Last week’s analysis expected more upwards movement to a target at 14,658. Price did move higher as expected, reaching 14,684.49, 26.49 points above the target, before turning downwards.

I have two wave counts for you this week. Because we should always assume the trend remains the same until proven otherwise the main wave count will expect a continuation of the trend. The alternate wave count is unconfirmed. We can use trend channels and price points for confirmation of the alternate.

Click on the charts below to enlarge.

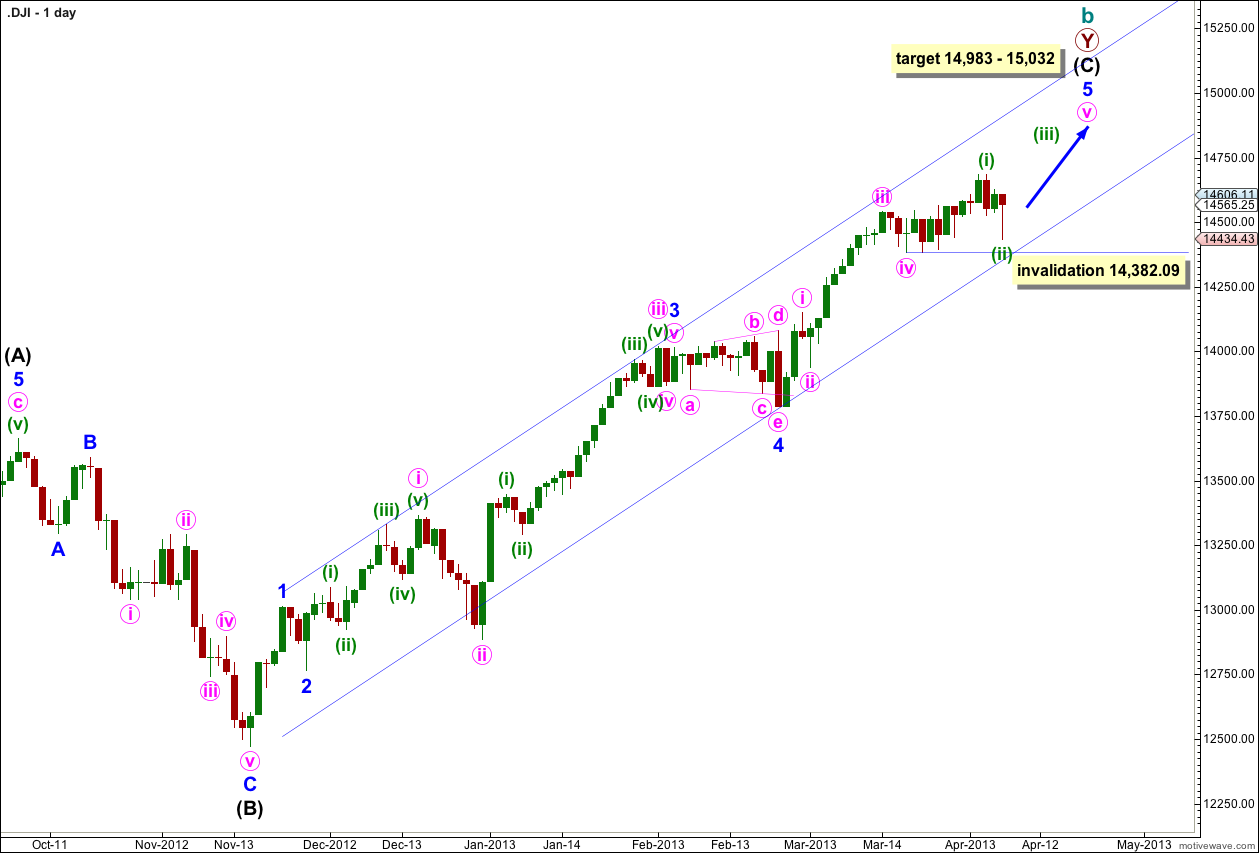

Main Wave Count.

Cycle wave b is a double zigzag correction. Price is within the second zigzag labeled primary wave Y.

I have adjusted the main wave count to see minute wave iv within minor wave v not as a triangle but as a more brief double correction.

Minute wave v within minor wave 5 may be incomplete.

At 15,032 minor wave 5 would reach equality in length with minor wave 3. Because there is no Fibonacci ratio between minor waves 3 and 1 it would be more likely that minor wave 5 would exhibit a Fibonacci ratio to either of 3 or 1.

