Movement above 1,599.78 invalidated the main wave count from last analysis and confirmed the alternate. At that stage price was expected to be in a higher degree longer lasting correction with an initial expected target about 1,646.

Click on the charts below to enlarge.

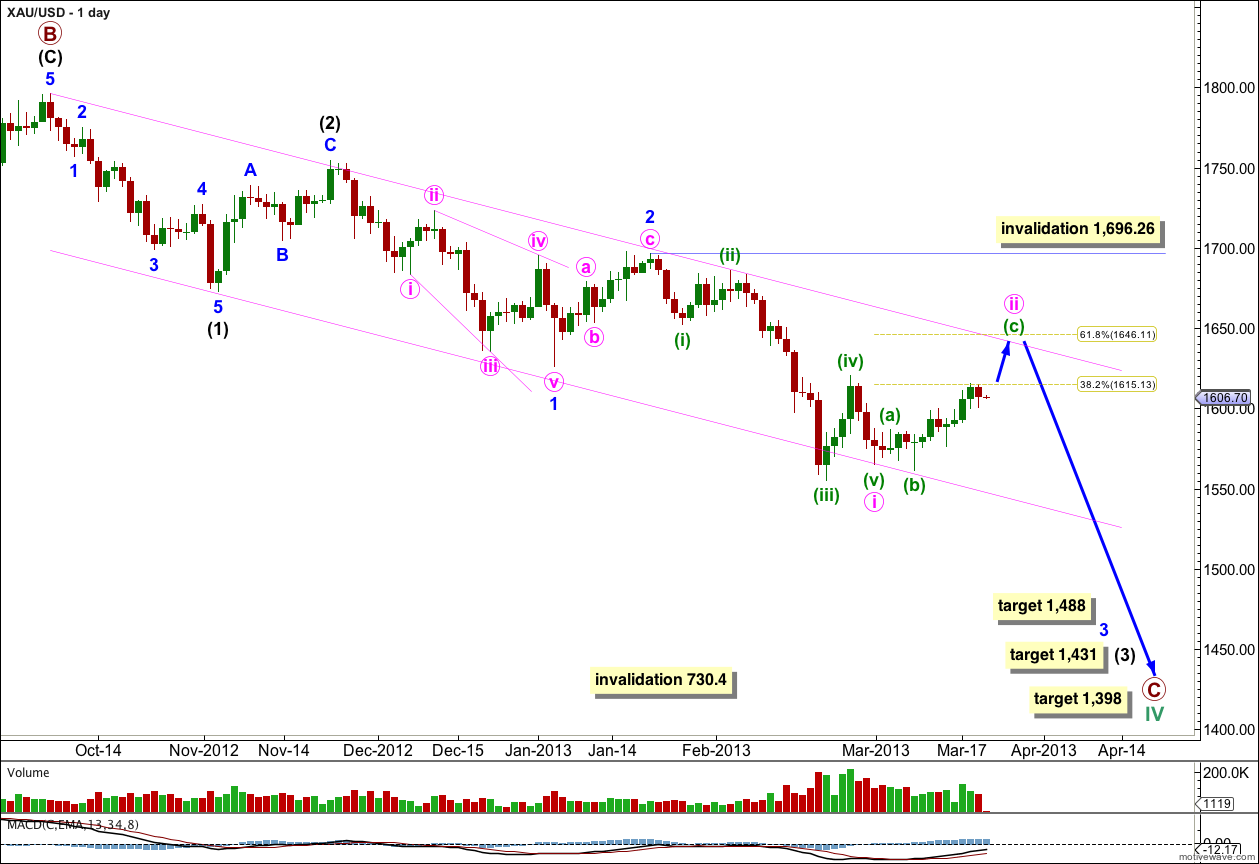

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun. Within intermediate wave minor waves 1 and 2 are complete and minor wave 3 is underway.

Within minor wave 3 minute wave i is complete and minute wave ii is close to completion. It should complete within the next few days. Thereafter, momentum to the downside should build as the middle of a third wave unfolds.

At 1,488 minor wave 3 would reach 1.618 the length of minor wave 1.

At 1,431 intermediate wave (3) would reach 2.618 the length of intermediate wave (1). This target is weeks away.

At 1,398 primary wave C would reach equality in length with primary wave A. This target is still weeks to months away.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated at minute degree with movement above 1,696.26.

The parallel channel drawn here is a best fit. I would expect upwards movement for minute wave ii to find resistance about the upper edge of this channel.

