Last analysis expected more choppy overlapping movement for Friday’s session which is mostly what happened.

This correction is most likely incomplete. The wave count remains the same.

Click on the charts below to enlarge.

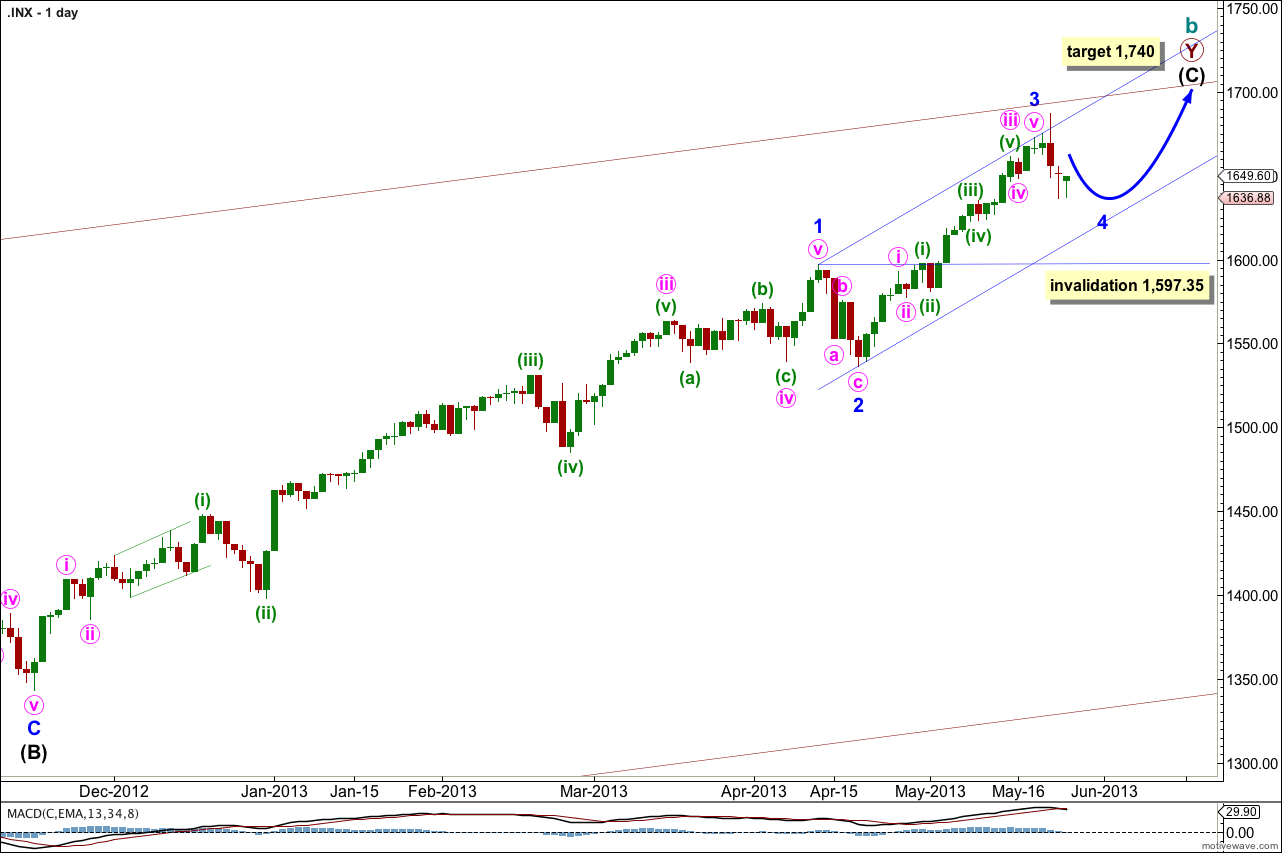

Within intermediate wave (C) minor wave 1 was extended. Minor wave 3 is showing an increase in momentum beyond that seen within minor wave 1.

Minor wave 3 may now be complete. There is no Fibonacci ratios between minor waves 3 and 1. This means it is highly likely we should see a Fibonacci ratio between minor wave 5 and either of 3 or 1.

