Oil analysis last week expected price to move strongly lower as the middle of a third wave unfolded which is exactly what has happened.

Targets have not been met, but the structure is incomplete. It should continue to move lower over the next week.

Click on the charts below to enlarge.

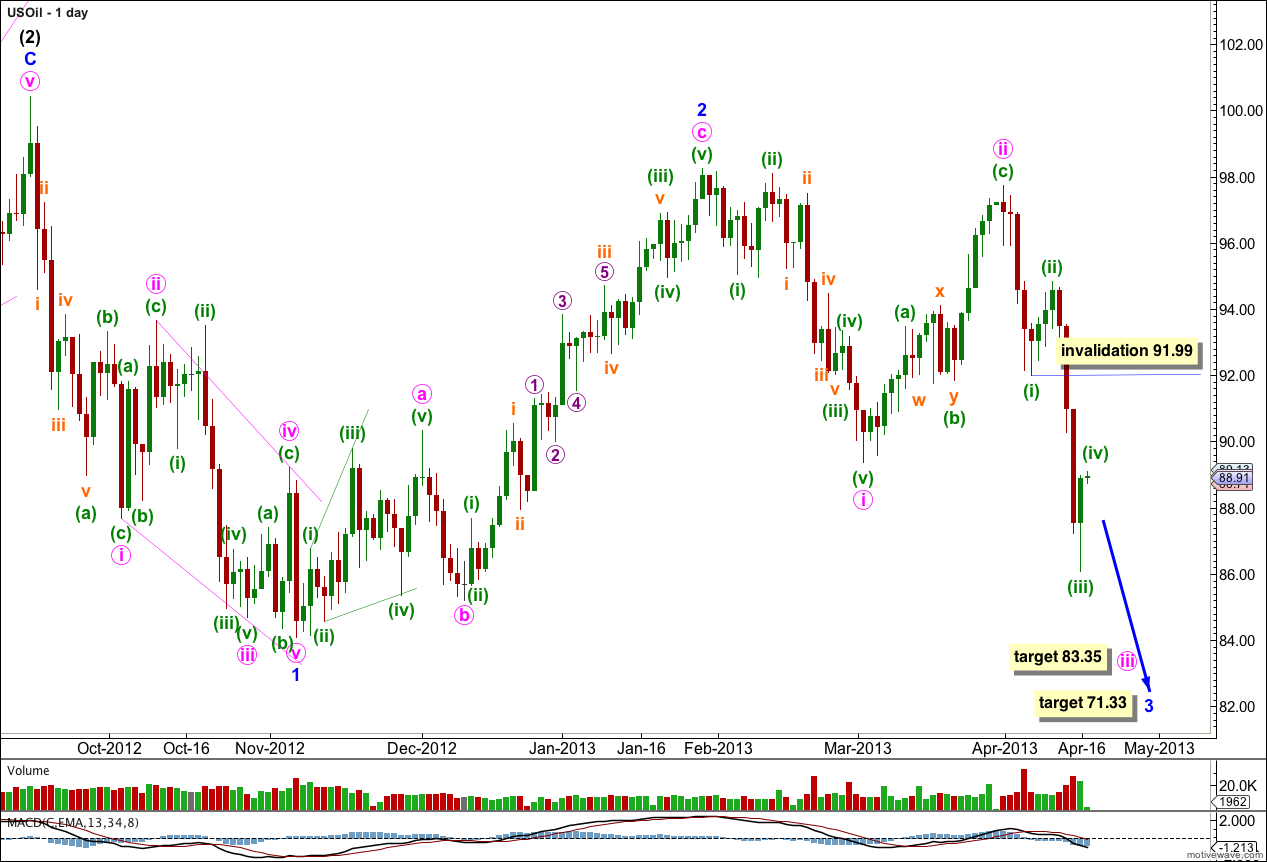

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor waves 1 and 2 are complete.

Minor wave 3 must make a new low below the end of minor wave 1 at 84.07.

At 71.33 minor wave 3 would reach 1.618 the length of minor wave 1.

