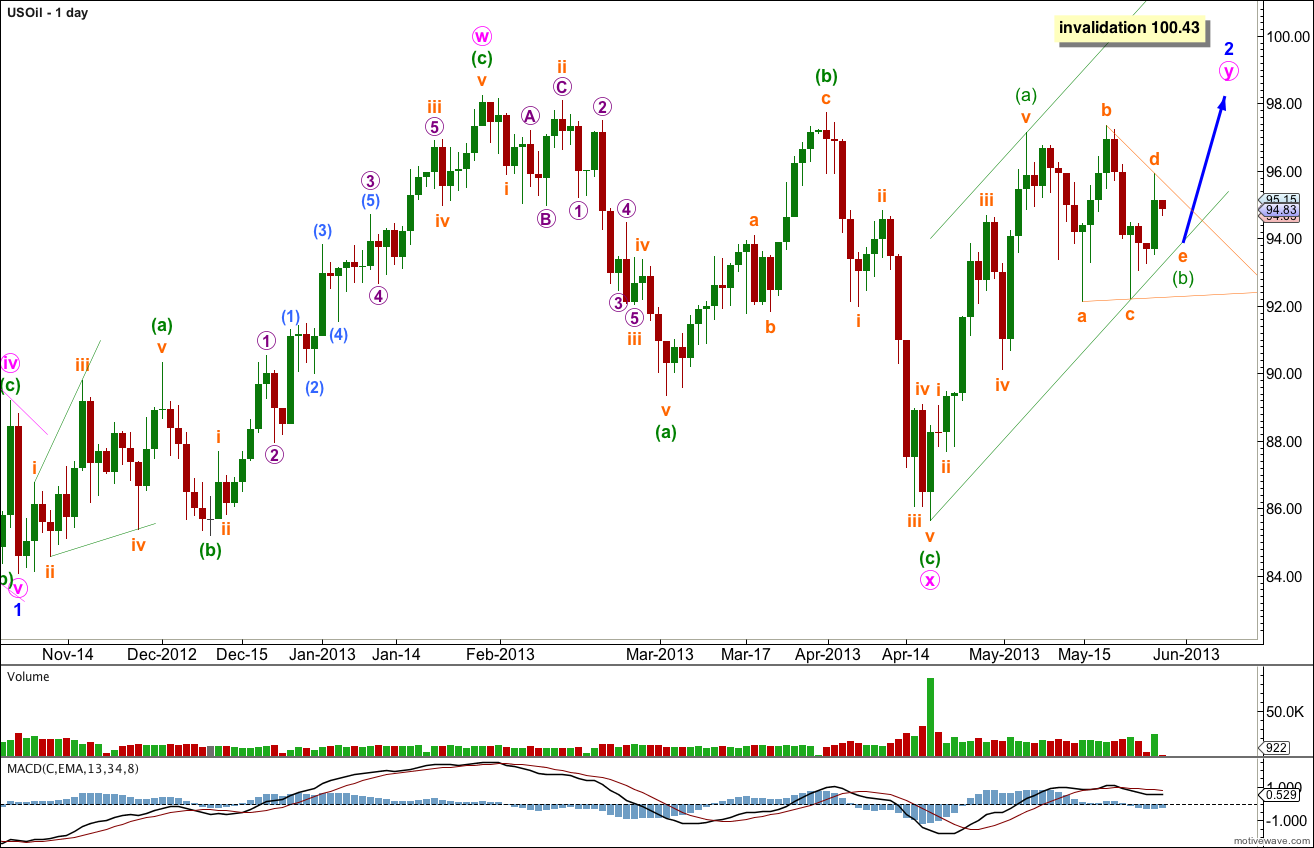

Last analysis had two wave counts. They both remain valid.

Price has remained below the invalidation point at 100.43.

Click on the charts below to enlarge.

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor wave 1 is complete and minor wave 2 may be an incomplete double zigzag. Within the double zigzag structure of minor wave 2 the first zigzag labeled minute wave w is complete, as is the three joining the two structures labeled minute wave x. Within minute wave y zigzag minuette wave (a) subdivides into a five wave impulse. Minuette wave (b) may be completing a triangle.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 100.43.

