Last week’s analysis of gold expected price to fall for the week. A new low was made and then price moved higher, remaining below the invalidation point on the daily chart.

Click on the charts below to enlarge.

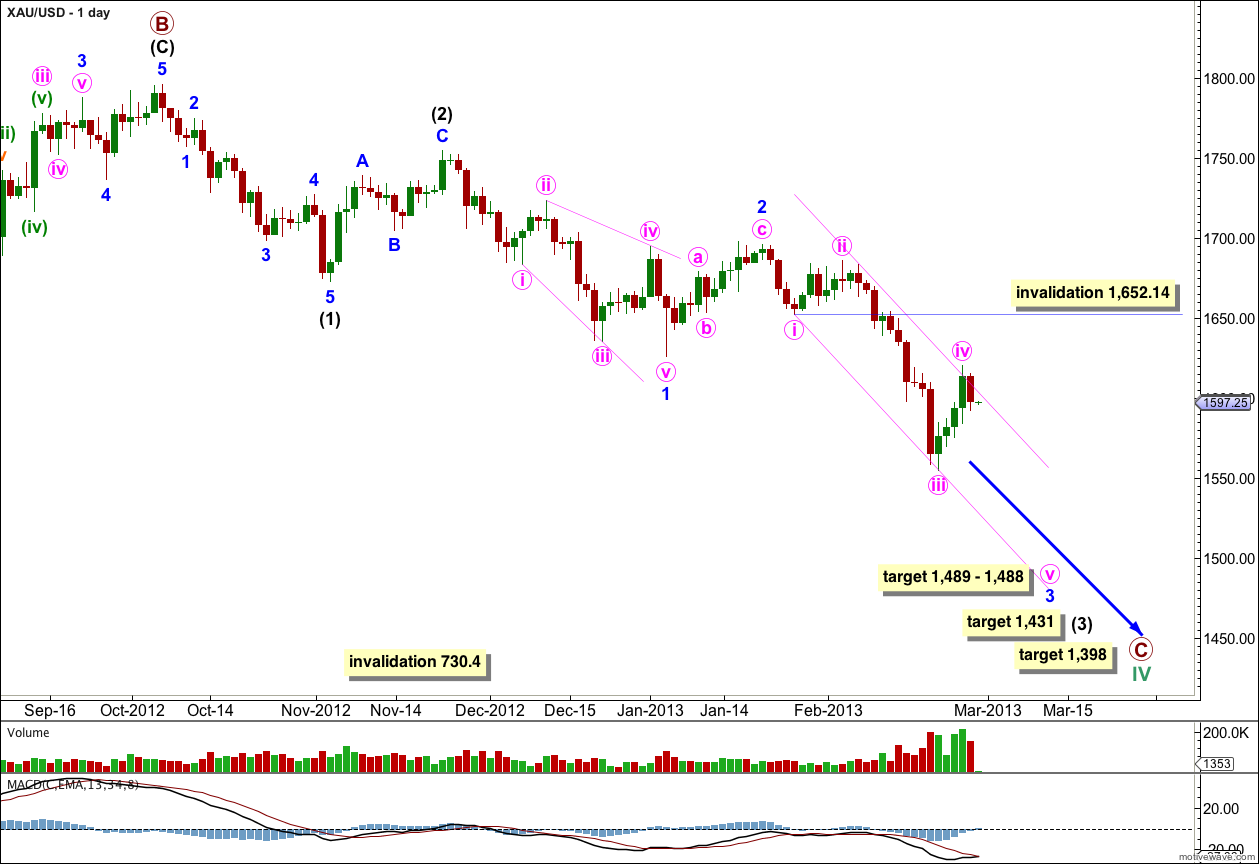

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun. Within intermediate wave (3) price may have today moved into the middle of it. Minor wave 1 was a leading diagonal, and minor wave 2 zigzag was a 55% correction of minor wave 1.

Within the zigzags of intermediate wave (2) and minor wave 2 there are no Fibonacci ratios between the A and C waves.

At 1,488 minor wave 3 would reach 1.618 the length of minor wave 1.

At 1,431 intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

At this stage minute wave iii is most likely complete and has no Fibonacci ratio to minute wave i. Minute wave iv may not move into minute wave i price territory. This daily wave count is invalidated at minute degree with movement above 1,652.14.

Main Hourly Wave Count.

