Yesterday’s analysis expected further upwards movement towards a target at 1,693 to 1,700 which was expected to be a few days away. We did see some upwards movement but price fell 5.82 points short of the target before turning lower to breach the invalidation point on the hourly chart.

The wave count is mostly the same. I expect the fourth wave correction I thought was a few days away has arrived early.

Click on the charts below to enlarge.

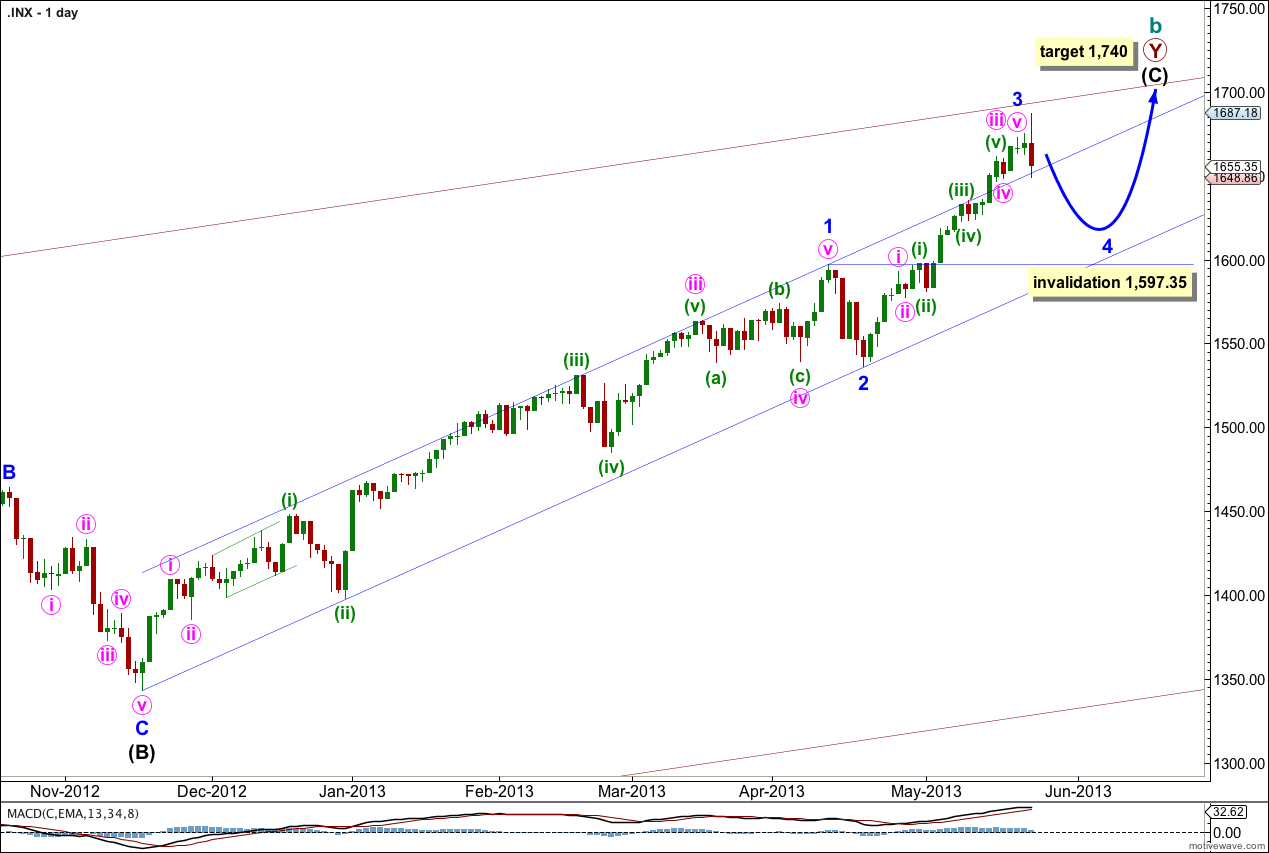

Within intermediate wave (C) minor wave 1 was extended. Minor wave 3 is showing an increase in momentum beyond that seen within minor wave 1.

Minor wave 3 may now be complete. There is no Fibonacci ratios between minor waves 3 and 1. This means it is highly likely we should see a Fibonacci ratio between minor wave 5 and either of 3 or 1.