Minor wave 3 is shorter than minor wave 1. Minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

I have redrawn the parallel channel about intermediate wave (C) today using Elliott’s first technique. Draw the first trend line from the highs of minor waves 1 to 3, then place a parallel copy upon the low of minor wave 2. Expect minor wave 4 to find support at the lower edge of this channel. The following fifth wave may end midway in the channel where it intersects with the upper maroon trend line.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

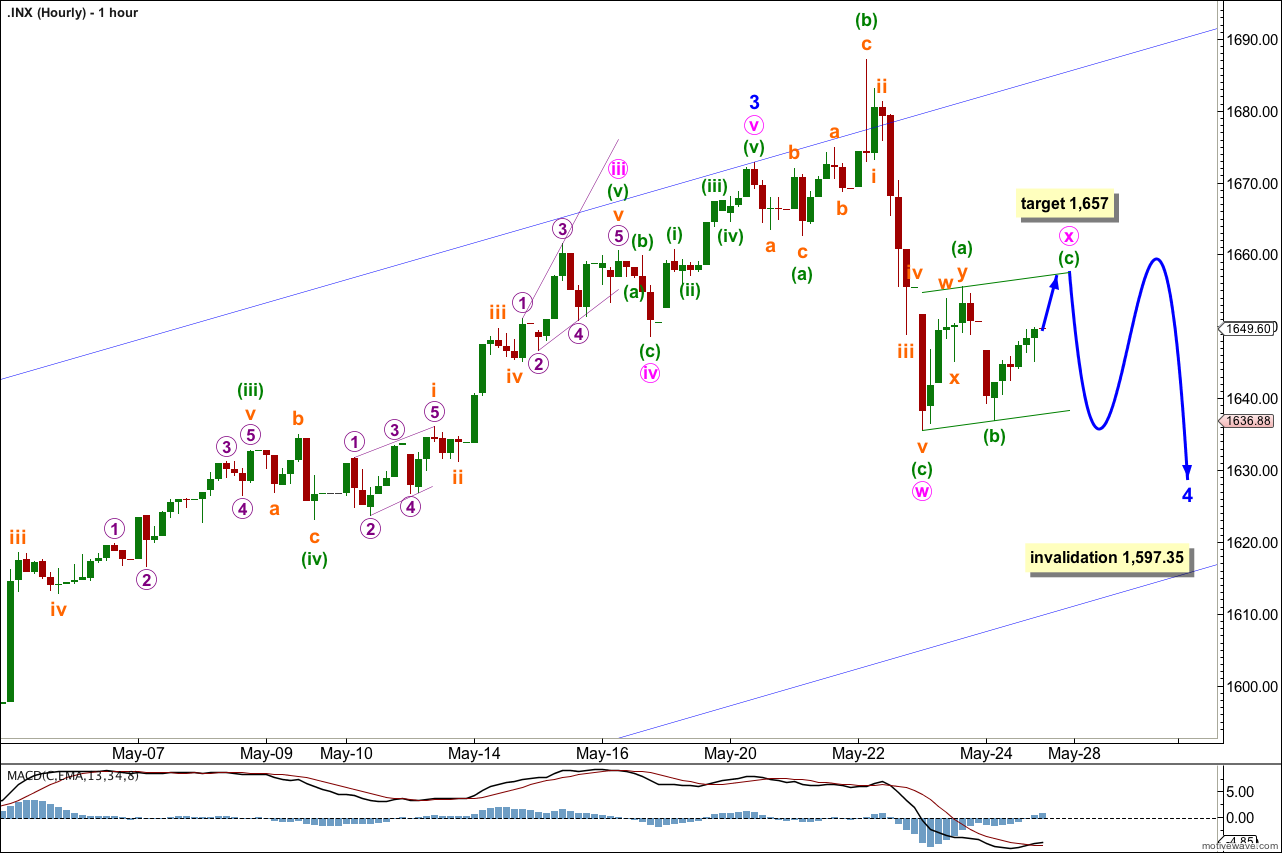

Within this possible double for minor wave 4 minute wave x may be unfolding as a flat correction, and not a more common zigzag.

Within minute wave x the first upwards movement subdivides as a double zigzag. This may be minuette wave (a) within a flat correction.

Minuette wave (b) is a 93% correction of minuette wave (a) so this may be a regular flat. A regular flat would most likely expect minuette wave (c) to reach equality with minuette wave (a) at 1,657, and to find resistance at the upper edge of the parallel channel containing minute wave x.

When minute wave x is complete we may expect further choppy overlapping sideways movement for a second corrective structure which would be labeled minute wave y. Minute wave y may be a flat, zigzag or triangle, and should move price sideways and not necessarily much lower.

Minor wave 4 may find support at the lower edge of the parallel channel copied over here from the daily chart.

If minor wave 4 lasts another one to three days it would be nicely in proportion to its counterpart minor wave 2. So far it is showing good alternation.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.