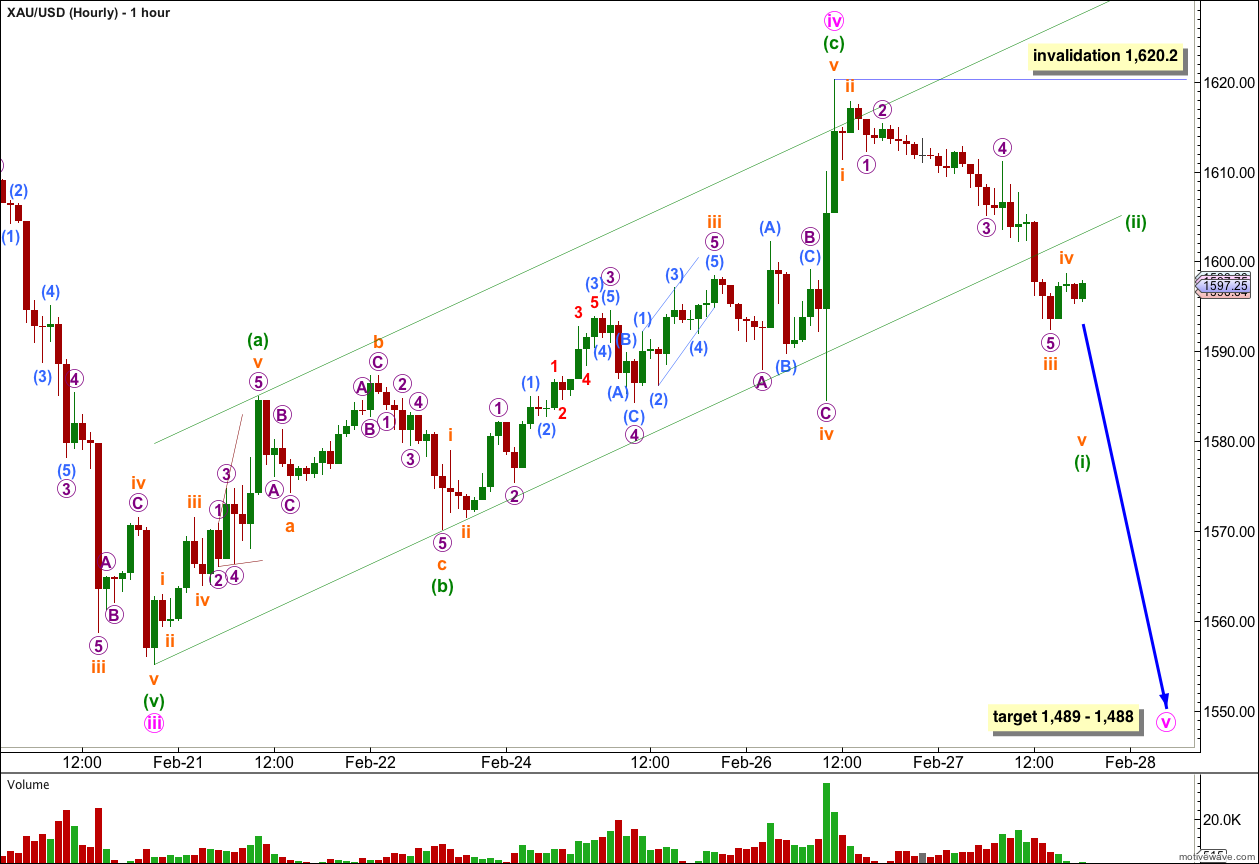

Because the upwards structure for minute wave iv is a complete zigzag and it already slightly overshoots the channel containing downwards movement it is likely that this correction is over.

Minuette wave (c) is just 1.76 short of 1.618 the length of minuette wave (a).

Ratios within minuette wave (a) are: subminuette wave iii is 0.44 short of 1.618 the length of subminuette wave i, and subminuette wave v is 0.68 longer than 2.618 the length of subminuette wave i.

Minuette wave (b) is an expanded flat correction. Subminuette wave b is a 121% correction of subminuette wave a, and subminuette wave c is just 0.13 short of 1.618 the length of subminuette wave a.

Ratios within minuette wave (c) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 1.62 short of 4.236 the length of subminuette wave i.

If minute wave iv is complete then within minute wave v minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 1,620.2.

Alternate Hourly Wave Count.

If we move everything within minute wave iv down one degree we may have only seen minuette wave (a) within minute wave iv.

Minute wave iv may be unfolding as a flat correction, or as a double (if minuette wave (a) is relabeled as minuette wave (w) the first structure in a double).

If minute wave iv is unfolding as a flat correction then minuette wave (b) must reach at least 90% the length of minuette wave (a). This would be achieved at 1,562.

Minuette wave (b) may make a new low below the start of minuette wave (a), and for a flat is reasonably likely to do so. There can be no downwards price point which differentiates this alternate from the main wave count, and only the structure will indicate which wave count is correct. Minuette wave (b) must unfold as a three wave structure.

If minute wave iv is a double then there is no lower price point which minuette wave (x) would have to reach, but it must unfold as a three. Again, it is structure of this downwards wave which differentiates this alternate from the main wave count.

When minuette wave (b) (or minuette wave (x)) is complete then minuette wave (c) is likely to make a new high above the end of minuette wave (a) at 1,620.20.

If minuete wave iv is a double combination then we would expect mostly sideways movement for a few days yet.

Lara,

I appreciate your work on gold. I have a question regarding the index you are charting. Your charts indicate XAU/USD. Please give me some clarification.

Thank you,

Rodney

Au = chemical symbol for gold. XAU/USD is the gold price in US dollars.

I was using a different data feed previously. Before I changed to this google / yahoo feed I checked several price points to see if it was the same. It is.