Last week’s analysis expected upwards movement for the week which is exactly what happened. I expect the same next week although Monday and Tuesday may first take price lower for a second wave correction.

Click on the charts below to enlarge.

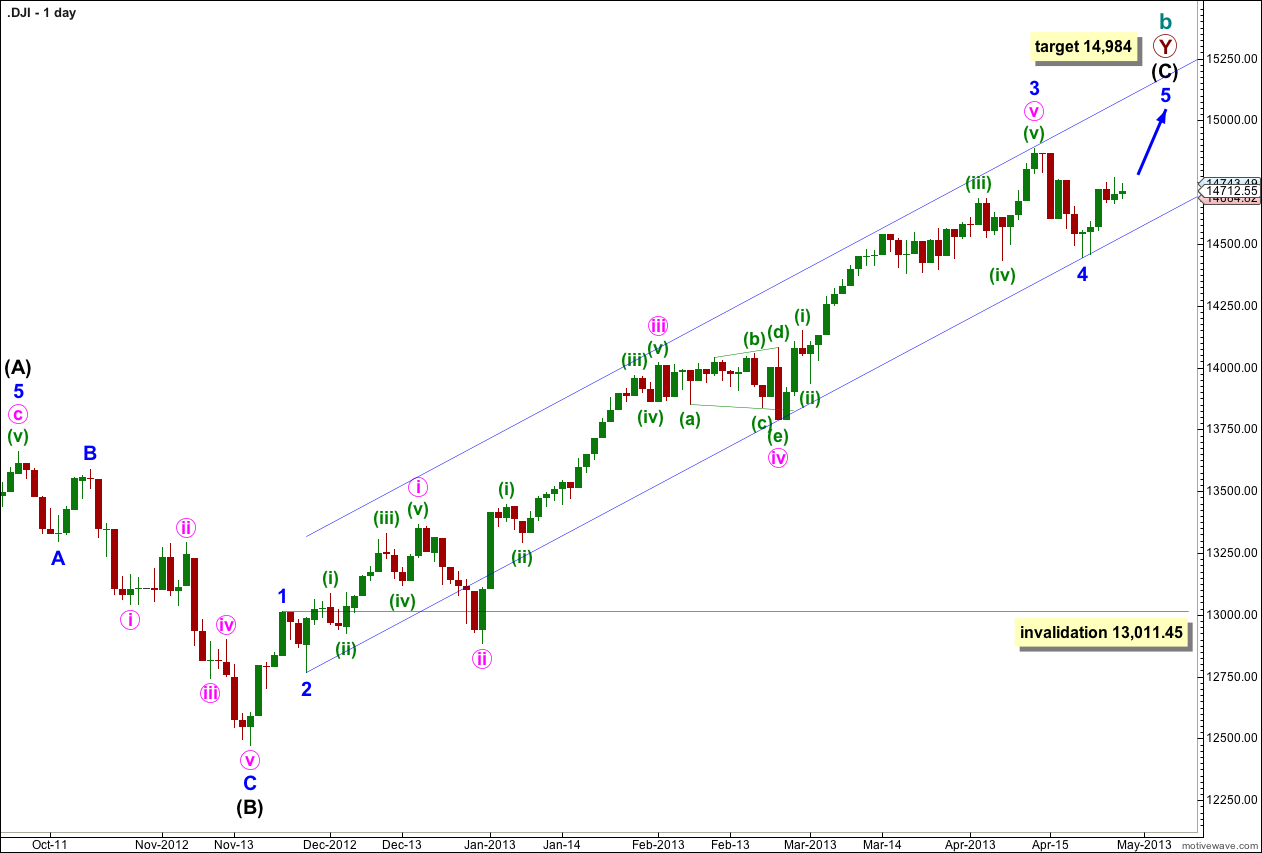

There are several possible ways to label this long upwards movement of intermediate wave (C). This wave count sees minor waves 3 and 4 complete.

At 14,984 minor wave 5 would reach equality in length with minor wave 1.

The channel drawn here uses Elliott’s second technique. Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. Minor wave 5 may end midway within the channel, or should find resistance at the upper edge. When the channel is clearly breached by downwards movement we shall have an indication of a possible trend change.

Minor wave 4 is most likely to be over as a zigzag. However, if it continues sideways as a triangle, flat or combination it may not move into minor wave 1 price territory. This wave count is invalidated with movement below 13,011.45.