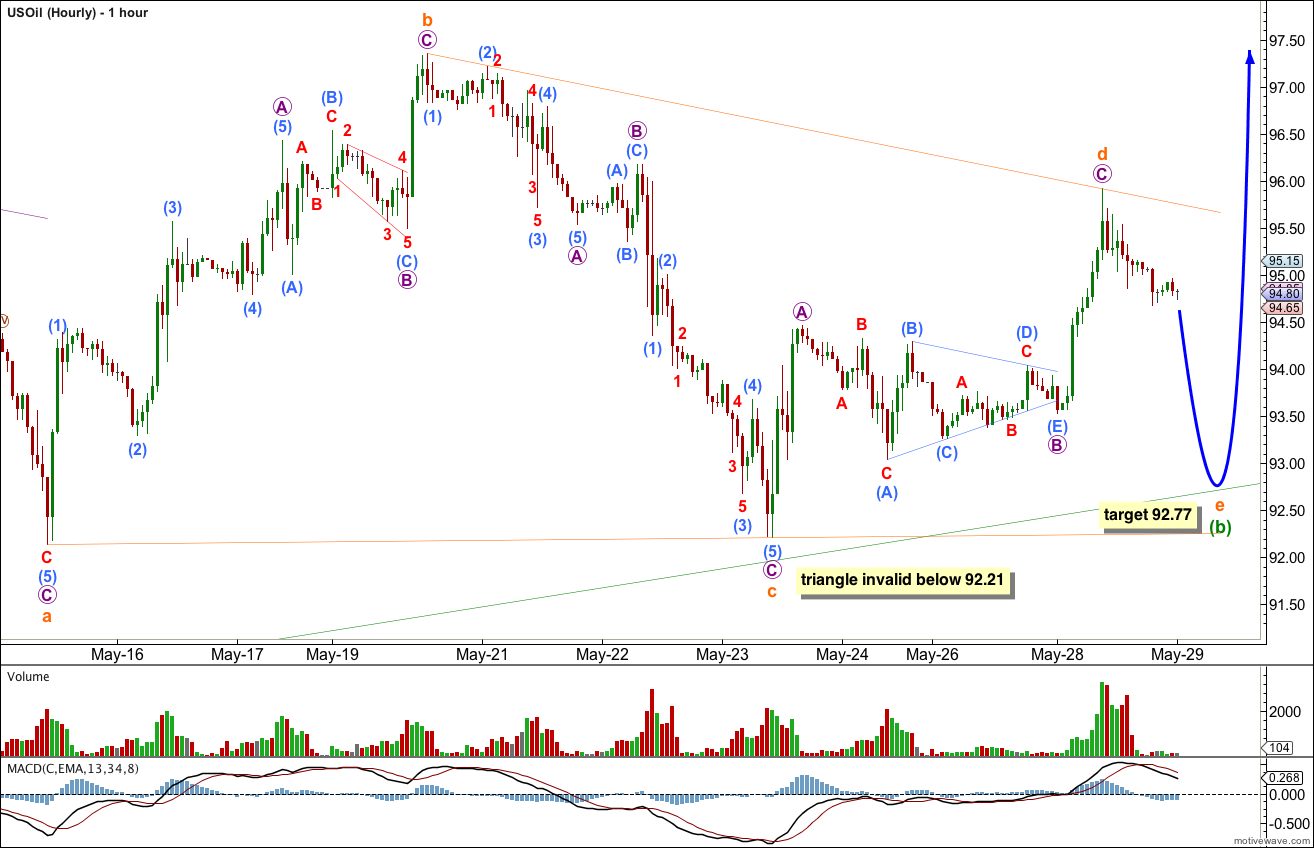

Within minuette wave (b) this structure may be a triangle yet to complete.

Each subwave so far subdivides into a zigzag. Only the final wave downwards, subminuette wave e, needs to complete.

The triangle is a running contracting triangle. Within a contracting triangle subminuette wave e may not move beyond the end of subminuette wave c. The triangle is invalidated with movement below 92.21.

Further downwards movement would be expected for subminuette wave e to end about 92.77.

Thereafter price should turn upwards to make a new high above 97.14 for minuette wave (c) to move beyond the end of minuette wave (a) to avoid a truncation.

Minuette wave (c) may be about 7.11 in length if it is 0.618 the length of minuette wave (a).

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 100.43.

Movement below 92.21 prior to the completion of minor wave 2 would indicate the alternate wave count below may be correct.