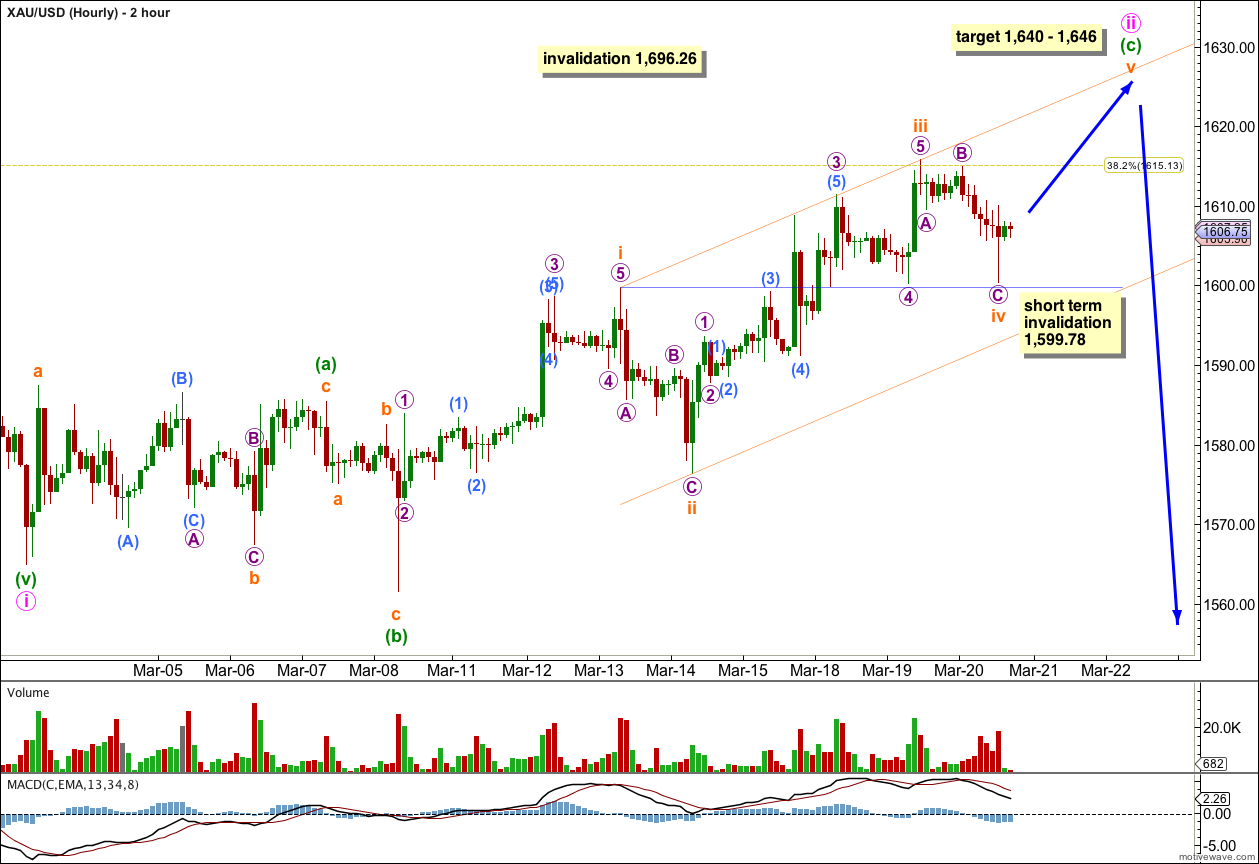

This two hourly chart shows the whole structure of the expanded flat correction for minute wave ii. So far minuette wave (c) has just passed 2.618 the length of minuette wave (a) and they may not exhibit a Fibonacci ratio to each other.

Within minuette wave (c) subminuette wave iii is just 0.31 longer than equality with subminuette wave i. Subminuette wave v is less likely to exhibit a Fibonacci ratio to either of subminuette waves i or iii. This makes target calculation difficult; Fibonacci ratios of minute wave i may be the most reliable.

At 1,640 subminuette wave v would reach equality in length with subminuette wave iii. At 1,646 minute wave ii would reach up to the 0.618 Fibonacci ratio of minute wave i. I favour the upper edge of this target zone, but it does not have a high probability.

We may use Elliott’s channeling technique to draw a channel about minuette wave (c). Draw the first trend line from the highs of subminuette waves i to iii, then place a parallel copy upon the low of subminuette wave ii. So far subminuette wave iv remains contained within the channel. Subminuette wave v may end either mid way within the channel, or about the upper edge. When the channel is breached by subsequent downwards movement then we may expect that minuette wave (c) is complete and so minute wave ii is complete.

The next wave would be a third wave to the downside. This is likely to begin sometime over the next week, perhaps after only one or two more sessions.

In the short term (before a five up for subminuette wave v is complete) any further downwards movement for subminuette wave iv may not move into subminuette wave i price territory. This wave count is invalidated with movement below 1,599.78.