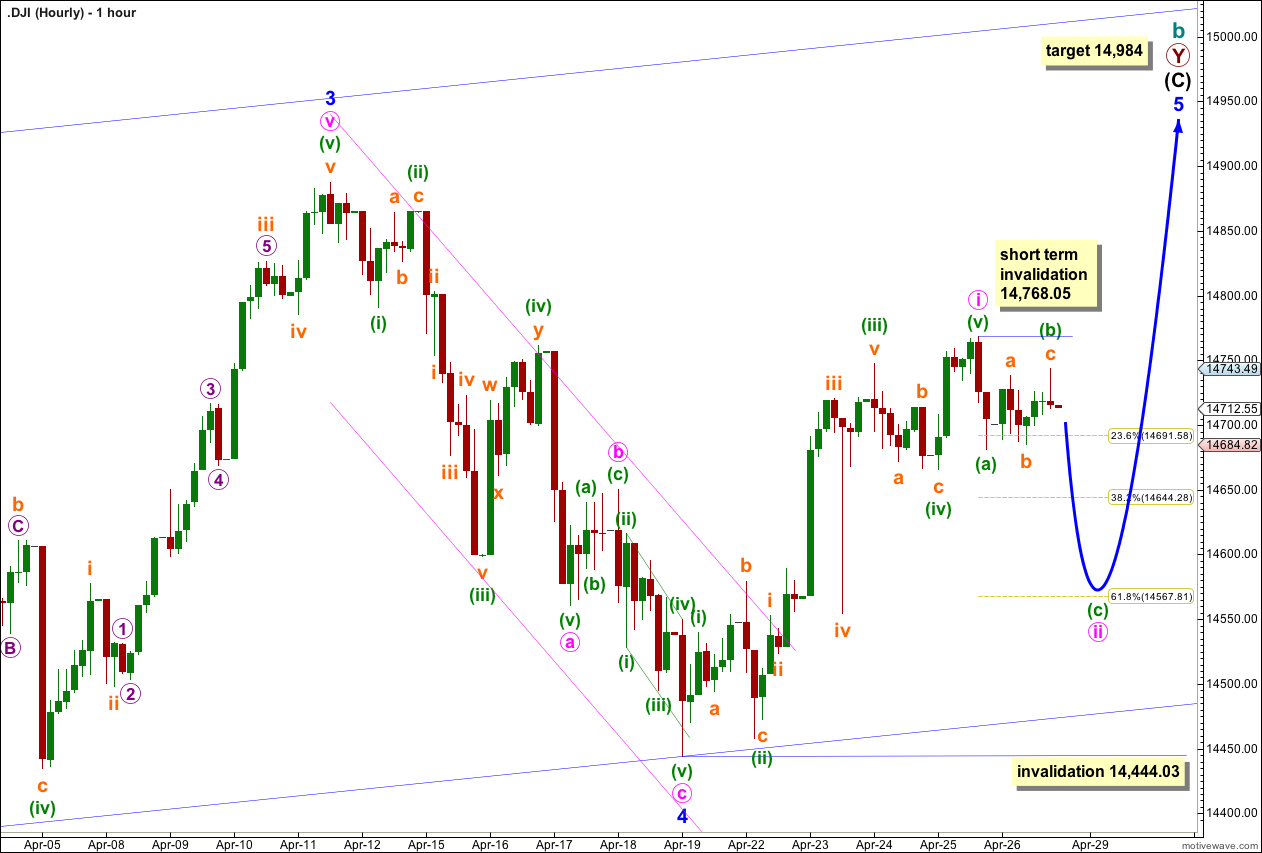

Upwards movement for the week subdivides nicely as a five wave impulse. This may be minute wave i within minor wave 5 complete and lasting a Fibonacci 5 days.

We may see downwards movement for one to three days for minute wave ii. It may end about one of the Fibonacci ratios of minute wave i, with the 0.618 Fibonacci ratio at 14,567.81 the most likely.

Within the zigzag of minute wave ii minuette wave (b) may not move beyond the start of minuette wave (a). The labeling of minute wave ii as incomplete is invalidated with movement above 14,768.05 during Monday’s session.

The piece of downwards movement during Friday’s session labeled minuette wave (a) on the five minute chart is ambiguous; it may be seen as a five or a three. If we see this movement as a three then it is possible that minute wave ii is over at 14,681.49. If we see movement above 14,768.05 during Monday’s session then I would expect that minute wave iii upwards would likely have begun.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated at minor degree with movement below 14,444.03.

