Last analysis expected more upwards movement. Price has moved mostly sideways in a very small range.

The daily chart is the same today. I have two hourly wave counts for you: the main is the same as yesterday and the alternate is the idea I outlined yesterday now charted.

Click on the charts below to enlarge.

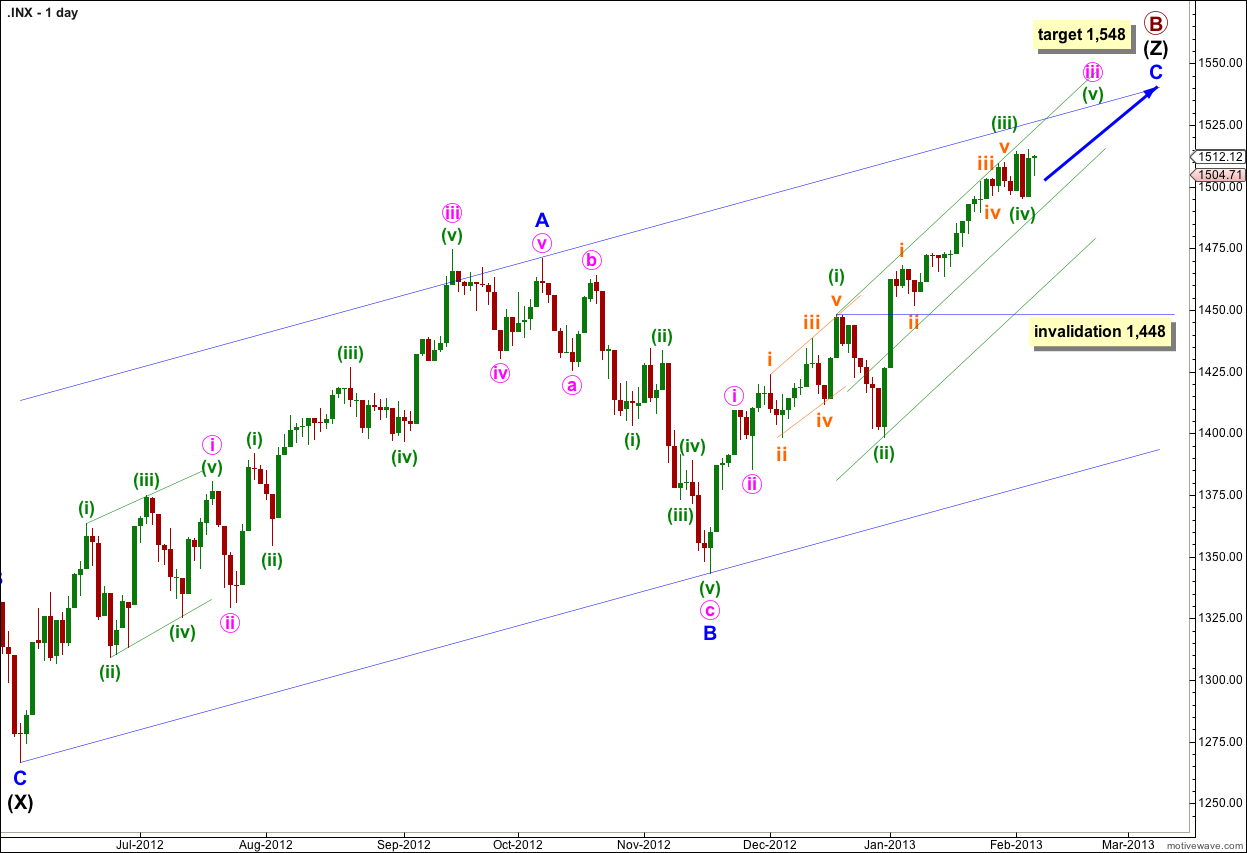

The structure for primary wave B is a triple zigzag. Because three is the maximum number of structures within a multiple when this third zigzag is finally complete then the entire correction for primary wave B must be complete. There is no other Elliott wave structure which could allow for upwards movement within this wave count at cycle degree.

Wave (Z) black is incomplete as an exaggerated zigzag, wave C blue within it is incomplete.

Within wave iii pink of wave C blue there are some interesting Fibonacci time relationships: wave (i) green lasted 14 days (one more than a Fibonacci 13), wave (ii) green lasted a Fibonacci 8 days, wave (iii) green lasted 20 days (one less than a Fibonacci 21) and wave (iv) green may have been over in a Fibonacci 3 days. If wave (v) green lasts one more session it would have lasted a Fibonacci 3 days. For the alternate wave count below if wave (iv) green is not over and lasts three more sessions it would have been equal in duration to wave (ii) green at a Fibonacci 8 sessions.

