At the request of a member here is a wave count for BHP.

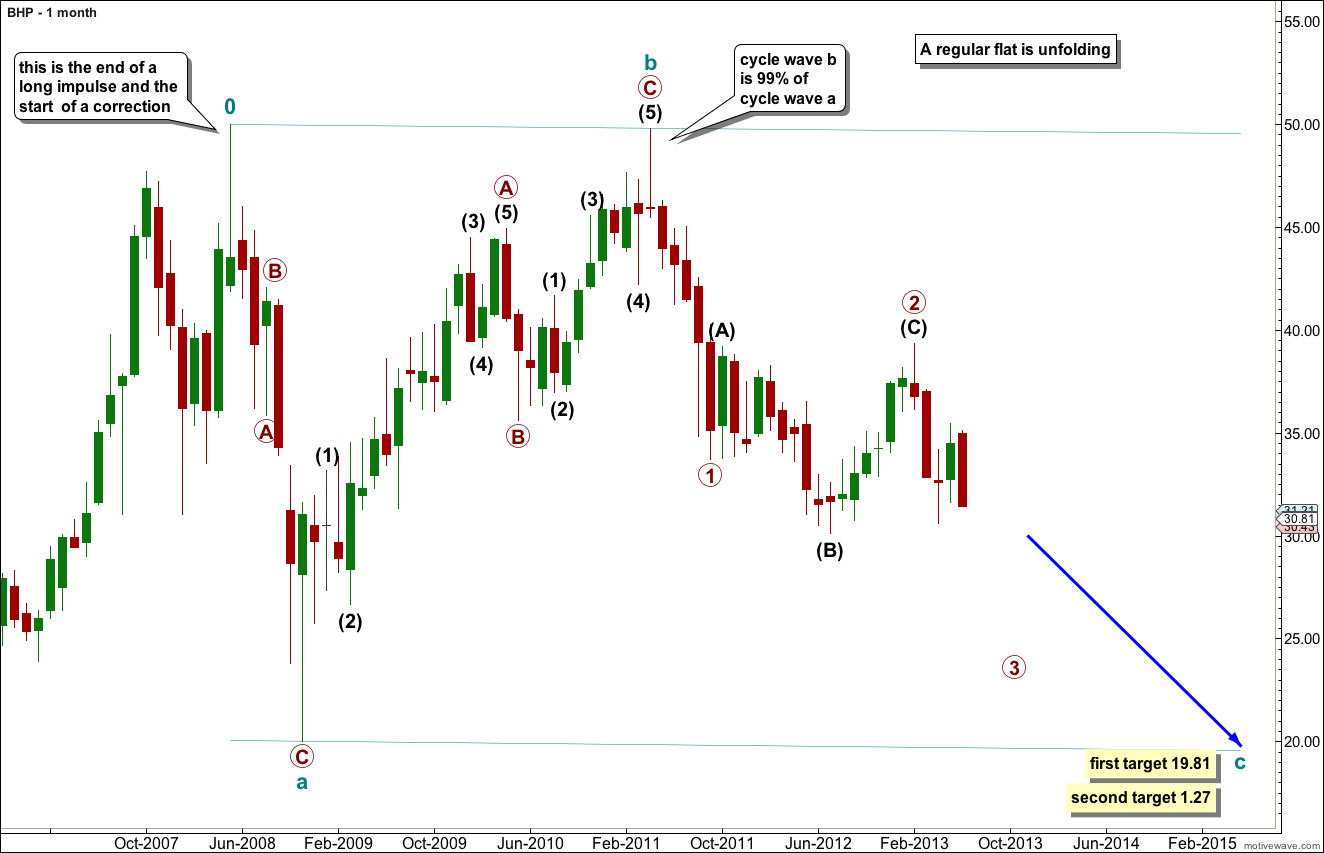

I have started the wave count at the all time high at $50 on May, 2008. Prior to this point it looks like a long cycle or super cycle degree impulse completed upwards. My wave count will focus on the following correction which is at super cycle or cycle degree because the purpose is to see if the trend is over or will continue downwards.

