Last analysis expected the S&P 500 had entered a fourth wave correction. The alternate hourly wave count looked at the possibility that the fourth wave had not yet arrived. Upwards movement confirms the alternate hourly wave count.

Click on the charts below to enlarge.

This trend is not over and price should continue to move higher for maybe about another few weeks.

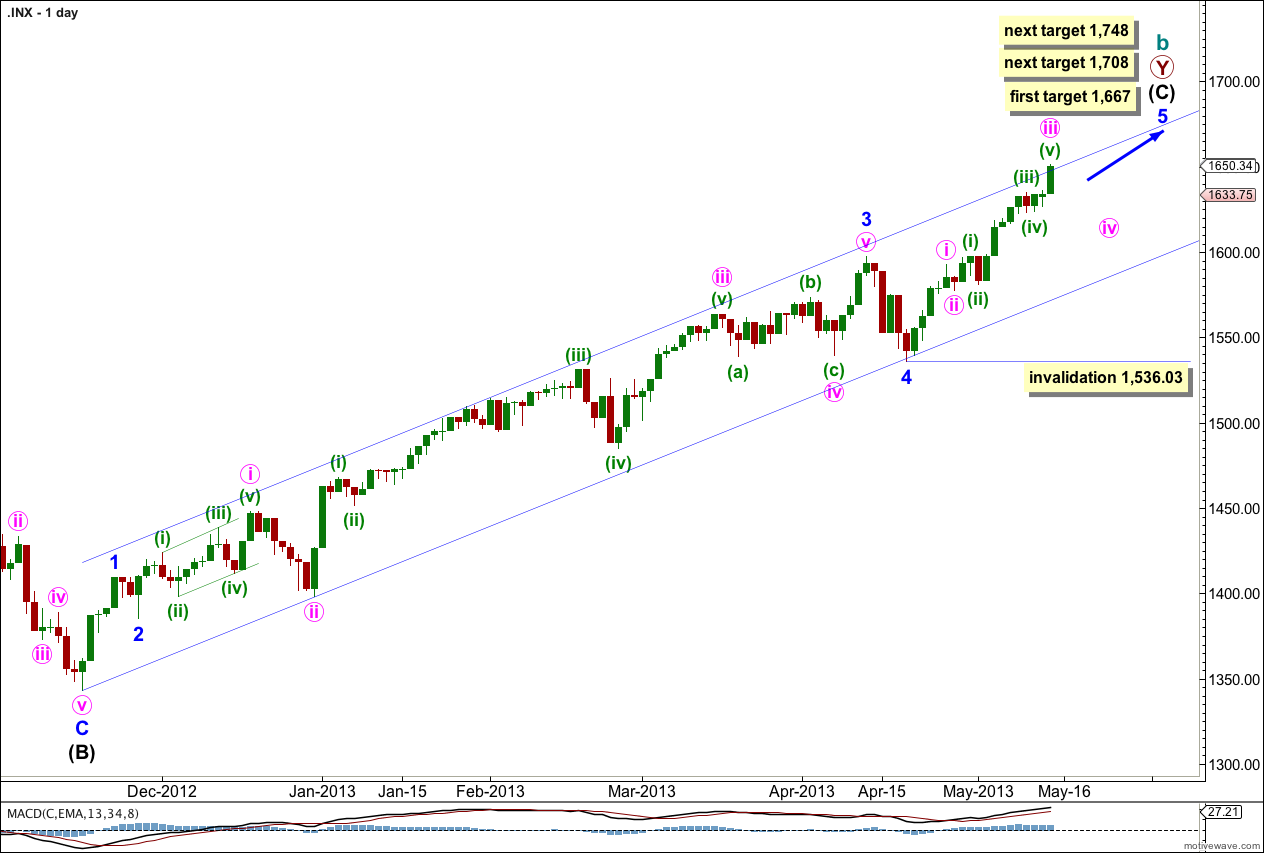

Draw a channel about intermediate wave (C) here on the daily chart. Draw the first trend line from the start of intermediate wave (C) to the low of minute wave ii within minor wave 3. Place a parallel copy to contain all this upwards movement. So far this channel shows very closely where price is finding support and resistance and should continue to do so.

The wave count within minor wave 3 fits with MACD as an indicator of momentum. The strongest piece of upwards movement within intermediate wave (C) corresponds to the middle of a third wave.

Within intermediate wave (C) minor wave 4 is over and minor wave 5 is underway. Because there is no Fibonacci ratio between minor waves 1 and 3 I would expect to see a ratio for minor wave 5.

Minor wave 5 is showing subdivisions at minute degree on the daily chart, and minute wave iii within it is also showing subdivisions on the daily chart which is very common.

