Movement above 14,768.05 indicated a correction was over and a third wave upwards should have begun. However, choppy overlapping movement for the early part of the week was not a third wave. The third wave arrived on Wednesday.

Click on the charts below to enlarge.

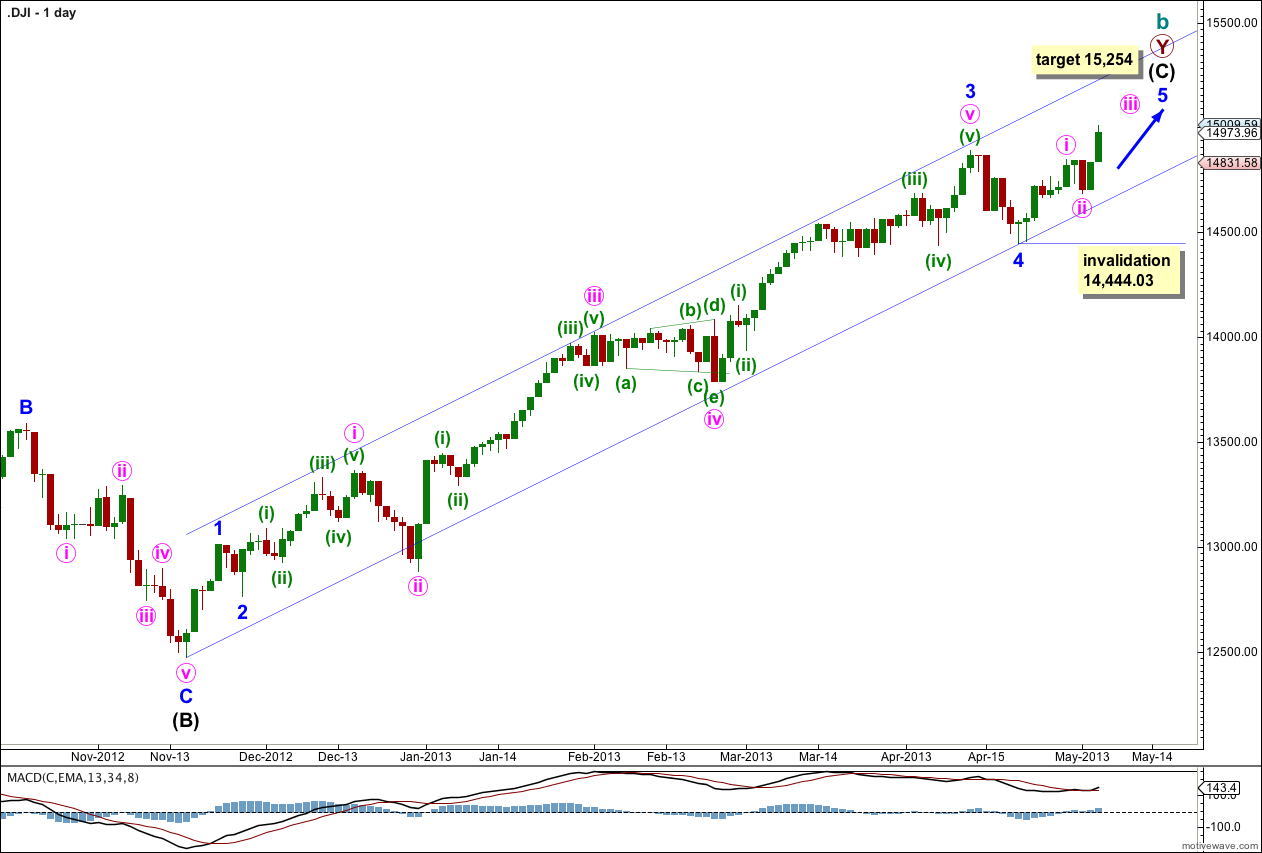

There are several possible ways to label this long upwards movement of intermediate wave (C). This wave count sees minor waves 3 and 4 complete.

At 15,254 minor wave 5 would reach 0.382 the length minor wave 3.

The channel drawn here is a best fit. Draw the first trend line from the start of intermediate wave (C) to the low of minor wave 4, then place a parallel copy upon the high of minute wave (iii) within minor wave 3. Minor wave 5 may end midway within the channel, or should find resistance at the upper edge. When the channel is clearly breached by downwards movement we shall have an indication of a possible trend change.

At this stage we have some divergence with price trending higher and MACD trending lower. If this divergence continues on the daily chart this wave count will expect a trend change in coming weeks, maybe about two to four weeks away.