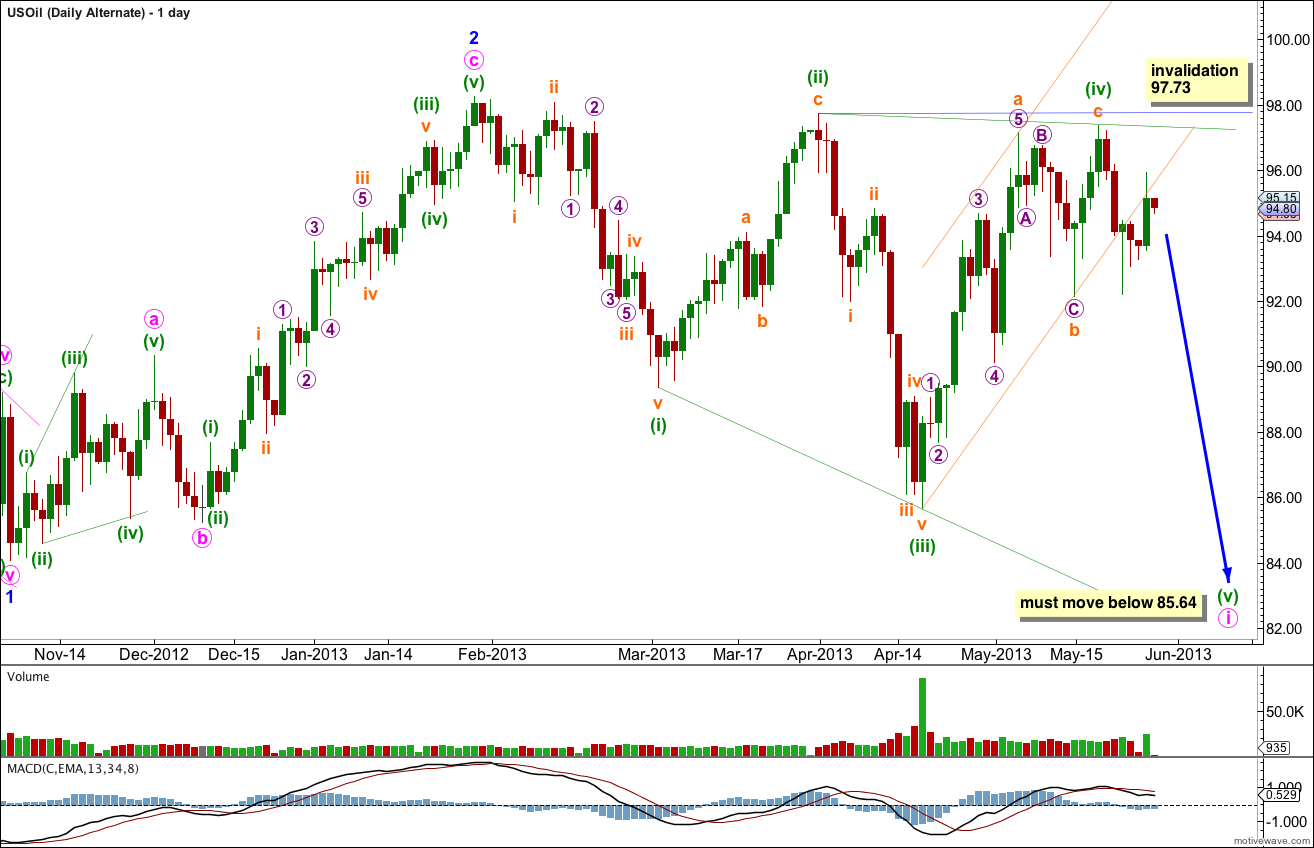

Alternate Wave Count.

Within intermediate wave (3) minor waves 1 and 2 may both be complete.

Within minor wave 3 minute wave i may be unfolding as a leading diagonal. Within the leading diagonal minuette waves (ii) and (iv) must subdivide into zigzags, and minuette waves (i), (iii), and (v) are usually zigzags but may also subdivide as impulses. Second and fourth waves of diagonals are usually deep corrections, between 66% to 81%. Minuette wave (ii) is deeper at 94% and minuette wave (iv) is now 97%.

If price does not move above 97.73 this alternate would remain valid.