Minor wave 5 has passed equality with minor wave 1 and is extending. At 1,667 (which now looks unlikely) minor wave 5 would reach 0.618 the length of minor wave 3. If price keeps rising through this first target, or if when it gets there the structure is incomplete, then the next target is at 1,708 where minor wave 5 would reach 2.618 the length of minor wave 1. Again, if price continues higher through this target the next possible end would be at 1,748 where minor wave 5 would reach equality in length with minor wave 3.

It would be somewhat unlikely that minor wave 5 would be longer than the extended minor wave 3.

Within minor wave 5 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,536.03.

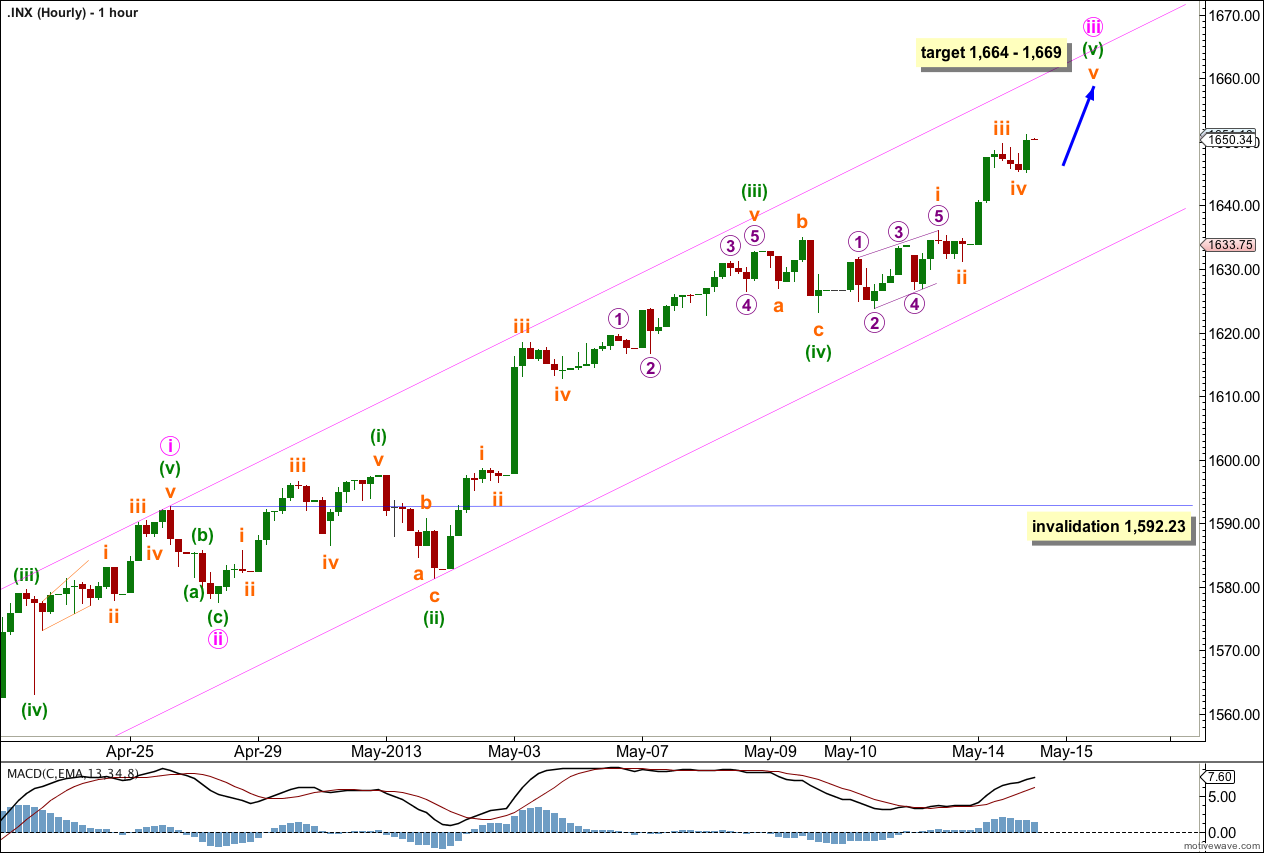

Minuette wave (v) is not over and is extending. Within it subminuette wave ii did not move lower; the session began with a third wave upwards.

There is no Fibonacci ratio between subminuette waves iii and i. It is more likely that we shall see a Fibonacci ratio between subminuette wave v and either of iii or i. At 1,664 subminuette wave v would reach equality in length with subminuette wave iii.

At 1,669 minute wave iii would reach 1.618 the length of minute wave i.

This gives us a 5 point target zone calculated at two wave degrees.

When minute wave iii is complete then we should see downwards movement for minute wave iv to last between one to four days. Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,592.23.