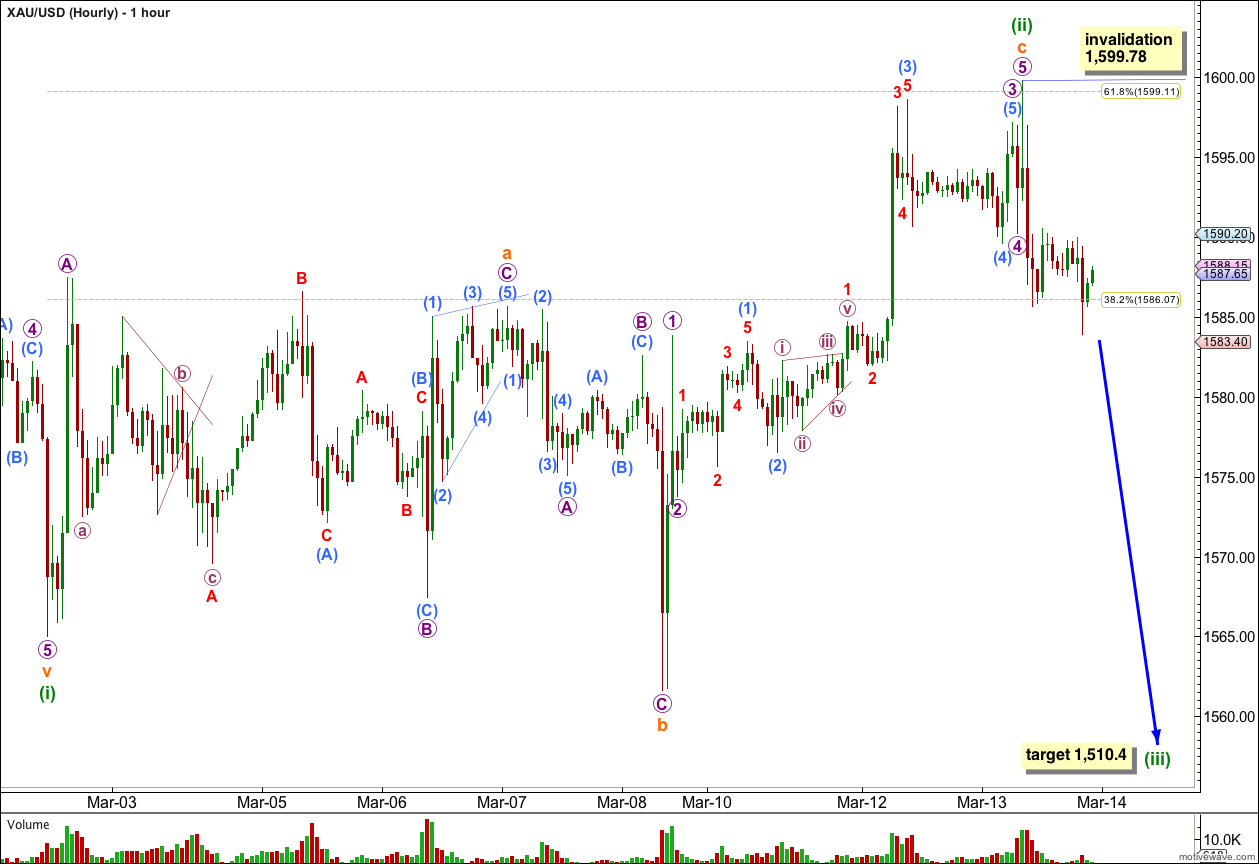

Last week’s analysis expected gold to rise towards one of two targets. The first target was at 1,590 and the second at 1,604. Price has moved higher to reach up to 1,599.78, 4.22 below the second target.

This week I expect gold to resume the downwards trend.

Click on the charts below to enlarge.

