Last week’s analysis expected downwards movement from the Dow. With a new high the main wave count was invalidated and the alternate confirmed. However, the structure at cycle and primary degree on the monthly chart was starting to look unlikely. I have a new monthly wave count for you this week.

Click on the charts below to enlarge.

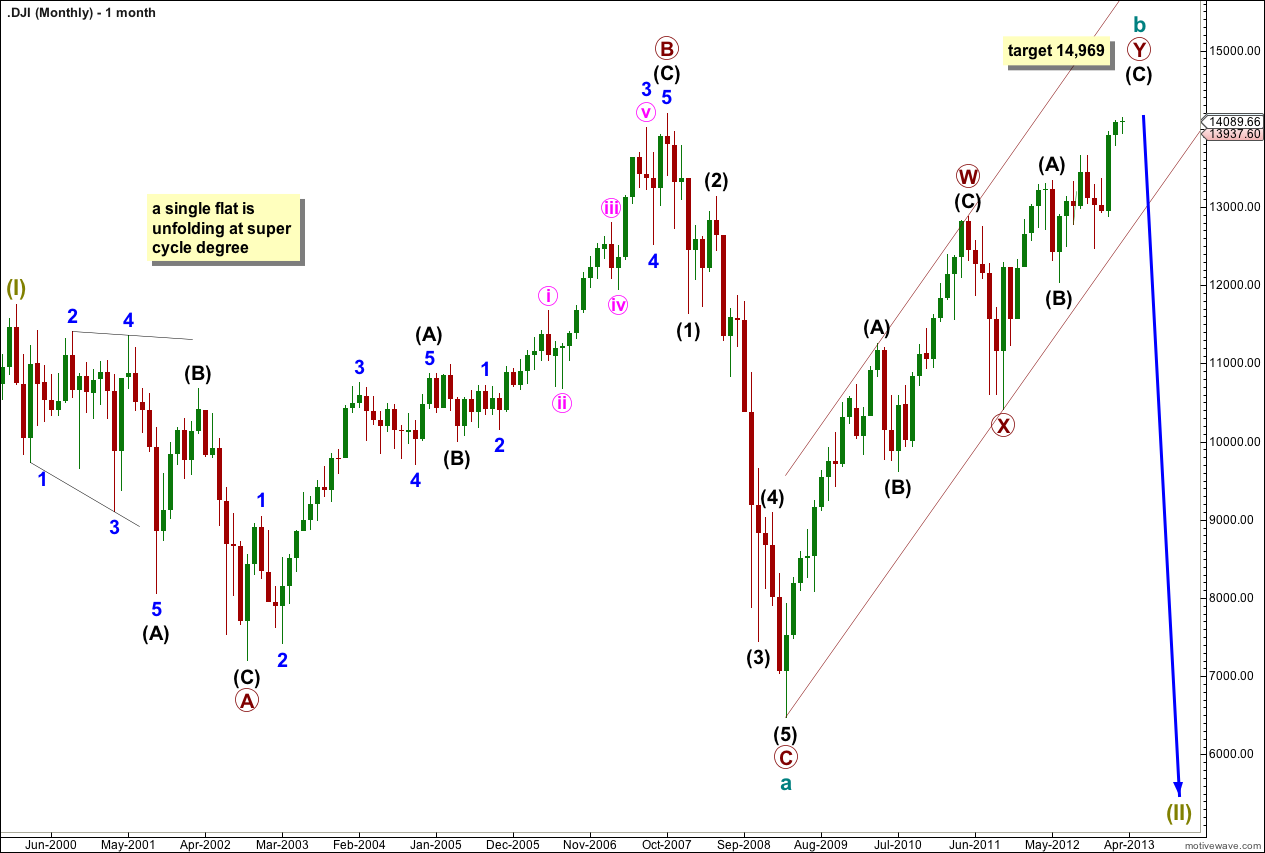

Main Monthly Wave Count.

The last monthly wave count saw a double flat unfolding at super cycle degree. This new monthly wave count sees a single flat unfolding at super cycle degree.

Within the single flat correction cycle wave a is a three wave structure, an expanded flat correction. Within it primary wave B is a 154% correction of primary wave A, and primary wave C is 362 points longer than 1.618 the length of primary wave A (a 4.7% variation which is acceptable).

Cycle wave b passed 105% the length of cycle wave a at 12,014 so the structure at super cycle degree is most likely to be an expanded flat. We would expect cycle wave c to be 1.618 the length of cycle wave a, about 8,544 points in length.

Cycle wave b is an incomplete double zigzag structure. The second zigzag, primary wave Y is incomplete. At 14,969 intermediate wave (C) would reach equality in length with intermediate wave (A).