Click on the charts below to enlarge.

The corrective structure is a regular flat. Cycle wave a subdivides into a three wave zigzag. Cycle wave b is also a three and is 99% of cycle wave a. Cycle wave c is incomplete and may end about the lower edge of the trend channel, about the same level as cycle wave a. If cycle wave c reaches equality with cycle wave a it will end at 19.81.

However, the structure within cycle wave c so far indicates it may extend. If the next wave down shows an increase in momentum it may be a third wave within cycle wave c and so cycle wave c may reach 1.618 the length of cycle wave a at 1.27.

Within cycle wave a primary wave C is just 0.87 short of 1.618 the length of primary wave A.

Within cycle wave b primary wave C is 1.18 short of 0.618 the length of primary wave A.

Within primary wave A of cycle wave b there are no adequate Fibonacci ratios between intermediate waves (1), (3) and (5).

Within primary wave C of cycle wave b there are no adequate Fibonacci ratios between intermediate waves (1), (3) and (5).

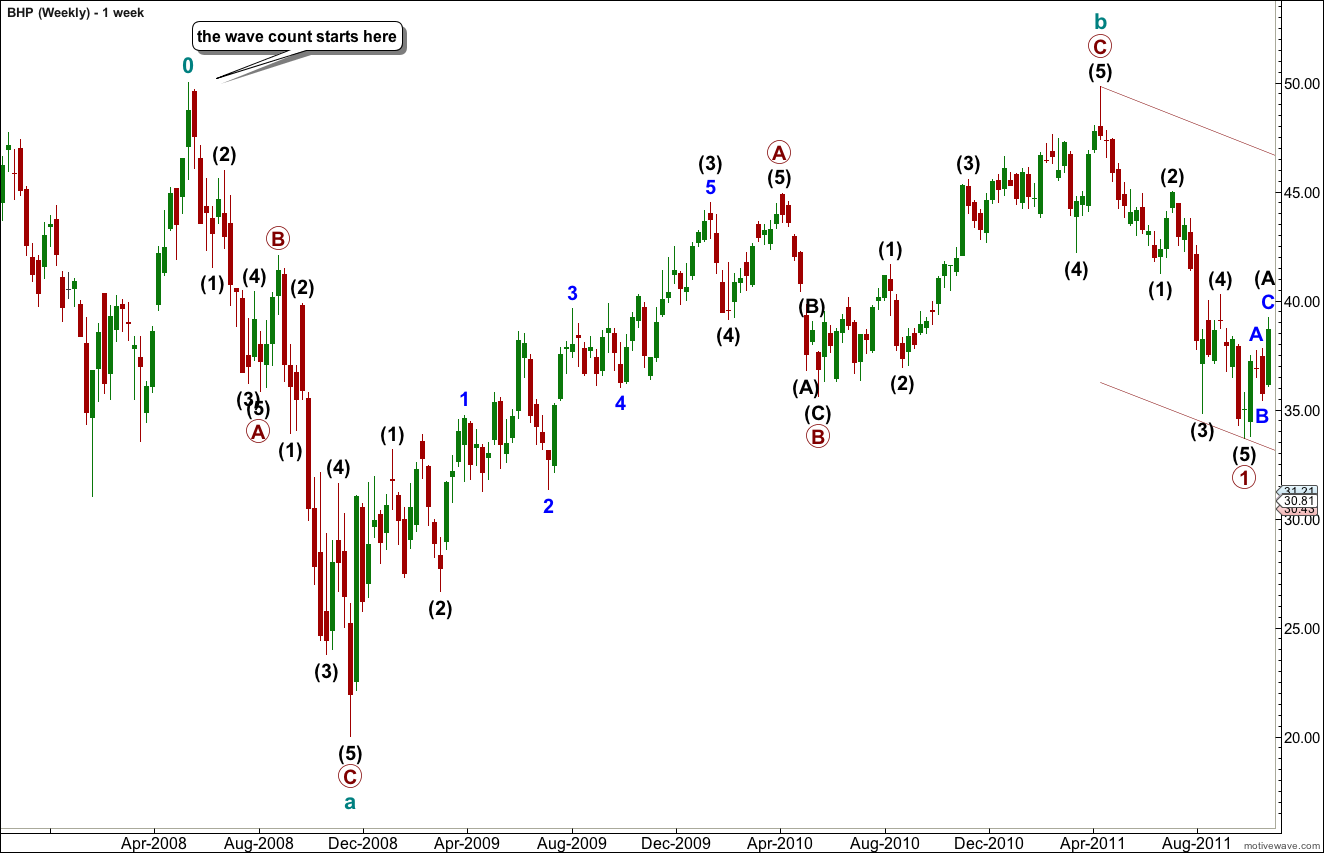

This weekly chart looks at the structure within cycle waves a and b.

Within primary wave A of cycle wave a there are no adequate Fibonacci ratios between intermediate waves (1), (3), and (5).

Within primary wave C of cycle wave a there are no adequate Fibonacci ratios between intermediate waves (1), (3), and (5).

