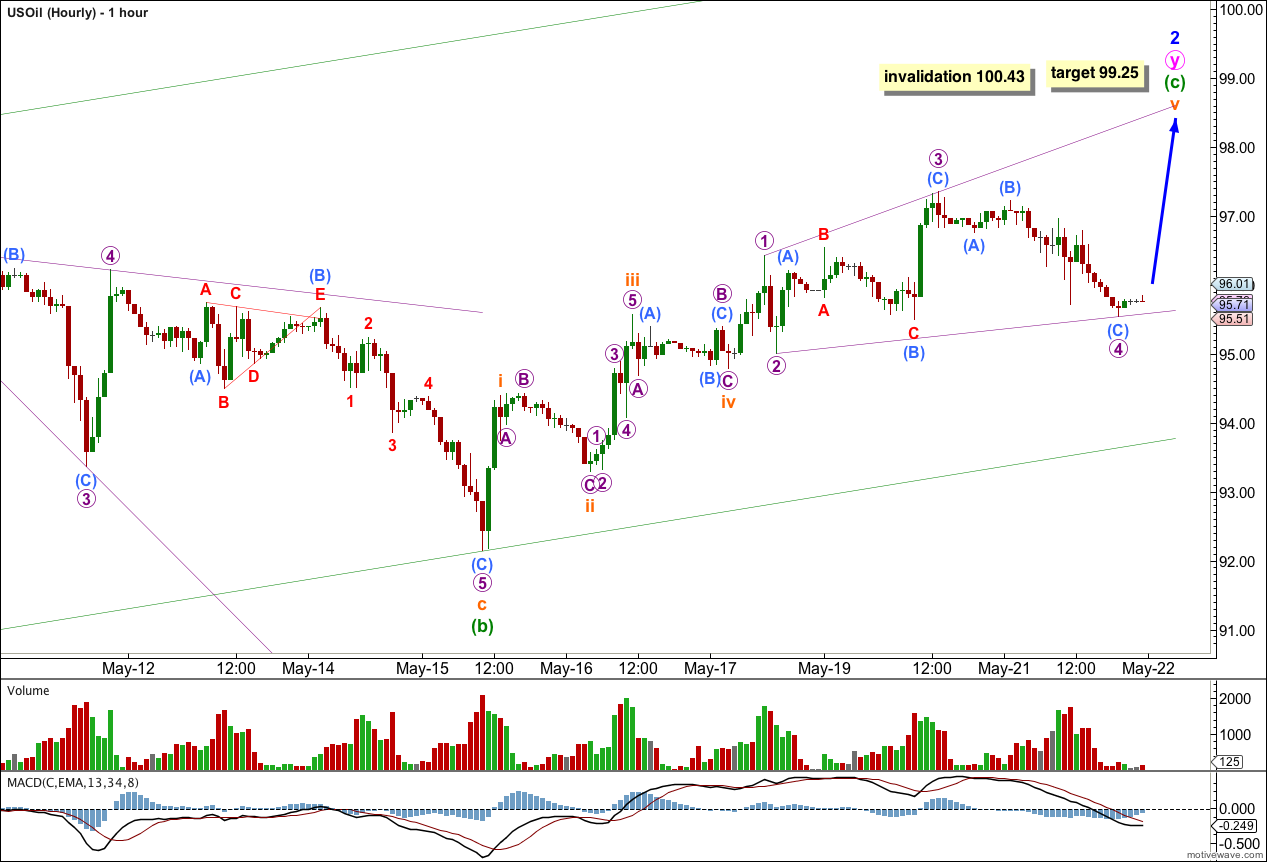

This deeper than expected upwards movement has indicated the prior wave count may be incorrect, although the daily chart remained valid.

I have taken another look at the bigger picture. I expect this upwards movement may be part of a larger second wave correction.

Click on the charts below to enlarge.