We may draw a parallel channel about cycle wave b. When this channel is clearly breached by downwards movement then we shall have trend channel confirmation of a trend change at cycle wave degree. At that stage we may have a lot of confidence that price is in a new downwards trend extremely likely to make a new low below 6,469.95 to avoid a truncation and a rare running flat.

Within primary wave Y intermediate waves (A) and (B) are complete. Within intermediate wave (C) minor waves 1, 2 and 3 are complete.

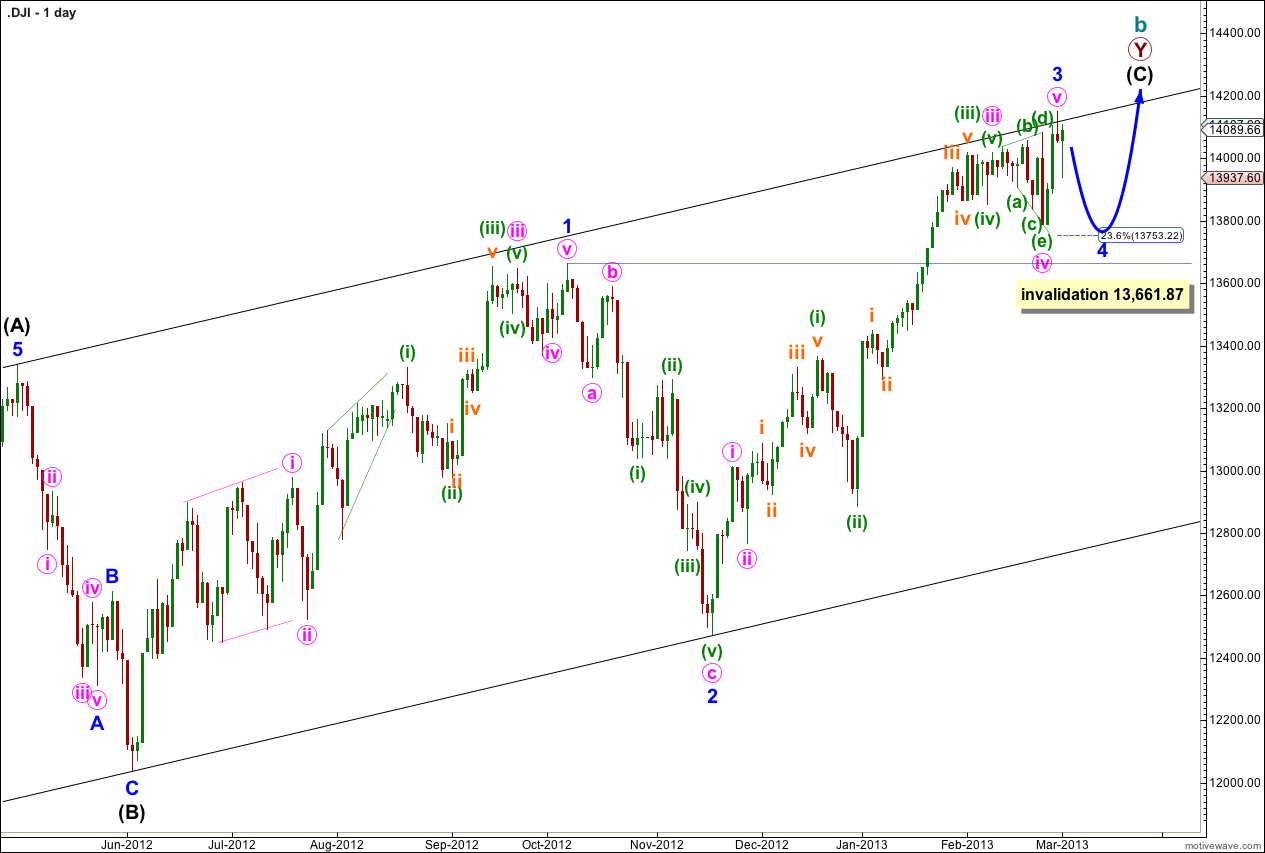

Minor wave 3 is just 50.88 points longer than equality with minor wave 1.

Minor wave 2 was a deep 73% zigzag correction of minor wave 1. Given the guideline of alternation I would expect minor wave 4 to be a shallow correction of minor wave 3.

Minor wave 4 is most likely to end about the fourth wave of one lesser degree, about 13,784 and about the 0.236 Fibonacci ratio at 13,753.

Ratios within minor wave 3 are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is 31.44 points longer than 0.618 the length of minute wave i.

Ratios within minute wave iii of minor wave 3 are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is just 0.38 points longer than 0.146 the length of minuette wave (iii).