Within intermediate wave (3) of primary wave A of cycle wave b ratios are: minor wave 3 is 0.20 longer than equality with minor wave 1, and minor wave 5 is 0.17 longer than equality with minor wave 3.

Within primary wave B intermediate wave (C) is 0.33 longer than 0.382 the length of intermediate wave (A).

Ratios within primary wave 1 within cycle wave c are: there is no Fibonacci ratio between intermediate waves (3) and (1), and intermediate wave (5) is 0.29 longer than 0.618 the length of intermediate wave (3).

Primary wave 2 is an expanded flat correction. Within it intermediate wave (B) is a 165% correction of intermediate wave (A). Intermediate wave (C) is just 0.30 longer than 1.618 the length of intermediate wave (A).

Within intermediate wave (A) of primary wave 2 minor wave C is 0.24 longer than equality with minor wave A.

Within intermediate wave (B) of primary wave 2 minor wave C is 0.51 short of 1.618 the length of minor wave A.

Within minor wave B of intermediate wave (B) of primary wave 2 there is no Fibonacci ratio between minute waves a and c.

Ratios within minor wave C of intermediate wave (B) of primary wave 2 are: minute wave iii has no adequate Fibonacci ratio to minute wave i, and minute wave v is 0.23 short of equality with minute wave i.

Ratios within intermediate wave (C) of primary wave 2 are: minor wave 3 is 0.36 longer than equality with minor wave 1, and minor wave 5 is exactly 0.618 the length of minor wave 3.