Minor wave 3 is shorter than minor wave 1. Minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

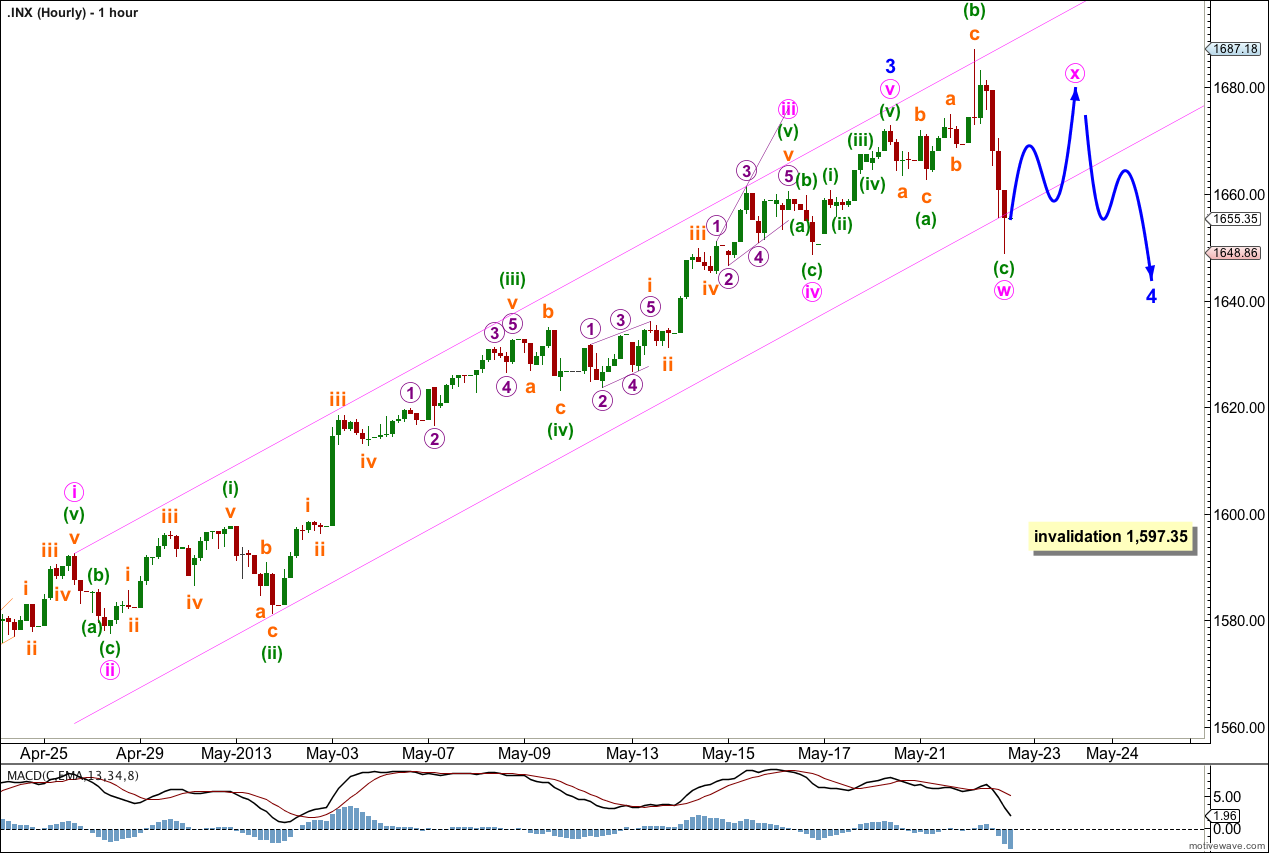

The upwards movement to start Wednesday’s session has unfolded as a three wave zigzag structure. This cannot be seen as a five so it cannot be the third wave upwards we were expecting.

Movement to a new low below the start of minute wave v at 1,648.60 would provide more confidence in this wave count, specifically the idea that minor wave 4 is underway.

Within minor wave 3 there are no Fibonacci ratios between minute waves i, iii and v. This concerns me slightly, and I have spent some time looking at subdivisions within minor wave 3 to see if I have this labeling wrong. However, this labeling has a good fit and agrees perfectly with MACD. I will leave it as is.

Within the early stages of minor wave 4 an expanded flat correction is either complete or very close to completion. Minute waves a and b subdivide perfectly into three wave structures. Minute wave c has no Fibonacci ratio to minute wave a.

It is unlikely (but possible) that minor wave 4 is over so quickly as a single flat correction. It is most likely that it will continue further sideways as a double flat or double combination. This requires a three wave structure upwards to join the two structures of the double, which would be labeled minute wave x and is most likely to subdivide as a zigzag. Minute wave x may make a new price extreme beyond the start of minute wave w.

When minute wave x is complete I would expect a second corrective structure in a double to unfold. This may be either a flat (most likely), zigzag or triangle.

Overall minor wave 4 should last about five to seven days. It would be most likely to end within the price territory of the fourth wave of one lesser degree which is 1,660.51 to 1,648.60. It is most likely to move sideways with a lot of choppy, overlapping movement which is difficult to analyse and will only become clear when it is complete.

Minor wave 4 should breach the parallel channel containing minor wave 3.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.