At 1,548 wave C blue would reach equality with wave A blue. At that point primary wave B would be a 166% correction of primary wave A. This target may be too high. When waves iii and iv pink are complete I will recalculate the target based upon pink wave degree.

I have used Elliott’s channeling technique to draw a channel about wave (Z) black zigzag. Price may find resistance at the upper edge of the channel.

Within wave iii pink wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated with movement below 1,448.

I have drawn a double wide channel about wave iii pink: draw the first trend line from the highs of waves (i) to (iii) green then place a parallel copy upon the low of wave (ii) green. Place a second parallel copy mid way within the channel. Price may remain within the upper half of the channel and may find resistance at the upper trend line.

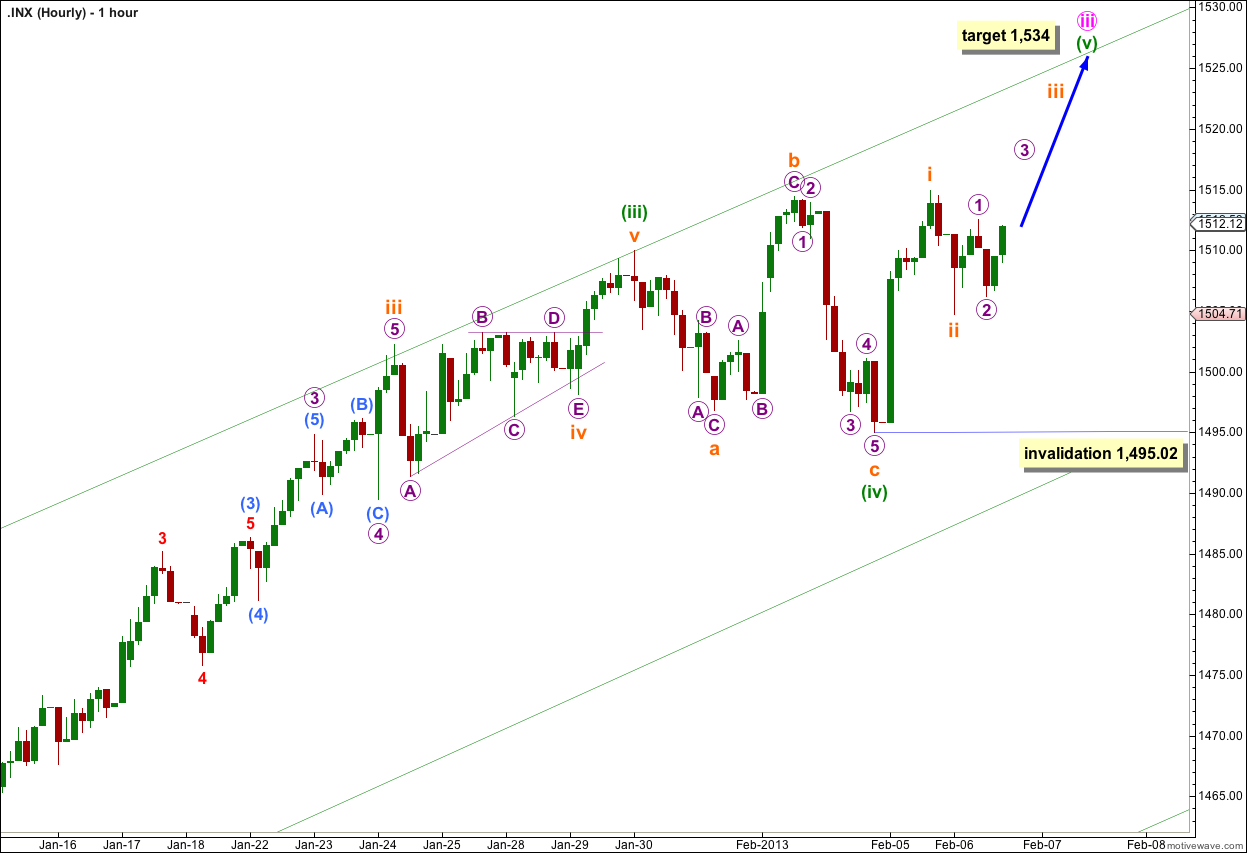

Main Hourly Wave Count.

Wave (v) green may have begun.

Wave (iv) green would have lasted a Fibonacci three sessions. Wave (v) green may end in either one more session to make a Fibonacci three, or another three sessions to make a Fibonacci five.

At 1,534 wave (v) green would reach 0.618 the length of wave (i) green.