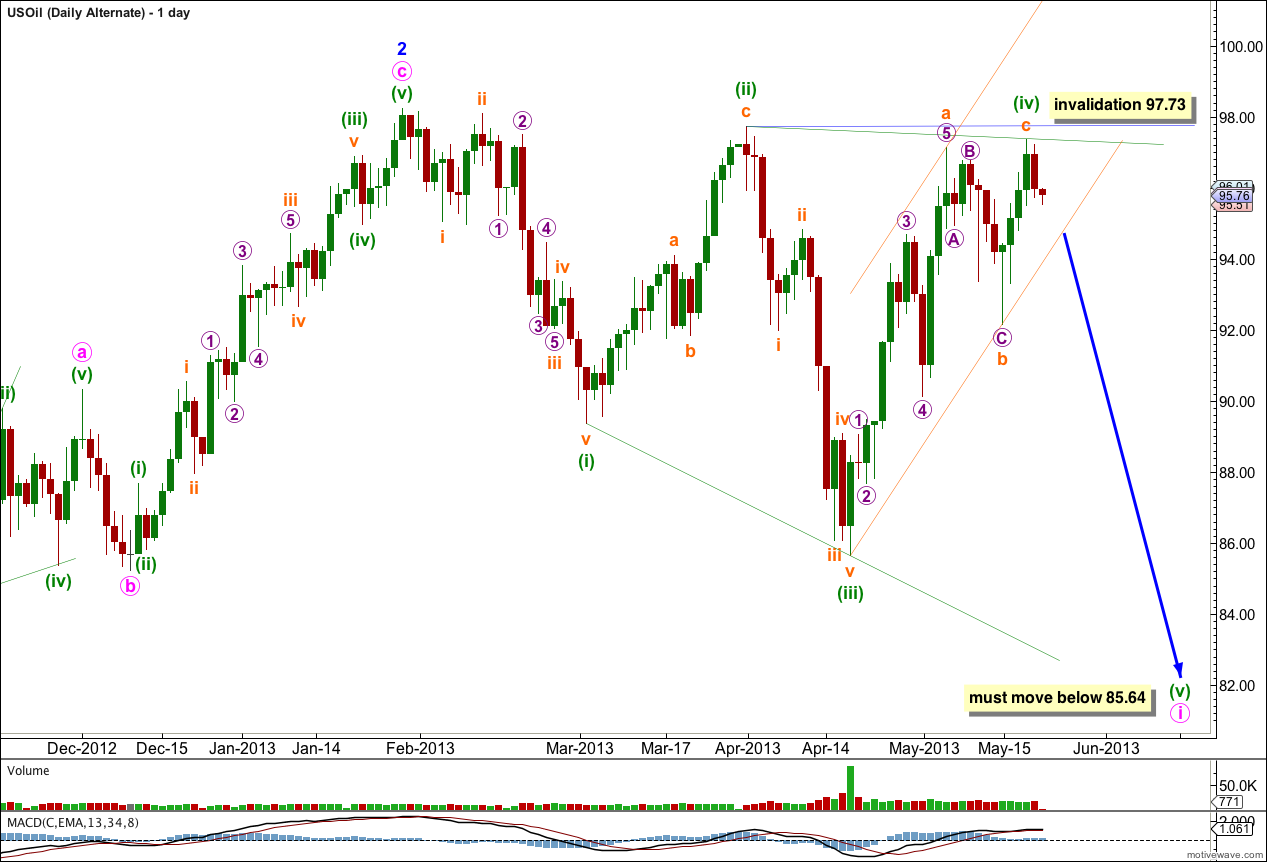

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor wave 1 is complete and minor wave 2 may be an incomplete double zigzag. At 99.25 minuette wave (c) within the second zigzag of minute wave y would reach 0.618 the length of minuette wave (a).

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 100.43.

Within minor wave 2 the hourly chart above shows the end of the second zigzag, minute wave y. Within minute wave y minuette wave (c) is an incomplete structure.

Within minuette wave (c) the fifth wave of subminuette wave v may be unfolding as an ending expanding diagonal.

Within minuette wave (c) subminuette wave iii is just 0.03 longer than equality with subminuette wave i. It would not expect to see a Fibonacci ratio between subminuette wave v and either of i or iii. I will leave the target calculation at minuette wave degree.

This wave count requires one final upwards wave which would be most likely to be longer than 2.34.

When that is complete this wave count expects a trend change and the start of a third wave downwards at minor wave degree.

A clear breach of the parallel channel about the second zigzag of minute wave y would be an early indication of the start of a third wave down. Movement below 92.14 would provide price confirmation of a trend change. This change should come within the next two days or so.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 100.43.

Alternate Wave Count.

This was previously my main wave count. The depth of minuette waves (ii) and (iv) within this possible leading diagonal reduce the probability of this wave count.

Within intermediate wave (3) minor waves 1 and 2 may both be complete.

Within minor wave 3 minute wave i may be unfolding as a leading diagonal. Within the leading diagonal minuette waves (ii) and (iv) must subdivide into zigzags, and minuette waves (i), (iii), and (v) are usually zigzags but may also subdivide as impulses. Second and fourth waves of diagonals are usually deep corrections, between 66% to 81%. Minuette wave (ii) is deeper at 94% and minuette wave (iv) is now 97%.

If price does not move above 97.73 this alternate would remain valid.