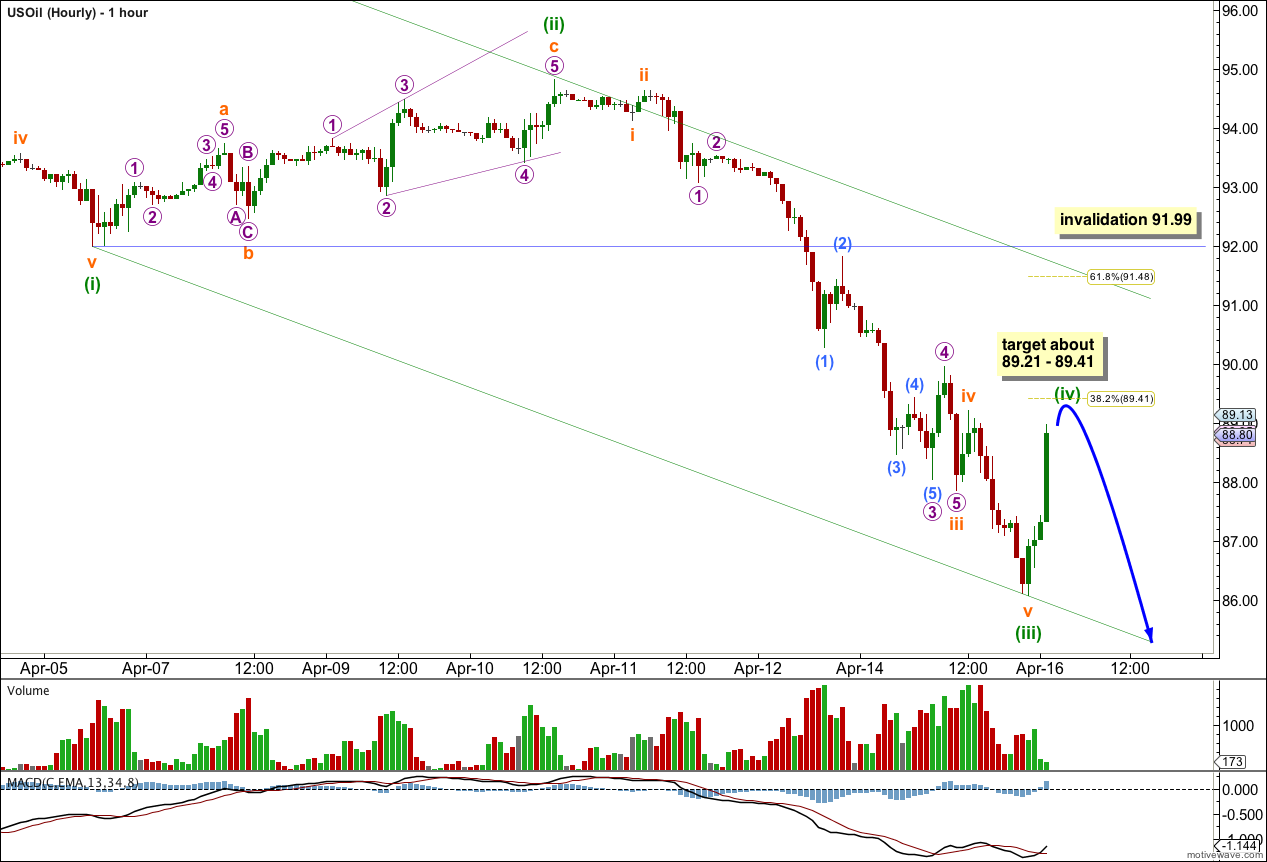

Within minute wave ii there is no Fibonacci ratio between minuette waves (a) and (c).

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 91.99.

The strong downwards movement of the last three days is exactly what we should expect to see for a third wave. I may consider moving the degree of labeling of minuette wave (iii) down one degree if the next wave down increases further in momentum.

Last analysis expected a little upwards movement to complete minuette wave (ii) to a target at 95.07 to 95.29. Price did move higher to 94.82, just 0.25 short of the target zone. Thereafter, price turned downwards in a third wave.

Within minuette wave (iii) it looks likely that this structure is complete.

Ratios within minuette wave (iii) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.22 longer than 4.236 the length of subminuette wave i.

Ratios within submineutte wave iii are: micro wave 3 has no Fibonacci ratio to micro wave 1, and micro wave 5 is exactly 0.382 the length of micro wave 3.

Ratios within micro wave 3 are: submicro wave (3) is just 0.10 longer than equality with submicro wave (1), and submicro wave (5) is 0.11 longer than 0.382 the length of submicro wave (3).

Minuette wave (iv) may end about the fourth wave of one lesser degree about 89.21 which is close to the 0.382 Fibonacci ratio of minuette wave (iii) at 89.41.

Minuette wave (ii) was a zigzag so we may expect minuette wave (iv) to be most likely a flat, double or triangle.

Draw a channel about this third wave. Draw the first trend line from the lows of minuette waves (i) to (iii), then place a parallel copy upon the high of minuette wave (ii). Expect price to be contained within this channel; if minuette wave (iv) moves above the target it should find resistance about the upper edge of the channel. Minuette wave (v) down to follow may end either midway within the channel, or should find support at the lower edge.

Minuette wave (ii) lasted three days. I would expect minuette wave (iv) to last about three or five days, depending upon which structure it unfolds as.