Last week’s main wave count expected more upwards movement to a short term target for the week at 14,921. Price reached up to 14,887.51, 33.49 points short of the target.

The alternate wave count was invalidated on Tuesday with a new high, and at that stage we may have had more confidence in the short term target for the main wave count.

The target remains the same. I have just the one daily and one hourly wave count for you this week.

Click on the charts below to enlarge.

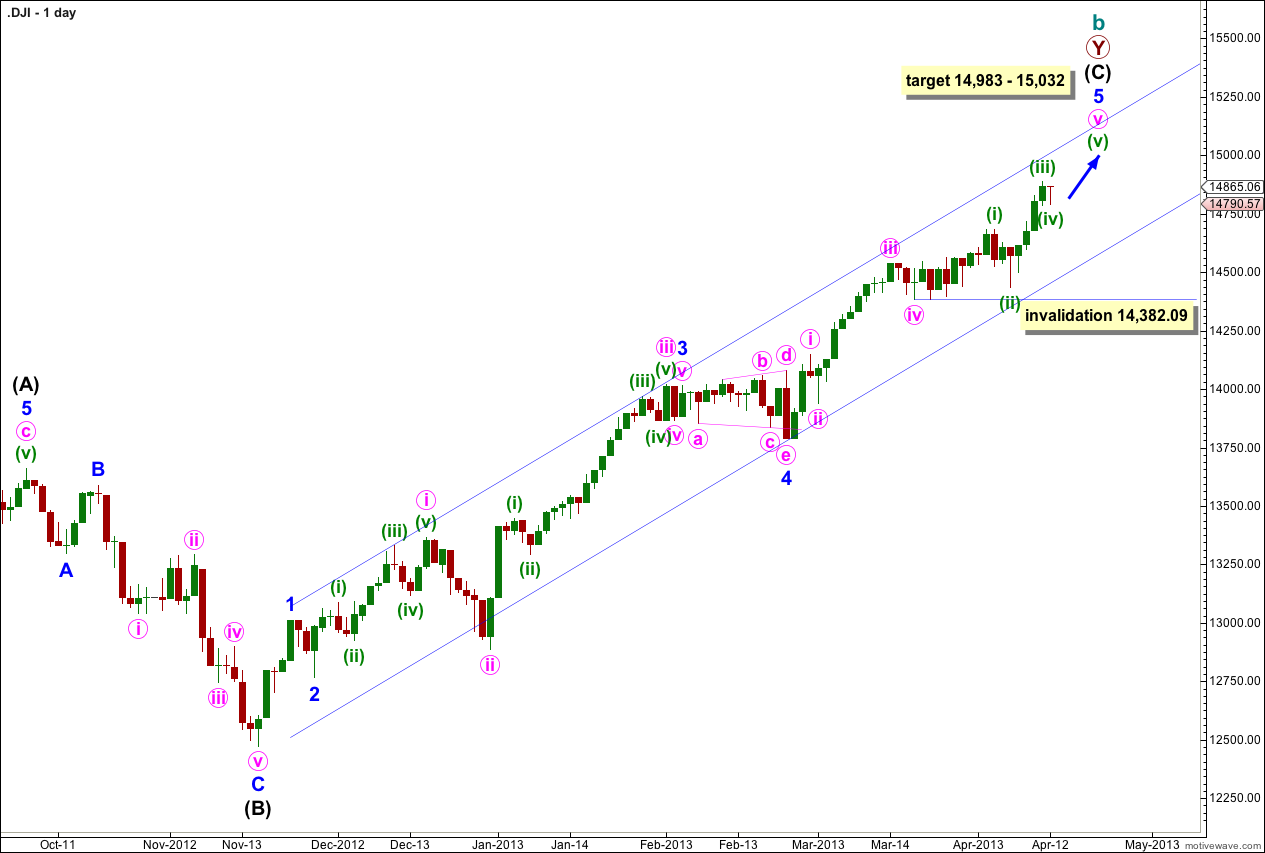

Cycle wave b is a double zigzag correction. Price is within the second zigzag labeled primary wave Y.

Minute wave v within minor wave 5 may be incomplete.

At 15,032 minor wave 5 would reach equality in length with minor wave 3. Because there is no Fibonacci ratio between minor waves 3 and 1 it would be more likely that minor wave 5 would exhibit a Fibonacci ratio to either of 3 or 1.

Within minor wave 5 minute wave iii is just 10.89 points longer than 1.618 the length of minute wave i. At 14,983 minute wave v would reach equality in length with minute wave iii. This target has a lower probability because there is already a good Fibonacci ratio within minor wave 5. For this reason I favour the upper end of the target zone.

Minor wave 5 may end either midway or about the upper edge of the channel drawn here using Elliott’s technique. Draw this channel first with a trend line from the highs of minor waves 1 to 3 (push this line up slightly to encompass most of this movement), then place a parallel copy upon the low of minor wave 4. While minor wave 5 is incomplete price should remain contained within this channel.

Within minute wave v minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 14,382.09.