Within minor wave 5 minute wave iii is just 10.89 points longer than 1.618 the length of minute wave i. At 14,983 minute wave v would reach equality in length with minute wave iii. This target has a lower probability because there is already a good Fibonacci ratio within minor wave 5. For this reason I favour the upper end of the target zone.

Minor wave 5 may end either midway or about the upper edge of the channel drawn here using Elliott’s technique. Draw this channel first with a trend line from the highs of minor waves 1 to 3 (push this line up slightly to encompass most of this movement), then place a parallel copy upon the low of minor wave 4. While minor wave 5 is incomplete price should remain contained within this channel.

Within minute wave v minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 14,382.09.

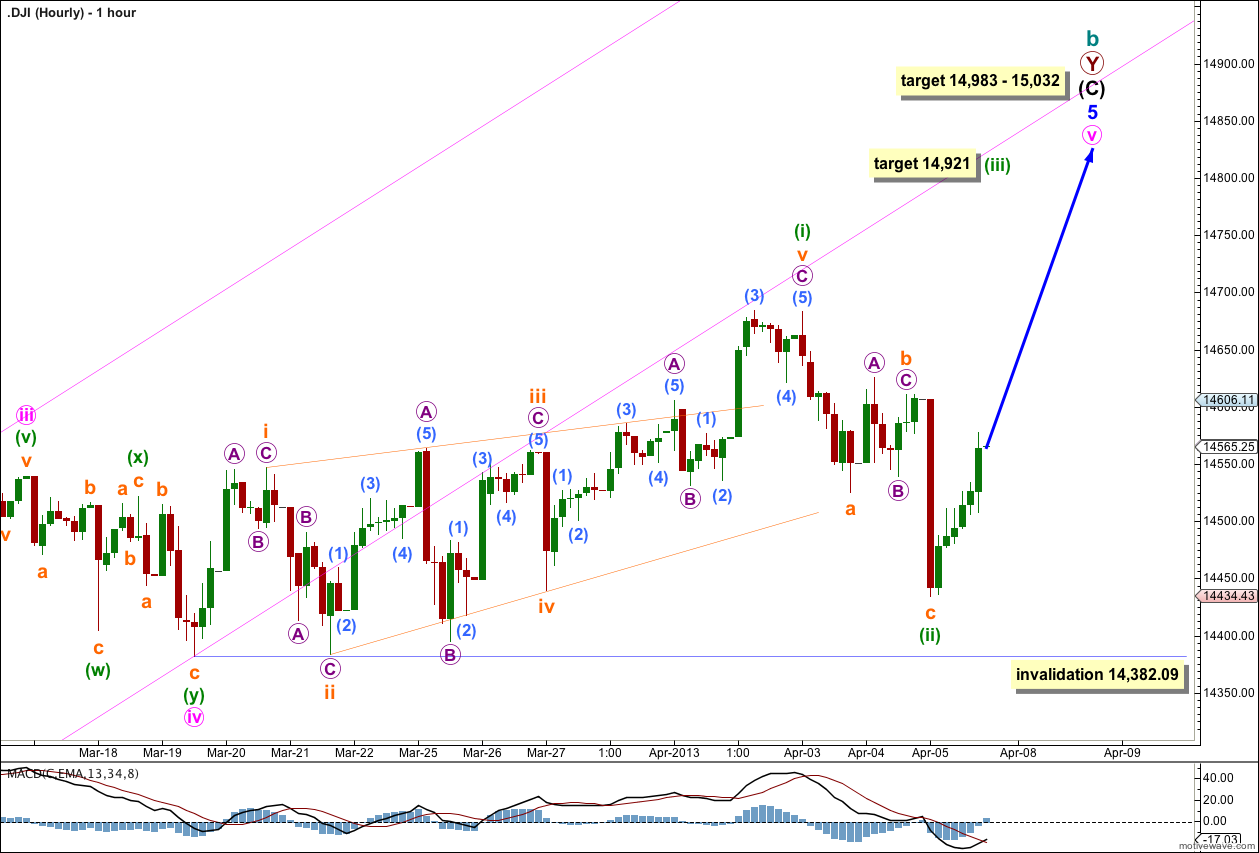

Minute wave iv may have been a double zigzag structure which was over at 14,382.09. Within minute wave v minuette wave (i) may be a leading diagonal. The diagonal wave lengths are not what would be expected, but as the third wave is not the shortest this structure is acceptable, although the probability that this wave count is correct is slightly reduced.

Minuette wave (ii) is a complete zigzag structure. Minuette wave (iii) should move price strongly higher during Monday’s session and maybe into Tuesday and Wednesday, depending upon the duration of the corrections within it. At 14,921 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

The pink channel drawn here is about minor wave 5 and is clearly breached by downwards movement. This may be an indication that we have seen a trend change, and it does make this wave count look a little strange on the hourly chart.