Ratios within minuette wave (i) of minute wave iii of minor wave 3 are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is just 3.51 points short of 0.618 the length of subminuette wave iii.

Ratios within minuette wave (iii) of minute wave iii of minor wave 3 are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 8 points longer than 0.236 the length of subminuette wave iii.

Minute wave iv may have been a very rare expanding triangle.

I would expect very choppy overlapping sideways movement for the next two to four weeks for minor wave 4.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 13,661.87.

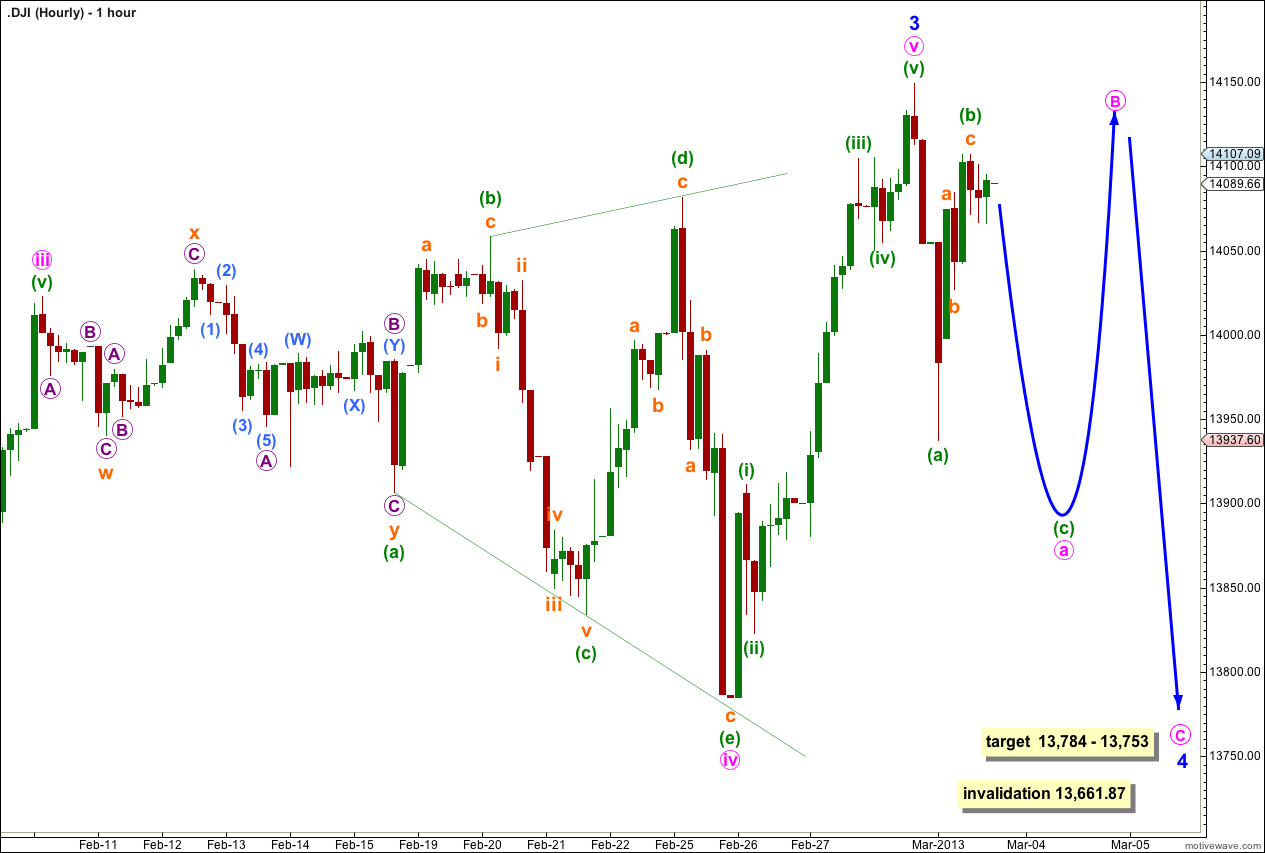

The hourly chart shows the structure of minute wave iv expanding triangle.

If minor wave 4 is to be a flat correction which is most likely then within it minute wave a must subdivide into a three wave structure.

Within minute wave a minuette wave (c) would reach equality in length with minuette wave (a) at 13,895.

Thereafter, minute wave b should be at least 90% the length of minute wave a and may make a new high.

Minor wave 4 may also be a double flat, double combination or triangle. At the end of next week we may have a clearer idea of which structure is unfolding. All these structures essentially expect choppy overlapping sideways movement which may include slight new highs, to last about a couple of weeks or so.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 13,661.87.