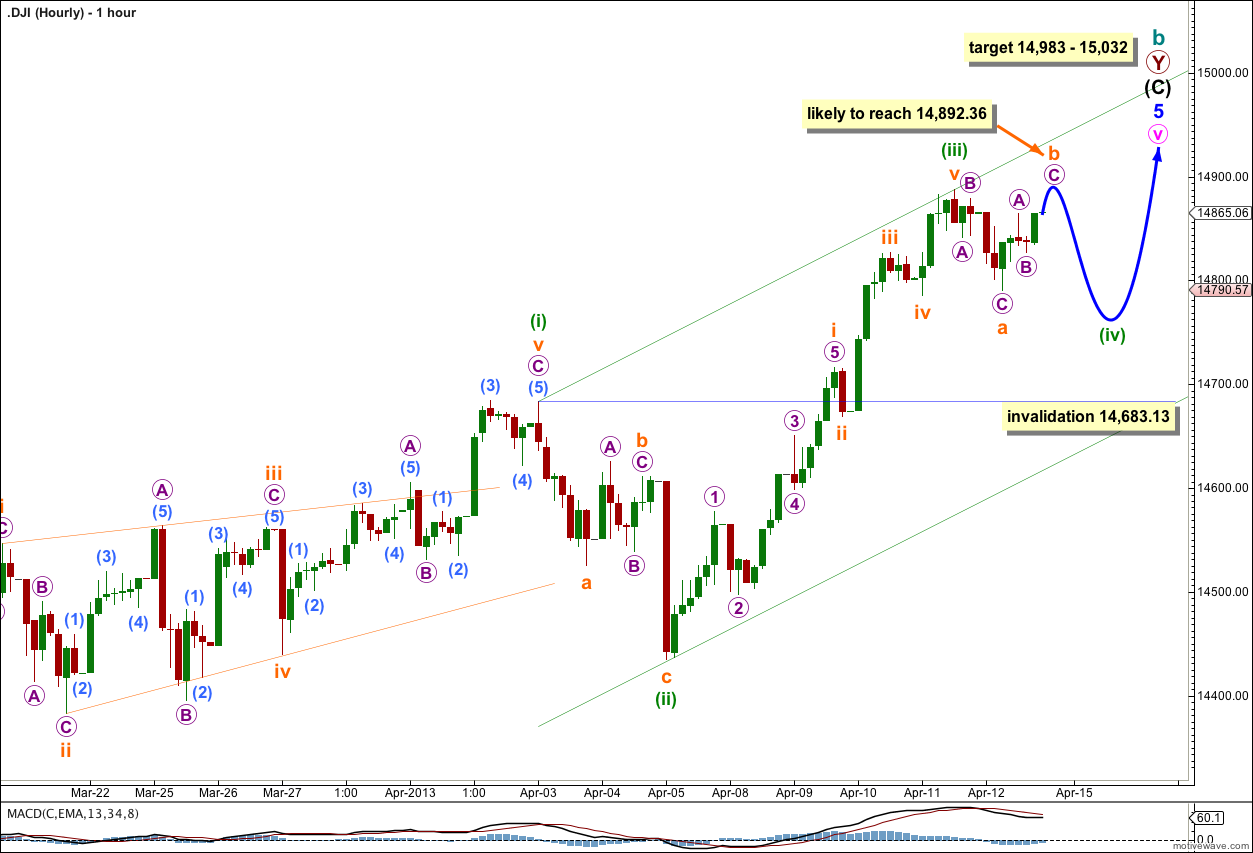

Within minute wave v minuette waves (i), (ii) and now (iii) are complete. Minuette wave (iii) is 34 points short of 1.618 the length of minuette wave (i), a 7.5% variation which is acceptable (is less than 10%).

Within minuette wave (iii) subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is just 5.59 points short of 0.382 the length of subminuette wave i.

Subminuette wave i within minuette wave (iii) is extended. Within it micro wave 3 is 9.45 points longer than equality with micro wave 1, and micro wave 5 has no Fibonacci ratio to either of micro waves 1 or 3.

Draw a parallel channel about minute wave v using Elliott’s channeling technique. Draw the first trend line from the highs of minuette waves (i) to (iii), then place a parallel copy upon the low of minuette wave (ii). Minuette wave (iv) should find support at the lower trend line and minuette wave (v) may end midway within the channel, or should find resistance at the upper edge.

Minuette wave (ii) was a deep zigzag correction. Given the guideline of alternation we may expect minuette wave (iv) to be a sideways shallow flat, double or triangle (in order of probability). If minuette wave (iv) is a flat correction then subminuette wave b must move up to the minimum requirement of 90% the length of subminuette wave a at 14,877.82. If minuette wave (iv) is an expanded flat correction then subminuette wave b must reach 105% the length of subminuette wave a at 14,892.36. This is likely as expanded flats are the most common type of flat.

When subminuette wave b is complete then subminuette wave c is extremely likely to reach below the end of subminuette wave a at 14,790.57 to avoid a truncation and a rare running flat correction.

When the first three wave structure is completed then we shall have an alternate looking at the possibility of a double. I will move the degree of labeling within the first correction down one degree and label it subminuette wave w.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 14,683.13.