave (ii) is a 66% correction of minuette wave (i).

The structure for minuette wave (ii) fits best as a complete zigzag and it is already a very deep correction. It looks most likely to be over here. However, this structure is ambiguous and it may only be submimuette wave a within the zigzag. Minuette wave (ii) may yet continue a little higher. It may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 15,340.09.

Within the new downwards trend there may be a leading diagonal unfolding for subminuette wave i. The next small downwards movement should move price below 14,884.80. Thereafter, the fourth wave of the diagonal should overlap back into first wave price territory, but may not move beyond the end of the second wave. The final fifth wave may not be truncated.

Overall this main wave count expects choppy overlapping downwards movement for the start of the week, followed by a deep second wave correction for subminuette wave ii. Subminuette wave iii should show a strong increase in downwards momentum.

Movement below 14,551.27 would provide confirmation of this wave count next week. At that stage minuette wave (ii) would have to be over and minuette wave (iii) would have moved beyond the end of minuette wave (i).

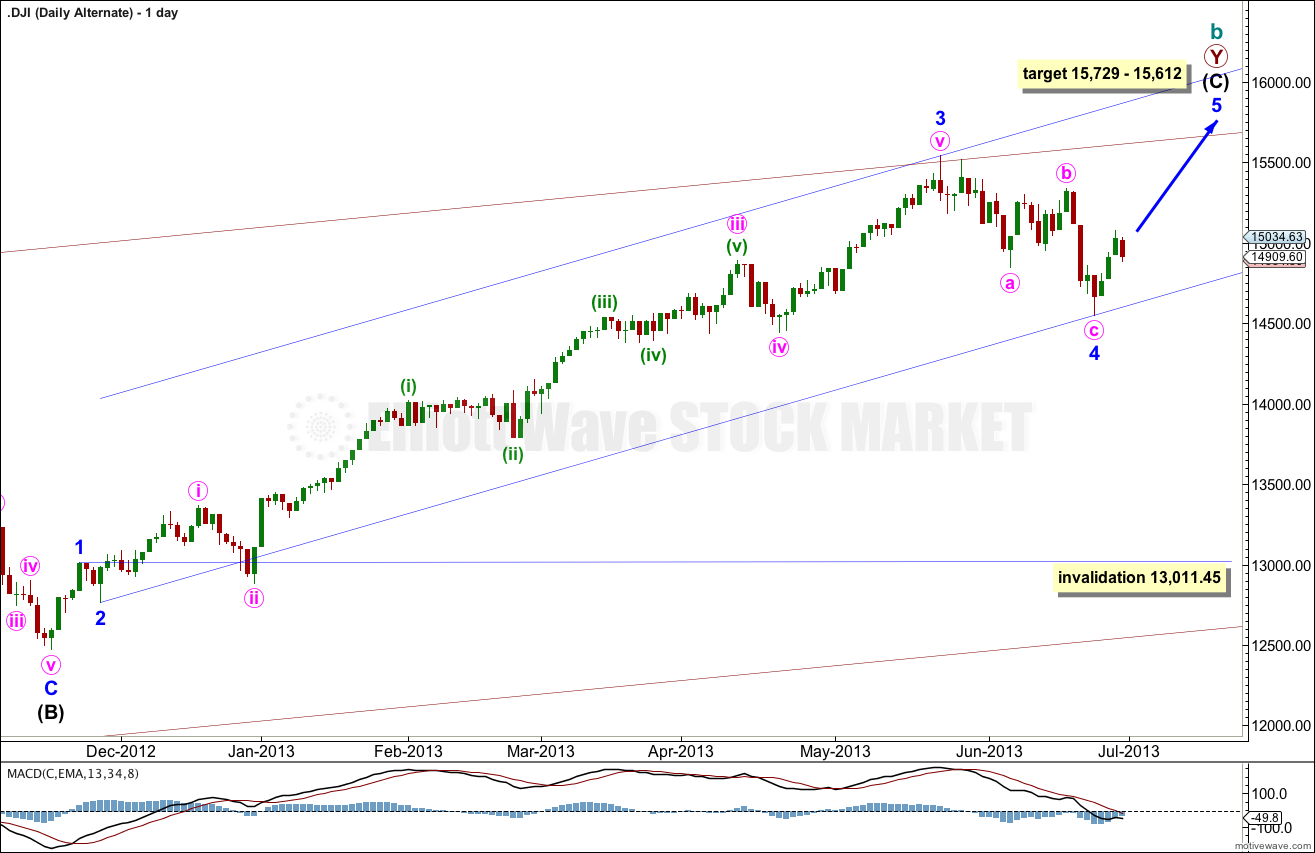

Alternate Wave Count.

I have readjusted the labeling within intermediate wave (C) back to that used up to the middle of May, 2013. Within it minor wave 1 may have been a short brief wave, with minor wave 3 a long extension. This wave count agrees with MACD: it sees the strongest upwards momentum as within a third wave. There is no classic technical divergence between price trending higher and MACD trending higher which indicates we may not have seen a trend change.