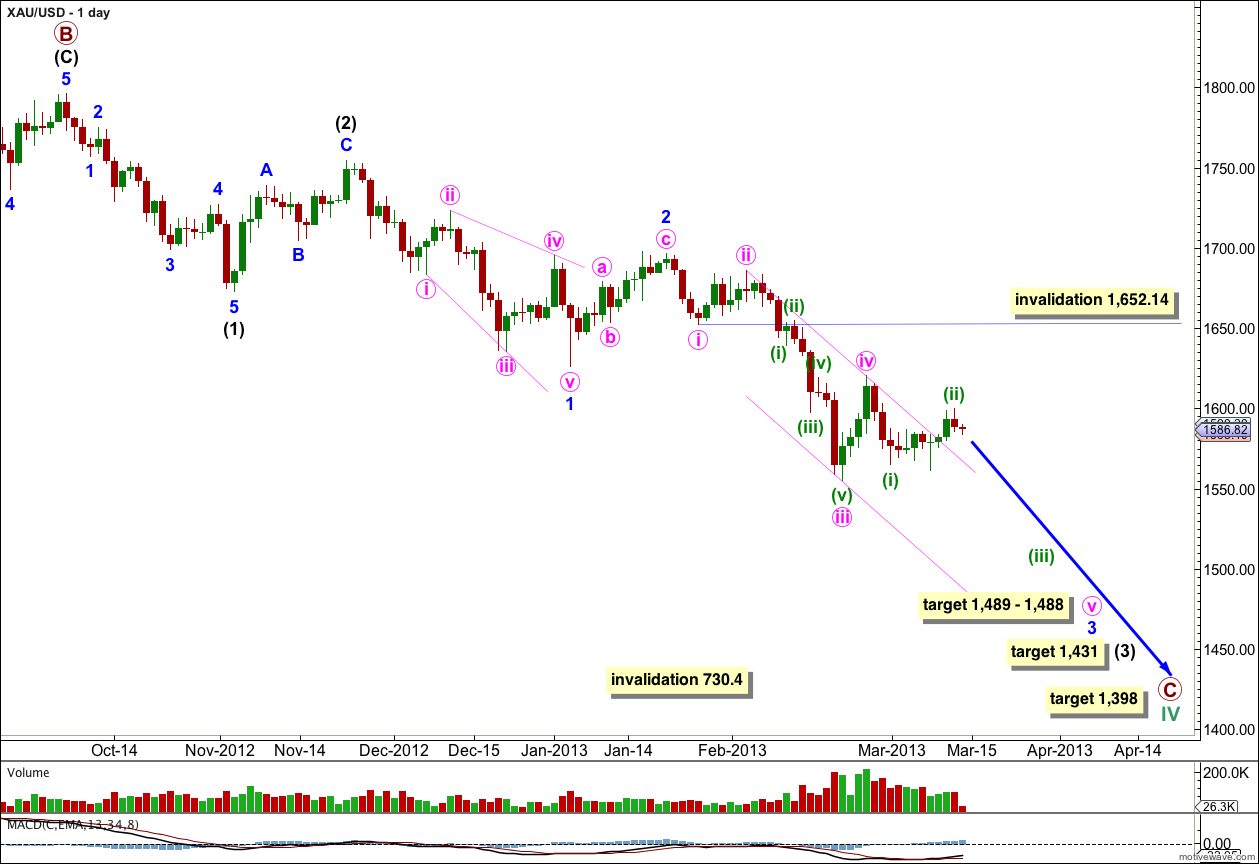

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun. Within intermediate wave (3) price may have just moved through the middle of it over the last week. MACD does show an increase in downwards momentum for the middle of minor wave 3 beyond that seen for minor wave 1.

Minor wave 1 was a leading diagonal, and minor wave 2 zigzag was a 55% correction of minor wave 1.

Within the zigzags of intermediate wave (2) and minor wave 2 there are no Fibonacci ratios between the A and C waves.

At 1,488 minor wave 3 would reach 1.618 the length of minor wave 1. At 1,489 minute wave v within minor wave 3 would reach equality in length with minute wave iii.

At 1,431 intermediate wave (3) would reach 2.618 the length of intermediate wave (1). This target is weeks away.

At 1,398 primary wave C would reach equality in length with primary wave A. This target is still weeks to months away.

At this stage minute wave iii is most likely complete and has no Fibonacci ratio to minute wave i. Minute wave iv may not move into minute wave i price territory. This daily wave count is invalidated at minute degree with movement above 1,652.14.

Price is not contained within the channel drawn about minor wave 3. The long duration of minuette wave (ii) may be a small cause for concern with this wave count. If it extends any higher I would consider that it could be minute wave iv moving further as a double combination or maybe a triangle.

If momentum increases further for the next downwards wave then minor wave 3 may be extending further. I would move the labeling within it down one degree.

Minuette wave (ii) is now a completed flat correction. Subminuette wave b is a 116% correction of subminuette wave a and subminuette wave c has no Fibonacci ratio to subminuette wave a.

Ratios within subminuette wave c are: micro wave 3 is 1.15 longer than equality with micro wave 1, and micro wave 5 is 0.61 longer than 0.382 the length of micro wave 3.

With minuette wave (ii) now ending with a slight overshoot of the 0.618 Fibonacci ratio of minuette wave (i), and a complete structure, it is most likely that it is over now.

I would expect strong downwards movement this week for gold.

At 1,510.4 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Minuette wave (i) lasted a Fibonacci 3 sessions and minuette wave (ii) may now be over in a Fibonacci 8 sessions. Minuette wave (iii) may last either 3 or 5 sessions.

Within minuette wave (iii) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,599.78.

If this wave count is invalidated with upwards movement then I would consider the alternate below may be correct.

Alternate Daily Wave Count.

This wave count is the same as the main daily wave count up to the high labeled minor wave 2. Thereafter, I have moved the degree of labeling within minor wave 3 down one degree and seen minute wave i as over with a truncated fifth wave.

The subdivisions are essentially the same as the main daily wave count. This alternate expects minor wave 3 may be further extended. Calculated targets may be too high.

If price continues to rise this week then I expect the correction would be a higher degree than minuette and this wave count would make more sense.

Minute wave ii may not move beyond the start of minute wave i. This alternate is invalidated with movement above 1,696.26.