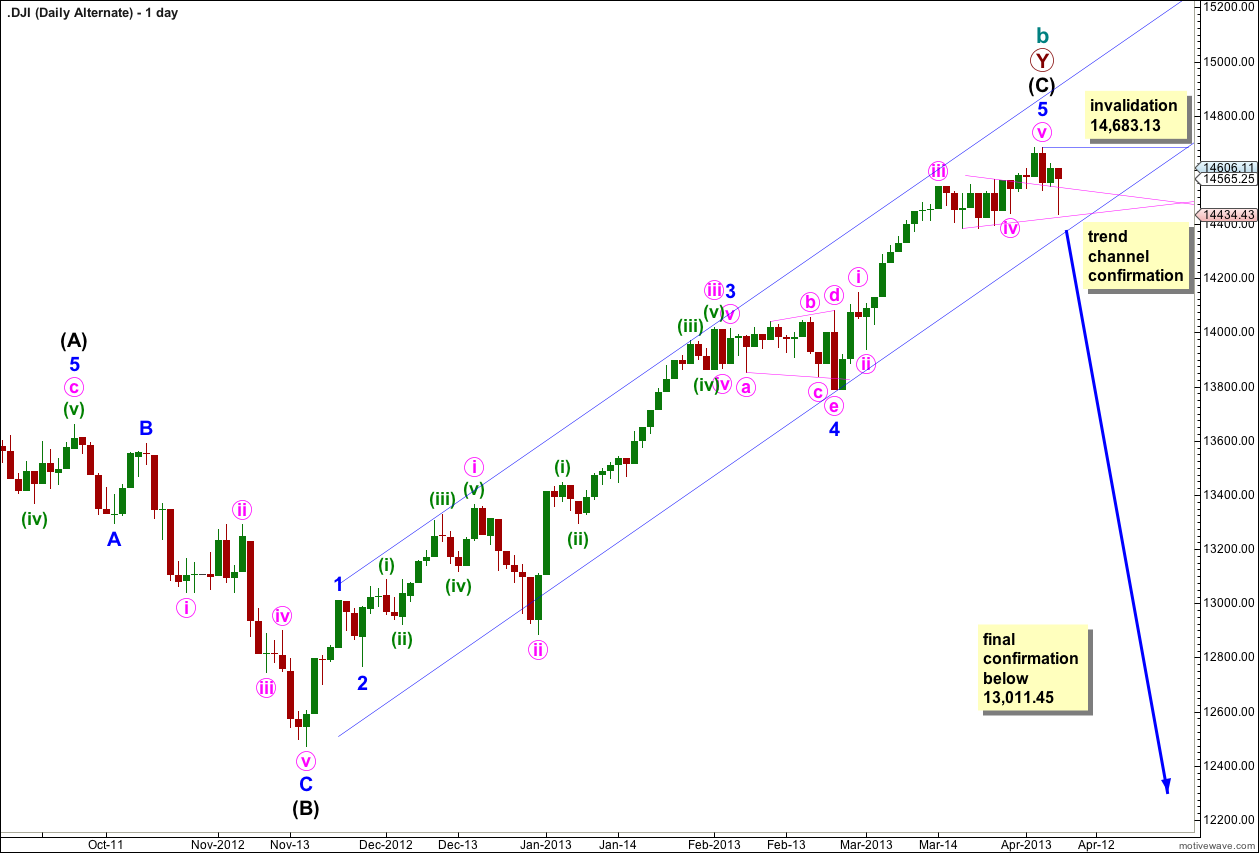

Alternate Wave Count.

It is possible that cycle wave b is over at 155% the length of cycle wave a. If this is correct then the new downwards trend for cycle wave c should last from one to several years and take price substantially below the end of cycle wave a at 6,469.95. Because this trend change is very big it is wise to wait for some confirmation before having any confidence in it.

Intermediate wave (C) is 199 points longer than 0.618 the length of intermediate wave (A) (a 9% variation, less than 10% may be considered acceptable).

Within intermediate wave (C) there is no Fibonacci ratio between minor waves 3 and 1, and minor wave 5 is 25.46 points longer than 1.618 the length of minor wave 1.

Within minor wave 5 minute wave iii is 10.89 points longer than 1.618 the length of minute wave i, and minute wave v is 13.73 points longer than 0.382 the length of minute wave iii.

We need to see a clear channel breach of this channel containing intermediate wave (C) to have any confidence in this trend change, with a full daily candlestick below the lower trend line and not touching it.

