Further strong upwards movement invalidated the main wave count. This upwards movement cannot be a fourth wave of an impulse because it has entered first wave price territory. It must be a second wave correction, or the structure is a diagonal and not an impulse.

The wave count is changed and makes sense of these last two deep corrections.

Click on the charts below to enlarge.

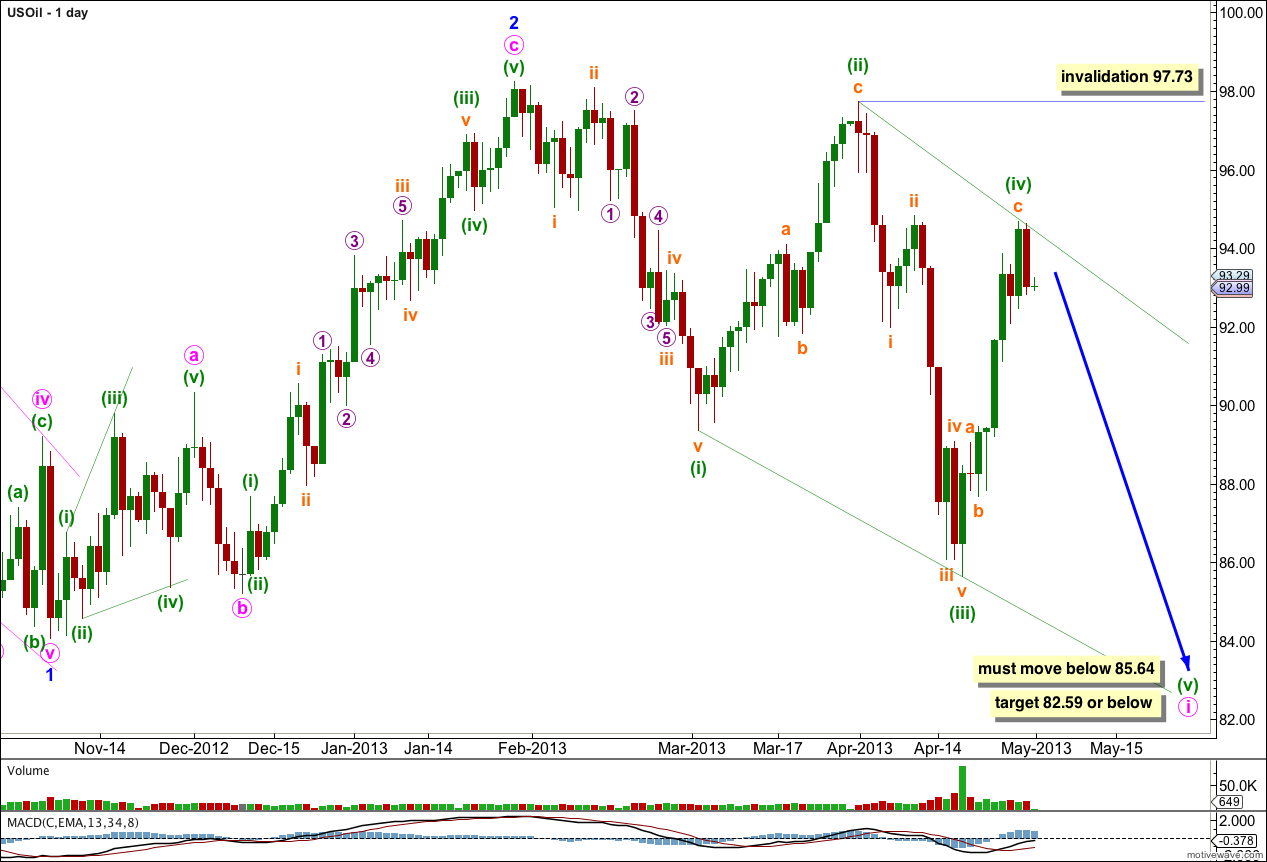

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor waves 1 and 2 are complete.

Within minor wave 3 minute wave i may be unfolding as a leading diagonal. Within the leading diagonal minuette waves (ii) and (iv) must subdivide into zigzags, and minuette waves (i), (iii), and (v) are usually zigzags but may also subdivide as impulses. Second and fourth waves of diagonals are usually deep corrections, between 66% to 81%. Minuette wave (ii) is deeper at 94% and minuette wave (iv) is so far 75%.

Within the leading diagonal minuette wave (v) may not be truncated, it must move below 85.64.

The diagonal is expanding (although the trend lines contract because of the angle of minuette wave (iv) ). We should expect minuette wave (v) to be longer than minuette wave (iii) so to move below 82.59. However, I have seen diagonals where the third wave is still the longest, so this may not happen.