Within wave (v) green any further extension of wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement below 1,495.02.

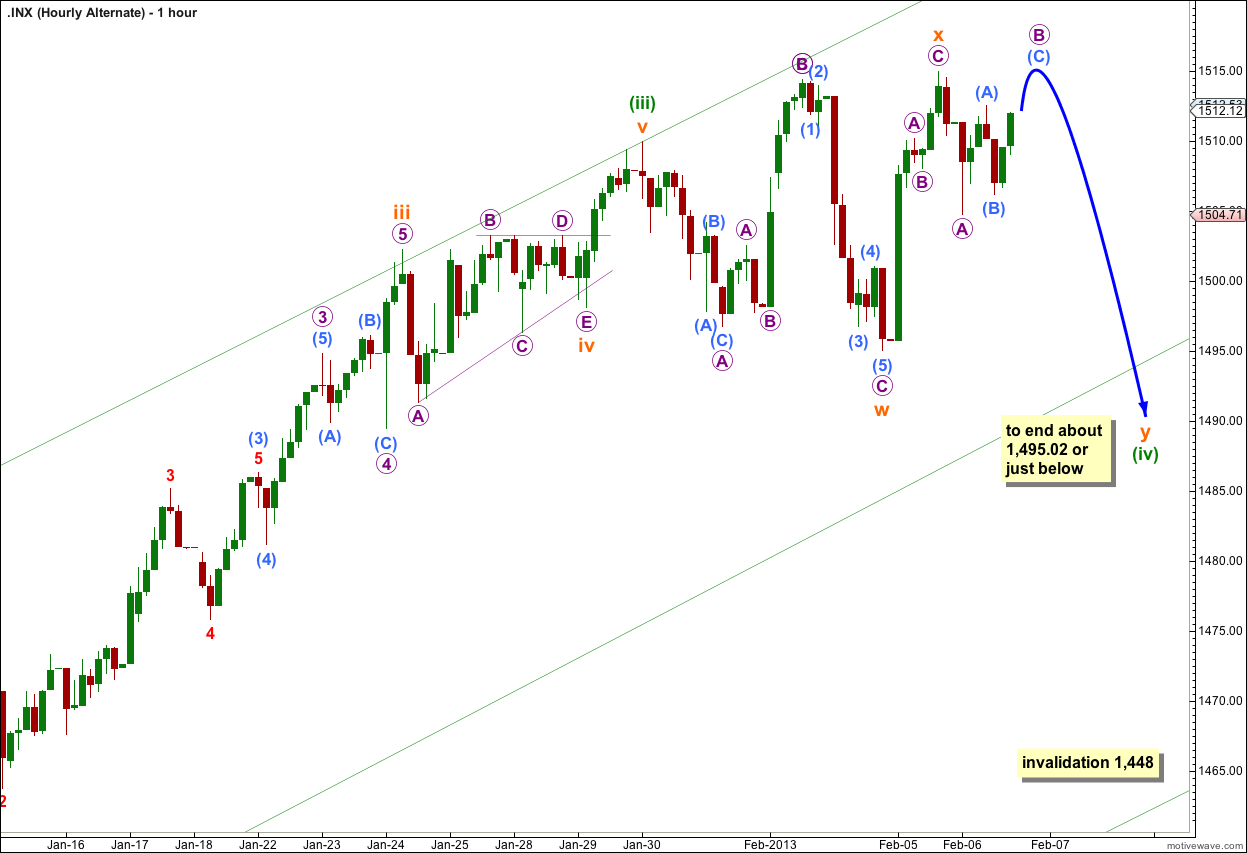

Alternate Hourly Wave Count.

Wave (iv) green may be incomplete as a double flat correction.

If wave (iv) green ends after another three sessions it would have lasted a Fibonacci eight sessions.

Within wave (iv) green the first structure in the double is labeled wave w orange. The double is joined by a three in the opposite direction labeled wave x orange. The second structure in the double is labeled wave y orange and is an incomplete flat correction.

The most common type of flat is an expanded flat which has a B wave that makes a new price extreme beyond the start of the A wave. Movement to a new high above the start of wave A purple at 1,514.96 would indicate an expanded flat correction may be unfolding. There can be no upper invalidation point for this wave count.

When wave B purple is complete then wave C purple is extremely likely to take price to a new low beyond the end of wave A purple below 1,504.71.

The purpose of a double flat is to take up time and move price sideways, not to deepen a correction. We would expect the correction to end about or just below the end of wave w orange at 1,495.02, and not significantly lower.

Wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated with movement below 1,448.