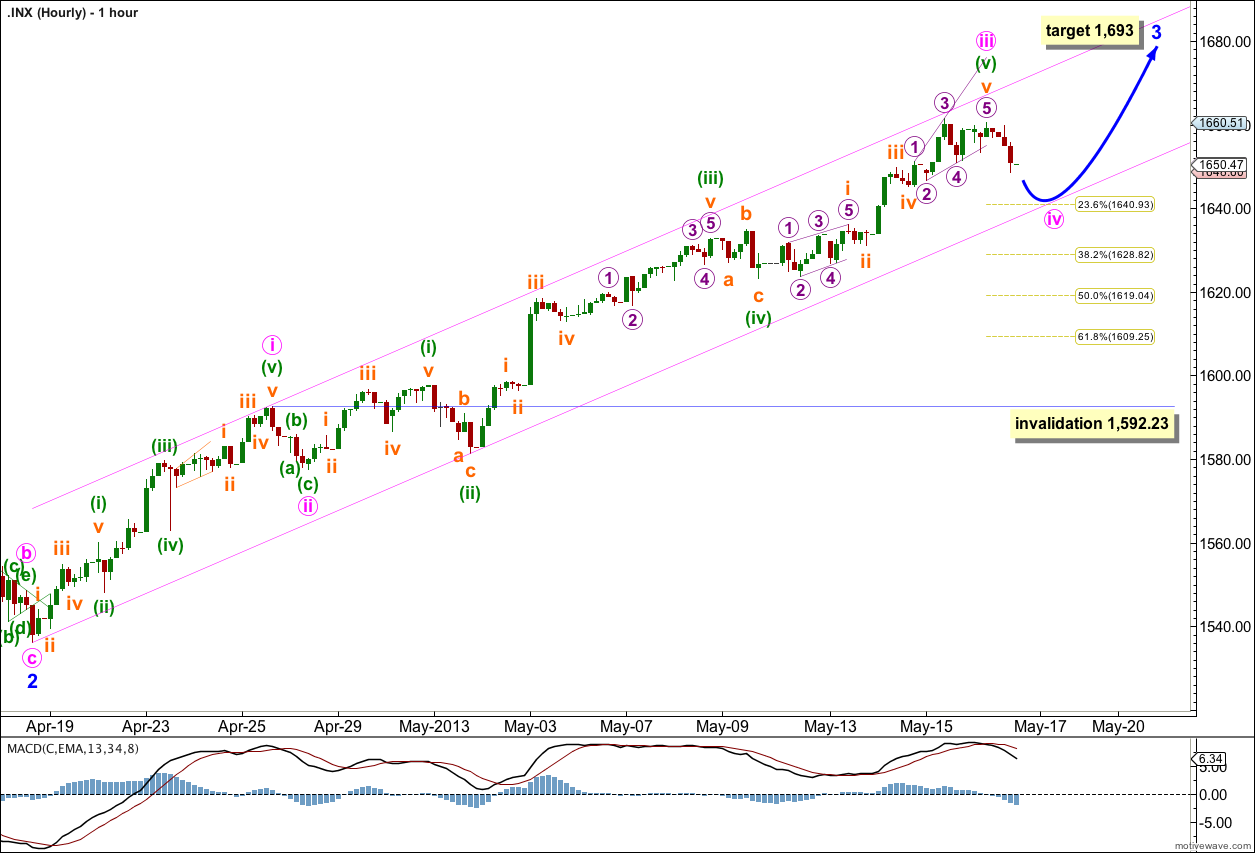

Yesterday’s analysis expected upwards movement to a short term target at 1,666 to 1,669 before price turned downwards to begin a fourth wave correction. We did see upwards movement but it was very slight and fell short 5.49 points short of the target.

A recent increase in upwards momentum has indicated the labeling within intermediate wave (C) was incorrect. I have adjusted this labeling but it makes little difference to expected direction. It will however affect target calculation.

Click on the charts below to enlarge.