Minuette wave (iv) of the diagonal should overlap into minuette wave (i) price territory, but may not move beyond the start of minuette wave (ii) price territory. This wave count is invalidated with movement above 97.73.

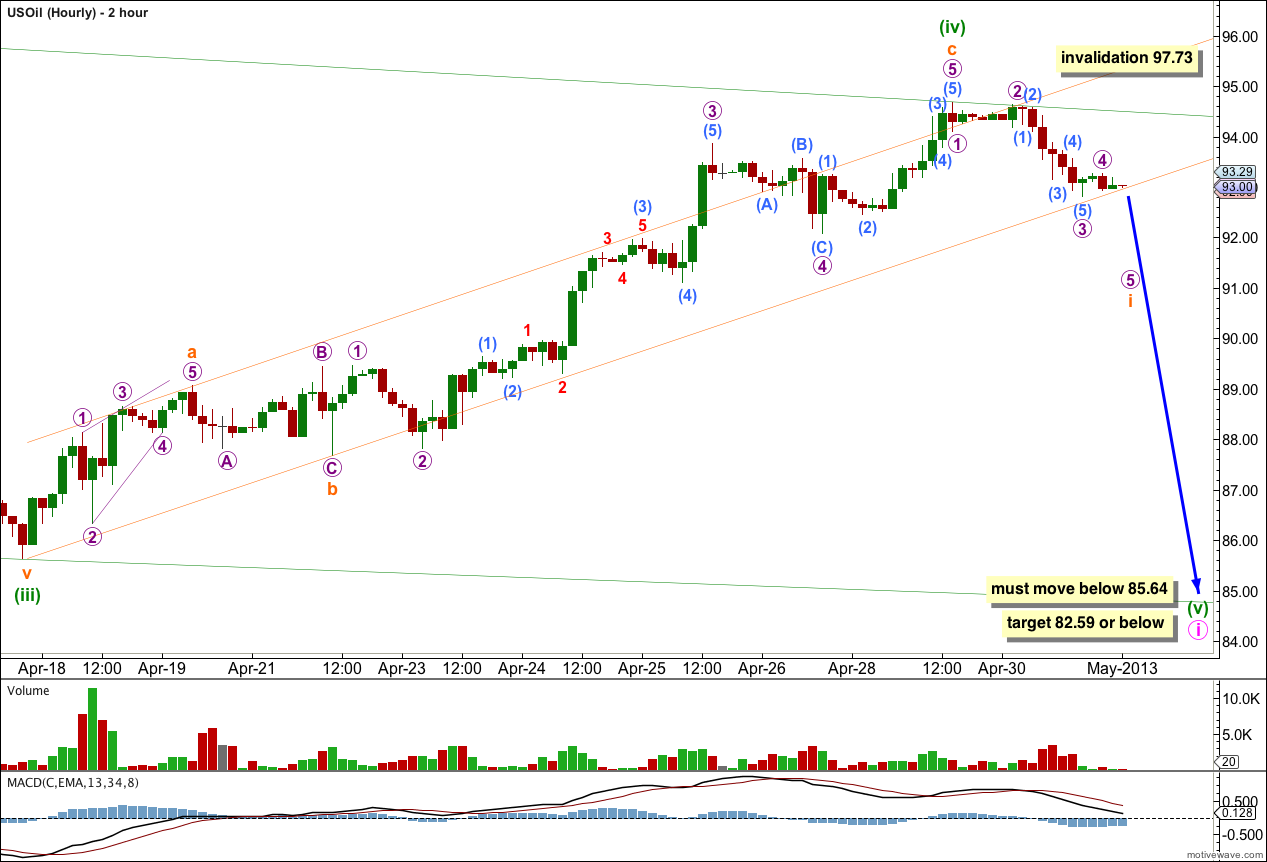

This 2 hourly chart shows all of the zigzag for minuette wave (iv). We may use Elliott’s channeling technique for a correction to draw a channel about this movement. Draw the first trendline from the start of minuette wave (iv) to the low of subminuette wave b within it, then place a parallel copy upon the high of subminuette wave a. So far this channel has not been breached by downwards movement.

We would need to see this channel breached by downwards movement to be confident that minuette wave (iv) is completed and the next wave down, minuette wave (v), has begun.

At that stage we may be confident that we shall see a new low below 85.64, and probably below 82.59.

Minuette wave (iv) may not move beyond the start of minuette wave (ii). This wave count is invalidated with movement above 97.73.