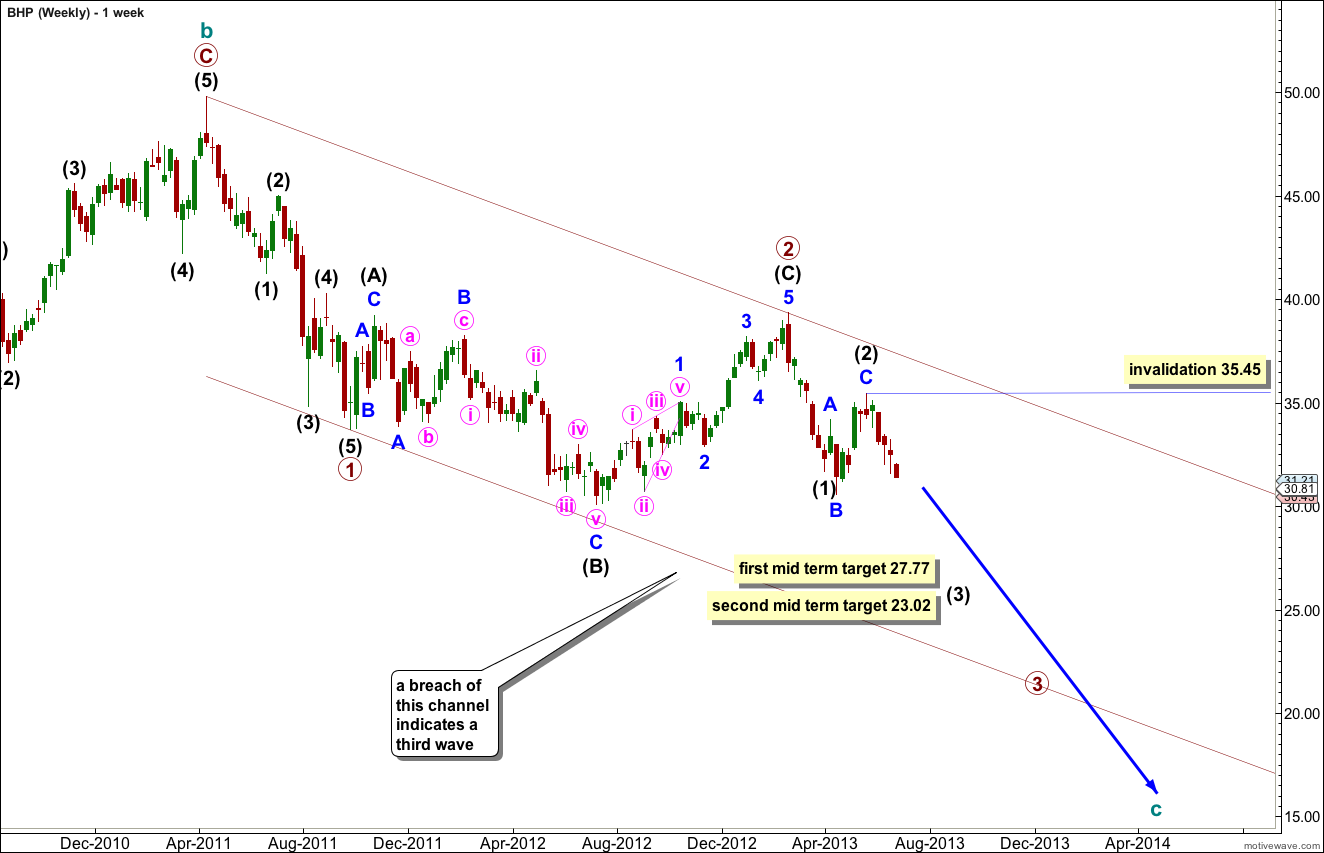

Intermediate wave (2) within primary wave 3 subdivides as an expanded flat correction. Within it minor wave B is a 143% correction of minor wave A. There is no adequate Fibonacci ratio between minor waves A and C.

At 27.77 intermediate wave (3) would reach equality in length with intermediate wave (1).

At 23.02 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

I have drawn an acceleration channel about downwards movement. If BHP is currently within a third wave down I would expect this channel to be breached to the downside.

Downwards momentum should increase over the next few weeks.

In conclusion, Elliott Wave structures look reasonably typical for BHP. There is a lack of Fibonacci ratios between actionary waves within impulses. Fibonacci ratios between A and C waves of corrections seem to be common for this stock. The long term targets for cycle wave c may be more reliable than mid term targets for intermediate wave (3) for this reason.