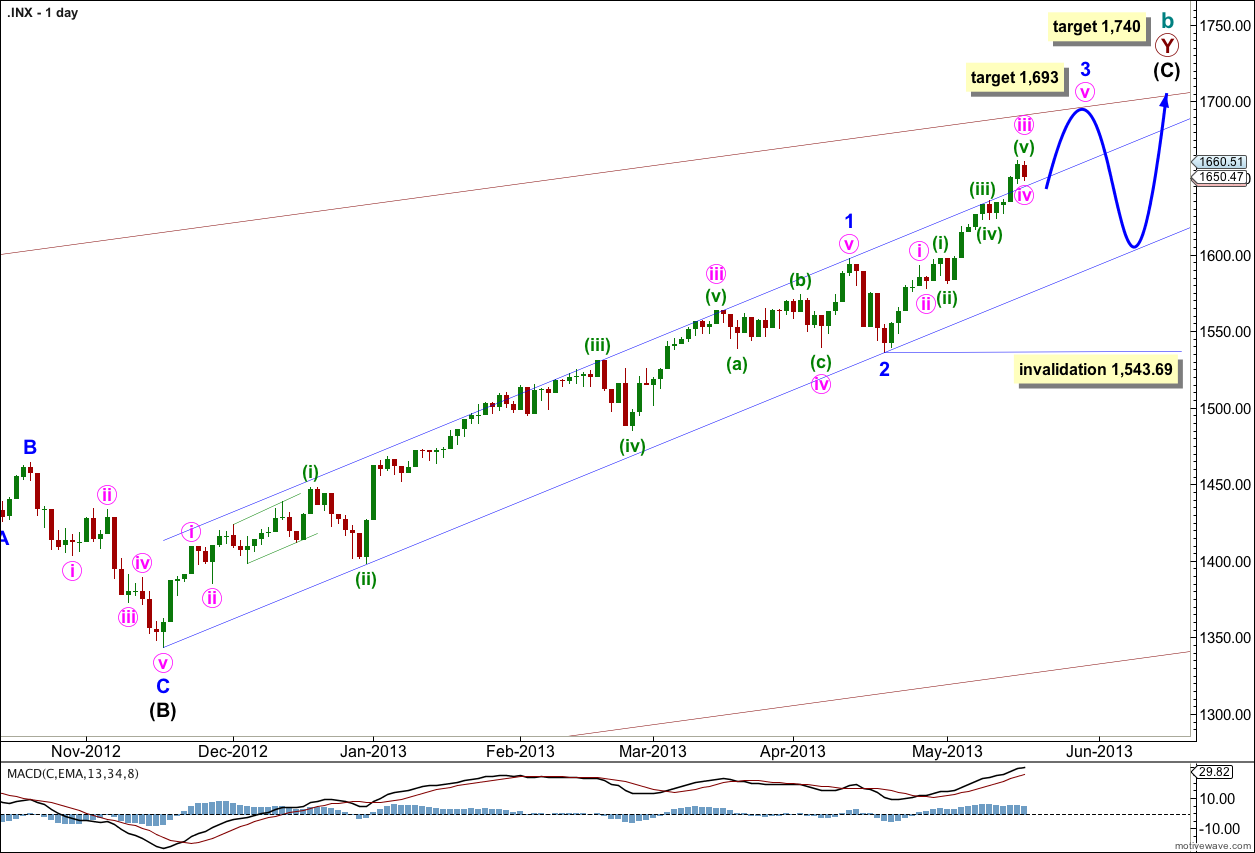

The bigger picture on the monthly chart remains unchanged and may be viewed here.

Within intermediate wave (C) I have adjusted the wave count at minor degree today. I have done this because over the last few days we have seen a new high in momentum and the channel has been breached by upwards movement. This movement looks like a third wave, and not a fifth.

There are several possible ways to label this upwards movement because there are so many corrections within it. This labeling fits with momentum.

Within intermediate wave (C) minor wave 1 was extended. Minor wave 3 is showing an increase in momentum beyond that seen within minor wave 1.

Ratios within minor wave 1 are: minute wave iii is 5.6 points longer than 2.618 the length of minute wave i, and minute wave v has no Fibonacci ratio to minute waves iii or i.

Ratios within minute wave iii of minor wave 1 are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is 3.78 points short of 0.618 the length of minuette wave (iii).

So far within minor wave 3 minute waves i and iii may be complete. Minute wave iii has no Fibonacci ratio to minute wave i.

Minute wave iv may have begun during Thursday’s session. It is possible that it could be over already or very soon as it already shows on the daily chart in proportion to its counterpart minute wave ii. Minute wave iv may continue further for another one to three sessions, but it should not be longer than that in order to keep the right look.

This wave count requires an end to minor waves 3, 4 and 5. Minor wave 3 is unlikely to be extended also and would most likely be 0.618 the length of minor wave 1. This is achieved at 1,693.

Minor wave 5 would most likely be equal in length to minor wave 3, or it may be 0.618 the length of minor wave 3. If minor wave 3 is shorter than minor wave 1 then minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

The adjustment to this wave count within intermediate wave (C) to be in line with observed momentum has the implication that the upwards trend will last longer than previously expected.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Within minor wave 3 if we move the degree of labeling all down one degree and are yet to see a minute wave ii correction then minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,543.69.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

At the hourly chart level this wave count looks the same as yesterday’s chart, but the difference is this upwards impulse is minor wave 3 and not minor wave 5.

There was only a very slight upwards movement early in Thursday’s session which failed to make a new high. An ending diagonal may have a truncated fifth wave. This final fifth wave subdivides into a zigzag so the structure is valid, although within the diagonal the third wave is still the longest wave.

Within minuette wave (v) there are no adequate Fibonacci ratios between subminuette waves i, iii and v.

Because there is no Fibonacci ratio between minute waves iii and i I will expect to see a Fibonacci ratio between minute wave v and either of iii or i. When minute wave iv is completed I will calculate the target for minor wave 3 to end using minute wave degree in addition to the minor degree calculation. This target of 1,693 may change or widen to a zone.

It is likely that minute wave iv will find support at the lower edge of the parallel channel drawn here as a best fit. We should see some alternation between the shallow brief zigzag correction of minute wave ii with minute wave iv. Minute wave iv is most likely to be a flat correction, or it may be a combination, and less likely a triangle. It may be longer lasting than minute wave i if it is a more time consuming structure.

If minute wave iv finds support at the lower edge of this channel it may be a shallow 0.236 Fibonacci ratio of minute wave iii ending about 1,640.93.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,592.23.