The biggest problem with this alternate at this stage and the reason why it has a lower probability than the main wave count is the size of minor wave 4 in comparison to all the other corrections within intermediate wave (C). It is hugely out of proportion giving this wave count a rather odd look and reducing the probability.

At 15,729 intermediate wave (C) would reach equality with intermediate wave (A).

At 15,612 minor wave 5 would reach 0.382 the length of minor wave 3. This gives us a 117 point target zone if there is to be a final upwards wave lasting a few weeks before the trend change at cycle degree.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 13,011.45.

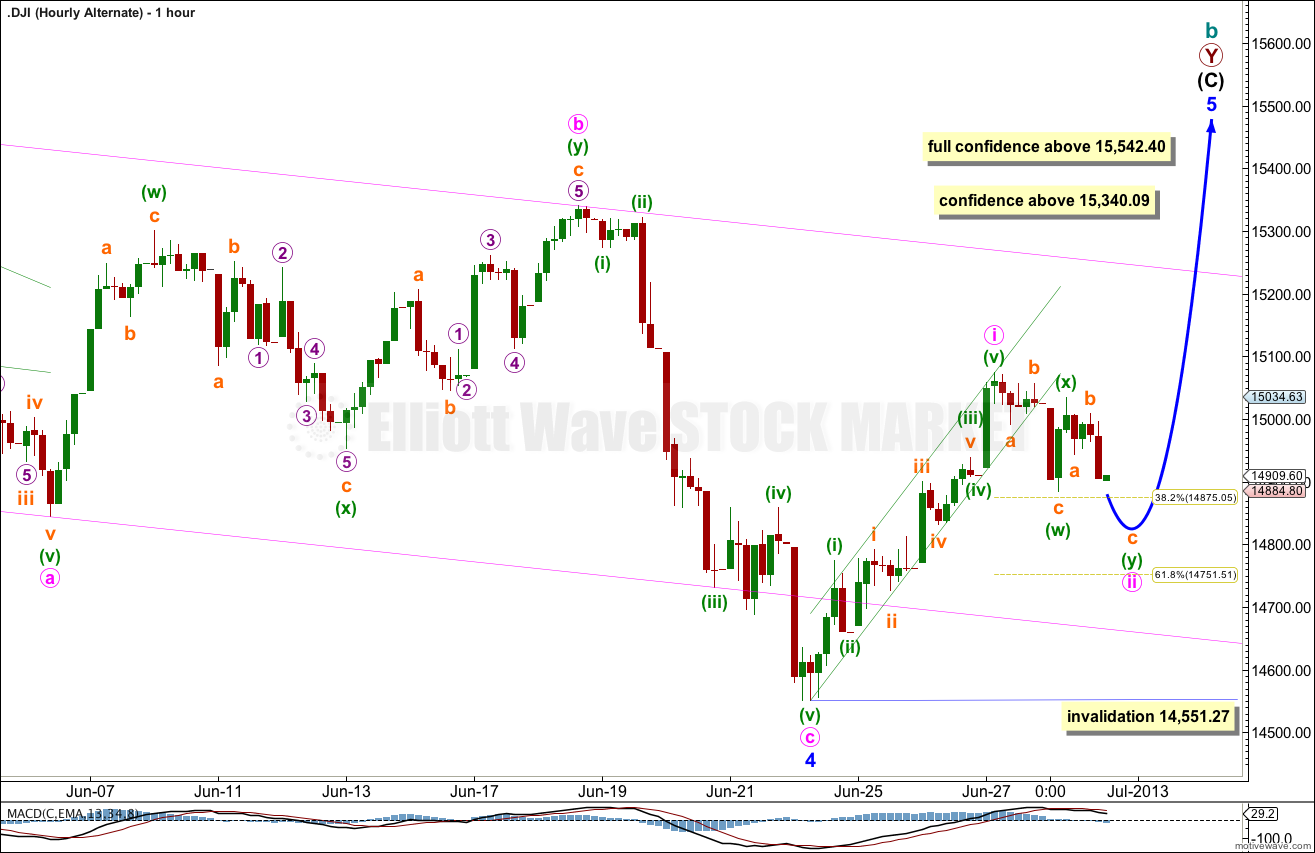

Within minor wave 5 so far upwards movement can be seen as a five wave impulse. Friday’s sideways and slightly lower movement may have been the start of minute wave ii as a double zigzag or double combination.

Within minute wave ii the second structure of the double labeled minuette wave (y) may unfold either as a zigzag, flat or triangle.

Minuette wave ii may not move beyond the start of minuette wave i. This wave count is invalidated with movement below 14,551.27.

Movement above 15,340.09 would invalidate the main hourly wave count and provide some confidence to this alternate.