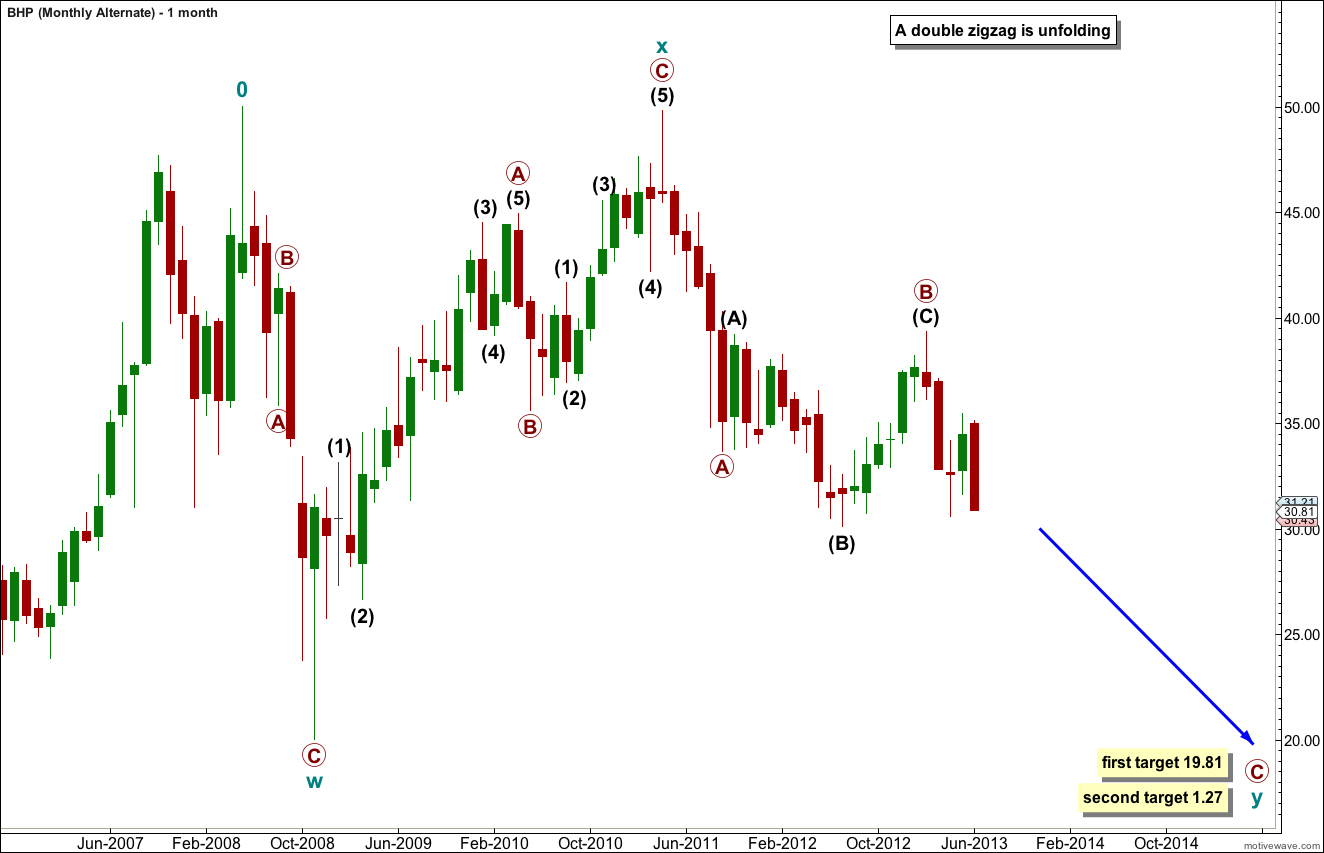

Alternate Monthly Wave Count.

This corrective structure may be a double zigzag. However, the purpose of double zigzags is to deepen a correction when the first zigzag does not move price far enough against the main trend, and so X waves within double zigzags do not tend to be this deep. The whole structure should move clearly against the prior impulsive trend, but this movement is sideways.

The expectation for more downwards movement would be the same. This alternate sees a first target for cycle wave y at a point just above primary wave W which does not achieve the purpose of this structure. At 19.81 primary wave C would reach equality with primary wave a. The second target has a higher probability for this wave count. At 1.27 primary wave C would reach 1.618 the length of primary wave A.