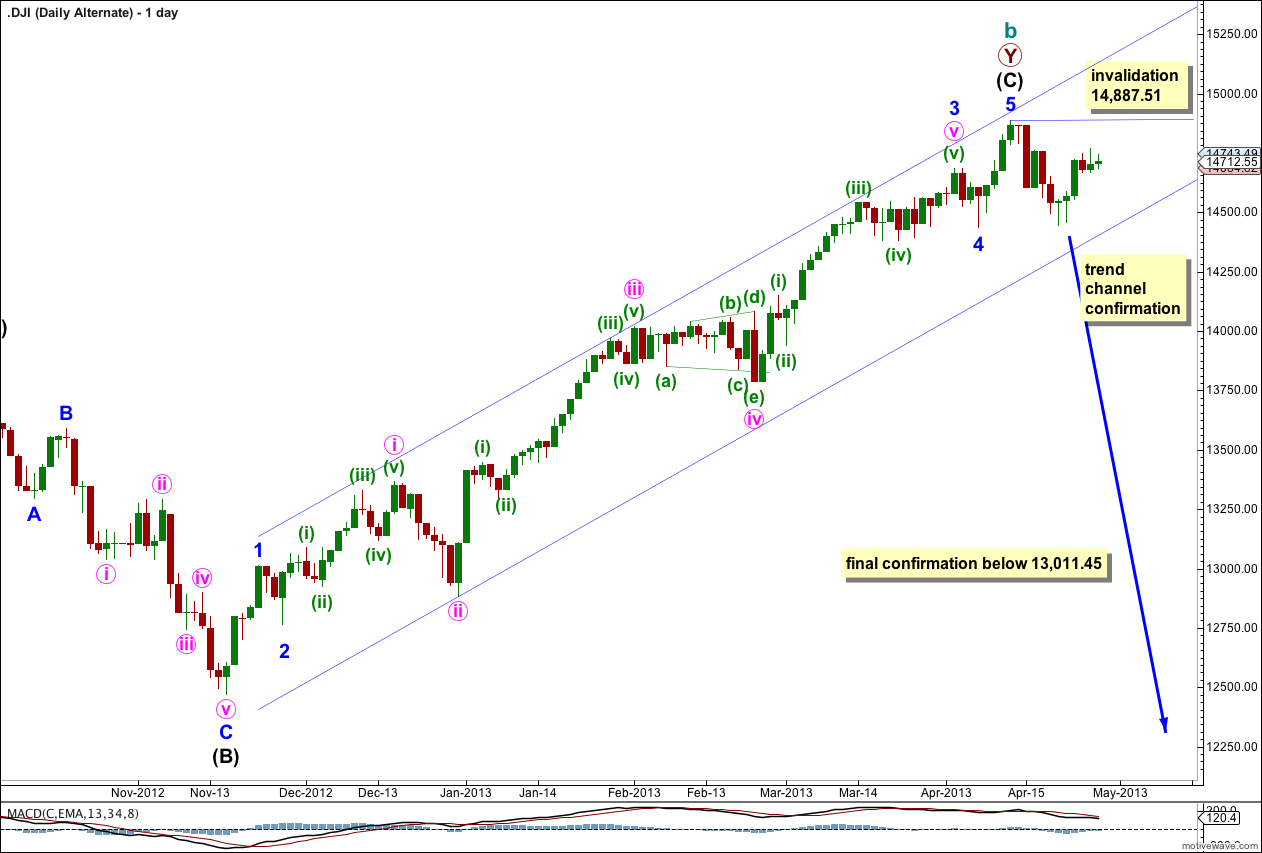

Alternate Wave Count.

There are several possible ways to label upwards movement for intermediate wave (C). This alternate looks at the possibility that it may be over.

This is a very big trend change. The new downwards trend is at cycle degree and should last one to several years. It should take price substantially below 6,469.95. It is wise to wait for confirmation of this trend change before having confidence in it.

This wave count has a better fit than the main wave count. The difference is within minuette wave (iii) of minute wave v of minor wave 3. For this alternate this piece of movement subdivides nicely into a five wave structure.

Within the new downwards trend no second wave correction may move beyond the start of its first wave. This alternate is invalidated with movement above 14,887.51.