Within minor wave 5 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 14,444.03

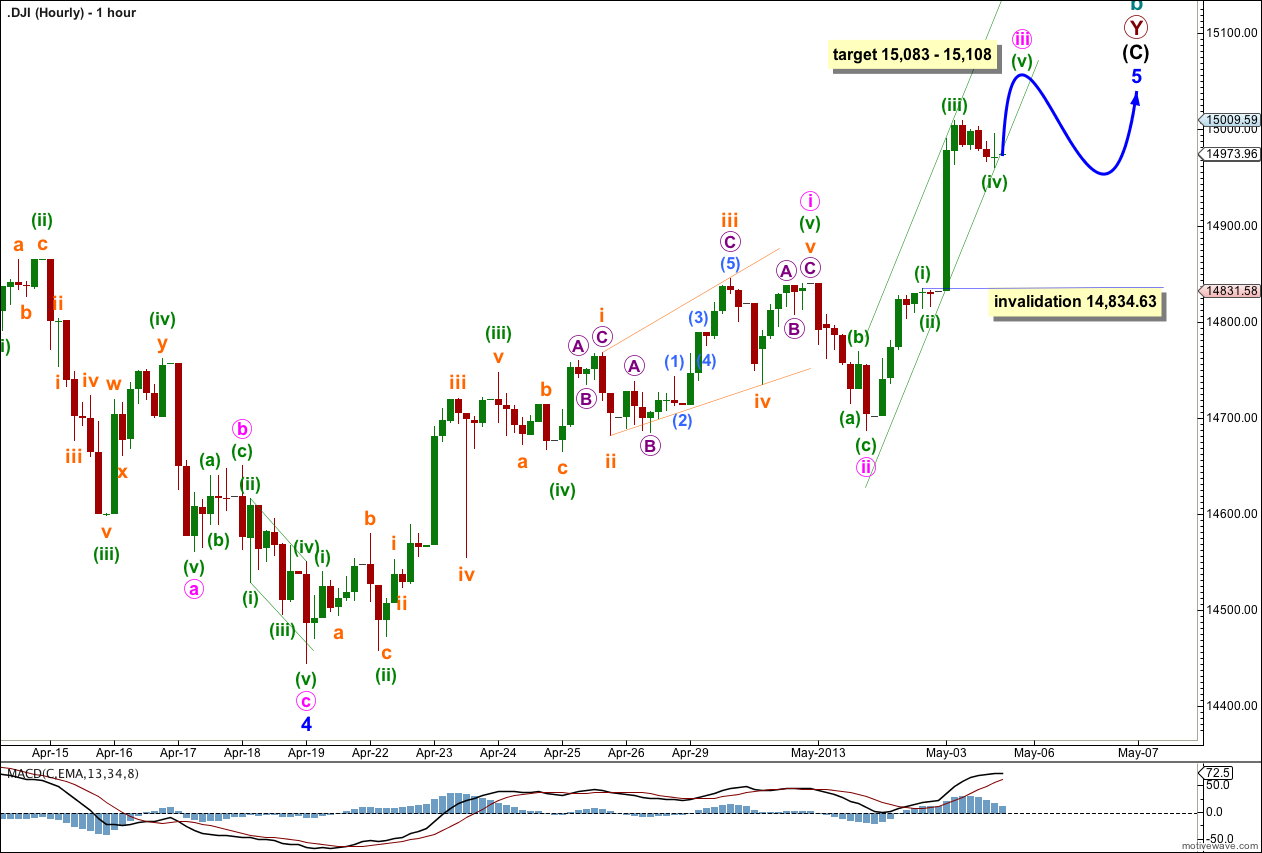

Minute wave i moved higher and within it minuette wave (v) unfolded as an ending expanding diagonal. Within an ending diagonal all the subwaves must subdivide into zigzags (including the third wave) and the fourth wave must overlap the first wave price territory. This ending diagonal has a third wave which is still the longest, and the fifth wave is very slightly truncated. The subdivisons all fit; they are all zigzags.

Upwards movement for Friday’s session has increased in momentum indicating the middle of the third wave unfolded. There is no Fibonacci ratio between minuette waves (iii) and (i). I would expect to see a Fibonacci ratio between minuette wave (v) and either of (i) or (iii). At 15,108 minuette wave (v) would reach equality in length with minuette wave (i).

At 15,083 minute wave iii would reach equality in length with minute wave i. This gives us a 25 point target zone which should be met early or mid next week.

Draw a best fit parallel channel about minute wave iii. Minuette wave (v) may remain contained within this channel. When the channel is clearly breached by downwards movement then minute wave iii may be over and minute wave iv should be underway.

Because minute wave ii was shallow (38.6%) we may expect minute wave iv to be relatively deep.

Within minute wave iii minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 14,834.63.