Final price confirmation would come with movement below 13,011.45 as at that stage downwards movement could not be just a fourth wave correction within intermediate wave (C) and so it would have to be over.

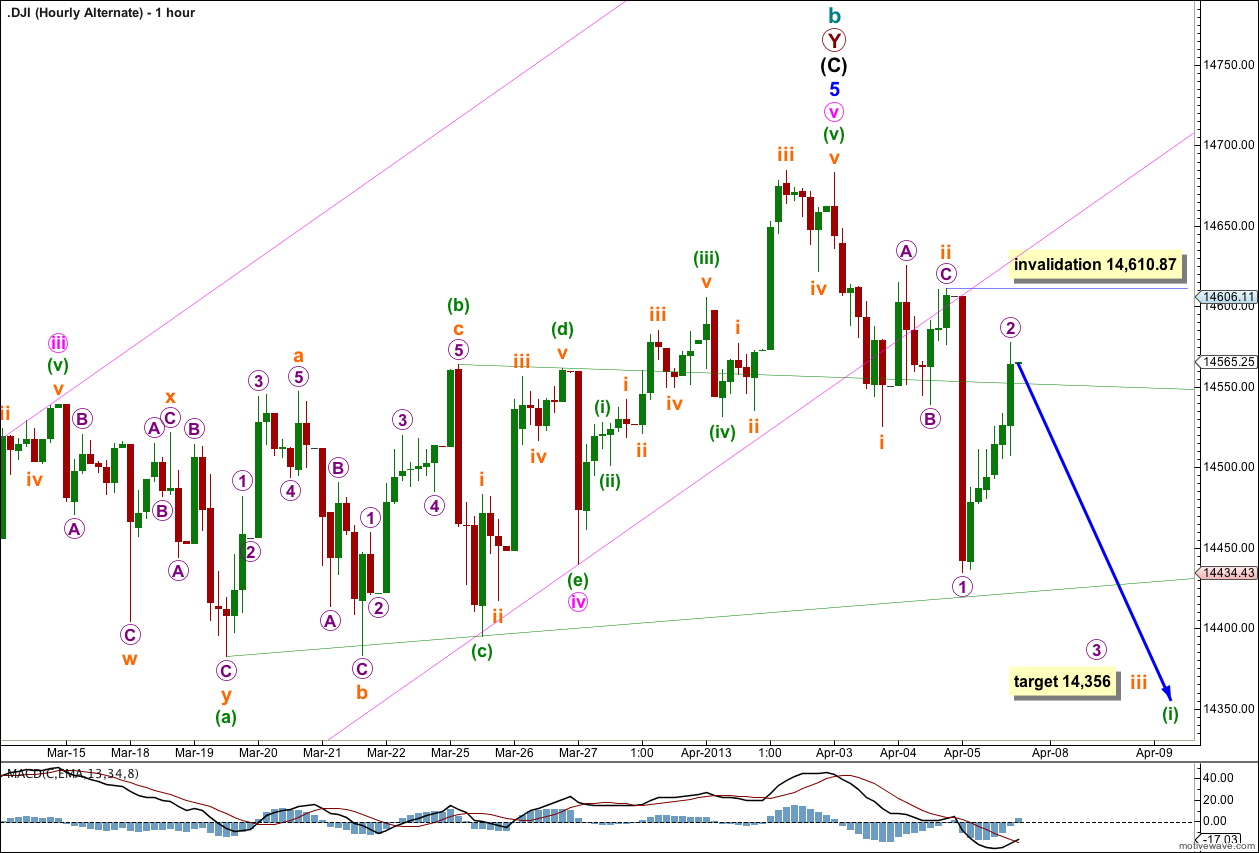

This alternate wave count follows on from last week’s main wave count. Minute wave iv looks like a running barrier triangle, all subdivisions fit perfectly.

Minute wave v may have ended last week as a short simple impulse, ending midway within the parallel channel containing minor wave 5.

The channel is clearly breached which may be a very early indication that we may have seen a trend change. We still need to see a clear channel breach of the larger channel on the daily chart to have confidence in this wave count.

So far to the downside we do not have a clear five wave structure.

If downwards movement is beginning as an impulse (rather than the only other option, a leading diagonal) then we have two overlapping first and second waves. This indicates an increase in downwards momentum.

Within minuette wave (i) subminuette wave iii would reach 1.618 the length of subminuette wave i at 14,356. If this wave count is correct then this target should be met next week.

Within subminuette wave iii micro wave 2 may not move beyond the start of micro wave 1. This wave count is invalidated at micro degree with movement above 14,610.87.